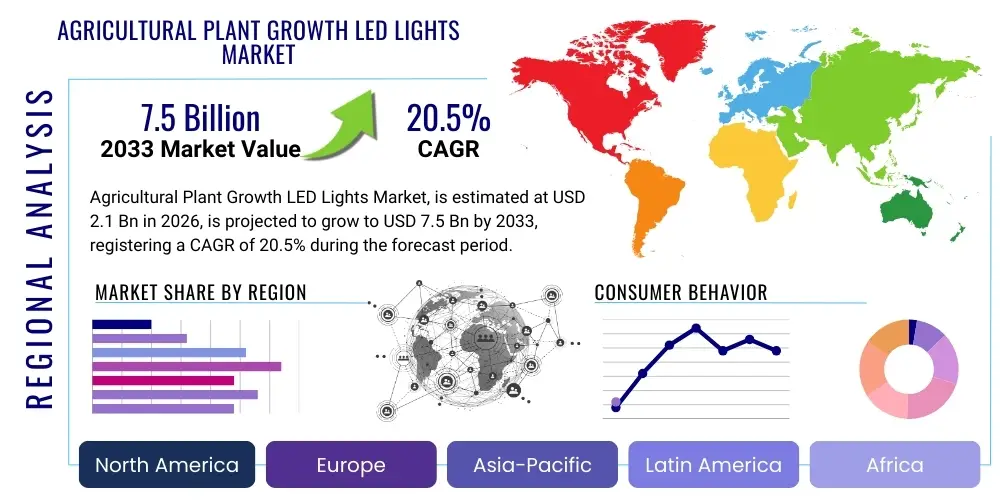

Agricultural Plant Growth LED Lights Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439150 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Agricultural Plant Growth LED Lights Market Size

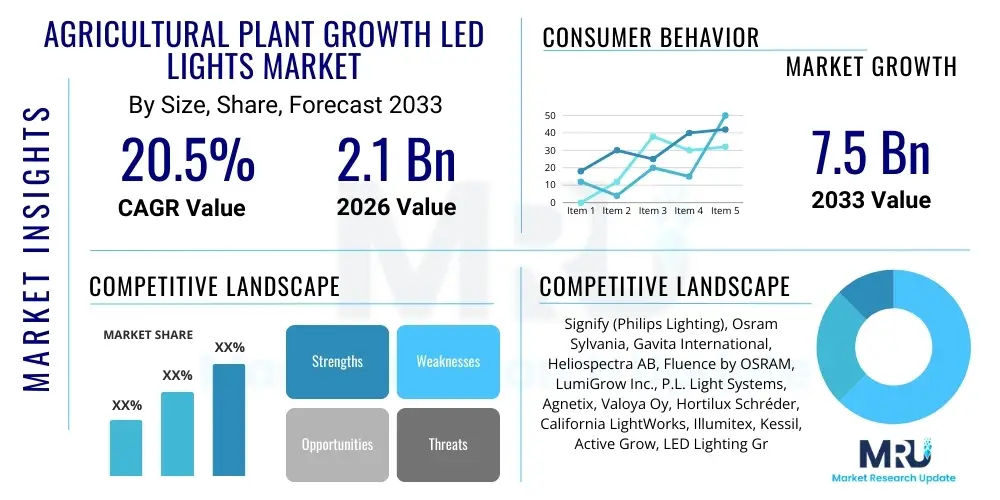

The Agricultural Plant Growth LED Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033.

Agricultural Plant Growth LED Lights Market introduction

The Agricultural Plant Growth LED Lights Market encompasses the design, manufacture, and deployment of specialized solid-state lighting fixtures tailored to optimize plant photosynthesis, photomorphogenesis, and overall crop yield within Controlled Environment Agriculture (CEA) settings. These LED systems are fundamentally distinct from conventional lighting sources, offering precise control over the spectral distribution, intensity, and photoperiod, directly influencing plant development across various stages, including germination, vegetative growth, and flowering. The inherent efficiency, extended lifespan, and reduced heat output of LED technology represent a significant paradigm shift from traditional High-Pressure Sodium (HPS) or fluorescent lamps, enabling greater energy savings and minimizing the requirement for extensive cooling infrastructure in indoor farms and greenhouses. The product description spans across various fixture types, including top lighting, inter-lighting, and vertical farming modules, all designed to meet specific photosynthetic photon flux density (PPFD) requirements for diverse crop types ranging from leafy greens and herbs to vine crops and cannabis.

Major applications of Agricultural Plant Growth LED Lights are concentrated heavily within commercial greenhouse operations, vertical farms, tissue culture laboratories, and research institutions dedicated to plant science. Vertical farming, in particular, acts as a pivotal growth engine, as LED lighting is essential for achieving multi-layer production systems where natural light is inaccessible or insufficient. The primary benefits driving market adoption include significantly improved energy efficiency (often 40-60% savings compared to HPS), precise spectral tunability allowing growers to tailor light recipes for specific physiological outcomes (such as enhancing flavor or nutritional content), and the ability to maintain consistent production year-round, regardless of external climate conditions. This reliability is crucial for urban farming initiatives aiming to reduce food miles and ensure local food security.

The market's trajectory is strongly driven by the increasing global demand for food security amid shrinking arable land, coupled with the rapid adoption of Controlled Environment Agriculture technologies, especially in regions with extreme weather variability or limited daylight hours. Furthermore, regulatory shifts favoring sustainable and energy-efficient agricultural practices, alongside substantial investment in large-scale vertical farming projects by venture capitalists and corporate entities, solidify the foundational drivers. The necessity for advanced crop management solutions that maximize yield density while minimizing resource consumption positions LED grow lights as an indispensable technology for the future of sustainable food production, compelling conventional growers to transition and new market entrants to adopt this technology from inception.

Agricultural Plant Growth LED Lights Market Executive Summary

The Agricultural Plant Growth LED Lights Market is characterized by robust technological innovation and aggressive capital investment, projecting a high CAGR driven primarily by the global shift towards resource-efficient farming methodologies, such as vertical farming and advanced greenhouses. Key business trends indicate a strong focus on merger and acquisition activities among established lighting and horticulture technology firms to consolidate spectral expertise and expand geographical reach. Furthermore, there is a distinct trend towards integrating Internet of Things (IoT) sensors and Artificial Intelligence (AI) platforms directly into LED fixtures, transforming simple illumination tools into sophisticated data collection and growth optimization systems, thereby enhancing profitability for end-users and increasing the value proposition of modern lighting solutions.

Regionally, North America and Europe currently dominate the market due to early adoption of CEA techniques, high consumer demand for locally sourced specialty crops, and supportive regulatory environments, particularly concerning the legalized cultivation of cannabis, which requires high-intensity, controlled lighting. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, propelled by massive governmental investments in food security infrastructure, urbanization pressures requiring vertical farm deployment in densely populated areas, and the burgeoning adoption of greenhouse technology in China, Japan, and India. The Middle East and Africa (MEA) are also showing promising potential, driven by the acute need for climate-independent food production in arid environments, making highly efficient LED systems critical for survival.

Segmentation trends reveal that the top lighting segment holds the largest market share due to its ubiquitous application in large-scale commercial greenhouses, while the white and blue spectral type segment is witnessing rapid uptake due to its balanced efficiency and utility across various crop types. The primary demand split remains between greenhouses and vertical farms, with vertical farms driving the highest innovation in custom spectrum development and fixture miniaturization. The high initial capital expenditure (CAPEX) associated with LED systems remains a restraint, but this is increasingly mitigated by significant operational expenditure (OPEX) savings over the fixture lifespan and enhanced yield predictability, encouraging greater institutional investment in technologically advanced farming operations.

AI Impact Analysis on Agricultural Plant Growth LED Lights Market

User inquiries regarding AI's influence on the Agricultural Plant Growth LED Lights Market primarily revolve around optimizing energy use, customizing light recipes in real-time, and predictive maintenance of lighting hardware. Users seek to understand how AI algorithms can interpret complex sensor data (e.g., CO2 levels, humidity, plant stress indicators) to dynamically adjust the light spectrum and intensity, moving beyond static, pre-programmed schedules to highly responsive, plant-specific photobiology management. Key concerns include the accessibility and ease of integration of these AI platforms for smaller growers and the necessity for robust, specialized training datasets required to make accurate spectral recommendations for novel crop varieties. Ultimately, the market expects AI integration to be the primary differentiator, transforming standardized LED fixtures into intelligent tools capable of maximizing photosynthetic efficiency, minimizing electricity consumption, and providing an unparalleled level of control over crop morphology and biochemical composition.

- AI-driven spectral optimization allows for real-time adjustments of light intensity (PPFD) and quality (spectral composition) based on environmental inputs and plant health monitoring.

- Predictive maintenance schedules for LED drivers and fixtures are established using AI algorithms, significantly reducing unexpected operational downtime and associated maintenance costs.

- Integration of machine learning models with vision systems (e.g., hyperspectral imaging) enables the detection of nutrient deficiencies or diseases earlier than human monitoring, allowing AI to automatically adjust lighting parameters as a non-chemical treatment.

- Energy consumption optimization through AI ensures lights operate only when maximally beneficial for photosynthesis, correlating spectral output with dynamic electricity pricing to minimize OPEX.

- Yield forecasting and quality control enhancement are achieved by correlating historical growth data under specific light recipes with current environmental conditions, providing actionable insights for growers.

- AI facilitates the development of automated, personalized 'light recipes' for thousands of specific crop cultivars, optimizing parameters like flavor, texture, and nutritional value.

- Data integration from various IoT sensors (climate, substrate moisture, nutrient flow) creates a holistic data environment, enabling AI to manage the entire CEA ecosystem holistically, not just the lighting component.

- AI assists in standardizing growth protocols across distributed vertical farms, ensuring consistent crop quality and yield irrespective of geographical location or operator skill level.

- Advanced AI platforms will enable fully autonomous environmental control systems where lighting becomes one of several interconnected actuators managed without human intervention.

- Improved resource allocation efficiency, including water and fertilizer, results from AI accurately determining the plant's growth phase and correlating resource needs with optimized light delivery.

DRO & Impact Forces Of Agricultural Plant Growth LED Lights Market

The Agricultural Plant Growth LED Lights Market is fundamentally influenced by powerful drivers, notably the urgent need for sustainable agriculture, the proliferation of resource-intensive vertical farming operations, and the decreasing cost structure of LED technology, making it increasingly competitive against traditional lighting. However, market growth is significantly restrained by the high initial capital investment required for installing extensive LED systems, particularly for smaller and mid-sized agricultural enterprises, coupled with a lack of standardized spectral efficacy metrics which complicates comparison and adoption decisions for end-users. Opportunities arise from technological advancements, specifically the integration of smart controls (IoT, AI) and the expansion into niche, high-value crop markets like medicinal plants and specialty berries, offering higher returns on investment and justifying the initial cost outlay. The confluence of these factors creates a dynamic impact force where sustained innovation and energy efficiency gains consistently push against initial economic barriers, resulting in strong long-term market acceleration.

Key drivers include the global push for local food production to minimize supply chain vulnerability and carbon footprint, accelerating the adoption of urban farming, which is wholly reliant on artificial lighting. Furthermore, the legislative relaxation regarding cannabis cultivation globally has created a massive, high-margin end-user segment demanding highly precise, scalable LED solutions for optimizing potency and yield. The restraints are often centered around the knowledge gap—many conventional growers lack the specialized understanding of photobiology required to fully exploit the capabilities of tunable LED systems, leading to underutilization or sub-optimal performance, thus slowing widespread adoption among traditional greenhouse operators. Moreover, regulatory fragmentation across regions concerning energy subsidies and environmental standards can create operational hurdles for international market expansion.

The primary opportunities lie in the development of modular and retrofittable LED systems designed to seamlessly integrate into existing greenhouse infrastructure, reducing the financial burden of complete facility overhauls. Strategic partnerships between LED manufacturers and data analytics companies are opening new avenues for subscription-based services centered around light recipe optimization and growth management, enhancing recurring revenue streams. The overarching impact forces demonstrate that while market entry requires significant capital, the sustained competitive advantage derived from energy savings, high yield density, and precise crop control ensures that the overall market momentum remains robustly positive, compelling large agricultural corporations and tech giants to invest heavily in the infrastructure supporting CEA and LED technologies.

- Drivers:

- Rapid expansion of vertical farming and Controlled Environment Agriculture (CEA) globally.

- Increased demand for local, high-quality, and pesticide-free specialty crops.

- Significant advancements in LED spectral efficiency and longevity, reducing operational costs.

- Favorable regulatory landscape supporting sustainable and energy-efficient agricultural technologies.

- Growing legalization and commercialization of medicinal plants (e.g., cannabis), requiring precise spectral control.

- Restraints:

- High initial capital expenditure (CAPEX) required for large-scale LED installation compared to traditional HPS lighting.

- Lack of standardized efficacy metrics and confusion regarding optimal spectral recipes among end-users.

- Requirement for specialized technical expertise in photobiology and system integration.

- Potential market saturation in certain high-growth segments (e.g., leafy greens) impacting short-term ROI.

- Opportunities:

- Integration of smart controls, IoT, and AI for dynamic light management and optimization.

- Development of customized LED fixtures specifically for arid climates and remote agricultural setups.

- Growth in supplementary lighting applications in large-scale food greenhouses.

- Expansion into emerging markets, particularly APAC and MEA, driven by food security imperatives.

- Impact Forces:

- Technological substitution rate remains high as LEDs continuously outperform legacy lighting systems on efficiency.

- Bargaining power of suppliers is moderate, driven by complex semiconductor manufacturing but mitigated by numerous assembly players.

- Threat of new entrants is moderate, balanced by low barriers to LED assembly but high barriers to establishing reputation and spectral expertise.

Segmentation Analysis

The Agricultural Plant Growth LED Lights Market is meticulously segmented across dimensions including spectral type, application environment, mounting type, and power consumption, enabling precise analysis of demand patterns and strategic market positioning. The segmentation highlights the diversification of products from general-purpose fixtures to highly specialized solutions tailored for specific crop requirements and structural limitations, such as multi-tier vertical farming racks versus expansive greenhouse ceilings. Understanding these segments is critical for manufacturers to align their R&D investments with high-growth niches, particularly those centered around efficiency metrics and IoT compatibility. The increasing shift towards fully customizable spectrums, managed by digital controls, is blurring the lines between traditional spectral types, but for commercial purposes, the fundamental segmentation by output spectrum remains the clearest indicator of product function and target crop suitability.

The market volume is currently dominated by commercial applications, encompassing large-scale food production and floriculture, emphasizing durability and high-intensity output. Conversely, the segmentation by mounting type—specifically inter-lighting and vertical farming modules—is driving the highest percentage growth, reflecting the intense focus on maximizing light penetration and spatial efficiency in dense growing environments. Further analysis reveals a critical split based on the business model: dedicated lighting hardware sales versus integrated system solutions incorporating software and data analytics. This service-oriented segmentation represents a significant future growth opportunity, moving the market value proposition from hardware provision to optimized growth management.

- By Spectral Type:

- White/Broad Spectrum

- Blue and Red Spectrum (Dual-band/Specific-band)

- UV and Far-Red (Supplemental/Specialty Spectrum)

- By Application Environment:

- Greenhouses

- Vertical Farms/Indoor Farms

- Research Facilities and Tissue Culture Laboratories

- By Mounting Type/Fixture Type:

- Top Lighting (Canopy Lighting)

- Inter-Lighting (Intracanopy Lighting)

- Vertical Farming Modules/Rack Lights

- By Power Consumption (Wattage):

- Low Power (Below 100W)

- Medium Power (100W – 300W)

- High Power (Above 300W)

- By Crop Type:

- Leafy Greens and Herbs

- Fruits and Vegetables (e.g., Tomatoes, Cucumbers)

- Floriculture and Ornamental Crops

- Cannabis and Medicinal Plants

Value Chain Analysis For Agricultural Plant Growth LED Lights Market

The value chain for Agricultural Plant Growth LED Lights begins with the upstream raw materials supply, predominantly focusing on semiconductor components, specialized phosphors, and heat sink materials (aluminum). The integrity and efficacy of the final product are highly dependent on the quality of LED chips, where suppliers like Nichia, Osram, and Samsung play a crucial role in providing high Photosynthetic Photon Flux (PPF) diodes optimized for specific horticultural wavelengths. Manufacturing complexity involves stringent quality control for spectral stability and thermal management, as operational temperature significantly impacts the lifespan and output of the LED fixture. The upstream segment is characterized by relatively concentrated chip manufacturing, giving key component suppliers moderate leverage over downstream assemblers.

The midstream involves the core activities of fixture assembly, electronic driver integration, optical design, and programming of smart control systems. This stage is dominated by specialized horticulture lighting companies that convert raw components into robust, water-resistant, and spectrally accurate lighting solutions. Research and Development (R&D) at this stage focuses heavily on optimizing light distribution patterns, ensuring uniform PPFD across the canopy, and developing robust data communication protocols for integration into existing farm management systems. Distribution channels are bifurcated between direct sales to large-scale vertical farm integrators and indirect sales through specialized horticultural distributors and system integrators who provide advisory services alongside the physical product, guiding end-users on optimal installation and spectral recipe deployment.

Downstream activities include installation, commissioning, maintenance, and the provision of ongoing services related to spectral optimization and software updates. Direct sales are prevalent for massive, highly customized projects, where manufacturers collaborate closely with farm architects and growers from the design phase. The end-users—ranging from commercial greenhouses to research laboratories—require significant post-sales support due to the specialized nature of the technology. The increasing adoption of the "lighting as a service" model, where payment is tied to performance and yield, is fundamentally altering the downstream economics, driving manufacturers to focus on long-term performance guarantees and data-driven insights rather than just hardware sales. This focus on long-term value creation ensures adherence to quality and pushes the market toward higher standardization and efficacy.

Agricultural Plant Growth LED Lights Market Potential Customers

Potential customers for Agricultural Plant Growth LED Lights are highly diversified but converge around organizations seeking controlled, predictable, and sustainable crop production independent of climate variability. The primary customer base includes large commercial greenhouse operators who utilize LED lights for supplemental lighting, especially during winter months or low-light periods, aiming to boost yield and quality beyond what natural sunlight alone permits. These customers require robust, high-power top-lighting solutions with exceptional thermal management capabilities and dimming functionalities to seamlessly blend with solar radiation. The secondary, and most rapidly growing, segment comprises large-scale vertical farming entities that operate multi-tiered indoor facilities, for which LED lights are the sole source of energy for photosynthesis, necessitating highly efficient, low-profile rack lighting modules with customizable spectral outputs.

A significant niche market consists of research and academic institutions, alongside biotechnology and pharmaceutical companies specializing in plant-based drug development. These end-users demand highly specialized, reproducible, and precisely controllable lighting environments to study photobiology, conduct genetic research, or cultivate specific medicinal plants under validated conditions. For this segment, the focus is less on volume and more on precision, customization, and data logging capabilities. Furthermore, emerging markets include small-to-medium enterprises (SMEs) involved in urban farming initiatives and community-supported agriculture (CSA) programs, utilizing smaller, modular LED systems to produce high-value crops like microgreens and leafy vegetables for local distribution.

The newest and fastest-growing customer group is the licensed commercial cannabis cultivators globally, who require high-intensity, full-spectrum, or tailored spectrum LED fixtures to maximize cannabinoid and terpene production efficiency. These buyers often invest heavily in premium fixtures due to the high return on investment associated with improved potency and yield metrics in a heavily regulated and profitable industry. All potential buyers are increasingly motivated not solely by the purchase price, but by the overall cost of ownership (TCO), factoring in energy consumption, fixture longevity, and the potential yield increase achievable through advanced spectral control, making the return on investment (ROI) metric the paramount decision criterion for high-volume transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), Osram Sylvania, Gavita International, Heliospectra AB, Fluence by OSRAM, LumiGrow Inc., P.L. Light Systems, Agnetix, Valoya Oy, Hortilux Schréder, California LightWorks, Illumitex, Kessil, Active Grow, LED Lighting Group, Fohse Inc., Cree LED, Samsung Electronics, Sanan Optoelectronics, Shenzhen Fitolite Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Plant Growth LED Lights Market Key Technology Landscape

The technological landscape of the Agricultural Plant Growth LED Lights Market is rapidly evolving, moving beyond simple diode efficiency to sophisticated system integration and spectral control. The core technology relies on high-power, high-efficacy LED chips, predominantly based on Gallium Nitride (GaN) materials, optimized to produce light in the photosynthetically active radiation (PAR) range (400-700 nm). A crucial technological frontier is the development of advanced thermal management solutions, such as passive cooling using specialized heat sinks or active liquid cooling systems, which are essential for maintaining diode lifespan and spectral stability, particularly in high-humidity CEA environments. Poor thermal management directly results in 'color shift' and accelerated lumen degradation, making robust heat dissipation a competitive advantage for manufacturers.

Beyond the physical fixture, significant technological advancements center on control systems and spectral tunability. Modern LED grow lights utilize highly sophisticated drivers and control boards that allow for precise, instantaneous adjustment of the ratios and intensities of multiple color channels (typically red, blue, green, and far-red). This level of control facilitates the implementation of dynamic light recipes (DLPs) tailored to the specific photoperiodic and photomorphogenic needs of different plant stages, enhancing factors like compactness, root development, or flowering induction. Furthermore, the standardization of communication protocols, such as DALI (Digital Addressable Lighting Interface) or proprietary wireless protocols, is essential for seamless integration with overarching environmental control platforms (EAPs) used in large commercial farms, allowing lights to be managed remotely via central software interfaces.

The emerging technological frontier is the convergence of photonics, data science, and biological sensors. Innovations in technology include the embedding of wireless sensors for data collection (e.g., measuring canopy temperature or light interception efficiency) directly into the fixture. This facilitates Generative Engine Optimization (GEO) efforts by providing high-fidelity data necessary for AI and machine learning algorithms to learn and refine optimal spectral recipes autonomously. Moreover, the shift toward flexible and rollable LED modules, utilizing organic LED (OLED) or micro-LED technology, promises future designs that are thinner, lighter, and more suitable for complex, curved surfaces within advanced modular vertical farm designs, pushing the boundaries of spatial efficiency and spectral uniformity. Compliance with stringent efficiency standards (e.g., μmol/J) continues to drive incremental improvements in semiconductor and fixture design.

Regional Highlights

Geographical market dynamics are highly fragmented, reflecting disparities in climate, arable land availability, energy costs, and regulatory frameworks surrounding CEA and controlled substance cultivation. North America, driven by the United States and Canada, remains a dominant force, primarily fueled by massive investment in the high-value cannabis industry and the subsequent demand for highly precise, commercial-grade LED lighting fixtures. The regional market benefits from a well-established infrastructure for horticulture technology and significant private sector funding directed toward large-scale vertical farm projects in metropolitan areas aimed at mitigating supply chain risks and improving local produce quality.

Europe represents a mature market, led by the Netherlands, which is globally recognized for its advanced greenhouse technology and expertise in protected horticulture. European growth is sustained by strong environmental mandates favoring energy-efficient technologies, leading to rapid adoption of LED supplemental lighting systems to replace outdated HPS fixtures. Government incentives and carbon reduction goals further accelerate this transition. The expansion of CEA in Northern Europe addresses shorter daylight hours and aims to maintain year-round productivity, making spectrally customized LED inter-lighting and top lighting essential for vine crops and floriculture.

Asia Pacific (APAC) is projected to be the fastest-growing region, characterized by extensive investment, particularly from Japan, South Korea, and China, in massive indoor farming complexes designed to address pressing food security challenges resulting from high population density and diminishing agricultural land. Governmental support for smart agriculture initiatives, coupled with rapid urbanization, mandates the efficient use of space, thereby driving extraordinary demand for vertical farming modules and high-density LED arrays. The Middle East and Africa (MEA) offer high potential, albeit from a lower base, as nations in the Gulf Cooperation Council (GCC) seek climate-independent solutions for food production in arid, resource-scarce environments, necessitating fully controlled, high-efficiency LED indoor farms to grow staples and specialized crops, overcoming severe temperature and water limitations.

- North America (NA): Dominant market share fueled by legalized commercial cannabis cultivation, high adoption rate in vertical farming, and robust venture capital investment in AgTech startups. Focus on high-wattage, full-spectrum fixtures and sophisticated control systems. Key countries: U.S. and Canada.

- Europe: Mature market with high penetration in commercial greenhouses. Growth driven by energy efficiency mandates, replacement of HPS systems, and strong expertise in controlled horticulture (e.g., Netherlands). Emphasis on inter-lighting and research-driven spectral optimization.

- Asia Pacific (APAC): Highest CAGR projected, driven by aggressive governmental investments in food security, rapid urbanization, and establishment of large-scale plant factories in China, Japan, and South Korea. Focus on dense, multi-tier vertical farming solutions.

- Latin America (LATAM): Emerging market primarily driven by floriculture and specific high-value crop exports, with increasing demand for climate control solutions, including supplemental LED lighting, particularly in Mexico and Brazil.

- Middle East and Africa (MEA): High growth potential fueled by the critical need for desert agriculture solutions and water-efficient farming. Demand centers around self-sufficiency and resource-independent food production, requiring high-specification indoor farms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Plant Growth LED Lights Market.- Signify (Philips Lighting)

- Osram Sylvania

- Gavita International

- Fluence by OSRAM

- Heliospectra AB

- LumiGrow Inc.

- P.L. Light Systems

- Hortilux Schréder

- Agnetix

- Valoya Oy

- California LightWorks

- Cree LED

- Samsung Electronics

- Nichia Corporation

- Bridgelux Inc.

- Fohse Inc.

- Illumitex

- Active Grow

- LED Lighting Group

- San'an Optoelectronics

- Shenzhen Fitolite Technology Co. Ltd.

- BIOS Lighting

- Hydrofarm Holdings Group

- EpiLED Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Agricultural Plant Growth LED Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Agricultural Plant Growth LED Lights Market?

The primary driver is the global proliferation and commercial viability of Controlled Environment Agriculture (CEA), particularly large-scale vertical farms and advanced greenhouses. These systems rely entirely on LEDs for energy efficiency, precise spectral control, and the ability to maintain year-round production, addressing escalating global food security concerns and the demand for locally sourced, high-quality crops.

How does spectral tunability in LED grow lights benefit commercial growers?

Spectral tunability allows commercial growers to precisely control the ratio of specific wavelengths (e.g., red, blue, far-red) delivered to the plants. This control is crucial for optimizing various physiological processes, such as promoting vegetative growth, inducing flowering, manipulating plant morphology (size and shape), and enhancing the biosynthesis of specific compounds like essential oils or cannabinoids, leading to higher yield and improved crop quality.

What are the key differences between LED top lighting and LED inter-lighting applications?

Top lighting (canopy lighting) fixtures are mounted high above the plants, providing high-intensity light (PPFD) across the entire canopy, typically used for staple crops and supplemental greenhouse lighting. Inter-lighting fixtures are long, low-intensity bars placed within the plant canopy (usually vine crops like tomatoes or cucumbers) to ensure light penetrates lower leaves, optimizing photosynthesis deeper within the plant structure and increasing overall yield per plant.

What is the biggest financial restraint inhibiting wider adoption of Agricultural Plant Growth LEDs?

The biggest restraint is the high initial Capital Expenditure (CAPEX) required for the procurement and installation of high-quality LED lighting systems compared to conventional High-Pressure Sodium (HPS) lamps. While LEDs offer substantial long-term savings in energy (OPEX) and maintenance due to higher efficiency and lifespan, the upfront investment can pose a significant barrier, especially for smaller agricultural businesses or those operating on tight investment timelines.

Which technology integration is expected to revolutionize the market dynamics of LED grow lights?

The integration of Artificial Intelligence (AI) and Internet of Things (IoT) sensors is expected to revolutionize market dynamics. AI allows for dynamic light management, optimizing spectral output and intensity in real-time based on live environmental and plant feedback, moving systems from static programming to predictive, performance-based control, thereby maximizing energy utilization (micromole per Joule) and crop yield consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager