Agricultural Mowers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433774 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Mowers Market Size

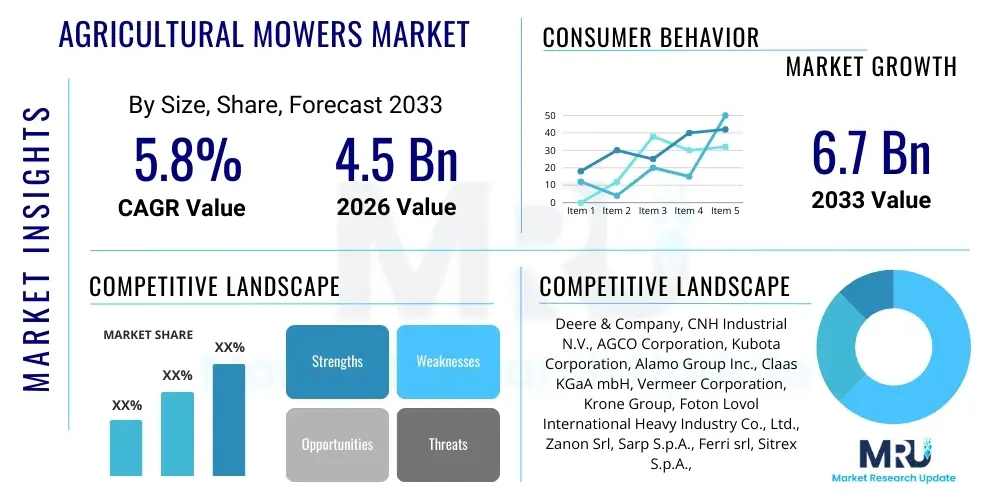

The Agricultural Mowers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Agricultural Mowers Market introduction

The Agricultural Mowers Market encompasses a vital segment of the farm machinery sector, providing implements essential for forage harvesting, pasture maintenance, and efficient residue management across diverse agricultural landscapes worldwide. These machines, ranging from simple sickle bar mowers to complex, multi-disc self-propelled units, are designed to deliver precise cutting performance, minimizing field losses and maximizing the nutritional quality of harvested material, which is critical for the thriving global livestock industry. The continuous evolution of agricultural practices, marked by larger farm sizes and the imperative for time-sensitive operations, has compelled manufacturers to innovate rapidly, focusing on enhanced durability, wider cutting widths, and reduced operational power consumption. The current market dynamic reflects a pronounced shift towards equipment that can handle higher throughput under demanding conditions, ensuring reliability during peak harvesting seasons when operational downtime incurs significant financial loss. This drive for efficiency positions modern mowers as indispensable tools in commercial farming.

The primary applications of agricultural mowers extend significantly beyond simple grass cutting, playing a pivotal role in the production cycle of hay, silage, and bioenergy crops. Forage harvesting, particularly for dairy and beef cattle operations, relies on mowers equipped with conditioning features that accelerate the drying process, preserving nutrient content and enhancing feed quality. Furthermore, mowers are increasingly utilized in environmental stewardship roles, such as managing cover crops, controlling invasive species in pastures, and shredding heavy crop residues like corn stalks, which aids in quicker decomposition and prepares the seedbed for subsequent planting cycles. The versatility of these machines, facilitated by quick-attach systems and interchangeable heads, allows farmers to perform multiple tasks with a single power unit, delivering substantial economic benefits through optimized equipment utilization and reduction in capital outlay for specialized machinery.

Market expansion is fundamentally driven by macro-economic forces, including the sustained rise in global protein consumption, which directly increases the demand for high-quality animal feed, intensifying the need for efficient forage production technologies. Key driving factors also include government policies across major agricultural economies offering subsidies and incentives for farm mechanization and the replacement of outdated equipment with modern, efficient machinery that adheres to contemporary safety and environmental standards. Additionally, the perennial challenge of skilled agricultural labor scarcity globally necessitates greater reliance on automated and high-output machinery, making mowers that offer wider working widths and integrated smart controls particularly attractive investments for forward-thinking agricultural enterprises focused on long-term sustainability and operational scalability.

Agricultural Mowers Market Executive Summary

The Agricultural Mowers Market is experiencing a robust period of expansion characterized by technological convergence and geographical shifts in demand intensity. Business trends highlight a consolidation among top-tier manufacturers who are heavily investing in Research and Development (R&D) focused on electrification, sensor technology, and enhancing machine connectivity through the Internet of Things (IoT). This push towards Smart Agriculture necessitates mowers capable of communicating performance data, undergoing remote diagnostics, and integrating seamlessly with broader Farm Management Information Systems (FMIS). Manufacturers are aggressively competing on total lifetime cost and aftermarket support, recognizing that reliability and minimized downtime are crucial decision metrics for end-users, especially commercial operators dealing with highly time-sensitive harvesting schedules.

Regional trends reveal a significant growth divergence based on maturity and mechanization levels. Developed regions, including North America and Western Europe, maintain high market valuation due to their early adoption of large, self-propelled, and precision-enabled mowers. Growth here is primarily driven by replacement cycles and the increasing uptake of premium, autonomous features designed to maximize output per hectare while reducing human input. Conversely, the Asia Pacific region, fueled by massive government initiatives in China and India, exhibits significantly faster volumetric growth. This surge is driven by efforts to modernize highly fragmented landholdings, transitioning millions of farmers from manual labor to affordable, robust, tractor-attached mowers, thus unlocking substantial scaling potential for regional and global OEMs specializing in mid-range utility equipment.

Segmentation trends confirm the enduring dominance of disc mowers within the rotary category for dedicated hay and silage production due to their superior cutting speed and cleanliness. However, flail mowers are seeing specialized growth in residue management, particularly as conservation tillage practices gain traction globally to improve soil health and reduce erosion. The overarching trend across all segments is the increasing integration of intelligent hydraulics and automatic leveling systems, ensuring consistent cutting height regardless of terrain undulations. This technological sophistication standardizes high-precision results, transforming what was traditionally a purely mechanical piece of equipment into a sophisticated, data-generating asset critical for optimizing the quality and quantity of harvested agricultural output.

AI Impact Analysis on Agricultural Mowers Market

User inquiries into Artificial Intelligence (AI) integration in the Agricultural Mowers Market reflect high expectations regarding the realization of true field autonomy and advanced data utilization. Common questions probe the feasibility of AI-driven systems in optimizing complex field geometries, ensuring operational safety in varied field conditions, and accurately assessing crop health during the mowing pass. Farmers are particularly concerned about the financial viability and required technical expertise for operating AI-enhanced machinery, seeking clear justification for the high initial investment through proven savings in fuel, labor, and long-term maintenance costs. The consensus expectation is that AI will move mowers from merely efficient tools to proactive, decision-making machines capable of autonomous resource management and optimized field execution, fundamentally altering operational protocols.

AI's fundamental impact is centered on the shift from programmed automation to contextual awareness. Through sophisticated machine learning algorithms processing data streams from multiple sensors—including GPS, LiDAR, and computer vision cameras—AI allows mowers to adapt dynamically to changing environmental conditions. For instance, vision-based AI can differentiate between desirable crop and weeds or obstacles, allowing selective intervention and ensuring that the cutting mechanism is only engaged where necessary, minimizing energy waste and optimizing biomass harvest for quality control. Furthermore, AI models are essential for predictive failure analysis; by learning the operational signatures of components like gearboxes and bearings under various loads and environmental stresses, AI provides alerts far in advance of catastrophic failure. This predictive capability significantly improves operational reliability, especially during time-critical harvesting windows, thereby boosting farm profitability and minimizing costly emergency repairs.

The commercialization trajectory involves phasing in AI across various machinery tiers. Currently, advanced self-propelled mowers use AI for optimizing headland turns and calculating precise fuel consumption based on field topography and expected output. Moving forward, AI will enable swarming technology, where multiple mowers operate collaboratively and autonomously, coordinated by a central intelligent system to maximize coverage and logistical efficiency across mega-farms. This enhanced level of coordination, coupled with the ability of AI to audit the consistency of the cut material (e.g., measuring stem length and conditioning effect), secures AI's position as a transformative technology that drives the market toward higher precision, enhanced sustainability, and truly unmanned field operations across the industry spectrum.

- AI-powered Path Optimization: Minimizes overlap and fuel consumption by generating the most efficient mowing routes using advanced spatial analytics and minimizing redundant passes in irregularly shaped fields.

- Real-time Biomass Assessment: Uses computer vision and sensor fusion to gauge crop density, moisture content, and crop health, dynamically adjusting cutting height, speed, and conditioning intensity for optimal harvesting quality and nutrient preservation.

- Autonomous Operation and Collision Avoidance: Enhances operational safety and enables continuous, unsupervised fieldwork through sophisticated sensor arrays (Lidar, Radar, Vision) and rapid decision-making algorithms for instant obstacle identification, classification, and effective avoidance.

- Predictive Maintenance Analytics: Monitors critical machine performance metrics, including vibration profiles, hydraulic pressure, and thermal signatures, to forecast potential mechanical failures, thus maximizing uptime and significantly extending the machine’s operational lifespan and reducing maintenance costs.

- Integration with Farm Management Systems (FMS): Facilitates seamless, bidirectional data transfer regarding precise field productivity, machinery utilization metrics, localized input costs per hectare, and overall operational efficiency reports accessible via centralized cloud platforms for strategic farm planning.

DRO & Impact Forces Of Agricultural Mowers Market

The Agricultural Mowers Market is governed by robust Drivers, tempered by significant Restraints, yet presenting compelling Opportunities, collectively creating a complex set of Impact Forces that steer its evolution. A principal driver is the relentless global pressure to increase agricultural yields and improve feed quality, directly necessitating investment in sophisticated mowing and conditioning technology that maximizes biomass recovery and minimizes nutrient loss. Further propelling the market is the irreversible trend of global agricultural labor urbanization and scarcity, compelling farmers, particularly in developed economies, to substitute increasingly expensive human labor with higher capacity, automated machinery. This substitution effect makes the efficiency gains offered by modern wide-cut mowers economically compelling despite their high capital cost, ensuring operational continuity during critical harvesting periods.

Conversely, the market faces significant restraints, chief among them being the considerable initial investment cost associated with high-precision, self-propelled or sophisticated tractor-mounted units, which can deter adoption among smaller farming enterprises or those in regions with underdeveloped financing infrastructure and lower access to credit. Furthermore, the operational performance of mowers is highly dependent on favorable weather conditions; unexpected climate variability or extreme weather events can severely shorten crucial harvesting windows, impacting purchasing confidence and perceived return on investment. Additionally, market stability is occasionally threatened by volatility in global agricultural commodity prices, which directly influences the disposable income farmers allocate toward large machinery purchases, often leading to delayed equipment replacement cycles and a preference for used machinery over new investments.

Opportunities for expansion are abundant, particularly through the commercial development and scaling of fully electric and hybrid mowers, which align with stringent global carbon reduction mandates and offer significant operational savings through reduced reliance on volatile diesel prices and lower maintenance requirements. Another key opportunity lies in specialized applications, such as the use of advanced flail mowers for biomass harvesting (e.g., dedicated energy crops) for renewable energy production, creating entirely new high-growth segments independent of traditional hay markets. Moreover, manufacturers who successfully introduce flexible ownership models, such as leasing, subscription services, or specialized equipment rental pools, are poised to unlock the significant latent demand from small and medium-sized farms previously constrained by large upfront capital requirements, significantly broadening the market access and utilization base.

Segmentation Analysis

The detailed segmentation of the Agricultural Mowers Market provides essential clarity on product differentiation and consumer preferences, allowing strategic focus on high-growth niches and specialized applications. Segmentation by machine Type is foundational, distinguishing between rotary mowers (such as high-speed disc mowers preferred for rapid forage harvesting), flail mowers (ideal for heavy residue mulching, roadside maintenance, and specialty cleanup), and the traditional sickle bar mowers (retained for steep terrain or minimal disturbance cutting applications). The continuous integration of high-performance conditioning features (roller or tine type) within the disc mower segment is a primary technological differentiator driving purchasing decisions among commercial forage producers.

Segmentation based on Mounting Type—Tractor-Mounted versus Self-Propelled—directly reflects the scale of operation and operational budget of the end-user. Tractor-mounted mowers offer versatility, cost-efficiency, and adaptability, making them suitable for medium-sized operations utilizing existing power units across various tasks. In contrast, self-propelled mowers, characterized by massive working widths, integrated conditioning, superior ergonomics, and dedicated power units, are the undisputed standard choice for large commercial enterprises and custom harvesting crews where maximizing acreage covered per hour and minimizing human fatigue are paramount operational priorities. The trend is moving towards larger, multi-unit combinations within the mounted segment, attempting to bridge the gap in efficiency between mounted and self-propelled systems without incurring the prohibitive capital cost of dedicated machines.

The application segment is critical, linking machine specifications directly to specific end-user requirements and ecological needs. Haymaking remains the largest application segment globally, demanding maximum speed and high-quality conditioning to optimize drying time. Conversely, applications in specialty crops (vineyards, orchards) require narrow, offset flail or specialized rotary mowers designed to handle inter-row and under-vine debris without damaging sensitive plant structures or disrupting trellising. This high degree of application specificity necessitates specialized product lines, offering manufacturers avenues to capture high-margin demand by addressing unique agricultural challenges through tailored machine configurations, further confirming the fragmented and technologically specialized nature of market demand beyond general field cutting.

- Type: Rotary Mowers (Disc Mowers, Drum Mowers), Flail Mowers (Vertical Axis, Horizontal Axis, Offset Flail), Sickle Bar Mowers (Reciprocating)

- Mounting Type/Power: Tractor-Mounted (Trailed Mowers, Semi-Mounted Mowers, Rear-Mounted Mowers, Triple-Mower Combinations), Self-Propelled Mowers (High-Capacity Windrowers, Dedicated Units), Hand-Operated/Walk-Behind Mowers

- Application: Haymaking and Forage Production (Silage, Haylage, Dry Hay), Pasture and Range Land Management (Weed Control, Grazing Optimization), Crop Residue Management (Stubble Mulching, Shredding), Turf and Grounds Maintenance (Commercial & Municipal), Specialty Crop Mowing (Vineyard, Orchard Floor Management, Biomass Harvesting)

- Cutting Width: Small Capacity (Under 2.5 meters), Medium Capacity (2.5 to 4.5 meters), High Capacity (Above 4.5 meters, including combinations up to 10 meters)

- End-User: Commercial Farming Enterprises (Large-scale operations), Small and Hobby Farms, Government Agencies and Municipalities, Contract Farming Service Providers (Custom Harvesters)

Value Chain Analysis For Agricultural Mowers Market

The commencement of the Agricultural Mowers Value Chain is defined by the meticulous sourcing of specialized industrial inputs, categorized as upstream activities. These inputs include high-grade, abrasion-resistant steel alloys and specialized composites required for durable blades and cutter bars that withstand extreme impact and wear, precision-machined gearing for reliable power transmission, advanced hydraulic components, and increasingly, sophisticated electronic control units and sensor arrays for smart integration. The quality and stability of these upstream supplier relationships are paramount, as the performance guarantee and perceived quality of the finished mower are intrinsically linked to the reliability and longevity of these core components. Effective supply chain management focuses on mitigating volatility in essential raw material prices, particularly specialized steel, while ensuring adherence to stringent quality controls for high-stress components such as bearings and driveline elements.

The manufacturing stage, dominated by Original Equipment Manufacturers (OEMs), involves precision engineering and assembly, transforming raw materials and components into market-ready machinery. This stage includes core value-addition activities such as advanced robotic welding, complex machining of critical drive train elements, application of protective coatings, and the integration of conditioning rolls or tines. Manufacturers differentiate themselves here through patented technologies related to cutting mechanics (e.g., quick-change blade systems), hydraulic flotation systems (to reduce ground pressure and minimize soil contamination), and sophisticated user-friendly digital interfaces for operational control. Post-manufacturing, the focus shifts to robust quality assurance and compliance testing to meet varying international safety and operational standards (e.g., ISO, CE), ensuring that the heavy investment in R&D translates into demonstrable field reliability and operator safety.

Distribution and downstream services are critical for market success and long-term customer satisfaction, creating enduring value for both manufacturer and end-user. The distribution network is primarily indirect, relying on established regional dealer networks providing localized sales presence, crucial financing options, immediate technical support, and critical parts availability. Dealers act as the essential bridge, offering necessary operator training, machine calibration, and immediate repair capabilities, significantly impacting customer loyalty and maximizing machine uptime during peak season. The lifecycle profitability of the market heavily depends on the aftermarket segment, where the sale of high-wear parts (blades, belts, skid shoes) and specialized technical services generates sustained revenue, ensuring that the value chain extends far beyond the initial high-value sale of the agricultural mower itself.

Agricultural Mowers Market Potential Customers

The core customer base for high-capacity agricultural mowers consists of large commercial farming enterprises specializing in row crops and high-volume livestock operations, particularly those focused on dairy and beef production, which demand substantial and continuous supplies of high-quality forage. These customers possess the financial capacity and scale to justify investment in self-propelled mowers or wide-span multi-unit trailed combinations that offer exceptional throughput and efficiency over thousands of hectares. Their purchasing criteria are centered around rigorous metrics such as acres per hour, total cost of ownership (TCO), cutting consistency, and the integration of advanced conditioning features that maximize drying speed and nutrient retention in the resulting hay or silage product, demonstrating a strong preference for flagship, technologically integrated models from Tier 1 global manufacturers.

Mid-sized and small family farms constitute a high-volume customer segment, although they often purchase lower-cost, highly versatile tractor-mounted implements, such as mid-range disc or flail mowers. For this demographic, flexibility and utility are paramount; they require equipment that can be used interchangeably for haying, routine pasture maintenance, and light residue cleanup, optimizing the utilization of their existing smaller tractor fleets. Affordability, ease of attachment via standardized PTO connections, simplified maintenance procedures, and robust local dealer support are the predominant factors driving their purchasing decisions, often favoring reputable regional brands or the utility lines offered by major global OEMs to ensure reliable access to spare parts and service expertise.

A rapidly growing customer base includes agricultural service contractors and shared equipment pools. These entities purchase high-end equipment not for their own land, but to offer specialized mowing and harvesting services to multiple smaller farms lacking the capital for individual ownership. Since their business model hinges entirely on equipment uptime and maximum efficiency across diverse client operations, they invest in the most robust, high-performance machinery available, often equipped with the latest telematics and remote monitoring features to optimize scheduling, utilization, and preventative maintenance across various client locations. Government agencies, including highway maintenance departments and large institutional land managers, also represent a stable niche segment requiring heavy-duty flail and boom mowers for roadside verges, parks, and other non-agricultural, public land maintenance applications that demand rugged reliability and compliance with specific safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, Alamo Group Inc., Claas KGaA mbH, Vermeer Corporation, Krone Group, Foton Lovol International Heavy Industry Co., Ltd., Zanon Srl, Sarp S.p.A., Ferri srl, Sitrex S.p.A., Schulte Industries, Maschio Gaspardo S.p.A., SaMASZ, Pottinger GmbH, Lely Holding N.V., Woods Equipment Company, Mahindra & Mahindra Ltd. (Farm Equipment Sector) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Mowers Market Key Technology Landscape

The technology landscape of the Agricultural Mowers Market is undergoing rapid transformation, moving beyond basic mechanical functionality towards sophisticated mechatronics and digital control integration. A primary advancement involves cutter bar and drive technology, specifically the widespread implementation of high-speed disc mowers with modular cutter bars that feature quick-change blades and individual drive protection (shear bolts or break-away clutches) to significantly minimize repair time and maximize precious uptime in the event of striking an obstacle. Furthermore, manufacturers are universally adopting lightweight, high-tensile steel and specialized composites for cutter bars and frames, significantly reducing the overall weight of the implement while maintaining superior rigidity and strength, leading to decreased power requirements and improved fuel efficiency for the towing tractor.

Precision agriculture tools are fundamentally integrated into modern mowing platforms as standard features. Telematics and high-precision GPS guidance systems (often RTK-enabled) are now common, allowing operators to map cut and uncut areas accurately, manage field boundaries, and optimize turnarounds at headlands using automated sequencing, thereby ensuring highly repeatable and efficient passes. This digital integration extends to the proactive monitoring of operational performance, where advanced sensors measure parameters like vibration, bearing temperature, blade sharpness, and crop flow, transmitting this critical data back to the tractor’s cab display or to cloud-based farm management platforms. This continuous data stream facilitates critical decision-making regarding machine performance and enables proactive maintenance scheduling, fundamentally shifting the market focus from reactive repairs to highly predictive asset management.

Looking ahead, the development of electrified and fully autonomous self-propelled systems represents the pinnacle of current Research and Development efforts. Electric mowers, primarily in the smaller utility segment or as concept self-propelled units, address growing global environmental concerns by eliminating direct carbon emissions and significantly reducing operational noise pollution, a crucial factor in densely populated agricultural regions. Furthermore, structural design improvements, such as optimized center-of-gravity placement and advanced suspension systems, enhance maneuverability and minimize soil compaction, a crucial factor in sustainable farming and protecting soil structure integrity. The commitment to developing robust, automated drivelines capable of handling the high forces generated by extremely wide cutting widths, while simultaneously ensuring system longevity and minimal energy consumption, defines the technological competitiveness in the future agricultural mowing market.

Regional Highlights

North America continues to be a powerhouse in the Agricultural Mowers Market, representing a substantial share of global revenue. The region is characterized by exceptionally large farm sizes and a high degree of technological readiness, favoring the robust adoption of wide-working-width mowers and massive self-propelled windrowers equipped with sophisticated conditioning units and integrated GPS technology. The market dynamics here are defined by low operational margins and high labor costs, making investment in speed, capacity, and automation absolutely critical for farmer profitability and operational viability. Key demand centers are the Midwest and California, where hay and alfalfa production is intensive, necessitating machines that can cover vast areas quickly and reliably. The region also acts as a primary testing ground for next-generation technologies, including semi-autonomous and robotic mowing solutions that integrate high-precision RTK guidance for optimized field coverage and efficiency, ensuring minimal crop loss and maximized resource utilization, maintaining North America's position as a leader in market value and technological maturity.

Europe holds a significant position, emphasizing high quality and environmental performance, driven by the European Union’s strong regulatory framework concerning emissions, noise pollution, and soil health (e.g., Stage V emissions standards). The structure of the European market, often involving complex topography and smaller, highly specialized family farms, necessitates mowers that are exceptionally versatile, highly maneuverable, and feature advanced ground contour following mechanisms, such as hydro-pneumatic suspension, to protect delicate swards and minimize soil contamination. Germany, Italy, and France are the largest consuming nations, driving demand for premium tandem and triple-mower combinations designed for precision cutting and gentle conditioning that respects the integrity of the soil structure. Furthermore, the strong political and societal push toward sustainable agriculture in Scandinavia and Central Europe is accelerating the market for low-emission and electric power solutions, influencing global OEM product strategies toward eco-friendly designs that promise reduced operational sound and a lower carbon footprint.

The Asia Pacific (APAC) market is the undeniable engine of volumetric growth, experiencing a profound transformation spurred by rapid agricultural modernization programs, particularly in Southeast Asia, China, and India, which hold the world’s largest agricultural labor force. While the sheer size of the farming population suggests massive potential, the current demand is dominated by affordable, robust, and easy-to-maintain tractor-mounted rotary and flail mowers suitable for small and medium landholdings, prioritizing low capital outlay over advanced features. Government subsidies and favorable financing schemes are instrumental in encouraging the transition from manual labor to mechanization, which is crucial for increasing national food output and stabilizing rural economies. As farm consolidation occurs and economic prosperity increases, the region is expected to swiftly move up the technology curve, creating a burgeoning market for medium-capacity, high-efficiency equipment with basic conditioning capabilities in the medium-to-long term, presenting significant opportunities for manufacturers who can localize production and service support effectively and understand the nuances of highly fragmented land ownership.

Latin America, particularly the agricultural powerhouses of Brazil and Argentina, demonstrates strong demand for robust, heavy-duty mowers essential for managing extensive cattle grazing land and large-scale forage production, supporting major global beef and dairy industries. The focus here is on durability and capacity to handle challenging, often uneven, terrain and dense tropical grasses, prioritizing mechanical strength and easy repairability over complex electronics due to logistical challenges in remote regions. The market is less focused on highly sophisticated electronics compared to North America or Europe, preferring mechanically reliable systems that are easy to service in remote locations with limited access to specialized technicians. Finally, the Middle East and Africa (MEA) represent fragmented but strategically important growth areas. Investment is concentrated in regions prioritizing food security, such as parts of North Africa and South Africa, driving demand for resilient and reliable mowers to support growing commercial feed production and pasture establishment projects, often funded or supported by international aid or government development funds seeking baseline mechanization capabilities to address regional food deficits efficiently and sustainably.

- North America: Market leader in value; characterized by high capacity self-propelled mowers, rapid adoption of automation (autonomy/robotics), and focus on efficiency due to severe labor scarcity and large commercial farm operations.

- Europe: Driven by strict environmental regulations and high demand for quality forage; strong segment growth for hybrid/electric mowers, and precision articulated mounted combinations optimized for varied field sizes and soil conservation.

- Asia Pacific (APAC): Highest projected CAGR; fueled by aggressive government mechanization policies; currently dominated by cost-effective tractor-mounted rotary and flail mowers for fragmented farmlands, with future growth expected in medium-capacity, conditioned machinery.

- Latin America: Demand centered on heavy-duty, robust, and mechanically simple mowers for vast pasture management and large-scale, high-volume forage harvesting in commercial zones like the Brazilian Cerrado and Argentine Pampas.

- Middle East and Africa (MEA): Emerging markets focusing on initial mechanization, reliable, and easily maintainable machinery to enhance local food security and support nascent commercial farming initiatives in stable economies across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Mowers Market.- Deere & Company

- CNH Industrial N.V. (Case IH, New Holland Agriculture)

- AGCO Corporation (Fendt, Massey Ferguson, Valtra)

- Kubota Corporation

- Alamo Group Inc.

- Claas KGaA mbH

- Vermeer Corporation

- Krone Group

- Foton Lovol International Heavy Industry Co., Ltd.

- Zanon Srl

- Sarp S.p.A.

- Ferri srl

- Sitrex S.p.A.

- Schulte Industries

- Maschio Gaspardo S.p.A.

- SaMASZ

- Pottinger GmbH

- Lely Holding N.V. (Forage division acquired by AGCO in 2017)

- Woods Equipment Company

- Mahindra & Mahindra Ltd. (Farm Equipment Sector)

Frequently Asked Questions

Analyze common user questions about the Agricultural Mowers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Agricultural Mowers Market?

The Agricultural Mowers Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 5.8% over the forecast period of 2026 to 2033, primarily driven by the intensification of global agricultural operations and the critical need for mechanized forage production systems.

Which type of agricultural mower currently holds the largest market share?

Rotary mowers, specifically high-speed disc mowers, command the largest market share due to their superior cutting efficiency, clean cut, and capacity for integrating conditioning systems, making them indispensable for high-volume commercial hay and silage production globally.

How is AI impacting the future development of agricultural mowers?

AI is fundamentally transforming the market by enabling autonomous field operations, optimizing fuel use through intelligent path planning, and facilitating advanced predictive maintenance, thereby significantly reducing labor costs and maximizing machine uptime for commercial farmers.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region, particularly countries undergoing rapid farm modernization like China and India, is projected to demonstrate the fastest market growth, supported by governmental subsidies promoting the mass adoption of mechanized agricultural equipment.

What are the primary factors restraining the market growth for advanced agricultural mowers?

The key restraints include the substantial high initial capital investment required for sophisticated, large-capacity mowers, volatility in global crop prices affecting farmer purchasing power, and the continued need for reliable infrastructure and skilled technical support in developing regions.

What role does conditioning technology play in modern mowing?

Conditioning technology is vital, as it crushes or crimps the cut forage stems immediately after cutting, dramatically accelerating the drying process. This speed is essential for preserving the maximum nutritional value (protein and energy content) of the harvested crop before baling or ensiling.

Why are self-propelled mowers gaining traction despite their higher cost?

Self-propelled mowers are preferred by large commercial enterprises because they offer the highest capacity (acres per hour), superior maneuverability, and dedicated chassis stability, leading to maximum efficiency, reduced soil compaction, and superior operator comfort during intensive, time-sensitive harvesting operations.

How do modern mowers address the issue of soil contamination in forage?

Modern mowers utilize advanced hydraulic and hydro-pneumatic flotation systems that allow the cutter bar to track ground contours precisely, minimizing ground pressure and preventing the blades from disturbing the soil surface, thereby significantly reducing ash content and contamination in the harvested forage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager