Agricultural Pesticides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432282 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Agricultural Pesticides Market Size

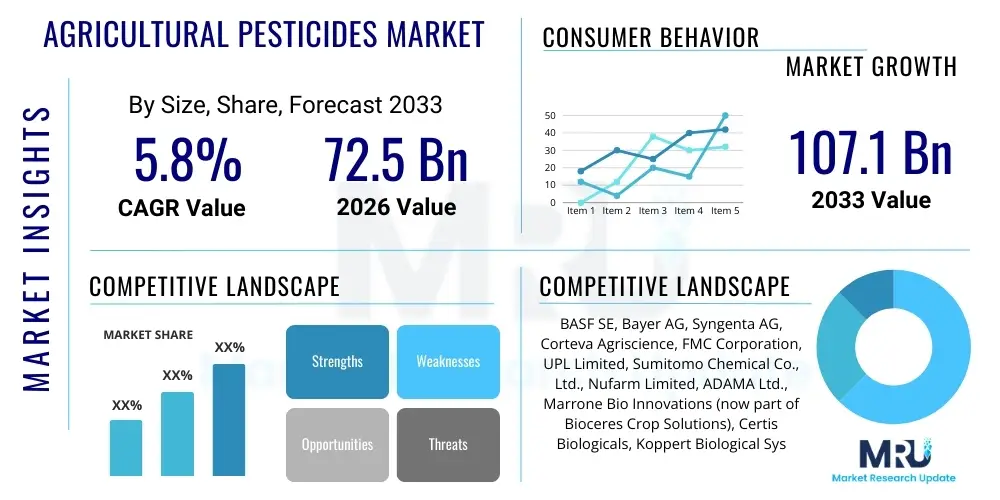

The Agricultural Pesticides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $72.5 Billion in 2026 and is projected to reach $107.1 Billion by the end of the forecast period in 2033.

Agricultural Pesticides Market introduction

The Agricultural Pesticides Market encompasses the manufacturing and distribution of chemical and biological agents designed to protect crops from pests, weeds, and diseases, thereby enhancing crop yield and quality. These products, ranging from synthetic conventional pesticides like herbicides, insecticides, and fungicides, to rapidly evolving biological solutions such as biopesticides and biofertilizers, are critical inputs in modern agriculture globally. The primary objective is to manage biotic stress factors that severely impact productivity, ensuring food security for a growing global population. The increasing pressure on arable land and the need for high-efficiency farming practices have firmly established pesticides as indispensable components of the agricultural value chain, driving continuous innovation in formulation and application techniques.

The product description spans across various chemical classes, including organophosphates, carbamates, pyrethroids, and neonicotinoids, although the market trend is shifting towards reduced-risk products due to stringent regulatory scrutiny. Major applications include row crop protection (corn, soybeans, wheat), fruits and vegetables, and plantation crops. The market benefits significantly from increased farming intensity in developing regions, the rise of genetically modified (GM) crops that require specific pesticide regimes, and the adoption of integrated pest management (IPM) strategies. These products offer tangible benefits such as increased yields, improved product quality, and reduced post-harvest losses, translating directly into economic stability for farmers.

Key driving factors fueling market expansion include the decreasing availability of farm labor, necessitating effective chemical control methods, coupled with escalating global food demand driven by demographic growth and urbanization. Furthermore, the persistent threat posed by herbicide-resistant weeds and insecticide-resistant pests compels manufacturers to invest heavily in research and development, introducing novel active ingredients and sophisticated delivery systems. While environmental concerns and regulatory hurdles (especially in the European Union) temper growth, the underlying necessity for efficient crop protection against biological adversaries ensures robust market momentum.

Agricultural Pesticides Market Executive Summary

The Agricultural Pesticides Market demonstrates robust resilience underpinned by structural demand for global food supply, despite facing significant headwinds related to sustainability and chemical residue concerns. Business trends highlight a pronounced shift toward R&D investment focused on biologicals and specialized precision agriculture application methods, moving away from broad-spectrum conventional pesticides. Mergers and acquisitions remain a crucial strategy for key industry players to consolidate intellectual property portfolios, specifically around seed technology and crop protection integration, ensuring end-to-end solutions for farmers. The emphasis on digital agriculture platforms, providing predictive analytics for pest outbreaks and optimized application timing, represents the leading technological advancement shaping the competitive landscape and improving product efficacy and environmental profiles.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by vast agricultural lands, increasing mechanization, and government subsidies encouraging intensive farming practices, particularly in China and India. North America and Europe, while being mature markets, drive premiumization, focusing heavily on regulatory compliance, low-toxicity products, and advanced formulation development. Latin America, specifically Brazil and Argentina, represents a critical market due to extensive soybean and corn production, exhibiting high consumption rates for both herbicides and fungicides necessary to manage intense tropical pest pressure. These regional disparities dictate product mix, with conventional synthetic chemicals dominating emerging economies, while biologicals gain ground rapidly in stringent regulatory environments.

In terms of segment trends, Herbicides maintain the largest market share due to the widespread necessity of weed control in major crops, closely followed by Fungicides, driven by increasing disease incidence related to changing climate patterns. However, the Biopesticides segment is witnessing the highest CAGR, spurred by consumer demand for residue-free produce and governmental initiatives promoting sustainable agriculture (IPM). Furthermore, seed treatment applications are gaining prominence as a targeted, low-dosage method of early crop protection. The market structure is increasingly bifurcated between high-volume, cost-effective generic products and proprietary, high-value, novel formulations offering superior performance and favorable environmental profiles, ensuring innovation remains central to market competitiveness.

AI Impact Analysis on Agricultural Pesticides Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Agricultural Pesticides Market predominantly center on how AI can reduce overall pesticide use, improve targeted application efficiency, and support the shift towards sustainable farming models. Key themes include the implementation of precision scouting and disease prediction models to minimize prophylactic spraying, the role of AI-driven robotics in ultra-precise pesticide delivery, and the creation of novel active ingredients using AI-powered chemical synthesis simulation. Users are keen to understand the economic viability of integrating complex AI platforms with existing farming infrastructure and how AI data can assist regulatory bodies in monitoring pesticide efficacy and environmental fate. The central expectation is that AI will fundamentally transition pesticide use from broad-scale application to highly localized, needs-based intervention, thereby mitigating environmental risks while maximizing crop protection effectiveness and optimizing farmer return on investment.

- AI-Powered Disease and Pest Prediction: Utilizing machine learning algorithms on satellite imagery, drone footage, and historical climate data to accurately forecast outbreaks, enabling preventative, targeted spraying rather than calendar-based application.

- Precision Spraying Optimization: AI algorithms guiding variable rate technology (VRT) nozzles on sprayers and drones, ensuring pesticides are only applied where necessary, drastically reducing input volumes and minimizing drift and runoff.

- Autonomous Scouting and Monitoring: Implementation of computer vision and deep learning models on autonomous ground vehicles (AGVs) or drones for real-time identification of specific pests and weeds, defining application zones with centimeter-level accuracy.

- Accelerated Active Ingredient Discovery: AI and computational chemistry speeding up the R&D process for novel, safer, and highly efficacious biological or synthetic compounds, reducing the time and cost associated with laboratory screening.

- Supply Chain and Inventory Management: AI improving demand forecasting and logistics for pesticide distributors, ensuring regional availability of specific formulations required during high-risk application windows, thus preventing crop loss due to supply delays.

- Regulatory Compliance and Reporting: Automated data collection and AI-driven reporting tools simplifying complex regulatory requirements for farmers regarding pesticide usage history, environmental impact, and residue management.

DRO & Impact Forces Of Agricultural Pesticides Market

The dynamics of the Agricultural Pesticides Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive environment and future trajectory. Drivers predominantly include the essential need to secure global food supplies for an expanding population, coupled with diminishing arable land resources, necessitating yield maximization through effective crop protection. The increasing prevalence of pest resistance, demanding continual innovation in product chemistry, also acts as a fundamental driver. Conversely, significant restraints are imposed by increasingly stringent regulatory environments, particularly in developed economies, focusing on reducing maximum residue limits (MRLs) and banning certain high-toxicity legacy chemistries. Public and consumer aversion to chemical residues, alongside environmental concerns regarding water and soil contamination, represent persistent market constraints that push innovation toward biological alternatives.

Opportunities for growth are concentrated in the rapidly expanding biologicals segment, including bioinsecticides, biofungicides, and bionematicides, which offer sustainable solutions appealing to organic and sustainable farming mandates. Furthermore, the integration of advanced digital farming technologies, such as IoT sensors, drones, and AI-guided VRT systems, presents a massive opportunity to enhance pesticide efficacy and reduce application rates, thereby improving the economic and environmental value proposition. Developing economies in APAC and Latin America, characterized by large, unprotected acreage and the rapid adoption of intensive agriculture, offer substantial untapped market potential for established synthetic and emerging biological products.

The primary impact forces acting on the market structure include intense regulatory scrutiny (Political/Legal force) demanding heavy R&D expenditure for registration and compliance, and technological advancements (Technological force) enabling precision application and faster discovery of novel chemistries. Additionally, shifting consumer preferences (Social force) towards residue-free and sustainably produced food fundamentally alters demand patterns, favoring biopesticides and integrated pest management (IPM) strategies. These forces collectively compel incumbent manufacturers to divest from older, riskier chemistries and pivot strategic resources towards high-value, digitally-enabled, and biologically-derived solutions, significantly raising the barriers to entry for new conventional competitors while simultaneously opening the field for specialized biological startups.

Segmentation Analysis

The Agricultural Pesticides Market is comprehensively segmented based on Type, Crop Type, Application, and Formulation. This granular segmentation is essential for understanding shifting consumption patterns and tailoring product development to specific agricultural needs globally. The Type segment, differentiating between conventional synthetic chemicals and biological products, illustrates the dichotomy of the modern market, where conventional high-volume segments coexist with rapidly growing, low-toxicity biological solutions. Crop Type segmentation reveals the highest revenue concentration in staple food production (cereals and grains), but faster growth in high-value horticulture crops (fruits and vegetables), driven by stricter quality standards and intensive farming practices requiring frequent specialized treatments. Formulation type highlights the shift towards water-dispersible granules (WG) and suspension concentrates (SC) for improved handling and efficacy, while application methods underscore the rising importance of targeted, high-precision delivery systems like seed treatment and soil application to minimize environmental dispersion.

- By Type:

- Synthetic Pesticides (Conventional)

- Herbicides

- Insecticides

- Fungicides

- Others (Nematicides, Rodenticides)

- Biopesticides (Biological)

- Bioherbicides

- Bioinsecticides

- Biofungicides

- Others (Bionematicides)

- By Crop Type:

- Cereals & Grains (Wheat, Maize, Rice)

- Fruits & Vegetables

- Oilseeds & Pulses (Soybeans, Canola)

- Other Crops (Cotton, Sugarcane, Plantation Crops)

- By Application Method:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post-Harvest

- By Formulation:

- Dry Formulations (Wettable Powders, Granules)

- Liquid Formulations (Suspension Concentrates, Emulsifiable Concentrates)

Value Chain Analysis For Agricultural Pesticides Market

The value chain for the Agricultural Pesticides Market is intricate, spanning from raw material sourcing and R&D through to manufacturing, distribution, and final application. Upstream activities are dominated by specialized chemical manufacturers providing active ingredients (AIs) and inert carriers, requiring significant capital investment in highly regulated chemical processes. The most critical upstream element is the extensive, multi-year R&D phase necessary to discover, test, and register a new conventional AI, often costing hundreds of millions of dollars. For biological products, the upstream focuses more on strain isolation, fermentation, and mass production of microbial agents or botanical extracts, which demands specialized biological expertise rather than heavy chemistry infrastructure.

Midstream activities involve the formulation and manufacturing processes where AIs are combined with inert ingredients to create commercially viable products (e.g., EC, SC, WG). This stage is crucial for ensuring product stability, shelf life, and efficacy upon application. Distribution forms the backbone of the downstream segment, relying on a vast network that includes primary distributors, regional wholesalers, local agro-dealers, and cooperatives. Direct sales channels are increasingly utilized by major manufacturers, particularly for large commercial farms, to offer bundled solutions incorporating seeds, fertilizers, and digital advisory services alongside pesticides.

The final downstream users, the farmers, rely heavily on agricultural extension services and local dealers for product recommendation, usage instructions, and safety protocols. The increasing shift towards precision agriculture mandates that distribution channels must now also deliver technical training and integrate sophisticated digital tools for optimal product application. The dual nature of the distribution—large-scale bulk sales to commercial farms versus smaller-scale sales through local retail outlets—requires a highly adaptable supply chain structure. Indirect channels, through large regional distributors, handle the majority of volume, while direct engagement facilitates high-value integrated solutions and quicker market penetration for novel products.

Agricultural Pesticides Market Potential Customers

The primary end-users and buyers of agricultural pesticides are defined by their scale of operation, crop diversity, and adoption rate of modern farming techniques. The largest segment of potential customers comprises large-scale commercial farming enterprises focused on high-volume row crops such as corn, soybeans, and wheat, particularly in North America, South America, and Eastern Europe. These industrial farms prioritize cost-efficiency, broad-spectrum control, and compatibility with mechanized application equipment, making them the primary consumers of high-volume synthetic herbicides and fungicides used for resistance management and yield stabilization. These customers often negotiate directly with major global manufacturers or large distributors for comprehensive input contracts.

A second crucial segment includes horticulture and specialty crop producers (fruits, vegetables, vineyards, and ornamental crops). These customers demand specialized, high-performance pesticides, often with short pre-harvest intervals (PHIs) and low environmental impact, given the direct consumption of their produce. This segment is a key driver for the biopesticides market, as quality standards, appearance, and residue management are paramount. Small and medium-sized farmers, particularly prevalent across Asia Pacific and Africa, form the third significant customer base. While consumption per farm is lower, the sheer number of these operations makes them essential for volume. This segment often relies on affordable, generic formulations and guidance provided through government extension services or local agro-dealers, focusing on managing staple food crops like rice and maize.

The emerging customer base includes organic and sustainable farming operations and large corporate food processing companies that influence input decisions across their supply chains. These customers increasingly mandate the use of IPM strategies and biopesticides to meet specific sustainability targets and consumer demands for environmentally responsible food production. Furthermore, entities involved in public health and infrastructure maintenance, such as mosquito control and vegetation management along railway lines, also constitute a niche but consistent market for specialized pesticide formulations and services, expanding the traditional agricultural focus.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $72.5 Billion |

| Market Forecast in 2033 | $107.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation, UPL Limited, Sumitomo Chemical Co., Ltd., Nufarm Limited, ADAMA Ltd., Marrone Bio Innovations (now part of Bioceres Crop Solutions), Certis Biologicals, Koppert Biological Systems, Isagro S.p.A., Gowan Company, Mitsui Chemicals Agro, Inc., Dow Inc., Nippon Soda Co., Ltd., Novozymes, BioWorks, Inc., Chr. Hansen Holding A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Pesticides Market Key Technology Landscape

The technological landscape of the Agricultural Pesticides Market is rapidly evolving, driven primarily by the need for enhanced efficacy, reduced environmental footprint, and compliance with strict residue limits. Formulation technology represents a crucial area of innovation, with manufacturers moving away from older, solvent-based emulsifiable concentrates (ECs) toward safer, more effective aqueous systems like suspension concentrates (SCs), micro-encapsulation, and water-dispersible granules (WDGs). Micro-encapsulation technology, in particular, is vital as it allows for controlled and sustained release of the active ingredient, enhancing residual activity, reducing volatility, and protecting the active molecules from rapid degradation by UV light or moisture. This improves the cost-effectiveness for farmers by requiring fewer applications and ensuring better crop protection throughout critical growth stages.

A second major technological frontier is the integration of digital tools, which is transforming application methodology. Precision agriculture technologies, including satellite imagery, drone mapping, GPS guidance, and variable rate technology (VRT) sprayers, are enabling site-specific pest management. These systems utilize data fusion and machine learning algorithms (as detailed in the AI analysis) to generate prescription maps, dictating the precise amount of pesticide needed at every square meter of the field. This capability not only optimizes input use, saving significant costs for farmers, but also adheres to environmental best practices by severely limiting chemical application to non-infested areas, thereby minimizing runoff and contamination risks.

Furthermore, significant technological advances are occurring in the development and mass production of biopesticides. Research focuses on optimizing microbial fermentation processes to achieve stable, high-titer production of bacteria, fungi, and viruses used as biocontrol agents. Genetic sequencing and advanced screening technologies are speeding up the identification of naturally occurring strains with superior pest control attributes. Seed treatment technology, another critical area, uses advanced polymers and coatings to apply small, concentrated doses of pesticides or biologicals directly onto the seed surface, providing protection during the vulnerable germination phase while requiring significantly less chemical input compared to traditional broadcast spraying methods.

Regional Highlights

Regional dynamics are instrumental in defining the growth and specialization within the global Agricultural Pesticides Market, reflecting variations in climate, crop mix, regulatory intensity, and farming intensity.

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by the need for intensified production of staple crops (rice, wheat) for massive populations in China, India, and Southeast Asia. Regulatory environments are often less stringent than in the West, leading to high consumption of generic synthetic pesticides. However, rising governmental promotion of sustainable agriculture and increasing farm mechanization are creating new demand pockets for advanced formulations and application technologies.

- North America: Characterized by large-scale mechanized farming, North America is a mature market dominated by herbicides, particularly those related to herbicide-tolerant crops (e.g., glyphosate and glufosinate). The region leads in the adoption of precision agriculture, VRT, and digital farming platforms. Regulatory standards, especially concerning environmental impact and worker safety, drive demand for specialized, low-risk, and biologically-derived products.

- Europe: Europe is defined by stringent regulatory policies (e.g., the EU's Farm to Fork Strategy and high scrutiny under REACH), leading to the phase-out of many conventional active ingredients. Consequently, Europe is the global leader in adopting biopesticides and Integrated Pest Management (IPM) techniques. Market growth here is focused on innovation in formulation, non-chemical alternatives, and maximizing efficacy within strict environmental constraints.

- Latin America (LATAM): LATAM, particularly Brazil and Argentina, is a high-consumption market critical for global soybean and corn production. Tropical climates necessitate high inputs of fungicides and insecticides due to severe pest and disease pressure. This region serves as a massive consumption hub for both proprietary and generic synthetic products, though environmental pressures are beginning to push biological adoption.

- Middle East and Africa (MEA): This region presents nascent opportunities, primarily focused on staple crop protection (wheat, vegetables) and combating specific threats like locust infestations. Market development is often hampered by infrastructural and economic volatility, but increasing investment in large-scale commercial farming (especially in Gulf Cooperation Council countries) and improved irrigation projects is expected to fuel future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Pesticides Market.- BASF SE

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Nufarm Limited

- ADAMA Ltd.

- Mitsui Chemicals Agro, Inc.

- Gowan Company

- Isagro S.p.A.

- Marrone Bio Innovations (now part of Bioceres Crop Solutions)

- Certis Biologicals

- Koppert Biological Systems

- Nippon Soda Co., Ltd.

- Arysta LifeScience (part of UPL)

- Rotam CropSciences

- Dow Inc.

- Novozymes

Frequently Asked Questions

Analyze common user questions about the Agricultural Pesticides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from conventional synthetic pesticides to biopesticides?

The shift is primarily driven by rigorous regulatory actions, particularly in Europe, banning high-risk synthetic chemistries. Additionally, increasing consumer demand for residue-free food, coupled with the rising incidence of pest resistance to older chemicals, makes biopesticides a safer, environmentally friendly, and necessary component of modern Integrated Pest Management (IPM) strategies, offering new modes of action.

How do precision agriculture technologies impact the future consumption volume of pesticides?

Precision agriculture, utilizing AI, VRT, and drone technology, enables highly localized and needs-based application, significantly reducing overall consumption volumes per hectare. While usage rates decrease, the demand shifts towards higher-value, specialized formulations compatible with these advanced delivery systems, enhancing cost-efficiency and environmental stewardship for farmers.

Which geographic region demonstrates the strongest growth potential for agricultural pesticides?

The Asia Pacific (APAC) region exhibits the strongest growth potential due to its massive, fragmented agricultural landscape, high demand for staple food production, increasing farmer education, and the ongoing transition from subsistence to commercial farming methods in countries like India and China, fueling robust demand for all pesticide types.

What is the most significant regulatory challenge facing pesticide manufacturers?

The most significant challenge is the rising stringency and unpredictability of global regulatory reviews, specifically concerning toxicology, ecotoxicology, and maximum residue limits (MRLs). These hurdles increase R&D costs, extend time-to-market for new products, and often lead to the compulsory phase-out of established, profitable active ingredients deemed high-risk, forcing companies to constantly invest in novel, safer chemistries.

What role does genetic resistance play in shaping the pesticide market?

Genetic resistance, particularly herbicide resistance in weeds, is a critical market driver, compelling manufacturers to continually develop new classes of chemicals and specialized combination products (adjuvants and tank mixes) to maintain efficacy. This resistance necessitates the promotion of Integrated Pest Management (IPM) practices and boosts the demand for rotational chemistries and biological control agents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager