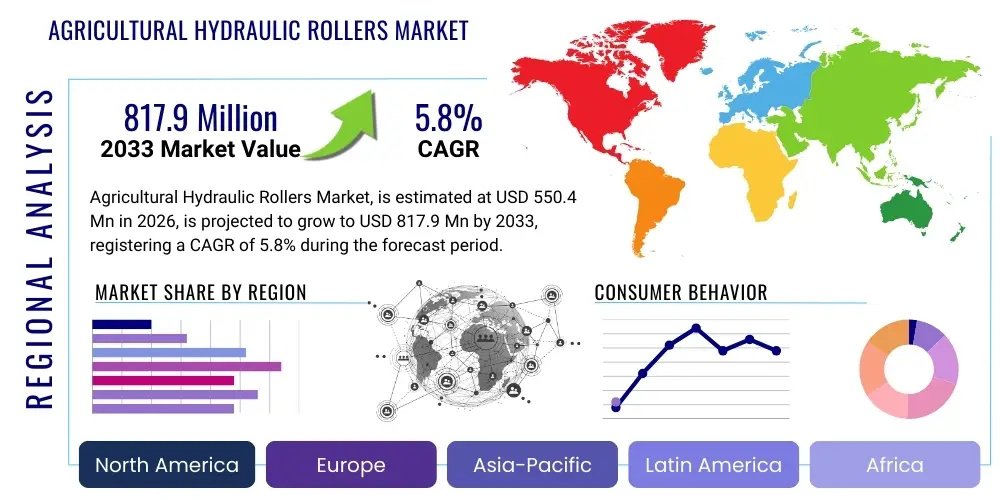

Agricultural Hydraulic Rollers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436206 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Agricultural Hydraulic Rollers Market Size

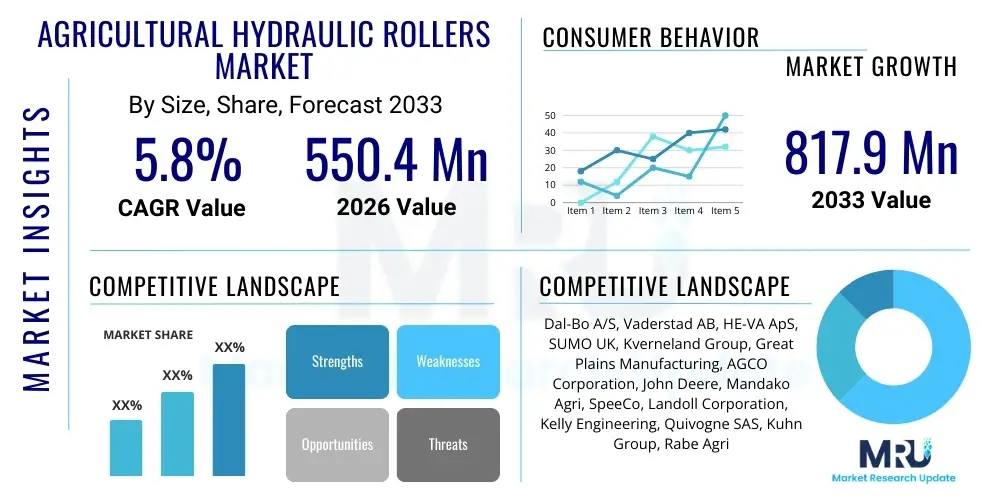

The Agricultural Hydraulic Rollers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550.4 Million in 2026 and is projected to reach USD 817.9 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing global emphasis on soil health preservation, the rapid adoption of mechanized farming techniques in emerging economies, and the continuous innovation in roller design focusing on wider working widths and integrated smart technologies.

Agricultural Hydraulic Rollers Market introduction

The Agricultural Hydraulic Rollers Market encompasses machinery utilized primarily for consolidating soil after plowing or seeding, ensuring optimal seed-to-soil contact, minimizing moisture loss, and creating a uniform surface for subsequent farming operations. These rollers, powered and controlled using hydraulic systems integrated into tractors, are essential components in modern precision agriculture, especially in large-scale farming where efficiency and consistency are paramount. Their primary function is improving germination rates by breaking down clods and firming the seedbed, leading directly to enhanced crop yields and operational productivity.

The product range within this market includes various roller types, such as Cambridge, smooth, and crimper rollers, differentiated by their ring design and intended application—from delicate seedbeds to heavy residue management. Major applications span across cereal production, oilseed cultivation, and fodder crops, serving diverse agricultural sectors globally. The robustness, adaptability to varying soil types, and ease of folding/unfolding due to hydraulic mechanisms drive their market penetration, particularly in regions practicing minimum tillage or conservation agriculture, where controlled soil disturbance is crucial for sustainability.

Driving factors for market expansion include escalating global food demand necessitating higher yields, government subsidies promoting farm mechanization, and the inherent benefits offered by these implements, such as reduced wind erosion, improved water infiltration, and streamlined field operations. As farmers increasingly seek high-throughput equipment capable of covering vast areas quickly, the demand for large, hydraulically foldable rollers continues to rise, establishing the product as an indispensable tool for efficient and profitable crop production.

Agricultural Hydraulic Rollers Market Executive Summary

The global Agricultural Hydraulic Rollers Market is experiencing robust expansion driven by sustained agricultural mechanization trends across Asia Pacific and Latin America, coupled with technological advancements enhancing operational efficiency in North America and Europe. Business trends indicate a strong move toward manufacturing wider rollers (up to 12 meters or more) to maximize output per pass, alongside integrating features like precision monitoring and GPS guidance to support site-specific farming practices. Manufacturers are focusing on durable materials and modular designs to reduce maintenance costs and increase the lifespan of the equipment, reflecting a growing industry focus on total cost of ownership (TCO).

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely due to ongoing governmental initiatives aimed at modernizing farming practices, particularly in populous countries such as India and China, where farm holdings are consolidating and the need for efficient machinery is peaking. North America and Europe remain mature markets, characterized by high adoption rates of advanced, large-scale hydraulic rollers, where growth is primarily driven by replacement cycles and the uptake of intelligent, data-enabled machinery. Environmental regulations focusing on soil compaction mitigation also influence product development, pushing innovation toward lighter yet robust roller designs.

Segmentation trends highlight the dominance of the Cambridge Roller segment due to its versatility across different soil types and its effectiveness in seedbed preparation. However, the multi-function roller segment, capable of simultaneous rolling and incorporating chemicals or managing crop residue, is gaining traction due. By operational capacity, the medium-to-large capacity rollers (over 6 meters working width) represent the largest revenue share, catering to the needs of commercial, industrial-scale agricultural operations seeking optimal productivity and reduced fuel consumption per hectare.

AI Impact Analysis on Agricultural Hydraulic Rollers Market

Common user questions regarding AI's impact on agricultural hydraulic rollers frequently center on whether AI can transform these traditionally mechanical implements into 'smart' data collection tools, how predictive maintenance affects equipment longevity, and the potential for fully autonomous rolling operations. Users are keen to understand if AI can optimize rolling pressure and speed based on real-time soil conditions, thereby eliminating guesswork and maximizing soil health benefits. The collective expectation is that AI integration will shift hydraulic rollers from simple consolidation tools to advanced, dynamic soil engagement systems capable of contributing valuable geotechnical data back into the farm management system (FMS).

The direct application of Artificial Intelligence (AI) in this market manifests primarily through sensor integration and data analytics. Hydraulic rollers equipped with sophisticated sensors can collect highly granular data on soil density, moisture levels, and surface topology during operation. AI algorithms then process this massive dataset to generate prescription maps for subsequent farming activities, such as variable rate seeding or fertilization. This integration enhances the roller's value proposition significantly, transforming it into a high-utility data capture platform rather than just a ground preparation tool.

Furthermore, AI algorithms are crucial for optimizing the operational parameters of advanced hydraulic systems. By continuously analyzing performance data, AI systems can dynamically adjust the hydraulic pressure applied to the roller segments in real-time to match heterogeneous field conditions, preventing over-compaction in sensitive areas while ensuring adequate firmness where needed. This level of precision, facilitated by machine learning models trained on vast amounts of historical soil data, significantly improves both the efficiency of the rolling process and the long-term sustainability of soil structure, driving the adoption of premium, AI-ready roller systems.

- AI-driven Predictive Maintenance: Reduces unexpected downtime by forecasting component failure based on vibration and stress data.

- Real-time Soil Mapping: Utilizes integrated sensors (e.g., LiDAR, pressure sensors) to map soil density and heterogeneity during rolling.

- Autonomous Operation: Enables hydraulic rollers to operate independently, following optimized paths and adjusting parameters without human input.

- Optimized Variable Pressure Application: Machine learning adjusts hydraulic pressure dynamically to maintain ideal seedbed conditions across diverse terrain.

- Enhanced Data Integration: Feeds high-resolution soil data directly into farm management software for holistic yield optimization strategies.

DRO & Impact Forces Of Agricultural Hydraulic Rollers Market

The Agricultural Hydraulic Rollers Market is shaped by powerful driving forces such as the pervasive need for efficiency gains in large-scale agriculture and supportive governmental policies encouraging farm mechanization, particularly in developing regions. These drivers are tempered by significant restraints, including the high initial capital investment required for these heavy-duty implements and the fragmented nature of agricultural land ownership in several key markets, which limits the uptake of very large hydraulic models. Opportunities reside in the burgeoning trend of sustainable and conservation agriculture, requiring specialized residue management rollers, and the expansion into niche crop applications demanding precise seedbed firming.

Key drivers include the global increase in commercial farming acreage, necessitating wide-width, high-throughput equipment to reduce operational hours and labor costs. The recognized importance of proper soil consolidation in boosting germination rates and ultimately maximizing yield per hectare also acts as a primary market accelerator. Furthermore, continuous hydraulic system improvements, making the rollers easier to fold, transport, and adjust, contribute significantly to their attractiveness compared to older mechanical counterparts. The increasing adoption of minimum tillage practices, which still require surface consolidation without deep soil inversion, specifically favors specialized roller designs.

However, the market faces constraints related to the volatility of raw material prices (steel and hydraulic components), impacting manufacturing costs and end-product pricing. Operational complexity and the necessity for skilled labor to maintain and operate advanced hydraulic machinery pose a barrier in certain markets. The impact forces show that while technological sophistication (positive force) drives replacement cycles in mature markets, economic viability and capital availability (negative constraint) heavily influence purchasing decisions in emerging economies. The overarching impact force pushing the market forward remains the inextricable link between precise soil consolidation and reliable crop productivity.

- Drivers (D): Increased Global Farm Mechanization; Focus on Soil Health and Moisture Retention; Expansion of Large-Scale Commercial Farming.

- Restraints (R): High Initial Investment and Maintenance Costs; Volatility in Raw Material Prices; Fragmentation of Agricultural Land Ownership.

- Opportunities (O): Growing Adoption of Conservation Tillage Practices; Development of Multi-Functional and Smart Rollers; Market Penetration in Emerging Economies (APAC, LATAM).

- Impact Forces: Technological Innovation (High Positive Impact); Economic Viability (Medium Negative Impact); Environmental Regulations (Medium Positive Impact).

Segmentation Analysis

The Agricultural Hydraulic Rollers Market is meticulously segmented based on product type, operational width, drive type, application, and geographical region, offering a clear view of specialized market demands. The segmentation by product type—including Cambridge, Smooth, and Crimper rollers—allows manufacturers to tailor specifications precisely to distinct soil and residue management requirements. Operational width segmentation is critical, ranging from small-scale rollers (under 3 meters) to ultra-wide commercial units (over 9 meters), directly reflecting the size and scale of farming operations catered to, with larger widths dominating revenue streams in highly industrialized agricultural zones.

Further analysis of the market segments reveals the growing prominence of hydraulically controlled and towed rollers over mounted systems, preferred for their stability, increased working capacity, and simplified integration with high-horsepower tractors. Application segmentation clearly delineates demand between pre-seeding preparation, post-seeding firming, and crop residue management, indicating shifts toward versatile rollers capable of handling multiple roles across the farming cycle. This granular segmentation provides essential intelligence for market participants aiming to develop products that align closely with regional farming methodologies and economic structures.

The robust market structure is underpinned by the essential function of the product, ensuring that regardless of crop type or farming methodology, soil consolidation remains a prerequisite for maximizing yields. This fundamental necessity guarantees persistent demand across all segments. Strategic segmentation allows for targeted investment, such as focusing R&D on specialized crimper rollers tailored for organic and cover cropping systems, or scaling manufacturing for high-volume, standard Cambridge rollers demanded by staple crop producers worldwide.

- By Product Type:

- Cambridge Rollers

- Smooth Rollers

- Crimper Rollers (Cover Crop Rollers)

- Multi-Function Rollers

- By Operational Width:

- Small (Under 3 Meters)

- Medium (3 to 6 Meters)

- Large (Over 6 Meters)

- By Drive Type:

- Towed Rollers

- Mounted Rollers

- By Application:

- Seedbed Preparation

- Post-Seeding Firming

- Residue Management

- General Field Consolidation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Agricultural Hydraulic Rollers Market

The value chain for the Agricultural Hydraulic Rollers Market begins with upstream activities involving the procurement of critical raw materials, primarily high-grade structural steel, specialized hydraulic components (cylinders, hoses, valves), and robust tires/wheels. Manufacturing involves precision engineering, cutting, welding, and assembly, requiring significant capital expenditure in specialized fabrication facilities. Efficiency at this stage is crucial, as the weight and size of the final product make material handling and logistical planning complex. Manufacturers often seek localized supply chain partnerships for heavy steel components to mitigate transportation costs and supply risks.

The midstream focuses on the distribution channel, which is typically a multi-layered system involving major agricultural machinery dealerships, specialized equipment distributors, and increasingly, direct sales channels for larger, custom orders. Dealership networks provide essential localized support, including sales consultations, financing options, and critical after-sales service and spare parts availability. The effectiveness of this distribution network is a significant competitive differentiator, particularly in penetrating remote or fragmented agricultural regions.

Downstream activities involve the end-users (farmers, contractors) utilizing the equipment, followed by maintenance and support. The nature of the hydraulic roller, being a heavy, high-wear implement, mandates a steady supply of replacement parts and expert maintenance services. Direct and indirect distribution channels coexist; direct channels facilitate high-volume sales to large corporate farms or farm cooperatives, offering better margins and control, while indirect channels leverage dealer expertise to reach small-to-medium enterprises (SMEs) and manage regional inventory. The robustness of the aftermarket service determines long-term customer satisfaction and brand loyalty.

Agricultural Hydraulic Rollers Market Potential Customers

Potential customers for agricultural hydraulic rollers primarily consist of commercial farmers and professional agricultural contractors operating medium to large farm holdings where efficiency and output maximization are paramount. These buyers require durable, wide-width rollers capable of covering extensive acreage in a limited timeframe. The key characteristics sought by these end-users are reliability, hydraulic folding ease for transport, and minimal maintenance requirements, ensuring maximum uptime during crucial planting seasons.

In addition to large-scale commodity crop producers (like corn, wheat, and soybean farmers), a growing customer base includes farms dedicated to specialized crops, such as those utilizing conservation tillage or organic farming methods. These segments demand specific types of rollers, particularly crimper rollers, which are essential for managing cover crops without the use of herbicides. Agricultural leasing companies and machinery cooperatives also represent significant institutional buyers, purchasing equipment in bulk for rental or shared use among member farmers.

Furthermore, government-backed farming projects and agricultural research institutions act as purchasers, often requiring specialized or advanced hydraulic rollers for experimental or demonstration purposes. The overall buyer base is shifting towards technology-savvy users who integrate data from the roller (e.g., soil density maps) into their overall farm management information systems, pushing demand toward smart, sensor-equipped models that justify their higher initial investment through superior data yield and operational precision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.4 Million |

| Market Forecast in 2033 | USD 817.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dal-Bo A/S, Vaderstad AB, HE-VA ApS, SUMO UK, Kverneland Group, Great Plains Manufacturing, AGCO Corporation, John Deere, Mandako Agri, SpeeCo, Landoll Corporation, Kelly Engineering, Quivogne SAS, Kuhn Group, Rabe Agri |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Hydraulic Rollers Market Key Technology Landscape

The technology landscape of the Agricultural Hydraulic Rollers Market is evolving rapidly, moving beyond basic mechanical implements to sophisticated systems that enhance precision and ease of operation. Central to this evolution is the advancement in hydraulic control systems, which allow for seamless and rapid folding/unfolding of multi-section rollers, maximizing transport safety and minimizing setup time in the field. Modern hydraulic systems also incorporate pressure regulation technology, enabling the operator to precisely control the rolling weight applied to the soil, which is crucial for preventing over-compaction, especially in variable soil conditions.

Furthermore, the integration of smart farming technologies marks a major technological shift. Many contemporary hydraulic rollers are equipped with GPS capabilities for accurate pass alignment, preventing overlap and saving fuel. Sensor technology is increasingly employed to monitor critical operational parameters, such as axle load, roll speed, and ground resistance. This data is processed by on-board telematics units, providing operators with real-time feedback and logging performance metrics, thereby aligning roller operations with the broader precision agriculture ecosystem.

Materials science also plays a significant role, with manufacturers adopting high-strength, lightweight steel alloys (HSS) to construct larger implements without excessive weight penalties. This enables the creation of ultra-wide rollers that fold compactly for road transport, balancing operational efficiency with logistical compliance. Specialized roller ring profiles and elastomer damping systems are also being developed to absorb shock, extend bearing life, and optimize soil engagement characteristics, showcasing a commitment to durability and maximizing return on investment for end-users.

Regional Highlights

The dynamics of the Agricultural Hydraulic Rollers Market exhibit distinct variations across global regions, reflecting differences in farming scale, technological adoption, and governmental regulations concerning soil management.

North America (primarily the US and Canada) represents a highly mature market characterized by very large farm sizes and high mechanization levels. Demand in this region is dominated by large-width, high-speed hydraulic rollers and advanced models featuring integrated precision monitoring systems. The market growth here is driven less by initial adoption and more by replacement cycles and the uptake of equipment compatible with autonomous farming systems. Strong emphasis is placed on reliability and durability to handle continuous operation across vast fields.

Europe, particularly Western and Central Europe, is a major market strongly influenced by environmental regulations (e.g., EU policies on soil conservation and compaction). This drives demand for specialized equipment, such as articulated rollers and those designed for cover crop management (crimpers). The market is segmented, with demand for large implements in Eastern European cereal-producing areas and smaller, more agile equipment suitable for mixed farming systems in Western Europe. Innovation frequently focuses on reducing machine weight relative to working width.

Asia Pacific (APAC) stands out as the fastest-growing region. This acceleration is fueled by the rapid shift from traditional farming methods to mechanized agriculture, supported by government subsidies and increasing foreign direct investment in agriculture. While small and medium-sized rollers dominate in areas with fragmented land holdings, the burgeoning commercial farming sector in countries like Australia and parts of India drives demand for high-capacity hydraulic units. Market penetration is closely tied to improving agricultural infrastructure and farmer education on soil health benefits.

Latin America (LATAM), particularly Brazil and Argentina, shows significant potential due to vast commodity production (soybeans, corn). These regions require heavy-duty hydraulic rollers suitable for minimum tillage and no-till farming systems prevalent across the Pampas region. The need for precise residue management is a major demand driver. The Middle East and Africa (MEA) market is nascent but growing, primarily driven by large corporate farming ventures in South Africa and governmental initiatives to enhance food security in drier climates, requiring rollers designed specifically for moisture conservation.

- North America: High adoption of ultra-wide, technologically integrated rollers; focus on autonomous readiness and efficiency in large acreage farming.

- Europe: Driven by environmental compliance and conservation agriculture; demand for specialized crimper rollers and low ground-pressure designs.

- Asia Pacific (APAC): Rapid growth supported by increasing farm mechanization and government incentives; rising demand for medium-to-large capacity rollers in countries modernizing agriculture.

- Latin America (LATAM): Strong demand linked to no-till farming practices; focus on durable, heavy-duty rollers for tough soil conditions and residue management.

- Middle East and Africa (MEA): Emerging market driven by commercial farming investments and the imperative to maximize moisture retention in arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Hydraulic Rollers Market.- Dal-Bo A/S

- Vaderstad AB

- HE-VA ApS

- SUMO UK

- Kverneland Group

- Great Plains Manufacturing

- AGCO Corporation

- John Deere

- Mandako Agri

- SpeeCo

- Landoll Corporation

- Kelly Engineering

- Quivogne SAS

- Kuhn Group

- Rabe Agri

- LEMKEN GmbH & Co. KG

- Amazone-Werke H. Schöttler GmbH

- McConnel Ltd

- Horsch Maschinen GmbH

- Farmet a.s.

Frequently Asked Questions

Analyze common user questions about the Agricultural Hydraulic Rollers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a hydraulic roller from a standard agricultural roller?

A hydraulic roller uses an integrated hydraulic system, typically powered by the tractor, to manage the folding, unfolding, and often the pressure control of the roller segments. This allows for significantly wider working widths (up to 18m) that can be safely and easily folded for road transport, maximizing field efficiency and minimizing manual labor compared to rigid or mechanical rollers.

How does the use of hydraulic rollers affect long-term soil health?

When used correctly with appropriate pressure settings, hydraulic rollers positively impact soil health by ensuring optimal seed-to-soil contact, which boosts germination rates. They also crush large clods, stabilize the soil surface to prevent wind and water erosion, and seal moisture in. Advanced rollers minimize deep compaction by distributing weight evenly and allowing pressure adjustments based on real-time field data.

Which geographical region exhibits the fastest growth rate for hydraulic roller adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This rapid expansion is driven by strong government focus on farm modernization, increasing adoption of mechanized large-scale farming techniques, and rising awareness among farmers regarding the necessity of precise soil consolidation for improved crop productivity and yield optimization.

What is the primary factor restraining market growth in developed countries?

In developed markets like North America and Western Europe, the primary restraint is the high initial capital investment required for purchasing advanced, wide-width hydraulic rollers integrated with precision agriculture technology. Although the return on investment (ROI) is high, the substantial upfront cost can be prohibitive for smaller farming enterprises or during periods of economic uncertainty in the agricultural sector.

What role does Artificial Intelligence (AI) play in modern hydraulic roller design?

AI is integrated into modern hydraulic rollers primarily for optimization and predictive maintenance. AI algorithms process real-time sensor data (soil density, moisture) to automatically adjust the hydraulic pressure applied to the roller, ensuring optimized firmness and preventing compaction. AI also analyzes operational data to predict maintenance needs, thus minimizing unplanned downtime and extending equipment lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager