Aerospace Quick Lock Pins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433703 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aerospace Quick Lock Pins Market Size

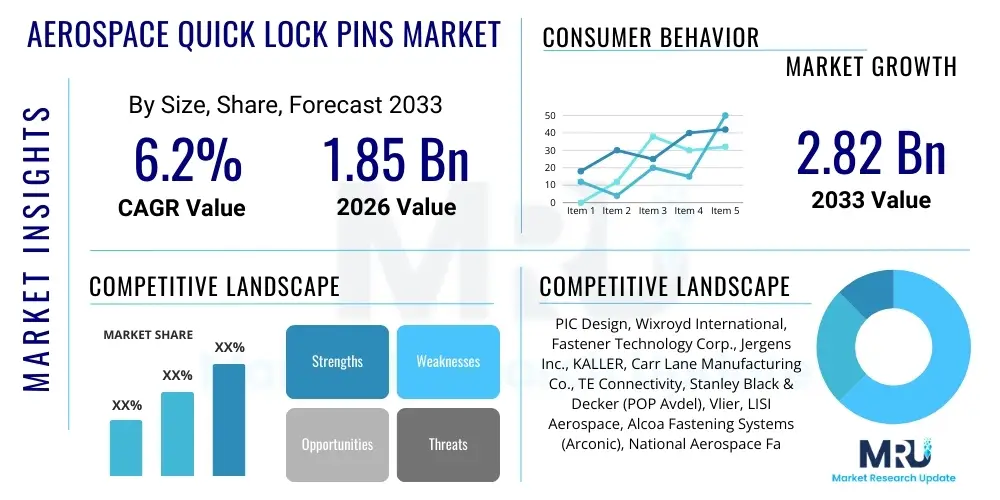

The Aerospace Quick Lock Pins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.82 Billion by the end of the forecast period in 2033.

Aerospace Quick Lock Pins Market introduction

The Aerospace Quick Lock Pins Market encompasses specialized fastening solutions designed for rapid, secure, and repeatable connections in critical aerospace assemblies. Quick lock pins, also known as quick release pins, ball lock pins, or detent pins, are engineered to provide high shear strength and vibration resistance while allowing maintenance personnel or operators to connect and disconnect components swiftly without the need for tools. These components are essential in applications requiring frequent changeouts, such as ground support equipment, aircraft jigs and fixtures, flight control surfaces for inspection access, and various removable payload systems in both commercial and military aviation. The inherent design features—including a push-button or lever mechanism—ensure positive locking, a non-negotiable requirement for safety-critical aerospace environments. The market growth is inextricably linked to increasing aircraft production rates, modernization efforts in global air fleets, and stringent regulations governing aircraft maintenance and safety standards.

Aerospace Quick Lock Pins are typically manufactured from high-strength, lightweight materials such as stainless steel, heat-treated alloy steel, and specialized aluminum alloys, often coated or surface-treated for enhanced corrosion resistance and durability in extreme operational conditions. Their primary function revolves around ensuring reliable temporary or semi-permanent fastening, bridging the gap between standard permanent fasteners (like bolts and rivets) and quick-access panels. Major applications span structural assembly, engine maintenance tooling, passenger seating reconfiguration, cargo handling systems, and military ordnance loading systems. The complexity of modern aircraft designs, particularly those involving composites and advanced materials, necessitates precision-engineered quick-lock solutions that maintain tight tolerances and structural integrity under dynamic loads and thermal fluctuations. Furthermore, the market for quick lock pins is intrinsically tied to global aircraft utilization rates. When utilization increases, the frequency of required maintenance checks (A-checks, C-checks, D-checks) rises, directly accelerating the replacement cycle for quick-release hardware. This hardware, essential for accessing hydraulics, avionics bays, and inspection ports, undergoes repetitive stress and wear. Consequently, the aftermarket segment becomes a vital revenue stream, requiring manufacturers to maintain large, diversified inventory buffers to meet global Aircraft on Ground (AOG) demands swiftly.

The core benefits of adopting Quick Lock Pins include significantly reduced MRO (Maintenance, Repair, and Overhaul) turnaround times, improved operational efficiency, and enhanced worker safety during assembly and maintenance procedures. These pins eliminate the risk of loose hardware associated with conventional fastening methods that require tools and offer a clear visual or tactile indication of secure locking, thereby minimizing human error. Driving factors for market expansion include the substantial backlog of commercial aircraft orders, the global expansion of low-cost carriers necessitating faster turnaround times, and increased military spending on tactical aircraft platforms that utilize these pins for external payload mounting and rapid configuration changes. Furthermore, the increasing complexity and size of test and alignment fixtures used in aerospace manufacturing create sustained demand for high-precision, quick-locking devices. Aerospace manufacturers are increasingly adopting lean manufacturing principles, which necessitates standardized, reliable tooling. Quick lock pins are indispensable in this context, forming the backbone of modular assembly jigs and fixture systems that ensure precise alignment during complex fuselage or wing section joining. The consistency provided by certified quick-release pins minimizes potential assembly discrepancies, which is critical given the tight tolerances required for modern composite structures.

Aerospace Quick Lock Pins Market Executive Summary

The Aerospace Quick Lock Pins Market exhibits robust growth driven by accelerating global commercial aviation traffic and the mandated replacement cycles for aging fleets. Business trends indicate a strong shift towards lightweight and higher-performance materials, such as titanium and advanced stainless steels, to meet stringent weight reduction targets in modern aircraft programs (e.g., Airbus A350, Boeing 787). Key market participants are focusing on developing pins with integrated sensor technologies for real-time monitoring of locking status and usage cycles, optimizing preventive maintenance schedules. Furthermore, consolidation among specialized fastener manufacturers is noted, aimed at achieving economies of scale and broadening product portfolios to serve large Tier 1 suppliers and Original Equipment Manufacturers (OEMs) directly. The increasing adoption of automation in aerospace manufacturing is also necessitating Quick Lock Pins optimized for robotic insertion and removal processes, driving innovation in ergonomic and highly repeatable designs. The necessity for continuous innovation in corrosion prevention, driven by exposure to corrosive environments and de-icing fluids, is pushing manufacturers towards advanced non-cadmium surface treatments and specialized PVD/CVD coatings to extend component service life.

Regionally, North America remains the dominant market segment, attributed to the presence of major aircraft OEMs (Boeing, Lockheed Martin), extensive MRO infrastructure, and high defense spending which relies heavily on quick-change components for military aircraft. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by massive fleet expansion, particularly in China and India, and the rapid development of indigenous aerospace manufacturing capabilities. European market growth is steady, driven by Airbus production rates and strong investment in advanced aerospace research and development programs (e.g., EU Clean Sky initiatives). Global supply chain vulnerabilities post-pandemic have highlighted the need for localized manufacturing and diversified sourcing strategies, influencing regional investment patterns in specialized component production. The proliferation of MRO activities across Southeast Asia and the Middle East is reshaping distribution strategies, necessitating the establishment of regional fulfillment centers to minimize AOG time and logistics costs for critical replacement parts.

Segment trends reveal that the 'Double-Acting' pin type segment holds a significant share due to its enhanced safety features and suitability for critical applications where positive locking confirmation is paramount. By application, the 'MRO & Aftermarket' segment is experiencing rapid expansion as older aircraft require frequent inspections and replacement of high-wear components like pins. In terms of end-use, the 'Commercial Aviation' sector dominates revenue due to sheer volume, but the 'Military & Defense' segment provides stable, high-margin opportunities driven by customization requirements and advanced material specifications necessary for harsh operational environments. The trend towards modular aircraft designs and standardized tooling further reinforces the necessity for robust, interoperable quick-lock solutions across all maintenance levels. The ongoing development of Unmanned Aerial Systems (UAS) and reusable space launch vehicles is also creating specialized niche demand for ultra-lightweight and high-tolerance quick-release mechanisms, pushing material science boundaries.

AI Impact Analysis on Aerospace Quick Lock Pins Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Quick Lock Pins market often revolve around predictive maintenance integration, automated quality assurance, and design optimization. Users are particularly interested in how AI algorithms can predict fastener failure based on operational data (vibration, temperature, load cycles) collected by smart pins, moving maintenance from scheduled to condition-based paradigms. Concerns also focus on whether AI-driven design tools will lead to radical redesigns, potentially replacing traditional mechanical pins with sensor-laden smart components that are managed digitally. The prevailing expectation is that AI will not replace the fundamental mechanical pin but rather enhance its integration into sophisticated digital twin environments, optimizing material usage, detecting counterfeit parts via image recognition, and streamlining complex assembly sequences involving hundreds of quick-release mechanisms. The digitalization facilitated by AI also provides essential data for maintaining compliance and full traceability records required by aerospace regulatory bodies.

- AI-Driven Predictive Failure Analysis: Utilizing sensor data (load, cycles) integrated into high-end pins to predict fatigue and material degradation, optimizing replacement schedules and reducing unexpected failures.

- Automated Visual Inspection: Employing machine learning and computer vision systems during manufacturing and MRO processes to instantly verify correct pin seating, locking mechanism integrity, and surface finish compliance, drastically reducing human inspection time and error.

- Generative Design Optimization: AI tools exploring topological optimization for pin bodies and locking mechanisms, allowing manufacturers to create lighter, stronger pins tailored precisely to specific stress profiles, minimizing excess material use and improving performance characteristics.

- Supply Chain and Inventory Management: AI algorithms forecasting demand for specific pin variants ( based on flight schedules and MRO activity) to prevent stockouts of critical safety components and optimize global distribution networks.

- Digital Twin Integration: Embedding quick-lock pin status (locked/unlocked) into the aircraft's digital twin model, providing real-time configuration status essential for automated flight readiness checks and minimizing pre-flight documentation errors, particularly in highly complex military platforms.

DRO & Impact Forces Of Aerospace Quick Lock Pins Market

The market dynamics for Aerospace Quick Lock Pins are heavily influenced by stringent safety regulations, the cyclical nature of aircraft manufacturing, and continuous pressure to reduce operational weight. Drivers include the global mandate for fleet modernization, the increasing complexity of MRO operations requiring faster access to internal components, and the consistent demand from the defense sector for robust, multi-application fastening solutions. Restraints primarily involve the high cost associated with manufacturing precision-engineered components from specialized aerospace-grade materials, the necessity for zero-defect tolerance requiring extensive quality control, and the relatively long qualification and certification process for new fastening technologies within the highly regulated aerospace industry. Opportunities lie in the development of next-generation pins integrating IoT and smart features for enhanced safety monitoring, the expansion into emerging aerospace markets in APAC, and the growing demand for specialized pins in unmanned aerial vehicle (UAV) and space launch vehicle applications. These forces collectively shape the market's direction, balancing innovation against the fundamental requirement for absolute reliability and safety.

The impact forces analysis highlights competitive rivalry among established fastener manufacturers who possess the necessary AS9100 certification and long-standing OEM contracts. The bargaining power of buyers (large OEMs and MRO providers) is high due to volume purchasing and standardized technical specifications, placing continuous downward pressure on pricing, although the criticality of the component limits substitution. The threat of new entrants is low, primarily due to the immense capital investment required for high-precision manufacturing and the demanding regulatory barriers to entry. Securing airworthiness approvals (FAA/EASA) for new designs acts as a significant deterrent. The threat of substitutes is moderate; while conventional bolts and screws remain primary alternatives for permanent fixtures, for quick-release applications, substitution is limited, primarily coming from proprietary locking mechanisms developed internally by OEMs, though Quick Lock Pins remain the industry standard for tooling and access panels. Supplier power is moderate to high, particularly for suppliers providing specialized high-performance alloys (e.g., Inconel, specific titanium grades) essential for extreme environment applications, demanding strategic sourcing and long-term metal procurement agreements.

The market also faces macro-economic forces, including fluctuations in global fuel prices affecting airline profitability (and subsequently MRO budgets), geopolitical instability impacting defense spending, and global economic health determining commercial aircraft order backlogs. Technological advancements, such as additive manufacturing (3D printing), present a dual impact: an opportunity to rapidly prototype specialized pins but also a challenge to established forging and machining processes. Overall, the market remains fundamentally strong due to the non-negotiable requirement for safety and the continuous operational life of aircraft, ensuring sustained demand regardless of minor economic fluctuations. The necessity for rigorous certification and traceability is a major restraint; every pin used in critical aerospace applications must provide full material and process traceability, demanding sophisticated quality management systems that smaller, non-specialized manufacturers cannot easily replicate. This regulatory intensity concentrates market share among established, certified industry players.

Segmentation Analysis

The Aerospace Quick Lock Pins market is segmented across various dimensions, including Pin Type, Application, Material, and End-User, providing a comprehensive view of market dynamics and adoption patterns. Segmentation by Pin Type—encompassing Single-Acting, Double-Acting, and Lift-and-Turn types—reflects the differing levels of required security and ease of use in diverse aerospace environments. Application segmentation distinguishes between Manufacturing & Assembly (jigs, fixtures), MRO & Aftermarket (access panels, tooling), and Ground Support Equipment. Material segmentation is crucial, differentiating between standard components (stainless steel, aluminum) and high-performance solutions (titanium, specialty alloys) needed for extreme temperature or high-load environments. Understanding these segments is vital for stakeholders to tailor product development and market entry strategies effectively, addressing specific pain points across the aerospace value chain, from initial build to long-term maintenance. The complexity inherent in modern aircraft maintenance strongly favors the adoption of robust Double-Acting pins due to their superior safety characteristics.

- By Pin Type:

- Single-Acting (Push/Pull)

- Double-Acting (Ball Lock)

- Lift-and-Turn Pins (Quarter-Turn)

- Detent Pins

- By Application:

- Manufacturing and Assembly (Jigs & Fixtures)

- Maintenance, Repair, and Overhaul (MRO)

- Ground Support Equipment (GSE)

- Testing and Calibration Equipment

- By Material:

- Stainless Steel (300/400 series)

- Aluminum Alloys

- Titanium and High-Performance Alloys

- Heat-Treated Alloy Steel

- By End-User:

- Commercial Aviation

- Military and Defense

- Space (Launch Vehicles and Satellites)

Value Chain Analysis For Aerospace Quick Lock Pins Market

The value chain for Aerospace Quick Lock Pins begins with specialized raw material suppliers providing aerospace-grade metals, requiring strict traceability and material certifications (e.g., DFARS compliance for certain defense applications). This upstream analysis reveals high dependence on a few key metal processors for high-strength steel, titanium, and aluminum necessary for maintaining structural integrity and lightweight characteristics. The subsequent stage involves core manufacturing activities, including precision machining, forging, heat treatment, and specialized coating applications (e.g., high-performance passivation treatments). This manufacturing stage is highly capital-intensive and requires rigorous quality control systems (AS9100). The competitive advantage at this stage often lies in proprietary design patents, advanced robotic machining capabilities, and efficient manufacturing scale capable of maintaining extremely tight dimensional tolerances essential for fit and function.

Distribution channels for quick lock pins vary significantly based on the end-user and application criticality. Direct channels are predominantly used for serving large Original Equipment Manufacturers (OEMs) like Boeing or Airbus, where pins are customized, ordered in large volumes, and often integrated directly into the assembly line Bill of Materials (BOM). These direct contracts require long-term partnership commitments, integrated logistics support, and continuous quality audits. Indirect channels involve specialized aerospace distributors and MRO parts suppliers (e.g., large inventory houses) who stock standardized pins and related fasteners for the aftermarket segment and smaller MRO shops globally. The complexity of the product and the need for certified traceability make indirect distribution highly regulated, prioritizing authorized and certified dealers to prevent counterfeit products from entering the supply chain, a critical safety concern that necessitates robust inventory tracking systems and secure warehousing practices.

The downstream analysis focuses on the integration and use of these pins by end-users. For OEMs, quick lock pins are integrated into their assembly jigs, tooling, and final aircraft structures (e.g., cargo door mechanisms). For MRO providers, they are critical wear items replaced during scheduled maintenance, particularly in areas requiring frequent access. The final stage involves the maintenance and eventual decommissioning of the aircraft, which generates demand for replacement parts. Efficiency in the logistics of these high-criticality, low-volume components is paramount, ensuring that pins are delivered Just-In-Time (JIT) to minimize costly aircraft downtime (AOG - Aircraft on Ground situations). Furthermore, the integration of quick lock pins into modular ground support equipment (GSE) is vital for efficient airport operations, adding another high-volume end-use category where durability and ergonomic design are key purchasing factors, albeit with less stringent flight-critical certification requirements.

Aerospace Quick Lock Pins Market Potential Customers

The primary customers for Aerospace Quick Lock Pins are entities involved in the design, manufacture, operation, and maintenance of flight vehicles and related ground support infrastructure. This includes major global aircraft manufacturers who utilize these pins extensively in their production tooling and increasingly in their final product design for modularity and rapid assembly. Defense contractors represent another significant customer segment, particularly those building military transport aircraft, fighter jets, and tactical UAVs, where load-out configurations must be changed rapidly in operational theaters. Furthermore, global Maintenance, Repair, and Overhaul (MRO) facilities, ranging from independent service providers to airline captive MRO departments, are continuous consumers, purchasing pins as consumables for fleet upkeep, especially for engine cowlings, inspection panels, and custom jigs, driving high volume aftermarket sales globally.

Beyond the core aviation sectors, the expanding space industry presents a rapidly growing customer base. Companies involved in launch vehicle manufacturing, satellite assembly, and reusable launch vehicle components require robust, high-tolerance quick-release mechanisms for ground integration, payload mounting, and testing fixtures, often demanding pins capable of withstanding extreme environmental conditions like cryogenic temperatures. Ground Support Equipment (GSE) providers, who manufacture specialized vehicles, trailers, and lifting apparatus for airport and hangar operations, also represent a stable customer segment, requiring durable pins for their frequently used, high-stress equipment. The purchasing decision for all these customers is overwhelmingly influenced by certification, material traceability, compliance with AS/EN standards, and reliability, often overshadowing cost considerations due to the severe safety implications of component failure. The ongoing demographic shift in the maintenance workforce also increases the value of quick lock pins due to their ease of use, simplifying complex procedures for less experienced technicians.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.82 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PIC Design, Wixroyd International, Fastener Technology Corp., Jergens Inc., KALLER, Carr Lane Manufacturing Co., TE Connectivity, Stanley Black & Decker (POP Avdel), Vlier, LISI Aerospace, Alcoa Fastening Systems (Arconic), National Aerospace Fasteners (NAF), SPS Technologies (a PCC Company), Ruland Manufacturing Co. Inc., Monroe, Airfasco, Valco/Valley Tool & Die, Advanced Assembly Products (AAP), KATO Fastening Systems, C. E. M. Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Quick Lock Pins Market Key Technology Landscape

The technology landscape for Aerospace Quick Lock Pins is dominated by advancements in material science and precision manufacturing techniques, aimed at maximizing strength-to-weight ratios and component longevity under extreme stress. Key technological focuses include the utilization of advanced Nickel-based superalloys and specific grades of titanium (e.g., Ti-6Al-4V) to withstand high temperatures experienced in engine sections and supersonic flight regimes, necessitating sophisticated machining processes like five-axis CNC milling and electron beam welding for complex assemblies. Surface treatment technology is also paramount, moving away from environmentally harmful coatings (like traditional cadmium plating) towards High-Velocity Oxy-Fuel (HVOF) coatings, specialized ceramic coatings, or proprietary passivation treatments to enhance corrosion resistance and wear life without compromising material integrity. The industry is also refining cold forging and roll-forming techniques to improve the structural grain flow of the metal in high-stress areas, boosting fatigue resistance critical for components subject to millions of flight cycles.

A burgeoning technological trend is the integration of miniaturized electronic components, transforming traditional mechanical pins into 'Smart Pins.' These pins incorporate micro-sensors, often utilizing MEMS technology, to monitor critical parameters such as shear load, temperature, vibrational frequency, and, most importantly, positive locking status. This data is then wirelessly transmitted (via low-power Bluetooth or RFID) to the aircraft's central maintenance computer or a handheld device used by ground crews. This provides irrefutable evidence that critical components are properly fastened, reducing the reliance on manual visual checks and significantly enhancing safety documentation and compliance verification during quick turnarounds, particularly relevant in the high-frequency MRO segment. Furthermore, the complexity of 'Smart Pins' requires advanced metrology and integrated statistical process control (SPC) during manufacturing to ensure the consistency of both mechanical and electronic integrity, which contributes to their premium positioning in the market.

Innovation extends into manufacturing processes through the application of Industry 4.0 principles. Automated robotic assembly lines are increasingly used to manufacture complex pin assemblies, ensuring consistency far exceeding manual capabilities and maintaining the extremely tight tolerances required. Additive Manufacturing (AM), or 3D printing, is currently utilized primarily for prototyping complex internal locking mechanisms or producing specialized tooling pins, rather than flight-critical components, due to ongoing challenges in material certification consistency and structural isotropy. However, continuous research is pushing AM towards certification for non-primary structural elements, which could disrupt the traditional supply chain by allowing for on-demand local manufacturing of specialized pin variants directly at MRO facilities. The stringent certification process for new materials and designs, including extensive performance and environmental testing, remains a significant component of the overall technology landscape, underscoring the industry's commitment to zero-defect standards.

Regional Highlights

The global Aerospace Quick Lock Pins market exhibits distinct regional dynamics shaped by manufacturing concentration, MRO activity, and defense expenditures. North America, specifically the United States, represents the largest market share due to the headquarters of global aviation giants (Boeing, Lockheed Martin, etc.), robust government spending on military aircraft sustainment, and a well-established ecosystem of specialized fastener suppliers and research institutions. The region sets many global quality and performance standards (e.g., NASM, AS standards), influencing global market trends. The high demand for precision tooling and advanced defense platforms ensures a continuous, high-value revenue stream, particularly for smart pin technology development and adoption.

Asia Pacific (APAC) is the fastest-growing region, driven by massive investments in new airport infrastructure, burgeoning middle-class air travel demand, and the corresponding necessity for fleet expansion (especially single-aisle jets). Countries like China and India are rapidly increasing their domestic MRO capabilities and localized aircraft assembly (e.g., COMAC programs), creating exponential demand for certified quick-lock components. Supply chain localization and joint ventures with Western suppliers are key strategic focus areas in APAC, aimed at building self-sufficiency and reducing dependency on lengthy international logistics chains. This regional dynamism, fueled by both commercial volume and emerging indigenous defense programs, positions APAC as the primary engine for future market expansion.

Europe maintains a strong market position, primarily driven by the consistent high-volume production schedules of Airbus and its supply chain network, alongside significant defense and helicopter manufacturing industries. European standards (EN series) govern the market, emphasizing precision engineering and environmentally sustainable manufacturing practices, especially concerning plating chemicals (e.g., REACH compliance). Latin America, the Middle East, and Africa (LAMEA) represent emerging markets, with demand primarily dictated by the importation and maintenance of Western and Russian aircraft, focusing heavily on aftermarket MRO supply rather than local manufacturing. The Middle East, in particular, showcases high demand driven by sophisticated national carriers investing heavily in localized high-end MRO facilities and requiring premium, certified quick-lock pins for their modern fleets.

- North America (USA and Canada): Market dominance driven by OEM concentration, high defense budgets, and leadership in specialized material technology and smart pin development. The region holds the largest revenue share and dictates many global quality standards.

- Asia Pacific (China, India, Japan): Highest growth trajectory fueled by explosive commercial fleet growth, establishing new regional MRO hubs, and increasing localized manufacturing of civil and military aircraft. Focus on high-volume, cost-effective MRO supply solutions.

- Europe (Germany, France, UK): Stable demand supported by major OEM production (Airbus, engine manufacturers) and stringent safety regulations demanding high-quality, certified fastening solutions. Strong emphasis on environmental compliance and high-precision component manufacturing.

- Middle East & Africa (MEA): Growth tied to large regional airlines expanding their MRO capabilities (e.g., UAE, Qatar) and ongoing military procurement for quick turnaround maintenance requirements, demanding premium, certified imported components.

- Latin America (LATAM): Market driven primarily by commercial fleet maintenance and replacement cycles, heavily reliant on imported parts and international distribution channels, focusing on quick availability of aftermarket hardware to minimize aircraft downtime.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Quick Lock Pins Market.- PIC Design (A division of Allied Motion, focusing on precision components)

- Jergens Inc. (Leading manufacturer of industrial and aerospace tooling components)

- Carr Lane Manufacturing Co. (Key player in jig, fixture, and component tooling)

- LISI Aerospace (Major global producer of aerospace fasteners and assembly components)

- SPS Technologies (A Precision Castparts Corp. (PCC) Company - dominant in aerospace fasteners)

- Fastener Technology Corp. (FTC - Specializing in high-performance aerospace fasteners)

- National Aerospace Fasteners (NAF)

- Wixroyd International Ltd. (Provider of quick release pins and components)

- TE Connectivity (Though broader, offers specialized aerospace connection solutions)

- Stanley Black & Decker (Through its Avdel/POP brands, focusing on high-speed fastening)

- Vlier (Specializing in spring plungers and quick release pins)

- KALLER (Focusing on nitrogen gas springs and related tooling components)

- Ruland Manufacturing Co. Inc.

- Monroe Fluid Technology

- Airfasco (Specializing in certified aerospace hardware)

- Valco/Valley Tool & Die, Inc.

- Advanced Assembly Products (AAP)

- KATO Fastening Systems

- C. E. M. Company (A Stanley Engineered Fastening Brand)

- Wichita Fastener Co. Inc.

Frequently Asked Questions

Analyze common user questions about the Aerospace Quick Lock Pins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a quick lock pin in aerospace applications?

The primary function of an aerospace quick lock pin is to provide a reliable, high-shear, and rapidly releasable connection for non-permanent components such as maintenance access panels, ground support equipment, assembly jigs, and frequently removed payload systems. They facilitate fast configuration changes without requiring specialized tools.

Why are Double-Acting quick lock pins preferred over Single-Acting types?

Double-Acting pins are often preferred for critical, high-load applications because they require a separate action (typically a push button) to release the locking balls, ensuring enhanced security and positive locking engagement. This design minimizes the risk of accidental release under vibration or stress, a requirement for stringent safety standards.

What materials are commonly used to manufacture aerospace quick lock pins?

Aerospace quick lock pins are typically manufactured from high-performance materials including 300 and 400 series Stainless Steel (for corrosion resistance and strength), heat-treated Alloy Steel (for maximum shear strength), and lightweight Titanium Alloys (for weight-sensitive applications). Advanced corrosion-resistant coatings are also standard.

How does the MRO segment influence the demand for quick lock pins?

The MRO (Maintenance, Repair, and Overhaul) segment is a significant demand driver because quick lock pins are classified as consumables or wear items in tooling and high-cycle access points. Increased flight hours and aging fleets necessitate more frequent maintenance cycles, resulting in sustained, high-volume replacement demand for these certified components essential for minimizing Aircraft on Ground (AOG) time.

What regulatory standards govern the certification of these pins?

Certification is governed by stringent international and national standards, including NASM (National Aerospace Standard Metric), AS (Aerospace Standard), and EN (European Norm) specifications. Manufacturers must also maintain quality management certification such as AS9100 to ensure traceability and consistent quality suitable for flight-critical environments, which is the highest barrier to entry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager