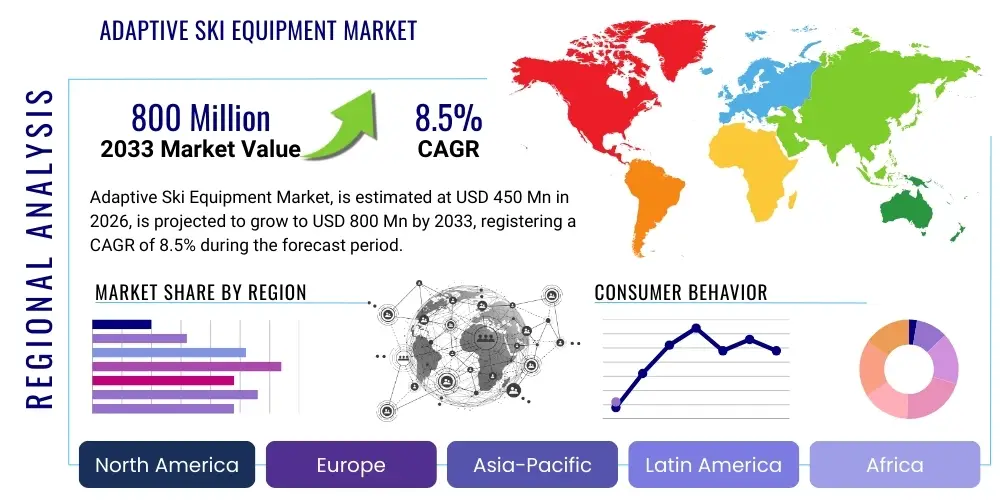

Adaptive Ski Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439108 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Adaptive Ski Equipment Market Size

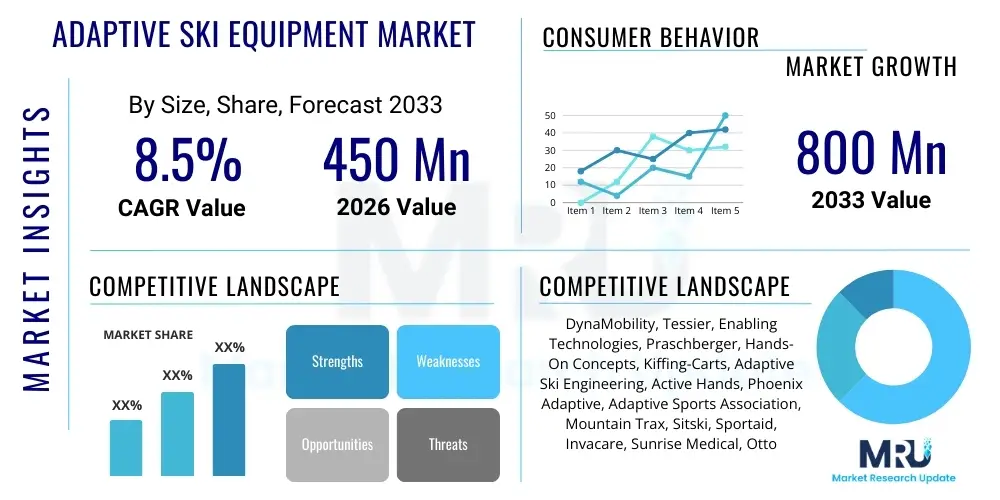

The Adaptive Ski Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Adaptive Ski Equipment Market introduction

The Adaptive Ski Equipment Market encompasses specialized gear and modifications designed to enable individuals with physical disabilities, sensory impairments, or mobility challenges to participate in snow sports, particularly downhill and cross-country skiing. This equipment spans a wide range of products, including monoskis, bisks, adaptive outriggers, specialized stabilizers, and custom seating systems, all engineered to maximize stability, control, and user independence on the slopes. The primary objective of this market is to lower the barrier to entry for disabled athletes and recreational skiers, promoting inclusivity and therapeutic physical activity.

Major applications for adaptive ski equipment are highly concentrated in therapeutic rehabilitation settings, competitive adaptive sports, and recreational tourism at inclusive ski resorts. These products are crucial for organizations that run adaptive sports programs, enabling them to safely teach skiing techniques to diverse populations, including veterans, individuals with spinal cord injuries, amputees, and those with cerebral palsy. The rising visibility of events like the Paralympic Games further stimulates demand, encouraging technological innovation and wider adoption globally.

Key benefits driving market expansion include the significant improvements in quality of life for users, offering psychological benefits such as increased self-confidence and social integration, alongside physical health improvements like enhanced balance and strength. Driving factors fueling the market include increasing governmental support and funding for adaptive sports initiatives, a growing aging population seeking accessible recreational activities, and continuous advancements in lightweight and durable materials engineering, making the equipment more reliable and easier to handle.

Adaptive Ski Equipment Market Executive Summary

The Adaptive Ski Equipment Market is characterized by steady growth, driven primarily by increasing awareness of adaptive sports benefits and supportive governmental policies promoting accessibility in tourism and recreation. Business trends indicate a strong focus on customization and modular design, allowing equipment to be finely tuned to individual user needs and specific disabilities. Furthermore, strategic partnerships between equipment manufacturers, rehabilitation centers, and specialized ski resorts are becoming essential for product testing, distribution, and market penetration, ensuring that innovative designs quickly reach the target consumer base and specialized procurement channels.

Regionally, North America and Europe currently dominate the market due to established infrastructure, high disposable income, and mature adaptive sports programs. However, the Asia Pacific region is poised for rapid growth, fueled by increasing investment in sports infrastructure, particularly in countries hosting major international winter events, and rising acceptance of disability inclusion. Regional trends also highlight the proliferation of rental and lease models, especially in high-traffic ski destinations, which reduces the initial cost barrier for new participants and organizations.

Segment trends reveal that the Mono Ski and Bi Ski categories maintain the largest market share, catering to users with significant lower body mobility limitations. However, the fastest growth is anticipated in specialized accessory segments, such as electronic stabilizers and sensor-equipped outriggers, reflecting the ongoing integration of advanced technology for enhanced safety and performance. The distribution landscape is shifting towards specialized online retail platforms, which offer greater product variety and direct consumer access, bypassing traditional general sports stores.

AI Impact Analysis on Adaptive Ski Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Adaptive Ski Equipment Market primarily center on how AI can enhance safety, optimize performance customization, and streamline rehabilitation processes. Users frequently ask about AI's role in real-time performance tracking, predictive maintenance for complex equipment like sit-skis, and the development of personalized training programs. Key themes include the expectation that AI will move beyond simple data logging to provide actionable, instantaneous feedback to adaptive skiers and instructors, improving skill acquisition and reducing the risk of injury. There is significant concern, however, regarding data privacy and the affordability of AI-integrated equipment, ensuring that these high-tech advancements remain accessible to the diverse adaptive community.

The immediate influence of AI is observable in advanced biomechanical analysis tools used in fitting and training. AI algorithms can process complex sensor data from adaptive equipment (e.g., pressure sensors in seating, motion trackers in outriggers) to analyze weight distribution, balance stability, and movement efficiency. This data enables manufacturers to create dynamically adjustable equipment that adapts to minor physical changes or environmental conditions (like snow texture or slope gradient). Such personalization significantly improves user comfort and competitive performance, pushing the boundaries of what adaptive athletes can achieve on the slopes.

Looking forward, AI is expected to revolutionize equipment maintenance and accessibility. Predictive maintenance models, leveraging machine learning, can forecast potential equipment failure based on usage patterns and stress data, minimizing downtime for specialized and often expensive gear. Furthermore, AI-powered diagnostic tools in rehabilitation centers can help physical therapists rapidly determine the most suitable type of adaptive equipment for a patient based on their specific functional capabilities, significantly accelerating the integration of skiing into therapeutic routines and widening the overall addressable market.

- AI-driven real-time performance feedback systems enhance training and technique correction.

- Machine learning algorithms optimize personalized equipment fitting and customization based on biomechanical data.

- Predictive maintenance using sensor data reduces equipment failure and ensures user safety.

- AI aids in rapid diagnosis and recommendation of suitable adaptive equipment in clinical settings.

- Advanced image recognition assists visually impaired skiers by processing visual input into haptic or auditory guidance cues.

DRO & Impact Forces Of Adaptive Ski Equipment Market

The Adaptive Ski Equipment Market is fundamentally shaped by a confluence of driving forces related to social inclusion, regulatory support, and technological progress. Conversely, high production costs and limitations in global infrastructure pose significant restraints. Opportunities lie in expanding geographical reach into emerging winter sports markets and integrating therapeutic technologies. The overall market trajectory is primarily dictated by the increasing mainstream acceptance of adaptive sports, transforming it from a niche medical necessity into a recognized segment of the global sports and recreation industry.

Key drivers include substantial growth in adaptive sports organizations worldwide, actively promoting accessibility and participation; favorable government legislation mandating accessible infrastructure at public and private ski resorts; and ongoing material science innovations resulting in lighter, stronger, and more ergonomic equipment. These factors collectively push manufacturers towards higher production volumes and continuous product improvement. However, restraints such as the specialized nature of manufacturing, which leads to high unit costs compared to standard ski gear, and the limited number of certified adaptive ski instructors globally, act as friction points limiting immediate mass adoption.

Opportunities for growth are abundant in strategic areas: developing modular equipment suitable for multiple disability types, thereby streamlining manufacturing; penetrating untapped markets in Eastern Europe and parts of Asia where winter sports culture is developing; and integrating smart features like IoT connectivity and GPS tracking for enhanced safety and data collection. The impact forces underscore that social acceptance and policy environment are critical external catalysts, while internal technological innovation determines competitive advantage and market share distribution.

Segmentation Analysis

The Adaptive Ski Equipment market is intricately segmented based on product type, catering to various mobility needs and physical challenges, as well as by the end-user base, ranging from individual competitive athletes to large institutional clients like rehabilitation centers and rental services. Understanding these segmentations is vital for manufacturers to tailor product development and marketing strategies effectively. Segmentation by distribution channel further highlights the evolving retail landscape, moving increasingly towards specialized online platforms that can offer detailed product comparisons and expert consultation, which is crucial given the complexity and customization required for this equipment.

The primary segments, such as Mono Skis and Bi Skis, define the core market structure, representing essential devices for severe lower-limb impairment. Meanwhile, the accessory segment, including Outriggers and Stabilizers, demonstrates robust growth driven by recreational skiers who require enhanced balance support rather than full seating systems. Geographical segmentation emphasizes that maturity levels vary significantly, with North America and Europe prioritizing technological advancement and established safety standards, while emerging markets focus on basic accessibility and infrastructure development.

This detailed segmentation analysis aids stakeholders in identifying high-growth segments, understanding procurement patterns, and mitigating risks associated with specialized manufacturing. The reliance on institutional end-users (rehabilitation and adaptive sports organizations) means that sales cycles often involve rigorous approval processes and bulk purchasing, requiring manufacturers to maintain stringent quality control and offer comprehensive support services and instructor training packages.

- Product Type

- Mono Skis

- Bi Skis

- Outriggers and Stabilizers

- Sit Skis (Bobsleds)

- Stand-Up Adaptive Skis

- Adaptive Ski Bindings and Boots

- End-User

- Individual Athletes and Recreational Skiers

- Rehabilitation Centers and Hospitals

- Ski Resorts and Rental Services

- Adaptive Sports Organizations and Non-Profits

- Distribution Channel

- Specialty Sports Stores (Physical Retail)

- Online Retail Platforms (E-commerce)

- Direct Sales (Manufacturer to Institution)

Value Chain Analysis For Adaptive Ski Equipment Market

The value chain for adaptive ski equipment is complex, beginning with highly specialized raw material sourcing and design, progressing through niche manufacturing and assembly, and concluding with specialized distribution and extensive after-sales support. The upstream analysis is dominated by material innovation, focusing heavily on lightweight yet extremely durable materials such as specialized aluminum alloys, carbon fiber composites, and high-strength plastics necessary to ensure both safety and optimal performance under extreme conditions. R&D is a capital-intensive phase, requiring significant investment to comply with rigorous safety certifications unique to medical and sports equipment, differentiating this chain from standard sporting goods.

Midstream activities involve low-volume, high-precision manufacturing. Unlike mass-market skiing gear, adaptive equipment often requires customized fittings and highly skilled assembly technicians, leading to higher labor costs and less automation. Quality assurance checks are exceptionally stringent due to the direct impact on user safety and mobility. Key players often maintain proprietary intellectual property regarding suspension systems (especially for monoskis) and ergonomic seating configurations, creating high barriers to entry for new competitors and reinforcing the importance of specialized expertise.

The downstream analysis highlights the crucial role of specialized distribution channels. Direct sales to rehabilitation centers and adaptive sports organizations (B2B) remain significant, requiring manufacturers to maintain strong relationships with therapists and instructors. Indirect distribution through specialty sports stores or dedicated online adaptive equipment retailers is essential for reaching individual users. Unlike conventional retail, distribution often includes mandatory consultation and fitting services, ensuring the equipment is correctly set up for the user's specific disability, thus integrating the sales process tightly with essential technical support.

Adaptive Ski Equipment Market Potential Customers

The core customer base for the Adaptive Ski Equipment Market consists of individuals with diverse physical disabilities seeking recreational and competitive participation in winter sports. This includes individuals with spinal cord injuries (SCI), amputations, cerebral palsy, multiple sclerosis, and visual impairments. These end-users are highly motivated consumers, often prioritizing safety, comfort, and performance customization above initial cost, reflecting the essential nature of the equipment for their activity.

Beyond individual consumers, institutional buyers represent a massive procurement channel. Rehabilitation centers and physical therapy clinics often purchase fleets of adaptive equipment for patient therapy and mobility training, integrating skiing into comprehensive recovery programs. These organizations require durable, versatile, and easy-to-maintain equipment suitable for multiple users and frequently rely on established, certified brands.

Furthermore, adaptive sports organizations, non-profit groups, and government-funded programs that organize adaptive ski camps and events are major clients. They are responsible for equipping hundreds of participants annually, requiring bulk purchases of standardized yet robust equipment, including beginner-friendly models. Finally, ski resorts and rental services located in regions prioritizing inclusive tourism form a rapidly growing customer segment, purchasing equipment for rental pools to cater to visiting disabled skiers and generate accessible revenue streams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DynaMobility, Tessier, Enabling Technologies, Praschberger, Hands-On Concepts, Kiffing-Carts, Adaptive Ski Engineering, Active Hands, Phoenix Adaptive, Adaptive Sports Association, Mountain Trax, Sitski, Sportaid, Invacare, Sunrise Medical, Ottobock, UGE Medical, Skier's Edge, Freedom Factory, Access to Recreation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adaptive Ski Equipment Market Key Technology Landscape

The technological landscape of the Adaptive Ski Equipment Market is characterized by continuous refinement in materials science and the strategic integration of microelectronics and sensor technology to enhance safety and user interaction. The primary focus remains on developing lightweight, high-tensile materials, such as aerospace-grade carbon fiber and specialized titanium alloys, which are crucial for minimizing overall equipment weight while ensuring maximum structural integrity and shock absorption. Advanced dampening and suspension systems, often derived from mountain biking or aerospace engineering, are paramount in monoskis and bisks to mitigate the impact of uneven terrain and provide a smoother, more controllable ride for users with limited torso stability.

Beyond structural advancements, the market is increasingly adopting smart technologies. This includes integrating IoT sensors into outriggers and seating systems to monitor pressure distribution, center of gravity shifts, and speed. These sensors provide instructors and athletes with real-time telemetric data essential for fine-tuning technique and optimizing equipment settings. Furthermore, electrically controlled or pneumatic adjustment mechanisms are emerging, allowing users or instructors to make subtle, dynamic changes to binding positions or suspension stiffness instantly, adapting to changing snow conditions without needing to stop.

The development of highly ergonomic and customizable seating interfaces, often utilizing 3D scanning and printing technologies, is another pivotal trend. This allows for precise contouring that maximizes comfort and postural support, crucial for long days on the slopes and preventing pressure sores for sit-ski users. Technology in this market aims not just at enabling participation but at achieving parity in performance and experience with standard skiing, utilizing sophisticated engineering to bridge physical gaps and ensure a high level of responsive control.

Regional Highlights

- North America: Dominates the global market, driven by highly established adaptive sports infrastructure, robust funding mechanisms (including veteran support programs), and a strong culture of outdoor recreation. The US and Canada host numerous world-class adaptive ski resorts and possess a high density of organizations, such as Disabled Sports USA, ensuring high demand for state-of-the-art equipment and specialized rental services. Technological adoption, particularly in customization (3D printing of parts) and telemetry, is highest here.

- Europe: Represents the second-largest market, characterized by strong governmental support for disability inclusion and excellent ski resort accessibility in Alpine nations (Austria, Switzerland, France). European manufacturers are leaders in high-end, precision-engineered monoskis and bi-skis, often focusing on competitive performance models. Central and Western Europe exhibit high market maturity, with steady replacement cycles for institutional equipment.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by increasing investment in winter sports infrastructure, particularly following recent major winter events in South Korea and China. Rising awareness of adaptive sports benefits and improving economic conditions are driving initial market penetration. The focus is currently on establishing foundational adaptive ski programs and importing proven equipment models.

- Latin America: Characterized by lower market maturity and limited infrastructure, demand is concentrated in key areas like Chile and Argentina, which possess viable winter tourism markets. Growth is slow but steady, primarily driven by philanthropic organizations and small, dedicated adaptive programs reliant on international donations or specialized imports.

- Middle East and Africa (MEA): This region holds the smallest share, with demand being highly localized to specific urban centers and luxury indoor ski facilities (e.g., UAE). The market potential is constrained by climatic conditions and the nascent stage of adaptive sports development, primarily relying on imported equipment for specialized rehabilitation purposes rather than widespread recreational use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adaptive Ski Equipment Market.- DynaMobility

- Tessier

- Enabling Technologies

- Praschberger

- Hands-On Concepts

- Kiffing-Carts

- Adaptive Ski Engineering

- Active Hands

- Phoenix Adaptive

- Adaptive Sports Association

- Mountain Trax

- Sitski

- Sportaid

- Invacare

- Sunrise Medical

- Ottobock

- UGE Medical

- Skier's Edge

- Freedom Factory

- Access to Recreation

Frequently Asked Questions

Analyze common user questions about the Adaptive Ski Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Adaptive Ski Equipment Market?

The primary driver is the increasing societal focus on disability inclusion and accessibility, strongly supported by government mandates and the expansion of global adaptive sports organizations that actively promote participation in winter sports for individuals with physical limitations.

How does a Mono Ski differ functionally from a Bi Ski?

A Mono Ski (sit ski) uses a single wide ski underneath a suspended seat, offering high maneuverability and performance for advanced skiers, often those with high-level spinal cord injuries, who rely heavily on outriggers for balance. A Bi Ski uses two parallel skis for increased stability, often preferred by beginners or those with less core strength.

What role does carbon fiber play in modern adaptive ski equipment manufacturing?

Carbon fiber is crucial for reducing the weight of equipment, especially in monoski frames and outriggers, without sacrificing structural strength. This weight reduction enhances user control, reduces fatigue, and improves the overall responsiveness and competitive performance of the gear.

Which distribution channel is most important for institutional sales in this market?

Direct Sales (Manufacturer to Institution) is the most critical channel for institutional buyers like rehabilitation centers and large adaptive sports organizations. This channel ensures specialized consulting, bulk purchase discounts, and essential long-term technical support and maintenance agreements.

Are adaptive ski resorts required to have specific certifications?

While resort certification varies regionally, many successful adaptive ski centers adhere to international standards (like those set by Professional Ski Instructors of America and Adaptive Sports USA) regarding equipment safety, instructor training, and slope accessibility to ensure a safe and professional environment.

How is technology addressing the challenge of customization in adaptive skiing?

Technology leverages 3D scanning and printing to create custom-fit seating inserts and component parts tailored precisely to an individual's unique physical contours and support needs, significantly improving comfort, reducing pressure points, and maximizing control transmission to the equipment.

What are the key barriers to entry for new companies in the Adaptive Ski Equipment Market?

Key barriers include the requirement for highly specialized R&D to meet stringent safety and performance standards, the need for deep integration with the medical and rehabilitation communities, and the high cost associated with low-volume, precision manufacturing processes.

Do insurance policies typically cover the cost of adaptive ski equipment?

Coverage is highly variable; while recreational equipment is often not covered, some specialized components (especially those classified as durable medical equipment or part of rehabilitation therapy) may be partially reimbursed, depending on regional healthcare systems and individual policy specifics.

What is the expected impact of AI on adaptive ski safety?

AI is expected to significantly boost safety through predictive maintenance alerts for critical components, and via real-time stability monitoring systems that provide immediate feedback to the skier and instructor, helping prevent falls and equipment failure.

Which region currently leads the market in terms of technological innovation?

North America and Western Europe lead in technological innovation, particularly in integrating smart sensors, developing advanced suspension systems, and implementing rapid prototyping techniques for personalized adaptive components.

What is the role of adaptive sports non-profits in the market ecosystem?

Adaptive sports non-profits are crucial end-users and influencers; they purchase equipment fleets, conduct training programs, serve as primary consultants for new product development, and frequently provide subsidies or rental options to individual skiers, bridging the gap between high costs and consumer affordability.

How do outriggers enhance adaptive skiing for stand-up skiers?

Outriggers are specialized forearm crutches mounted on small ski tips. For stand-up adaptive skiers (e.g., amputees), they provide essential lateral stability, assist with turning (steering inputs), and aid in starting, stopping, and balancing, acting as integral stabilizing limbs.

Is the market leaning more towards rental or ownership models?

While institutional clients predominantly own equipment, the individual recreational segment shows a growing lean towards sophisticated rental and lease models, especially for high-cost items like monoskis, reducing the financial commitment required for initial or infrequent participation.

How important are training and certification programs for market success?

They are fundamentally important. Since adaptive equipment requires specific knowledge for safe and effective use, manufacturer success is closely tied to partnerships that offer comprehensive training and certification for adaptive instructors and rehabilitation specialists who recommend and fit the gear.

What is the main challenge related to the supply chain in this niche market?

The main challenge is managing a supply chain that requires precision manufacturing and low-volume production. This complexity makes it difficult to achieve economies of scale, contributing directly to the high final price of the specialized equipment.

What is meant by the term "Adaptive Ski Bindings"?

Adaptive ski bindings are specialized interfaces that securely connect a standard ski boot or an orthopedic brace to the ski. They often feature extra-high release settings or modified actuation mechanisms to accommodate users with varied physical strength or control over their lower extremities.

How do regulatory standards influence product design?

Regulatory standards, particularly those concerning medical devices and sports safety (e.g., ISO standards), impose strict requirements on material durability, load bearing capacity, and the reliability of suspension/release mechanisms, directly influencing the complexity and cost of product design and testing.

What are the prospects for Adaptive Ski Equipment in the competitive sports segment?

The competitive segment offers high growth potential, driven by technological advancements that enhance athletic performance, increasing global visibility through the Paralympics, and the demand for ultra-lightweight, high-customization equipment specifically designed for elite athletes.

How does the geriatric population impact the Adaptive Ski Equipment Market?

As the geriatric population seeks to maintain active lifestyles, there is a rising demand for equipment, such as stabilizing outriggers and easily manageable stand-up adaptive skis, catering to age-related mobility challenges rather than congenital disabilities, thus broadening the consumer base.

What is the significance of ergonomic seating in Sit Skis?

Ergonomic seating is critical in Sit Skis because it provides crucial postural support and stability, prevents injury, and ensures efficient energy transfer from the skier's body to the ski, enabling precise control necessary for safe maneuvering and turning.

How are environmental factors influencing material choices in this market?

Manufacturers are increasingly seeking durable materials that can withstand extreme cold and moisture while also pursuing sustainable and recyclable components, addressing both performance requirements and growing consumer demand for environmentally responsible sporting goods.

What is the difference between Upstream and Downstream analysis in this value chain?

Upstream analysis covers R&D, specialized material procurement (carbon fiber, titanium), and initial design. Downstream analysis focuses on specialized distribution (e.g., direct sales to rehab centers), customized fitting services, and post-sale technical support and maintenance.

Are international travel restrictions a significant restraint on the market?

Yes, because adaptive skiing often involves travel to specialized resorts, international travel restrictions and accessibility challenges in transit can significantly restrain the market by limiting participation and the flow of adaptive tourists.

How does the market address the needs of visually impaired skiers?

The market primarily addresses visually impaired skiers through specialized auditory guidance equipment, often using Bluetooth technology for instructors to provide clear, real-time verbal directional cues, and through the development of sensor-based navigation aids.

What is the projected CAGR for the Adaptive Ski Equipment Market between 2026 and 2033?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2026 to 2033, reflecting stable growth driven by accessibility initiatives and technological advancements.

Why is customization crucial for the Adaptive Ski Equipment Market?

Customization is crucial because a standard solution cannot meet the diverse and highly individualized needs arising from different types and degrees of physical disability. Precise customization ensures maximum safety, optimal performance, and comfortable use.

What role do specialty sports stores play in the distribution channel?

Specialty sports stores, both physical and online, are essential for providing expert advice, detailed product demonstrations, and post-sale support, acting as crucial intermediaries between niche manufacturers and knowledgeable individual consumers.

How does the increasing adoption of telemetric data benefit adaptive skiers?

Telemetric data (collected via integrated sensors) allows instructors and therapists to objectively analyze parameters like balance, pressure distribution, and turning forces, providing data-driven insights that accelerate skill development and prevent improper technique, ultimately enhancing safety and performance.

Which segment of the end-user market is expected to show the fastest growth?

The Ski Resorts and Rental Services segment is expected to show accelerated growth as inclusive tourism gains momentum and resorts globally invest in diverse adaptive equipment fleets to attract the growing demographic of disabled recreational travelers.

What is the definition of a "Stabilizer" in adaptive ski equipment?

Stabilizers generally refer to adaptive poles or frames used by stand-up skiers (e.g., those with prosthetic limbs) who require additional support to maintain balance and confidence. They are typically used in conjunction with standard skis or specialized boots.

How is the market addressing the issue of high equipment cost?

The market addresses high costs through increased availability of rental and leasing programs, bulk purchasing by non-profits and institutions that subsidize user fees, and advancements in modular design which potentially lower manufacturing costs over time.

What is the primary competitive advantage for leading adaptive equipment manufacturers?

The primary competitive advantage lies in proprietary suspension technology, rigorous safety certifications, established relationships with global adaptive sports organizations, and the ability to offer highly reliable, customizable, and ergonomically superior products.

How do governments in North America specifically drive market demand?

Governments in North America drive demand through legislation mandating accessible facilities, significant funding for adaptive sports programs often tied to veteran rehabilitation, and policies that encourage public and private investment in inclusive recreational infrastructure.

What technological feature is common in high-performance monoskis?

High-performance monoskis frequently feature sophisticated, adjustable hydraulic or pneumatic suspension systems derived from motorsports, which allow athletes to precisely tune the dampening characteristics to optimize speed and handling under competitive conditions.

What constraints limit the adoption of adaptive ski equipment in Latin America?

Adoption in Latin America is primarily limited by inadequate winter sports infrastructure, lower average disposable income compared to developed markets, and fewer established governmental or non-profit programs dedicated to adaptive sports funding.

Which segments are classified under the Product Type segmentation?

Product Type segmentation includes Mono Skis, Bi Skis, Outriggers and Stabilizers, Sit Skis (Bobsleds), Stand-Up Adaptive Skis, and Adaptive Ski Bindings and Boots.

What distinguishes the manufacturing process of adaptive equipment from standard ski gear?

Adaptive equipment manufacturing is characterized by lower volume, higher reliance on specialized labor and precision assembly, greater need for customization, and stringent testing requirements related to medical device standards, unlike the mass-production methods used for standard gear.

Why is after-sales support so critical in the adaptive ski market?

After-sales support is critical because adaptive equipment requires periodic specialized maintenance, calibration, and fitting adjustments as the user's physical condition or skill level evolves. Reliability and quick repairs are essential for user safety and continuity of participation.

How is the increasing visibility of the Paralympic Games impacting the market?

The increased visibility of the Paralympic Games elevates public awareness, inspires more individuals with disabilities to participate in skiing, and drives manufacturers to invest heavily in R&D to develop elite competitive equipment, pushing the boundaries of technology for the entire market.

What are the ethical concerns surrounding AI integration into adaptive skiing?

Ethical concerns include ensuring data privacy for highly personal biomechanical and medical information collected by sensors, and mitigating the risk of creating a technology gap where advanced, AI-integrated equipment becomes unaffordable to the majority of adaptive skiers.

What specific materials are essential for high-performance adaptive ski equipment?

Essential materials include lightweight and high-tensile materials such as aerospace-grade aluminum alloys, various grades of carbon fiber composites for structural frames, and advanced polymers for specialized seating and components requiring impact resistance.

How does the market cater to the therapeutic needs of rehabilitation centers?

The market provides rugged, multi-user compatible equipment fleets and works directly with therapists to offer training protocols, integrating skiing as a motivational and effective physical therapy tool to improve balance, core strength, and mobility.

What factors contribute to the projected rapid growth in the APAC region?

Rapid growth in APAC is attributed to increased government investment in winter sports infrastructure, a growing middle class with higher disposable incomes, and the rising influence of international sporting events promoting disability inclusion and accessibility.

How do manufacturers ensure product reliability and safety under severe stress?

Manufacturers ensure reliability through rigorous material fatigue testing, adhering to ISO and medical device standards, using non-destructive testing techniques (NDT), and conducting extensive real-world testing in various snow conditions under professional supervision.

What is the forecasted market value of Adaptive Ski Equipment by 2033?

The Adaptive Ski Equipment Market is projected to reach an estimated value of USD 800 Million by the end of the forecast period in 2033, demonstrating robust long-term financial viability.

In the value chain, why is R&D considered capital-intensive?

R&D is capital-intensive due to the need for continuous material innovation, developing complex, proprietary suspension systems, and the substantial costs associated with achieving mandatory safety certifications specific to specialized medical and sports equipment.

How do ski resorts benefit financially from investing in adaptive equipment rental fleets?

Resorts benefit by tapping into the growing adaptive tourism segment, diversifying their revenue streams, enhancing their reputation for inclusivity, and often receiving tax incentives or grants associated with infrastructure accessibility improvements.

What percentage of the market is represented by Sit Skis (Mono and Bi)?

Sit Skis (Mono and Bi) collectively represent the largest market share segment by product type, as they cater to the needs of individuals with the most significant lower body mobility impairments, forming the historical core of adaptive ski participation.

What is the key technological challenge in designing adaptive ski boots and bindings?

The key challenge is creating interfaces that offer the necessary precision and stiffness for control, while simultaneously accommodating orthopedic bracing, varying levels of ankle rigidity, and ensuring user-friendly mechanisms for donning and doffing the equipment.

How is the shift towards modular design impacting the market?

Modular design allows manufacturers to use interchangeable components, catering to a wider range of disabilities with fewer unique parts. This streamlines the inventory, reduces long-term maintenance costs, and makes customization easier and more affordable for end-users.

What is the significance of the Base Year 2025 in the market report?

The Base Year 2025 serves as the reference point for establishing current market conditions, financial metrics, and technological adoption rates against which all subsequent forecast growth (2026-2033) and CAGR calculations are benchmarked.

How do ethical considerations influence marketing strategies in this market?

Marketing strategies must maintain high ethical standards, emphasizing authenticity, focusing on enablement and performance rather than disability, and ensuring that product claims about safety and functionality are rigorously validated and clearly communicated to vulnerable consumer groups.

What are the key drivers originating from the social inclusion aspect?

Social inclusion drivers include the increasing expectation that public recreational spaces must be accessible, the growth of social media platforms promoting successful adaptive sports stories, and legislative pushes for equal opportunities in recreation and leisure activities.

Which component typically requires the most frequent replacement or maintenance?

The suspension systems, particularly shock absorbers and linkages in monoskis, typically require the most frequent specialized maintenance or replacement due to the high stress, repeated impact loading, and exposure to extreme cold and moisture they endure during use.

What distinguishes the product offerings of large medical device companies in this market?

Large medical device companies often leverage their extensive R&D in materials and prosthetics, focusing on integrating adaptive ski equipment into broader mobility solutions, emphasizing ergonomic precision and clinical-grade safety standards.

How does the Adaptive Ski Equipment market contribute to the broader therapeutic sector?

It contributes by providing specialized tools that enhance patient physical and psychological rehabilitation. Skiing serves as a powerful motivational activity, improving physical attributes like balance, coordination, and strength, and boosting mental well-being and social confidence.

What is the role of sensor technology in optimizing outrigger performance?

Sensors integrated into outriggers measure pressure and angle, providing data that helps users and instructors optimize the outrigger deployment technique, ensuring they provide maximum necessary stability without becoming an inefficient drag force during turns.

Why is the Direct Sales distribution channel important for B2B transactions?

Direct Sales is critical for B2B transactions (e.g., selling fleets to hospitals) because it allows manufacturers to manage complex contracts, offer extensive customization, provide required on-site training for institutional staff, and ensure compliance with procurement specifications.

What is the expected long-term impact of lightweight materials on market growth?

The shift to lightweight materials (carbon fiber) lowers the effort required for users to handle and transport equipment, making skiing more accessible and enjoyable, thereby increasing participation rates and stimulating overall market demand in the long term.

How do advancements in prosthetics influence the design of stand-up adaptive equipment?

Advancements in prosthetic limb technology, particularly highly articulated knees and ankles, directly influence the design of adaptive bindings and ski geometry, allowing manufacturers to optimize the equipment interface for better energy transfer and turning precision.

What are the primary factors summarized in the Executive Summary?

The Executive Summary summarizes key business trends (customization, partnerships), regional trends (dominance of North America/Europe, rapid growth in APAC), and segment trends (high growth in accessories, stable sit-ski demand).

Why is the adaptive ski market generally considered a high-value niche market?

It is considered high-value because the equipment requires specialized, low-volume, precision engineering and materials, resulting in high unit prices, despite the overall market volume being smaller compared to the conventional ski industry.

How do manufacturers ensure the versatility of equipment for multiple disabilities?

Manufacturers achieve versatility through modular design, offering interchangeable components (like different seating sizes or customizable binding plates) that can be quickly adjusted or swapped to accommodate varying physical characteristics and support ne

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager