Aerospace Industry Paint Spray Guns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435476 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Aerospace Industry Paint Spray Guns Market Size

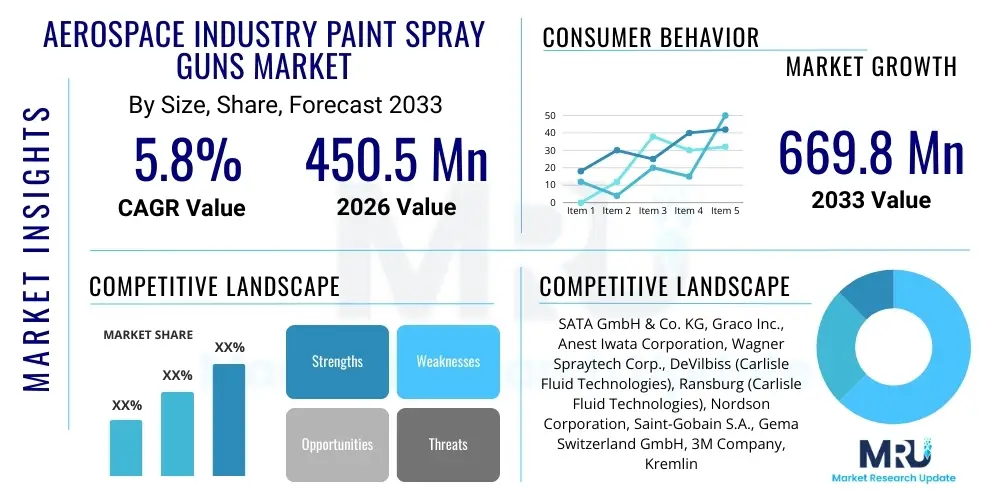

The Aerospace Industry Paint Spray Guns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 669.8 Million by the end of the forecast period in 2033.

Aerospace Industry Paint Spray Guns Market introduction

The Aerospace Industry Paint Spray Guns Market encompasses specialized equipment utilized for applying protective and aesthetic coatings onto aircraft structures, components, and associated aerospace hardware. These tools are engineered to meet stringent aerospace quality standards, requiring precision, uniformity, and minimal overspray, crucial for performance factors such as weight reduction and aerodynamic smoothness. The market primarily includes High Volume Low Pressure (HVLP), Reduced Pressure (RP), electrostatic, and conventional spray systems, adapted specifically for the unique demands of aerospace materials like composites, aluminum alloys, and titanium.

These sophisticated spray guns are vital across the entire aerospace lifecycle, from Original Equipment Manufacturer (OEM) final assembly lines where primer and topcoats are applied, to Maintenance, Repair, and Overhaul (MRO) facilities conducting touch-ups and complete refinishing operations. The primary applications involve applying specialized coatings such as chromate-free primers, polyurethane topcoats, and erosion-resistant finishes for both interior and exterior surfaces of commercial airliners, military jets, and spacecraft components. The operational benefits include superior transfer efficiency, reduction in Volatile Organic Compounds (VOC) emissions, and enhanced coating adherence and durability, which are critical for resisting extreme environmental conditions.

Key driving factors accelerating market growth include the substantial increase in global commercial aircraft fleet size, demanding continuous MRO activities, and the technological evolution toward lighter, more advanced coating materials that require precise application equipment. Furthermore, strict regulatory pressures from bodies such as the Environmental Protection Agency (EPA) and various aviation authorities compel operators and manufacturers to adopt high-transfer efficiency systems (like HVLP and electrostatic) to minimize material waste and adhere to environmental compliance standards. The push for automation in finishing processes to improve throughput and consistency also significantly contributes to the demand for advanced, robot-compatible spray gun technology.

Aerospace Industry Paint Spray Guns Market Executive Summary

The Aerospace Industry Paint Spray Guns Market is characterized by a strong emphasis on precision, efficiency, and environmental compliance, driving consistent demand across key aerospace sectors. Current business trends indicate a definitive shift towards digital integration, where spray guns are increasingly compatible with robotic systems and feature integrated sensors for real-time monitoring of flow rates and pressure. This technological integration aims to enhance process consistency, crucial for achieving critical coating thickness and uniformity on complex aerospace geometries. The market sees heavy investment in research and development focused on creating durable equipment capable of handling new generation, highly viscous, and waterborne aerospace coatings, ensuring longevity and compliance with stringent material specifications.

Regionally, North America maintains market dominance, propelled by the presence of major aerospace OEMs and extensive MRO networks serving both commercial and defense sectors. However, the Asia Pacific (APAC) region is demonstrating the fastest growth rate, fueled by massive infrastructure investments in aviation, substantial fleet expansion in countries like China and India, and the establishment of new, localized MRO centers. Europe remains a strong market, driven by strict environmental regulations mandating the adoption of high-efficiency spray technologies (HVLP/RP) and continued investment in defense modernization programs which require specialized military-grade coatings. Market penetration in Latin America and MEA is slowly increasing, focusing primarily on maintenance operations for existing international fleets.

Segmentation trends highlight the superior growth rate of the High Volume Low Pressure (HVLP) technology segment due to its excellent transfer efficiency and regulatory acceptance, minimizing environmental impact. By application, the Commercial Aircraft segment dominates volume usage due to high MRO frequency, while the Military Aircraft segment drives demand for specialized, high-performance electrostatic systems necessary for stealth coatings and extreme durability requirements. OEM Manufacturers represent the largest revenue share as they purchase integrated, high-throughput systems for initial application, although MRO facilities contribute significantly to the aftermarket for replacement guns and related accessories, focusing on portability and ease of use.

AI Impact Analysis on Aerospace Industry Paint Spray Guns Market

User queries regarding the impact of Artificial Intelligence (AI) in the paint spray gun sector generally center on how AI can enhance coating consistency, reduce material waste, and integrate predictive maintenance capabilities. Key concerns often revolve around the feasibility and cost of retrofitting existing analog systems with AI-driven sensors and control units, and the accuracy of AI algorithms in interpreting complex factors like humidity, temperature variations, and the unique geometry of aerospace parts. Users expect AI to move beyond simple automation, enabling true cognitive control over the spraying process, optimizing parameters in real-time to guarantee perfect adhesion and thickness uniformity, thereby eliminating human error and drastically improving first-pass yield, which is critical in high-cost aerospace operations.

AI is set to revolutionize the finishing process by transforming traditional manual control into a data-driven, closed-loop system. It achieves this by integrating high-resolution vision systems and sensors (measuring distance, angle, and flow) into robotic or automated spray booths. AI algorithms process this massive dataset in microseconds, adjusting gun pressure, atomization air, and fan pattern dynamically based on deviations detected during application, compensating instantly for robot trajectory errors or inconsistent coating viscosity. This level of precise control significantly reduces instances of runs, sags, and orange peel texture, saving millions in rework costs inherent to aerospace coating failures.

Furthermore, AI significantly impacts equipment uptime and lifecycle management. By analyzing operational data from integrated sensors—monitoring vibration, usage cycles, and component stress—AI models can predict component failure (e.g., nozzle wear, needle valve degradation) well before they occur. This transition from reactive to predictive maintenance minimizes unexpected downtime in critical MRO schedules, where delays are extremely costly. The application of AI also extends to training, simulating complex spray patterns and environmental conditions, helping technicians quickly adapt to new materials and equipment while minimizing expensive material consumption during the learning phase.

- AI-driven real-time parameter optimization ensures coating thickness uniformity and minimizes material waste.

- Predictive maintenance analytics extend the lifespan of high-value spray equipment and prevent unscheduled downtime.

- Integration with robotic arms uses AI vision systems for precise path planning on complex, non-uniform aerospace components.

- AI facilitates defect detection (e.g., fisheyes, blistering) during application through high-speed visual inspection systems.

- Cognitive process control systems adapt automatically to changes in ambient temperature and humidity for stable application quality.

DRO & Impact Forces Of Aerospace Industry Paint Spray Guns Market

The market dynamics are governed by a complex interplay of stringent safety regulations, relentless technological advancement in materials science, and the demanding operational lifecycle of aircraft. Drivers include the global expansion of commercial fleets and the necessity for protective coatings against extreme conditions, while restraints center around high initial investment costs for advanced systems and the specialized skill set required for precision aerospace application. Opportunities arise from the transition to sustainable, low-VOC coatings, which necessitate new precision equipment, and the increasing adoption of automated painting solutions. These forces collectively shape the market's trajectory, mandating efficiency improvements and compliance as core competitive differentiators.

Drivers: A primary driver is the accelerating MRO frequency due to the aging global fleet and the high utilization rates of modern aircraft, necessitating regular, quality refinishing. Secondly, the increasing use of advanced, lightweight composite materials in aircraft manufacturing requires specialized, delicate application techniques to ensure coating adhesion without compromising structural integrity, thereby driving the demand for precise, low-pressure systems. Finally, global environmental regulations, particularly those restricting VOC and HAP (Hazardous Air Pollutants) content, push manufacturers toward HVLP and electrostatic guns that maximize transfer efficiency and minimize harmful emissions, accelerating equipment replacement cycles across the industry.

Restraints: The market faces significant restraints, notably the high initial capital expenditure associated with purchasing sophisticated, certified aerospace-grade spray gun systems, especially robotic installations, which can be prohibitive for smaller MRO operations. Furthermore, the steep learning curve and the shortage of highly skilled technicians trained to operate and maintain these specialized high-precision instruments pose a persistent operational challenge. The rigorous certification and qualification processes required for equipment used in aerospace applications also create a barrier to entry, adding complexity and time to product development cycles.

Opportunities: Major opportunities lie in developing integrated smart spray gun systems compatible with Industry 4.0 principles, offering data analytics and connectivity for process traceability. The rise of plasma and ceramic thermal spray coatings for specific high-stress components (like turbine blades) presents a lucrative niche for developing specialized application nozzles and control systems. Moreover, manufacturers are increasingly focusing on modular spray gun designs that allow for quick interchangeability between different coating types (e.g., polyurethane, epoxy, conductive paints), maximizing utilization in diverse MRO environments.

Segmentation Analysis

The Aerospace Industry Paint Spray Guns Market is meticulously segmented based on the technological principles employed for atomization, the specific aircraft application where the equipment is utilized, and the primary end-user adopting the technology. Segmentation by technology is crucial as it reflects the efficiency and regulatory compliance of the equipment, with HVLP and electrostatic systems gaining prominence. Application segmentation highlights the different demands of commercial vs. military sectors, influencing required durability and complexity. End-user categorization separates OEM production requirements from MRO flexibility needs, dictating the typical volume, robustness, and automation level of the deployed equipment.

The technology segment is dominated by High Volume Low Pressure (HVLP) systems due to their superior transfer efficiency (often above 65%) and compliance with environmental standards, making them the standard for large-area coating tasks in commercial aviation. However, electrostatic spray guns hold a significant share in specialized applications, particularly for conductive coatings and intricate components, maximizing wrap-around effect and material utilization. The application segment sees Commercial Aircraft leading in unit volume due to continuous maintenance schedules, while the Military Aircraft segment drives demand for specialized, highly durable, and often customized, non-reflective coating application systems designed for stealth characteristics and extreme operational conditions.

In terms of end-users, OEM manufacturers demand high-precision, automated systems capable of maintaining consistent quality across mass production lines, often integrating spray guns into large robotic paint booths. Conversely, MRO facilities require flexible, handheld, and easily portable equipment suitable for quick repairs, localized touch-ups, and variable component sizes. The growth trajectory suggests that while OEMs generate the initial high-value sales, MRO providers offer sustained demand for replacement parts, service kits, and consumables, ensuring ongoing market liquidity.

- Technology:

- High Volume Low Pressure (HVLP)

- Reduced Pressure (RP)

- Electrostatic Spray Guns

- Airless Spray Guns

- Conventional Spray Guns

- Application:

- Commercial Aircraft (Narrow-body, Wide-body)

- Military Aircraft (Fighters, Bombers, Transport)

- General Aviation (Business Jets, Helicopters)

- Space Systems and Launch Vehicles

- End-User:

- OEM Manufacturers

- MRO Facilities

- Custom Finishing Shops

Value Chain Analysis For Aerospace Industry Paint Spray Guns Market

The value chain for aerospace paint spray guns begins with the upstream raw material suppliers, predominantly specializing in high-grade, corrosion-resistant metals (stainless steel, specialized alloys) and engineered plastics for durable components like nozzles, needles, and air caps. Precision machining and molding facilities transform these raw materials into highly specialized spray gun components, requiring tight tolerances for consistent atomization. This stage is critical as the quality of internal components directly impacts transfer efficiency and coating uniformity, factors that are non-negotiable in aerospace applications.

Midstream activities involve the core manufacturing and assembly of the spray gun systems by key market players, including extensive R&D focusing on fluid dynamics, robotics integration, and regulatory compliance (e.g., meeting ATEX/explosion proofing standards). Manufacturers often differentiate themselves through proprietary air cap designs, fluid control systems, and ergonomic features tailored for prolonged use in complex environments. Distribution channels are highly specialized, often relying on direct sales teams or certified, technical distributors who can offer localized training, spare parts inventory, and technical support critical for maintaining aerospace certifications.

Downstream analysis focuses on the end-users—OEMs and MRO facilities. Direct sales are prevalent for large volume, automated equipment destined for OEM production lines, ensuring precise installation and integration support. Indirect distribution, leveraging specialized industrial suppliers and MRO consumables providers, caters to the aftermarket, offering replacement parts, service kits, and portable spray guns for field maintenance. The effectiveness of the downstream segment is highly dependent on the quality of after-sales technical support and the ability of distributors to respond quickly to critical aerospace maintenance schedules.

Aerospace Industry Paint Spray Guns Market Potential Customers

The primary consumers for aerospace paint spray guns are organizations involved in the manufacturing, assembly, maintenance, and refurbishment of aircraft and spacecraft. This includes large multinational aerospace corporations that operate extensive production facilities demanding integrated, highly automated painting solutions to meet stringent throughput requirements. These Original Equipment Manufacturers (OEMs) are the largest purchasers of high-end robotic spray systems designed for initial coating applications on new airframes, engines, and major components, where consistency and efficiency are paramount.

A second major customer group comprises Maintenance, Repair, and Overhaul (MRO) facilities, ranging from independent third-party service providers to airline-owned maintenance shops. MRO customers typically purchase replacement spray guns, smaller, portable, and ergonomically designed manual guns, and a constant supply of related accessories and spares. Their demand is driven by scheduled maintenance cycles, localized damage repair, and complete exterior livery changes, focusing on versatility and fast setup times across various coating types.

Furthermore, specialized segments such as military depots and government aerospace contractors are crucial buyers, often requiring ruggedized, custom-specified equipment for applying radar-absorbing materials (RAM) or highly durable, chemical-resistant finishes. These buyers prioritize equipment reliability under harsh conditions and often utilize electrostatic systems for specialized coating coverage. Finally, small custom finishing shops that handle parts for general aviation aircraft or subcontract specialized component painting represent a dispersed but significant portion of the aftermarket, favoring flexible, mid-range HVLP systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 669.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SATA GmbH & Co. KG, Graco Inc., Anest Iwata Corporation, Wagner Spraytech Corp., DeVilbiss (Carlisle Fluid Technologies), Ransburg (Carlisle Fluid Technologies), Nordson Corporation, Saint-Gobain S.A., Gema Switzerland GmbH, 3M Company, Kremlin Rexson (SAMES KREMLIN), Binks (Carlisle Fluid Technologies), Parker Hannifin Corporation, C.A. Technologies, AccuSpray, Fuji Spray, Wiwa GmbH, Atlas Copco AB, Spraying Systems Co., ITW Industrial Fluid Management. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Industry Paint Spray Guns Market Key Technology Landscape

The technological landscape of the Aerospace Industry Paint Spray Guns Market is rapidly evolving, moving towards greater efficiency, digitalization, and specialized material handling capabilities. The dominant trend involves the refinement of High Volume Low Pressure (HVLP) and Reduced Pressure (RP) technologies to achieve even higher transfer efficiencies (often exceeding 70%) crucial for minimizing material costs and environmental impact, particularly concerning primers and topcoats on large fuselages. These systems utilize advanced air caps and fluid nozzles engineered from wear-resistant materials to maintain consistent spray patterns despite prolonged use with aggressive aerospace coatings. Furthermore, the development of lightweight, ergonomic composite materials for the gun bodies themselves enhances operator comfort and reduces fatigue in manual applications.

Another significant area of innovation is the proliferation of electrostatic systems specifically designed for aerospace-grade conductive and non-conductive coatings. Modern electrostatic guns feature highly controllable charging systems that optimize the wrap-around effect, especially on complex, three-dimensional components like engine parts or landing gear structures, leading to substantial material savings. These systems are increasingly integrated into automated paint booths, utilizing precise voltage control mechanisms that dynamically adjust based on component geometry detected by sensors, ensuring uniform film build-up across complex surfaces while meeting strict military and commercial aerospace standards for conductivity and radar transparency.

The integration of IoT and sensors represents a major technological leap. Next-generation spray guns are equipped with smart sensors capable of monitoring fluid pressure, atomization air pressure, temperature, and material flow rates in real-time. This data is transmitted wirelessly to a centralized control system for immediate analysis and historical tracking, ensuring full process traceability—a mandatory requirement in aerospace quality assurance. This digital connectivity facilitates predictive maintenance, allowing users to anticipate wear on critical components like needle packing and nozzles, thereby maximizing operational uptime and ensuring the consistent quality demanded by both MRO schedules and OEM assembly lines.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most technologically mature market for aerospace paint spray guns globally. This dominance is attributed to the presence of major Tier 1 aerospace manufacturers (Boeing, Lockheed Martin, Northrop Grumman) and the largest concentration of certified MRO facilities. The region leads in adopting advanced automation, especially robotic paint systems integrated with HVLP and sophisticated electrostatic technologies for complex military and commercial aircraft production. Regulatory compliance with EPA standards drives consistent demand for high-transfer efficiency equipment, maintaining a robust aftermarket for consumables and precision replacement parts.

- Europe: The European market is characterized by stringent environmental regulations, particularly REACH standards, which mandate the adoption of low-VOC and waterborne coatings, thereby driving demand for highly efficient RP and HVLP equipment. Countries like Germany, France, and the UK host significant aerospace industrial bases (Airbus, BAE Systems), fostering a mature market for specialized and certified coating equipment. Innovation in Europe often focuses on ergonomic design and integration with digitally controlled pressure systems to achieve unparalleled precision in both OEM and heavy maintenance operations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, propelled by exponential growth in passenger traffic, resulting in massive fleet expansion and subsequent establishment of new MRO hubs in China, India, and Southeast Asia. While the region currently utilizes a mix of conventional and HVLP technologies, rapid industrialization and governmental investments in indigenous aerospace programs are accelerating the shift toward sophisticated, automated painting solutions, creating lucrative opportunities for global spray gun manufacturers seeking high-volume sales.

- Latin America (LATAM): The LATAM market is primarily driven by MRO demand serving regional airlines and military fleets. Brazil, Mexico, and Chile are key demand centers. The focus here is often on cost-effective, durable equipment capable of handling diverse environmental conditions. While investment in automation is slower compared to North America or Europe, there is steady growth in demand for reliable HVLP systems for routine maintenance tasks.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated around major aviation hubs (UAE, Qatar, Saudi Arabia) which have invested heavily in state-of-the-art MRO facilities to service the expansive international fleet passing through the region. Demand is focused on high-performance equipment suited for quick turnarounds and high-temperature environments. Military spending in certain MEA countries also contributes significantly to specialized paint gun procurement for defense applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Industry Paint Spray Guns Market.- SATA GmbH & Co. KG

- Graco Inc.

- Anest Iwata Corporation

- Wagner Spraytech Corp.

- DeVilbiss (Carlisle Fluid Technologies)

- Ransburg (Carlisle Fluid Technologies)

- Nordson Corporation

- Saint-Gobain S.A.

- Gema Switzerland GmbH

- 3M Company

- Kremlin Rexson (SAMES KREMLIN)

- Binks (Carlisle Fluid Technologies)

- Parker Hannifin Corporation

- C.A. Technologies

- AccuSpray

- Fuji Spray

- Wiwa GmbH

- Atlas Copco AB

- Spraying Systems Co.

- ITW Industrial Fluid Management

Frequently Asked Questions

Analyze common user questions about the Aerospace Industry Paint Spray Guns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary coating application technologies used in the aerospace industry?

The aerospace industry predominantly utilizes High Volume Low Pressure (HVLP) and Reduced Pressure (RP) systems for superior transfer efficiency and compliance with environmental regulations regarding Volatile Organic Compounds (VOCs). Electrostatic spray guns are also crucial for specialized conductive or non-conductive coatings, ensuring maximum wrap-around effect and material utilization on complex components.

How do environmental regulations impact the demand for aerospace paint spray guns?

Stringent environmental regulations, such as those imposed by the EPA and REACH, mandate low-VOC and high-solids coatings. This drives demand for high-transfer efficiency spray guns (HVLP and electrostatic) as these technologies significantly reduce overspray, material waste, and the release of hazardous air pollutants (HAPs), compelling continuous equipment upgrades across MRO and OEM facilities.

What role does automation play in the future of the aerospace paint spray gun market?

Automation is crucial for achieving high repeatability and consistent quality in aerospace coatings. Robotic paint systems, integrated with smart spray guns and AI-driven process control, minimize human error, optimize coating thickness uniformity across complex geometries, and improve throughput in high-volume OEM manufacturing and large MRO tasks.

Which sector, OEM or MRO, drives the largest demand for paint spray guns?

While Original Equipment Manufacturers (OEMs) drive high-value sales for integrated, complex robotic systems used in new production lines, Maintenance, Repair, and Overhaul (MRO) facilities represent the sustained volume market. MRO drives constant demand for portable, manual spray guns, replacement parts, and accessories necessary for routine fleet maintenance, touch-ups, and complete refinishing cycles.

What specific challenges are faced when applying specialized military or stealth coatings?

Applying specialized military coatings, such as Radar Absorbent Material (RAM) or non-reflective finishes, requires extreme precision, specific film thicknesses, and often demands specialized electrostatic or robotic non-metallic equipment to avoid contamination. The challenges include maintaining certification compliance, handling highly viscous materials, and ensuring zero defects critical for operational stealth and durability in harsh environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager