AdBlue Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432684 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

AdBlue Market Size

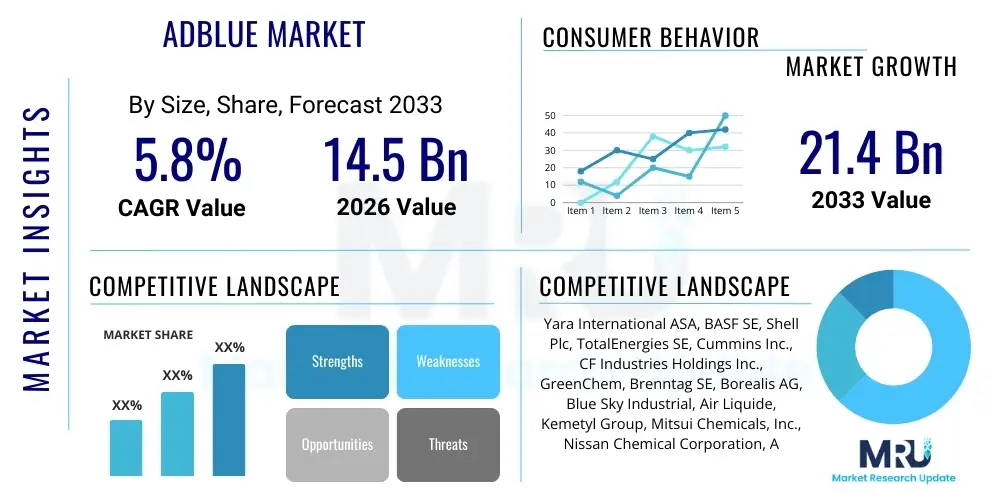

The AdBlue Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.4 Billion by the end of the forecast period in 2033.

AdBlue Market introduction

The AdBlue market, synonymous with Diesel Exhaust Fluid (DEF) in North America, centers around a non-toxic, colorless, and odorless solution comprising 32.5% high-purity urea and 67.5% deionized water. This solution is crucial for the operation of vehicles equipped with Selective Catalytic Reduction (SCR) technology, primarily diesel-powered heavy-duty trucks, buses, off-road machinery, and modern passenger cars. The primary function of AdBlue is to chemically react with harmful nitrogen oxide (NOx) emissions within the SCR system, converting them into harmless nitrogen gas and steam, thereby enabling compliance with stringent global emission standards such as Euro V, Euro VI, EPA 2010, and their subsequent iterations. The product’s definition is strictly governed by ISO 22241, ensuring quality control and consistency across the supply chain, which is essential for protecting the sophisticated SCR catalytic converters in modern engines.

Major applications of AdBlue span the entire transportation and industrial sectors utilizing diesel engines. The commercial vehicle segment, including long-haul freight transport and urban delivery fleets, represents the largest consumer base due to mandatory emission regulations and high annual mileage. Furthermore, the agricultural sector uses substantial volumes for high-horsepower tractors and combines, while construction and mining industries rely on it for heavy machinery and generators. Benefits associated with AdBlue usage are manifold, encompassing significant reductions in air pollution, improved fuel efficiency in SCR-equipped engines (as manufacturers can optimize engine tuning for power rather than emission control), and adherence to legal mandates, preventing operational restrictions or financial penalties associated with non-compliance. The inherent environmental stewardship associated with reduced smog precursors also serves as a strong intangible benefit for corporate fleet operators seeking enhanced sustainability profiles.

The market is predominantly driven by continuously tightening global environmental regulations, particularly in major automotive markets like the European Union, China, and India, which are transitioning toward lower emission norms for both on-road and non-road diesel engines. The increasing global fleet size of SCR-equipped vehicles, particularly in developing economies prioritizing infrastructure development and logistics expansion, provides sustained demand. Additionally, consumer awareness regarding air quality, coupled with technological advancements in dosing systems that enhance AdBlue efficiency and reliability, further supports market expansion. Infrastructure buildout, including the proliferation of AdBlue dispensing pumps at retail fuel stations and dedicated fleet depots, facilitates greater access and reduces the total cost of ownership for operators, cementing its position as an indispensable automotive consumable.

AdBlue Market Executive Summary

The AdBlue market is experiencing robust growth fueled by mandatory global regulatory shifts toward lower diesel engine emissions, underpinned by significant expansion in the heavy-duty vehicle fleet worldwide. Key business trends include the vertical integration of urea producers into the downstream DEF supply chain, allowing for better control over purity and logistics, alongside increasing competition in distribution and retail sales channels, especially as major oil companies and specialized chemical providers vie for market share. Regional trends demonstrate Europe and North America maintaining high consumption rates due to mature regulatory frameworks, while the Asia Pacific region, led by China and India, exhibits the highest growth trajectory, driven by mass adoption of SCR technology necessitated by new national emission standards and massive investments in logistics infrastructure. Simultaneously, there is an observable shift towards bulk supply and automated telemetry systems for fleet operators seeking operational efficiencies and guaranteed supply security.

Segment trends reveal that the transportation sector remains the dominant end-user, with a pronounced shift towards packaged AdBlue for passenger and light commercial vehicles, contrasting with the high volume bulk deliveries essential for large trucking fleets. The segmentation based on volume shows that canisters and smaller packs are critical for the retail aftermarket, whereas tanks and dispensing systems are paramount for large industrial applications and refueling stations. From a competitive standpoint, the market is moderately concentrated, with key manufacturers focusing on establishing extensive, certified distribution networks to combat the threat of low-quality, non-compliant products entering the market, which could damage SCR systems and lead to regulatory fines. Strategic market players are also investing in smart solutions, such as integrated tank monitoring and automated replenishment services, enhancing the overall value proposition for high-volume users and bolstering client loyalty.

The market outlook is highly positive, conditioned primarily on adherence to and enforcement of global emission standards. While electrification poses a long-term existential threat to diesel usage, the short to medium-term necessity of diesel in long-haul transport, construction, and agriculture ensures sustained demand for AdBlue. The market is increasingly characterized by optimization in logistics—moving away from traditional distribution models to more localized production or smart regional hubs to minimize transportation costs and associated carbon footprint of the fluid itself. Successive iterations of engine technology and SCR systems are projected to increase the efficiency and potentially the dosing rates of AdBlue, supporting volume growth. Furthermore, the market will need to adapt to the transition towards marine applications, where similar urea-based reductants are becoming standard for large vessels complying with MARPOL Annex VI regulations, opening a specialized, high-volume marine segment.

AI Impact Analysis on AdBlue Market

User queries regarding the impact of Artificial Intelligence (AI) on the AdBlue market primarily revolve around three central themes: optimizing DEF consumption and logistics, predicting maintenance needs for SCR systems, and ensuring product quality traceability. Users are intensely interested in how AI can move the market beyond static distribution models to predictive replenishment, minimizing stockouts for fleet operators while simultaneously reducing distributor inventory carrying costs. Key concerns include the integration complexity of AI algorithms with existing telematics and fleet management systems, and the data privacy implications associated with monitoring vehicle performance and DEF usage patterns. Expectations are high that AI will lead to significant operational savings through precise consumption analytics, dynamic routing for bulk deliveries, and early detection of SCR system malfunctions, ultimately enhancing the reliability and cost-effectiveness of diesel fleets utilizing AdBlue.

The core application of AI within the AdBlue ecosystem involves advanced telematics analysis. By applying machine learning algorithms to real-time data streams—including engine load, geographical location, ambient temperature, altitude, and historical dosing rates—AI models can accurately predict the remaining AdBlue range and estimate future consumption requirements for individual vehicles or entire fleets. This predictive maintenance capability extends beyond simple consumption; AI can detect anomalies in the SCR dosing mechanism or catalytic converter performance, allowing for pre-emptive servicing. For instance, an unexpected spike or drop in the dosing rate, flagged by an AI system, could indicate a faulty sensor or potential crystallization issue long before a dashboard warning light is triggered, saving the fleet operator significant downtime and repair costs associated with crystallized DEF blockages in the exhaust system.

Furthermore, AI significantly enhances the supply chain efficiency and product authenticity crucial for the high-purity urea solution. Machine vision and data analytics are increasingly used in production facilities to monitor the mixing process and ensure ISO 22241 compliance, maintaining the stringent purity standards required. In logistics, AI optimizes delivery schedules and routes based not only on geographical proximity but also on real-time inventory levels reported by smart tank sensors at customer sites. This shift from scheduled deliveries to demand-driven, dynamic replenishment reduces operational costs for suppliers and improves service reliability for customers. Traceability, a growing concern given the prevalence of substandard knock-offs, is also addressed, with AI platforms verifying the certified origin and quality of the fluid throughout its journey from production batch to the vehicle tank.

- AI-driven Predictive Consumption: Optimizing fleet replenishment cycles based on real-time operational data, minimizing inventory and stockouts.

- SCR System Diagnostics: Machine learning models analyzing dosing patterns and exhaust data to predict and prevent failures related to sensor faults or DEF crystallization.

- Dynamic Supply Chain Optimization: Utilizing algorithms for real-time route optimization and scheduling of bulk deliveries, reducing transportation costs and lead times.

- Quality Assurance and Traceability: Applying vision systems and blockchain integrated with AI to verify ISO 22241 compliance and product authenticity throughout the distribution network.

- Integrated Telematics Reporting: Generating detailed reports on environmental performance and AdBlue expenditure, aiding fleet managers in regulatory compliance documentation.

DRO & Impact Forces Of AdBlue Market

The market for AdBlue is fundamentally shaped by a confluence of regulatory mandates (Drivers), logistical complexities (Restraints), infrastructure investment (Opportunities), and the overarching pressure of environmental accountability (Impact Forces). The dominant driver is the universal adoption and enforcement of Euro VI, EPA 2010, Bharat Stage VI, and comparable global emission standards for all new diesel vehicles. This regulatory push makes SCR technology, and thus AdBlue, mandatory for modern diesel operation. Simultaneously, the restraint landscape is characterized by the need for meticulous quality control—low-quality DEF can severely damage SCR systems, leading to consumer reluctance or preference for certified, often costlier, products. Logistical restraints include the relatively high weight and water content of AdBlue, which makes long-distance transportation inefficient, requiring localized production or decentralized distribution hubs. Opportunities arise from expanding the application base into non-road mobile machinery (NRMM), marine vessels, and railway locomotives, all facing increasing emission scrutiny. The primary impact force is the non-negotiable requirement for diesel engines to meet environmental goals, making AdBlue usage a direct cost of operation that cannot be circumvented.

A major driving force is the increasing longevity and retention rate of existing diesel fleets globally. As modern heavy-duty vehicles have operational lifespans stretching over a decade, the installed base of SCR-equipped engines continues to grow, ensuring sustained aftermarket demand. Furthermore, governments are increasingly linking vehicle registration and operational permits directly to the maintenance and functionality of emission control systems, including the correct usage of AdBlue, thereby institutionalizing demand. Technological drivers also include improvements in urea production efficiency and the development of specialized AdBlue blends designed for extreme climatic conditions (such as cold-weather applications), broadening the geographical market penetration. These factors collectively push the market forward, transforming AdBlue from a niche chemical into an essential operational fluid.

Conversely, significant restraints include the volatility of global urea prices, which directly impacts the production cost of AdBlue, creating margin pressure for manufacturers and price instability for end-users. The perception of AdBlue as an additional operational expense, especially in price-sensitive developing markets, presents a psychological barrier, though the regulatory penalty for non-compliance often outweighs the fluid cost. Opportunities are strongly linked to the expansion of dispensing infrastructure, particularly the installation of AdBlue pumps at commercial trucking stops and public fueling stations in newly developing highway corridors. Moreover, specialized packaging solutions and the rise of smart, subscription-based replenishment services offer avenues for maximizing customer convenience and capturing recurring revenue. The fundamental impact force dictating market survival and growth is the continuous legislative momentum aimed at reducing urban air pollution, guaranteeing the long-term relevance of NOx reduction technologies across all diesel applications.

Segmentation Analysis

The AdBlue market segmentation provides a critical view of consumption patterns, supply logistics, and target end-users, differentiating demand across various vehicle types, packaging formats, and distribution channels. The structure is primarily delineated by the vehicle category, highlighting the significant volume disparity between the heavy-duty commercial sector (highest volume consumer) and the passenger vehicle segment (highest frequency, lower volume consumer). Furthermore, segmentation by packaging type dictates the complexity of the supply chain, ranging from large, industrial ISO containers requiring specialized handling to small, convenient retail canisters. Analyzing these segments is essential for stakeholders to optimize production batch sizes, distribution logistics, and marketing strategies, ensuring alignment with the specific operational needs of diverse customer groups, such as individual car owners, municipal transit authorities, and global shipping companies.

- By Application/End-User:

- Commercial Vehicles (Heavy-Duty Trucks, Buses, Light Commercial Vehicles)

- Passenger Vehicles (Diesel Cars and SUVs)

- Non-Road Mobile Machinery (NRMM) (Construction Equipment, Agricultural Machinery, Mining Equipment)

- Railways and Marine (Locomotives, Inland Waterways Vessels, Ocean-going Ships)

- Industrial (Stationary Diesel Engines, Generators)

- By Packaging Type:

- Canisters (1, 5, 10, 20 Liter)

- Drums and Intermediate Bulk Containers (IBCs) (200, 1000 Liter)

- Bulk (Tanker Load and Depot Supply)

- By Distribution Channel:

- Retail Outlets (Gas Stations, Hypermarkets, Auto Stores)

- OEM Networks and Dealerships

- Fleet Operators and Bulk Suppliers (Direct to Fleet)

- Online Sales Channels

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For AdBlue Market

The AdBlue value chain initiates with the upstream sourcing of high-purity urea, a petrochemical derivative, followed by the rigorous manufacturing process involving blending with demineralized water according to the ISO 22241 specification. Upstream complexity is centered on securing consistent, high-quality urea supply, as industrial-grade urea is unsuitable due to trace mineral contamination that could damage SCR catalysts. Major fertilizer and chemical producers often form strategic alliances or integrate vertically to ensure the necessary purity levels are maintained. Midstream activities involve the conversion process, certified quality control testing, and packaging into diverse formats, ranging from bulk storage in ISO tanks to sophisticated small-volume retail canisters. The necessity of maintaining non-contaminating handling equipment throughout this stage is paramount.

The downstream segment focuses heavily on logistics and distribution, tailored to meet varying customer demands. Distribution channels are bifurcated into direct and indirect routes. Direct sales typically involve bulk deliveries via specialized tankers equipped with stainless steel components to large-scale fleet depots, industrial sites, and wholesale fuel stations, often managed through dedicated supply contracts. This channel prioritizes volume efficiency and reduced unit costs. Indirect channels, essential for the aftermarket and passenger vehicles, rely on extensive networks of retailers, automotive parts stores, and Original Equipment Manufacturer (OEM) dealership services, where packaged AdBlue (drums and canisters) is stocked. The high-volume, low-margin nature of the product necessitates highly optimized, localized distribution centers to minimize transport costs relative to the fluid's inherent value.

The distribution landscape is characterized by increasing reliance on digital tracking and smart inventory management, particularly for bulk customers. The choice of distribution channel significantly impacts pricing; direct bulk sales offer the lowest cost per liter, while retail canisters command higher margins due to packaging and convenience. Competition in the downstream segment is intense, driving continuous pressure on logistics providers to enhance service reliability and product accessibility. Successful market players strategically manage a hybrid distribution model, balancing the profitability of high-margin retail sales with the guaranteed volume and stability provided by long-term bulk supply contracts to major commercial fleets. The entire chain is audited periodically to ensure the temperature stability and purity of the reductant solution are maintained until the point of dispensing.

AdBlue Market Potential Customers

Potential customers for the AdBlue market are primarily defined by the ownership and operation of diesel engines equipped with Selective Catalytic Reduction (SCR) technology across multiple sectors. The largest and most strategically important segment comprises major commercial trucking and logistics companies, which consume vast quantities of AdBlue through centralized fleet depots, necessitating bulk supply contracts and specialized dispensing equipment. These customers are highly sensitive to supply reliability and product purity, as engine downtime due to SCR system failure results in significant financial losses. Urban public transportation authorities, managing municipal bus fleets that operate in dense regulatory environments, also represent critical high-volume buyers seeking uninterrupted supply chains and robust compliance documentation.

The second major category includes the Non-Road Mobile Machinery (NRMM) sector, encompassing agricultural enterprises, large-scale construction firms, and mining operations. These end-users typically operate high-horsepower engines intermittently or in remote locations, demanding reliable supply via Intermediate Bulk Containers (IBCs) or localized tank storage. The integration of stringent emission controls (e.g., Tier 4 Final, Stage V) in off-road equipment has rapidly expanded this customer base. Furthermore, individual owners of modern diesel passenger vehicles form the retail customer base, purchasing AdBlue in smaller canisters through retail outlets and service stations, driven by convenience and immediate need for dashboard-indicated refills.

Emerging potential customer segments include the marine and railway industries. Large commercial ships and inland barges complying with sulfur and NOx emission control areas (ECAs) are adopting urea injection systems, transforming ports and marine bunkering operations into specialized AdBlue supply points. Similarly, railway companies upgrading their locomotive fleets to modern, emission-compliant diesel engines represent a significant, though specialized, bulk consumer. These diverse customer needs dictate the product's packaging, distribution infrastructure investment, and the specialized technical support required by suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yara International ASA, BASF SE, Shell Plc, TotalEnergies SE, Cummins Inc., CF Industries Holdings Inc., GreenChem, Brenntag SE, Borealis AG, Blue Sky Industrial, Air Liquide, Kemetyl Group, Mitsui Chemicals, Inc., Nissan Chemical Corporation, ADX International, Colonial Chemical, China Petrochemical Corporation (Sinopec), NOVAX, Razi Petrochemical Co., and Kruse Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AdBlue Market Key Technology Landscape

The technology landscape in the AdBlue market is bifurcated into manufacturing purity standards and the sophisticated dosing and monitoring systems utilized in the vehicle. On the manufacturing side, the critical technology revolves around ultra-pure urea production and deionization processes necessary to meet the stringent specifications of ISO 22241. Any deviation in mineral or metallic content can severely poison the platinum-based catalytic converter, necessitating advanced filtration and quality control testing, including spectroscopy and high-performance liquid chromatography, to ensure batch consistency. Furthermore, storage and handling technologies are crucial, focusing on materials science to prevent contamination—stainless steel is standard—and specialized filling equipment to avoid introducing particulates during packaging and dispensing.

Within the vehicle, the technology is centered on the Selective Catalytic Reduction (SCR) system itself. Key components include the AdBlue tank (often heated to prevent freezing at -11°C), the metering or dosing unit (which precisely injects the fluid into the exhaust stream based on real-time engine operating parameters such as temperature and NOx sensor readings), and the post-treatment catalyst. Technological advancements are focused on improving the efficiency and reliability of the dosing unit, moving towards airless or integrated dosing pumps that reduce complexity and maintenance. Modern SCR systems also incorporate sophisticated diagnostic technology—often leveraging AI and machine learning through the vehicle's telematics unit—to monitor dosing rates and catalyst efficiency, ensuring continuous compliance with OBD (On-Board Diagnostics) regulatory requirements.

A significant area of current technological development is infrastructure deployment and smart logistics. This includes the implementation of smart tank monitoring systems (often wireless, connected devices) that track inventory levels at customer depots, allowing suppliers to employ automated, predictive replenishment schedules. Dispensing technology at fuel stations is also advancing, with integrated flow meters and temperature controls ensuring the correct amount of fluid is dispensed without risk of freezing or crystallization in the nozzle system. Overall, the technological trajectory is moving towards greater integration between the fluid quality verification, the vehicle's consumption monitoring, and the supplier’s logistics planning, creating a seamless, compliant operational environment for diesel fleets.

Regional Highlights

- Europe: Regulatory Pioneer and Mature Market

Europe holds a dominant position in the global AdBlue market, primarily due to the early and strict implementation of Euro VI emission standards for all commercial and passenger vehicles. This regulatory environment created a substantial installed base of SCR-equipped vehicles, guaranteeing consistent, high-volume demand. The market here is highly mature, characterized by established distribution networks, strong infrastructure (ubiquitous AdBlue pumps at fuel stations), and intense competition among major petrochemical companies and dedicated AdBlue specialists. Furthermore, Europe leads in the adoption of AdBlue for Non-Road Mobile Machinery (NRMM) under Stage V regulations, significantly expanding the addressable market beyond traditional on-road transport. The focus is on logistics optimization, certified quality (VDA certification is crucial), and supplying bulk volumes directly to the expansive logistics hubs critical to the European supply chain network.

Germany, France, and the UK are the core consumption centers, reflecting their dense industrial activity and stringent urban air quality controls. The trend in Europe is shifting towards utilizing telematics and automated supply management systems, especially for large haulage fleets traversing multiple countries. This ensures regulatory compliance across different national jurisdictions. While the long-term threat of diesel phase-out exists, the sheer size and operational necessity of the existing diesel fleet in sectors like construction, agriculture, and logistics ensure that Europe will remain the largest contributor to market revenue throughout the forecast period. Expansion of low-emission zones (LEZs) across European cities further reinforces the necessity of using compliant fluids.

- North America (DEF Market): Standardized and Highly Concentrated

North America, where AdBlue is known as Diesel Exhaust Fluid (DEF), is characterized by the Environmental Protection Agency’s (EPA) 2010 mandates, primarily targeting heavy-duty highway trucks. The vast geography necessitates robust logistics and decentralized production facilities, focusing heavily on bulk transport and large storage solutions at major trucking hubs. The U.S. commercial fleet sector is the single largest consumer in the region, demanding high reliability and consistent supply to minimize downtime on long-haul routes. The market benefits from highly standardized OEM requirements and is less fragmented than Europe, often dominated by major fuel distributors and specialized chemical companies.

Recent growth drivers include the expansion of DEF usage into medium-duty trucks and increasing adoption in off-highway sectors such as mining and oil exploration equipment, which must comply with local and federal air quality rules. A key difference from Europe is the emphasis on integrated fleet solutions, where DEF consumption is often bundled with fuel cards and maintenance contracts. Maintaining supply chain resilience across extreme climate variations, from the freezing Midwest to the hot Southwest, necessitates advanced technical solutions, including temperature-controlled storage and specialized DEF formulations designed for freeze-thaw cycles.

- Asia Pacific (APAC): High-Growth Engine Driven by Regulatory Catch-Up

The Asia Pacific region, particularly China and India, represents the fastest-growing market globally. This exponential growth is directly linked to the rapid implementation of stringent emission standards, such as China VI and Bharat Stage VI (BS VI) in India, which require the immediate adoption of SCR technology for all new diesel vehicles. The sheer volume of newly manufactured commercial vehicles and the expansion of national highway infrastructure are catalyzing demand. China is the single largest potential consumer market, driven by its immense logistics sector and stringent national environmental policies aimed at reducing urban smog.

The APAC market, however, faces significant challenges related to establishing widespread quality control and distribution infrastructure in highly dispersed geographical areas. Price sensitivity is higher, leading to a focus on efficient, local manufacturing of AdBlue to minimize transportation costs. Opportunities abound in building out the retail infrastructure and educating fleet operators on the risks associated with non-compliant fluids. The transition of existing fleets and the high concentration of manufacturing output make APAC the strategic focal point for global market expansion and investment over the coming decade.

- Latin America (LATAM): Emerging Markets and Infrastructure Challenges

The LATAM market is nascent but shows significant potential, primarily driven by Brazil and Mexico, which are gradually aligning their emission standards (such as PROCONVE P7/P8 in Brazil) with European and North American mandates. Consumption is currently concentrated in major urban centers and key logistics corridors, with demand driven mainly by new heavy commercial vehicle imports equipped with SCR. Challenges include establishing standardized distribution networks, managing logistical complexities across varied terrain, and combatting economic volatility which can affect fleet turnover rates and investment in modern compliant vehicles.

Market development is characterized by a gradual shift from centralized, localized supply to expanding the network of public dispensing points. International suppliers often partner with local petrochemical companies to manage production and distribution, navigating country-specific regulatory requirements and high import tariffs on raw materials. The agricultural sector, crucial in Brazil and Argentina, is becoming an increasingly important customer base as emission controls expand to off-road equipment.

- Middle East and Africa (MEA): Limited Adoption with Future Potential

The MEA market is currently the smallest consumer segment, characterized by slower adoption of stringent emission standards, except for specific GCC nations and South Africa, which have implemented regulations comparable to Euro IV/V. Consumption is concentrated in logistics hubs, major construction projects, and high-quality imports of European and Japanese diesel vehicles. Low domestic regulatory pressure in many African nations means older, non-SCR diesel engines are still prevalent, limiting current AdBlue penetration.

Future growth potential is tied to large-scale infrastructure projects requiring modern, compliant construction equipment and increasing regulatory harmonization across the GCC bloc. Key growth strategies focus on establishing supply points in major ports and logistics corridors serving international transport and maritime clients. The hot climate requires specialized storage solutions to prevent urea decomposition, demanding investment in robust, temperature-stable infrastructure by suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AdBlue Market.- Yara International ASA

- BASF SE

- Shell Plc

- TotalEnergies SE

- Cummins Inc. (Through their Fleetguard and related divisions)

- CF Industries Holdings Inc.

- GreenChem

- Brenntag SE

- Borealis AG

- Blue Sky Industrial

- Air Liquide

- Kemetyl Group

- Mitsui Chemicals, Inc.

- Nissan Chemical Corporation

- ADX International

- Colonial Chemical

- China Petrochemical Corporation (Sinopec)

- NOVAX

- Razi Petrochemical Co.

- Kruse Group

- AdBlue Production (Pty) Ltd.

- AUS Blue

- Pinnacle Oils

- HCFP (Hydrocarbon Field Production)

- Innospec Inc.

- Dynaflex

- Oil & Gas Company (OGC) DEF

Frequently Asked Questions

Analyze common user questions about the AdBlue market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the AdBlue market?

The primary driver is the global implementation and stringent enforcement of modern diesel emission standards (e.g., Euro VI, EPA 2010, BS VI). These mandates require new diesel vehicles, especially heavy commercial trucks and buses, to utilize Selective Catalytic Reduction (SCR) technology, making AdBlue usage mandatory for regulatory compliance.

Is there a difference between AdBlue and Diesel Exhaust Fluid (DEF)?

No, AdBlue is the registered trade name used predominantly in Europe, while DEF (Diesel Exhaust Fluid) is the common name used in North America. Both are identical, highly pure aqueous urea solutions (32.5% urea) manufactured and certified to the international quality standard ISO 22241 to ensure optimal performance in SCR systems.

How does the quality of AdBlue impact vehicle performance and maintenance costs?

Using low-quality or contaminated AdBlue that does not meet ISO 22241 specifications can lead to the formation of harmful deposits and crystallization within the SCR system, causing severe damage to the catalyst, dosing unit, and injectors. This results in costly repairs, engine derating, and potential regulatory fines for non-compliance, emphasizing the importance of sourcing certified products.

Which geographical region exhibits the fastest anticipated growth in AdBlue consumption?

The Asia Pacific (APAC) region, driven predominantly by China and India, is projected to show the fastest growth rate. This rapid expansion is a direct result of the recent and widespread adoption of equivalent stringent emission standards (China VI and BS VI) across their immense, growing fleets of commercial vehicles and infrastructure development projects.

What are the key logistical challenges faced by AdBlue suppliers?

Key challenges include managing the high volume and weight of the product (67.5% water), which increases transportation costs; the necessity of maintaining stringent temperature control to prevent freezing or decomposition; and the strategic requirement for extensive, non-contaminating dispensing infrastructure across wide geographical areas to support large commercial fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- AdBlue Market Statistics 2025 Analysis By Application (Transport companies, Public transportation, Mining/ Construction, Agriculture, Marine, Passenger vehicles), By Type (Below 20 L, 20L-200L, 200L-1000L), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Adblue Dispensers Market Statistics 2025 Analysis By Application (Retail Location, Commercial Location), By Type (One-side Type, Doubel-side Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Adblue Filling Machines Market Statistics 2025 Analysis By Application (Retail Location, Commercial Location), By Type (One-side Type, Doubel-side Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Adblue Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (<10 L, 10L~200L, 200L~1000L), By Application (Public Transportation, Mining/Construction, Agriculture), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager