Aerospace Drive Belts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431451 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Aerospace Drive Belts Market Size

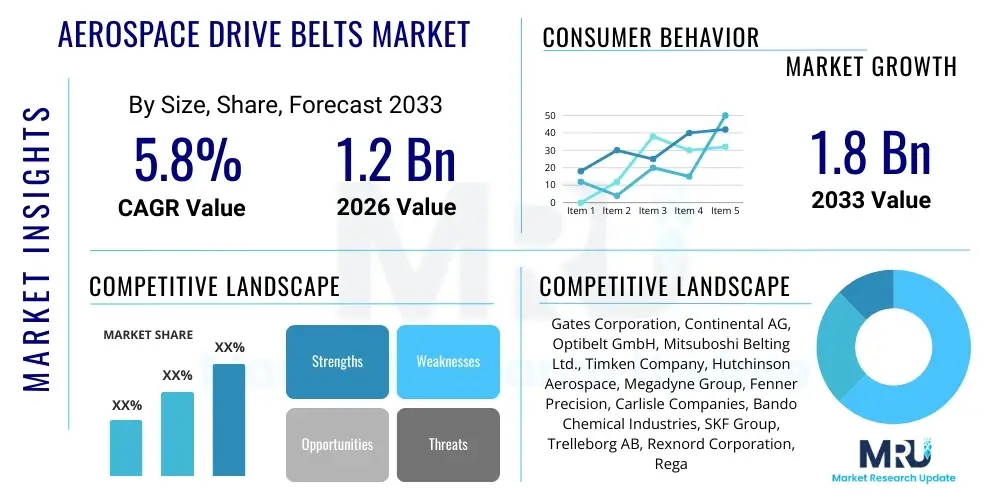

The Aerospace Drive Belts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for commercial aircraft, coupled with the mandatory and regular replacement cycles necessitated by stringent safety and operational requirements within the aerospace sector. Drive belts are essential components in various auxiliary and critical aircraft systems, where reliability and low weight are paramount, sustaining market expansion despite high barrier to entry for new players.

The valuation reflects robust demand originating from both Original Equipment Manufacturers (OEMs) for new aircraft production and Maintenance, Repair, and Overhaul (MRO) activities. As global air traffic recovers and airlines invest in more fuel-efficient fleets, the production rate of narrow-body and wide-body aircraft increases, directly translating into higher unit consumption of drive belts. Furthermore, the specialized nature of aerospace belts, often requiring high-performance materials like aramid fibers or proprietary rubber compounds designed to withstand extreme temperatures, pressures, and vibration loads, commands premium pricing, contributing significantly to the overall market valuation.

Aerospace Drive Belts Market introduction

The Aerospace Drive Belts Market encompasses the manufacturing, distribution, and utilization of high-performance belts designed specifically for power transmission and motion control applications within aircraft, spacecraft, and unmanned aerial vehicles (UAVs). These specialized belts, unlike standard industrial belts, must adhere to exceptionally rigorous industry standards, including FAA and EASA certifications, ensuring resistance to hydraulic fluids, extreme thermal cycling, and high dynamic stress loads encountered during flight operations. The primary product categories include V-belts, synchronous timing belts, and flat belts, each optimized for different applications such as engine accessory drives, actuation systems for flight controls, and environmental control system (ECS) components. The fundamental requirement in aerospace power transmission is minimizing weight while maximizing reliability and longevity, making advanced material science critical to product success.

Major applications of aerospace drive belts include the mechanical linkage between the engine gearbox and auxiliary power units (APUs), driving pumps, generators, and compressors necessary for aircraft functionality. Their benefit lies in providing a highly efficient, quiet, and maintenance-friendly alternative to complex gearboxes or chain drives, particularly in non-propulsion systems where weight reduction is prioritized. The precision engineering involved ensures minimal slip and precise timing, vital for flight-critical operations. Key driving factors include the sustained rise in global defense budgets favoring high-performance military platforms, the replacement demand generated by aging commercial fleets, and the technological pivot toward more electric aircraft (MEA), which, while reducing hydraulic systems, still relies on mechanical linkages for numerous critical auxiliary functions.

The inherent reliability of these certified components, coupled with ongoing advancements in lightweight, durable materials such as specialized polymers and composite reinforcements, solidifies the market's foundational stability. The shift towards autonomous and remotely piloted systems further diversifies the application landscape, integrating drive belts into sophisticated electro-mechanical actuation systems for precision maneuvering. This continuous innovation cycle ensures that despite the slow pace of new component certification, demand remains consistent across both civil and defense segments worldwide, maintaining the specialized nature and high value of the market offerings.

Aerospace Drive Belts Market Executive Summary

The Aerospace Drive Belts Market is characterized by highly consolidated business trends dominated by a few global manufacturers with established OEM relationships and requisite regulatory certifications. Key business trends include aggressive investment in R&D focusing on ultra-lightweight materials and enhanced thermal stability, crucial for next-generation aircraft designs striving for fuel efficiency and higher operational envelopes. The market is fundamentally cyclical, closely tracking aircraft delivery schedules, yet insulated by the constant demand from the MRO sector, which mandates periodic replacement of critical safety components. Strategic alliances between belt manufacturers and specialized material suppliers are becoming commonplace to gain a competitive edge in performance specifications and rapid prototyping of components for new aircraft programs.

Regionally, North America maintains market supremacy, primarily due to the overwhelming presence of major OEMs like Boeing and Lockheed Martin, coupled with significant MRO and defense spending infrastructure. Asia Pacific exhibits the fastest growth rate, fueled by substantial fleet expansions in China, India, and Southeast Asia to accommodate soaring regional passenger traffic. European trends are focused heavily on advancements in military and defense aviation, with companies leveraging European Union (EU) initiatives to promote sustainable aviation technology, which often includes lightweight auxiliary systems. Segment trends show a pronounced shift towards synchronous belts due to their efficiency and precision, particularly in flight control surfaces and auxiliary power drives where exact synchronization is non-negotiable. Furthermore, military aircraft remain a robust application segment, demanding custom, highly resilient belts capable of enduring extreme mission profiles.

Overall, the market is poised for steady, reliable growth, leveraging the non-discretionary nature of aerospace component replacement. The technological frontier is defined by longevity and weight reduction, driving competitive strategy. As regulatory scrutiny over aircraft safety intensifies, the necessity for certified, high-quality drive belts remains absolute, ensuring market stability. The convergence of commercial expansion in developing economies and sustained modernization efforts in mature markets provides a dual engine for sustained revenue generation across the forecast period, positioning the market as critical yet highly specialized within the broader aerospace supply chain.

AI Impact Analysis on Aerospace Drive Belts Market

Common user inquiries regarding AI's influence on the Aerospace Drive Belts Market frequently center on predictive maintenance capabilities, optimization of inventory and supply chains, and the use of machine learning to design superior materials and predict component lifespan under varying flight conditions. Users are keen to understand how AI-driven sensors embedded near belt systems can detect early signs of wear, thereby extending MRO intervals and preventing catastrophic failures. The key themes revolve around transitioning from time-based maintenance to condition-based maintenance (CBM), enhancing safety, and reducing operational costs. There is a general expectation that AI will not only refine logistics and inventory management for replacement parts but also significantly influence the manufacturing process by simulating stress tests and optimizing production parameters for increased yield and quality assurance.

- AI integration facilitates predictive maintenance, utilizing sensor data to forecast belt degradation and optimize replacement schedules, thereby minimizing aircraft downtime.

- Machine learning algorithms enhance material science research by simulating performance under extreme aerospace conditions, leading to the development of lighter and more durable belt compounds.

- AI optimizes the aerospace supply chain by accurately forecasting MRO demand spikes and managing inventory levels for highly critical, long-lead-time components like specialized drive belts.

- Generative design tools, powered by AI, are used by engineers to create novel belt geometries and profiles that maximize power transfer efficiency while meeting stringent weight restrictions.

- Quality control in manufacturing benefits from computer vision and AI inspection systems, ensuring microscopic defects in belt materials are identified prior to assembly and certification.

DRO & Impact Forces Of Aerospace Drive Belts Market

The Aerospace Drive Belts Market is primarily driven by the continuous expansion of global commercial and general aviation fleets, necessitating vast quantities of certified parts for both initial build and aftermarket support. The increasing focus across the aerospace industry on improving fuel efficiency translates into a demand for lightweight and highly efficient auxiliary components, favoring advanced belts over heavier gear or chain systems where possible. Restraints predominantly involve the highly complex and lengthy certification process imposed by regulatory bodies (e.g., FAA, EASA), which requires extensive testing and documentation, creating significant barriers to entry and slowing down the adoption of genuinely novel materials or designs. Additionally, the reliance on specialty materials such as aramid and carbon fibers makes production costs high and susceptible to supply chain volatility.

Opportunities for market growth are abundant in the rapidly expanding Unmanned Aerial Vehicle (UAV) and Urban Air Mobility (UAM) sectors, where electric propulsion systems and precision actuation units heavily depend on reliable, compact drive mechanisms. Furthermore, the push towards the More Electric Aircraft (MEA) paradigm requires specialized, highly insulated drive belts capable of operating reliably in close proximity to high-voltage electrical components. The impact forces shaping the market include intense regulatory pressure that mandates zero-failure tolerance, keeping quality and reliability as the dominant competitive metrics. Technological impact is centered on material innovation, specifically synthesizing compounds that offer extreme thermal resistance and enhanced durability without compromising weight targets.

The interplay of these factors creates a dynamic where innovation is essential but must be proven through exhaustive safety protocols. The major impact force is the inherent safety requirement of aviation, making component reliability a non-negotiable parameter that dictates purchasing decisions far more than price. This force sustains the dominance of established players who possess the necessary historical data and regulatory compliance infrastructure. The necessity for routine component replacement due to wear and tear acts as a constant demand stabilizer, mitigating the impact of cyclical downturns in new aircraft deliveries.

Segmentation Analysis

The Aerospace Drive Belts Market is strategically segmented based on factors including the type of belt, the specific application within the aircraft, and the type of aircraft utilizing the component. This multidimensional segmentation allows manufacturers and analysts to precisely target specific engineering needs within the complex aerospace ecosystem. By Type, the market differentiates between standard V-belts, which are highly efficient and common in auxiliary drives, and precision synchronous belts, which are critical for timing and indexing applications. Application segmentation recognizes the varying operational demands placed on belts used in engine accessories versus those in flight control mechanisms. Finally, segmenting by Aircraft Type distinguishes between the high volume, moderate tolerance requirements of commercial aircraft and the specialized, extreme performance requirements of military and space applications, ensuring tailored solutions meet unique structural and environmental criteria.

- By Type:

- Synchronous Belts (Timing Belts)

- V-Belts (Wedge, Narrow)

- Flat Belts

- Specialty and Composite Belts

- By Application:

- Engine Auxiliary Systems (Pumps, Generators, Alternators)

- Actuation Systems (Flaps, Slats, Trim Tabs)

- Flight Control Surfaces

- Landing Gear Systems

- Environmental Control Systems (ECS)

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body)

- Military Aircraft (Fighter Jets, Transport, Helicopters)

- General Aviation

- Unmanned Aerial Vehicles (UAVs)

- By Material:

- Rubber (Neoprene, EPDM)

- Polyurethane

- Aramid Fiber Reinforced

- Carbon Fiber Composites

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) Providers

- Airlines and Operators

Value Chain Analysis For Aerospace Drive Belts Market

The value chain for the Aerospace Drive Belts Market begins with upstream activities focused on the procurement of highly specialized raw materials, primarily advanced polymers (like HBNR, proprietary synthetic rubbers, and polyurethanes) and high-strength reinforcing fibers (aramid, fiberglass, and carbon fibers). Manufacturers rely heavily on a specialized set of chemical and textile suppliers who can guarantee material purity, consistency, and traceability—key requirements for aerospace certification. This upstream segment is characterized by long-term contracts and stringent quality control protocols, as material failure is a critical safety issue. The subsequent manufacturing phase involves precision molding, curing, and often proprietary processes to integrate the reinforcement fibers, followed by intensive non-destructive testing and inspection to ensure zero defects before certification submission.

The downstream analysis involves the distribution channel, which is highly controlled and segmented. Direct distribution channels are predominantly used for OEM sales, where manufacturers work directly with major airframe producers (e.g., Boeing, Airbus) to integrate belts into new aircraft designs. This process involves lengthy qualification periods. Indirect distribution is managed through highly specialized, authorized aerospace parts distributors and MRO providers. These intermediaries manage the global aftermarket demand, supplying replacement belts to airlines and independent MRO shops worldwide. Strict anti-counterfeiting measures are enforced at this stage due to the critical safety function of the components, ensuring only certified products reach the end-users.

The channel complexity highlights the strategic importance of MRO logistics. Direct sales ensure tight quality control and collaborative design for OEMs, whereas the indirect network guarantees global accessibility and rapid response times for repair activities, particularly in regions far from manufacturing hubs. This structure ensures that traceability from raw material batch to installed component is maintained throughout the entire lifespan, fulfilling the paramount regulatory requirement for safety and accountability in the aerospace sector.

Aerospace Drive Belts Market Potential Customers

The primary consumers and end-users of aerospace drive belts are segmented into three major categories: Original Equipment Manufacturers (OEMs), who incorporate the belts into newly constructed aircraft; Maintenance, Repair, and Overhaul (MRO) service providers, who handle scheduled and unscheduled replacements; and direct operators, such as global airlines and defense organizations. OEMs represent a highly consolidated customer base, including giants like Boeing, Airbus, Embraer, and various defense contractors. Sales to OEMs require deep integration into the aircraft design process, focusing on performance, weight, and lifespan optimization to meet specific platform requirements, often resulting in long-term, exclusive supply agreements.

MRO facilities, both captive (owned by airlines) and independent (third-party maintenance providers), constitute the largest volume customer segment by replacement units, as aerospace drive belts are subject to defined flight-hour replacement intervals regardless of visual condition. These customers prioritize inventory availability, component certification documentation, and competitive pricing for bulk procurement. Finally, large commercial airlines and military air forces often maintain their own parts inventories and in-house MRO capabilities, acting as direct buyers of certified replacement parts to ensure operational readiness and regulatory compliance, making them essential strategic targets for premium, high-reliability products.

The defense sector, encompassing various governmental air forces and specialized military contractors, represents another crucial, albeit highly regulated, customer base. These customers often require belts designed to extreme specifications, capable of surviving harsh environmental and operational conditions unique to military transport, fighter, and surveillance aircraft. Catering to this segment demands high security clearance and specialized material handling, distinguishing it from the commercial market focus.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gates Corporation, Continental AG, Optibelt GmbH, Mitsuboshi Belting Ltd., Timken Company, Hutchinson Aerospace, Megadyne Group, Fenner Precision, Carlisle Companies, Bando Chemical Industries, SKF Group, Trelleborg AB, Rexnord Corporation, Regal Rexnord, Dayco Products, Jason Industrial, PIX Transmissions, Tsubakimoto Chain Co., Renold PLC, Habasit AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Drive Belts Market Key Technology Landscape

The technology landscape for aerospace drive belts is rapidly evolving, moving beyond conventional rubber and nylon constructions towards high-performance materials crucial for handling extreme operational profiles. A key technological focus is the development and commercialization of belts reinforced with high-modulus, low-density fibers such as aramid (Kevlar/Twaron) and carbon fiber. These reinforcements significantly increase tensile strength and dimensional stability, allowing the belts to maintain their precise length and profile under heavy load and rapid temperature fluctuation, which is vital for synchronization in systems like flight control actuators. Furthermore, manufacturers are employing advanced elastomer formulations, including highly saturated nitrile (HSN) and proprietary fluoroelastomers, which offer superior resistance to aggressive aviation fluids (hydraulic oils, jet fuel) and extreme heat exposure.

Another crucial technological advancement involves precision manufacturing processes like specialized tooth geometry and non-destructive testing (NDT) methodologies. Synchronous belts, particularly, utilize highly specific tooth profiles optimized for minimal friction and maximum shear strength, ensuring highly efficient power transmission without slippage. NDT techniques, often leveraging ultrasonic or X-ray inspection, are mandatory to guarantee the internal integrity and homogeneity of the composite materials, certifying that no voids or micro-cracks exist that could lead to in-flight failure. These quality assurance technologies directly address the zero-tolerance safety standards mandated by aviation authorities globally.

Looking ahead, the integration of smart technology is defining the future landscape. This includes incorporating micro-sensors or RFID tags into the belt material during manufacture, enabling real-time condition monitoring (RCM). RCM allows operators to track operational parameters such as tension, vibration, and temperature, transmitting data wirelessly for AI-driven predictive maintenance analysis. This technological pivot from simple mechanical components to integrated smart systems represents a significant shift, promising substantial improvements in safety, operational readiness, and reduced unplanned maintenance costs across commercial and military fleets worldwide.

Regional Highlights

The global market for Aerospace Drive Belts displays significant regional variations driven by industrial concentration, military spending, and fleet modernization cycles.

- North America: This region dominates the market due to the concentration of major aircraft OEMs (Boeing, Lockheed Martin) and engine manufacturers. The U.S. remains the largest consumer, fueled by substantial military budgets and extensive commercial fleet operations, creating consistent demand for both new installations and MRO services.

- Europe: Characterized by the presence of Airbus and strong military defense industrial bases (UK, France, Germany). The region emphasizes technological excellence, driving demand for premium, highly certified drive belts, particularly in advanced rotorcraft and new generation fighter programs.

- Asia Pacific (APAC): Positioned as the fastest-growing region, driven by burgeoning economies, rapid urbanization, and corresponding massive commercial fleet expansion, particularly in China and India. The regional focus is currently on high-volume procurement and establishing robust local MRO capabilities.

- Latin America: This region maintains a steady demand primarily through fleet modernization efforts and MRO requirements for existing commercial aircraft. Market size is smaller compared to North America and Europe, often relying on imported components from key global suppliers.

- Middle East and Africa (MEA): Growth is primarily associated with major hub airlines investing in large, modern fleets (e.g., Emirates, Qatar Airways). High reliance on imported technology and significant defense expenditure in certain Middle Eastern countries contribute to market consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Drive Belts Market.- Gates Corporation

- Continental AG

- Optibelt GmbH

- Mitsuboshi Belting Ltd.

- Timken Company

- Hutchinson Aerospace

- Megadyne Group

- Fenner Precision

- Carlisle Companies

- Bando Chemical Industries

- SKF Group

- Trelleborg AB

- Rexnord Corporation

- Regal Rexnord

- Dayco Products

- Jason Industrial

- PIX Transmissions

- Tsubakimoto Chain Co.

- Renold PLC

- Habasit AG

Frequently Asked Questions

Analyze common user questions about the Aerospace Drive Belts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Aerospace Drive Belts Market?

The primary driver is the non-discretionary Maintenance, Repair, and Overhaul (MRO) cycle, which mandates the periodic replacement of certified drive belts at defined flight-hour intervals, combined with the global expansion of commercial aircraft fleets by OEMs.

How do certification requirements impact the adoption of new drive belt technologies?

Stringent regulatory requirements (FAA, EASA) necessitate extensive, multi-year testing and documentation for any new material or design change. This dramatically increases the cost and time to market, acting as a major restraint but ensuring paramount safety standards are met.

Which aircraft segment contributes most significantly to market revenue?

The Commercial Aircraft segment, particularly narrow-body and wide-body jets, contributes the largest revenue share due to the high volume of aircraft produced and the intensive MRO cycle demanded by global airline operations.

What are the key material innovations enhancing belt performance in aerospace applications?

Key innovations involve the use of high-strength reinforcement fibers, such as Aramid and Carbon Fiber, combined with specialized high-temperature elastomers like HSN and fluoroelastomers, ensuring superior resistance to heat, chemicals, and mechanical stress.

How is the concept of More Electric Aircraft (MEA) influencing drive belt design?

The MEA paradigm is driving demand for belts capable of operating in proximity to high-voltage systems and higher temperatures. Manufacturers are responding by developing belts with enhanced electrical insulation and thermal management capabilities while maintaining lightweight properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager