Advanced Ceramics and Nanoceramic Powders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432964 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Advanced Ceramics and Nanoceramic Powders Market Size

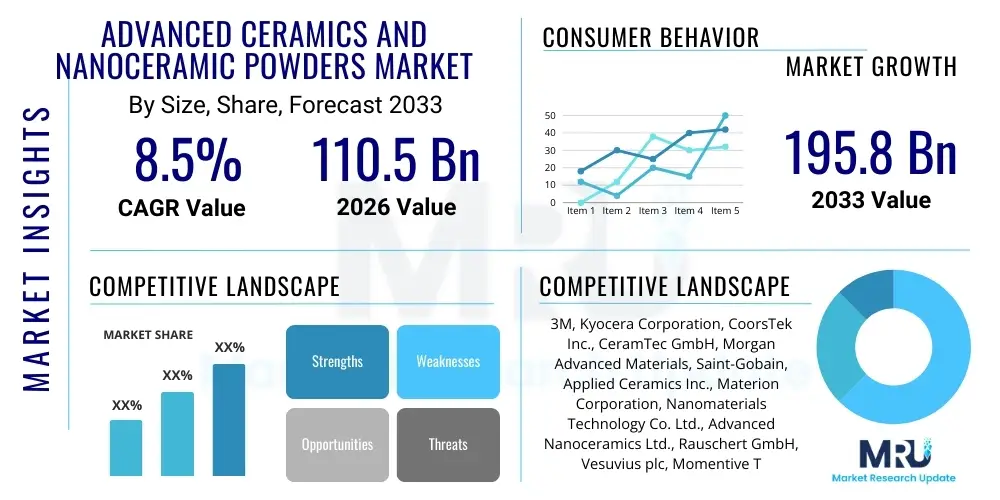

The Advanced Ceramics and Nanoceramic Powders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 195.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is fundamentally driven by the escalating demand for high-performance materials capable of withstanding extreme conditions, particularly within rapidly expanding sectors such as semiconductor manufacturing, electric vehicle components, and advanced medical devices. The shift towards miniaturization and enhanced functional density across these industries necessitates the superior thermal, mechanical, and electrical properties inherent in advanced ceramic materials, ensuring sustained market expansion throughout the projection period.

Advanced Ceramics and Nanoceramic Powders Market introduction

The Advanced Ceramics and Nanoceramic Powders Market encompasses materials engineered to exhibit superior mechanical, thermal, electrical, and chemical properties compared to traditional ceramics. Advanced ceramics are typically synthesized under controlled conditions and include materials like alumina, zirconia, silicon carbide, and silicon nitride. Nanoceramic powders, representing the cutting edge of this field, possess ultrafine particle sizes (typically below 100 nm), which impart unique quantum effects and vastly improved structural integrity, density, and catalytic activity. These materials are indispensable in high-tech applications where standard metals and polymers fail, driving innovation across complex engineering domains.

Major applications of these specialized materials span vital global industries. In electronics, advanced ceramics are crucial for substrates, insulators, and packaging due to their excellent dielectric strength and thermal management capabilities, supporting the proliferation of 5G infrastructure and high-power electronic modules. The automotive sector utilizes them for wear-resistant engine components, sensors, and structural parts in electric vehicles (EVs) to improve energy efficiency and durability. Furthermore, their biocompatibility makes them paramount in medical fields for dental implants, joint replacements, and high-precision surgical instruments, cementing their status as cornerstone materials for modern technological advancement.

The market growth is primarily driven by escalating research and development efforts aimed at tailoring ceramic properties for specific end-use requirements, coupled with supportive governmental policies promoting sustainable and energy-efficient technologies. Key benefits include exceptional hardness, resistance to corrosion and wear, high melting points, and superior electrical insulation. These driving factors converge to establish advanced ceramics and nanoceramic powders as essential enablers of next-generation manufacturing processes and product design across global economies.

Advanced Ceramics and Nanoceramic Powders Market Executive Summary

The Advanced Ceramics and Nanoceramic Powders Market is experiencing significant acceleration, catalyzed by fundamental business trends centered on material innovation and supply chain resilience. Key business trends include aggressive vertical integration by major players seeking control over powder synthesis and final component fabrication, alongside strategic mergers and acquisitions focused on securing specialized intellectual property, particularly in nanoceramic processing. The shift towards circular economy models is also influencing product development, driving interest in recycling methods for high-value ceramic components used in industrial applications, thus impacting the long-term cost structures of raw materials.

Regional dynamics highlight Asia Pacific (APAC), led by China, Japan, and South Korea, as the dominant growth region, fueled by massive investments in semiconductor manufacturing, consumer electronics production, and the burgeoning electric vehicle market. North America and Europe, while mature, emphasize high-end, specialized applications, particularly in aerospace, defense, and premium medical device manufacturing, focusing on nanoceramic components and functional coatings. These regions are characterized by stringent regulatory standards demanding ultra-high purity and reliability, dictating the focus of technological research and market entry barriers.

Segmentation trends indicate robust expansion in the Zirconia and Silicon Carbide segments due to their indispensable roles in energy storage and high-power electronics, respectively. The Application segment is overwhelmingly led by Electronics & Electrical components, reflecting global reliance on sophisticated devices. Simultaneously, the Medical segment is demonstrating the highest growth potential, driven by the increasing global demand for non-metallic, long-lasting orthopedic and dental solutions. Manufacturers are focusing on scaling up cost-effective synthesis techniques for nanoceramic powders to meet diversified industrial demand without compromising material performance.

AI Impact Analysis on Advanced Ceramics and Nanoceramic Powders Market

User inquiries regarding AI's influence in the Advanced Ceramics and Nanoceramic Powders Market primarily revolve around how machine learning can accelerate material discovery, optimize complex manufacturing processes, and improve quality control, particularly for nanoceramic synthesis. Users are keen to understand if AI can effectively predict material properties based on atomic structure simulations, significantly reducing the time and cost associated with traditional trial-and-error R&D cycles. Furthermore, significant concern and interest exist regarding AI's role in optimizing sintering and forming processes, which are highly sensitive to temperature, pressure, and raw material purity—variables that can be managed and fine-tuned through sophisticated AI algorithms.

The key thematic expectation is that Artificial Intelligence will revolutionize the upstream segment of the value chain. AI-driven predictive modeling is increasingly being adopted to analyze large datasets derived from material synthesis experiments, allowing researchers to quickly identify optimal compositions and processing parameters for ceramics with desired performance characteristics (e.g., enhanced toughness, increased thermal conductivity). This capability shortens the product lifecycle, moving new materials from concept to commercialization much faster than conventional methods, thereby enhancing competitive advantage for adopting firms.

In manufacturing, AI and machine learning algorithms are integrated into robotic systems for precision material handling, defect detection, and real-time process monitoring. This enables the consistent production of high-purity nanoceramic powders with tight particle size distributions—a crucial factor determining the final component quality. The deployment of smart factories, leveraging AI for predictive maintenance and yield optimization, is expected to reduce operational waste and energy consumption, addressing both economic and sustainability objectives within the advanced ceramics industry.

- AI-Driven Material Discovery: Accelerates the identification of novel ceramic compositions through high-throughput screening and computational modeling.

- Process Optimization: Utilizes machine learning to fine-tune sintering temperatures, mixing ratios, and pressure profiles, ensuring consistent nanoceramic powder quality.

- Quality Control and Defect Detection: Enhances real-time monitoring and detection of microscopic defects in ceramic components using computer vision and pattern recognition.

- Supply Chain Forecasting: Improves demand prediction for specialized raw materials, optimizing inventory levels and mitigating supply chain risks.

- Predictive Maintenance: AI algorithms analyze sensor data from manufacturing equipment to predict failures, minimizing downtime and maintenance costs in production facilities.

DRO & Impact Forces Of Advanced Ceramics and Nanoceramic Powders Market

The dynamics of the Advanced Ceramics and Nanoceramic Powders Market are shaped by powerful Drivers, inherent Restraints, and transformative Opportunities, collectively known as DRO factors, which exert significant Impact Forces on market progression. The overarching impact force is the accelerating global technological transition across critical sectors, including the widespread adoption of Electric Vehicles (EVs) which require highly durable battery components and lightweight structural parts, and the perpetual advancement in semiconductor technology demanding superior thermal dissipation and insulating materials. These needs create a sustained pull for high-performance ceramic materials, reinforcing the market’s positive trajectory.

Key drivers center around the shift towards miniaturization in electronics, demanding components that maintain integrity under high thermal and electrical loads, which only advanced ceramics can satisfy. Furthermore, regulatory mandates promoting energy efficiency, especially in industrial heating and power generation, are increasing the demand for ceramic filters, catalysts, and high-temperature heat exchangers. However, the market faces significant restraints, primarily stemming from the extremely high processing costs associated with achieving ultra-high purity and precise microstructure control, particularly for nanoceramic powders. The complexity and energy intensity of sintering processes, coupled with the capital expenditure required for specialized manufacturing equipment, present substantial barriers to entry and limit production scalability.

Opportunities for growth are concentrated in the development of 3D printing technologies optimized for ceramics, enabling complex geometries and personalized component fabrication in medical and aerospace sectors. Moreover, advancements in composite ceramics, combining ceramic matrices with other materials, promise enhanced fracture toughness and ductility, overcoming traditional limitations of brittle ceramics. The convergence of these factors creates intense market pressure, rewarding innovation in synthesis techniques and cost-reduction strategies, ensuring that companies focusing on application-specific materials and scalable manufacturing processes will capture the dominant market share.

Segmentation Analysis

The Advanced Ceramics and Nanoceramic Powders Market is extensively segmented by Material, Application, and End-User, reflecting the specialized nature of its products and their customized industrial deployment. Segmentation provides a clear framework for analyzing market dynamics, revealing that material types dictate performance characteristics, while application sectors drive specific volume and purity requirements. The overall market structure emphasizes high-value segments where material performance directly impacts system reliability and safety, such as in aerospace turbofan blades and medical implants.

The Material segment, encompassing Alumina, Zirconia, and Silicon Carbide, dominates the market due to the established reliability and relatively mature processing techniques for these oxides and non-oxides. However, newer materials like Silicon Nitride and Boron Nitride are exhibiting rapid growth due to their superior performance in high-temperature, high-stress environments. The Application segmentation clearly demonstrates the critical role of ceramics in enabling modern infrastructure, with the Electronics & Electrical sector consuming the largest volume, while high-growth areas like specialized environmental filtration and catalytic converters are expanding rapidly due to environmental legislation.

Furthermore, end-user analysis confirms the market's reliance on high-tech manufacturing, where the Semiconductor and Energy Storage industries are becoming key revenue drivers. The demand from the semiconductor industry is particularly inelastic, requiring the highest standards of material purity and dimensional accuracy for components like wafer chucks and process chambers. This detailed segmentation allows manufacturers to target R&D investments toward materials and processes that offer maximum return based on specific end-user performance requirements.

- By Material:

- Alumina Ceramics (Aluminum Oxide)

- Zirconia Ceramics (Zirconium Oxide)

- Silicon Carbide (SiC)

- Silicon Nitride (Si3N4)

- Titanium Carbide and Boride

- Others (e.g., Boron Carbide, Nanocrystalline Diamond)

- By Application:

- Electronics & Electrical (Substrates, Insulators, Sensors)

- Automotive (Engine components, Sensors, Catalyst carriers)

- Medical & Healthcare (Implants, Dental Ceramics, Bioceramics)

- Aerospace & Defense (Thermal shielding, Structural components)

- Industrial (Wear parts, Cutting tools, Pumps)

- Environmental (Filters, Catalytic systems)

- By End-User:

- Semiconductor Industry

- Energy Production and Storage

- Chemical Processing and Petrochemicals

- Optics and Photonics

- Heavy Machinery and Metallurgy

Value Chain Analysis For Advanced Ceramics and Nanoceramic Powders Market

The value chain for Advanced Ceramics and Nanoceramic Powders is highly specialized, beginning with the extraction and refining of high-purity raw materials (upstream) and culminating in the distribution of complex finished components (downstream). The upstream segment is dominated by the sourcing of critical precursor materials such as bauxite (for alumina), zircon sand (for zirconia), and specialized chemical compounds necessary for silicon carbide and nitride synthesis. This phase is characterized by intense focus on impurity control, as even trace elements can drastically compromise the final ceramic performance. Suppliers in this segment often require proprietary purification technologies and strict quality assurance protocols, making the input segment a critical bottleneck for high-performance applications.

Midstream activities involve the highly technical process of powder synthesis, including chemical precipitation, sol-gel methods, plasma synthesis, and mechanical milling, which determine the nanoceramic powder characteristics such as particle size distribution, morphology, and surface area. Following powder production, the component fabrication stage involves forming (pressing, casting, injection molding) and high-temperature sintering. This manufacturing phase adds the most significant value, relying on sophisticated equipment and proprietary know-how to achieve high density and precise dimensional tolerances. Integration between powder producers and component manufacturers is increasingly common to ensure optimized material use and quality consistency.

Distribution channels for advanced ceramic products are primarily direct for large-volume industrial end-users (e.g., major semiconductor firms or aerospace contractors), necessitating direct technical consultation and sales support. Indirect channels, involving specialized distributors and agents, handle smaller orders or specialized niche products, particularly in the medical and tooling markets. The complex nature of the products requires that both direct and indirect channels maintain a high degree of technical competence to provide necessary after-sales service and application guidance, differentiating this market from commodity material supply chains.

Advanced Ceramics and Nanoceramic Powders Market Potential Customers

Potential customers, or end-users, of advanced ceramics and nanoceramic powders are predominantly large-scale industrial consumers and specialized manufacturers operating in high-reliability and high-stress environments. These buyers prioritize material longevity, performance under extreme conditions (high temperature, high voltage, corrosive chemicals), and precision manufacturing capabilities over cost. Key buyers include global semiconductor foundries requiring materials for plasma-resistant components like electrostatic chucks and showerheads, where contamination and erosion must be minimized to ensure wafer purity and process uptime.

The automotive sector, particularly manufacturers of electric vehicles and sophisticated internal combustion engine components (spark plug insulators, glow plugs, wear parts), represents another critical customer base. These customers demand ceramics that reduce weight, increase energy efficiency, and improve component lifespan under continuous thermal cycling and mechanical load. Similarly, the aerospace and defense sectors are substantial buyers, utilizing these materials for rocket nozzles, thermal protection systems, and lightweight armor plating, necessitating materials with exceptional strength-to-weight ratios and thermal stability.

Beyond these high-tech manufacturing giants, the medical device industry forms a specialized but rapidly growing customer segment. Hospitals, orthopedic manufacturers, and dental laboratories procure bioceramic materials (e.g., specialized zirconia and alumina) for load-bearing implants, dental restorations, and sterile surgical instruments. These buyers require materials that exhibit absolute biocompatibility, chemical inertness, and superior wear resistance, making the procurement decisions highly regulated and quality-driven, often focusing on certifications and material provenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 195.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Kyocera Corporation, CoorsTek Inc., CeramTec GmbH, Morgan Advanced Materials, Saint-Gobain, Applied Ceramics Inc., Materion Corporation, Nanomaterials Technology Co. Ltd., Advanced Nanoceramics Ltd., Rauschert GmbH, Vesuvius plc, Momentive Technologies, Almatis GmbH, Corning Incorporated, AGC Inc., Elan Technology, KCC Corporation, Ceradyne Inc. (3M subsidiary), Hitachi Metals Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advanced Ceramics and Nanoceramic Powders Market Key Technology Landscape

The technological landscape of the Advanced Ceramics and Nanoceramic Powders Market is characterized by continuous innovation aimed at achieving tighter control over material microstructure and increasing manufacturing efficiency. A core area of technological focus is advanced powder synthesis methods. Techniques like chemical vapor deposition (CVD), plasma synthesis, and hydrothermal synthesis are critical for producing nanoceramic powders with uniform size, spherical morphology, and high purity, which are prerequisites for components used in sensitive electronics and biomedical applications. The ability to mass-produce these finely controlled powders cost-effectively is a major technological hurdle that ongoing research seeks to address.

In the component manufacturing phase, key technological shifts include the refinement of sintering techniques. Spark Plasma Sintering (SPS) and Hot Isostatic Pressing (HIP) technologies are gaining prominence because they allow for rapid densification at lower temperatures compared to conventional pressureless sintering. This reduction in processing temperature minimizes grain growth, preserving the beneficial properties associated with the nanostructure of the starting powder, resulting in components with superior mechanical strength and density. Furthermore, microwave-assisted sintering is emerging as an energy-efficient alternative, reducing overall processing time and operating costs.

Additive Manufacturing (AM), specifically stereolithography (SLA), digital light processing (DLP), and binder jetting adapted for ceramic slurries, represents a transformational technology. Ceramic 3D printing enables the creation of complex, near-net-shape geometries previously impossible to achieve through traditional machining or pressing. This capability is vital for customizing components in medical devices (e.g., custom bone scaffolds) and designing intricate channels in heat exchangers and microreactors. The integration of advanced computational modeling and AI with these AM processes is optimizing feedstock development and reducing internal stresses during printing, pushing the boundaries of ceramic complexity and reliability.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market share, primarily driven by China, South Korea, and Japan. This region serves as the global hub for consumer electronics, automotive production (including EVs), and semiconductor manufacturing. Massive government and private sector investment in foundry expansion, coupled with strong domestic demand for high-performance materials in renewable energy infrastructure, ensures continued, rapid market growth. The region benefits from robust supply chain integration, from raw material processing to final component assembly.

- North America: Characterized by a high demand for specialized, low-volume, high-value ceramic components, particularly in the Aerospace & Defense sectors. The US market focuses heavily on R&D for next-generation materials, including advanced ceramic composites for ballistic protection and extreme temperature applications in aircraft engines. Growth is also significant in the medical device sector, driven by stringent quality standards and technological leadership in orthopedic and dental applications.

- Europe: Europe represents a mature market with significant emphasis on industrial applications (machinery, tooling) and environmental technologies (filters, catalysts). Germany, France, and the UK are key contributors, driven by a strong automotive industry transitioning to EVs and strict environmental regulations demanding cleaner manufacturing processes. The regional market growth is supported by collaborative research between universities and industrial players focusing on material sustainability and energy efficiency improvements in ceramic processing.

- Latin America (LATAM): The LATAM market is nascent but growing, primarily driven by industrial modernization in Brazil and Mexico, focusing on mining equipment, oil and gas infrastructure, and automotive components. Market expansion is reliant on international investment and technology transfer, with increasing adoption of advanced ceramics to improve operational lifespan and reduce maintenance costs in heavy industry.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states, driven by significant investments in energy infrastructure, petrochemicals, and defense procurement. Advanced ceramics are utilized for corrosion-resistant components in refineries and for high-temperature applications in power generation. The market size remains smaller compared to major regions but shows potential based on diversification away from traditional oil and gas sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advanced Ceramics and Nanoceramic Powders Market.- 3M

- Kyocera Corporation

- CoorsTek Inc.

- CeramTec GmbH

- Morgan Advanced Materials

- Saint-Gobain

- Applied Ceramics Inc.

- Materion Corporation

- Nanomaterials Technology Co. Ltd.

- Advanced Nanoceramics Ltd.

- Rauschert GmbH

- Vesuvius plc

- Momentive Technologies

- Almatis GmbH

- Corning Incorporated

- AGC Inc.

- Elan Technology

- KCC Corporation

- Ceradyne Inc. (3M subsidiary)

- Hitachi Metals Ltd.

Frequently Asked Questions

Analyze common user questions about the Advanced Ceramics and Nanoceramic Powders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of nanoceramic powders?

The primary applications fueling market growth are high-density electronic packaging, advanced thermal management systems in Electric Vehicles (EVs), and ultra-wear-resistant coatings and components utilized in aerospace and precision industrial tooling. Nanoceramic powders provide the necessary superior mechanical and thermal properties essential for miniaturization and efficiency gains in these sectors.

Which material segment holds the largest share in the advanced ceramics market?

Alumina Ceramics (Aluminum Oxide) currently holds the largest market share due to its excellent dielectric properties, hardness, chemical inertness, and relative cost-effectiveness compared to more exotic materials. Alumina is widely used across electronics, electrical insulation, and traditional industrial wear applications, ensuring its market dominance.

What major restraints impede the scalability of advanced ceramic component manufacturing?

The primary restraints are the high capital investment required for specialized high-temperature sintering and pressing equipment (like Hot Isostatic Presses), the elevated cost of producing ultra-high purity precursor powders, and the technical complexity involved in achieving precise dimensional accuracy and defect-free components during the intricate fabrication process.

How is the Electric Vehicle (EV) industry impacting the demand for advanced ceramics?

The EV industry is significantly boosting demand by requiring high-performance ceramics for crucial components such as power electronics substrates (to manage heat dissipation in inverters), battery separators, and lightweight brake systems. Ceramics ensure reliability, safety, and operational efficiency under the high electrical and thermal loads inherent in modern EV powertrains.

What role does 3D printing play in the future development of advanced ceramics?

3D printing (Additive Manufacturing) is a transformative technology enabling the creation of complex, intricate geometries and customized parts, particularly beneficial for medical implants, specialized heat exchangers, and micro-fluidic devices. This technology allows for rapid prototyping and the efficient production of components that are impractical or impossible to fabricate using conventional ceramic shaping methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager