AEM Multicore Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438902 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

AEM Multicore Market Size

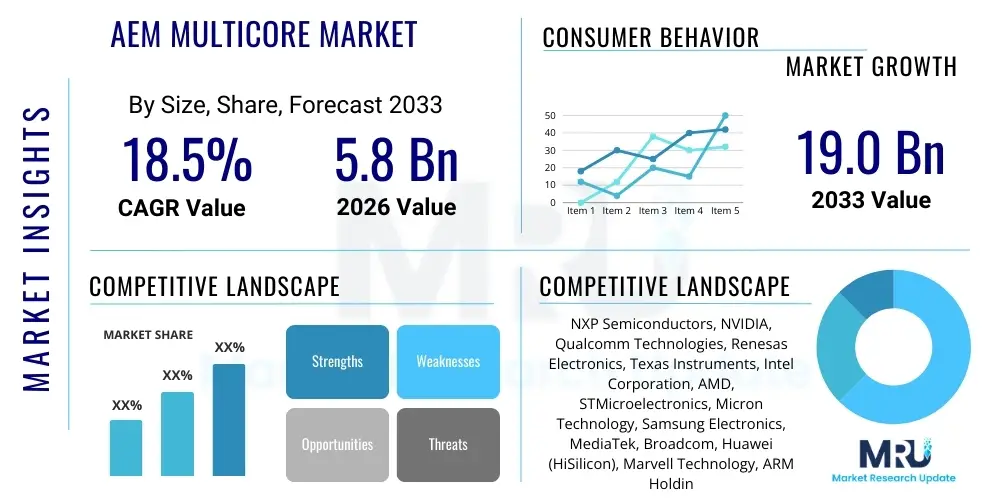

The AEM Multicore Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $19.0 Billion by the end of the forecast period in 2033.

AEM Multicore Market introduction

The Advanced Embedded Multicore (AEM Multicore) Market encompasses specialized semiconductor solutions designed to execute complex, real-time computational workloads across diverse industrial, automotive, and data center environments. These systems leverage heterogeneous core architectures, often integrating conventional CPUs, specialized Digital Signal Processors (DSPs), Graphics Processing Units (GPUs), and customized accelerators like Neural Processing Units (NPUs) or Field-Programmable Gate Arrays (FPGAs) onto a single silicon die or package. This architectural complexity is specifically engineered to meet stringent requirements for power efficiency, low latency, and high throughput, which are essential for modern applications such as autonomous driving, industrial IoT (IIoT), and advanced telecommunications infrastructure.

The primary benefit derived from AEM Multicore systems lies in their exceptional ability to handle parallel processing tasks efficiently, allowing for superior workload distribution compared to traditional single-core or homogenous multicore architectures. This capability is critical in environments where machine learning inference, sensor fusion, and predictive maintenance algorithms must operate concurrently without compromising performance or energy consumption. Major applications span the high-reliability sectors, including safety-critical systems in aerospace and defense, advanced driver-assistance systems (ADAS) in automotive manufacturing, and high-density switching in 5G network infrastructure. The versatility of AEM architectures allows original equipment manufacturers (OEMs) to tailor computing resources precisely to application needs, optimizing both cost and thermal footprints.

Driving factors for the accelerated market adoption of AEM Multicore solutions include the exponential growth in data generation at the edge, the increasing sophistication of embedded AI algorithms, and the global imperative for energy efficiency in computing. Furthermore, the transition toward highly interconnected industrial processes and autonomous systems mandates robust, fault-tolerant processing capabilities that AEM platforms inherently provide. The ongoing miniaturization of semiconductor processes, coupled with advancements in chiplet technology, further enables the integration of more cores and specialized functions, pushing the performance envelope and solidifying the AEM Multicore platform as foundational technology for next-generation embedded computation.

AEM Multicore Market Executive Summary

The AEM Multicore Market is characterized by intense innovation driven by the convergence of edge computing demands and the necessity for power-optimized processing. Business trends indicate a strategic shift among major semiconductor providers toward offering comprehensive System-on-Chip (SoC) solutions that bundle multicore processing units with proprietary software stacks and development kits, thereby lowering the barrier to entry for developers targeting specialized applications like AI inference at the network periphery. Furthermore, geopolitical factors influencing the semiconductor supply chain are accelerating regional investment in advanced fabrication capabilities, particularly within the US, Europe, and Asia Pacific, aiming to secure resilient sourcing for these mission-critical components. Consolidation through strategic partnerships and mergers focused on acquiring specialized IP cores (such as RISC-V expertise) is also defining the competitive landscape.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market for AEM Multicore technology, primarily due to its robust electronics manufacturing ecosystem, massive consumer electronics production, and rapid deployment of 5G infrastructure. North America maintains a leadership position in fundamental research and development, particularly concerning high-performance computing (HPC) and advanced cloud-edge integration solutions, while Europe is establishing significant market share driven by stringent automotive safety standards (ISO 26262) and large-scale industrial automation initiatives. Investment in local fabrication plants across these regions underscores the strategic importance of domestic semiconductor supply, mitigating reliance on cross-border supply chains for foundational hardware.

Segmentation trends reveal that the heterogeneous multicore segment, which combines diverse core types (e.g., mixing high-performance cores with high-efficiency cores), is outpacing the growth of homogeneous architectures. This trend is directly linked to the requirement for maximizing performance per watt in resource-constrained edge devices. Application-wise, the automotive sector, propelled by Level 3 and Level 4 autonomous driving system demands, represents the fastest-growing end-user segment. Concurrently, the increasing complexity of industrial internet of things (IIoT) applications is driving strong demand for embedded AEM solutions capable of sophisticated sensor data processing and localized decision-making, confirming the market trajectory toward highly specialized and customized silicon solutions.

AI Impact Analysis on AEM Multicore Market

User inquiries regarding the interplay between Artificial Intelligence (AI) and the AEM Multicore Market consistently center on efficiency, deployment feasibility, and architectural needs. Common questions include: "How do AEM multicore architectures specifically optimize the execution of AI inference models at the edge?" and "Will dedicated AI accelerators entirely replace general-purpose CPU cores in these systems?" Users are concerned about thermal management challenges when running intensive AI workloads and the tooling required to efficiently partition machine learning models across heterogeneous core types. The core expectation is that AEM Multicore systems should serve as the foundational hardware platform that makes real-time, high-fidelity AI ubiquitous, moving processing out of the cloud and into the device itself.

AI's primary impact on AEM Multicore design is the mandate for architectural specialization. Traditional homogeneous multicore designs struggle to efficiently handle the matrix multiplication and convolution operations typical of deep neural networks without incurring significant power costs. AEM architectures mitigate this by integrating dedicated accelerators, such as NPUs or tensor cores, which dramatically improve the performance-per-watt ratio for inference tasks. This specialization ensures that core computing resources remain available for general system operations, operating systems, and legacy code execution, while AI tasks benefit from tailored silicon, leading to lower latency and higher system responsiveness required in critical applications like predictive maintenance and autonomous control systems.

Furthermore, the growth of TinyML (Machine Learning on microcontrollers) and Edge AI necessitates that AEM platforms support highly constrained environments. This drives innovation in interconnect fabrics and memory coherence protocols, ensuring that data can be seamlessly shared between different processing elements (CPU, GPU, NPU) with minimal overhead. The market success of future AEM solutions will be intrinsically tied to their ability to provide robust, developer-friendly frameworks that allow easy mapping of complex, multi-stage AI pipelines onto heterogeneous silicon. This integration capability is vital for advancing the deployment of sophisticated vision systems, natural language processing models, and sophisticated sensor fusion applications in mass-market devices.

- AI algorithms necessitate heterogeneous core design, driving the integration of dedicated Neural Processing Units (NPUs) alongside standard CPU cores.

- Increased demand for real-time Edge AI inference accelerates the market requirement for power-efficient AEM architectures.

- AI development toolchains must evolve to seamlessly partition machine learning workloads across diverse core types within the AEM package.

- The complexity of sensor fusion in autonomous systems relies heavily on the low-latency parallel processing capabilities offered by AEM Multicore solutions.

- AI deployment pushes the technological boundaries regarding thermal management and interconnect bandwidth within compact embedded systems.

DRO & Impact Forces Of AEM Multicore Market

The AEM Multicore Market is currently experiencing powerful growth momentum stemming from critical technological and industrial shifts, primarily centered around the demand for sophisticated edge processing and improved energy efficiency. The main driver is the explosion of data generated by billions of IoT devices, requiring immediate, localized processing to minimize latency and bandwidth strain on cloud infrastructure. However, this advancement is constrained significantly by the escalating complexity of software development for heterogeneous hardware and the critical need for advanced thermal dissipation solutions in densely packed system architectures. Opportunities are abundant, specifically in emerging high-growth sectors such as 5G network slicing, advanced robotics, and personalized healthcare devices, all of which require the high reliability and customized performance delivered by AEM platforms. These forces collectively dictate market trajectory, influencing investment in specialized fabrication technologies and intellectual property licensing.

Drivers: The relentless pursuit of autonomy across automotive and industrial sectors mandates embedded systems capable of massive parallel computation for sensor data integration and real-time decision-making, which AEM multicore platforms are optimally suited to provide. Furthermore, the migration of complex AI inference models from the data center to the device level requires systems offering superior performance per watt, a core characteristic of specialized AEM designs. Regulatory pressures related to functional safety (e.g., ISO 26262 and IEC 61508) further compel industries to adopt robust, fault-tolerant multicore architectures that facilitate redundancy and reliable concurrent operation. The commercial rollout of 5G infrastructure also acts as a significant catalyst, demanding powerful and efficient AEM processors for base station and network equipment optimization.

Restraints: The primary constraint revolves around the significant challenge of developing effective software and middleware layers that can efficiently manage task scheduling and resource allocation across highly diverse, heterogeneous processing cores. Debugging and validating complex concurrent systems introduce considerable development overhead and time-to-market delays. Additionally, the cutting-edge process nodes required for manufacturing high-density AEM multicore chips lead to extremely high initial fabrication costs (NRE), making these solutions less viable for lower-volume applications. The physical limitations imposed by power density and thermal dissipation in increasingly compact embedded form factors also present a hard barrier to continued performance scaling.

Opportunities: The transition towards advanced semiconductor packaging techniques, such as chiplets and 3D stacking, presents a major opportunity to overcome physical limitations related to interconnect bandwidth and power efficiency, allowing for the integration of even more specialized cores. The rapid maturation of open-source instruction set architectures (ISAs) like RISC-V offers OEMs increased customization flexibility and reduces reliance on proprietary IP, fostering innovation in specialized core design optimized for domain-specific workloads. Expanding applications in high-reliability fields, particularly in aerospace, defense, and mission-critical medical imaging, provide lucrative, high-margin opportunities for fault-tolerant AEM multicore solutions.

Segmentation Analysis

The AEM Multicore Market is primarily segmented based on the type of core architecture employed, the specific end-use application domain, and the underlying process technology utilized for manufacturing. Understanding these segmentations is critical for market participants to tailor product offerings and allocate research and development resources effectively. The architecture segment is dominated by the distinction between homogenous (identical core types) and heterogeneous (mixed core types, optimized for different tasks) systems, with the latter showing accelerated growth due due to its superior adaptability for mixed workloads like control processing alongside AI inference.

Segmentation by application highlights distinct performance, power, and reliability requirements across different industry verticals. The automotive sector requires extreme reliability and strict safety certifications, driving demand for specific high-integrity cores. Conversely, the consumer electronics and mobile segment prioritizes power efficiency and integration density. Process technology segmentation is crucial as it dictates the achievable density and efficiency, with advanced nodes (5nm and below) enabling the integration of massively parallel core counts necessary for next-generation data center and high-end automotive processors, while legacy nodes remain relevant for lower-cost industrial control systems.

- By Core Architecture:

- Homogeneous Multicore Systems

- Heterogeneous Multicore Systems (CPU+GPU, CPU+DSP, CPU+NPU combinations)

- By Technology Node:

- 7nm and Above

- 5nm to 3nm

- Below 3nm (Advanced Nodes)

- By Application:

- Automotive (ADAS, Infotainment, Engine Control)

- Industrial IoT (Robotics, Factory Automation, Predictive Maintenance)

- Telecommunications (5G Base Stations, Edge Servers)

- Consumer Electronics (High-end Mobile Devices, Gaming Consoles)

- Aerospace and Defense (Mission-Critical Embedded Systems)

- Healthcare (Medical Imaging, Diagnostic Equipment)

- By Operating System Support:

- Real-Time Operating Systems (RTOS)

- General Purpose Operating Systems (GPOS)

- Bare-Metal/Hypervisor Implementations

Value Chain Analysis For AEM Multicore Market

The AEM Multicore value chain is highly specialized, starting with fundamental Intellectual Property (IP) design and extending through complex semiconductor fabrication processes, sophisticated system integration, and finally, deployment in mission-critical end-user systems. The upstream segment is dominated by specialized IP providers and Electronic Design Automation (EDA) tool vendors, whose advanced tools are necessary for designing and validating the concurrent operation of heterogeneous cores. Key players in this stage include firms that license foundational CPU and accelerator architectures, such as ARM, CEVA, and increasingly, those focusing on open-source standards like RISC-V. The quality and efficiency of the licensed IP fundamentally determine the performance characteristics of the final AEM product.

Midstream activities are characterized by intense capital expenditure in fabrication. This involves the complex manufacturing of chips by Integrated Device Manufacturers (IDMs) or specialized foundries (fabs), requiring massive investment in advanced lithography equipment necessary for producing sub-7nm process nodes. Post-fabrication, the chips undergo rigorous testing, packaging (including advanced 2.5D and 3D packaging techniques like chiplets), and quality assurance before moving downstream. The robustness of the supply chain, particularly regarding access to advanced fabrication capacity, is a primary risk factor in this segment, emphasizing the importance of diverse sourcing and supply chain resilience strategies.

The downstream segments involve Original Equipment Manufacturers (OEMs) and Tier 1 suppliers who integrate the multicore chips into finished products, such as automotive ECUs, industrial controllers, or network routers. Distribution channels are typically a mix of direct sales for large volume or strategic customers (especially in automotive and defense) and indirect distribution through specialized electronics distributors and value-added resellers (VARs) who provide localized technical support and pre-integrated module solutions. The complexity of AEM software stacks often necessitates a high degree of direct technical engagement between the semiconductor vendor and the end-user, ensuring optimized system performance and reliable operation in diverse deployment environments.

AEM Multicore Market Potential Customers

Potential customers for AEM Multicore products span across several high-value industries where high-density, low-latency, and power-efficient computation are non-negotiable requirements for operational success. The primary end-users are large-scale corporations and government entities driving the digital transformation, automation, and connectivity revolutions. Automotive Tier 1 suppliers and major manufacturers are massive consumers, purchasing AEM chips for sophisticated Advanced Driver-Assistance Systems (ADAS), autonomous driving platforms, and centralized vehicle compute domains that require functional safety assurance and real-time processing of massive sensor data streams. Industrial automation firms rely heavily on these systems for managing complex robotics, machine vision, and critical real-time control applications within smart factories.

Telecommunication infrastructure providers, particularly those building out 5G and future 6G networks, constitute another significant customer base. They utilize AEM multicore processors in baseband units, distributed units, and core network equipment to handle high-throughput packet processing, network function virtualization (NFV), and sophisticated resource allocation algorithms efficiently. Furthermore, developers of specialized edge data centers and micro-server infrastructure are increasingly adopting AEM solutions for highly localized computing tasks, enabling rapid content delivery and AI processing near the point of data origin. The inherent reliability and long lifecycle support required by the defense and aerospace sectors also position them as critical, high-margin buyers for these advanced embedded processing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $19.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NXP Semiconductors, NVIDIA, Qualcomm Technologies, Renesas Electronics, Texas Instruments, Intel Corporation, AMD, STMicroelectronics, Micron Technology, Samsung Electronics, MediaTek, Broadcom, Huawei (HiSilicon), Marvell Technology, ARM Holdings, Synopsys, Siemens EDA, Lattice Semiconductor, Xilinx (now AMD), Microchip Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AEM Multicore Market Key Technology Landscape

The AEM Multicore Market is defined by foundational and cutting-edge technologies aimed at maximizing computational density and power efficiency within physically constrained envelopes. Central to this landscape are advancements in semiconductor process technology, particularly the migration to FinFET and Gate-All-Around (GAA) architectures, which enable higher transistor density and lower leakage currents essential for incorporating hundreds of cores onto a single die. This continuous miniaturization underpins the performance scaling necessary for high-throughput applications like sensor fusion and complex industrial control. Furthermore, the development of specialized interconnect fabrics, such as high-speed on-chip meshes or NoC (Network-on-Chip) topologies, is critical for ensuring low-latency communication and efficient data coherence between disparate core types (CPUs, NPUs, GPUs) in heterogeneous systems.

Another pivotal technological trend is the modularization of silicon through chiplet technology. By breaking down complex AEM architectures into smaller, specialized chiplets connected via advanced packaging techniques (like 2.5D or 3D stacking), manufacturers can enhance yield, improve integration flexibility, and mix different process nodes for optimal performance. This approach allows a manufacturer to pair a high-performance CPU chiplet built on a bleeding-edge node with a cost-effective I/O chiplet built on a mature node, optimizing overall system cost and performance characteristics. Complementing this hardware innovation is the growing adoption of non-proprietary instruction sets, specifically RISC-V, which offers unparalleled flexibility in custom core design, enabling tailored acceleration of highly specific algorithms used in AI inference and cryptography.

The software stack supporting AEM Multicore architectures is equally important, driving the development of advanced hypervisors and Real-Time Operating Systems (RTOS) that can reliably manage concurrent execution across diverse cores, ensuring hard real-time guarantees required by safety-critical applications. Advanced compiler technology and heterogeneous programming frameworks, such as OpenCL or CUDA adaptations for embedded platforms, are essential for allowing developers to efficiently map complex parallel tasks onto the diverse silicon resources. The integration of advanced power management units (PMUs) and dynamic voltage and frequency scaling (DVFS) algorithms further optimizes the system's power consumption profile, ensuring peak efficiency across varying workload demands.

Regional Highlights

Regional dynamics significantly influence the trajectory of the AEM Multicore Market, reflecting variances in manufacturing capabilities, research and development investment, and specific regulatory demands across continents. The market is broadly partitioned into four major areas: North America, Europe, Asia Pacific (APAC), and the combined regions of Latin America, Middle East, and Africa (LAMEA).

North America leads in cutting-edge research, foundational IP development, and the adoption of AEM multicore technology within high-performance computing (HPC), cloud-to-edge infrastructure, and advanced defense systems. The presence of dominant chip design firms and major cloud service providers (CSPs) drives consistent demand for high-end, customized AEM solutions optimized for low-latency network processing and massive data handling. Significant government and private sector investment in domestic semiconductor fabrication ensures a robust technological ecosystem, focusing heavily on sub-5nm processes and specialized AI accelerators.

The Asia Pacific (APAC) region dominates the market in terms of production volume and rapid commercial deployment, driven by colossal consumer electronics manufacturing, widespread industrial automation, and rapid 5G infrastructure rollout, particularly in China, South Korea, Taiwan, and Japan. This region is the primary consumer of AEM solutions for mobile devices, smart city infrastructure, and IoT deployments. APAC's strength lies in its extensive foundry network, which dictates global supply chain availability and pricing, making it the epicenter for high-volume, cost-optimized AEM production and rapid time-to-market strategies.

Europe is distinguished by its strong regulatory environment and leadership in the automotive and industrial automation sectors. Strict adherence to functional safety standards (ISO 26262) drives the adoption of highly reliable, safety-certified AEM multicore systems for autonomous and electric vehicle platforms. Investment is concentrated in developing embedded systems that prioritize fault tolerance, long-term operational integrity, and specific industrial communication protocols, making European manufacturers key players in the high-reliability, embedded segment.

The Latin America, Middle East, and Africa (LAMEA) region represents an emerging market, primarily driven by investments in national digital transformation initiatives, telecommunications infrastructure upgrades (transition to 5G), and localized smart grid development. While currently relying heavily on imports from APAC and North America, increasing regional data sovereignty regulations and localized industrialization efforts are expected to spur moderate growth, particularly in applications related to oil and gas exploration (IIoT) and localized data processing requirements.

- North America: Focuses on high-performance computing, advanced AI accelerators, and cloud-edge synergy; major hub for IP design and software tool development.

- Asia Pacific (APAC): Leads in volume manufacturing, consumer electronics integration, 5G deployment, and automotive adoption; critical for global supply chain resilience.

- Europe: Driven by strict automotive safety standards (ADAS/EV), industrial automation, and high-reliability embedded systems; key regulatory market.

- Latin America, Middle East, and Africa (LAMEA): Emerging growth fueled by telecommunications upgrades, localized industrial IoT projects, and government-backed digitization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AEM Multicore Market.- NXP Semiconductors

- NVIDIA

- Qualcomm Technologies

- Renesas Electronics

- Texas Instruments

- Intel Corporation

- AMD

- STMicroelectronics

- Micron Technology

- Samsung Electronics

- MediaTek

- Broadcom

- Huawei (HiSilicon)

- Marvell Technology

- ARM Holdings

- Synopsys

- Siemens EDA

- Lattice Semiconductor

- Xilinx (now part of AMD)

- Microchip Technology

Frequently Asked Questions

Analyze common user questions about the AEM Multicore market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Heterogeneous AEM Multicore systems over Homogeneous systems?

Heterogeneous AEM Multicore systems offer optimized performance-per-watt ratios by assigning specialized tasks (like AI inference or graphics rendering) to dedicated accelerator cores (NPUs or GPUs) while reserving general-purpose CPUs for control and system management, resulting in superior efficiency and lower latency for mixed workloads compared to using identical core types for all tasks.

How does the integration of RISC-V architecture impact the AEM Multicore Market?

RISC-V architecture provides an open, customizable Instruction Set Architecture (ISA) that allows companies to develop highly optimized and domain-specific AEM cores without licensing proprietary IP. This accelerates innovation, particularly in specialized fields like edge AI and industrial control, by lowering design costs and increasing architectural flexibility.

What is the most significant technical restraint facing AEM Multicore designers today?

The most significant technical restraint is managing power density and thermal dissipation (heat) within compact, high-density packages. As the number of cores and specialized accelerators increases, advanced cooling solutions and highly efficient power management algorithms become essential to maintain operational reliability and prevent thermal throttling.

Which industry segment is currently driving the largest demand for certified AEM Multicore solutions?

The automotive industry is currently the largest driver for certified AEM Multicore solutions, specifically for Advanced Driver-Assistance Systems (ADAS) and autonomous driving platforms, due to stringent requirements for functional safety (ISO 26262) and the need for massive, real-time sensor data processing.

How do advanced packaging techniques, like chiplets, contribute to market growth?

Advanced packaging techniques, particularly chiplets, allow manufacturers to integrate multiple distinct silicon dies (processors, memory, I/O) into a single module. This modularity improves manufacturing yield, enables the mixing of best-in-class components from different processes, and overcomes the physical limits of integrating massive complexity onto a single monolithic die, thereby accelerating the development of highly powerful AEM systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager