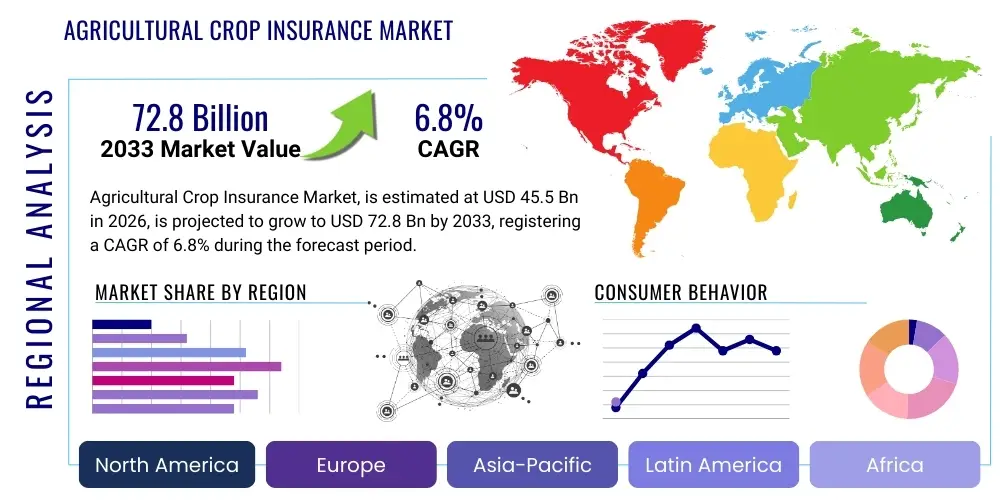

Agricultural Crop Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438032 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Agricultural Crop Insurance Market Size

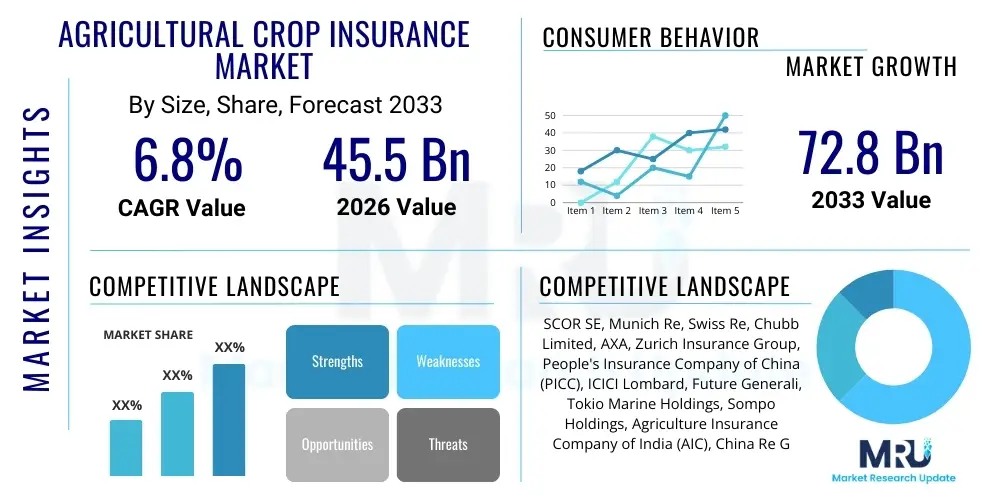

The Agricultural Crop Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 72.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating global climate variability, which increases the frequency and severity of extreme weather events, compelling governmental bodies and private insurers to enhance risk mitigation frameworks for the agricultural sector. Furthermore, the increasing adoption of technology, such as satellite imagery and IoT sensors, is enabling more accurate risk assessment and efficient claims processing, thereby expanding the accessibility and appeal of crop insurance products, particularly in developing economies.

Agricultural Crop Insurance Market introduction

The Agricultural Crop Insurance Market encompasses various risk management products designed to protect farmers against financial losses resulting from natural disasters, pests, diseases, and market price fluctuations. These insurance mechanisms are foundational to ensuring global food security and stabilizing farm incomes. Products offered range from traditional indemnity policies, such as Multi-Peril Crop Insurance (MPCI), which compensates based on actual yield loss, to innovative parametric or index-based insurance that triggers payouts based on pre-defined weather indices like rainfall deficit or temperature extremes. The primary application of this market is to safeguard capital investment in farming operations, ensuring continuity and stability even during periods of high environmental stress.

Key benefits driving the expansion of this market include the promotion of sustainable agricultural practices, reduced reliance on ad-hoc government disaster relief funds, and enhanced credit access for farmers. Financial institutions are more willing to lend capital when agricultural assets are insured, creating a positive feedback loop for sectoral growth and technological adoption. The standardization of insurance products, supported by government subsidies in many developed and emerging economies, further accelerates market penetration among small and large-scale farming enterprises.

Major driving factors include the intensification of agricultural production to meet burgeoning global population demand, coupled with increasingly volatile weather patterns attributable to climate change. Regulatory environments, particularly in regions like North America and Europe, mandate or heavily subsidize insurance participation, stabilizing the core market. Moreover, the shift towards data-driven farming (precision agriculture) provides insurers with granular, real-time data necessary to refine risk modeling and develop highly customized insurance offerings, moving beyond generalized regional policies toward farm-specific solutions that are both cost-effective and highly reliable.

Agricultural Crop Insurance Market Executive Summary

The Agricultural Crop Insurance Market is characterized by significant business transformation driven by climate risks and technological integration. Business trends indicate a strong move toward public-private partnerships, where governments underwrite catastrophic risk while private entities manage distribution and claims processing efficiency. Insurtech startups are rapidly disrupting traditional models by leveraging geospatial analytics and machine learning to offer parametric insurance solutions, which dramatically reduce the time and cost associated with loss adjustment. This operational efficiency is crucial for maintaining profitability amidst rising loss frequency and severity, necessitating continuous adaptation of risk pooling and reinsurance strategies by major market players globally.

Regionally, North America maintains market dominance due to comprehensive government programs, particularly the U.S. Federal Crop Insurance Program (FCIP), which heavily subsidizes premiums. However, Asia Pacific is projected to exhibit the fastest growth rate, fueled by large-scale government initiatives in India and China aimed at protecting millions of smallholder farmers from climate shocks and enhancing agricultural productivity. European markets are focusing on sustainability-linked insurance products that incentivize environmentally friendly practices, while Latin America and the Middle East and Africa (MEA) represent high-potential, underserved markets where index-based insurance is gaining traction due to lower operational complexity and data constraints.

Segmentation trends highlight a critical shift from Multi-Peril Crop Insurance (MPCI) toward Revenue Insurance and Index-Based Insurance. Revenue insurance, which protects against simultaneous drops in yield and price, offers farmers more holistic financial security. Meanwhile, the rapid adoption of index-based products is expanding the coverage footprint in emerging markets where traditional loss assessment infrastructure is scarce or expensive. Furthermore, digital distribution channels, including mobile platforms and agricultural aggregators, are becoming instrumental in reaching remote farming communities, thus accelerating overall market penetration rates across diverse crop types, ranging from staple food crops to high-value cash crops.

AI Impact Analysis on Agricultural Crop Insurance Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on agricultural crop insurance often center on predictive accuracy, claims speed, and affordability. Users frequently ask if AI can reliably forecast localized weather anomalies, how rapidly claims can be settled using satellite data and machine vision, and whether these technological advancements will ultimately reduce premium costs for farmers. There is also significant interest in AI's role in fraud detection and customizing policies based on individual farm risk profiles, moving away from aggregated regional risk assessments. The overarching expectation is that AI will democratize access to insurance by making complex risk modeling manageable and reducing the manual intervention required for traditional underwriting and loss adjustment processes.

AI is transforming the agricultural insurance value chain by enabling insurers to process massive, disparate datasets—including satellite imagery, historical yield data, soil conditions, and real-time weather feeds—to generate hyper-localized risk assessments. This capability allows for dynamic pricing models that accurately reflect specific farm risk factors, potentially lowering costs for low-risk farmers and ensuring adequate coverage capacity for high-risk operations. Furthermore, Machine Learning algorithms enhance fraud detection capabilities by identifying anomalous claims patterns that human auditors might overlook, ensuring the sustainability and integrity of insurance programs, which is vital for both private sector investment and publicly subsidized schemes.

The integration of AI, particularly through deep learning applied to remote sensing data, facilitates instant, impartial claims verification. Instead of relying on time-consuming physical field visits, insurers can automatically detect the extent of crop damage (e.g., area affected by flooding or drought) immediately following an event. This accelerates payout processes from weeks or months to days, significantly improving farmer liquidity post-disaster and increasing farmer confidence in the product. The transition toward automated, data-driven operations positions AI as the core driver for scaling insurance adoption in previously inaccessible or high-risk agricultural zones globally.

- Enhanced accuracy in yield forecasting and localized weather risk modeling using deep learning algorithms.

- Automation of claims processing via machine vision analysis of satellite and drone imagery, leading to rapid payouts.

- Personalized risk-based pricing and customized policy recommendations based on farm-specific historical data.

- Significant reduction in fraudulent claims through sophisticated pattern recognition and anomaly detection techniques.

- Development of next-generation parametric insurance products that utilize AI-driven indices for automatic trigger release.

DRO & Impact Forces Of Agricultural Crop Insurance Market

The Agricultural Crop Insurance Market is principally shaped by the critical interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the overwhelming global need for robust risk mitigation strategies due to increasing climate volatility and the subsequent economic insecurity faced by farming communities. This is often coupled with strong governmental support, typically manifested through premium subsidies and risk-sharing mechanisms, which substantially lower the barrier to entry for farmers and encourage widespread participation. Additionally, advancements in remote sensing, geospatial analytics, and big data processing capabilities act as technological drivers, making insurance more precise and operationally efficient for insurers.

Restraints largely center on structural challenges, including basis risk in index-based products, which occurs when the insured farmer's actual loss does not perfectly align with the measured index (e.g., local rainfall differs significantly from the regional weather station reading). Furthermore, low agricultural literacy and skepticism regarding insurance benefits, particularly in emerging economies, hinder adoption. High operational costs associated with traditional loss assessment methodologies, especially across vast, remote agricultural landscapes, and the difficulty in obtaining reliable, long-term historical yield data necessary for actuarial soundness pose ongoing financial and logistical constraints for insurers.

Opportunities for market expansion are abundant, particularly in developing innovative, low-cost insurance solutions tailored for smallholder farmers, such as micro-insurance models utilizing mobile platforms. The integration of blockchain technology offers an opportunity to enhance transparency and reduce administrative overhead in claims processing. Moreover, the increasing public and private sector investment in climate-resilient agriculture creates an opportunity for insurers to bundle insurance products with sustainable farming incentives, fostering a market environment that rewards risk mitigation and environmental stewardship. The shift toward specialized coverage for emerging risks, such as cyber threats to precision agriculture systems, also represents a niche opportunity for growth.

Segmentation Analysis

The Agricultural Crop Insurance Market segmentation provides a granular view of market dynamics based on the types of coverage offered, the specific crops protected, the channels used for distribution, and the nature of the farming operation. Understanding these segments is crucial for insurers designing targeted products and for policymakers structuring effective subsidy programs. The complexity of the global agricultural landscape necessitates varied product offerings, ensuring that insurance can effectively address the diverse needs of large commercial operations, which often prioritize yield and revenue protection, and small subsistence farms, which often require simple, low-premium, index-based solutions for catastrophic loss coverage.

The segmentation by Coverage Type, particularly the rise of Revenue Insurance, reflects the maturing market's response to volatile agricultural commodity markets, offering protection not just against physical loss but against financial instability. Segmentation by Crops underscores the disproportionate market value attributed to staple crops like corn, soybeans, and rice, which often receive the highest level of government support and market penetration. Distribution Channel analysis highlights the move towards digital platforms and bancassurance models, leveraging existing customer relationships and technology to minimize distribution costs and maximize reach in remote areas, ultimately driving the overall market's structural evolution.

- Coverage Type:

- Multi-peril Crop Insurance (MPCI)

- Crop Hail Insurance (CHI)

- Revenue Insurance (Yield and Price Protection)

- Index-Based Insurance (Area Yield Index, Weather Index, Vegetation Index)

- Crops:

- Food Crops (Grains, Oilseeds, Pulses)

- Cash Crops (Cotton, Sugarcane, Tobacco, Coffee)

- Horticultural Crops (Fruits, Vegetables, Floriculture)

- Distribution Channel:

- Direct Sales Agents

- Bancassurance

- Brokers/Agencies

- Digital/Online Channels (Insurtech Platforms, Mobile Apps)

- Farming Type:

- Subsistence Farming

- Commercial Farming (Large-Scale, Corporate Farms)

Value Chain Analysis For Agricultural Crop Insurance Market

The value chain for agricultural crop insurance begins with upstream activities focused on data acquisition and risk modeling. Upstream analysis involves technology providers supplying satellite imagery, weather data services, actuarial consulting, and core policy administration software platforms. Reinsurance companies, which absorb a significant portion of the primary insurers' catastrophic risk, are fundamental upstream partners, providing the financial capacity needed to underwrite large-scale agricultural risk portfolios, particularly those backed by government subsidies. The quality and reliability of external data sources directly impact the accuracy and solvency of the resulting insurance products offered downstream.

The core of the value chain involves the primary insurers and governmental bodies responsible for product design, pricing, underwriting, and policy issuance. Distribution channels form the crucial link to the end-user. Direct channels involve dedicated sales agents who often provide advisory services to farmers, ensuring proper coverage selection. Indirect distribution, encompassing bancassurance, brokers, and digital platforms, leverages existing trust networks (banks) or widespread digital infrastructure (mobile apps) to reach a broader, more diverse client base efficiently. Insurtech platforms, operating often through indirect channels, are focused on streamlining policy issuance and claims verification using geospatial tools.

Downstream activities center on claims management, loss adjustment, and final payout. This phase increasingly relies on technology, moving away from manual assessment to automated verification using drone and satellite imagery, speeding up the process significantly. Furthermore, this stage includes ongoing customer relationship management and feedback collection, which loops back into upstream risk modeling for product refinement. The interdependence between primary insurers, reinsurers, and technological service providers is critical for maintaining market stability, especially given the rising severity of global climate-related events that necessitate highly efficient capital deployment mechanisms for rapid recovery.

Agricultural Crop Insurance Market Potential Customers

The primary end-users and buyers of agricultural crop insurance products are farmers, ranging from small-scale subsistence operators in developing economies to large commercial agribusinesses in industrialized nations. Commercial farms typically seek comprehensive, high-value coverage, such as Revenue Insurance, which protects against large financial swings dueating to volatility in yield and commodity prices. These operations often engage directly with brokers or large insurance companies and require sophisticated risk management tools integrated with their precision agriculture systems.

Smallholder farmers constitute a vast, emerging potential customer segment, particularly across Asia Pacific and Africa, and they are best served by simple, affordable, index-based micro-insurance products. For this group, the distribution mechanism is critical; policies must be easily accessible, often via mobile phones or cooperative banks, with extremely transparent and rapid payout mechanisms to ensure trust. Governments often act as implicit customers by heavily subsidizing these policies, recognizing the broader societal benefit of stabilizing rural incomes and ensuring national food security.

Beyond the direct farm owner, financial institutions, including rural banks and agricultural credit societies, are crucial stakeholders and indirect customers. They rely on crop insurance as collateral protection for the loans extended to farmers for inputs like seeds, fertilizers, and machinery. By mitigating default risk associated with crop failure, insurance enables greater access to agricultural credit, driving investment and modernization across the sector. Commodity trading companies and processors also benefit indirectly by having a more stable supply chain when key raw materials are protected by robust insurance mechanisms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.8 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCOR SE, Munich Re, Swiss Re, Chubb Limited, AXA, Zurich Insurance Group, People's Insurance Company of China (PICC), ICICI Lombard, Future Generali, Tokio Marine Holdings, Sompo Holdings, Agriculture Insurance Company of India (AIC), China Re Group, Everest Re Group, Hannover Re, Allianz SE, Liberty Mutual Insurance, Great American Insurance Group, QBE Insurance Group, Farmers Mutual Hail. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Crop Insurance Market Key Technology Landscape

The agricultural crop insurance landscape is increasingly defined by the integration of sophisticated digital technologies, moving the industry toward a predictive and automated framework. Central to this technological transformation is the deployment of Geospatial Information Systems (GIS) and remote sensing capabilities, utilizing high-resolution satellite and drone imagery. These tools provide insurers with objective, scalable methods for monitoring crop health, assessing land usage, and verifying damages remotely following an adverse event. This reliance on unbiased, geographically referenced data mitigates moral hazard, speeds up the claims process, and is fundamental to the operational viability of index-based insurance models where payouts are triggered automatically by observed environmental conditions rather than manual inspection.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the second pillar of technological advancement. AI algorithms are applied extensively in risk modeling to analyze vast historical datasets, including localized climate patterns, soil composition, and past yield variability, resulting in highly precise, farm-level risk assessments that allow for dynamic and fair pricing. Furthermore, ML-powered chatbots and virtual assistants are being used in distribution and customer service to educate farmers on policy terms and facilitate claims submissions via mobile platforms. This automation reduces administrative costs significantly, making small policies viable and expanding the reach of insurance to remote and underserved populations.

Complementary technologies such as the Internet of Things (IoT), utilizing ground-based sensors for real-time monitoring of weather, soil moisture, and temperature, provide crucial data validation for parametric policies and enhance the accuracy of yield forecasts. Furthermore, blockchain technology is emerging as a potential solution for enhancing data security and creating transparent, immutable records of policy issuance and claims settlement. By streamlining verification processes and reducing counterparty risk, these interconnected technologies are converging to create a frictionless, highly transparent, and robust insurance ecosystem capable of handling the increasing frequency and complexity of modern agricultural risks driven by climate change.

Regional Highlights

The global Agricultural Crop Insurance Market exhibits distinct regional dynamics driven by local agricultural practices, regulatory frameworks, and climate vulnerabilities. North America, particularly the United States, commands the largest market share due to the highly institutionalized and heavily subsidized Federal Crop Insurance Program (FCIP). The region focuses heavily on sophisticated Revenue Insurance products for large-scale commodity crops (corn, soybeans, wheat) and leverages advanced technology for predictive modeling and rapid claims processing. The stability and high participation rates resulting from government support ensure continuous market dominance, though growth remains tied to policy revisions and climate-related risk exposure volatility.

Asia Pacific (APAC) represents the fastest-growing region globally, propelled by immense governmental initiatives aimed at protecting smallholder farmers, particularly in populous nations like India (Pradhan Mantri Fasal Bima Yojana - PMFBY) and China. These programs are characterized by massive scale and a strong reliance on technological solutions, including satellite-based remote sensing and mobile platforms, necessary to manage millions of individual policies efficiently. The APAC region is a crucial testing ground for scalable index-based and micro-insurance solutions designed to overcome challenges related to data scarcity and high administrative costs associated with traditional insurance models in highly fragmented agricultural sectors.

Europe maintains a mature market, driven by the Common Agricultural Policy (CAP) and national schemes, focusing on risk management tools that incentivize environmental sustainability. European insurers are increasingly developing tailored products for specialty crops and focusing on innovative climate adaptation measures integrated into insurance policies. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing nascent growth. In these regions, the lack of extensive historical data and robust physical infrastructure necessitates the adoption of cost-effective, index-based insurance as the primary entry point, often facilitated by international development organizations and reinsurers focused on catastrophe risk transfer and building local actuarial capacity.

- North America: Market leader defined by high subsidy rates, dominance of Multi-peril and Revenue Insurance, and extensive use of precision agriculture data integration.

- Asia Pacific (APAC): Fastest growth region; driven by large-scale government-backed schemes (e.g., India, China) focused on smallholder inclusion and index-based technology adoption.

- Europe: Mature market emphasizing climate resilience, linking insurance to sustainable farming practices, and offering specialized coverage for high-value horticultural products.

- Latin America: High potential market facing increasing climate risk; focus on developing parametric solutions for tropical crops and stabilizing volatile local agricultural economies.

- Middle East and Africa (MEA): Underserved market where micro-insurance and index-based products, often supported by public-private partnerships, are crucial for mitigating drought and famine risks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Crop Insurance Market.- SCOR SE

- Munich Re

- Swiss Re

- Chubb Limited

- AXA

- Zurich Insurance Group

- People's Insurance Company of China (PICC)

- ICICI Lombard General Insurance Company Limited

- Future Generali India Insurance Company Limited

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Agriculture Insurance Company of India (AIC)

- China Re Group

- Everest Re Group, Ltd.

- Hannover Re

- Allianz SE

- Liberty Mutual Insurance Company

- Great American Insurance Group

- QBE Insurance Group Limited

- Farmers Mutual Hail Insurance Company of Iowa

Frequently Asked Questions

Analyze common user questions about the Agricultural Crop Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Agricultural Crop Insurance Market?

The central driver is the increasing frequency and severity of extreme weather events and climate variability globally. These events substantially elevate the financial risk associated with farming, compelling farmers and governments alike to invest in robust risk transfer mechanisms like crop insurance to ensure income stability and food security.

How does technological integration, specifically AI, affect crop insurance pricing?

AI, using machine learning on satellite and sensor data, enables granular, farm-specific risk assessments. This allows insurers to move away from broad regional pricing to dynamic, localized pricing models, often resulting in fairer premiums for low-risk farmers and overall increased actuarial accuracy for the insurer.

What is the difference between MPCI and Index-Based Crop Insurance?

Multi-Peril Crop Insurance (MPCI) is an indemnity product that compensates farmers based on their actual measured yield loss, requiring costly field assessment. Index-Based Insurance (Parametric) triggers a payout automatically based on a predefined index (like rainfall or temperature at a regional weather station), regardless of the farmer's specific yield, ensuring faster payouts but involving basis risk.

Which region holds the largest market share in the Agricultural Crop Insurance Market?

North America, particularly the United States, holds the largest market share. This dominance is attributed to large-scale, comprehensive government subsidy programs, high rates of farmer participation, and the mature institutional framework supporting agricultural financial risk management.

What are the main distribution channels being utilized for reaching smallholder farmers?

The main channels for smallholder farmers are indirect methods, primarily Bancassurance (leveraging agricultural banks and credit cooperatives) and Digital/Online Channels, including mobile-based applications, which reduce distribution costs and provide ease of access in remote rural areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager