Aerated Confectionery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438231 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Aerated Confectionery Market Size

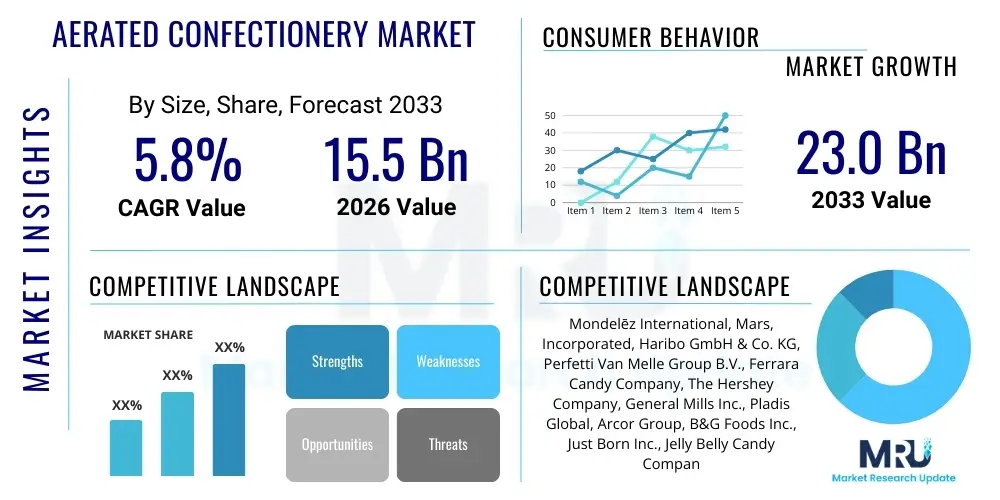

The Aerated Confectionery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Aerated Confectionery Market introduction

The Aerated Confectionery Market encompasses a diverse range of products characterized by the incorporation of air or gas into a sugar matrix, resulting in a light, soft, and often chewy texture. Key product categories include marshmallows, nougat, mousse, and various forms of meringue-based sweets and foamed gummies. This market is fundamentally driven by consumer preference for indulgent yet texturally unique food experiences, positioning aerated products as a favored choice in both seasonal and everyday snacking categories. These confections often utilize whipping agents like proteins (gelatin, egg white) or hydrocolloids to stabilize the foam structure, creating high overrun rates that reduce caloric density per volume while enhancing palatability.

Major applications of aerated confectionery extend beyond direct consumption and include utilization as inclusions in baked goods, toppings for desserts and hot beverages, and components in specialized trail mixes or breakfast cereals. The market benefits significantly from ongoing innovation in flavor profiles, functional ingredients (such as added vitamins or reduced sugar formulations), and the rise of visually appealing, artisanal confectionery products. Furthermore, the inherent versatility of aerated products allows manufacturers to cater to evolving consumer demand for premium, guilt-free indulgences and plant-based alternatives, particularly through the substitution of traditional animal-based foaming agents with vegan-friendly options like potato protein or pea protein.

Driving factors propelling market expansion include the increasing demand for convenience snacks, robust marketing strategies emphasizing nostalgic and comfort food attributes, and continuous technological advancements in aeration and extrusion processes that improve production efficiency and texture consistency. The expanding global retail footprint, especially in emerging economies, further facilitates product availability and penetration into new consumer bases, solidifying the market's trajectory towards sustained growth over the forecast period.

Aerated Confectionery Market Executive Summary

The Aerated Confectionery Market is experiencing notable shifts driven by a confluence of evolving consumer health consciousness and advancements in food technology, necessitating strategic adaptation among key industry players. Business trends are dominated by portfolio diversification toward natural ingredients, clean label formulations, and functional attributes, addressing the pervasive demand for 'better-for-you' indulgence. Companies are heavily investing in specialized equipment to handle alternative foaming agents and sophisticated packaging solutions that maintain product integrity, crucial for the highly delicate nature of aerated goods. Mergers, acquisitions, and strategic partnerships focusing on ingredient sourcing and distribution network optimization are shaping the competitive landscape, aiming to achieve supply chain resilience and global market reach.

Regionally, North America and Europe maintain dominance, characterized by high per capita consumption and mature regulatory environments that favor innovation in novel textures and premium offerings. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, increasing disposable incomes, and the introduction of Western-style confectionery products adapted to local tastes. Regional trends also show a distinct preference for smaller, individually packaged portions in developed markets, aligning with portion control trends, while emerging markets prioritize bulk and value offerings, creating varied strategic imperatives across geographies.

Segment trends reveal that Marshmallows retain the largest market share due to their versatility and mass appeal, though the Nougat and Specialized Foams (e.g., mochi inclusions) segments are exhibiting accelerated growth driven by gourmet and specialty confectionery stores. The increasing acceptance and commercial viability of plant-based and reduced-sugar aerated products, facilitated by fermentation technology and novel sweeteners, represent a critical pivot within the ingredients segment. This move towards health-centric modifications ensures the market remains responsive to demographic shifts, particularly among younger consumers actively seeking products that reconcile taste satisfaction with dietary goals.

AI Impact Analysis on Aerated Confectionery Market

User queries regarding the impact of Artificial Intelligence (AI) on the Aerated Confectionery Market frequently center on themes of quality control, predictive maintenance, personalized product development, and supply chain optimization. Consumers and industry professionals alike are keenly interested in how AI can standardize the highly variable aeration process—a critical factor for product consistency—and how machine learning algorithms can anticipate ingredient price volatility. Key concerns revolve around the initial high cost of integration for small-to-midsize confectionery manufacturers and the ethical implications of leveraging vast consumer data for hyper-personalized flavor recommendations. Overall, the expectation is that AI will primarily serve to minimize waste, accelerate new product development cycles (especially for complex hybrid textures), and ensure stringent food safety standards through real-time monitoring of processing parameters.

- AI-driven optimization of whipping and heating parameters to ensure perfect texture and moisture content consistently, reducing batch-to-batch variation.

- Predictive maintenance systems utilizing sensor data on production lines to minimize downtime associated with complex aeration and cooling equipment.

- Machine learning algorithms analyzing consumer feedback and regional trend data to accelerate the development of personalized flavor and ingredient combinations (AEO strategy).

- Enhanced supply chain visibility and risk management through AI modeling of raw material availability (sugar, gelatin, proteins) and logistics bottlenecks.

- Automated visual inspection using computer vision to detect subtle defects in shape, size, and coloring, improving quality assurance beyond human capability.

- Optimization of energy consumption in large-scale ovens and cooling tunnels via dynamic AI control systems, lowering operational expenditure.

- AI-based demand forecasting integrated with retail data to minimize inventory holding costs and prevent stockouts during peak seasonal periods.

DRO & Impact Forces Of Aerated Confectionery Market

The market dynamics of aerated confectionery are powerfully influenced by a balance between the inherent appeal of indulgence and the increasing pressure from public health initiatives advocating for sugar reduction. Key drivers include robust demand for novel textures and flavors, particularly among younger demographics who prioritize experiential snacking, coupled with technological advances enabling stable, long shelf-life products. However, restraints suchifying as volatility in raw material costs (especially sugar and specialty proteins) and the persistent consumer backlash against high sugar content pose significant challenges. Opportunities lie predominantly in capitalizing on the vegan and clean-label trends, leveraging natural colors and flavors, and expanding product offerings into functional food spaces, such as protein-enriched marshmallows or prebiotic nougat bars.

Impact forces govern the speed and direction of market growth. High competition among established global confectionery giants necessitates continuous investment in product differentiation and premiumization strategies (e.g., gourmet aeration techniques or exotic inclusions). Substitutes, such as baked goods or solid chocolate bars, exert moderate pressure, forcing aerated confectionery manufacturers to maintain competitive pricing and distinct textural advantages. The rising awareness of diet-related health issues acts as a powerful moderating force, compelling the industry to pivot towards lower-sugar alternatives and transparent ingredient sourcing.

The strategic response to these forces involves aggressive innovation in ingredient technology to overcome sugar dependency while maintaining desired textural attributes. Furthermore, effective digital marketing campaigns emphasizing the permissible indulgence and functional benefits of new products are crucial for converting health-conscious consumers. Successful market players are those who can navigate the regulatory landscape concerning sugar taxation and nutritional labeling while simultaneously optimizing their supply chain for novel, sustainable ingredients, thereby capitalizing on long-term growth opportunities.

Segmentation Analysis

The Aerated Confectionery Market is comprehensively segmented based on product type, ingredient type, distribution channel, and formulation characteristics, allowing for targeted analysis of consumer preferences and operational efficiencies. Product segmentation delineates core categories such as marshmallows, nougat, and specialized aerated forms, each characterized by distinct manufacturing processes and consumer use cases. Ingredient segmentation focuses heavily on the type of aeration agent used, separating gelatin-based, protein-based (dairy/plant), and specialized chemical leavening systems, reflecting the industry's pivot towards addressing dietary restrictions and ethical concerns. Understanding these segment dynamics is critical for manufacturers aiming to align their production capabilities with precise market demands.

Distribution analysis highlights the varying importance of mass retail channels versus specialty stores, where premium and artisanal aerated products command higher margins. Furthermore, formulation analysis, specifically examining standard sugar versus sugar-free or reduced-sugar variants, indicates the responsiveness of the market to pervasive health trends. The segmentation reveals a growing bifurcation: one track focusing on traditional, high-sugar indulgence, and another rapidly expanding track dedicated to innovative, health-aligned versions utilizing sophisticated sugar substitutes and functional inclusions.

The insights derived from this granular segmentation enable companies to develop highly personalized marketing strategies (AEO/GEO optimization) tailored to specific consumer demographics, such as targeting health-conscious millennials with vegan protein aerated products sold exclusively through e-commerce platforms, or focusing on traditional family packs through hypermarkets. The fastest-growing segments typically involve products addressing clean label requirements and incorporating exotic or functional flavor profiles, signaling a long-term trend away from generic formulations towards premium customization.

- By Product Type:

- Marshmallows

- Nougat

- Mousse/Sponge Confections

- Aerated Gummies and Jellies

- Meringue-based products

- By Ingredient Type:

- Gelatin-Based

- Plant Protein-Based (Pea, Soy, Potato)

- Dairy Protein-Based (Casein, Whey)

- Egg White-Based

- Hydrocolloid-Based

- By Formulation:

- Standard Sugar

- Reduced/Low Sugar

- Sugar-Free (Sweetener-Based)

- Functional (e.g., Vitamin-Enriched, High-Protein)

- By Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Confectionery Stores

Value Chain Analysis For Aerated Confectionery Market

The value chain for the Aerated Confectionery Market begins with the highly specialized procurement of upstream raw materials, including bulk sweeteners (sucrose, glucose syrup, high-intensity sweeteners), stabilizers (gelatin, hydrocolloids), foaming agents (proteins), and flavorings/colorings. The efficiency and cost-effectiveness of this initial stage are crucial, as ingredient quality directly impacts the texture and stability of the final aerated product. Suppliers must adhere to stringent quality control standards, particularly for protein sources, where slight variations can disrupt the foaming process. Manufacturers often engage in long-term contracts to mitigate the volatility inherent in commodity markets, utilizing advanced sourcing analytics to optimize inventory management and reduce lead times.

The core manufacturing process involves precision mixing, heating, aeration (whipping or extrusion), and controlled cooling/setting. Technological investment in highly sensitive whipping machines and climate-controlled drying tunnels is essential to achieve the desired overrun and textural consistency. Direct distribution typically involves large-scale manufacturers supplying national supermarket chains and hypermarkets, leveraging established logistics networks optimized for delicate, volume-sensitive products. Indirect distribution channels, often managed through wholesalers, agents, or third-party logistics (3PL) providers, are crucial for penetrating fragmented regional markets and reaching independent convenience stores or specialty retailers.

Downstream activities center on sophisticated packaging that provides moisture barriers and protection against physical damage, critical for maintaining the airy texture and shelf life. The marketing and sales segment emphasizes branding, seasonal promotions, and digital engagement, utilizing targeted online campaigns to drive consumer trials and loyalty. E-commerce platforms are increasingly vital, offering direct-to-consumer routes and enabling rapid iteration of limited-edition or personalized aerated products, significantly reducing dependence on traditional brick-and-mortar retail space for initial product launch success.

Aerated Confectionery Market Potential Customers

The primary end-users and buyers in the Aerated Confectionery Market span a wide demographic range, but can be broadly categorized into distinct segments based on consumption habits and purchasing drivers. The largest segment consists of general consumers, particularly children, adolescents, and young adults, who are driven by impulse purchasing, taste preferences, and the experiential novelty of these products. This group typically prioritizes traditional flavor profiles and vibrant visual aesthetics, frequently purchasing through mass retail and convenience channels. A significant driver for this segment is the affordability and accessible portion sizes offered by mainstream brands.

A second crucial customer base involves health-conscious adults and individuals with specific dietary needs (e.g., vegan, gluten-free, reduced-sugar diets). These buyers are often willing to pay a premium for specialized formulations, such as those utilizing plant proteins, natural sweeteners (like stevia or erythritol), or functional inclusions (e.g., collagen or fiber). This segment is heavily influenced by transparent labeling, sustainability claims, and product efficacy, often sourcing products through specialized health food stores or direct-to-consumer online platforms that offer detailed ingredient information and curated selections.

Finally, the industrial and foodservice sectors represent significant B2B customers. Food manufacturers purchase aerated confections as inclusions for premium baked goods, ice creams, and breakfast cereals, prioritizing bulk consistency, reliable supply, and specific textural performance in post-processing applications. Foodservice buyers, including cafes, restaurants, and catering companies, use these products as garnishes, dessert components, and hot beverage toppings, valuing visual appeal, melting stability, and cost-efficiency. Successful market players must develop dual strategies catering to both high-volume B2C impulse buying and precise B2B functional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mondelēz International, Mars, Incorporated, Haribo GmbH & Co. KG, Perfetti Van Melle Group B.V., Ferrara Candy Company, The Hershey Company, General Mills Inc., Pladis Global, Arcor Group, B&G Foods Inc., Just Born Inc., Jelly Belly Candy Company, Russell Stover Chocolates LLC, Farley’s & Sathers Candy Company, Barrett Agri Ltd., Spangler Candy Company, R.M. Palmer Company, PIM Brands Inc., Albanese Confectionery Group Inc., SweetGourmet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerated Confectionery Market Key Technology Landscape

The technological landscape of the Aerated Confectionery Market is defined by the need for precise control over the introduction and stabilization of air within high-viscosity sugar syrups. Key technologies revolve around continuous aeration systems, which have largely replaced traditional batch whipping methods, offering enhanced efficiency and consistent texture profiles (overrun control). Advanced pressure beating technology is crucial, utilizing specialized aeration heads to incorporate gases (typically filtered air or nitrogen) under controlled pressure, stabilizing the foam matrix instantaneously. Furthermore, highly precise cooling and drying tunnels, often utilizing dehumidified air and zoned temperature control, are employed to ensure rapid setting and prevent stickiness or collapse of the delicate cellular structure of the finished product, significantly impacting shelf stability.

Recent innovations focus heavily on extrusion technology, particularly for shaped marshmallows and nougat bars, where co-extrusion allows for the creation of multi-layered or filled aerated products with diverse textural elements. Specialized machinery is now being developed to handle non-traditional ingredients, such as high-protein plant-based batters and reduced-sugar formulations that often exhibit different rheological properties than standard gelatin-sugar mixes. This includes enhanced mixing equipment capable of rapidly hydrating and incorporating difficult-to-dissolve hydrocolloids and alternative sweeteners without compromising homogeneity, which is vital for product success.

Furthermore, packaging technology plays a pivotal role. The deployment of high-barrier films and modified atmosphere packaging (MAP) techniques is essential to protect aerated confections from moisture absorption and oxidation, extending both crunch (in crisp aerated products) and softness (in marshmallows). The integration of sensors and AI into these manufacturing lines is increasingly common, providing real-time feedback on density, moisture content, and visual integrity, ensuring that high-speed production maintains artisanal quality standards and meets stringent food safety requirements across global supply chains.

Regional Highlights

The global consumption and production landscape for aerated confectionery are distinctly segmented, with regional factors influencing flavor preferences, product formats, and distribution strategies. North America, driven by the massive popularity of marshmallows, particularly in seasonal activities (like s’mores) and snack bars, represents a mature and high-value market segment. European markets, specifically Western Europe, exhibit strong demand for nougat (often artisanal) and high-quality meringue products, reflecting a cultural appreciation for sophisticated, smaller-portion confectionery. Regulatory focus on sugar content and clean labeling in both regions drives significant innovation in low-sugar and natural ingredient substitution.

Asia Pacific (APAC) is characterized by immense potential for market penetration and rapid growth, primarily fueled by rising middle-class populations, Westernization of dietary habits, and the expansion of organized retail infrastructure. While traditional confections dominate, demand for imported aerated products (like premium marshmallows and specialized gummies) is surging. Manufacturers focus on localizing flavors (e.g., utilizing matcha, durian, or specific regional fruits) to gain consumer acceptance. The region demands efficient, high-volume manufacturing capabilities to serve its vast populations, making capital investment in state-of-the-art facilities a priority.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets showing steady, albeit slower, growth. LATAM often sees aerated confectionery incorporated into traditional desserts or sold as localized street food items, while the MEA market is influenced by cultural preferences for rich, textural sweets like specialized nougat (halva-like products) and requires strict adherence to Halal certification standards. Growth in these regions depends heavily on improving cold chain logistics and addressing local economic fluctuations to ensure consistent product accessibility and affordability across diverse socio-economic strata.

- North America: Market leader due to high consumption volume of marshmallows and strong retail presence; emphasis on innovation in texture (e.g., fluffy vs. dense) and functional additions (e.g., protein-enriched snacks).

- Europe: High adoption of premium, artisan nougat and sophisticated meringue products; strict regulatory environment driving rapid shifts towards reduced sugar and natural coloring agents.

- Asia Pacific (APAC): Fastest-growing region, characterized by increasing urbanization, adoption of western snacking trends, and significant opportunities for product localization (flavor adaptation).

- Latin America: Growth driven by expanding convenience store format penetration and the integration of aerated products into local dessert and snack traditions.

- Middle East & Africa (MEA): Emerging market focused on staple aerated products; growth contingent on improving distribution infrastructure and ensuring adherence to specific religious dietary requirements (Halal certification).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerated Confectionery Market.- Mondelēz International

- Mars, Incorporated

- Haribo GmbH & Co. KG

- Perfetti Van Melle Group B.V.

- Ferrara Candy Company

- The Hershey Company

- General Mills Inc.

- Pladis Global

- Arcor Group

- B&G Foods Inc.

- Just Born Inc.

- Jelly Belly Candy Company

- Russell Stover Chocolates LLC

- Farley’s & Sathers Candy Company

- Barrett Agri Ltd.

- Spangler Candy Company

- R.M. Palmer Company

- PIM Brands Inc.

- Albanese Confectionery Group Inc.

- SweetGourmet

Frequently Asked Questions

What are the primary drivers of growth in the Aerated Confectionery Market?

The primary growth drivers are robust consumer demand for unique, experiential textures and indulgent snacking options, coupled with continuous innovation in clean-label and functional formulations, such as vegan and high-protein variants. Expanding retail reach and efficient mass production technologies also facilitate market penetration globally, particularly in emerging Asian economies.

How is the global push for sugar reduction impacting aerated confectionery production?

Sugar reduction is significantly impacting production, forcing manufacturers to invest heavily in alternative sweeteners (stevia, polyols) and advanced hydrocolloids to replicate the essential texture and bulk provided by sucrose without compromising taste or structural integrity. This shift is fueling the fastest-growing segment: reduced-sugar and sugar-free aerated products.

Which product segment holds the largest share in the Aerated Confectionery Market?

Marshmallows currently hold the largest market share globally within the aerated confectionery sector due to their broad appeal, low manufacturing cost, and extreme versatility as both a standalone snack and an inclusion ingredient in baking, cereals, and hot beverages across North America and Europe.

What role does technology play in ensuring the quality of aerated confections?

Technology, specifically continuous pressure beating and advanced cooling/drying tunnels, is critical for achieving consistent quality (texture, density, and moisture content). Furthermore, AI-driven automation and computer vision systems are increasingly used for real-time quality control and predictive maintenance, ensuring high throughput while maintaining stringent food safety standards.

Which geographical region is projected to exhibit the highest CAGR during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2026 to 2033. This growth is attributed to rising disposable income, rapid urbanization, increased adoption of Western snacking culture, and the corresponding expansion of modern retail and e-commerce distribution channels across key countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager