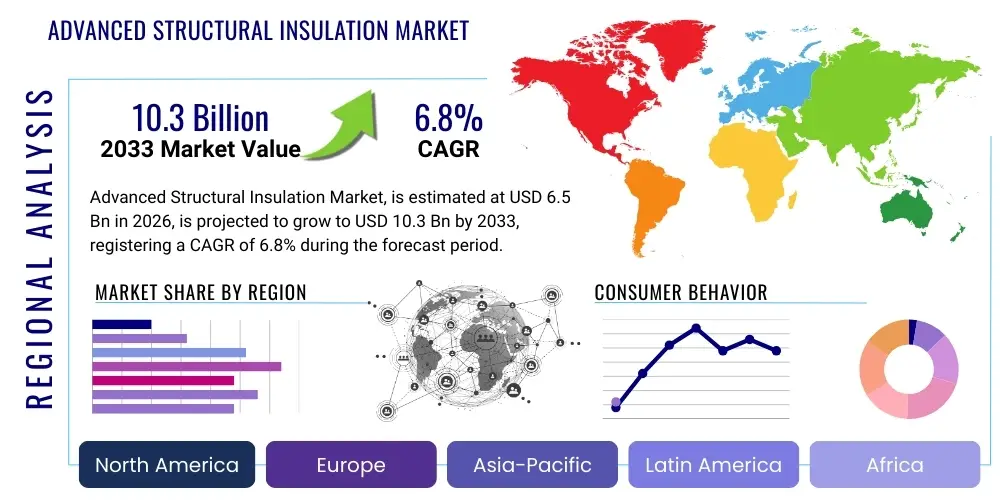

Advanced Structural Insulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437412 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Advanced Structural Insulation Market Size

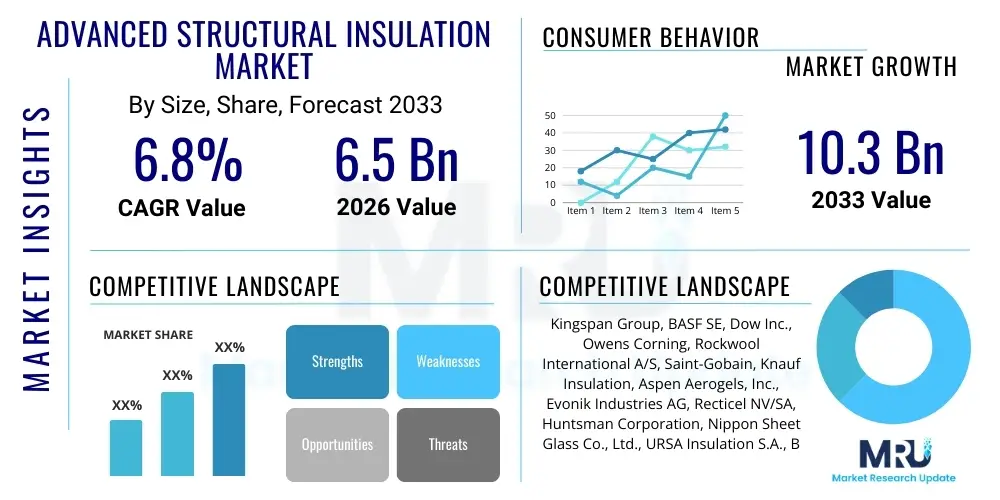

The Advanced Structural Insulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Advanced Structural Insulation Market introduction

The Advanced Structural Insulation Market encompasses high-performance thermal insulation materials designed to exceed the thermal efficiency standards of traditional insulation products. These advanced solutions, including materials like Vacuum Insulation Panels (VIPs), Aerogels, and high-density polyisocyanurate (PIR) and polyurethane (PUR) foams, are critical components in modern, energy-efficient building envelopes, cold storage facilities, and industrial applications requiring minimal heat transfer and thin profiles. The primary product description centers on materials offering superior R-values (thermal resistance) per unit of thickness, enabling architects and builders to meet stringent regulatory requirements for energy consumption, particularly in regions enforcing near-Zero Energy Building (nZEB) standards. Major applications span high-end residential construction, specialized commercial buildings such as data centers and hospitals, and complex industrial systems like cryogenic storage and petrochemical pipelines.

The core benefits derived from utilizing advanced structural insulation include substantial reduction in operational energy costs, improved occupant comfort through stabilized internal temperatures, and maximization of usable internal space due to thinner insulation layers compared to conventional alternatives like mineral wool or basic fiberglass. These materials also contribute significantly to the structural integrity and fire safety of a building, depending on the composition. Furthermore, the longevity and moisture resistance of products such as extruded polystyrene (XPS) and specific composites reduce the need for premature replacement, thereby lowering the total life-cycle cost of the structure.

The market is predominantly driven by increasing global awareness and governmental mandates concerning carbon emissions and energy efficiency in the built environment. Rapid urbanization in developing economies, coupled with significant investment in retrofitting aged infrastructure in developed nations, further fuels demand. The adoption of smart building technologies and the integration of highly effective thermal breaks within structural components necessitate the superior performance characteristics provided by advanced insulation solutions, positioning them as indispensable components in future construction practices.

Advanced Structural Insulation Market Executive Summary

The Advanced Structural Insulation Market is poised for robust expansion, primarily steered by stringent global energy efficiency regulations and a persistent push toward sustainable construction practices. Key business trends include the rising adoption of prefabricated and modular construction methods, which heavily rely on high-performance structural insulated panels (SIPs) for rapid deployment and guaranteed thermal performance consistency. Manufacturers are increasingly focusing on vertical integration and strategic partnerships to secure the supply of critical raw materials, such as specialized polymers and silica, while simultaneously expanding their R&D efforts into bio-based and recyclable advanced insulation materials to cater to the growing demand for circular economy solutions in construction.

Regionally, Europe maintains market leadership due to early adoption of nZEB standards and ambitious climate targets, driving intense demand for VIPs and Aerogel solutions in constrained urban retrofitting projects. The Asia Pacific region, however, represents the fastest-growing market segment, fueled by massive infrastructure development, increasing urbanization, and the nascent implementation of mandatory energy codes in rapidly developing countries like China and India. North America demonstrates consistent growth, largely driven by incentive programs promoting energy-efficient homebuilding and the rising popularity of high-R-value envelope systems in extreme climate zones. These regional variations dictate material preference, with PIR and XPS dominant in high-volume construction, while VIPs and Aerogels target niche, high-performance applications.

Segment trends reveal that the Polyisocyanurate (PIR) foam segment holds a commanding market share owing to its excellent fire performance and cost-effectiveness compared to highly specialized materials. Simultaneously, the application segment is witnessing a strong shift towards the commercial and industrial sectors, particularly cold chain logistics and specialized manufacturing facilities where temperature stability is paramount. The residential segment remains a foundational driver, especially with the introduction of governmental rebates for high-efficiency renovations. Segmentation analysis underscores a fundamental shift in buyer behavior, moving away from simple cost considerations to focusing on long-term performance metrics, life-cycle assessments, and certification compliance (e.g., LEED, BREEAM).

AI Impact Analysis on Advanced Structural Insulation Market

User queries regarding AI's influence in the Advanced Structural Insulation Market primarily revolve around four key themes: material science innovation acceleration, optimization of manufacturing processes, predictive performance modeling in building design, and supply chain efficiency. Users are keenly interested in how Artificial Intelligence can significantly reduce the lengthy R&D cycle required for new high-performance materials like novel aerogels or composites, expecting AI to analyze molecular structures and predict thermal conductivity properties with greater speed and accuracy than traditional laboratory testing. Furthermore, concerns are often raised about the integration of AI-driven quality control within the highly automated production lines of advanced insulation panels to ensure consistency and minimize waste, which is crucial given the high cost of advanced raw materials.

AI is fundamentally transforming the design and specification phase of advanced insulation. Machine learning algorithms are now capable of integrating complex datasets—including localized climate conditions, building orientation, material properties, and energy usage patterns—to optimize the thickness, placement, and type of structural insulation required to achieve specific performance targets (e.g., U-values or R-values). This capability reduces reliance on conservative engineering assumptions and leads to optimized material usage, directly impacting project costs and sustainability footprints. The use of Generative Design, powered by AI, allows architects to explore hundreds of high-performance envelope designs quickly, significantly streamlining the construction pre-planning phase.

In manufacturing and logistics, AI algorithms enhance operational efficiency by predicting equipment failures in foam production lines (preventive maintenance), optimizing cutting patterns to minimize material off-cuts (waste reduction), and managing complex, multi-site distribution networks for large construction projects. AI provides real-time adjustments to curing temperatures and pressures during the panel manufacturing process, ensuring optimal structural integrity and thermal performance across every batch. This rigorous, AI-assisted quality control minimizes product recalls and boosts manufacturer credibility, which is paramount in a market where product claims regarding thermal performance are heavily regulated and scrutinized by end-users.

- AI accelerates material R&D by simulating thermal and mechanical properties of novel insulation compounds.

- Predictive maintenance minimizes downtime in high-volume polyurethane and polyisocyanurate foam production lines.

- Machine learning optimizes insulation thickness and placement for specific building performance goals (Performance-Based Design).

- AI-driven supply chain management improves logistics for fragile materials like Vacuum Insulation Panels (VIPs) and Aerogel blankets.

- Image recognition AI enhances quality control, detecting microscopic flaws in panel lamination and material density.

DRO & Impact Forces Of Advanced Structural Insulation Market

The Advanced Structural Insulation Market is driven by a powerful confluence of regulatory mandates and sustainability imperatives (Drivers). Governments globally are enacting progressively stringent building energy codes, such as mandatory passive house standards or BREEAM/LEED certification requirements, which directly necessitate the use of high-R-value, advanced materials to achieve compliance. Simultaneously, soaring energy costs and the commitment of large corporations to Environmental, Social, and Governance (ESG) criteria provide a strong economic incentive for adopting insulation solutions that guarantee long-term operational savings. The scarcity of urban space further promotes demand for thin, high-performance materials like VIPs, which maximize internal floor area.

However, the market faces significant restraints, primarily concerning the high initial capital investment required for advanced materials compared to traditional insulation, creating a barrier to entry for cost-sensitive projects and developing markets. Furthermore, the complexity associated with the specialized installation of certain advanced products, such as aerogels or large structural insulated panels (SIPs), demands specialized training and certification, limiting the pool of qualified contractors. The durability and long-term performance verification of certain newer technologies remain an area of concern for risk-averse developers, particularly regarding moisture ingress and performance degradation over decades of service life.

Opportunities abound, centering on the immense potential in retrofitting existing commercial and residential building stock, especially in mature economies where 70% of the buildings that will exist in 2050 are already standing. The integration of advanced insulation with smart building management systems (BMS) offers enhanced value propositions by enabling dynamic thermal management. Furthermore, advancements in nanotechnology and material science are lowering production costs for previously prohibitively expensive materials, while the development of robust, fire-resistant, bio-based insulation materials addresses environmental concerns and opens new market segments. The growing cold chain industry, crucial for vaccine and food logistics, represents a specialized, high-growth area for advanced insulation adoption (e.g., use of high-density PUR in refrigerated containers).

Segmentation Analysis

The Advanced Structural Insulation Market is segmented based on material type, application, and form, reflecting the diverse requirements of the construction and industrial sectors. Material segmentation is crucial as it determines thermal performance (R-value), cost, fire resistance, and suitability for specific environments. Application segmentation highlights the highest growth areas, particularly the specialized demands of infrastructure and commercial cold storage, while segmentation by form reveals the industry preference for pre-manufactured composite panels for faster, quality-controlled installation, moving away from on-site applied foams and batts.

- By Material Type:

- Polyisocyanurate (PIR) Foam

- Polyurethane (PUR) Foam

- Extruded Polystyrene (XPS)

- Expanded Polystyrene (EPS)

- Mineral Wool (High Density)

- Vacuum Insulation Panels (VIPs)

- Aerogels

- Others (Bio-based, Phenolic Foam)

- By Application:

- Residential Buildings (New Construction & Retrofit)

- Commercial Buildings (Offices, Data Centers, Hospitals)

- Industrial Applications (Cold Storage, Cryogenics, Piping)

- Infrastructure (Bridges, Roadways, Specialized Structures)

- By Form:

- Boards and Panels (e.g., Structural Insulated Panels - SIPs)

- Foams (Spray and Rigid Foam Systems)

- Blankets and Rolls (e.g., Aerogel blankets)

- Other Forms (In-situ Fillers)

Value Chain Analysis For Advanced Structural Insulation Market

The value chain for advanced structural insulation begins significantly upstream with the sourcing and synthesis of specialized chemical and mineral raw materials. For polymer-based insulation (PIR/PUR), this involves obtaining isocyanates (MDI/TDI) and polyols, whose prices are heavily influenced by the petrochemical industry. For high-performance mineral materials, sourcing involves silica (for aerogels) or basalt/slag (for high-density mineral wool). Upstream activities are characterized by high capital expenditure for chemical processing plants and specialized synthesis capabilities, with material quality directly correlating to the final product's thermal efficiency. Fluctuations in crude oil prices, therefore, pose a critical risk across the polymer-based segments.

The midstream focuses on manufacturing and conversion processes, including chemical blending, foaming (e.g., continuous lamination of PUR/PIR boards), vacuum sealing (for VIPs), and composite panel assembly. This stage demands sophisticated automation and stringent quality control, especially for advanced products where micron-level precision is required to maintain the vacuum or the porous structure. Manufacturers employ rigorous testing protocols to certify R-values and fire safety ratings. A significant trend in the midstream is the shift toward prefabricated structural insulated panels (SIPs), which integrate insulation directly with structural sheathing, offering a ready-to-install solution that reduces on-site labor and guarantees performance integrity.

Downstream distribution channels are bifurcated between direct sales to large, specialized contractors and indirect distribution through networks of building material suppliers, specialized distributors, and wholesalers. Direct sales are preferred for complex, high-volume industrial projects (e.g., cold storage warehouses or large commercial developments) where technical consultation and customized panel cutting are required. Indirect channels efficiently serve small-to-mid-sized residential builders and the retrofit market. Technical expertise at the distributor level is paramount, as advanced insulation requires specific handling and installation knowledge, often involving certified installers to maintain product warranties. The complexity of these materials necessitates strong post-sale support, including on-site training and technical documentation.

Advanced Structural Insulation Market Potential Customers

Potential customers for advanced structural insulation materials span a broad spectrum of the construction, industrial, and infrastructure sectors, all linked by the common necessity of achieving high-level thermal performance and operational cost reduction. Key end-users include large-scale commercial real estate developers focused on premium office spaces and mixed-use complexes, particularly those targeting green building certifications (LEED Platinum, BREEAM Outstanding). These clients prioritize materials like VIPs or Aerogel blankets in areas where space is constrained but thermal performance cannot be compromised, often driven by tenant demands for sustainability and low operational expenses. Specialized commercial buyers, such as operators of data centers and hospitals, represent high-value customers due to their critical, 24/7 temperature and humidity control needs, favoring materials with exceptional fire resistance and stable long-term R-values.

The industrial sector constitutes another crucial customer base, specifically encompassing companies involved in cold chain logistics, food processing, and specialized chemical manufacturing (cryogenics). These facilities require robust, high-density insulation materials, primarily high-performance PUR and XPS, designed to withstand extreme temperature differentials and mechanical stress while minimizing energy consumption for refrigeration or freezing. The global expansion of pharmaceutical cold chains, driven by biologics and temperature-sensitive vaccines, is rapidly increasing the demand for advanced insulation materials capable of maintaining ultra-low temperatures reliably over long transport distances and storage periods.

The residential market, consisting of high-end custom home builders and large production home developers, forms the foundational volume segment. Driven by governmental incentives, rising consumer environmental consciousness, and the desire for enhanced comfort, these customers increasingly seek high-performance rigid boards (PIR/XPS) and Structural Insulated Panels (SIPs) for superior envelope performance compared to traditional methods. Furthermore, government agencies and municipal bodies involved in public works and utility infrastructure retrofits are significant buyers, utilizing advanced insulation for improving the efficiency of district heating pipes, water storage tanks, and transportation infrastructure to enhance energy security and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group, BASF SE, Dow Inc., Owens Corning, Rockwool International A/S, Saint-Gobain, Knauf Insulation, Aspen Aerogels, Inc., Evonik Industries AG, Recticel NV/SA, Huntsman Corporation, Nippon Sheet Glass Co., Ltd., URSA Insulation S.A., Beijing New Building Materials Public Limited Company (BNBM), Atlas Roofing Corporation, Foamular (part of Johns Manville), Morgan Advanced Materials, NanoPore Insulation Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advanced Structural Insulation Market Key Technology Landscape

The technological landscape of advanced structural insulation is defined by innovations centered on achieving superior thermal performance (lower lambda values) with reduced material thickness, enhancing fire safety, and improving sustainability profiles. Vacuum Insulation Panels (VIPs) represent a mature, high-end technology, utilizing microporous cores sealed under vacuum to virtually eliminate gaseous heat transfer. The core technology lies in developing highly durable, low-permeability envelopes (usually multi-layer laminates) to maintain the vacuum over a projected 50-year lifespan. Ongoing R&D focuses on creating more robust and flexible VIPs that can be easily integrated into complex building geometries without compromising the vacuum seal, alongside efforts to lower the manufacturing cost associated with the necessary precise vacuum sealing equipment.

Aerogels and their derivative technologies are rapidly moving from niche aerospace applications into mainstream construction. Silica aerogels, known for their extremely low density and thermal conductivity (often achieving an R-value of R-10 or more per inch), are being commercialized primarily as flexible blankets or granule additives. Key technological breakthroughs include supercritical drying alternatives and ambient pressure drying techniques, which substantially reduce the prohibitive production costs of traditional aerogel manufacturing. Furthermore, hybrid insulation technologies, where aerogel particles are integrated into standard PIR or glass matting, are emerging to offer improved performance/cost ratios, bridging the gap between commodity and ultra-high-performance materials.

For traditional bulk rigid insulation, technological progress focuses on enhancing the blowing agents used in PUR and PIR foams (moving towards hydrofluoroolefins (HFOs) to minimize Global Warming Potential - GWP), and improving the cellular structure consistency to optimize R-value homogeneity across the entire panel. Structural Insulated Panels (SIPs) manufacturing technology is also advancing, utilizing highly automated pressing and bonding techniques to ensure perfect lamination between the insulation core and the structural sheathing (typically OSB or cement board), maximizing both thermal integrity and structural load-bearing capacity. Fire performance enhancement through the incorporation of specialized fire retardants and intumescent layers remains a critical area of innovation across all polymeric insulation types.

Regional Highlights

- Europe: Dominates the market due to the mandatory implementation of the European Union’s Energy Performance of Buildings Directive (EPBD), requiring all new buildings to be nearly zero-energy (NZEB). This region leads in the adoption of VIPs and high-density mineral wool for retrofitting historic and highly regulated urban environments. Germany, the UK, and France are primary growth hubs, driven by national decarbonization strategies and substantial government subsidies for energy renovation.

- Asia Pacific (APAC): Exhibits the fastest growth rate, fueled by unprecedented infrastructure investment, rapid population growth, and increasing awareness of air conditioning reliance. China and India are focusing on establishing mandatory energy codes for commercial and residential construction. The region shows high demand for cost-effective, high-volume materials like XPS and EPS, with localized production scaling rapidly to meet demand.

- North America: Characterized by a strong emphasis on residential energy efficiency standards (e.g., stricter building codes in California and New York) and the prevalence of extreme hot and cold climates requiring high-performance envelopes. The market is strong for Structural Insulated Panels (SIPs) and advanced PUR foams, benefiting from federal tax credits and incentive programs promoting high-efficiency construction, particularly in the custom and luxury housing segments.

- Latin America (LATAM): Growth is moderate but accelerating, primarily concentrated in major economies like Brazil and Mexico. Demand is driven by commercial development (offices, shopping centers) seeking compliance with international green building standards to attract foreign investment. The focus remains on cost-effective rigid foams, though interest in advanced materials for specialized industrial cold storage is rising.

- Middle East and Africa (MEA): Growth is primarily spurred by massive infrastructure projects (e.g., NEOM in Saudi Arabia) and the necessity to mitigate extreme heat. High-R-value materials are critical for reducing massive air conditioning loads. Demand is particularly strong for robust, fire-resistant, and high-density insulation suitable for large-scale, prestige commercial and government buildings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advanced Structural Insulation Market.- Kingspan Group

- BASF SE

- Dow Inc.

- Owens Corning

- Rockwool International A/S

- Saint-Gobain

- Knauf Insulation

- Aspen Aerogels, Inc.

- Evonik Industries AG

- Recticel NV/SA

- Huntsman Corporation

- Nippon Sheet Glass Co., Ltd.

- URSA Insulation S.A.

- Beijing New Building Materials Public Limited Company (BNBM)

- Atlas Roofing Corporation

- Soprema Group

- IKO Polymeric

- Morgan Advanced Materials

- Armacell International S.A.

- NanoPore Insulation Ltd.

Frequently Asked Questions

Analyze common user questions about the Advanced Structural Insulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Advanced Structural Insulation?

The primary driver is the implementation of increasingly stringent global energy efficiency regulations and building codes, such as mandatory Net-Zero Energy Building (NZEB) standards, which compel the use of high-R-value, high-performance insulation to meet required thermal envelopes and minimize carbon emissions.

How do Advanced Structural Insulation materials compare to traditional insulation in terms of R-value?

Advanced materials, such as Vacuum Insulation Panels (VIPs) and Aerogels, offer significantly higher R-values (thermal resistance) per inch of thickness, often reaching R-10 to R-30 per inch, enabling architects to achieve high performance while minimizing the thickness of the building envelope, thus maximizing usable internal space.

Which advanced insulation material is expected to show the highest growth rate during the forecast period?

While Polyisocyanurate (PIR) foam currently holds the largest volume share, Aerogels and Vacuum Insulation Panels (VIPs) are projected to exhibit the highest growth rate due to technological advancements reducing their cost, and their necessity in specialized, high-performance applications like urban retrofitting and cryogenic industrial storage.

What role do Structural Insulated Panels (SIPs) play in the Advanced Structural Insulation Market?

SIPs are critical in the market by offering prefabricated, high-performance building components. They integrate the insulation core (often PUR or EPS) directly with structural sheathing, guaranteeing consistent thermal performance, rapid installation, and superior structural integrity compared to conventional stick-built construction methods.

What are the key sustainability challenges associated with advanced insulation materials?

Key challenges include managing the high Global Warming Potential (GWP) of older blowing agents used in polymer foams (though newer HFO agents mitigate this) and the difficulty in recycling complex composite materials like VIP envelopes or certain laminated panels at the end of their service life. Manufacturers are actively pursuing bio-based alternatives and design-for-disassembly protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager