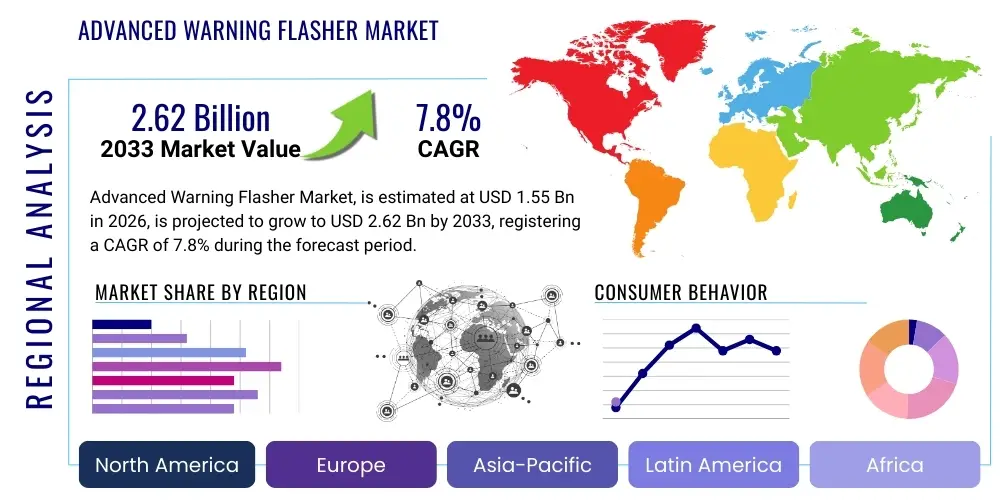

Advanced Warning Flasher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437169 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Advanced Warning Flasher Market Size

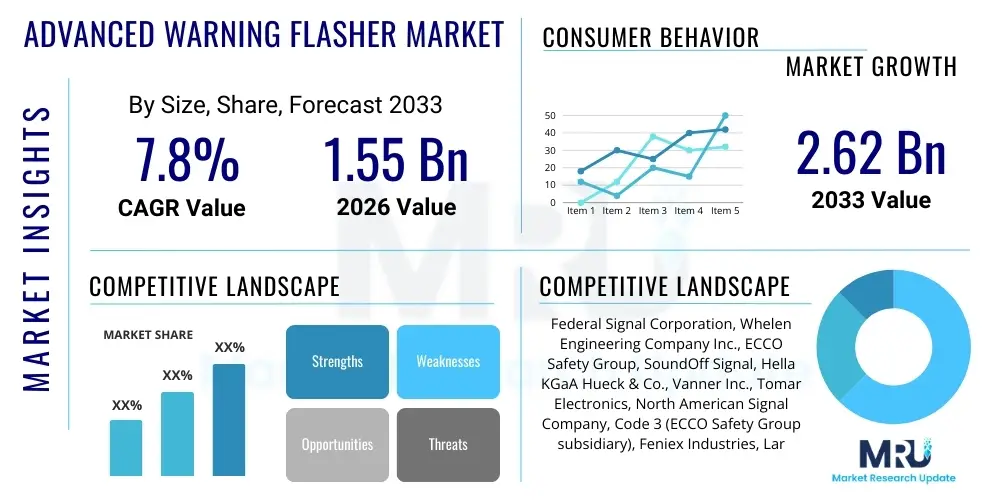

The Advanced Warning Flasher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.62 Billion by the end of the forecast period in 2033.

Advanced Warning Flasher Market introduction

The Advanced Warning Flasher Market encompasses specialized lighting devices designed to enhance visibility and alert motorists or personnel to hazardous conditions, temporary road obstructions, or emergency situations. These systems utilize sophisticated LED technology, offering superior luminosity, reduced power consumption, and extended operational life compared to traditional incandescent flashers. Key product offerings range from temporary, battery-operated barricade lights and flares to permanent, vehicle-mounted strobe systems and synchronized intersection warning arrays. The fundamental purpose of these advanced systems is minimizing accident frequency and maximizing response efficiency across various high-risk operational environments.

Major applications of advanced warning flashers span critical sectors including municipal traffic management, large-scale construction and infrastructure projects, logistics and freight transportation, and first responder emergency services (police, fire, EMS). The integration of robust, weather-resistant materials and smart control features—such as automatic activation based on ambient light or remote monitoring capabilities—further drives their adoption. As regulatory bodies globally mandate stricter safety protocols and visibility standards for roadside operations and mobile work zones, the demand for high-performance, compliant warning flashers continues to accelerate, underpinning the market's trajectory.

The primary benefits derived from deploying these advanced systems include substantial improvements in occupational safety, reduction in property damage costs, and streamlined operational compliance with regional safety codes (e.g., MUTCD in North America, ECE regulations in Europe). Driving factors are heavily weighted towards increased government spending on road network modernization, the rising frequency of severe weather events requiring specialized warning systems, and technological advancements that enable higher visibility patterns and greater energy efficiency, facilitating deployment in remote locations where reliable power sources are scarce.

Advanced Warning Flasher Market Executive Summary

Global business trends in the Advanced Warning Flasher Market are characterized by a pronounced shift towards IoT-enabled smart devices capable of wireless synchronization and real-time operational diagnostics. Fleet operators and infrastructure management entities are prioritizing systems that offer remote management of flash patterns, battery status, and geo-location tracking, directly integrating warning systems into broader fleet safety management platforms. Furthermore, sustainability initiatives are driving innovation towards solar-powered flashers and ultra-low power consumption LED arrays, reducing the environmental footprint and minimizing maintenance requirements associated with battery replacements, particularly in temporary work zone applications.

Regional trends indicate North America and Europe retaining mature market dominance, largely driven by stringent regulatory enforcement regarding temporary traffic control devices and high initial adoption rates of connected vehicle technology (V2X infrastructure). Conversely, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive ongoing infrastructure development projects in rapidly urbanizing economies like China and India, coupled with increasing government emphasis on industrial safety standards. Latin America and MEA markets show steady expansion, primarily targeting oil & gas exploration, mining operations, and critical logistics corridors that require robust, high-durability warning systems capable of operating in harsh climatic conditions.

Segmentation trends highlight the increasing demand for high-intensity, vehicle-mounted LED light bars and low-profile strobe systems, reflecting growth in the professional and commercial vehicle customization segment. By application, the infrastructure and construction segments remain the largest consumers, though the logistics and municipal fleet segment shows the most accelerated adoption rate due to the critical need for advanced warning indicators during roadside stops and deliveries. Technology segmentation favors high-lumen, multi-pattern flashers offering customization to specific jurisdictional requirements, ensuring versatility across international operational domains and enhancing warning efficacy during diverse environmental conditions such as fog or heavy precipitation.

AI Impact Analysis on Advanced Warning Flasher Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Advanced Warning Flasher Market frequently center on the potential for autonomous decision-making in warning systems, the optimization of flashing patterns based on real-time environmental data, and the role of predictive analytics in maintenance scheduling. Users are keen to understand how AI-driven sensor fusion—combining lidar, radar, and vision systems—can trigger highly specific and context-aware warnings, moving beyond simple on/off functionality. Key concerns revolve around the cybersecurity vulnerabilities of connected AI flashers and the regulatory framework required for systems that dynamically alter warning parameters based on computational risk assessment. Expectations include enhanced safety through reduced human intervention, dynamic pattern adjustments for optimal visibility relative to traffic speed and density, and integration with emerging smart city infrastructure to manage traffic flow around incidents automatically.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to forecast component failure (e.g., LED degradation, battery capacity depletion) in advanced flasher units, minimizing unexpected downtime.

- Dynamic Warning Pattern Optimization: AI adjusting flash frequency, intensity, and color based on real-time factors such as vehicle speed, distance, weather conditions, and ambient light levels to maximize alertness while minimizing visual distraction.

- Integration with Smart Traffic Management: AI linking flasher activation and pattern selection to centralized traffic control systems and V2X communication networks to coordinate warnings across multiple adjacent zones autonomously.

- Context-Aware Incident Detection: Employing AI-powered computer vision on connected fleet vehicles to automatically detect roadside hazards or disabled vehicles, triggering warning flashers immediately without manual intervention.

- Enhanced Energy Management: Machine learning optimization of power draw cycles in solar and battery-powered units, ensuring maximum operational duration during extended incidents or periods of low sunlight.

DRO & Impact Forces Of Advanced Warning Flasher Market

The Advanced Warning Flasher Market is significantly propelled by stringent governmental safety mandates and the continuous global investment in critical infrastructure development. A primary driver is the pervasive regulation requiring high-visibility markings and warning signals for all maintenance, utility, and emergency vehicles, pushing standard systems towards advanced LED and integrated strobe technology that meets higher lumen output and durability standards. Furthermore, the accelerating adoption of fleet telematics and IoT integration across commercial transportation sectors creates a powerful pull for advanced flashers that can report operational status, battery health, and geo-location data directly back to central management systems, enhancing compliance monitoring and reducing liability exposure. This technological maturation acts as a strong internal force sustaining market growth.

However, the market faces several restraining factors, notably the high initial investment cost associated with advanced, synchronized, and connected flasher systems compared to basic incandescent or early-generation LED models. This cost barrier can slow adoption among smaller municipalities or independent contractors, particularly in emerging economies where budget constraints are severe. Another restraint involves technical complexity, including ensuring electromagnetic compatibility (EMC) in densely packed vehicle environments and addressing concerns over battery life and reliability, especially in systems required to operate autonomously for prolonged periods without access to external charging infrastructure. Furthermore, the lack of universal global standards for optimal flash patterns and intensity creates friction for manufacturers and multi-national fleet operators.

Significant opportunities arise from the convergence of smart city initiatives and the development of Vehicle-to-Everything (V2X) communication protocols. Advanced flashers are poised to become critical endpoints in V2X networks, communicating real-time incident location and warning status directly to approaching autonomous and connected vehicles, thereby enabling highly precise safety responses. The expanding market for specialized, ruggedized warning systems in harsh environments—such as mining, maritime, and specialized agriculture—presents lucrative niche opportunities. Impact forces, therefore, include the mandatory governmental regulations acting as the strongest external driver, balanced against the internal challenge of standardizing high-performance system costs and ensuring robust wireless connectivity in all operational scenarios, which demands continuous R&D investment.

Segmentation Analysis

The Advanced Warning Flasher Market is systematically segmented based on key operational and technical attributes, allowing for granular market targeting and strategic analysis. Primary segmentation categories include technology (LED, Strobe, Incandescent), mounting type (Vehicle-Mounted, Portable/Temporary, Fixed Infrastructure), application (Emergency Services, Construction, Logistics, Traffic Control), and operational mode (Wired, Wireless/Synchronized). This structure reflects the diverse end-user requirements, ranging from immediate, high-intensity requirements of fire and police services to the prolonged, low-maintenance needs of roadside construction barricades. Analyzing these segments is essential for understanding regional adoption patterns and technological maturity.

The LED technology segment dominates the market due to superior energy efficiency, extended product lifecycle, and compliance with modern visibility standards. Within mounting types, the Vehicle-Mounted segment captures the largest market share, driven by the massive global fleet of utility, municipal, and commercial vehicles that require continuous, mandatory warning capabilities. However, the Portable/Temporary segment is exhibiting rapid CAGR, spurred by the proliferation of temporary work zones and the increasing reliance on quick-deploy safety systems for utility repairs and short-term roadside incidents. This segment is characterized by innovations in solar charging and magnetic mounting capabilities.

Application analysis demonstrates that the Construction and Infrastructure segment utilizes the highest volume of units, primarily ground-level barricade lights and traffic cones with integrated flashers. Conversely, the Emergency Services application segment drives demand for the highest performance and most technologically sophisticated products, demanding multi-color, multi-pattern, high-lumen light bars integrated with vehicle control systems. The ongoing standardization efforts across various governmental bodies concerning warning light specifications ensure that compliance remains a critical purchasing criterion across all analyzed market segments, reinforcing the shift towards premium, certified flasher solutions.

- Technology

- LED Flashers (Dominant and fastest growing)

- Strobe Flashers (High intensity, focused applications)

- Incandescent Flashers (Phasing out, niche markets)

- Mounting Type

- Vehicle-Mounted Flashers (Lightbars, Grille Lights)

- Portable/Temporary Flashers (Barricade Lights, Flare Replacements)

- Fixed Infrastructure Flashers (Traffic Signals, Bridges)

- Application

- Emergency Services (Police, Fire, EMS)

- Construction and Infrastructure

- Logistics and Commercial Fleets

- Utility and Maintenance Services

- Traffic Management and Public Safety

- Operational Mode

- Wired Systems

- Wireless/Synchronized Systems (IoT/Telematics Integrated)

Value Chain Analysis For Advanced Warning Flasher Market

The value chain for the Advanced Warning Flasher Market begins with upstream activities focused heavily on the procurement of specialized electronic components, primarily high-intensity LED chips, durable polymer enclosures (polycarbonate or ABS), and advanced power management systems (lithium-ion batteries, solar cells, charging circuits). Due to the requirements for environmental resilience (IP ratings) and high visibility, sourcing specialized materials that meet rigorous thermal and shock resistance standards is crucial. Manufacturing involves highly technical processes including injection molding, circuit board assembly (PCBA), photometric testing, and complex assembly required to achieve necessary compliance certifications such as ECE R65 or SAE J845/J595, adding significant value and technical barrier to entry at this stage.

Midstream activities involve sophisticated distribution channels necessary to reach the highly fragmented end-user base. Direct distribution is common for large-volume OEM contracts, where flashers are integrated directly into the manufacturing process of emergency vehicles or heavy construction equipment. Indirect distribution utilizes specialized wholesale distributors focusing on public safety equipment, fleet management solutions, and industrial safety supplies. These distributors often provide installation support, regulatory compliance consultancy, and post-sale maintenance, acting as critical intermediaries in connecting high-specification products with end-users who require localized expertise and certification adherence.

Downstream analysis focuses on the final application and integration. For vehicle-mounted flashers, installation often involves specialized upfitting service providers who integrate the warning system with the vehicle's electrical architecture and control panels. For temporary systems, the distribution relies on rental equipment companies and construction material suppliers. The market is increasingly influenced by after-sales service, including telematics subscriptions for connected systems and routine maintenance, solidifying long-term customer relationships and generating recurring revenue streams, especially from large governmental fleets and infrastructure contractors who demand maximized operational uptime.

Advanced Warning Flasher Market Potential Customers

The primary cohort of potential customers for Advanced Warning Flashers comprises governmental agencies at the federal, state, and local levels, encompassing departments responsible for public safety, transportation infrastructure, and municipal services. These agencies are non-discretionary buyers, driven by mandatory safety regulations and continuous cycles of fleet replacement and road network expansion. Their purchasing decisions prioritize product compliance with established national standards (e.g., DOT, ECE), system reliability in critical operational environments, and compatibility with standardized vehicle fleet management systems, making them the most stable and substantial demand source for high-volume, standardized flasher units.

A secondary, yet rapidly expanding customer base includes large commercial entities involved in logistics, mining, utility provision, and construction. Fleet operators within these sectors seek advanced flashers not only for legal compliance but as a critical component of risk mitigation strategies, protecting both personnel and valuable assets. The preference among these buyers leans towards ruggedized, high-durability systems that can withstand harsh operating conditions and integrated solutions offering remote monitoring capabilities to minimize roadside checks and ensure fleet-wide operational readiness, thus optimizing their total cost of ownership (TCO).

Finally, niche potential customers include independent utility service contractors, private security firms, and specialized vehicle modifiers (upfitters). These buyers often seek highly customized solutions, prioritizing specific light patterns, aesthetic integration (low-profile design), and ease of installation on diverse vehicle platforms. The market for individual consumer safety devices, such as personal roadside safety kits utilizing advanced magnetic LED flashers as replacements for chemical flares, also represents a growing, though lower-volume, potential market segment, driven by increased consumer awareness regarding vehicle safety and personal preparedness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.62 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Federal Signal Corporation, Whelen Engineering Company Inc., ECCO Safety Group, SoundOff Signal, Hella KGaA Hueck & Co., Vanner Inc., Tomar Electronics, North American Signal Company, Code 3 (ECCO Safety Group subsidiary), Feniex Industries, Larson Electronics, Star Headlight & Lantern Co., Juluen Enterprise Co., Ltd., Axixtech, M-Tech Automotive, Standby AB, Premier Hazard Systems Ltd., Optronics International, Nova Electronics, Abrams Mfg Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advanced Warning Flasher Market Key Technology Landscape

The technological landscape of the Advanced Warning Flasher Market is defined by the pervasive adoption of High-Intensity Discharge (HID) replacement systems using specialized LED clusters and enhanced control electronics. Modern systems utilize advanced optics, such as TIR (Total Internal Reflection) lenses and reflectors, to precisely control the beam angle and maximize light output efficiency, ensuring warnings are highly directional and visible even in bright daylight. A significant trend is the development of multi-color LED modules (e.g., white/amber/red switching capability) integrated into single light bars, allowing operators to switch warning priorities or regulatory compliance modes quickly, enhancing versatility across different operational jurisdictions and incident types without needing separate hardware.

Connectivity and power management represent another critical technology focus. Wireless synchronization, often utilizing low-power mesh networking protocols (like Bluetooth or specialized RF communication), allows multiple flashers (on a vehicle or a series of road barriers) to operate in unison, creating highly conspicuous and attention-grabbing warning patterns that are more effective than isolated units. Furthermore, energy efficiency improvements in LED drivers and the increasing integration of solar power management circuits are crucial for the portable flasher segment, extending battery life and reducing the necessity for frequent manual charging, thus improving operational readiness and reducing total maintenance costs in remote or extended deployment scenarios.

The market is also witnessing the rise of integrated sensor technology. Advanced flashers are incorporating accelerometers and gyroscopes to detect vehicle orientation or impact severity, automatically escalating warning patterns or alerting centralized command centers during an accident. Future technological convergence will see flashers embedding basic V2X transceivers, transforming them from passive warning emitters into active safety communication nodes that broadcast incident data directly to surrounding vehicles, thereby enabling true preventative safety actions by connected and autonomous driving systems. This transition is positioning warning flashers as integral components of future intelligent transportation systems (ITS).

Regional Highlights

- North America (USA, Canada, Mexico)

North America maintains a leading position in the Advanced Warning Flasher Market, primarily driven by rigorous federal and state safety regulations (e.g., MUTCD standards for temporary traffic control) and a highly structured public safety and utility infrastructure sector. The US, in particular, exhibits high demand for high-performance, complex vehicle-mounted systems, often requiring SAE Class 1 certification, reflecting the expectation for exceptional brightness and reliability. The region’s technological maturity encourages rapid adoption of IoT-enabled and synchronized flasher systems integrated with comprehensive fleet telematics, enabling proactive monitoring and remote control features essential for large commercial and municipal fleets. Market growth here is stable, characterized by replacement cycles and upgrades to increasingly connected, multi-functional lighting solutions.

The Canadian market follows similar stringent safety standards, with strong demand from resource extraction and logistics companies operating in extreme weather conditions, necessitating highly durable and cold-resistant flasher components. Mexico's market growth is tied closely to expanding infrastructure development and increasing regulatory harmonization with US safety standards, driving demand for compliant LED warning systems in construction and public works vehicles. The region, overall, serves as a benchmark for premium product performance and system integration complexity in the global market.

- Europe (Germany, UK, France, Italy, Spain)

Europe represents a highly compliant and innovation-focused market, significantly influenced by ECE R65 regulations, which standardize the intensity, color, and flash rate of warning devices across member states, facilitating cross-border operational consistency. This focus on regulatory alignment drives manufacturers towards high-quality, certified products. Western European countries, particularly Germany and the UK, prioritize energy efficiency and low-impact solutions, accelerating the adoption of solar-powered and highly optimized battery-operated warning systems for urban work zones and utility operations. Sustainability mandates often intersect with safety requirements, pushing innovation in material selection and system longevity.

The European market is also distinguished by strong penetration of specialized vehicle upfitting companies that demand tailored flasher solutions for diverse vehicle types (ambulances, road maintenance vehicles, towing services). Demand is further supported by governmental efforts to modernize urban traffic management systems, where integrated flashers play a critical role in signaling incidents and dynamically rerouting traffic. The emphasis on worker safety in EU directives ensures continuous investment in advanced portable warning systems that provide maximal protection for personnel operating on high-speed roadways, contributing to steady, compliance-driven market expansion.

- Asia Pacific (APAC) (China, Japan, India, South Korea)

The APAC region is the epicenter of future market growth for Advanced Warning Flashers, characterized by massive public and private investment in urbanization and infrastructure projects, particularly in China and India. While regulatory enforcement historically varied, standardization efforts are accelerating, particularly influenced by Japanese and South Korean standards which adhere to high technological benchmarks. The market is highly price-sensitive but simultaneously demands robust performance due to extensive construction activity and often challenging environmental conditions, leading to rapid adoption of affordable yet effective LED warning technologies.

China is a critical market both in terms of consumption and manufacturing capacity, driving global competition and supply chain optimization. India's demand is surging due to extensive national highway development programs and a heightened focus on industrial safety compliance across manufacturing and logistics sectors. South East Asian countries are increasingly integrating advanced flashers into new smart city developments and port infrastructure. The overall regional trend is defined by a swift transition from basic, high-maintenance incandescent lighting to scalable, durable LED solutions, positioning APAC as the highest growth market segment globally over the forecast period.

- Latin America (Brazil, Argentina, Mexico, Rest of Latam)

Latin America's market growth is intrinsically linked to commodity cycles, infrastructure spending, and the expansion of heavy industries such as mining and oil & gas exploration, which require highly reliable, heavy-duty warning flashers. While governmental budget constraints can limit widespread adoption of the most technologically complex systems, there is consistent demand for vehicle safety equipment driven by compulsory regulatory frameworks related to commercial vehicle operation and fleet safety. Brazil and Mexico represent the largest markets, benefitting from significant road network investment and the modernization of urban transit systems.

- Middle East and Africa (MEA) (GCC Countries, South Africa)

The MEA market is heterogeneous. The GCC countries (Saudi Arabia, UAE) demonstrate high demand for premium, technologically advanced flashers for high-profile infrastructure projects, port security, and sophisticated emergency services, characterized by purchasing power that supports the adoption of the latest integrated systems. The focus here is on high heat resistance and desert environment durability. In contrast, the African market is primarily driven by essential safety equipment needs in mining, utility projects, and basic traffic control, emphasizing cost-effectiveness and ruggedness, often relying on simple, low-power portable solutions capable of enduring limited maintenance resources and challenging power grid reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advanced Warning Flasher Market.- Federal Signal Corporation

- Whelen Engineering Company Inc.

- ECCO Safety Group

- SoundOff Signal

- Hella KGaA Hueck & Co.

- Vanner Inc.

- Tomar Electronics

- North American Signal Company

- Code 3 (ECCO Safety Group subsidiary)

- Feniex Industries

- Larson Electronics

- Star Headlight & Lantern Co.

- Juluen Enterprise Co., Ltd.

- Axixtech

- M-Tech Automotive

- Standby AB

- Premier Hazard Systems Ltd.

- Optronics International

- Nova Electronics

- Abrams Mfg Inc.

Frequently Asked Questions

Analyze common user questions about the Advanced Warning Flasher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Advanced Warning Flasher Market?

The primary technology driving market growth is high-intensity, energy-efficient LED clusters, coupled with advanced optics (TIR lenses) and integrated wireless synchronization capabilities. These advancements ensure superior visibility, longer battery life, and compliance with modern safety standards such as ECE R65 and SAE Class 1, critical for effective hazard signaling.

Which application segment holds the largest share in the Advanced Warning Flasher Market?

The Construction and Infrastructure application segment currently holds the largest volume share, driven by mandatory safety requirements for road maintenance, utility work, and large-scale public works projects, necessitating extensive deployment of both vehicle-mounted and portable barricade flashers.

How is the adoption of IoT influencing advanced warning flasher systems?

IoT integration enables advanced flashers to function as connected endpoints, supporting wireless synchronization across multiple units, providing real-time operational diagnostics (battery status, fault reporting), and allowing for remote control and pattern adjustment via centralized fleet management telematics platforms, significantly improving operational efficiency.

Which geographic region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR)?

The Asia Pacific (APAC) region is projected to exhibit the fastest CAGR, fueled by rapid urbanization, massive ongoing infrastructure development projects across major economies like China and India, and increasing governmental focus on harmonizing and enforcing industrial and traffic safety standards.

What are the main restraints impacting the growth of the Advanced Warning Flasher Market?

The main restraints include the high initial procurement cost of advanced, certified, and connected LED systems compared to conventional alternatives, ongoing challenges related to achieving universal global regulatory standardization, and technical limitations concerning the sustained, autonomous battery life required for portable units in extended field operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager