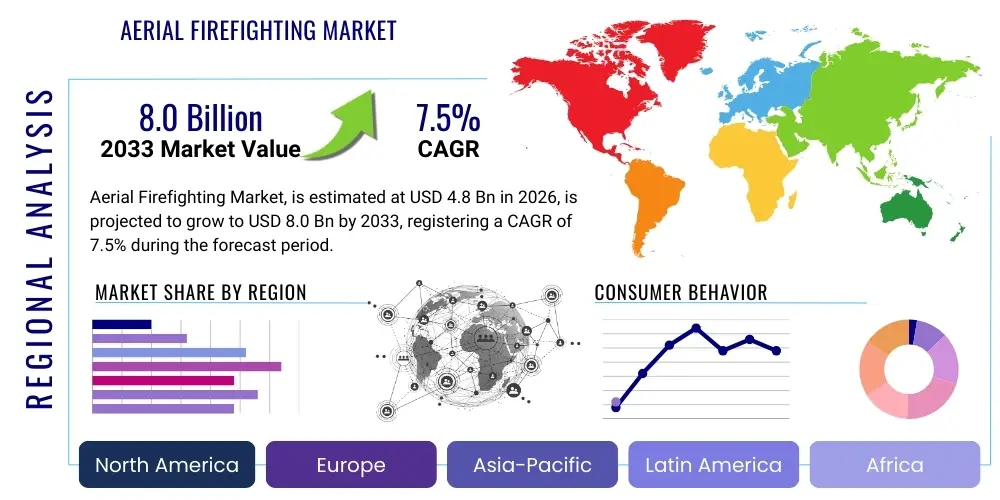

Aerial Firefighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438337 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aerial Firefighting Market Size

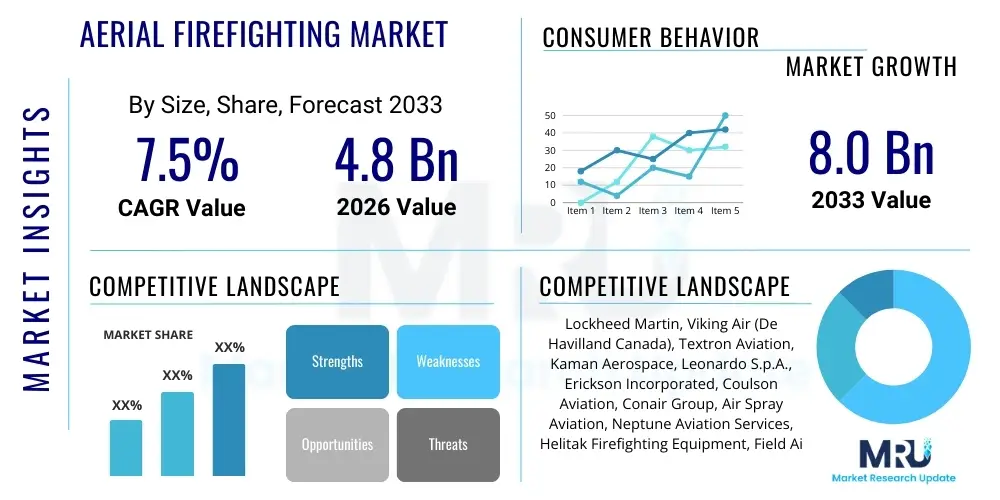

The Aerial Firefighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Aerial Firefighting Market introduction

The Aerial Firefighting Market encompasses the services, platforms, and associated technologies utilized for suppressing wildfires, bushfires, and other large-scale conflagrations through airborne deployment of water, retardants, and fire suppressants. This essential sector is driven by the escalating frequency and intensity of extreme weather events attributed to climate change, particularly in regions like North America, Australia, and the Mediterranean basin. The primary product segments include fixed-wing aircraft (such as air tankers and water bombers) and rotary-wing aircraft (helicopters used for water drops, surveillance, and troop transport). Specialized firefighting chemicals and advanced avionics systems form critical components of this ecosystem, supporting mission efficiency and safety.

Major applications of aerial firefighting span municipal firefighting support, forest management, disaster response, and infrastructure protection. Benefits derived from utilizing aerial platforms include rapid deployment capability, access to remote and inaccessible terrain, containment of large fire fronts, and the ability to conduct critical reconnaissance and mapping. The integration of advanced sensor technologies, such as infrared cameras and LiDAR, is enhancing situational awareness, allowing crews to track fire progression and deploy resources with precision. This technology integration is vital for mitigating risks associated with extreme heat, smoke, and unpredictable wind patterns that characterize contemporary megafires.

Key driving factors accelerating market expansion include significant governmental and private investments in fleet modernization and expansion across developed economies, prompted by inadequate existing resources to handle current fire seasons. Furthermore, the increasing public awareness regarding the devastating economic and ecological impacts of wildfires compels policymakers to allocate substantial budgets towards preventative measures and robust response capabilities. Technological advancements, particularly in payload capacity, operational range, and the development of high-visibility retardants, continue to improve the efficacy and safety of aerial operations, positioning the market for sustained growth.

Aerial Firefighting Market Executive Summary

The global Aerial Firefighting Market demonstrates robust growth, fundamentally propelled by worsening climate change trends that necessitate heightened emergency response readiness worldwide. Business trends indicate a strong move toward Public-Private Partnerships (PPPs) for securing specialized aircraft fleets and operational services, shifting the financial burden from purely governmental entities to outsourced contractors offering greater flexibility and rapid scaling capabilities. Investment is concentrated on procuring next-generation large air tankers (LATs) and integrating Unmanned Aerial Vehicles (UAVs) for reconnaissance and initial attack missions, reflecting a technological transition aimed at reducing human risk and increasing operational tempo.

Regionally, North America (particularly the US and Canada) remains the primary revenue generator due to the scale and severity of its annual wildfire seasons, driving high demand for complex, heavy-lift assets. However, significant emerging demand is observed in the Asia Pacific (APAC), particularly Australia and nations in Southeast Asia, which are investing heavily in permanent aerial suppression capabilities rather than relying solely on international aid. European nations, particularly Spain, Greece, and Portugal, are also modernizing their fleets to combat Mediterranean summer fires, emphasizing amphibious aircraft platforms like the Bombardier 415/CL-515, which are optimized for coastal and lake environments.

Segment trends reveal that the Aerial Services segment (including leasing, maintenance, and operational flight hours) dominates the market value, emphasizing the reliance on specialized operators rather than outright ownership by firefighting agencies. Within the Platform segment, fixed-wing aircraft hold a slight edge in terms of total retardant volume delivery capacity, but the rotary-wing segment is rapidly expanding due to its versatility in logistical support, precise water drops, and urban interface operations. The increasing complexity of aerial missions mandates greater reliance on advanced mission management systems and sophisticated communication networks to ensure coordinated, multi-asset responses.

AI Impact Analysis on Aerial Firefighting Market

Common user inquiries regarding AI's impact often revolve around whether AI can predict the location and intensity of future fires, how automation affects pilot safety and job security, and the feasibility of using fully autonomous firefighting aircraft. Users are keenly interested in predictive analytics capabilities, specifically the integration of AI models with satellite imagery, weather data, and topographical maps to generate high-fidelity fire spread forecasts. Key expectations center on AI serving as a decision support tool, optimizing resource allocation (which aircraft to send where), and enhancing real-time situational awareness for ground and air crews by filtering vast quantities of sensor data into actionable insights.

Artificial Intelligence (AI) is fundamentally transforming the aerial firefighting domain by enhancing predictive capabilities and optimizing response logistics. AI algorithms are being deployed to analyze massive datasets—including historical fire patterns, vegetation moisture levels, wind speed, and topography—to generate probabilistic models for fire ignition and propagation. This shift towards proactive risk management allows agencies to pre-position aerial assets, significantly reducing initial response times and increasing the chances of containing fires before they reach catastrophic dimensions. Furthermore, AI-driven image recognition software is being used on surveillance UAVs to automatically detect smoke plumes and hot spots in challenging, smoky conditions, far faster and more reliably than human operators.

In operational execution, AI is instrumental in flight path optimization and payload deployment accuracy. Advanced guidance systems leverage machine learning to calculate the precise release point for retardants based on real-time factors such as aircraft speed, wind drift, and fire line geometry. This optimization ensures maximum effectiveness of expensive retardant drops, reducing wastage and increasing the overall suppression rate. The integration of AI into mission control systems is also automating routine data tasks and complex calculations, freeing up command staff to focus on critical strategic decision-making and crew safety protocols.

- AI-driven Predictive Modeling: Enhancing the accuracy of wildfire ignition and spread forecasts using climate and terrestrial data.

- Autonomous Navigation and Control: Improving safety and precision for unmanned aerial systems used in reconnaissance and initial attack.

- Resource Optimization: Employing machine learning algorithms to optimally allocate fixed-wing and rotary assets based on fire severity and geographical constraints.

- Real-time Data Fusion: Processing complex sensor inputs (IR, LiDAR, visual) instantly to provide actionable, high-fidelity maps to flight crews.

- Automated Anomaly Detection: Utilizing computer vision for rapid, 24/7 detection of small fires or smoke plumes in remote areas.

DRO & Impact Forces Of Aerial Firefighting Market

The dynamics of the Aerial Firefighting Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the industry’s trajectory. The most significant driver is the undeniable global trend of increasing average temperatures and prolonged drought periods, which has extended the duration and severity of the fire season across continents. This environmental shift mandates continuous upgrades in fleet capacity and technology investments to manage increasingly complex and aggressive fire events. Concurrently, rapid urbanization near wildland-urban interfaces (WUI) elevates the stakes, requiring high-precision aerial support to protect human lives and infrastructure, thereby sustaining governmental investment.

However, the market faces significant restraints, primarily centered around the exceptionally high capital expenditure required for acquiring, operating, and maintaining specialized aircraft fleets. Large air tankers, for instance, demand substantial investment, and the operating costs associated with fuel, highly specialized personnel (pilots and ground crews), and periodic heavy maintenance cycles are prohibitive for many smaller national or regional governments. Furthermore, regulatory hurdles related to airspace management, particularly when integrating civilian aircraft, military aircraft, and emerging UAV technologies, often slow down the adoption and full utilization of new aerial assets.

Opportunities for growth are abundant, particularly in leveraging technological innovation. The increasing maturation of medium-to-large Unmanned Aerial Systems (UAS) offers a significant opportunity for low-cost, high-endurance surveillance and precision spotting, mitigating the risks associated with manned flight in hazardous environments. Additionally, the development of next-generation, environmentally benign retardants and the expansion of global service providers capable of rapid deployment and inter-regional resource sharing present avenues for market expansion, allowing nations to rent or contract sophisticated capabilities when needed, rather than maintaining them year-round.

Segmentation Analysis

The Aerial Firefighting Market is segmented primarily based on the type of platform used, the nature of the service provided, and the specific application areas. Analyzing these segments provides strategic insights into investment priorities and operational requirements across different regions. The platform segmentation highlights the fundamental operational difference between fixed-wing aircraft, which excel in high-volume, long-distance retardant drops, and rotary-wing aircraft, which offer superior maneuverability, precision targeting, and utility for personnel transport and rescue operations. This inherent versatility dictates procurement decisions for fire agencies.

Service segmentation, covering maintenance, repair, and overhaul (MRO), leasing, and operational support, represents the largest revenue share. This underscores the market structure wherein specialized private contractors often own and operate the expensive assets, providing ‘fire-as-a-service’ solutions to governmental clients. This model minimizes the public sector's fixed costs while ensuring access to a modern, well-maintained fleet during peak fire seasons. The segmentation by application clearly delineates the critical need for aerial support in protecting vast forest reserves, agricultural lands, and increasingly, vital industrial and urban interfaces.

- By Type (Platform):

- Fixed-Wing Aircraft (Air Tankers, Water Bombers)

- Rotary-Wing Aircraft (Helicopters)

- Unmanned Aerial Systems (UAS/Drones)

- By Service:

- Aircraft Leasing and Maintenance

- Operational Services (Pilot/Crew Hours)

- Chemical Supplies (Retardants and Foams)

- Training and Simulation

- By Application:

- Forest and Wildland Firefighting

- Infrastructure and Urban Interface Protection

- Oil, Gas, and Industrial Firefighting

Value Chain Analysis For Aerial Firefighting Market

The value chain for the Aerial Firefighting Market begins with the upstream segment, encompassing the design, manufacturing, and integration of specialized platforms. This includes major aerospace manufacturers supplying base aircraft, specialized modification companies converting these platforms into water bombers or firefighting helicopters, and chemical manufacturers producing high-efficacy retardants and foam concentrates. The upstream segment is characterized by high barriers to entry, driven by stringent aviation certifications, specialized engineering requirements, and significant intellectual property surrounding retardant chemistry and dispensing mechanisms. Critical components such as high-volume tanks, advanced gravity or pressurized discharge systems, and precision avionics packages are key inputs at this stage.

Midstream activities involve the operational deployment, maintenance, and service provision, which form the core revenue-generating layer. This segment is dominated by specialized aerial service providers (ASPs) who own, operate, and maintain the firefighting fleets under long-term or seasonal contracts with government agencies (e.g., US Forest Service, state governments, or equivalent international bodies). Distribution channels are predominantly direct, characterized by high-value, long-term contractual agreements. Indirect channels are less common but might include brokered service agreements or ad-hoc regional support pooling arrangements, particularly in Europe where shared resources are utilized across national boundaries during severe fire seasons.

The downstream segment consists of the end-users—national and regional emergency management agencies, forestry departments, and, in some cases, large private landholders or industrial facilities (like mining or oil operations). The success of the downstream operation relies heavily on integrating aerial capabilities with ground crew logistics and command structures. Key factors in the downstream analysis include fleet readiness, crew training levels, and the interoperability of communication systems between air and ground assets, ultimately determining the effectiveness of the overall firefighting effort and the justification of the significant operational expenditure.

Aerial Firefighting Market Potential Customers

The primary customers for aerial firefighting platforms and services are governmental and quasi-governmental organizations responsible for land management, public safety, and disaster response. These customers include national bodies such as the US Forest Service (USFS), Cal Fire, Parks Canada, Australia’s National Aerial Firefighting Centre (NAFC), and various European forestry and civil protection agencies. These entities require a consistent, reliable, and scalable fleet capable of rapid deployment across large geographic areas, driving demand for long-term operational leases and sophisticated maintenance packages tailored to high-utilization environments.

A second major customer category involves private entities and industrial sectors with significant assets exposed to wildfire risks. This includes large utility companies (power lines running through wildlands), forestry companies managing timber resources, and oil and gas operators whose infrastructure may be threatened. While these customers often rely on localized contracted services, their demand is focused on precision strikes, infrastructure protection, and sometimes, proprietary surveillance and mapping services offered by smaller, specialized UAS operators.

Furthermore, international aid and relief organizations, along with military bodies tasked with civil support, also represent potential customers, particularly in regions lacking sophisticated indigenous aerial capabilities. For these customers, the demand focuses less on outright ownership and more on short-term, large-scale mobilization capabilities often provided by major global aerial service contractors who can rapidly reposition assets across continents in response to seasonal demands or catastrophic events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, Viking Air (De Havilland Canada), Textron Aviation, Kaman Aerospace, Leonardo S.p.A., Erickson Incorporated, Coulson Aviation, Conair Group, Air Spray Aviation, Neptune Aviation Services, Helitak Firefighting Equipment, Field Air, Global SuperTanker Services (historical reference/asset owner), Airbus Helicopters, Kopter Group, Bell Textron, Firehawk Helicopters, Wipaire Inc., Kawak Aviation Technologies, Perimeter Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerial Firefighting Market Key Technology Landscape

The technological landscape of aerial firefighting is rapidly evolving, driven by the necessity for greater efficiency, precision, and safety in extreme operating environments. Central to this evolution is the development of high-capacity and rapid-loading retardant delivery systems. Modern aircraft utilize specialized internal or external tanks designed for computer-controlled dispersal, optimizing the coverage level and pattern of the drop to create effective firebreaks. Furthermore, the push towards utilizing Next-Generation Large Air Tankers (NG-LATs), often converted military or commercial transports, signifies a focus on increasing payload volume and extending operational range, enabling single aircraft to cover vast distances quickly.

A second crucial area of innovation lies in command, control, communications, and computers (C4) systems, often referred to as advanced avionics suites. These integrated systems facilitate real-time data sharing between aerial assets and ground command posts. Technologies such as high-definition mapping, synthetic vision systems, and sophisticated GPS-guided drop systems minimize human error and ensure that drops are executed accurately, even under low-visibility conditions caused by heavy smoke. Furthermore, the use of specialized sensors, including Forward-Looking Infrared (FLIR) and multispectral imaging, mounted on both manned and unmanned platforms, provides critical intelligence on fire intensity and hidden hot spots that ground crews cannot see.

Finally, the proliferation of specialized Unmanned Aerial Systems (UAS) represents a transformative technological shift. Small and medium drones are increasingly utilized for persistent surveillance, fire perimeter mapping, and real-time atmospheric data collection. Larger UAS platforms are being piloted for potential initial attack roles, carrying smaller specialized payloads or conducting complex mapping missions in environments deemed too dangerous for human pilots. This segment is characterized by rapid technological refresh cycles, focusing on battery life, sensor integration, and the autonomy levels of flight control systems to comply with stringent civil aviation regulations.

Regional Highlights

The global Aerial Firefighting Market exhibits distinct operational characteristics and investment patterns across key geographic regions. North America, encompassing the United States and Canada, stands as the largest and most mature market segment globally. This dominance is attributable to the sheer scale of the annual fire seasons, the vast tracts of wildland, and established government policies (such as the USFS and state-level contracts) that support a highly sophisticated, predominantly outsourced aerial fleet. The region dictates global trends in aircraft modernization (e.g., transition to NG-LATs) and the integration of highly specialized operational services, making it the primary hub for technological innovation and high-value service contracts.

Europe represents a crucial and rapidly expanding market, particularly the Mediterranean countries (Spain, Portugal, Greece, Italy) which experience severe summer fire seasons. Investment here is often concentrated on multi-role amphibious aircraft, such as the Bombardier 415/CL-515 variants, optimized for scooping water from nearby lakes and coastal areas. Furthermore, the European Union's RescEU mechanism promotes cross-border resource sharing, driving standardization in platform types and operational protocols. Central and Northern Europe are also increasing their aerial response capabilities, moving beyond ground-based suppression to protect valuable forest assets and prevent major air quality crises.

The Asia Pacific (APAC) region is poised for the highest growth rate, driven by recent catastrophic fire seasons in Australia and increasing environmental risks in emerging economies like Indonesia and China. Australia's commitment to enhancing its domestic fleet, coupled with strong reliance on international contracted services, fuels significant market demand. In contrast, Latin America and the Middle East & Africa (MEA) remain relatively nascent, characterized by fragmented procurement and reliance on less specialized fleets or international aid. However, increasing threats to oil and gas infrastructure in the MEA and the Amazon rainforest in Latin America are starting to trigger governmental interest in acquiring robust, year-round aerial firefighting capabilities.

- North America: Dominant market share; characterized by high reliance on private contract operators and large air tankers; strong early adoption of UAS and AI for predictive modeling.

- Europe: High growth in Mediterranean countries; focus on amphibious aircraft (scoopers); standardization driven by the European Union’s resource-sharing initiatives.

- Asia Pacific (APAC): Fastest growing region, primarily due to Australia's modernization efforts and increasing wildfire challenges in Southeast Asia; demand for heavy-lift helicopters and MRO services.

- Latin America: Emerging market, focused on managing forest fires in the Amazon and infrastructural protection; limited indigenous capabilities, high potential for leased services.

- Middle East and Africa (MEA): Focused primarily on industrial and limited wildland protection; increasing investment in helicopter fleets for rapid urban and industrial response.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerial Firefighting Market.- Lockheed Martin

- Viking Air (De Havilland Canada)

- Textron Aviation

- Kaman Aerospace

- Leonardo S.p.A.

- Erickson Incorporated

- Coulson Aviation

- Conair Group

- Air Spray Aviation

- Neptune Aviation Services

- Helitak Firefighting Equipment

- Field Air

- Airbus Helicopters

- Kopter Group

- Bell Textron

- Firehawk Helicopters

- Wipaire Inc.

- Kawak Aviation Technologies

- Perimeter Solutions

- Hillsboro Aviation

Frequently Asked Questions

Analyze common user questions about the Aerial Firefighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Aerial Firefighting Market?

The foremost driver is the accelerating impact of climate change, resulting in longer, hotter, and more severe wildfire seasons globally, necessitating significant governmental investments in specialized aerial suppression and reconnaissance assets.

Which aircraft platform dominates the aerial firefighting industry?

While fixed-wing Large Air Tankers (LATs) are critical for high-volume retardant drops, the rotary-wing (helicopter) segment is widely utilized due to its versatility, precision capability, and crucial role in logistical support, personnel transport, and urban interface protection.

How is technology, specifically AI, influencing aerial firefighting operations?

AI is primarily used for predictive modeling of fire behavior, optimizing the deployment and allocation of aircraft resources, and enhancing real-time situational awareness through rapid sensor data processing, thereby increasing mission effectiveness and safety.

What are the key financial restraints affecting market expansion?

The market is restrained by the exceptionally high capital expenditure required for procuring and maintaining specialized aircraft, combined with significant operational costs associated with highly trained crew, specialized fuel consumption, and regulatory compliance.

Which geographic region exhibits the highest demand for aerial firefighting services?

North America (particularly the US and Canada) currently holds the highest market share and demand, driven by the vast scale of their annual wildfires and established framework for contracting specialized private aerial service providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager