Aerospace Helmet Mounted Display Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438460 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Aerospace Helmet Mounted Display Market Size

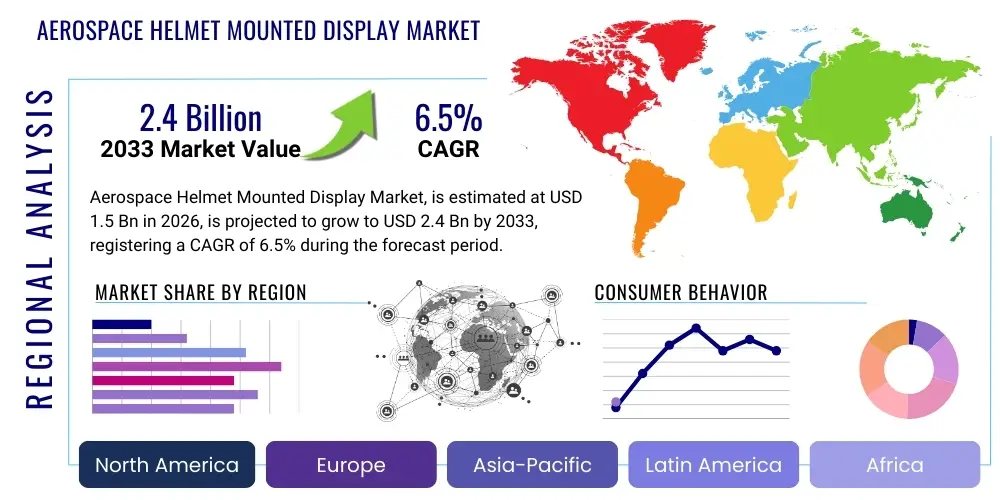

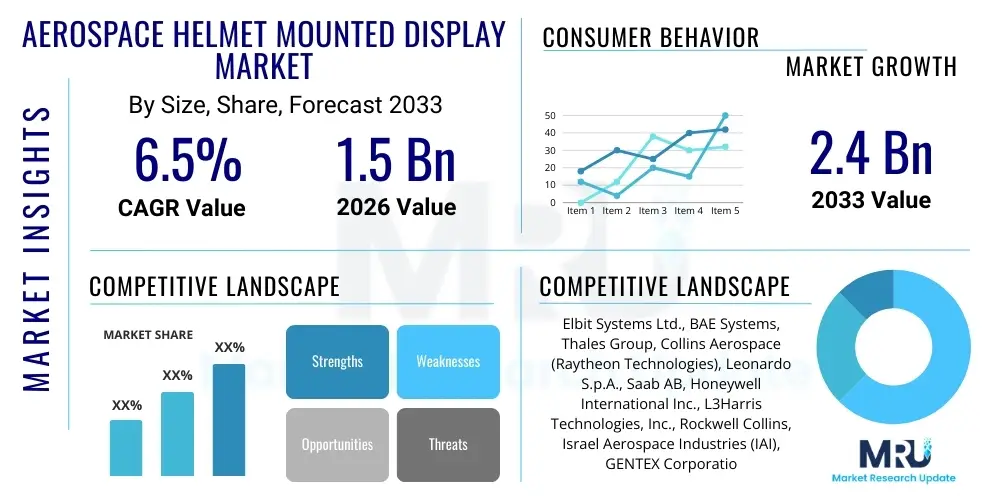

The Aerospace Helmet Mounted Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Aerospace Helmet Mounted Display Market introduction

The Aerospace Helmet Mounted Display (HMD) Market encompasses advanced visualization systems integrated directly into aviator helmets, primarily utilized in military aviation, but increasingly finding applications in complex commercial flight training and specialized paramilitary operations. These systems function by projecting critical flight, tactical, and sensor data directly onto the pilot's visor or an internal optical element, ensuring that essential information remains within the pilot's field of view regardless of head movement. This capability significantly enhances situational awareness, reduces cognitive load, and improves target acquisition accuracy, making HMDs indispensable tools in modern aerial combat and high-performance flight environments. Key products include those based on cathode ray tube (CRT) technology, which are rapidly being replaced by more advanced digital light processing (DLP) and organic light-emitting diode (OLED) systems, offering higher resolution, lower weight, and reduced power consumption.

The primary applications of HMDs revolve around tactical fighter jets, attack helicopters, and sophisticated training simulators. In tactical environments, HMDs enable the cueing of weapons systems, navigation aids, and thermal or night vision imagery. The integration of high-fidelity sensors, such as infrared tracking cameras and advanced data link systems, allows pilots to "look and shoot," a paradigm shift in air combat methodology. Furthermore, HMDs are crucial for synthetic vision systems (SVS) and enhanced vision systems (EVS), which are growing in relevance for commercial and military transport aircraft to improve safety during adverse weather conditions, though these are typically visor-mounted rather than full helmet systems in non-tactical roles.

Driving factors for this market include escalating global geopolitical tensions, necessitating continuous modernization of air force fleets, particularly in major economies like the United States, China, and Russia. The replacement cycle of aging fighter platforms (such as the F-16 or MiG-29) with fifth and sixth-generation aircraft (F-35, Su-57) mandates the inclusion of state-of-the-art HMDs, as these systems are often tightly integrated with the aircraft's primary mission systems architecture. Additionally, advancements in micro-display technology and the need for comprehensive pilot training solutions that simulate high-stress environments are propelling market expansion. The tangible benefits, such as superior mission effectiveness, reduced pilot reaction time, and enhanced safety, underpin the robust demand trajectory.

Aerospace Helmet Mounted Display Market Executive Summary

The Aerospace Helmet Mounted Display market is characterized by intense technological competition and high barriers to entry, driven primarily by long-term defense procurement cycles and stringent regulatory standards set by defense ministries globally. Current business trends indicate a strong shift towards digital and full-color HMDs, replacing older monochrome or CRT-based systems. Key manufacturers are focusing on miniaturization, power efficiency, and increasing the field of view (FoV) to provide maximum immersion and information density without obstructing natural vision. Furthermore, there is a pronounced trend toward modular HMD designs that allow for easy upgrades and integration with various platforms, ensuring cost-effectiveness over the lifespan of the aircraft. Collaboration between traditional aerospace primes and specialized optical technology firms is essential for rapid product development and securing major defense contracts.

Regionally, North America maintains the dominant market share, primarily due to the vast procurement activities of the US Department of Defense and significant investment in next-generation platforms like the F-35 Joint Strike Fighter, which utilizes a highly sophisticated HMD as its primary display interface. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, fueled by increasing defense budgets in China, India, and South Korea, coupled with ongoing military modernization programs aimed at countering regional threats. European market growth is steady, supported by collaborative defense programs (like the Eurofighter Typhoon upgrade cycles) and national initiatives focused on improving pilot training capabilities and deploying advanced surveillance assets. Regulatory complexity and export restrictions related to sensitive military technology heavily influence cross-regional sales.

In terms of segment trends, the fixed-wing aircraft segment accounts for the largest market share, driven by high unit volume requirements for fighter jets. However, the helicopter segment is expected to show significant growth, particularly in tactical and attack roles where HMDs provide vital information for low-altitude navigation and terrain-following flight. Technology-wise, OLED micro-displays are rapidly gaining traction over Liquid Crystal Displays (LCDs) due to their superior contrast ratios and reduced latency, which are critical for high-speed dynamic operations. The maintenance and upgrade services segment also represents a considerable portion of the market, reflecting the high cost and complexity associated with maintaining these highly customized and integrated systems throughout their operational lifespan.

AI Impact Analysis on Aerospace Helmet Mounted Display Market

Common user questions regarding AI’s impact on HMDs frequently center on how Artificial Intelligence can transform data overload into actionable intelligence, enhance real-time decision support, and improve the integration of autonomous systems. Users are concerned about whether AI integration will increase system complexity and latency, especially during high-stress maneuvers, and are highly interested in AI's role in predictive maintenance for HMD components. Key themes emerging from these inquiries include the demand for AI-driven sensor fusion that automatically prioritizes threats and displays the most critical information precisely when needed, effectively reducing the pilot's cognitive burden. There is also significant anticipation regarding AI algorithms customizing display layouts based on mission phase or pilot fatigue, thereby maximizing situational awareness and mission effectiveness. The consensus suggests AI is moving HMDs beyond mere visualization tools into intelligent, adaptive mission management platforms.

- AI enables sophisticated sensor fusion, merging inputs from radar, electro-optical/infrared (EO/IR), and threat detection systems into a unified, coherent tactical display.

- Predictive AI algorithms forecast potential system failures in HMD optics and electronics, shifting maintenance from reactive to proactive, thereby increasing mission readiness.

- Machine learning optimizes information display dynamically, prioritizing crucial data (e.g., immediate threat vectors or low-fuel warnings) based on mission context and operational environment.

- AI-powered voice command recognition and natural language processing minimize manual input requirements, allowing pilots to interact with aircraft systems and HMD functions hands-free.

- Deep learning models facilitate advanced augmented reality (AR) overlay calibration, ensuring precise alignment of virtual symbology with real-world targets despite rapid head movement and vibration.

- AI supports synthetic training environments by generating realistic, adaptive adversaries and complex scenarios displayed through the HMD, enhancing pilot proficiency evaluation.

DRO & Impact Forces Of Aerospace Helmet Mounted Display Market

The Aerospace HMD market is significantly influenced by key growth drivers such as the global focus on military aviation modernization and the mandatory need for enhanced situational awareness in advanced aircraft. However, the market faces strong restraints, primarily related to the extremely high development costs associated with micro-display technology, sensor integration, and rigorous qualification processes required for aerospace use. Opportunities are abundant in the expansion into high-fidelity training simulators and the application of HMD technology in emerging urban air mobility (UAM) platforms for emergency services. The impact forces acting on the market are substantial, largely driven by regulatory compliance (ITAR, export controls) and the technological pace set by defense research agencies, requiring manufacturers to maintain continuous innovation in optics, ergonomics, and processing power. The inherent dual-use nature of some HMD components also subjects the market to complex geopolitical pressures and supply chain volatility, impacting long-term procurement planning and market pricing.

Segmentation Analysis

The Aerospace Helmet Mounted Display market segmentation provides a granular view of market dynamics across various dimensions including aircraft type, technology utilized, and application area. This analysis is crucial for understanding specific procurement trends and technological preferences across global defense and aerospace organizations. The market is primarily segmented based on whether the HMD is used in fixed-wing or rotary-wing aircraft, reflecting different operational requirements concerning field of view, brightness, and vibration tolerance. Further technological distinctions are drawn based on display type (OLED, LCD, DLP) and the type of vision enhancement capability (Night Vision vs. Thermal Imaging). These segmentations directly influence R&D investment and competitive positioning among manufacturers seeking specialized niches within the global defense supply chain.

- By Aircraft Type:

- Fixed-Wing Aircraft (Fighter Jets, Trainer Aircraft)

- Rotary-Wing Aircraft (Attack Helicopters, Utility Helicopters)

- By Technology Type:

- Digital Light Processing (DLP)

- Liquid Crystal Display (LCD)

- Organic Light Emitting Diode (OLED)

- Cathode Ray Tube (CRT)

- By Display Type:

- Monochrome Display

- Full-Color Display

- By Application:

- Military Aviation (Combat, Reconnaissance)

- Civil Aviation (Training Simulators, Specialized Operations)

- By Component:

- Helmet

- Display Unit

- Tracking System (Magnetic, Optical, Inertial)

- Software/Interface

Value Chain Analysis For Aerospace Helmet Mounted Display Market

The value chain for the Aerospace Helmet Mounted Display market is highly specialized and complex, beginning with sophisticated upstream component providers. The upstream analysis focuses heavily on suppliers of micro-displays (OLED and DLP modules), high-precision optics (lenses, combiners, wave-guides), and advanced inertial measurement units (IMUs) necessary for precise head tracking. These components require aerospace-grade durability and often custom-manufacturing processes, leading to high dependency on a few specialized technology firms. Quality control and supply chain security are paramount at this stage, as performance limitations here directly translate to system limitations in the operational environment. Strategic partnerships with silicon manufacturers and optical engineering companies are vital for HMD integrators to ensure a consistent supply of cutting-edge technology.

The midstream of the value chain is dominated by Tier 1 and Tier 2 system integrators (the key companies listed below), who perform the integration, system software development, and rigorous testing necessary to combine components into a mission-ready HMD. This stage involves significant R&D spending to meet specific airframe interface requirements, ergonomics, and military qualification standards (e.g., MIL-STD compliance). Downstream analysis focuses on the distribution channels, which are predominantly direct sales to government defense ministries (e.g., US DoD, European MoDs) or through established prime contractors (e.g., Lockheed Martin, Boeing) who integrate the HMD into their overall aircraft platform offering. Indirect channels are primarily utilized for spare parts, maintenance contracts, and sometimes for simulator HMD sales, often involving authorized service centers or third-party aerospace logistics providers.

The profitability across the value chain is highest in the specialized upstream component manufacturing and the final system integration phases, given the intellectual property and certification costs involved. Direct sales are favored for large military contracts as they allow for better control over technology transfer and compliance with strict export regulations, such as the International Traffic in Arms Regulations (ITAR). The customer lifecycle often includes decades of post-sales support, upgrades, and modernization programs, ensuring long-term revenue streams in the maintenance segment of the value chain.

Aerospace Helmet Mounted Display Market Potential Customers

The primary customers for Aerospace Helmet Mounted Displays are national defense organizations, specifically the air forces and army aviation units globally, which purchase these systems as part of comprehensive aircraft procurement or modernization programs. High-performance fighter jet operators, such as those flying the F-35, Eurofighter Typhoon, and Dassault Rafale, represent the most critical end-users due to the absolute necessity of HMDs for their advanced weapon systems and flight controls. Beyond tactical aviation, a significant potential customer base exists within helicopter operators focusing on attack (e.g., Apache, Tiger) and complex search and rescue (SAR) missions, where HMDs drastically improve visibility and flight coordination in challenging visual conditions.

A rapidly growing segment of potential customers includes specialized military and commercial flight training academies and simulation centers. These institutions require high-fidelity HMDs for their full-flight simulators (FFS) to replicate realistic operational environments and sensor inputs without incurring the high costs of actual flight hours. Simulator manufacturers purchase these systems to integrate them into training devices for pilot certification and recurring proficiency checks. Furthermore, emerging potential customers are specialized governmental agencies, such as border patrol, coast guard, and forestry services that operate high-speed surveillance aircraft or specialized mission helicopters requiring enhanced vision capabilities for effective operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elbit Systems Ltd., BAE Systems, Thales Group, Collins Aerospace (Raytheon Technologies), Leonardo S.p.A., Saab AB, Honeywell International Inc., L3Harris Technologies, Inc., Rockwell Collins, Israel Aerospace Industries (IAI), GENTEX Corporation, Denel Dynamics, Q-Sight, Kaiser Electro-Optics, Near-Eye Display, Inc., Optics 1, Inc., Flight Visions, Inc., ReVision Military, SurVision, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Helmet Mounted Display Market Key Technology Landscape

The technological landscape of the Aerospace Helmet Mounted Display market is characterized by a rapid transition from legacy Cathode Ray Tube (CRT) systems to advanced digital micro-display technologies, primarily focusing on superior image quality, reduced size, weight, and power (SWaP), and enhanced robustness. Organic Light-Emitting Diode (OLED) micro-displays represent the current cutting edge, offering exceptional contrast ratios, true blacks, and fast response times crucial for dynamic tactical environments. Waveguide technology is also gaining prominence, particularly in newer, lighter systems, as it allows for the projection of imagery onto the visor with minimal optical footprint, ensuring that the helmet maintains ergonomic balance and a wide, unobstructed field of regard. The move towards full-color digital displays is essential for integrating complex, multi-layered information feeds, improving data interpretation and threat prioritization.

Sensor fusion and high-fidelity head tracking systems are integral to HMD functionality and represent a significant area of technological investment. Modern HMDs rely on highly accurate hybrid tracking systems—combining magnetic, optical, and inertial tracking—to ensure that the displayed symbology remains precisely aligned with the outside world, even under high G-forces and vibration. The accuracy of the head tracking system directly impacts weapon cueing precision and the effectiveness of augmented reality overlays. Furthermore, advancements in digital video processing units (VPUs) and dedicated mission computers are necessary to handle the massive streams of data required for simultaneous display of synthetic vision, infrared imagery, and tactical symbology with negligible latency, a mandatory requirement for safety and mission success in high-speed flight.

Future technological development is centered on incorporating sophisticated augmented reality (AR) capabilities that go beyond simple symbology overlays. This includes integrating AI-driven systems to highlight critical objects or pathways in real-time, such as marking enemy positions or outlining safe landing zones under poor visibility conditions. The development of next-generation display materials, potentially utilizing micro-LED technology, promises even higher brightness levels necessary for effective daylight operation, while simultaneously reducing power consumption further. The technological race is focused on achieving wider fields of view (FoV) approaching the natural limits of human vision, ensuring the HMD serves as a seamless extension of the pilot's senses rather than a distraction or limitation.

Regional Highlights

- North America: This region holds the largest market share, driven primarily by the extensive defense budgets of the United States. The demand is heavily concentrated in sophisticated systems for fifth-generation fighters like the F-35 (Lockheed Martin F-35 Helmet-Mounted Display System, HMDS) and ongoing upgrades for F-15 and F/A-18 fleets. The presence of major defense prime contractors (e.g., Collins Aerospace, L3Harris, Raytheon) and robust R&D infrastructure solidify the region's dominance. Investment focuses on integration with new training platforms and AI-enabled cockpit technologies.

- Europe: The European market is stable, spurred by collaborative programs such as the Eurofighter Typhoon and national programs like the Dassault Rafale, both of which utilize advanced HMD systems (e.g., Thales Scorpion). Key growth factors include the need for advanced pilot training simulators, increased procurement of new attack helicopters, and modernization initiatives across key NATO allies (UK, Germany, France). Technological focus is on modularity and compliance with specific European safety and operational standards.

- Asia Pacific (APAC): APAC is the fastest-growing region, characterized by high growth in military expenditure across China, India, and South Korea. These nations are actively modernizing their air forces, either through indigenous aircraft development (e.g., China’s J-20) or large-scale procurement from international suppliers. The demand is driven by geopolitical instability, requiring advanced capabilities for aerial superiority and border security. Countries are increasingly seeking technology transfer and localized manufacturing capabilities for HMD components.

- Latin America: This region represents a smaller, yet growing, market focused on modernizing existing light fighter and attack helicopter fleets, particularly in countries like Brazil and Chile. Procurement often involves refurbishment of older aircraft, necessitating HMD systems that are compatible with legacy avionics architecture but offer modern tactical capabilities. Budgetary constraints often favor cost-effective or refurbished display solutions.

- Middle East and Africa (MEA): Growth in MEA is highly dependent on oil revenues and geopolitical tensions, leading to periodic, large-scale defense purchases, particularly from Gulf Cooperation Council (GCC) states. These countries are procuring high-end Western fighter jets, such as F-16s and Typhoons, thus driving demand for fully integrated HMD packages. The region is a key target for US and European HMD exporters due to high spending power for sophisticated defense systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Helmet Mounted Display Market.- Elbit Systems Ltd.

- BAE Systems

- Thales Group

- Collins Aerospace (Raytheon Technologies)

- Leonardo S.p.A.

- Saab AB

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Rockwell Collins

- Israel Aerospace Industries (IAI)

- GENTEX Corporation

- Denel Dynamics

- Q-Sight (An Elbit Subsidiary)

- Kaiser Electro-Optics

- Near-Eye Display, Inc.

- Optics 1, Inc.

- Flight Visions, Inc.

- ReVision Military (Now part of Revision Eyewear)

- SurVision, Inc.

- Swarovski Optik KG (Specialized Optics Supplier)

Frequently Asked Questions

Analyze common user questions about the Aerospace Helmet Mounted Display market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for full-color HMD systems in military aviation?

The shift to full-color HMDs is driven by the necessity to integrate complex, multi-layered data feeds from advanced sensors and mission systems. Full color allows for rapid differentiation between friendly, hostile, and neutral targets, map overlays, and synthetic vision symbology, drastically enhancing the pilot's ability to process critical tactical information and reduce cognitive strain in highly congested battlespaces. This capability is paramount for fifth and sixth-generation aircraft.

How do technological advancements like OLED displays affect the Aerospace HMD market?

OLED technology significantly improves HMD performance by offering superior contrast ratios, faster refresh rates, and wider fields of view compared to older LCD or CRT systems. The enhanced clarity and reduced latency provided by OLED micro-displays are crucial for maintaining situational awareness and precision cueing during high-G maneuvers, simultaneously contributing to lower overall system weight and power consumption (SWaP).

Which geographical region exhibits the fastest growth rate for HMD procurement and why?

The Asia Pacific (APAC) region, specifically countries such as India and China, demonstrates the fastest growth rate. This rapid expansion is attributed to large-scale military modernization programs, increasing defense budgets aimed at regional security concerns, and significant investment in new generation indigenous and imported fighter platforms that mandate the use of highly sophisticated, integrated HMD solutions.

What are the main integration challenges faced when deploying HMDs on legacy aircraft platforms?

The primary challenges involve system compatibility and latency. Integrating modern digital HMDs with older, analog avionics architectures requires complex interface units and custom software development. Additionally, ensuring precise head tracking accuracy and minimal processing latency under the limited bandwidth of legacy aircraft systems presents significant engineering hurdles that increase modernization costs and timeframes.

How does the development of augmented reality (AR) capability enhance the functionality of Aerospace HMDs?

AR capability transforms the HMD from a data display into an interactive, real-world overlay tool. It utilizes real-time sensor data (like EO/IR and LiDAR) processed by AI to place virtual information, such as weapon aiming points, precise navigation vectors, or threat prioritization alerts, directly onto the corresponding physical location in the pilot's external view. This seamless blending of virtual and real environments maximizes tactical advantage and operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager