AFM Probe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434518 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

AFM Probe Market Size

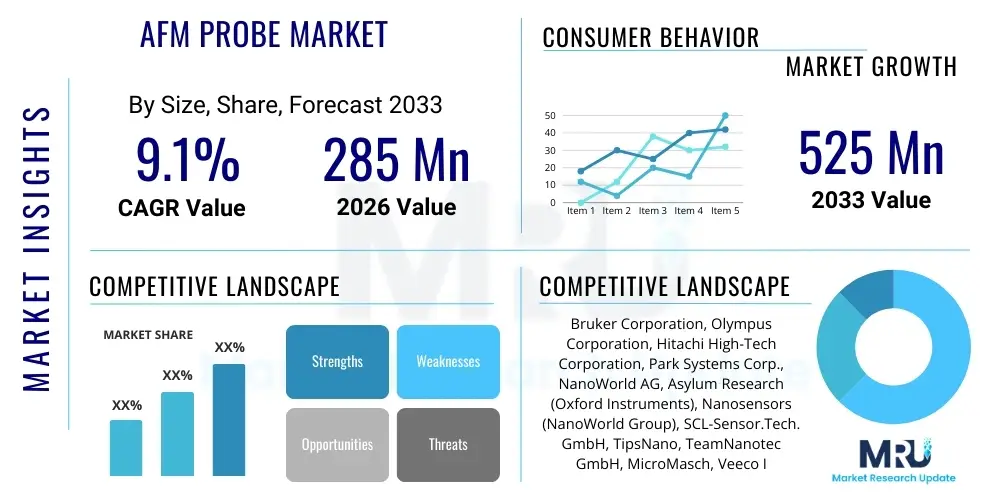

The AFM Probe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% between 2026 and 2033. The market is estimated at USD 285 Million in 2026 and is projected to reach USD 525 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-resolution nanoscale imaging and manipulation techniques across advanced industrial and research sectors, particularly within semiconductor manufacturing and biotechnology.

AFM Probe Market introduction

The Atomic Force Microscope (AFM) Probe Market centers around highly specialized cantilever-tip assemblies crucial for imaging, measuring, and manipulating matter at the nanoscale. These probes, often constructed from silicon, silicon nitride, or diamond, serve as the tactile sensor that translates surface topography and forces into high-resolution images. They are indispensable tools in material science for surface characterization, in semiconductor fabrication for quality control and defect analysis, and in life sciences for studying biological samples at the cellular and molecular level.

Major applications for AFM probes span high-density data storage, polymer research, failure analysis in microelectronics, and advanced drug delivery system development. The fundamental benefit of using AFM probes lies in their ability to provide three-dimensional surface maps with angstrom-level resolution, operating in various environments including ambient air, vacuum, or liquid, without the need for extensive sample preparation typical of electron microscopy. The versatility of operation modes—such as contact, tapping, and non-contact modes—further enhances their utility across diverse scientific fields requiring precise force measurements and topographical data.

Key driving factors accelerating market growth include increasing global investments in nanotechnology research and development, continuous advancements in probe materials and tip geometry (e.g., high-aspect ratio tips for deep trench measurements), and the rising necessity for non-destructive, high-precision quality inspection in the semiconductor industry. Furthermore, the integration of AFM technology with other analytical techniques, such as Raman spectroscopy (AFM-Raman), is expanding the functional capabilities of probes, thereby broadening their adoption footprint across academia and commercial enterprises focusing on innovative material development.

AFM Probe Market Executive Summary

The AFM Probe market demonstrates robust expansion, primarily fueled by significant business trends focusing on miniaturization and high-throughput analysis, particularly in the microelectronics and life sciences industries. Demand is shifting towards specialized probes, such as electrically conductive probes for Scanning Spreading Resistance Microscopy (SSRM) and biologically functionalized tips, reflecting the need for multi-modal analysis capabilities beyond simple topographical mapping. Strategic acquisitions and collaborations among leading probe manufacturers and AFM system providers are key competitive strategies aimed at vertical integration and enhancing product compatibility across various instrument platforms, thereby streamlining the user experience and encouraging technological adoption.

Geographically, Asia Pacific (APAC) stands out as the fastest-growing region, driven by massive governmental investments in nanotechnology research centers, the concentration of major semiconductor fabrication facilities (Fabs) in countries like China, Taiwan, and South Korea, and the burgeoning biotechnology sector. North America and Europe maintain dominance in terms of market value due to established academic institutions and a strong presence of key technological innovators and early adopters, focusing heavily on R&D for next-generation materials and quantum computing applications requiring ultra-precise surface measurements. Regulatory environments favoring stringent material quality checks also support market expansion in these mature economies.

Segment trends reveal that the Silicon probes segment holds the largest market share due to its cost-effectiveness, widespread availability, and suitability for standard tapping and non-contact mode operations. However, the Silicon Nitride and Diamond probes segments are exhibiting the highest growth rates, driven by their superior hardness, wear resistance, and chemical inertness, making them ideal for high-force applications, prolonged scanning tasks, and operation in harsh chemical environments. Application-wise, the Semiconductor & Electronics segment remains paramount, constantly demanding bespoke probes for high-resolution critical dimension metrology and advanced failure analysis techniques, ensuring yield optimization in fabrication processes.

AI Impact Analysis on AFM Probe Market

Common user questions regarding AI's impact on the AFM Probe market typically revolve around how machine learning can automate image processing, enhance data interpretation speed, and potentially optimize the operational lifespan of expensive probes. Users frequently ask if AI can predict probe wear patterns, thereby maximizing experimental efficiency and reducing replacement costs, and whether AI algorithms can improve the signal-to-noise ratio in complex biological or noisy environmental AFM data. Furthermore, significant interest lies in using AI-driven feedback loops to automatically tune AFM parameters (like setpoint and gain) during scanning, eliminating tedious manual adjustments and enabling fully autonomous high-throughput measurements, especially relevant in industrial quality control and high-content screening applications.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to revolutionize the workflow associated with AFM probe usage, primarily by shifting the analytical burden from human operators to sophisticated algorithms. AI is deployed for automated image segmentation, defect detection in semiconductor wafers, and classifying material properties based on subtle variations in force-distance curves. This enhanced automation accelerates the transition of AFM from a complex research tool accessible only to specialists to a more robust, standardized instrument suitable for industrial environments requiring rapid, repeatable, and objective data analysis. Such capabilities are essential for handling the massive datasets generated by modern, large-area AFM scanners.

The predictive maintenance capabilities enabled by AI represent a critical development, impacting the lifespan and cost-efficiency of AFM probes. By analyzing the high-frequency operational data—including scanning speed, contact force history, and environmental conditions—ML models can accurately forecast the impending mechanical degradation or tip blunting of a probe. This foresight allows users to proactively replace probes before critical failure, ensuring data integrity and minimizing costly experimental downtime. Consequently, AI integration not only optimizes the experimental procedure but also contributes directly to lowering the total cost of ownership for high-precision AFM systems, making nanoscale characterization more economically viable for a broader range of industrial users.

- AI enhances automated AFM image analysis and defect classification, significantly accelerating throughput.

- Machine Learning algorithms optimize force spectroscopy data interpretation, aiding in precise material property mapping.

- AI-driven predictive models estimate AFM probe wear and lifetime, enabling proactive replacement and cost reduction.

- Real-time AI feedback loops automate the tuning of scanning parameters, improving data quality and operational efficiency.

- AI facilitates the integration of multi-modal AFM data (e.g., thermal, electrical, mechanical) for holistic material characterization.

DRO & Impact Forces Of AFM Probe Market

The AFM Probe market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. Primary drivers include the massive global expansion of the nanotechnology sector, the relentless pursuit of smaller features in microelectronic fabrication demanding higher resolution metrology, and the escalating application of AFM in biological research, particularly for cellular mechanics and single-molecule studies. These factors create consistent demand for specialized, high-performance probes capable of meeting increasingly stringent spatial and force resolution requirements.

Restraints largely center on the high costs associated with premium, specialized AFM probes (e.g., diamond tips, functionalized probes) and the inherent sensitivity of the AFM technique, which often requires highly trained personnel and stable, vibration-isolated laboratory environments. Furthermore, the limited operational lifetime of sharp, high-resolution tips due to wear and contamination poses a recurring operational challenge, adding to the recurring expense for heavy users. Competitive pressure from alternative high-resolution microscopy techniques, such as advanced electron microscopy (SEM/TEM), while offering complementary capabilities, can occasionally restrict the growth of the AFM market in specific industrial visualization tasks.

Opportunities for growth are concentrated in the development of microfabricated probe arrays for high-throughput parallel scanning, known as parallel AFM or Massive Probe Data Storage (M-PDS), offering scalability essential for industrial adoption. Significant potential also exists in the functionalization and surface modification of probes to enable specific chemical or biological sensing capabilities, opening doors in diagnostic technologies and environmental monitoring. The increasing adoption of benchtop and portable AFM systems also broadens the accessibility of the technology beyond centralized research labs, thus expanding the customer base and driving consistent probe consumption.

Segmentation Analysis

The AFM Probe market is meticulously segmented based on material, probe type, operation mode, application, and end-user, reflecting the diverse requirements of nanoscale analysis across various industries. Understanding these segments is crucial as the choice of probe directly impacts measurement quality, durability, and compatibility with the sample and environment. The materials used, such as silicon or silicon nitride, dictate the stiffness and sharpness of the cantilever, affecting the achievable resolution and the force applied to the sample surface. This detailed segmentation allows manufacturers to tailor products precisely to specialized scientific and industrial needs, from high-speed imaging to delicate biological force measurements.

The segmentation by probe type, ranging from standard tips to high-aspect ratio probes and colloidal probes, highlights the necessity for geometry optimization based on the task, such as measuring deep trenches in semiconductor patterns or quantifying adhesion forces between particles. Furthermore, the application segmentation—covering life sciences, material science, and semiconductors—demonstrates the market's reliance on sector-specific innovation, where advancements in one area (e.g., electrically conductive tips for semiconductors) often spur developments in others. This granularity ensures that market players can strategically focus their research and distribution efforts toward high-growth niches requiring specialized probe technology.

- By Material:

- Silicon Probes

- Silicon Nitride Probes (Si3N4)

- Diamond Probes

- Specialty Probes (e.g., Carbon Nanotube (CNT) tips)

- By Probe Type:

- Standard Tips

- High-Aspect Ratio Tips

- Colloidal Probes

- Functionalized Probes (Chemical, Biological)

- By Operation Mode:

- Contact Mode Probes

- Non-Contact Mode Probes

- Tapping Mode Probes (Intermittent Contact)

- Specialized Mode Probes (e.g., MFM, EFM, KPFM, Nanoindentation)

- By Application:

- Semiconductor & Electronics

- Material Science & Metallurgy

- Life Sciences & Biotechnology

- Chemical & Petrochemical Research

- Academia & Research Institutions

- By End-User:

- Industrial Manufacturing (Semiconductor Fabs, Chemical Plants)

- Research Laboratories (Governmental, University)

- Biotech and Pharmaceutical Companies

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For AFM Probe Market

The value chain for the AFM Probe Market begins with highly specialized upstream activities centered around raw material procurement and advanced microfabrication. Key upstream suppliers provide high-purity silicon wafers, silicon nitride precursors, and specialized diamond materials, which are then processed using techniques like photolithography, deep reactive ion etching (DRIE), and chemical vapor deposition (CVD) to create the delicate cantilever and tip structures. This stage requires significant intellectual property and precision engineering, as the geometrical accuracy and material integrity of the final probe directly dictate the AFM system’s performance and reliability. Key challenges here involve maintaining consistency in tip radius and ensuring mass production scalability while retaining nanoscale precision.

Midstream operations involve the core manufacturing and functionalization processes, including the deposition of specialized coatings (e.g., conductive metals like platinum or gold), chemical surface treatments for biological compatibility, and quality control checks involving Scanning Electron Microscopy (SEM) verification. The distribution channel is bifurcated into direct sales and indirect sales. Direct distribution is crucial for large industrial customers and high-volume institutional buyers, allowing for tailored technical support and bulk customization. Indirect distribution relies heavily on regional distributors and specialized scientific equipment suppliers who bundle the probes with AFM instruments and other peripheral consumables, effectively reaching smaller research labs and academic users globally.

The downstream analysis focuses on the end-users—primarily research laboratories, university cleanrooms, and industrial quality control departments. The high technical nature of the product mandates robust post-sale support, training, and continuous technical documentation, often provided directly by the probe manufacturer or the AFM system vendor. The performance feedback loop from these downstream users is vital, driving continuous improvement in probe design, particularly concerning issues like tip wear, drift, and chemical compatibility, ensuring that manufacturers rapidly respond to evolving application demands, such as the need for probes compatible with high-speed fluidic environments or elevated temperatures.

AFM Probe Market Potential Customers

The primary consumers and end-users of AFM probes are organizations deeply involved in material innovation, advanced manufacturing, and complex biological studies, where nanoscale surface characterization is a mandatory component of research or quality assurance protocols. These include semiconductor fabrication plants (Fabs) requiring probes for critical dimension metrology and defect review, ensuring the integrity of complex circuit layouts below 10nm features. Similarly, research divisions within multinational electronics corporations utilize probes for developing new high-k dielectric materials and optimizing thin-film solar cell technologies.

In the academic sector, university research groups and government laboratories form a substantial customer base, purchasing diverse arrays of probes for exploratory material science, physics research, and interdisciplinary nanotechnology projects. They often require specialized, novel probes, such as those integrated with optical fibers or those designed for extreme environmental conditions. The life sciences industry, encompassing pharmaceutical companies and biotechnology firms, constitutes a rapidly expanding customer segment, utilizing probes to map cell stiffness, characterize protein aggregation, and analyze the mechanics of DNA and other biopolymers, often requiring specialized liquid-compatible and low-force silicon nitride tips.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285 Million |

| Market Forecast in 2033 | USD 525 Million |

| Growth Rate | 9.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bruker Corporation, Olympus Corporation, Hitachi High-Tech Corporation, Park Systems Corp., NanoWorld AG, Asylum Research (Oxford Instruments), Nanosensors (NanoWorld Group), SCL-Sensor.Tech. GmbH, TipsNano, TeamNanotec GmbH, MicroMasch, Veeco Instruments, R&D Micrometrology, Rocky Mountain Nanotechnology, HQ:TM AFM Probes, Windsor Scientific Ltd, AppNano, NanoAndMore GmbH, BudgetSensors, Horiba Scientific |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AFM Probe Market Key Technology Landscape

The technological landscape of the AFM Probe market is defined by continuous innovation in microfabrication techniques aimed at achieving superior resolution, durability, and functionality. A critical technological trend is the transition from conventional silicon tips to advanced materials like highly doped silicon, chemical vapor deposition (CVD) diamond, and low-stress silicon nitride, which offer tailored mechanical and electrical properties. Specifically, the development of high-aspect ratio probes, achieved through focused ion beam (FIB) milling or specialized deep reactive ion etching (DRIE) processes, is crucial for accurately measuring structures with steep sidewalls, indispensable in advanced semiconductor processing where feature depths often exceed their width.

Another major technological advancement involves the integration of advanced functionalities directly onto the cantilever or tip structure. This includes the development of heated probes for Thermal AFM (T-AFM) and micro-thermogravimetry, utilizing integrated resistive elements for localized thermal analysis at the nanoscale. Similarly, technological progress in conductive coatings, particularly utilizing ultrathin platinum or titanium-nitride layers, has been pivotal for enabling Electrical AFM modes such as Conducting AFM (C-AFM) and Scanning Capacitance Microscopy (SCM), allowing researchers to simultaneously map topography and electrical properties, essential for characterizing nanoscale devices.

Furthermore, the emerging field of parallel AFM (p-AFM) heavily relies on technology permitting the simultaneous operation of large arrays of microfabricated cantilevers (up to thousands), drastically increasing scanning throughput for industrial inspection applications. This requires sophisticated micro-electro-mechanical systems (MEMS) technology for individual probe addressing and actuation, coupled with integrated optics or piezoresistive sensing mechanisms embedded within the cantilever structure itself. These advancements are aimed at positioning AFM as a viable, high-speed metrology solution for large-scale industrial quality control, moving beyond its traditional role primarily as a research tool.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily due to the concentration of the global semiconductor manufacturing base in countries like Taiwan, South Korea, China, and Japan. Massive government initiatives supporting nanotechnology and material science research, coupled with significant investments in new fabrication facilities (Fabs) requiring high-precision in-line metrology, are driving the demand for specialized, high-volume AFM probes. China, in particular, is aggressively investing in domestic AFM technology and manufacturing capabilities, contributing substantially to regional consumption.

- North America: North America holds the largest market share in terms of revenue, driven by its established dominance in fundamental scientific research, advanced pharmaceutical development, and the presence of major AFM system and probe manufacturers (e.g., Bruker, Veeco, Oxford Instruments). High adoption rates in government and university research laboratories, especially for cutting-edge applications in quantum computing materials and advanced composite analysis, ensure sustained demand for high-end, customized, and novel probe types.

- Europe: Europe is characterized by mature research infrastructure, strong regulatory support for material safety and quality, and high utilization of AFM in automotive, aerospace, and renewable energy sectors. Countries like Germany, the UK, and France are key consumers, focusing on advanced polymer science, surface engineering, and failure analysis. The European Union's strong emphasis on funding collaborative research projects in nanotechnology maintains a high steady demand for standard and specialized probes.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by growing investment in localized R&D facilities, especially in oil and gas research (MEA) and material science in Brazil and Mexico (LATAM). While currently smaller, these regions offer substantial long-term growth potential as their industrial bases expand and adopt Western metrology standards. Demand is currently centered on basic, robust probes suitable for environmental and educational applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AFM Probe Market.- Bruker Corporation

- Olympus Corporation

- Hitachi High-Tech Corporation

- Park Systems Corp.

- NanoWorld AG

- Asylum Research (Oxford Instruments)

- Nanosensors (NanoWorld Group)

- SCL-Sensor.Tech. GmbH

- TipsNano

- TeamNanotec GmbH

- MicroMasch

- Veeco Instruments

- R&D Micrometrology

- Rocky Mountain Nanotechnology

- HQ:TM AFM Probes

- Windsor Scientific Ltd

- AppNano

- NanoAndMore GmbH

- BudgetSensors

- Horiba Scientific

Frequently Asked Questions

Analyze common user questions about the AFM Probe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the AFM Probe Market between 2026 and 2033?

The AFM Probe Market is expected to exhibit robust growth, projected at a Compound Annual Growth Rate (CAGR) of 9.1% during the forecast period from 2026 to 2033, driven by expanding applications in semiconductor metrology and biotechnology research.

Which material segment holds the largest share and which is the fastest-growing?

Silicon Probes currently hold the largest market share due to their widespread use in standard tapping mode applications and cost-efficiency. However, the Silicon Nitride and Diamond Probes segments are the fastest-growing, driven by demand for enhanced wear resistance and chemical inertness in challenging industrial environments.

How does the semiconductor industry influence the demand for AFM Probes?

The semiconductor industry is a primary driver, demanding specialized AFM probes for high-resolution critical dimension (CD) metrology and defect analysis on advanced integrated circuits (ICs). The relentless miniaturization of semiconductor features below 10nm necessitates high-aspect ratio and electrically conductive probes for quality assurance and yield optimization.

What role does AI play in optimizing the use of AFM Probes?

AI is increasingly used to optimize AFM probe usage by automating image processing, enhancing data interpretation speed, and implementing predictive maintenance models to estimate probe wear and lifetime. This automation minimizes downtime and reduces the total cost of ownership for AFM systems.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is forecasted to experience the highest growth rate, primarily attributed to substantial governmental investment in nanotechnology R&D and the heavy concentration of large-scale semiconductor fabrication facilities and manufacturing centers across countries like China, South Korea, and Taiwan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- AFM Probe Market Size Report By Type (Silicon AFM Probes, Silicon Nitride AFM Probes, Diamond AFM Probes), By Application (Life Sciences and Biology, Materials, Semiconductors and Electronics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- AFM Probe Market Statistics 2025 Analysis By Application (Life Sciences and Biology, Materials, Semiconductors and Electronics), By Type (Silicon AFM Probes, Silicon Nitride AFM Probes, Diamond AFM Probes), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- AFM Probe Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Diamond AFM Probes, Silicon Nitride AFM Probes, Silicon AFM Probes, Others), By Application (Semiconductors and Electronics, Materials, Life Sciences and Biology, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager