Agribusiness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433958 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Agribusiness Market Size

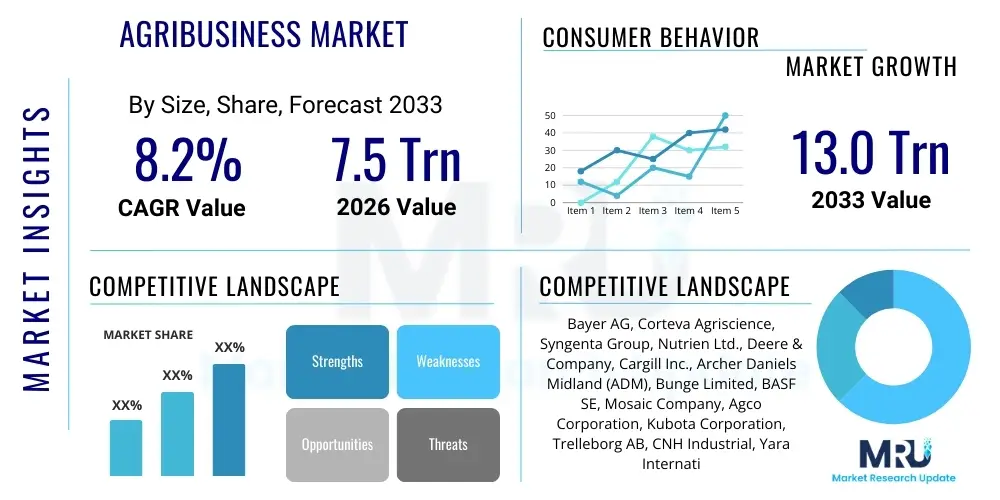

The Agribusiness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at $7.5 Trillion USD in 2026 and is projected to reach $13.0 Trillion USD by the end of the forecast period in 2033. This substantial expansion is driven by the necessity of global food security, rapid technological integration, particularly in precision agriculture and sustainable farming practices, and shifting consumer preferences towards specialized, high-value agricultural products. The complexity of global supply chains and the increasing need for resource efficiency are major factors contributing to the market's robust valuation increase over the coming years.

Agribusiness Market introduction

The Agribusiness Market encompasses the entire economic ecosystem involved in the production, processing, distribution, and consumption of agricultural products. This vast sector includes farm equipment manufacturing, seed and fertilizer production, agricultural finance, crop and livestock farming, food processing, and wholesale and retail distribution. The primary objective is meeting the nutritional demands of a growing global population while addressing challenges related to climate change, water scarcity, and arable land limitations. Major applications span food production, biofuels, textile raw materials, and pharmaceuticals derived from bio-based sources, positioning agribusiness as a cornerstone of global commerce and human welfare.

The core benefits of a strong agribusiness sector include ensuring global food security, fostering rural economic development, and promoting environmental sustainability through advanced farming techniques. Key driving factors accelerating market growth include increasing adoption of mechanization and automation across farming stages, significant governmental and private sector investment in agricultural research and development (R&D), and the integration of digital technologies such as IoT sensors, drones, and data analytics to optimize crop yields and minimize waste. Furthermore, evolving regulatory environments prioritizing sustainable and traceable food systems are mandating technological upgrades and operational efficiencies across the value chain, thereby stimulating market activity and innovation.

Agribusiness Market Executive Summary

The Agribusiness Market is experiencing transformative business trends characterized by consolidation among large multinational agricultural technology (AgriTech) firms and a surge in startup innovation focused on sustainable solutions like vertical farming and bio-pesticides. Global business trends highlight increased investment in resilient supply chains, shifting away from purely commodity-focused agriculture towards specialized, high-value, and organic produce, driven by affluent consumer demand. Regional trends show North America and Europe leading in AgriTech adoption and regulatory pushes for sustainability, while the Asia Pacific (APAC) region dominates in terms of production volume and population-driven demand growth, particularly emphasizing irrigation technology and yield improvement in developing economies. Latin America is emerging as a critical hub for large-scale commodity export and sustainable land management initiatives, reflecting diverse regional drivers.

Segment trends indicate rapid expansion in the precision agriculture segment, fueled by the decreasing cost of sensors and the improved accuracy of satellite imagery and GPS guidance systems. The seed technology segment continues to innovate with genetically modified (GM) and gene-edited crops offering enhanced resilience against pests and climate variability. The livestock segment is increasingly focusing on animal welfare monitoring and feed efficiency through data integration. Furthermore, the bio-fertilizer and bio-pesticide segments are outpacing synthetic chemical growth, reflecting both consumer preference and stricter environmental regulations globally. These technological and consumption shifts underscore a move towards efficiency, sustainability, and data-driven decision-making throughout the entire agricultural supply chain, driving high capital expenditure across all major segments.

AI Impact Analysis on Agribusiness Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize crop yield prediction, optimize resource usage (water, fertilizer), automate complex farm tasks, and enhance supply chain traceability in the agribusiness sector. Common concerns center on the accessibility and affordability of AI tools for smallholder farmers, the reliability of data input from diverse agricultural environments, and the potential displacement of agricultural labor. Users expect AI to mitigate risks associated with climate variability, improve disease and pest detection accuracy, and ultimately make farming more sustainable and profitable. The key themes revolve around achieving 'more with less' through data-driven precision, and ensuring that AI integration leads to equitable benefits across different farm sizes and geographical locations, while navigating the challenges of data privacy and infrastructure requirements necessary for effective deployment.

The integration of AI systems is profoundly reshaping the operational dynamics of the agribusiness industry, moving it from traditional, labor-intensive methods to highly automated, data-centric practices. Machine learning algorithms are crucial for processing vast datasets generated by IoT sensors, drones, and satellite imagery, enabling real-time diagnostics on soil health, plant stress levels, and irrigation requirements. This capability minimizes resource wastage, significantly reducing environmental impact and operational costs. Furthermore, AI-powered robotics are taking over repetitive and skilled tasks, such as precision seeding, targeted spraying, and automated harvesting, addressing persistent labor shortages, especially in developed agricultural markets. The computational power of AI provides predictive maintenance for farm machinery, enhancing equipment longevity and reducing unexpected downtime during critical farming cycles.

Beyond the field, AI is vital for optimizing the complex logistics inherent in agricultural supply chains. Predictive analytics helps forecast demand fluctuations and manage inventory efficiently, minimizing post-harvest losses which currently account for a significant portion of food waste globally. In livestock farming, AI monitors animal behavior and health indicators, allowing for early detection of illnesses, improving animal welfare, and optimizing feeding regimes for maximum output. The ability of AI to analyze and verify traceability data from farm to fork also builds consumer trust and ensures compliance with increasingly stringent food safety and origin standards. Overall, AI acts as a fundamental technology layer driving the transition towards a truly sustainable, resilient, and highly productive global food system, justifying its rapid and extensive adoption across all segments of the agribusiness market structure.

- AI-driven optimization of irrigation schedules reduces water consumption by up to 30%.

- Machine learning models predict crop diseases and pest outbreaks with over 90% accuracy, enabling proactive intervention.

- Autonomous tractors and harvesting robots perform tasks with sub-centimeter precision, optimizing seed and fertilizer placement.

- Predictive analytics minimizes post-harvest losses by improving cold chain logistics and inventory management.

- AI enhances genetic research by analyzing genome data faster, accelerating the development of climate-resilient crop varieties.

DRO & Impact Forces Of Agribusiness Market

The Agribusiness Market is shaped by powerful and often contradictory forces. Key drivers include the escalating global population, which fundamentally necessitates higher food production yields, coupled with rapid urbanization that pressures available agricultural land. Technological advancements, particularly in biotechnology, genomics, and digital farming tools (such as IoT and AI), provide the means to meet this demand sustainably. Conversely, significant restraints include the acute impact of climate change, leading to unpredictable weather patterns, droughts, and floods that threaten crop stability. Furthermore, regulatory hurdles related to gene modification and chemical use, alongside the volatility of commodity prices and high upfront investment costs for precision equipment, slow the adoption rate, particularly among smaller farming enterprises across developing regions.

Opportunities for growth are abundant, primarily centered on sustainable agriculture and the concept of a circular economy. The rising global demand for organic, specialized, and functional foods creates lucrative high-margin markets distinct from bulk commodities. Investment opportunities are significant in developing climate-smart agricultural infrastructure, including advanced vertical and indoor farming technologies that mitigate weather risks entirely. Moreover, the integration of blockchain technology offers an unprecedented opportunity to enhance food safety and traceability, addressing critical consumer trust issues. The continuous development of bio-based inputs—bio-fertilizers, bio-pesticides, and biostimulants—presents a major opportunity to replace environmentally harmful synthetic chemicals, aligning with global sustainability objectives and opening new high-growth segments within the input supply market.

The impact forces driving market change are concentrated on resource scarcity and environmental stewardship. The need to conserve water and manage soil degradation forces innovation towards minimum tillage and highly efficient irrigation systems (e.g., drip irrigation). Geopolitical instability and trade disputes influence commodity flows and pricing, requiring resilience and diversification in sourcing and distribution channels. Societal pressure for transparency regarding food origins and production ethics compels companies to invest heavily in certifications and advanced tracking technologies. These collective Drivers, Restraints, and Opportunities (DRO) create a highly dynamic environment where innovation in sustainability and efficiency is not merely an advantage but a foundational requirement for market participation and long-term viability, fundamentally restructuring the global agribusiness value chain and directing capital toward climate-resilient solutions.

Segmentation Analysis

The Agribusiness Market segmentation provides a crucial framework for understanding the diverse components that constitute the global food and agricultural economy. The market is broadly segmented based on Input Type (Seeds, Fertilizers, Crop Protection Chemicals, Equipment, Feed), Sector (Crop Production, Livestock, Fisheries, Forestry), Application (Food, Biofuels, Fiber), and Farm Type (Commercial Farming, Smallholder Farming). This structural breakdown allows market participants, policymakers, and investors to analyze specific growth trajectories, regulatory impacts, and technological adoption rates unique to each sub-sector. The high fragmentation in end-use applications, ranging from basic commodities like wheat and corn to niche products such as specialty organic herbs and insect protein, underscores the complexity and breadth of the market landscape, requiring specialized strategies for success in each category.

- By Input Type: Seeds and Seedlings (Hybrid, Genetically Modified), Fertilizers (Nitrogenous, Phosphatic, Potassic, Biofertilizers), Crop Protection Chemicals (Herbicides, Insecticides, Fungicides, Biopesticides), Machinery & Equipment (Tractors, Harvesters, Irrigation Systems, Drones, Sensors), Animal Feed and Supplements.

- By Sector: Crop Production (Grains, Fruits and Vegetables, Oilseeds, Plantations), Livestock (Poultry, Swine, Cattle, Dairy), Aquaculture and Fisheries, Forestry.

- By Application: Food and Beverage Industry, Biofuels and Industrial Raw Materials, Textile and Fiber Production, Animal Nutrition, Pharmaceuticals.

- By Farming Technology: Conventional Farming, Precision Agriculture (Variable Rate Technology, GPS/GIS), Protected Cultivation (Greenhouses, Vertical Farms), Organic Farming.

Value Chain Analysis For Agribusiness Market

The Agribusiness Value Chain is intricate, commencing with upstream activities focused on research, development, and the production of necessary inputs. The upstream segment involves seed developers, chemical manufacturers (fertilizers and pesticides), and agricultural machinery producers. Companies operating here invest heavily in R&D to create resilient crop varieties, efficient machinery, and environmentally safer chemical inputs. The critical nature of these inputs dictates that this stage is often dominated by large multinational corporations due to high capital requirements and intellectual property protection, establishing a foundational bottleneck that influences productivity and sustainability across the entire chain.

Midstream activities primarily encompass farming operations, harvesting, storage (silos and refrigerated facilities), and initial processing steps like milling, cleaning, and sorting. This stage is highly localized and exposed to environmental variables and logistical challenges. Following this, the chain moves to major downstream activities, involving large-scale food processors, manufacturers, and packagers who transform raw agricultural products into marketable consumer goods. This segment often consolidates significant market power, driven by branding, marketing efficiency, and the ability to meet large retail demands. The integration of advanced traceability technologies, such as blockchain, is becoming critical in the midstream and downstream segments to ensure product integrity and comply with international trade standards and consumer mandates for transparency.

Distribution channels connect the processors to the end consumers, encompassing direct channels (e.g., farmers markets, farm-to-table initiatives) and indirect channels (e.g., large-scale supermarkets, wholesalers, international traders). The shift toward e-commerce and direct consumer relationships (DTC) is disrupting traditional indirect distribution models, offering farmers higher margin opportunities and consumers fresher products. However, indirect channels, particularly global commodity trading houses and large retailers, remain essential for ensuring large-volume global supply. Effective logistics, including cold chain management for perishable goods, is paramount for minimizing waste and maintaining product quality across these complex, multi-tiered distribution networks, ultimately determining the cost and availability of food products globally.

Agribusiness Market Potential Customers

The potential customer base for the Agribusiness Market is exceptionally broad, spanning multiple sectors from direct producers to industrial consumers and end retailers. Primary end-users are the commercial farmers and large agricultural enterprises that directly purchase seeds, fertilizers, machinery, and advanced AgriTech solutions (e.g., software, sensors, drones) to maximize output and efficiency. These customers prioritize high-yield potential, cost-effectiveness, and technological integration that supports data-driven decision-making. Their purchasing decisions are heavily influenced by climate conditions, commodity price outlooks, and access to agricultural credit, requiring input suppliers to offer flexible financing and robust technical support services to secure loyalty and increase market penetration among this critical demographic.

Secondary end-users include the vast Food and Beverage processing industry, which consumes raw agricultural output (grains, fruits, meats) as essential raw materials for packaged foods, beverages, and restaurant supplies. Furthermore, industrial sectors such as biofuel producers (using crops like corn and sugarcane), textile manufacturers (using cotton and flax), and pharmaceutical companies (sourcing botanicals and specialized ingredients) represent significant B2B customers. These buyers demand specific quality parameters, consistent supply volumes, and stringent certifications regarding sustainability and origin, driving the need for sophisticated supply chain management and quality control within the agribusiness sector to meet diverse industrial specifications globally.

Finally, global commodity traders, wholesalers, and large retail chains (supermarkets) serve as major indirect buyers, facilitating the movement of agricultural goods from production regions to consumption centers worldwide. These entities require reliability, volume capacity, and competitive pricing, often negotiating long-term contracts based on futures markets. Emerging customer segments include households utilizing Controlled Environment Agriculture (CEA) systems (e.g., small hydroponic kits) and governmental/NGO bodies involved in food aid and large-scale agricultural development projects. Understanding the varied needs of these potential customers—from maximizing yield on a commercial farm to ensuring traceability for a retail consumer—is paramount for companies seeking to strategically position their products and services within the multifaceted agribusiness ecosystem and achieve sustainable revenue streams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Trillion USD |

| Market Forecast in 2033 | $13.0 Trillion USD |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Corteva Agriscience, Syngenta Group, Nutrien Ltd., Deere & Company, Cargill Inc., Archer Daniels Midland (ADM), Bunge Limited, BASF SE, Mosaic Company, Agco Corporation, Kubota Corporation, Trelleborg AB, CNH Industrial, Yara International, Eurofins Scientific, Zoetis Inc., Elanco Animal Health, KWS SAAT SE, Fuji Oil Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agribusiness Market Key Technology Landscape

The Agribusiness Market is characterized by a rapid and continuous influx of disruptive technologies aimed at enhancing productivity, improving sustainability, and building resilience against environmental pressures. Precision Agriculture stands as the central technological pillar, leveraging the Internet of Things (IoT) through sensors, drones, and GPS-enabled farm equipment to collect granular, field-specific data. This data feeds into sophisticated farm management software and AI platforms, allowing farmers to execute Variable Rate Technology (VRT) for precise application of inputs like water and fertilizer. This shift from uniform field treatment to hyper-localized management represents a fundamental overhaul of farming practices, significantly boosting input efficiency and reducing the ecological footprint of agriculture across commercial operations globally.

Biotechnology and genomics represent another critical dimension of the technological landscape. Advancements in gene editing tools, such as CRISPR-Cas9, are accelerating the development of new crop varieties that possess enhanced resistance to diseases, require less water, and offer higher nutritional value. These innovations provide a critical answer to the challenges posed by climate change and the need for higher yields on limited arable land. Furthermore, the development and commercialization of bio-based inputs—including bio-pesticides, bio-fertilizers, and biostimulants—are gaining traction. These sustainable alternatives reduce reliance on synthetic chemicals, aligning with consumer demand for organic and residue-free foods, and are driven by regulatory trends favoring environmentally friendly agricultural inputs across highly regulated European and North American markets.

Digitalization and automation are also reshaping the processing and distribution segments. Blockchain technology is increasingly being adopted to create immutable records of product movement, significantly enhancing traceability and verifying quality and origin claims, which is vital for high-value exports and specialized food products. Automation extends beyond robotics in the field to automated storage and retrieval systems (ASRS) in food processing plants and sophisticated cold chain logistics management systems that monitor temperature and humidity in real-time. These interconnected technologies form a robust, data-driven ecosystem designed not only to increase farm-level output but also to streamline the entire supply chain, minimize post-harvest losses, and ensure food safety and integrity for the global consumer base, marking a full-scale digital transformation of the traditional agribusiness model.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents a mature and technologically advanced agribusiness market. The region is a global leader in the adoption of Precision Agriculture (PA) technologies, including large-scale deployment of autonomous farm equipment, satellite imaging, and sophisticated farm management software. The robust presence of major AgriTech companies and large commercial farms drives continuous investment in R&D and rapid commercialization of genetically modified (GM) seeds and biological inputs. Strong governmental support for crop insurance and subsidies further stabilizes the market. The high demand for biofuels (e.g., ethanol from corn) and meat products creates massive demand for commodity crops, while simultaneous consumer interest in organic and specialty foods fuels diversification and technological advancement in controlled environment agriculture systems like vertical farms, positioning the region at the forefront of agricultural innovation and high-value production.

- Europe: Europe is characterized by stringent environmental regulations, a high focus on sustainability, and strong consumer preferences for locally sourced and organic food. This regulatory environment restricts the use of certain synthetic chemicals and GM crops, driving high adoption rates for bio-pesticides, bio-fertilizers, and advanced soil health management practices. The Common Agricultural Policy (CAP) plays a pivotal role in shaping market dynamics through subsidies linked to environmental performance and rural development. Western European nations, such as the Netherlands and Germany, are global pioneers in greenhouse technology and protected cultivation, maximizing yields on limited land. Eastern Europe offers significant potential for large-scale conventional farming modernization and increased capacity utilization, particularly in grain production, making the entire continent a balanced market focused on both high-tech input reduction and sustainable output maximization.

- Asia Pacific (APAC): APAC is the largest market in terms of production volume and consumer base, driven primarily by high population density, rising disposable incomes, and the immense pressure to ensure national food security, particularly in India, China, and Southeast Asian nations. The region’s growth is characterized by heavy investment in irrigation infrastructure and farm mechanization to improve yields among millions of smallholder farmers. Demand for high-quality animal protein (meat and aquaculture) is soaring, rapidly accelerating the feed and livestock management segments. While conventional methods still dominate, countries like China and Japan are aggressively adopting smart farming techniques, utilizing drones and IoT for crop monitoring and pest control, often leapfrogging traditional technology adoption stages, making it the most dynamic region for growth and technological catch-up.

- Latin America: Latin America, led by Brazil and Argentina, serves as a global powerhouse for commodity exports, particularly soybeans, corn, beef, and sugarcane. The region benefits from vast arable land and favorable climates, making it highly competitive in global trade. Market growth is closely tied to global commodity prices and international demand. The primary focus is on large-scale mechanized farming and integrated pest management to protect extensive monocultures. However, the region also faces significant environmental scrutiny regarding deforestation and sustainable land use. Opportunities are emerging in the integration of digital platforms for supply chain transparency and traceability, catering to international buyers who prioritize sustainability compliance, thereby demanding advanced agricultural data management and responsible land stewardship practices.

- Middle East and Africa (MEA): The MEA region presents unique challenges due to extreme climate conditions, scarcity of water resources, and political instability in certain sub-regions. Market growth is heavily concentrated on technologies that mitigate these fundamental constraints. Controlled Environment Agriculture (CEA), including high-tech greenhouses and vertical farms, is experiencing significant investment in the Gulf Cooperation Council (GCC) countries to enhance local food production and reduce import dependency. In Africa, the market is driven by increasing investment in basic mechanization, drought-resistant seeds, and mobile technology platforms that provide real-time agricultural information and financial access to smallholder farmers, focusing intensely on resilience, water-use efficiency, and localized food security initiatives tailored to harsh climatic constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agribusiness Market.- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Nutrien Ltd.

- Deere & Company

- Cargill Inc.

- Archer Daniels Midland (ADM)

- Bunge Limited

- BASF SE

- Mosaic Company

- Agco Corporation

- Kubota Corporation

- Trelleborg AB

- CNH Industrial

- Yara International

- Eurofins Scientific

- Zoetis Inc.

- Elanco Animal Health

- KWS SAAT SE

- Fuji Oil Co., Ltd.

- Wilmar International Limited

- The J.M. Smucker Company

- Tyson Foods, Inc.

- Marubeni Corporation

- Olam International

Frequently Asked Questions

Analyze common user questions about the Agribusiness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological trends driving growth in the Agribusiness Market?

The primary technological trends are centered on Precision Agriculture (PA), utilizing IoT sensors, AI, and drones for data-driven farming; the accelerated development of high-yield, climate-resilient seeds through biotechnology; and the adoption of blockchain for enhanced supply chain traceability and food safety verification.

How is climate change impacting global agribusiness operations and investment strategies?

Climate change introduces volatility, increasing the frequency of extreme weather events and necessitating significant investment in climate-smart agriculture (CSA). This includes developing drought-resistant crops, advanced irrigation systems, and controlled environment agriculture (CEA) to secure yields and minimize environmental risk exposure.

Which regional market holds the largest growth potential for agribusiness investment?

The Asia Pacific (APAC) region holds the largest potential due to its immense population, rising consumer demand for protein and quality food, and massive governmental efforts to modernize and mechanize agricultural practices across key developing economies like India and China.

What role do bio-based inputs play in the future of the Agribusiness Market?

Bio-based inputs, such as bio-fertilizers and bio-pesticides, are critical for the market's future, as they support sustainable farming, reduce environmental toxicity, and meet strict global regulatory requirements and consumer demands for organic and sustainably produced food, thereby expanding the high-growth segment of the crop protection market.

What is the main challenge facing smallholder farmers in adopting modern AgriTech?

The main challenge is the high initial capital investment required for precision equipment and digital infrastructure, coupled with insufficient access to financing, technical training, and reliable internet connectivity necessary to effectively utilize advanced AgriTech solutions and participate fully in the digital agricultural economy.

How does supply chain resilience affect market valuation?

Supply chain resilience directly impacts market valuation by ensuring continuous supply and minimizing post-harvest losses, which improves profitability and stability. Companies investing in localized production, diversified sourcing, and advanced cold chain logistics gain a competitive advantage and higher valuation due to reduced risk exposure.

What are the key drivers for the livestock segment growth?

The livestock segment growth is primarily driven by rising global demand for animal protein, particularly in emerging economies, combined with technological advancements in animal health monitoring (using IoT and AI), optimized feed efficiency, and improved animal welfare standards to maximize productivity.

What are the key differences between upstream and downstream agribusiness segments?

Upstream segments focus on research, development, and manufacturing of necessary inputs (seeds, machinery, fertilizers), characterized by high R&D intensity. Downstream segments involve processing, packaging, distribution, and retail, characterized by large-scale logistics, brand marketing, and direct consumer interaction.

Why is data analytics essential for modern agribusiness?

Data analytics is essential as it transforms raw data from sensors and satellites into actionable insights for optimizing planting, harvesting, and input application. This leads to higher yields, lower operational costs, precise risk management, and enhanced compliance with sustainability metrics throughout the food production cycle.

How is the move towards vertical farming changing the market dynamics?

Vertical farming is disrupting traditional dynamics by enabling year-round production of specialty crops, reducing reliance on weather and geographical constraints, minimizing water usage, and significantly cutting transportation costs by locating farms closer to urban consumer centers, shifting focus from field-based output to Controlled Environment Agriculture (CEA).

What financial mechanisms support agribusiness growth?

Growth is supported by governmental subsidies, agricultural credit facilities, futures contracts hedging against price volatility, private equity investments in AgriTech startups, and specialized green financing instruments targeted at sustainable and climate-resilient farming projects across various developing and developed nations.

What is Variable Rate Technology (VRT) and its impact on the fertilizer market?

VRT uses GPS and sensor data to vary the amount of fertilizer, seed, or water applied across a field based on specific need zones. This reduces overall fertilizer usage, minimizes runoff and environmental pollution, and maximizes yield per unit of input, driving demand for technologically compatible machinery and high-precision mapping services within the input market structure.

How does the increasing consumer awareness of food origin affect the supply chain?

Increased consumer awareness demands greater transparency and traceability. This necessitates investment in technologies like blockchain and advanced digital tracking systems, compelling suppliers and retailers to verify and communicate the origin, processing methods, and ethical sourcing practices of their agricultural products rigorously.

What competitive advantages do diversified agribusiness conglomerates possess?

Diversified conglomerates benefit from vertical integration, controlling aspects from seed production to food processing and distribution. This integration minimizes external risks, enables streamlined quality control, and allows for superior operational efficiencies and margin capture across multiple stages of the complex value chain, yielding significant economies of scope and scale.

What is the projected role of robotics in large-scale farming?

Robotics are projected to take over labor-intensive tasks such as weeding, targeted spraying, and harvesting in large- scale farming operations. This automation addresses critical labor shortages, enhances precision for input application, and allows for 24/7 operations, thereby significantly improving overall farm productivity and reducing reliance on manual labor.

How are government policies influencing market trends in developed regions?

Government policies in developed regions primarily influence trends through sustainability mandates, restrictions on pesticide use, and incentives for adopting regenerative agriculture practices. These policies redirect R&D towards bio-inputs and efficiency technologies, shaping market offerings towards environmentally responsible solutions.

Why is the Agribusiness market considered a high-priority sector globally?

The Agribusiness market is high-priority because it is intrinsically linked to global food security, public health, water resource management, and climate change mitigation. Its stability and growth are essential for socio-economic development and geopolitical stability worldwide, commanding attention from policymakers and international organizations.

What challenges does the use of Genetically Modified (GM) crops face?

GM crops face regulatory hurdles regarding approval processes in various regions, significant public skepticism regarding long-term health and environmental effects, and trade barriers due to varying national standards, requiring complex international agreements and rigorous scientific validation for widespread adoption.

How important is soil health management in modern agribusiness?

Soil health management is critically important as healthy soil is the foundation of sustainable productivity. Practices like no-till farming, cover cropping, and optimized nutrient cycling improve water retention, reduce erosion, sequester carbon, and ultimately enhance crop resilience and long-term farm profitability, reducing dependency on chemical inputs.

Which component of the input segment is experiencing the fastest growth?

The technology and specialized biological inputs segment (including bio-fertilizers, biopesticides, and farm management software) is currently experiencing the fastest growth, outpacing traditional segments like generic synthetic chemicals and conventional machinery due to global mandates for resource efficiency and sustainability.

What is the primary role of venture capital in the Agribusiness Market?

Venture capital plays a vital role by funding high-risk, high-reward AgriTech startups focused on developing solutions such as specialized AI algorithms for yield prediction, novel insect protein production, and advanced sensing hardware, accelerating the pace of innovation and market entry for disruptive technologies.

How are mergers and acquisitions affecting market structure?

M&A activities, particularly the consolidation among major seed, chemical, and machinery providers, are creating integrated giants that control significant portions of the input supply chain. This trend centralizes R&D efforts but raises concerns about reduced competition and product choice for the end farmer.

What impact does water scarcity have on agricultural technology adoption?

Water scarcity drives mandatory adoption of advanced water conservation technologies, including precise drip irrigation systems, sensors for real-time moisture monitoring, and water-efficient crop varieties, increasing the market demand for smart water management solutions across arid and semi-arid agricultural zones worldwide.

Define the concept of regenerative agriculture in the context of agribusiness.

Regenerative agriculture is an approach focused on rebuilding soil health and fertility, increasing biodiversity, and improving the water cycle through practices such as minimal soil disturbance, diverse crop rotations, and cover cropping, serving as a key sustainability objective for major food companies and land stewards globally.

What are the challenges associated with digital adoption by smallholder farmers?

Challenges include limited access to stable internet and electricity, high costs of smartphones and sensors, lack of technical literacy and training, and the absence of localized digital content and tailored financial solutions that cater specifically to the constraints and crop diversity typical of small farming operations.

How do fluctuating commodity prices influence investment decisions in agribusiness?

Fluctuating commodity prices introduce revenue instability, making long-term investment decisions difficult. High prices incentivize production expansion and equipment upgrades, while low prices enforce cost-cutting, risk management strategies (like hedging), and a focus on efficiency improvements through advanced technology adoption.

What is the importance of global trade agreements for the agribusiness sector?

Global trade agreements are vital as they determine market access, set quality standards, influence pricing, and reduce tariffs and non-tariff barriers for agricultural products, enabling the massive cross-border movement of commodities and high-value processed foods essential for the market's overall economic functionality.

What is the primary driver behind the shift towards plant-based protein sources?

The shift is primarily driven by rising consumer health consciousness, ethical concerns regarding animal welfare, environmental impact mitigation (especially reducing greenhouse gas emissions from livestock), and the development of innovative, palatable plant-based food products that mimic traditional animal protein textures and flavors.

How do governments address labor shortages in agriculture through technology?

Governments encourage the adoption of automation and robotic solutions, ranging from specialized harvesting robots to automated sorting systems, often through R&D tax credits and subsidies for technology acquisition, aiming to maintain productivity despite persistent demographic shifts away from manual farm labor.

What is the predicted long-term impact of blockchain on food transparency?

Blockchain is predicted to establish an unprecedented level of verifiable, tamper-proof transparency across the food supply chain, allowing consumers to instantaneously trace products back to the farm of origin, thereby significantly reducing fraud, improving recall efficiency, and strengthening consumer trust in food safety certifications and claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager