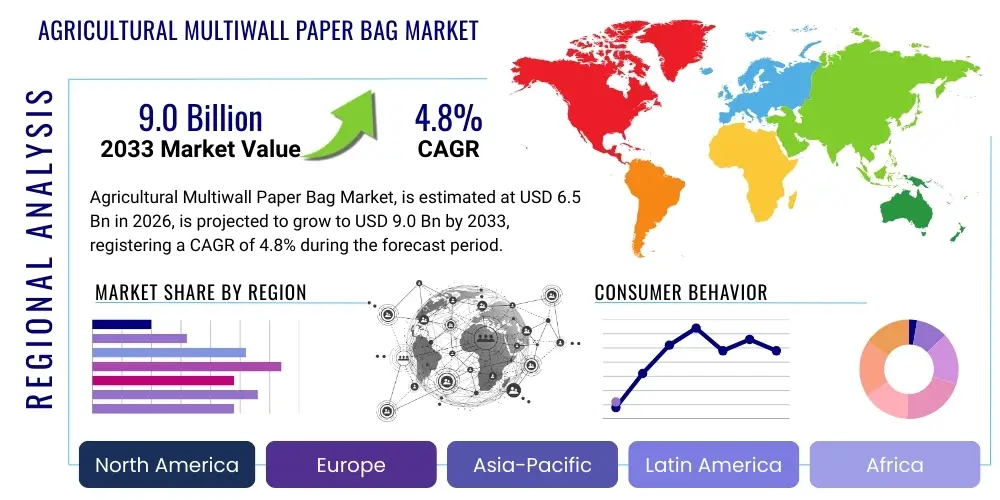

Agricultural Multiwall Paper Bag Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438411 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Agricultural Multiwall Paper Bag Market Size

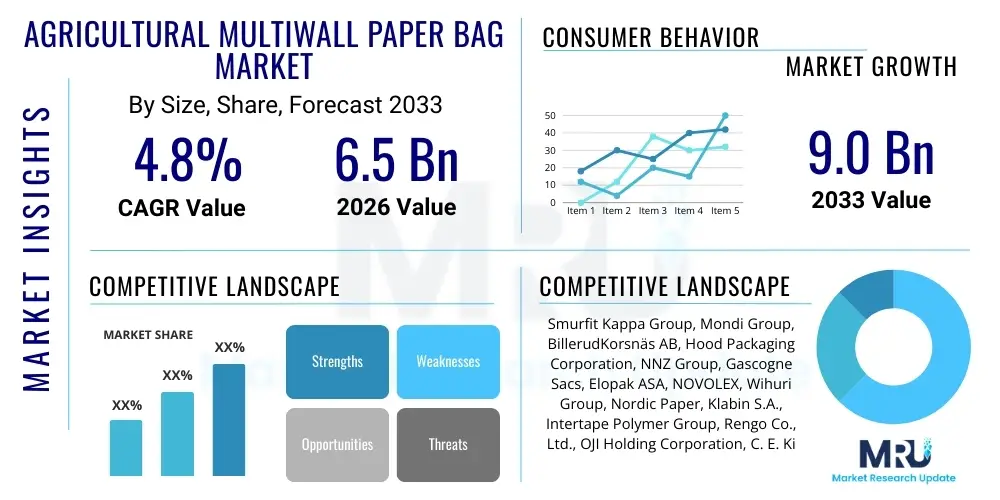

The Agricultural Multiwall Paper Bag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing global demand for sustainable packaging solutions in the agricultural sector, driven by stringent environmental regulations and rising consumer preference for bio-degradable materials over conventional plastic alternatives.

Market expansion is particularly robust in developing economies, where agricultural production is escalating rapidly to meet growing populations and shifting dietary habits. Multiwall paper bags offer exceptional structural integrity, crucial for the packaging, storage, and long-distance transport of granular agricultural products such as seeds, fertilizers, animal feed, and specialized chemical powders. The technological advancements in paper manufacturing, including enhanced barrier coatings and moisture resistance treatments, further solidify their position as the preferred packaging medium, ensuring product quality and minimizing spoilage during the supply chain lifecycle.

Agricultural Multiwall Paper Bag Market introduction

The Agricultural Multiwall Paper Bag Market encompasses the production, distribution, and consumption of heavy-duty bags constructed from multiple layers of high-strength paper, engineered specifically for agricultural applications. These bags are essential packaging formats designed to handle large volumes and heavy loads of agricultural inputs and outputs, offering critical protection against moisture, punctures, and external contaminants. The product is defined by its layered structure, often incorporating internal plastic liners or specialized coatings to enhance barrier properties, making it suitable for hygroscopic materials like fertilizers and certain types of seed.

Major applications of multiwall paper bags span across diverse agricultural segments, including the packaging of animal feed formulations, fertilizers (both granular and powdered), various types of seeds (corn, wheat, rice), specialized agricultural chemicals, and crop protection products. The key benefits driving adoption include superior stacking strength, eco-friendliness due to biodegradability and recyclability, and excellent printability for branding and compliance labeling. These factors are particularly vital in markets emphasizing sustainable practices and traceable supply chains.

The market growth is primarily driven by the surging global demand for food security, which necessitates increased fertilizer and seed usage, alongside the regulatory push for plastic reduction. Furthermore, the efficiency and cost-effectiveness of automated filling and sealing processes compatible with multiwall bags contribute significantly to their continued penetration across commercial farming operations globally. The ongoing transition towards precision agriculture also indirectly supports this market by increasing demand for highly specialized, small-batch fertilizers and supplements requiring robust packaging.

Agricultural Multiwall Paper Bag Market Executive Summary

The Agricultural Multiwall Paper Bag Market is characterized by robust growth projections, fueled by fundamental shifts in environmental mandates and the increasing mechanization of agricultural logistics across major producing regions. Key business trends include aggressive capacity expansion by major manufacturers in Asia Pacific and Eastern Europe to capitalize on low-cost labor and proximity to raw material sources (pulp and paper). Furthermore, strategic mergers and acquisitions focused on vertical integration—from paper production to bag conversion—are prominent, allowing companies to control quality, manage supply chain volatility, and achieve economies of scale necessary to compete effectively against flexible plastic packaging alternatives.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, primarily due to the vast agricultural acreage in countries like India, China, and Southeast Asian nations, coupled with escalating government initiatives promoting sustainable farming and packaging. Europe and North America, while mature, are seeing sustained demand driven by strict recycling and waste reduction goals, forcing agricultural companies to transition away from non-recyclable plastic sacks. Latin America, particularly Brazil and Argentina, represents a significant growth vector owing to their massive export-oriented agricultural sectors (soybeans, corn, beef), which demand reliable, internationally compliant packaging standards.

In terms of segments, the Paste Valve segment is anticipated to maintain leadership due to its suitability for high-speed, automated filling lines commonly used for granular fertilizers and cementitious products, offering excellent dust control and minimal product leakage. Concurrently, the Seed segment, though smaller in volume than fertilizer or feed, exhibits high-value growth potential driven by the packaging requirements of high-value, treated seeds that necessitate superior moisture barriers and structural protection. The demand for recyclable and compostable bags (Material segment) is rapidly outpacing traditional virgin paper bags, reflecting the overarching corporate focus on achieving circular economy goals within the agricultural supply chain.

AI Impact Analysis on Agricultural Multiwall Paper Bag Market

User queries regarding AI's influence on the multiwall paper bag market primarily revolve around three areas: optimizing supply chain logistics, enhancing quality control during manufacturing, and predicting raw material price fluctuations (pulp and paper). Users seek confirmation on whether AI-driven demand forecasting will lead to more efficient production schedules, reducing waste and lead times. There is a strong concern regarding the integration of AI-powered vision systems for defect detection in high-speed bag production, ensuring the structural integrity essential for heavy agricultural contents. Furthermore, agricultural input companies inquire about using predictive analytics, often powered by machine learning, to anticipate seasonal spikes in demand for specific feed or fertilizer packaging types based on localized weather patterns and crop yield forecasts, thereby optimizing bag inventory management and minimizing holding costs across the supply chain.

- AI-driven Predictive Maintenance: Utilizing sensor data on converting machinery to predict equipment failure, minimizing unplanned downtime and maximizing production efficiency for multiwall bag manufacturers.

- Optimized Supply Chain Logistics: Machine learning algorithms analyze historical shipping data, warehouse capacity, and transport costs to optimize the distribution routes of finished bags to agricultural customers.

- Enhanced Quality Control (QC): AI-powered vision systems automatically detect minute defects (e.g., inadequate glue seams, printing errors, weak paper layers) at high speeds during the manufacturing process, ensuring superior bag reliability.

- Demand Forecasting Accuracy: AI models integrate diverse data sources—weather patterns, commodity prices, and historical sales—to generate highly accurate predictions of seasonal and regional demand for specific bag formats (e.g., 25kg fertilizer bags vs. 50lb feed bags).

- Raw Material Price Prediction: Using natural language processing (NLP) and time-series analysis to model global pulp market dynamics, helping procurement teams lock in optimal pricing for kraft paper supplies.

- Waste Reduction Strategies: AI identifies patterns in material usage and cutting optimization during the bag formation process, leading to significant reduction in paper waste and improving overall resource efficiency.

DRO & Impact Forces Of Agricultural Multiwall Paper Bag Market

The dynamics of the Agricultural Multiwall Paper Bag Market are governed by a complex interplay of environmental regulations, technological advancements, and raw material volatility. The primary drivers are the worldwide legislative shift favoring sustainable packaging and the robust growth in global agricultural trade, necessitating durable and compliant packaging. However, the market faces significant restraints, chiefly the sustained price volatility of virgin kraft paper pulp and the fierce competition presented by advanced plastic woven sacks, which often offer superior moisture barriers and cost-effectiveness in certain high-humidity applications. Opportunities lie predominantly in developing specialized, high-barrier bio-plastic lined multiwall bags and expanding penetration in emerging markets with rapidly industrializing agricultural sectors.

The market is critically influenced by several key impact forces. The substitution threat is moderate to high; while paper bags are environmentally superior, the performance parity of durable plastic alternatives keeps pricing pressure high. The bargaining power of buyers (large fertilizer producers, seed companies) is significant due to the standardized nature of the product and the volume of procurement, compelling manufacturers to focus heavily on operational efficiencies and cost control. Conversely, the bargaining power of suppliers (pulp and paper mills) is moderate, fluctuating based on global wood fiber availability and geopolitical factors affecting forestry practices and trade.

Technological advancement serves as a pivotal impact force, particularly innovation in water-based barrier coatings and recyclable films, which directly address the historical weaknesses of paper bags (susceptibility to moisture). Manufacturers are constantly investing in faster and more precise automated machinery to improve manufacturing throughput and reduce labor costs, thereby strengthening profitability margins. Furthermore, the growing trend of corporate social responsibility (CSR) initiatives across the agricultural value chain acts as a powerful external force, pushing key stakeholders toward verifiable, sustainable packaging solutions, a space where multiwall paper bags hold a distinct advantage.

- Drivers (D):

- Increasing global focus on sustainable and biodegradable packaging solutions mandated by governmental regulations (e.g., EU directives).

- Rising demand for fertilizers, seeds, and animal feed driven by population growth and commercial farming expansion in APAC and Latin America.

- Superior stacking strength and compatibility with high-speed automated filling equipment.

- Restraints (R):

- High volatility and escalating costs of virgin kraft paper pulp, impacting manufacturing margins.

- Competition from cheaper and highly durable plastic woven sacks (PP woven bags) and FIBCs (Flexible Intermediate Bulk Containers).

- Susceptibility of standard paper bags to moisture and tear without specialized, often costly, barrier layers.

- Opportunities (O):

- Development and commercialization of multiwall paper bags incorporating advanced, compostable barrier films.

- Market penetration expansion into specialized, high-margin agricultural segments such as organic fertilizers and premium animal nutrition supplements.

- Adoption of smart packaging technologies (RFID, QR codes) integrated into multiwall bags for enhanced traceability and anti-counterfeiting measures.

- Impact Forces:

- Threat of New Entrants: Low (High capital investment and complex machinery required).

- Bargaining Power of Buyers: High (Volume procurement by large agribusinesses).

- Bargaining Power of Suppliers: Moderate (Dependent on global pulp market cyclicality).

- Threat of Substitutes: Moderate to High (Plastic sacks remain a strong, low-cost substitute).

- Intensity of Rivalry: High (Fragmented market with intense price competition among regional and global players).

Segmentation Analysis

The Agricultural Multiwall Paper Bag Market is segmented based on the core structure (Bag Type), the material composition (Material), the closure mechanism (Closure Type), and the specific agricultural end-user application (Application). This detailed segmentation allows stakeholders to analyze nuanced demand patterns. For instance, the demand for bags with built-in moisture barriers (Material segment) is crucial for the Fertilizer application segment, while the Feed segment emphasizes high strength and anti-slip outer layers for secure stacking. Analyzing these segments helps manufacturers align their product innovation and marketing strategies with the specific technical and logistical requirements of different agricultural customers, ensuring maximized market capture and optimized product portfolio management across diverse geographies and farming practices.

- Bag Type:

- Sewn Open Mouth (SOM) Bags

- Pinched Bottom Open Mouth (PBOM) Bags

- Paste Valve Bags

- Self-Opening Square Bottom (SOS) Bags

- Material:

- Recycled Kraft Paper

- Virgin Kraft Paper

- Paper with PE Liner

- Paper with Aluminum Foil Barrier

- Closure Type:

- Adhesive/Heat Seal

- Stitch/Sewn Closure

- Valve Closure

- Application:

- Fertilizers and Soil Amendments

- Animal Feed (Poultry, Cattle, Swine)

- Seeds and Grains

- Agricultural Chemicals and Crop Protection Products

- Flour and Starch

- Dairy and Milk Powder

Value Chain Analysis For Agricultural Multiwall Paper Bag Market

The value chain for the Agricultural Multiwall Paper Bag Market begins with the upstream procurement of raw materials, predominantly wood pulp and virgin or recycled kraft paper, often sourced from large integrated pulp and paper mills. This stage is highly critical as raw material costs represent the largest expense component in bag manufacturing. Further upstream inputs include specialized adhesives, inks for printing, and barrier materials like polyethylene (PE) or polypropylene (PP) films required for moisture-sensitive contents. Efficiency in managing these raw material streams, particularly minimizing waste during paper conversion, is key to maintaining competitive pricing in the downstream market.

The core manufacturing and conversion process involves printing, layering, forming the tube, and finally closing the bottom (sewing, pasting, or pinching), often utilizing highly automated machinery. Manufacturers must continuously invest in high-speed converting equipment to meet the volume demands of agricultural clients. The distribution channel is crucial; direct distribution often occurs between large bag manufacturers and major agribusinesses (Tier 1 customers like multinational fertilizer corporations), facilitating custom specifications and bulk ordering. Indirect distribution involves packaging distributors and wholesalers who service smaller regional agricultural cooperatives, independent farms, and smaller feed mills.

Downstream analysis focuses on the end-users, primarily agricultural producers and input suppliers (fertilizer, seed, feed companies). Efficiency at this stage is determined by the bag’s performance during automated filling, stacking, storage, and eventual end-user handling. The movement toward sustainable packaging also forces downstream users to consider the end-of-life characteristics, favoring bags that are easily recyclable or compostable. The entire value chain is currently emphasizing traceability and sustainable sourcing certifications, driven by regulatory compliance and consumer scrutiny regarding the environmental footprint of agricultural products.

Agricultural Multiwall Paper Bag Market Potential Customers

The primary potential customers and end-users of agricultural multiwall paper bags are the large, multinational corporations and regional enterprises specializing in the production and distribution of foundational agricultural inputs. These customers require high volumes of reliable packaging that guarantees product integrity from the production line through to field application or animal consumption. Key buyers include global fertilizer manufacturers (e.g., producers of urea, NPK blends, DAP), who rely on the structural stability and moisture protection offered by paper valve bags for high-density, granular products.

Another crucial segment comprises major animal nutrition and feed manufacturers, covering feed for poultry, swine, and cattle. These entities require highly branded, aesthetically pleasing bags that offer robust protection against pest infestation and moisture ingress, often using Sewn Open Mouth or Pinched Bottom bags. The high-stakes seed industry, dealing with valuable genetically modified or specially treated seeds, constitutes a high-margin customer base demanding exceptionally strong, often smaller-sized multiwall bags with superior moisture and oxygen barriers to preserve seed viability over extended periods.

Additionally, smaller, niche market customers include regional agricultural chemical formulators, flour mills catering to rural areas, and specialized producers of organic soil amendments and peat moss products. These buyers often prioritize flexibility in order size and specialized features such as handle cuts or easy-open strips. The market is increasingly seeing demand from customers who require packaging aligned with specific certifications (e.g., FSC certified paper), demonstrating a strong commitment to sustainable raw material sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smurfit Kappa Group, Mondi Group, BillerudKorsnäs AB, Hood Packaging Corporation, NNZ Group, Gascogne Sacs, Elopak ASA, NOVOLEX, Wihuri Group, Nordic Paper, Klabin S.A., Intertape Polymer Group, Rengo Co., Ltd., OJI Holding Corporation, C. E. King Limited, Bemis Company Inc., Rosenflex (UK) Ltd., Sanwei Packaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Multiwall Paper Bag Market Key Technology Landscape

The technological landscape of the agricultural multiwall paper bag market is primarily focused on enhancing efficiency, improving barrier properties, and integrating sustainability features. One major technological advancement involves high-speed tuber and bottomer machinery, which utilizes advanced robotics and precision gluing systems to significantly increase production throughput and reduce labor requirements per unit. Modern converting lines incorporate inline quality inspection systems, often based on machine vision technology, to detect structural flaws, inconsistencies in adhesive application, and printing registration errors instantaneously, ensuring that every bag meets the stringent performance requirements for heavy agricultural loads and automated filling processes.

Another critical area of innovation is in functional coating and barrier technologies. Traditional multiwall bags often required a plastic inner liner (PE) for moisture resistance, complicating recycling. Current research and development are concentrated on developing water-based, fully recyclable barrier coatings that can be applied directly to the paper layers. These coatings, based on modified polymers or specialized mineral-based compounds, provide comparable moisture vapor transmission rates (MVTR) to thin plastic films, but allow the entire bag structure to be categorized as paper-recyclable, directly addressing the circular economy goals of end-users and regulatory bodies.

Furthermore, technology is enhancing the customization and differentiation of the product. Digital printing and flexographic technologies have evolved to allow for high-resolution, multi-color graphics directly onto the kraft paper surface, enabling agricultural companies to use their packaging for enhanced branding and essential regulatory information display. Integrated technologies such as micro-perforation systems are being employed to allow for optimal air release during high-speed filling (especially for powdered products like milk replacers or fine fertilizers) while maintaining minimal product leakage, optimizing both the filling process and the stability of the palletized load during transit.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand for agricultural multiwall paper bags, dictated by local farming intensity, regulatory frameworks concerning packaging waste, and infrastructural capabilities. Asia Pacific (APAC) is unequivocally the largest and fastest-growing market, driven by massive agricultural output from nations like China and India, coupled with rapid urbanization that demands sophisticated packaging for processed feed and seeds. Government policies across Southeast Asia, particularly concerning rice and palm oil production, necessitate robust, cost-effective packaging, positioning APAC as the powerhouse of global demand for these packaging formats. The region is also becoming a major manufacturing hub due to lower operational costs, leading to high production capacity dedicated to both domestic consumption and exports.

North America and Europe represent mature markets characterized by high adoption rates of automated filling systems and strong regulatory emphasis on sustainability. In Europe, the push toward bio-based packaging, influenced by EU directives on single-use plastics and recycling targets, ensures steady, high-value growth for paper bag manufacturers specializing in complex, eco-friendly barrier solutions. North America, driven primarily by large-scale commercial farming of corn, soybeans, and wheat, demands multiwall bags that prioritize extreme durability and compatibility with high-speed, 24/7 industrial operations. Latin America is rapidly emerging, with Brazil and Argentina driving substantial demand, particularly in the fertilizer and animal feed sectors, fueled by their roles as global agricultural commodity exporters.

- Asia Pacific (APAC): Dominates in terms of volume and growth rate. Driven by large populations, intensive farming, and increasing transition from traditional packaging to multiwall formats for rice, seeds, and fertilizer. Key countries: China, India, Indonesia.

- Europe: High-value market focused on sustainability, innovation in compostable barriers, and high-performance bags for specialized applications, such as dairy products and premium organic fertilizers. Regulatory mandates strongly support paper over plastic. Key countries: Germany, France, Italy.

- North America: Characterized by large-scale industrial farming operations, requiring high-strength bags optimized for automated filling and palletizing, particularly in the animal feed and seed sectors. Key countries: United States, Canada.

- Latin America (LATAM): Rapid growth fueled by massive agricultural export industries (soy, corn). Demand centers around durable packaging for bulk fertilizers and feed, balancing cost and performance. Key countries: Brazil, Argentina.

- Middle East and Africa (MEA): Emerging market with growing demand driven by increasing investment in domestic agriculture and livestock farming, leading to a rising need for imported and domestically packaged feed and fertilizer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Multiwall Paper Bag Market.- Smurfit Kappa Group

- Mondi Group

- BillerudKorsnäs AB

- Hood Packaging Corporation

- NNZ Group

- Gascogne Sacs

- Elopak ASA

- NOVOLEX

- Wihuri Group

- Nordic Paper

- Klabin S.A.

- Intertape Polymer Group

- Rengo Co., Ltd.

- OJI Holding Corporation

- C. E. King Limited

- Bemis Company Inc.

- Rosenflex (UK) Ltd.

- Sanwei Packaging

- Coveris Holdings S.A.

- Georgia-Pacific LLC

Frequently Asked Questions

Analyze common user questions about the Agricultural Multiwall Paper Bag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Agricultural Multiwall Paper Bag Market?

The primary driver is the accelerating global transition towards sustainable packaging, mandated by stringent environmental regulations and rising consumer preference for bio-degradable alternatives over traditional plastic packaging across key agricultural input sectors like fertilizer and animal feed. This shift is strongly supported by the need for robust, yet eco-friendly, packaging solutions compatible with high-speed automated logistics.

How does the volatility of raw material costs impact the profitability of multiwall bag manufacturers?

The profitability is significantly impacted by the price volatility of virgin and recycled kraft paper pulp, which constitutes the largest single input cost. Manufacturers must employ sophisticated hedging strategies and focus on operational efficiencies, such as minimizing trim waste and optimizing supply chain logistics, to mitigate these cost fluctuations and maintain competitive pricing in the downstream agricultural sector.

Which bag closure type is most prevalent for high-volume granular agricultural products like fertilizers?

The Paste Valve Bag closure type is most prevalent for high-volume, granular agricultural products, particularly fertilizers and cementitious materials. The valve mechanism allows for efficient, dust-free filling on automated equipment and offers excellent stacking stability and hermetic sealing upon filling, minimizing product leakage and contamination throughout the supply chain.

What are the key technological advancements addressing the moisture vulnerability of multiwall paper bags?

Key technological advancements focus on developing highly effective, fully recyclable barrier coatings. These specialized, water-based coatings, when applied directly to the inner paper layers, provide moisture vapor resistance comparable to thin plastic liners, allowing the resultant multiwall bag structure to be classified as mono-material (paper) for easier end-of-life recycling and disposal.

Which geographical region holds the largest market share and why is its growth rate so high?

Asia Pacific (APAC) holds the largest market share and exhibits the highest growth rate. This is due to the sheer scale of agricultural production in countries like China and India, increasing governmental focus on modernizing post-harvest logistics, and rising domestic consumption of packaged animal feed and high-quality seeds, all requiring robust and scalable multiwall packaging solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager