Adult Disposable Diaper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431582 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Adult Disposable Diaper Market Size

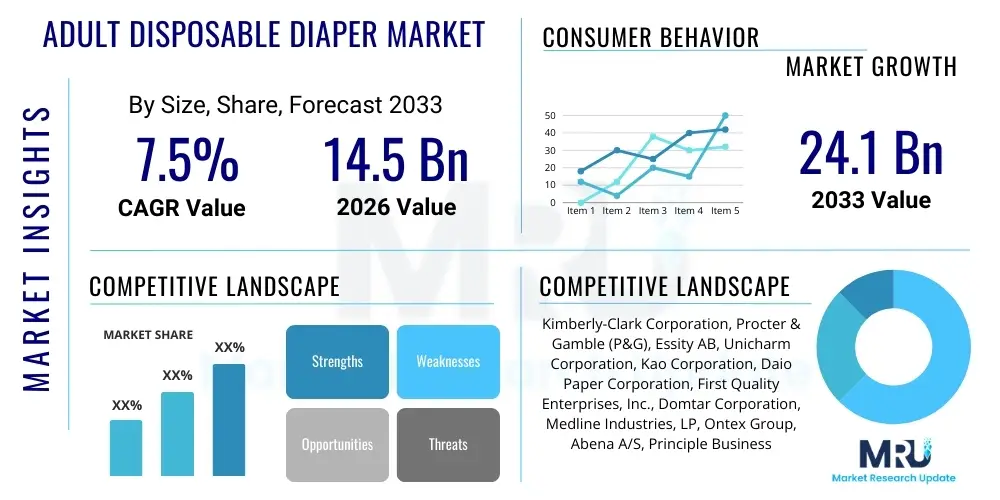

The Adult Disposable Diaper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $24.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by accelerating global demographic shifts, primarily the rapid increase in the elderly population across developed and developing economies, which correlates directly with higher prevalence rates of urinary and fecal incontinence. Furthermore, enhanced public awareness campaigns regarding incontinence management and reduced social stigma are contributing significantly to increased product adoption rates among target consumers.

Adult Disposable Diaper Market introduction

The Adult Disposable Diaper Market encompasses absorbent products designed for individuals experiencing bladder or bowel control issues, primarily due to aging, chronic health conditions, or mobility impairment. These products, ranging from large briefs to protective underwear and absorbent pads, are crucial components of medical care and personal hygiene, significantly enhancing the quality of life and dignity for millions globally. The market is characterized by ongoing innovation focused on improving core absorbency capabilities, optimizing fit and discretion, and integrating advanced features like odor neutralization and moisture indicators.

The primary applications of adult disposable diapers span clinical settings such as hospitals, long-term care facilities, and, most prominently, the rapidly expanding homecare segment. Benefits derived from these products include effective leakage protection, skin health preservation by managing moisture, and enabling users to maintain active lifestyles with confidence. The engineering focus is shifting towards more sustainable materials and ergonomic designs that mimic regular underwear, addressing both environmental concerns and user comfort.

Key driving factors underpinning market growth include the exponential growth in the 65+ age demographic, particularly in regions like Asia Pacific and North America; the rising incidence of chronic diseases such as diabetes, stroke, and obesity, which contribute to incontinence; and significant technological advancements in Super Absorbent Polymers (SAPs) and breathable materials that improve product performance. Additionally, evolving consumer attitudes favoring self-care and professional management of incontinence, coupled with improved availability through diverse retail and e-commerce channels, further catalyze market expansion.

Adult Disposable Diaper Market Executive Summary

The Adult Disposable Diaper Market exhibits strong momentum, fundamentally characterized by a robust shift from traditional, bulky briefs toward high-performance protective underwear, which offers enhanced mobility and discretion, catering primarily to active seniors. Major business trends revolve around intense competition among key players focusing on product premiumization through superior material science—specifically, maximizing thinness while maintaining high absorption capacity. Furthermore, consolidation within the supply chain and vertical integration by leading manufacturers are notable strategic movements aiming to secure raw material supplies and optimize production costs. Sustainability mandates are also reshaping manufacturing processes, pushing companies toward biodegradable components and responsible sourcing practices.

Regionally, the market presents a clear dichotomy: North America and Europe represent mature markets defined by high consumer spending power, established reimbursement structures, and incremental growth focused on innovation in smart diaper technology and specialty clinical products. Conversely, the Asia Pacific (APAC) region is the engine of volumetric growth, driven by massive demographic shifts in countries like China and India, coupled with rapidly expanding healthcare infrastructure and increasing disposable incomes, leading to higher penetration rates, particularly in the emerging middle-class segment.

Segmentation trends highlight the dominance of the protective underwear category due to shifting consumer preference towards convenience and dignity, overshadowing traditional flat-style products. The distribution landscape is undergoing a digital transformation, with e-commerce channels experiencing unprecedented growth. This shift is highly beneficial for end-users seeking privacy, bulk purchasing options, and subscription models, thus disrupting traditional brick-and-mortar retail dominance and enabling smaller, specialized brands to gain significant market share through targeted online marketing efforts.

AI Impact Analysis on Adult Disposable Diaper Market

User queries regarding AI’s impact on the Adult Disposable Diaper Market primarily center on three areas: optimizing supply chain logistics and inventory management for sensitive medical products, developing smart diaper technology for remote patient monitoring, and personalizing product recommendations based on individual incontinence severity and lifestyle. Users are highly interested in how predictive maintenance and demand forecasting, powered by machine learning algorithms, can prevent stockouts in institutional settings and ensure timely delivery to homecare users. Furthermore, there is significant anticipation regarding how AI-driven analysis of sensor data from smart diapers can provide real-time health insights to caregivers, improving skin health outcomes and reducing the frequency of changes, thereby cutting costs and labor.

The application of Artificial Intelligence within this sector is poised to revolutionize manufacturing efficiency and significantly enhance end-user personalized care. In manufacturing, AI models are optimizing material consumption, particularly the use of high-cost Super Absorbent Polymers, through predictive quality control systems that minimize defects. On the clinical side, AI algorithms analyzing patient-specific data (mobility levels, fluid intake patterns, medical history) will refine product fitting and type selection, moving away from generic recommendations towards tailored absorbent solutions, thereby increasing user satisfaction and clinical efficacy.

The integration of AI, particularly in sophisticated logistic planning and pattern recognition within sensor data, addresses critical market challenges such as waste management and labor shortages in long-term care facilities. By accurately predicting the optimal change time for a user—rather than relying on fixed schedules—AI systems minimize unnecessary changes, reducing costs and caregiver burnout. This shift transforms the product from a simple absorbent material into a data-generating medical tool, leading to entirely new revenue streams focused on continuous health monitoring and preventive care, creating competitive advantages for technologically advanced companies.

- AI-driven Demand Forecasting: Optimizing regional inventory levels and predicting purchasing patterns in the sensitive homecare segment.

- Manufacturing Optimization: Utilizing machine learning for predictive maintenance on production lines and enhancing quality control of material integration (SAPs, non-wovens).

- Smart Diaper Data Analysis: Processing sensor data (moisture, temperature, ammonia levels) to alert caregivers and predict potential skin issues or UTIs.

- Personalized Product Recommendation: AI platforms suggesting specific product types, sizes, and absorbency levels based on user profile and clinical data, enhancing user satisfaction.

- Supply Chain Resilience: Machine learning models predicting raw material price fluctuations and sourcing risks (fluff pulp, polymers) to ensure stable production.

DRO & Impact Forces Of Adult Disposable Diaper Market

The Adult Disposable Diaper Market dynamics are governed by powerful demographic tailwinds acting as primary drivers, countered by persistent socio-economic constraints and disposal challenges, while technological innovations offer significant future opportunities. The fundamental driver remains the burgeoning global geriatric population, which dictates sustained volume growth, alongside increased healthcare expenditure in emerging markets. Restraints largely center on the environmental footprint of non-biodegradable components, generating pushback from regulatory bodies and environmentally conscious consumers, alongside the financial burden on self-paying users, leading to high price sensitivity in certain market segments. Opportunities are significant, particularly in the development and commercialization of next-generation sustainable materials and the integration of IoT for sophisticated patient monitoring, transforming absorbent hygiene products into diagnostic tools.

Key impact forces shaping this market include the pervasive influence of social stigma, which, despite recent public awareness efforts, continues to restrain adoption rates among younger or moderately incontinent individuals who often seek less obvious solutions or delay seeking care. Furthermore, governmental regulations pertaining to medical device classification, particularly concerning new smart diaper technology, dictate market entry and testing complexity. Economic stability is also a critical force; in regions with limited insurance coverage, disposable diapers represent a significant out-of-pocket expense, making the market highly susceptible to pricing strategies and the proliferation of low-cost local competitors, especially in developing economies.

The interplay between these forces necessitates careful strategic positioning by market participants. Companies must balance the high cost associated with premium features (enhanced breathability, superior absorption cores) required by aging populations in affluent nations against the need for cost-effective, high-volume production for rapidly growing Asian markets. Addressing the environmental restraint through investment in bio-based polymers and circular economy initiatives is becoming non-negotiable for maintaining brand reputation and securing long-term market access in Western economies. The strategic pursuit of advanced technology integration (smart sensors) presents the strongest opportunity for differentiation and establishing a higher value proposition in a commoditizing product category.

Segmentation Analysis

The Adult Disposable Diaper Market is comprehensively segmented based on product type, end-user, and distribution channel, reflecting the varied needs of the incontinent population globally. Product segmentation distinguishes between bulky, high-capacity products (Adult Diapers/Briefs) typically used in bedridden or severe incontinence cases, and more discrete, mobility-focused options (Protective Underwear and Pads/Guards). This segmentation directly correlates with the user's level of physical activity and severity of incontinence, with protective underwear currently experiencing the fastest growth due to the desire for normalcy and independence among active seniors.

End-user segmentation clearly demarcates the shift from institutional care to decentralized homecare. While hospitals and nursing homes traditionally represented the largest buyers, the transition of long-term care into home settings, accelerated by technological advancements and cost pressures, has propelled the Homecare segment to prominence. Homecare users, often purchasing directly or via subscription, prioritize comfort, discretion, and reliable performance, influencing product design towards premium features and user-friendly packaging. Institutional procurement, conversely, remains highly sensitive to bulk pricing and standardized efficacy required for large-scale application.

Distribution channel analysis reveals a critical shift from traditional pharmacy and retail outlets towards specialized medical supply stores and, most dynamically, e-commerce platforms. E-commerce offers unparalleled convenience, the ability to discreetly manage recurring purchases (subscriptions), and access to a wider range of specialized products not stocked in mass retail. This digital shift has lowered barriers for direct-to-consumer brands and provided consumers with enhanced price transparency and product comparison capabilities, fundamentally altering traditional retail market share dynamics.

- Product Type:

- Adult Diapers (Briefs)

- Protective Underwear (Pull-ups)

- Pads and Liners (Guards)

- Others (Underpads, Boosters)

- End-User:

- Hospitals and Clinics

- Nursing Homes and Long-Term Care Facilities

- Homecare

- Distribution Channel:

- Retail Stores (Supermarkets, Pharmacies)

- Institutional Sales

- E-commerce and Online Pharmacies

- Incontinence Level:

- Light Incontinence

- Moderate Incontinence

- Severe Incontinence

Value Chain Analysis For Adult Disposable Diaper Market

The value chain for adult disposable diapers is complex and highly dependent on specialized raw materials, characterized by high-volume manufacturing and varied distribution channels. The upstream segment involves the procurement of key materials, dominated by fluff pulp (sourced from timber) for absorbency layers, non-woven fabrics (often polypropylene derivatives) for topsheets and backsheets, and high-performance Super Absorbent Polymers (SAPs) for core liquid retention. The cost and supply stability of these materials, particularly SAPs, which are often petrochemical-derived, significantly influence downstream production costs and product innovation cycles, making strategic sourcing and long-term contracts crucial for major manufacturers.

The midstream phase involves capital-intensive, high-speed automated manufacturing and assembly. This stage is dominated by large multinational companies that leverage economies of scale and sophisticated machinery to ensure consistent quality and minimize production defects. Effective process engineering focusing on waste minimization and energy efficiency is paramount. Quality control procedures, especially concerning bond strength, leak guards, and consistent application of SAP, are critical given the medical-grade nature of the product, requiring strict compliance with global health and safety standards.

The downstream involves multifaceted distribution and sales. The distribution channel is bifurcated into institutional (direct sales to hospitals and nursing homes) and retail/consumer channels (direct and indirect). Institutional sales are driven by tenders, volume discounts, and clinical credibility. Conversely, the indirect channel, particularly e-commerce, is expanding rapidly due to consumer demand for discretion and subscription models. Direct marketing and brand recognition play an essential role in the final segment, influencing end-user choice, as consumers often seek trusted brands for sensitive personal care needs.

Adult Disposable Diaper Market Potential Customers

The primary end-users and buyers in the Adult Disposable Diaper Market are multifaceted, spanning individual consumers managing personal health issues, professional caregivers, and large institutional purchasers focused on bulk operational needs. The largest and fastest-growing segment of potential customers comprises aging individuals (65+) living independently who seek products that integrate seamlessly into their daily lives, prioritizing discretion, comfort, and advanced features like odor control. This group often dictates a premiumization trend, favoring protective underwear and high-performance pads purchased through online channels.

Institutional customers, including hospitals, nursing homes, and assisted living facilities, represent another major segment. These buyers focus heavily on cost-effectiveness, bulk availability, standardized product lines that simplify inventory management, and reliable clinical performance to minimize secondary health risks like pressure ulcers. Their procurement decisions are often influenced by clinical liaison feedback and cost-per-use metrics, making them a crucial target for manufacturers offering integrated solutions and training services.

A third significant customer base includes individuals with specific chronic neurological or physical conditions (e.g., spinal cord injuries, Alzheimer's disease, post-surgery recovery) who require high-absorbency briefs, often procured by family members or home healthcare providers. The decision-makers in this segment often prioritize maximum absorption capacity, skin compatibility, and ease of application by a caregiver. The growing reliance on subscription services and specialized medical suppliers for ongoing needs underscores the importance of accessibility and reliability for these essential end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $24.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimberly-Clark Corporation, Procter & Gamble (P&G), Essity AB, Unicharm Corporation, Kao Corporation, Daio Paper Corporation, First Quality Enterprises, Inc., Domtar Corporation, Medline Industries, LP, Ontex Group, Abena A/S, Principle Business Enterprises, DSG International, Nobel Hygiene Ltd., Drylock Technologies, Hengan International Group Company Limited, Futuro Healthcare, TZMO SA, Hartmann Group, Coloplast A/S. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adult Disposable Diaper Market Key Technology Landscape

The Adult Disposable Diaper Market relies heavily on continuous innovation in material science and smart technology integration to meet evolving consumer demands for discretion, higher capacity, and skin health. The core technology centers around advanced Super Absorbent Polymers (SAPs), which have evolved significantly to hold greater volumes of liquid while maintaining a slim profile, directly addressing the key restraint of bulkiness. Modern SAP formulations are optimized for rapid absorption and effective fluid distribution, preventing clumping and ensuring uniform saturation, which is critical for long wear times and skin integrity. Furthermore, advancements in breathable backsheet technology, utilizing micro-perforated films and non-woven fabrics, are essential for air circulation, reducing humidity buildup, and mitigating the risk of skin irritations and pressure ulcers, particularly for bedridden patients.

Beyond material science, the most disruptive technological trend is the development and commercialization of "smart diapers." These products integrate embedded electronic sensors—often printed electronics or conductive fibers—that detect the presence and volume of urine or feces. When a threshold is met, the sensor communicates wirelessly (via Bluetooth or NFC) with a mobile application or caregiver alert system. This technology fundamentally shifts caregiving from scheduled changes to needs-based intervention, optimizing labor allocation in institutional settings and providing crucial data for remote patient monitoring in homecare. These systems also track saturation rates over time, allowing caregivers to monitor fluid output trends, which is valuable for clinical assessment.

Further technological refinement includes the development of environmentally conscious materials, such as bio-based and biodegradable non-woven materials, and the incorporation of advanced odor neutralization systems. These systems often utilize activated carbon or complex molecular encapsulations rather than simple perfumes, addressing a major psychological barrier to product adoption. The focus on sustainability—from cradle-to-gate material sourcing to end-of-life disposal—is driving significant R&D investment, aiming to create a product that aligns with regulatory pressures and modern environmental expectations without compromising performance attributes crucial for user dignity and health management.

Regional Highlights

- Asia Pacific (APAC): APAC is the engine of volumetric market expansion, driven by the sheer scale of its aging population (especially in China, Japan, and South Korea) and rapidly increasing healthcare access and disposable income across Southeast Asia. Japan currently holds the highest per capita consumption globally. The region is characterized by high price sensitivity outside of established economies, necessitating strategies focused on cost-efficient high-volume production, while simultaneously developing premium products for urban, affluent consumers.

- North America: North America represents a mature, high-value market defined by high product penetration and consumer willingness to pay for premium, discreet, and technologically advanced products (including smart diapers). Growth is steady, driven by advancements in chronic disease management and the expansive home healthcare sector. The regulatory environment is well-established, and competitive strategies emphasize brand loyalty, digital distribution dominance, and clinical partnerships.

- Europe: The European market is characterized by high awareness, robust regulatory standards, and a strong focus on sustainability. Countries in Western Europe, particularly Germany and Scandinavia, exhibit high adoption rates and advanced procurement systems, often involving national health services or extensive private insurance coverage. The market shows a strong preference for eco-labeled and clinically validated products, pushing manufacturers towards advanced material science and circular economy models.

- Latin America (LATAM): LATAM is an emerging growth region, benefiting from improved economic conditions and a nascent but growing awareness of incontinence management. Market growth is substantial but volatile, highly influenced by economic stability and currency fluctuations. The focus is primarily on affordable, high-quality basic products, with institutional purchasing still forming a significant portion of the market volume, although the middle class is increasingly driving retail demand.

- Middle East and Africa (MEA): MEA remains the smallest market but offers potential in specific urban centers and high-income countries within the GCC (Gulf Cooperation Council). Market penetration is relatively low, restrained by cultural factors and limited healthcare access outside major metropolitan areas. Growth is expected to be concentrated in clinical and institutional settings initially, with consumer demand rising as healthcare infrastructure and disposable incomes continue to improve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adult Disposable Diaper Market.- Kimberly-Clark Corporation

- Procter & Gamble (P&G)

- Essity AB

- Unicharm Corporation

- Kao Corporation

- Daio Paper Corporation

- First Quality Enterprises, Inc.

- Domtar Corporation

- Medline Industries, LP

- Ontex Group

- Abena A/S

- Principle Business Enterprises

- DSG International

- Nobel Hygiene Ltd.

- Drylock Technologies

- Hengan International Group Company Limited

- Futuro Healthcare

- TZMO SA

- Hartmann Group

- Coloplast A/S

Frequently Asked Questions

Analyze common user questions about the Adult Disposable Diaper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Adult Disposable Diaper Market?

The market growth is primarily driven by the exponential global increase in the geriatric population (aged 65 and above), which directly correlates with the rising prevalence of urinary and fecal incontinence. Secondary drivers include improved consumer awareness, reduced social stigma, and continuous innovation in product performance and discretion, encouraging higher adoption rates among the target demographic.

How is technology influencing the performance and design of adult diapers?

Technology is significantly advancing product design through the use of highly efficient Super Absorbent Polymers (SAPs) for thinner, yet higher-capacity cores. Crucially, the introduction of smart diapers with embedded sensors provides real-time moisture monitoring, enabling caregivers to optimize change schedules, thereby enhancing user skin health and reducing care labor costs.

Which product segment holds the highest growth potential in the forecast period?

Protective Underwear (Pull-ups) holds the highest growth potential. This category is favored by active seniors due to its resemblance to conventional underwear, offering maximum discretion, comfort, and mobility compared to traditional briefs, aligning with the strong market trend toward normalizing incontinence management.

What are the main restraints hindering the full market potential?

The primary restraints include the environmental impact of non-biodegradable components, leading to concerns about landfill waste and disposal challenges. Furthermore, the persistent social stigma associated with incontinence still prevents many individuals, particularly those with light or moderate conditions, from seeking or consistently using these essential products.

Is the Asia Pacific region expected to remain the fastest-growing market?

Yes, the Asia Pacific (APAC) region is projected to maintain the highest growth rate throughout the forecast period. This acceleration is fueled by immense demographic shifts in populous nations like China and India, where the aging population is rapidly expanding, coupled with expanding healthcare infrastructure and rising consumer purchasing power.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager