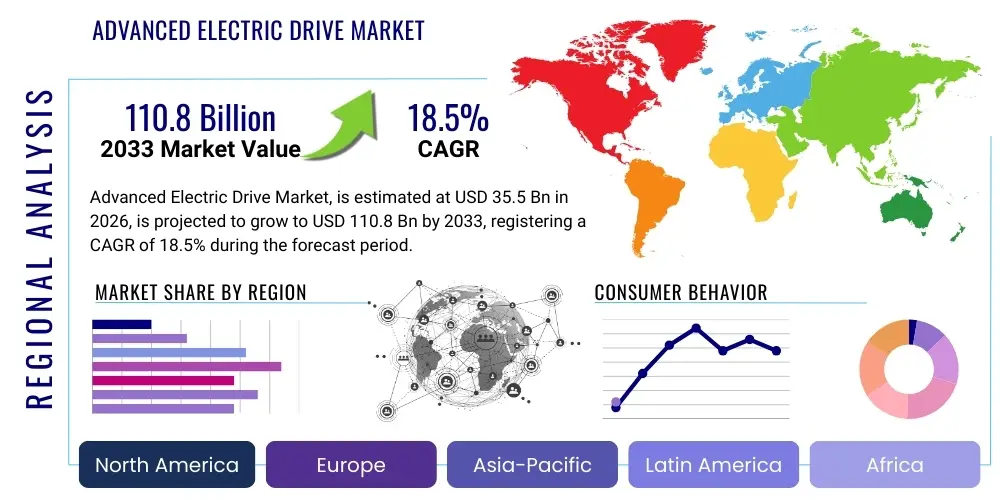

Advanced Electric Drive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435801 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Advanced Electric Drive Market Size

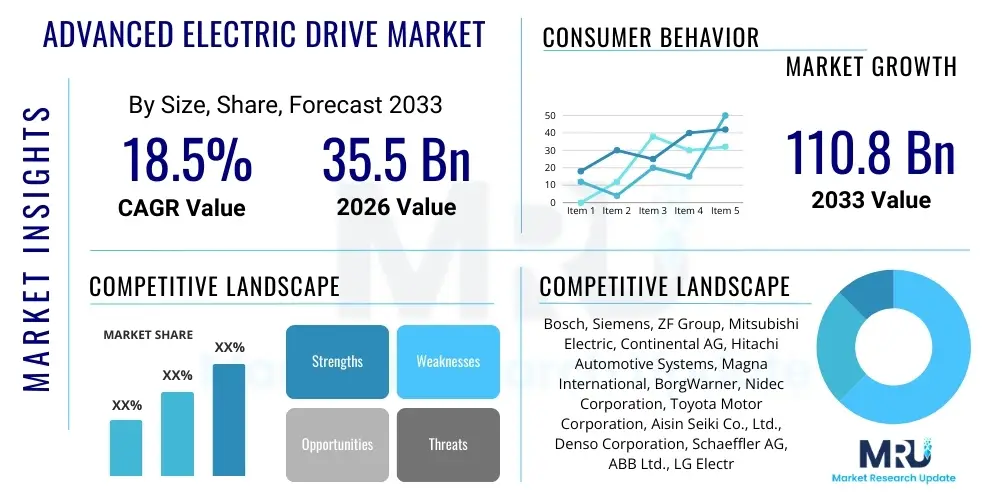

The Advanced Electric Drive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 110.8 Billion by the end of the forecast period in 2033.

Advanced Electric Drive Market introduction

The Advanced Electric Drive Market encompasses sophisticated systems vital for propelling electric and hybrid vehicles, alongside high-efficiency industrial applications. These systems integrate electric motors, power electronics (inverters and converters), advanced control software, and transmission mechanisms designed to maximize energy efficiency and performance output while minimizing size and weight. Product offerings include various motor types, such as Permanent Magnet Synchronous Motors (PMSMs) and AC Induction Motors, which are selected based on specific application requirements regarding torque density, cost, and operating speed range. The inherent efficiency of these advanced drives is a core factor driving global adoption, directly addressing regulatory pressures for lower carbon emissions and consumer demand for superior vehicle performance and reduced operational costs.

Major applications of advanced electric drives span the entire electromobility sector, predominantly focusing on Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). Beyond transportation, these drives are increasingly crucial in industrial automation, robotics, and renewable energy systems, where precise speed and torque control are essential for optimal operation. The market growth is fundamentally driven by robust governmental mandates promoting electrification, significant technological advancements improving power density and thermal management of drive systems, and the declining costs associated with key components like semiconductors and rare-earth magnets.

The core benefits derived from utilizing advanced electric drive systems include enhanced energy conversion efficiency, leading to increased vehicle range and reduced battery size requirements, superior reliability, and significantly lower maintenance requirements compared to traditional internal combustion engine (ICE) powertrains. Furthermore, these systems offer instantaneous torque delivery, resulting in superior acceleration and driving dynamics. The continuous innovation cycle, focusing on materials science for lighter components and software sophistication for predictive maintenance and optimized energy flow, solidifies the Advanced Electric Drive Market as a cornerstone of the global energy transition.

Advanced Electric Drive Market Executive Summary

The Advanced Electric Drive Market is experiencing accelerated growth, primarily fueled by the paradigm shift in the global automotive industry towards full electrification, reinforced by stringent emission standards across key geographies. Business trends indicate a strong push for vertical integration among major automotive OEMs, with companies increasingly prioritizing in-house development and manufacturing of critical components, specifically power electronics and electric motors, to secure supply chains and gain technological competitive advantages. Furthermore, strategic alliances and joint ventures focusing on shared platform development for electric drives are prevalent, aiming to rapidly scale production and reduce R&D expenditures. The market is also seeing a crucial trend toward Silicon Carbide (SiC) based power semiconductors due to their superior efficiency and thermal performance, which is a key differentiator in high-performance and long-range electric vehicles.

Regionally, Asia Pacific (APAC) dominates the market, driven overwhelmingly by the massive electric vehicle production and adoption in China, alongside strong policy support and manufacturing capabilities in South Korea and Japan. Europe is poised for rapid expansion, propelled by ambitious regulatory targets, such as the Fit for 55 package, and substantial consumer subsidies, establishing it as a leader in premium and technologically advanced EV adoption. North America is accelerating its infrastructure development and manufacturing capacity, particularly following governmental initiatives focused on domestic battery and electric component production, which is expected to normalize the supply chain challenges previously experienced.

In terms of segmentation, the Permanent Magnet Synchronous Motor (PMSM) segment maintains the highest market share due to its excellent power density and efficiency, making it the preferred choice for passenger EVs, although AC Induction Motors remain cost-effective for entry-level and heavy-duty applications. The application segment is heavily skewed towards Battery Electric Vehicles (BEVs), which are anticipated to exhibit the fastest growth trajectory throughout the forecast period. The trend towards higher power ratings (Above 250 kW) is noticeable, reflecting the industry's focus on performance vehicles and the electrification of larger commercial fleets, demanding more powerful and robust drive systems capable of handling elevated load conditions and thermal stress.

AI Impact Analysis on Advanced Electric Drive Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and Advanced Electric Drives frequently center on enhancing system efficiency, predicting failures, optimizing thermal management, and facilitating autonomous driving integration. Key themes emerging from these questions involve how AI algorithms can fine-tune inverter control strategies in real-time to minimize energy losses, the efficacy of machine learning models in predicting component degradation (like bearing wear or insulation failure) before critical breakdown, and the role of AI in optimizing charging and discharging cycles for battery longevity, directly impacting the drive system's operational parameters. Consumers and industry professionals alike are keenly interested in the potential for AI to transition electric drives from fixed, standardized components to dynamically adaptive systems that learn from operational data and external conditions.

The integration of AI is revolutionizing the design, manufacturing, and operational phases of advanced electric drive systems. In the design stage, generative AI and simulation tools powered by machine learning accelerate the development of complex electromagnetic structures and power electronics layouts, leading to higher power density and reduced material usage. During operation, AI models analyze vast streams of sensor data concerning temperature, vibration, current draw, and speed to implement predictive maintenance schedules, drastically reducing unplanned downtime and enhancing overall reliability. This shift from reactive maintenance to prescriptive optimization is critical for fleet operators and high-utilization industrial machinery.

Furthermore, AI algorithms are crucial for optimizing the complex interplay between the electric motor, the battery management system (BMS), and the vehicle control unit (VCU). Real-time optimization algorithms allow the drive system to dynamically adjust torque delivery and regenerative braking levels based on traffic conditions, driver behavior, and topographic data, thereby maximizing energy recuperation and extending the effective driving range. As autonomous driving becomes standard, AI ensures seamless and efficient power management, making instantaneous, high-precision adjustments to the drive system necessary for safety and performance in sensor-dense, rapidly changing environments.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast component failure and schedule proactive servicing, minimizing operational disruption.

- Real-time Efficiency Optimization: Implementing deep reinforcement learning for dynamic adjustment of inverter switching frequencies and motor control parameters, maximizing energy conversion efficiency.

- Generative Design Acceleration: Applying AI to optimize motor topology, winding configurations, and thermal pathways for superior power density and reduced manufacturing complexity.

- Enhanced Thermal Management: Using neural networks to predict thermal hotspots and dynamically manage cooling systems, preventing derating and ensuring peak performance under stress.

- Seamless Integration with VCU/BMS: Facilitating sophisticated data exchange and coordinated control between the electric drive, battery pack, and vehicle dynamics for optimized range and performance.

DRO & Impact Forces Of Advanced Electric Drive Market

The Advanced Electric Drive Market is shaped by a powerful confluence of Driving forces, Restraints, and Opportunities, collectively forming the Impact Forces that dictate its trajectory. Primary Drivers include stringent global regulatory shifts towards zero-emission vehicles, coupled with substantial government subsidies and tax incentives promoting EV adoption, creating immediate demand. Opportunities lie predominantly in the development of next-generation power semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), which promise significant gains in efficiency and power density, opening up new high-performance applications. However, the market faces constraints, notably the high initial cost of electric vehicles compared to conventional counterparts, largely driven by battery costs and the complexity of advanced drive components, alongside persistent concerns regarding the secure and ethical sourcing of critical raw materials, particularly rare-earth magnets essential for high-performance PMSMs.

The impact of these forces is creating a highly competitive and technologically evolving environment. The continuous decline in battery costs, while not a direct drive system factor, dramatically enhances the overall value proposition of EVs, thereby increasing the market pull for advanced drives. Conversely, the market’s reliance on complex global supply chains, particularly for microprocessors and high-purity materials, exposes it to geopolitical risks and trade disruptions, necessitating regionalized manufacturing strategies. The rapid pace of innovation also presents a restraint for legacy manufacturers, requiring massive capital investment in retooling and reskilling to adopt new manufacturing processes tailored for electrical components rather than mechanical systems.

Overall, the net impact force is highly positive and accelerating. The push for sustainability, combined with the proven performance superiority of electric drivetrains, overrides most current restraints. Key market participants are leveraging Opportunities, such as strategic partnerships with semiconductor manufacturers, to mitigate supply risks and capitalize on efficiency gains. The long-term driver remains the irreversible global commitment to decarbonization, ensuring sustained R&D investment into making electric drives smaller, lighter, and more cost-competitive across all transportation and industrial sectors. This momentum is further solidified by the increasing consumer awareness and preference for eco-friendly, high-performance mobility solutions.

Segmentation Analysis

The Advanced Electric Drive Market is comprehensively segmented based on three primary dimensions: Type, Application, and Power Rating, providing a granular view of market dynamics and technology preferences across various end-user industries. The segmentation by Type delineates between the dominant motor technologies, assessing their efficiency characteristics, cost implications, and suitability for specific vehicular platforms. The Application segmentation focuses on the end-use vehicle type or industry, reflecting the differing performance and durability requirements. Meanwhile, Power Rating segmentation is crucial for understanding the market distribution between light-duty passenger vehicles, which typically use lower power ratings, and heavy commercial vehicles or high-performance sports cars that require substantially higher power outputs.

The analysis reveals distinct technology adoption patterns. While Permanent Magnet Synchronous Motors (PMSMs) lead in passenger vehicle applications due to their high torque density and efficiency, AC Induction Motors (ACIMs) remain competitive in scenarios where cost sensitivity is paramount or where magnet supply volatility is a concern. The emerging segment of Switched Reluctance Motors (SRMs) is gaining traction, particularly for heavy-duty applications, owing to their robust structure and independence from rare-earth magnets. Understanding these segments is vital for strategic planning, allowing companies to tailor their R&D investments toward the most lucrative and rapidly evolving technology niches and application areas.

- By Type:

- Permanent Magnet Synchronous Motors (PMSM)

- AC Induction Motors (ACIM)

- Switched Reluctance Motors (SRM)

- Synchronous Reluctance Motors (SynRM)

- By Application:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- Industrial & Robotics

- Rail & Transit Systems

- By Power Rating:

- Less than 100 kW

- 100 kW to 250 kW

- Above 250 kW

Value Chain Analysis For Advanced Electric Drive Market

The value chain for the Advanced Electric Drive Market is complex, beginning with the upstream sourcing of raw materials, moving through highly specialized component manufacturing, and culminating in integration by OEMs and distribution to the end-users. The upstream segment is defined by the extraction and processing of critical materials, including rare-earth elements (like Neodymium and Dysprosium for magnets), copper, specialized steel alloys, and high-purity silicon or silicon carbide for power semiconductors. This stage faces significant geopolitical and environmental challenges, as the concentration of these resources in specific regions poses supply risks. Companies engaging in magnet and semiconductor production are critical links, requiring immense capital investment and highly technical manufacturing processes to achieve the necessary performance specifications and miniaturization.

Midstream activities involve the production of core sub-components: the electric motor assembly (stator, rotor, housing), the power electronics module (inverter, converter, controller), and the transmission/gearbox elements. Integration involves assembling these components into a complete drive unit. This phase is characterized by intense R&D focus on thermal management, electromagnetic compatibility, and control software optimization. Major Tier 1 suppliers and increasingly, large automotive OEMs, are responsible for this stage, focusing on modular designs that can be scaled across different vehicle platforms to achieve economies of scale and accelerate time-to-market. The quality and efficiency of the inverter, which converts DC battery power to AC motor power, are paramount to the drive system's overall performance.

The downstream distribution channel is bifurcated into direct sales to Original Equipment Manufacturers (OEMs) for new vehicle production (the primary channel) and indirect sales through a network of specialized distributors and service centers for the aftermarket (replacement parts and industrial applications). Automotive OEMs typically engage in direct, long-term contracts with Tier 1 drive system suppliers, often co-developing specific drive architectures. For industrial and rail applications, specialized system integrators play a significant role in adapting and installing standardized drive units into unique operational environments. The sophistication of these systems necessitates highly skilled service technicians, driving demand for specialized training within the aftermarket ecosystem to support long-term product maintenance and reliability.

Advanced Electric Drive Market Potential Customers

The potential customer base for the Advanced Electric Drive Market is broad but predominantly centered around sectors undergoing electrification transformation. Automotive Original Equipment Manufacturers (OEMs) constitute the largest segment of buyers, ranging from major global passenger car manufacturers (e.g., Tesla, Volkswagen Group, General Motors) to specialized electric bus and truck producers (e.g., BYD, Daimler Truck). These customers purchase fully integrated drive units or key sub-components (motors and inverters) for incorporation into their mass-produced electric and hybrid vehicle platforms. Their purchasing decisions are heavily influenced by power density, efficiency, cost parity, and reliability metrics, alongside the supplier's ability to ensure large-scale, consistent supply.

Beyond passenger vehicles, the Heavy-Duty Commercial Vehicle (HDCV) and Industrial sectors represent rapidly growing buyer segments. HDCV buyers, including logistics companies and municipal transit authorities, demand robust, high-torque drive systems capable of enduring long operational hours and heavy loads, where durability and total cost of ownership (TCO) are primary considerations. Industrial buyers, encompassing manufacturers of robotics, material handling equipment, and specialized machinery, seek high-precision, variable-speed drives to enhance automation efficiency and reduce energy consumption in manufacturing processes. This segment prioritizes customization and sophisticated control capabilities, often requiring drives that interface seamlessly with complex industrial automation protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 110.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Siemens, ZF Group, Mitsubishi Electric, Continental AG, Hitachi Automotive Systems, Magna International, BorgWarner, Nidec Corporation, Toyota Motor Corporation, Aisin Seiki Co., Ltd., Denso Corporation, Schaeffler AG, ABB Ltd., LG Electronics, Valeo, Johnson Electric, Tesla, General Motors, Yaskawa Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advanced Electric Drive Market Key Technology Landscape

The technological landscape of the Advanced Electric Drive Market is defined by continuous innovation focused on maximizing energy efficiency, increasing power density, and reducing reliance on costly or geopolitically sensitive materials. A pivotal shift is the widespread adoption of Wide Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and, increasingly, Gallium Nitride (GaN), in the inverter and converter power electronics. SiC MOSFETs offer significantly lower switching losses and can operate at much higher temperatures and frequencies than traditional Silicon IGBTs. This performance enhancement enables smaller, lighter, and more efficient inverters, directly contributing to extended EV range and reduced cooling system complexity and cost. OEMs view SiC technology as essential for their premium and high-performance vehicle lineups, establishing it as a current benchmark technology.

Motor design innovation centers primarily on reducing size while increasing torque output. Permanent Magnet Synchronous Motors (PMSMs) dominate due to their superior efficiency, but ongoing efforts are focused on developing motors that require fewer, or even no, rare-earth magnets to mitigate supply chain volatility and environmental concerns. Technologies such as Switched Reluctance Motors (SRMs) and Synaptics Reluctance Motors (SynRMs) are emerging as viable, magnet-free alternatives, offering high robustness and simplified manufacturing, especially appealing for heavy-duty and industrial applications where weight is less critical than reliability. Furthermore, there is intense focus on optimizing winding geometry, adopting hair-pin winding techniques to minimize copper losses and enhance power output, which is crucial for high-speed operation.

Finally, control software and thermal management systems are undergoing significant advancements, often leveraging AI and machine learning, as detailed previously. The software sophistication determines how efficiently the power electronics control the motor under varying load conditions. Integrated thermal management solutions, including advanced cooling techniques (e.g., direct oil cooling for stators and rotors), are necessary to handle the increased heat generated by high-power-density drives and WBG semiconductors. The overall trend is toward highly integrated, modular drive units, often combining the motor, inverter, and gearbox into a single, compact e-axle system, simplifying vehicle assembly and further improving system efficiency by eliminating external cabling and optimizing communication protocols.

Regional Highlights

The global Advanced Electric Drive Market exhibits diverse growth characteristics and maturity levels across key geographical regions, with Asia Pacific (APAC) serving as the undeniable powerhouse of production and adoption. APAC, dominated by China, benefits from aggressive national policies supporting the New Energy Vehicle (NEV) industry, massive domestic manufacturing capabilities, and a large consumer base rapidly transitioning to electrification. The region not only produces the highest volume of EVs but also controls a majority of the critical component supply chain, including magnets and power semiconductors, establishing it as the center of gravity for global market growth.

Europe represents the second-largest and fastest-growing region in terms of technology penetration and regulatory impetus. European governments, backed by the EU’s ambitious decarbonization targets, have implemented substantial incentives that drive robust consumer adoption, particularly for premium electric vehicles which demand high-performance, advanced electric drive systems. Countries like Germany, Norway, and the United Kingdom are pioneers, focusing heavily on integrating renewable energy sources with electric mobility. This region is a hotbed for specialized R&D in high-efficiency components and the production of innovative e-axle architectures by Tier 1 suppliers and indigenous automotive giants.

North America is catching up rapidly, driven primarily by favorable policies such as the US Inflation Reduction Act (IRA), which aims to localize the entire EV supply chain, from raw material processing to final assembly. This focus on domestic production is attracting significant investment in battery gigafactories and electric component manufacturing facilities, specifically targeting large-scale production of advanced drive units. While historically slower than APAC and Europe, the sheer size of the American market and the emphasis on electrifying heavy-duty trucks and fleet vehicles ensure a high growth potential for the high-power rating segment of the market. Latin America and Middle East & Africa (MEA) currently represent emerging markets, with growth dependent on regional government commitments to infrastructure development and fossil fuel reduction policies.

- Asia Pacific (APAC): Dominates in market size and production volume; driven by China’s strong governmental support and large-scale consumer adoption of NEVs; leading in component manufacturing and supply chain integration.

- Europe: High-growth market characterized by stringent emission standards and strong subsidies; focuses on high-efficiency, premium EV components and advanced e-axle integration; significant R&D hub for WBG semiconductor applications.

- North America: Accelerating market growth fueled by domestic manufacturing incentives (IRA); significant investment in electrifying passenger vehicles and commercial fleets, emphasizing the >250 kW power rating segment.

- Latin America & MEA: Emerging markets with reliance on strategic governmental commitments; initial growth concentrated in fleet electrification and public transit systems; technology adoption lags due to infrastructure challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advanced Electric Drive Market.- Bosch

- Siemens

- ZF Group

- Mitsubishi Electric

- Continental AG

- Hitachi Automotive Systems

- Magna International

- BorgWarner

- Nidec Corporation

- Toyota Motor Corporation

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Schaeffler AG

- ABB Ltd.

- LG Electronics

- Valeo

- Johnson Electric

- Tesla

- General Motors

- Yaskawa Electric

Frequently Asked Questions

Analyze common user questions about the Advanced Electric Drive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between PMSM and AC Induction Motors in advanced electric drives?

Permanent Magnet Synchronous Motors (PMSMs) use permanent magnets in the rotor, resulting in higher efficiency, greater power density, and better performance in compact spaces, making them ideal for high-end passenger EVs. AC Induction Motors (ACIMs) use electromagnetic induction for rotor current, avoiding the need for rare-earth magnets; they are generally more robust, cost-effective, and suitable for heavy-duty applications where peak efficiency is secondary to durability and low material cost.

How do Wide Bandgap semiconductors (SiC/GaN) influence the future performance of electric drives?

SiC and GaN semiconductors are critical for enhancing inverter performance by enabling higher switching frequencies and lower energy losses compared to traditional Silicon components. This results in smaller, lighter power electronics that can handle higher operating temperatures, significantly increasing the overall efficiency of the electric drive system and extending the vehicle’s driving range.

Which geographic region dominates the Advanced Electric Drive Market, and why?

The Asia Pacific (APAC) region currently dominates the market, primarily driven by China. This dominance is due to aggressive governmental policies supporting Electric Vehicles (EVs), substantial domestic production capacity for both vehicles and key components (like batteries and magnets), and high volume demand stemming from rapid consumer adoption within the region.

What are the main restraints hindering the growth of the Advanced Electric Drive Market?

Key restraints include the persistently high initial cost of incorporating advanced drive systems, especially when paired with expensive battery packs, and ongoing volatility in the supply chain for critical raw materials like rare-earth elements necessary for high-efficiency permanent magnets.

What role does AI play in improving the reliability of electric drive systems?

AI significantly enhances reliability by enabling predictive maintenance. Machine learning algorithms analyze real-time operational data (temperature, vibration, current) to accurately forecast potential component failures, allowing for proactive servicing and minimizing unexpected downtime, which is crucial for commercial fleet operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager