Adults Use Orthodontic Archwire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436369 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Adults Use Orthodontic Archwire Market Size

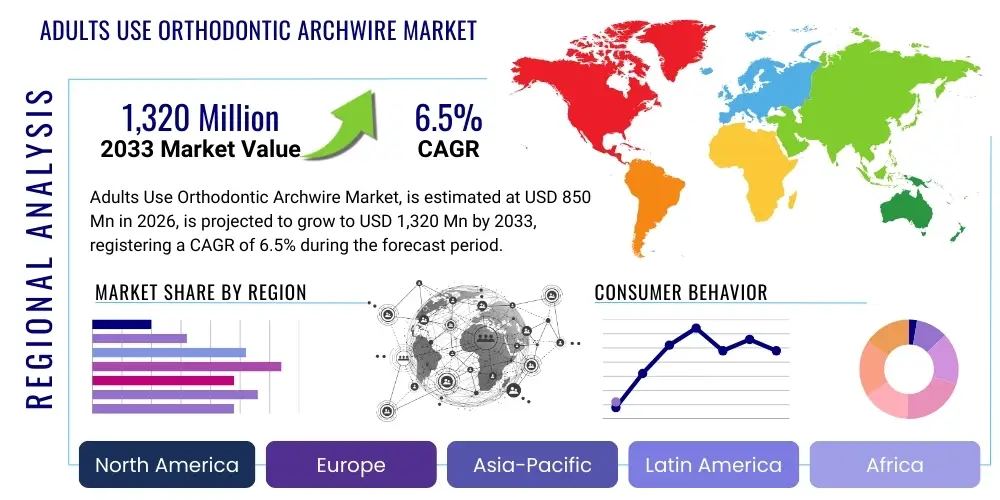

The Adults Use Orthodontic Archwire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $850 million in 2026 and is projected to reach $1,320 million by the end of the forecast period in 2033.

Adults Use Orthodontic Archwire Market introduction

The Adults Use Orthodontic Archwire Market encompasses the segment of specialized metal or non-metallic wires used in fixed orthodontic treatments specifically tailored for patients aged 18 and above. These archwires serve as the primary biomechanical tool, linking orthodontic brackets and delivering controlled, continuous forces necessary for precise tooth movement and correcting complex adult malocclusions. The distinct requirements of the adult demographic, including higher aesthetic expectations, potentially compromised periodontal structures, and pre-existing dental restorations, necessitate archwires with optimized properties, such as enhanced flexibility, reduced friction, and superior aesthetic attributes, driving material innovation particularly in nickel-titanium (NiTi) and aesthetic-coated stainless steel variants. The core function remains the translation, tipping, rotation, and intrusion of teeth, but the application emphasizes gentle, predictable force delivery to maintain patient comfort and minimize biological stress.

Product descriptions within this segment typically highlight materials like conventional stainless steel (known for strength and low cost), Nickel-Titanium (NiTi) alloys (favored for superelasticity and shape memory, crucial for initial leveling and alignment), and Beta-Titanium (TMA) wires (used primarily for intermediate and finishing mechanics due to superior formability). Major applications include comprehensive orthodontic correction for Class I, Class II, and Class III malocclusions, alignment correction prior to complex restorative dentistry, and resolving occlusal issues stemming from periodontal disease management. The demand for aesthetic archwires, often coated with polymers or rhodium, is particularly pronounced among adults seeking discreet treatment solutions that minimize the visual impact associated with traditional metallic braces, profoundly influencing procurement patterns in specialized orthodontic practices globally.

The primary benefits of modern archwires for adults include predictable force systems leading to efficient tooth movement, reduced treatment duration due to advanced material properties like thermal activation, and enhanced patient compliance derived from aesthetically pleasing options. Driving factors contributing to market expansion are the increasing global emphasis on cosmetic dentistry, higher disposable incomes allowing adults to afford specialized orthodontic care, and technological advancements such as robotic wire bending and CAD/CAM customization, which facilitate the creation of highly personalized and efficient archwire systems tailored to individual anatomical requirements and biomechanical goals. Furthermore, the growing prevalence of temporomandibular joint disorders (TMJD) requiring occlusal adjustments further contributes to the specialized need for precise archwire solutions.

Adults Use Orthodontic Archwire Market Executive Summary

The Adults Use Orthodontic Archwire Market is experiencing robust expansion, fundamentally driven by shifts in societal values placing a premium on dental aesthetics and functional longevity, complemented by significant technological evolution within dental materials science. Current business trends indicate a strong move toward customization and personalization, with manufacturers increasingly investing in digital workflow integration, enabling orthodontists to order robotically bent archwires that precisely match the patient's three-dimensional dental structure, thereby optimizing treatment efficiency and reducing material waste. Regionally, North America and Europe maintain market dominance due to high healthcare expenditure and established orthodontic infrastructure, yet the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, propelled by expanding middle-class populations, increasing awareness of orthodontic treatment benefits, and burgeoning dental tourism industries, particularly in countries like China and India.

Segment trends reveal that the Nickel-Titanium (NiTi) segment remains the largest by material type due to its unparalleled properties for initial and intermediate phases of adult treatment, offering light, continuous force systems vital for treating complex cases without excessive root resorption or discomfort. However, the aesthetic archwire segment, encompassing coated stainless steel and coated NiTi wires, is witnessing the fastest growth rate as adults prioritize invisible or low-visibility treatment options. Furthermore, the end-user segment is shifting, with specialized private orthodontic clinics constituting the primary consumers due to the complexity and high cost associated with advanced adult cases, although dental hospitals are also increasing their procurement volumes as they integrate comprehensive orthodontic departments capable of handling multi-disciplinary treatments.

The competitive landscape is characterized by established global players focusing on R&D for advanced coatings and alloy compositions, aiming to reduce friction, enhance bio-compatibility, and improve the wire’s resistance to permanent deformation. Strategic alliances and mergers are common as companies seek to expand their digital integration capabilities, linking archwire production directly to intraoral scanners and treatment simulation software. The overarching market trend emphasizes moving away from standardized, off-the-shelf products towards patient-specific solutions, positioning customization capabilities as a key competitive differentiator and accelerating the adoption of premium-priced archwires that deliver superior clinical outcomes and patient satisfaction in the increasingly demanding adult market.

AI Impact Analysis on Adults Use Orthodontic Archwire Market

User queries regarding the impact of Artificial Intelligence (AI) on the Adults Use Orthodontic Archwire Market frequently revolve around optimizing treatment planning, predicting required force systems, and automating the manufacturing process. Common concerns include: "How accurately can AI predict the ideal archwire sequence for a complex adult case?" "Will AI reduce the dependency on experienced orthodontists for wire bending?" and "What is the cost implication of AI-designed archwires?" The analysis suggests that users overwhelmingly expect AI to revolutionize the design and customization phase, particularly in optimizing archwire geometry to minimize treatment time and maximize stability. Key themes summarize around personalized biomechanics, reduced human error in prescribing forces, and faster digital integration, moving away from empirical clinical decisions towards data-driven, precise archwire prescription, which is critical given the unique challenges of adult bone density and periodontal health.

The role of AI is primarily concentrated in the pre-treatment diagnostic and planning phases, utilizing advanced machine learning algorithms to process vast datasets derived from 3D cone-eam computed tomography (CBCT) scans, intraoral scans, and cephalometric radiographs. AI algorithms can instantaneously model thousands of biomechanical scenarios, predicting tooth movement trajectories and suggesting the optimal archwire material, shape, and sequential progression required to achieve the desired outcome with maximum efficiency and minimal biological risk. This level of predictive analytics is particularly valuable in adult orthodontics where precise control of forces is paramount to prevent adverse effects such as root resorption or bone loss, thereby transforming the archwire from a standard component into a highly individualized, intelligent medical device.

Furthermore, AI significantly impacts manufacturing logistics. Integrating AI with robotic wire bending technology allows for the creation of completely customized archwires with precision unattainable through traditional manual or semi-automated methods. AI software dictates the exact forces required at specific points along the arch, translating these requirements into specific bends and torques implemented by robotic arms. This capability not only ensures mechanical accuracy but also enables mass customization, making complex, patient-specific archwires more accessible and cost-effective, thus streamlining the supply chain and ensuring that the prescribed archwire delivers the lightest possible force while achieving rapid and predictable tooth movement in sensitive adult dentitions.

- AI integration optimizes treatment planning by analyzing complex malocclusions and recommending ideal archwire sequencing.

- Predictive algorithms minimize treatment duration and reduce the risk of adverse effects like root resorption in adult patients.

- Machine learning models enhance diagnostic accuracy for defining the specific biomechanical properties required of the archwire.

- Robotic wire bending, guided by AI, facilitates the mass customization of patient-specific, precision-bent archwires.

- AI assists in quality control and material science, optimizing alloy properties for superelasticity and dimensional stability.

DRO & Impact Forces Of Adults Use Orthodontic Archwire Market

The Adults Use Orthodontic Archwire Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate market trajectory and adoption rates. Key drivers include the overwhelming global increase in aesthetic consciousness among adults, leading to a surge in demand for aesthetic orthodontic solutions, alongside substantial technological advancements in material science, particularly concerning shape memory alloys (NiTi) and low-friction coatings, which enhance clinical outcomes and patient comfort. Simultaneously, the market is restrained by the high overall cost of adult orthodontic treatment, which often requires a longer duration compared to adolescent treatment, coupled with regulatory hurdles pertaining to specialized medical devices in various jurisdictions. Opportunities mainly stem from the expanding use of customized and hybrid appliance systems, utilizing archwires in conjunction with mini-implants or clear aligner refinement phases, opening new segments for specialized, high-performance archwires, thereby creating dynamic impact forces on market expansion and innovation adoption.

Drivers are specifically centered on demographic shifts and technological maturity. The increasing longevity of the global population means more adults are seeking treatments to maintain dental function and aesthetics well into their senior years. This longevity driver is reinforced by the accessibility of information via social media and digital platforms, which destigmatizes adult orthodontic treatment and highlights successful outcomes, encouraging higher rates of patient enrollment. Furthermore, continuous material engineering focusing on bio-compatible, hypoallergenic materials and archwires that deliver ultra-low, persistent forces directly addresses the clinical challenges of adult orthodontics, positioning innovation as a central pillar of market growth. These drivers collectively exert a significant upward pressure on market valuation and product sophistication, fostering an environment where premium, specialized products gain prominence.

Conversely, significant restraints hinder rapid adoption. The requirement for specialized expertise in advanced archwire application limits the scope of treatment to highly trained orthodontists, restricting penetration in general dental practices. Moreover, competition from alternative treatment modalities, most notably clear aligner therapy, poses a substantial threat, particularly for mild to moderate adult cases, though archwires remain irreplaceable for complex biomechanical movements. Opportunities, however, present pathways for mitigation. The trend towards hybrid treatments, where clear aligners are used for initial alignment and archwires for complex finishing and torque control, represents a crucial growth area for advanced archwires. Additionally, emerging markets offer significant untapped potential for conventional and cost-effective archwires, provided manufacturers can navigate diverse regulatory landscapes and optimize distribution channels to meet localized demands effectively.

- Drivers: Growing aesthetic awareness among the adult population; technological innovation in NiTi and beta-titanium alloys; increasing disposable income globally; integration of digital orthodontics (CAD/CAM).

- Restraints: High cost and long duration of complex adult orthodontic treatments; strong competition from clear aligner systems; potential biological risks (e.g., root resorption) necessitating careful force application.

- Opportunities: Expansion into customized, robotically manufactured archwires; growth of hybrid treatments combining aligners and fixed appliances; development of advanced friction-reduction coatings; untapped market potential in developing economies.

- Impact Forces: High demand elasticity concerning aesthetics (pull factor); material science advancements (technology push); regulatory complexity (market friction); competitive substitution (market threat).

Segmentation Analysis

Segmentation of the Adults Use Orthodontic Archwire Market is critical for understanding specific demand characteristics, resource allocation, and strategic market positioning. The market is primarily segmented based on Material Type, Product Type, and End-User. Material Type is the most defining characteristic, differentiating between the conventional strength and durability of stainless steel and the advanced superelastic and thermal activation properties of Nickel-Titanium (NiTi), alongside specialized Beta-Titanium alloys used for finishing phases requiring intricate bending. Product Type segmentation distinguishes between highly utilized standardized, pre-formed archwires and the rapidly growing segment of customized, patient-specific archwires, often manufactured using robotic technology guided by 3D imaging data, which command a higher price point due to their precision and efficiency in complex adult cases.

The End-User segmentation primarily identifies specialized orthodontic clinics as the largest consumer base. These clinics handle the majority of complex adult malocclusions, demanding high-quality, specialized, and often aesthetic archwire systems. Dental hospitals and large academic institutions also represent significant, albeit secondary, segments, driven by their role in multi-disciplinary treatments, surgical orthodontics, and educational training. Understanding these segment profiles allows manufacturers to tailor their product offerings—ranging from bulk supply of standardized wires for lower-cost applications to high-margin, bespoke NiTi wires for top-tier private practices—and optimize their marketing and distribution strategies to meet the nuanced clinical and commercial requirements of each user type efficiently.

The fastest-growing segment is undeniably the customized product segment, driven by the desire for reduced treatment time and improved clinical predictability in adult patients who often have high expectations and low tolerance for prolonged treatment. Within the material segment, aesthetic archwires (coated or tooth-colored) are expected to outpace conventional metal wires due to the increasing reluctance of adults to display visible appliances, even though NiTi remains the volume leader overall. This ongoing segmentation dynamic highlights the industry's sustained pivot towards aesthetic and precision-engineered solutions that prioritize both clinical excellence and patient experience.

- By Material Type:

- Nickel-Titanium (NiTi) Archwires

- Stainless Steel Archwires

- Beta-Titanium (TMA) Archwires

- Aesthetic (Coated/Tooth-Colored) Archwires

- By Product Type:

- Pre-Formed/Standard Archwires

- Customized/Patient-Specific Archwires

- By End-User:

- Orthodontic Clinics (Specialized Private Practices)

- Dental Hospitals and Academic Institutions

- General Dental Practitioners (Limited Orthodontics)

Value Chain Analysis For Adults Use Orthodontic Archwire Market

The value chain for the Adults Use Orthodontic Archwire Market begins with the upstream procurement of highly specialized raw materials, primarily aerospace-grade metal alloys such as medical-grade stainless steel, nickel, and titanium. This stage is critical as the quality and purity of these metals directly influence the archwire's mechanical properties, including superelasticity, biocompatibility, and resistance to corrosion and permanent deformation. Key raw material suppliers, often specialized metal alloy producers, feed these materials to archwire manufacturers. The manufacturing phase involves complex processes like cold drawing, specialized heat treatment (for activating shape memory properties in NiTi), precision grinding, and, increasingly, robotic bending and advanced surface coating (e.g., rhodium or polymer coatings for aesthetic wires). Quality control is stringent here, ensuring dimensional accuracy and force consistency, which are non-negotiable for effective adult orthodontics.

The midstream section focuses on sophisticated manufacturing and packaging. For customized archwires, this phase integrates digital inputs (3D scan data and AI-driven treatment plans) to guide robotic precision forming. The distribution channel then takes precedence, moving the finished product from the manufacturer to the end-user. Direct distribution, where large global manufacturers sell directly to major orthodontic clinics or hospital chains, is common for premium, specialized products, ensuring optimal control over inventory and technical support. Indirect distribution utilizes regional or national dental supply distributors and wholesalers, providing broader market access, especially for high-volume, standardized archwires across smaller, dispersed clinics, optimizing logistical efficiency and managing inventory risk in diverse geographic locations.

Downstream analysis involves the direct interaction with the end-users: specialized orthodontists and dental clinics. The effectiveness of the value chain is ultimately measured by the clinical adoption rate and patient outcomes, requiring manufacturers to invest heavily in continuous education and technical support for orthodontists regarding the optimal use of advanced archwire systems. This highly specialized market demands robust after-sales support and continuous feedback loops connecting clinical performance data back to material R&D and manufacturing processes. The overall value addition is concentrated in the precision engineering and material science expertise applied during the manufacturing phase, resulting in a specialized medical device that dictates the success of multi-month or multi-year treatment protocols for adult patients.

Adults Use Orthodontic Archwire Market Potential Customers

The primary potential customers for Adults Use Orthodontic Archwires are highly specialized orthodontic practitioners who focus heavily on adult cases, including complex interdisciplinary treatments. These end-users require archwires that offer superior biomechanical control, highly aesthetic characteristics, and predictable force delivery to navigate the unique anatomical challenges present in adult dentition, such as compromised bone density or the presence of multiple prosthetic restorations. These private practices often prioritize premium, customized archwires, particularly those made of thermally activated NiTi and Beta-Titanium, as the efficacy and speed of treatment directly influence patient satisfaction and practice reputation, justifying the higher acquisition cost associated with personalized solutions.

Secondary but significant customers include large dental hospital networks and academic centers. These institutions often handle a high volume of complex surgical orthodontic cases and major malocclusion corrections, requiring diverse inventories of both conventional stainless steel wires for cost-effectiveness in general training, and high-performance alloys for specialized surgical segments. Their procurement processes are often centralized and volume-driven, but their clinical demands necessitate access to the full spectrum of archwire sizes, shapes, and material compositions, reflecting their role in comprehensive healthcare provision and research.

A burgeoning segment of potential customers includes General Dental Practitioners (GDPs) who are expanding their service offerings to include limited adult orthodontics, typically utilizing standardized aesthetic archwires in conjunction with pre-programmed bracket systems. While their volume per clinic is lower than specialists, their overall number contributes significantly to the market for standardized NiTi and aesthetic wires used for minor alignment corrections or cosmetic enhancements. These GDPs are highly sensitive to user-friendly systems and reliable supply chains, emphasizing the importance of indirect distribution channels for market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million |

| Market Forecast in 2033 | $1,320 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Align Technology, Dentsply Sirona, Ormco Corporation, G&H Orthodontics, American Orthodontics, GC Orthodontics, Rocky Mountain Orthodontics (RMO), TP Orthodontics, Henry Schein Inc., Forestadent, JJ Orthodontics, Dental Monitoring, Modern Arch, Great Lakes Orthodontics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adults Use Orthodontic Archwire Market Key Technology Landscape

The Adults Use Orthodontic Archwire Market is defined by continuous technological refinement aimed at improving material biomechanics and manufacturing precision. A central technology is the advancement in Nickel-Titanium (NiTi) alloys, particularly the refinement of thermal activation properties. These sophisticated shape memory alloys allow the archwire to be inserted into brackets easily while cold, and then activate its programmed shape and force delivery as it reaches oral temperature, ensuring light, biologically compatible, and continuous forces over extended periods. This technology is crucial for adult patients who require gentler force application to protect potentially fragile periodontal tissues. Furthermore, the development of high-performance Beta-Titanium (TMA) wires with improved springback and formability enables orthodontists to introduce customized finishing bends with greater ease and precision compared to traditional stainless steel, optimizing torque expression and fine-tuning occlusal relationships in the final stages of treatment.

A second major technological pillar is the widespread adoption of customized archwire manufacturing through robotic wire bending. Utilizing advanced CAD/CAM technology and three-dimensional digital models (derived from intraoral scanners), robotic arms precisely bend archwires according to a virtual treatment plan. This automation removes reliance on manual bending skill and ensures that the archwire is patient-specific, incorporating complex and precise adjustments tailored for individual tooth morphology and root positioning. This level of precision is increasingly demanded by adult patients seeking reduced treatment variability and maximum aesthetic results. Additionally, manufacturers are heavily investing in surface engineering, developing low-friction coatings (e.g., polymer, rhodium, or ion implantation) applied to both stainless steel and NiTi wires to reduce the frictional resistance between the archwire and the bracket, significantly improving sliding mechanics and accelerating tooth movement efficiency, particularly in closing extraction spaces common in complex adult cases.

The integration of digital workflow technologies, including remote monitoring and tele-orthodontics platforms, also influences archwire design and utilization. Archwires are increasingly designed to be compatible with sensors or external tracking systems that monitor treatment progression and force decay, allowing for timely adjustments and reducing unnecessary office visits. Future technological focus areas include the development of smart archwires that incorporate embedded micro-sensors to measure localized forces and temperature changes in real-time, providing unprecedented data feedback to the orthodontist. This convergence of material science, robotics, and digital informatics underscores the market's trajectory towards highly precise, data-driven, and patient-centric archwire solutions, essential for addressing the demanding clinical criteria of adult orthodontics.

Regional Highlights

The global Adults Use Orthodontic Archwire Market exhibits significant regional variations in terms of adoption rates, material preferences, and regulatory environments, influencing market revenues and future growth potential across different geographies. North America, encompassing the United States and Canada, currently holds the largest market share due to its established and sophisticated healthcare infrastructure, high per capita income leading to greater affordability of specialized adult treatments, and strong aesthetic awareness among the population. The region is characterized by high demand for premium, customized, and aesthetic archwire systems, driven by a large concentration of specialized orthodontic practices that quickly adopt innovative technologies like robotic wire bending and advanced NiTi alloys. Furthermore, favorable reimbursement scenarios and a high density of key market players contribute significantly to its market dominance and high average selling price for archwires.

Europe represents the second-largest market, exhibiting strong demand driven by robust public and private healthcare systems and stringent quality and safety standards imposed by regulatory bodies like the European Medicines Agency (EMA). Western European countries, including Germany, the UK, and France, show a high affinity for high-quality NiTi and Beta-Titanium archwires, focusing heavily on evidence-based clinical outcomes and long-term stability. The market here is mature, but continuous growth is ensured by an aging population seeking cosmetic and functional improvements, alongside ongoing technological integration, especially in Northern European countries where digital orthodontics is rapidly becoming the norm. The demand for bio-compatible and aesthetic solutions remains paramount, reflecting the sophisticated consumer base.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This rapid expansion is fueled by demographic trends, specifically massive population bases in China and India, coupled with rapid urbanization and a significant increase in disposable incomes, expanding the consumer base able to afford orthodontic treatments. While the adoption of conventional stainless steel archwires remains substantial due to cost considerations in some segments, the demand for advanced aesthetic NiTi archwires is surging among the rapidly expanding middle class in urban centers. Government initiatives aimed at improving oral health and the expansion of dental tourism further catalyze market penetration. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, but increasing awareness and investment in dental infrastructure suggest considerable untapped potential, particularly for entry-level and mid-range archwire products.

- North America: Market leader defined by high consumer spending on cosmetic treatments, early adoption of customized archwires, and substantial market presence of major global manufacturers.

- Europe: Second-largest market characterized by stringent quality standards, high demand for precision-engineered NiTi wires, and steady growth driven by demographic factors and sophisticated health systems.

- Asia Pacific (APAC): Fastest-growing region, driven by rising disposable incomes, population size, urbanization, and increasing access to orthodontic services, leading to surging demand for both conventional and aesthetic wires.

- Latin America and MEA: Emerging markets offering growth potential through improving dental healthcare access and increasing investment in local dental clinics, focusing initially on cost-effective archwire solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adults Use Orthodontic Archwire Market.- 3M Company

- Align Technology

- Dentsply Sirona

- Ormco Corporation

- G&H Orthodontics

- American Orthodontics

- GC Orthodontics

- Rocky Mountain Orthodontics (RMO)

- TP Orthodontics

- Henry Schein Inc.

- Forestadent

- JJ Orthodontics

- Modern Arch

- Great Lakes Orthodontics

- Adenta GmbH

- BioMers

- Ortho Technology Inc.

- UltiMed, Inc.

- Reliance Orthodontic Products

- ClearPath Orthodontics

Frequently Asked Questions

Analyze common user questions about the Adults Use Orthodontic Archwire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of NiTi archwires over stainless steel for adult orthodontic patients?

Nickel-Titanium (NiTi) archwires offer superior superelasticity and shape memory, delivering lighter, more continuous forces essential for gentle tooth movement in adults, thereby minimizing discomfort and reducing the risk of biological issues like root resorption, which are often concerns in complex adult treatments.

How is customization affecting the price and accessibility of orthodontic archwires for adults?

Customization, often achieved through AI and robotic bending, initially increases the unit price of archwires. However, the improved clinical efficiency, reduced overall treatment time, and lower likelihood of mid-treatment adjustments often result in a reduction in the total cost of care and significantly improves clinical predictability for the orthodontist.

What role do aesthetic archwires play in the growing adults use segment?

Aesthetic archwires, including rhodium-coated or tooth-colored variants, are crucial market drivers as they address the adult demographic's high demand for discreet treatment options. Their ability to blend visually with ceramic or clear brackets increases patient willingness to undergo treatment, fueling segment expansion.

Which geographical region exhibits the fastest growth potential for archwire market expansion?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR), driven by increasing urbanization, rising disposable incomes, and greater public awareness of orthodontic health and cosmetic procedures in countries such as China and India.

Are clear aligners expected to entirely replace fixed orthodontic archwires for adult patients?

No, while clear aligners are highly competitive for mild to moderate cases, fixed orthodontic archwires, particularly advanced NiTi and Beta-Titanium alloys, remain indispensable for treating complex malocclusions, achieving high levels of torque control, and managing surgical orthodontic cases, ensuring a sustained market presence in specialized adult care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager