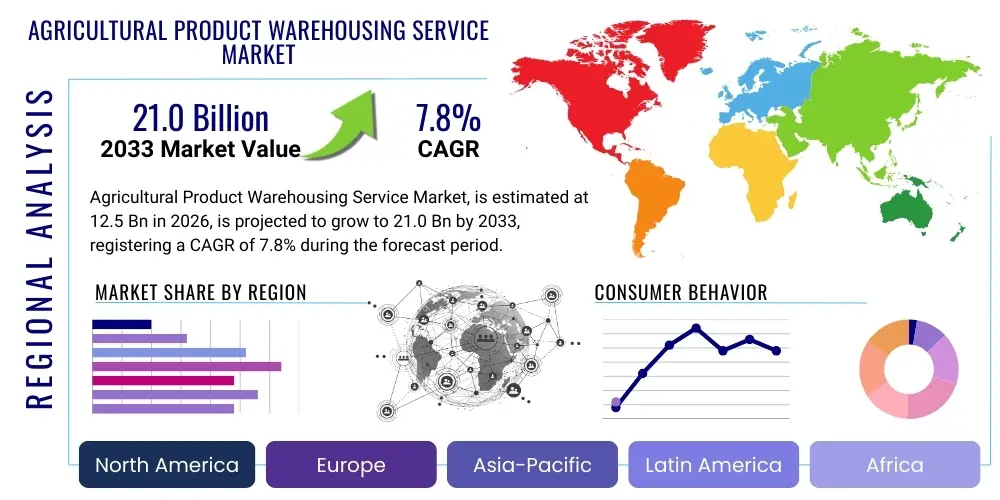

Agricultural Product Warehousing Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440673 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Agricultural Product Warehousing Service Market Size

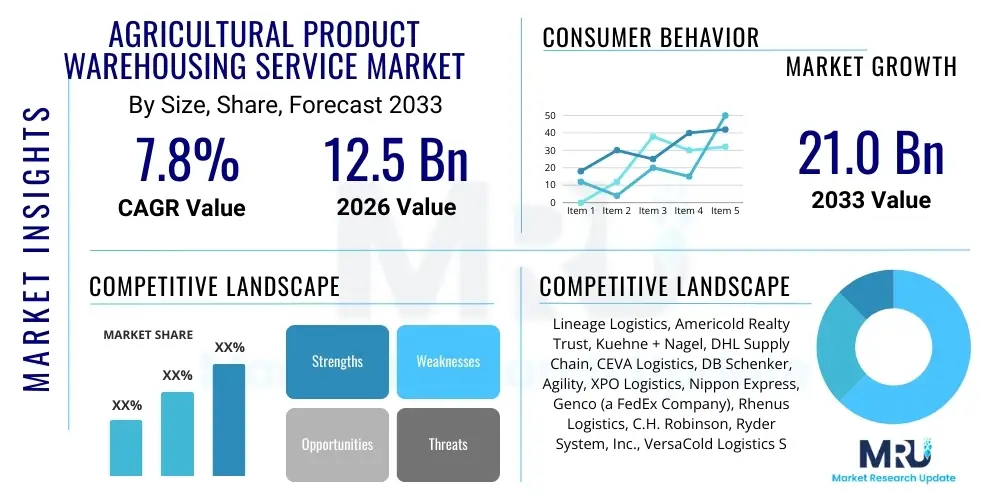

The Agricultural Product Warehousing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033. This substantial growth is driven by increasing global food demand, evolving supply chain complexities, and the imperative for efficient post-harvest management and storage to minimize spoilage and maximize shelf life. The market encompasses a wide array of services crucial for maintaining the quality and safety of agricultural commodities from farm to fork.

Agricultural Product Warehousing Service Market introduction

The Agricultural Product Warehousing Service Market provides essential infrastructure and logistical support for the storage, handling, and preservation of agricultural goods. This specialized sector addresses the unique challenges associated with perishable and seasonal products, ensuring their quality and extending their market availability. Services range from basic dry storage to advanced cold chain solutions, controlled atmosphere storage, and sophisticated inventory management systems designed to meet stringent food safety and quality standards.

Major applications of these services span across various stakeholders in the agricultural value chain, including farmers, food processors, wholesalers, retailers, and exporters. By leveraging professional warehousing, these entities can mitigate risks related to spoilage, pest infestation, and market price fluctuations, thereby enhancing profitability and operational efficiency. The benefits are multifold: reduced post-harvest losses, improved product quality retention, enhanced supply chain transparency, and access to broader markets, which ultimately contributes to global food security.

Key driving factors for market expansion include the burgeoning global population demanding consistent food supply, the increasing adoption of modern farming techniques yielding higher produce volumes, and the rising emphasis on food safety and quality regulations worldwide. Furthermore, the globalization of agricultural trade necessitates robust warehousing and logistics networks capable of handling diverse products across international borders. Technological advancements in storage solutions, such as IoT-enabled monitoring and automation, are also propelling market growth by offering more precise and efficient preservation methods.

Agricultural Product Ware warehousing Service Market Executive Summary

The Agricultural Product Warehousing Service Market is experiencing significant transformations driven by evolving global trade dynamics, technological advancements, and a heightened focus on food security and sustainability. Business trends indicate a strong move towards integrated logistics solutions, where warehousing is seamlessly combined with transportation, inventory management, and value-added services such as sorting, grading, and packaging. Strategic partnerships and consolidations among service providers are becoming prevalent, aimed at expanding geographic reach and enhancing service capabilities to cater to complex supply chain demands. Furthermore, there is a growing demand for customized warehousing solutions that can accommodate specific product requirements, from delicate fresh produce to bulk grains, necessitating flexible and technologically advanced facilities.

Regional trends highlight distinct growth patterns influenced by agricultural output, infrastructure development, and regulatory environments. Asia Pacific, particularly countries like India and China, represents a dominant and rapidly expanding market due to its vast agricultural production, rising population, and increasing investment in modern cold chain infrastructure. North America and Europe, characterized by established agricultural economies and advanced logistics networks, focus more on optimizing existing facilities with smart technologies and sustainable practices. Latin America and the Middle East & Africa are emerging as high-growth regions, driven by agricultural diversification, increasing foreign investment, and efforts to reduce post-harvest losses through improved storage solutions. Each region presents unique opportunities and challenges for service providers.

Segmentation trends reveal a clear shift towards specialized storage solutions, with cold storage and controlled atmosphere warehousing garnering substantial attention due to the rising trade of perishable goods and processed foods. The end-user segment is diversifying, with increasing demand from food processing industries, e-commerce platforms, and government food security programs, alongside traditional farmers and retailers. Technology adoption is a critical segment trend, as warehouse management systems (WMS), automation, Internet of Things (IoT) sensors, and artificial intelligence (AI) are becoming indispensable for optimizing operations, enhancing traceability, and ensuring product integrity across the entire warehousing process. This technological integration is driving efficiency gains and setting new industry standards for quality and reliability.

AI Impact Analysis on Agricultural Product Warehousing Service Market

User inquiries regarding AI's impact on agricultural product warehousing services frequently center on how these advanced technologies can enhance efficiency, reduce costs, and improve the quality and safety of stored produce. Common questions explore AI's role in predictive analytics for inventory management, optimizing storage conditions, automating warehouse operations, and identifying potential spoilage before it occurs. Users are keen to understand the practical applications of AI in real-time monitoring, demand forecasting, and smart routing within facilities, along with the investment required and the potential return on investment. The overarching themes reflect a strong expectation for AI to revolutionize traditional warehousing practices, making them more intelligent, responsive, and resilient to supply chain disruptions while also addressing labor challenges through automation and intelligent decision-making support.

- AI-powered predictive analytics optimize inventory levels, minimizing overstocking and stockouts by forecasting demand based on historical data, seasonal trends, and external factors.

- Real-time monitoring systems integrated with AI algorithms autonomously adjust environmental conditions such as temperature, humidity, and gas levels in controlled atmosphere storage to preserve product freshness and extend shelf life.

- Automated guided vehicles (AGVs) and robotic systems, driven by AI, enhance operational efficiency by handling picking, packing, and sorting tasks with greater speed and accuracy, reducing manual labor requirements.

- AI-enabled quality control systems utilize computer vision and machine learning to detect defects, spoilage, or contamination in agricultural products, significantly improving quality assurance and reducing waste.

- Optimized warehouse layouts and routing are achieved through AI algorithms, which analyze traffic patterns and storage needs to improve flow, reduce retrieval times, and maximize space utilization within facilities.

- Enhanced traceability and compliance are supported by AI, which processes vast datasets from farm to warehouse, providing granular insights into product origin, storage history, and adherence to regulatory standards.

- Predictive maintenance for warehousing equipment is enabled by AI, anticipating potential failures and scheduling maintenance proactively, thereby minimizing downtime and operational disruptions.

- Improved energy efficiency is a key outcome, as AI algorithms optimize lighting, cooling, and heating systems based on real-time data and demand patterns, leading to significant cost savings and reduced environmental impact.

- Intelligent security systems powered by AI enhance surveillance capabilities, identifying unusual activities or unauthorized access within the warehouse premises, thus improving asset protection.

- Decision support systems leverage AI to provide actionable insights for strategic planning, such as optimal location selection for new facilities or expansion strategies based on market analysis.

DRO & Impact Forces Of Agricultural Product Warehousing Service Market

The Agricultural Product Warehousing Service Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and competitive landscape. Key drivers include the escalating global population, which necessitates increased and efficient food production and storage, coupled with rising consumer awareness regarding food quality and safety standards. The expansion of international trade in agricultural commodities further fuels demand for sophisticated warehousing and logistics solutions capable of handling diverse products across vast distances. Additionally, the growing e-commerce sector for food and groceries demands robust cold chain and last-mile delivery capabilities, directly benefiting specialized warehousing services. Technological advancements, particularly in automation, IoT, and data analytics, are also acting as powerful catalysts, enabling greater efficiency, traceability, and precision in storage operations.

However, several restraints challenge market growth. The high initial capital investment required for establishing and upgrading modern warehousing facilities, especially those equipped with advanced cold chain and controlled atmosphere technologies, poses a significant barrier to entry and expansion. Regulatory complexities and stringent compliance requirements related to food safety, environmental standards, and labor laws can increase operational costs and administrative burdens for service providers. Furthermore, the chronic shortage of skilled labor for operating sophisticated warehousing technologies and managing complex logistics networks presents a substantial constraint, potentially impacting service quality and efficiency. Geopolitical uncertainties and trade protectionism can also disrupt supply chains, creating volatility in demand for warehousing services.

Opportunities within the market are abundant, primarily driven by the increasing demand for value-added services such as sorting, grading, packaging, and co-packing, which allow service providers to offer more comprehensive solutions to their clients. The growing adoption of smart warehousing technologies, including AI-powered inventory management and robotic automation, offers significant potential for operational optimization and competitive differentiation. Expansion into emerging markets, particularly in regions with underdeveloped post-harvest infrastructure but high agricultural output, presents lucrative growth avenues. The increasing focus on sustainability and waste reduction across the food supply chain also opens doors for innovative, eco-friendly warehousing solutions and services. Furthermore, the strategic development of integrated cold chain logistics networks, from farm to retail, offers opportunities for end-to-end service provision, strengthening market positions and enhancing customer loyalty.

Segmentation Analysis

The Agricultural Product Warehousing Service Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps in identifying specific market niches, understanding consumer preferences, and developing targeted strategies for growth. The market can be categorized based on various criteria, including the type of storage facility, the specific agricultural product being stored, the end-user leveraging these services, and the technological solutions integrated into the warehousing operations. Each segment presents unique operational demands, investment requirements, and growth potentials, reflecting the complex and varied nature of agricultural logistics. Analyzing these segments is crucial for stakeholders to identify their core competencies and areas for strategic expansion within this rapidly evolving industry.

- By Type of Storage:

- Cold Storage: Facilities maintaining low temperatures (e.g., for fruits, vegetables, dairy, meat).

- Controlled Atmosphere (CA) Storage: Facilities that regulate temperature, humidity, and gas composition (O2, CO2) for extended shelf life of specific produce.

- Dry Storage: Standard ambient temperature storage for non-perishable goods (e.g., grains, pulses, processed foods).

- Silos: Large structures primarily for bulk storage of grains, oilseeds, and other dry commodities.

- Liquid Storage: Tanks and specialized containers for liquid agricultural products (e.g., oils, juices).

- By Product Type:

- Grains & Cereals: Wheat, rice, corn, barley, etc.

- Fruits & Vegetables: Fresh produce requiring specific environmental conditions.

- Meat & Poultry: Perishable animal products demanding strict cold chain management.

- Dairy Products: Milk, cheese, yogurt, requiring refrigeration.

- Processed Foods: Canned goods, frozen foods, packaged snacks.

- Spices & Condiments: Products needing dry, controlled conditions to preserve flavor and aroma.

- Oilseeds: Soybeans, sunflower seeds, rapeseed, often stored in bulk.

- Beverages: Juices, alcoholic beverages, requiring controlled temperature.

- By End-User:

- Farmers & Cooperatives: Producers seeking storage solutions for their harvest.

- Food Processors: Companies that process raw agricultural products into finished goods.

- Retailers & Supermarkets: Businesses requiring consistent supply and storage for sales.

- Exporters & Importers: Entities involved in international trade of agricultural goods.

- Government Agencies: Public bodies managing strategic food reserves or distribution programs.

- Wholesalers & Distributors: Middlemen in the supply chain.

- Restaurants & Foodservice Providers: Businesses requiring inventory management for ingredients.

- By Technology/Service:

- Warehouse Management Systems (WMS): Software for inventory tracking, order fulfillment, and operational management.

- Automation & Robotics: Automated guided vehicles (AGVs), robotic arms for handling and sorting.

- Internet of Things (IoT) & Sensors: For real-time monitoring of temperature, humidity, pest presence.

- AI & Predictive Analytics: For demand forecasting, spoilage prediction, route optimization.

- Cold Chain Logistics: Integrated services ensuring temperature control from farm to consumer.

- Value-added Services: Sorting, grading, packaging, labeling, quality inspection, cross-docking.

- Supply Chain Consulting: Advisory services for optimizing agricultural logistics.

Value Chain Analysis For Agricultural Product Warehousing Service Market

The value chain for the Agricultural Product Warehousing Service Market commences with upstream activities involving the acquisition of land, construction of facilities, procurement of advanced storage technologies, and sourcing of specialized equipment. This includes suppliers of refrigeration units, environmental control systems, racking, material handling equipment, and sophisticated Warehouse Management System (WMS) software providers. Key upstream considerations also involve energy suppliers and infrastructure developers who provide the foundational utilities necessary for warehouse operations. The efficiency and cost-effectiveness of these upstream inputs directly influence the overall service delivery and pricing strategies downstream. Strategic relationships with technology vendors and construction firms are paramount for ensuring state-of-the-art facilities that meet evolving industry demands.

Downstream activities encompass the actual provision of warehousing services to a diverse clientele, including farmers, food processors, wholesalers, retailers, and government agencies. This involves receiving, storing, inventory management, order fulfillment, and dispatching of agricultural products. Beyond basic storage, value-added services such as sorting, grading, packaging, labeling, and quality control checks are increasingly becoming critical components of the downstream offerings, enhancing the attractiveness of the service provider. The effectiveness of these downstream operations directly impacts customer satisfaction, product integrity, and market competitiveness. Efficient downstream processes ensure timely delivery, minimal spoilage, and adherence to specific client requirements, bolstering reputation and fostering long-term client relationships.

The distribution channel for agricultural product warehousing services operates through both direct and indirect models. Direct channels involve service providers engaging directly with end-users, offering customized solutions tailored to specific needs, particularly for large-scale producers, food processing companies, and major retail chains. This model allows for greater control over service quality and direct client relationships. Indirect channels typically involve partnerships with third-party logistics (3PL) providers, freight forwarders, and aggregators who integrate warehousing services into broader supply chain solutions. These intermediaries help extend market reach, particularly to smaller farmers or businesses without direct access to large warehousing facilities. The choice of distribution channel often depends on the scale of operation, geographical reach, and the specific needs of the agricultural clients, with many service providers employing a hybrid approach to maximize market penetration and service flexibility.

Agricultural Product Warehousing Service Market Potential Customers

The Agricultural Product Warehousing Service Market caters to a wide array of end-users and buyers, spanning the entire agricultural value chain from farm to consumer. Farmers and agricultural cooperatives constitute a significant customer base, requiring storage solutions for their harvested crops before they are sold to processors or markets. These customers often seek facilities that can preserve product quality, mitigate post-harvest losses, and provide flexibility to hold products for optimal market prices. The ability to store large volumes of seasonal produce safely and efficiently is a primary concern for this segment. Furthermore, government bodies responsible for food security and strategic reserves also represent substantial potential customers, utilizing these services to manage national food stocks and distribution programs, often requiring large-scale, secure, and well-maintained storage options.

Food processors and manufacturers form another crucial segment of potential customers. These entities require a steady supply of raw agricultural materials and need efficient storage for both incoming raw products and outgoing processed goods. Their demand often includes specialized storage conditions for different ingredients, stringent hygiene standards, and robust inventory management systems that integrate with their production schedules. Warehousing services that offer value-added capabilities such as sorting, cleaning, and pre-processing can be particularly attractive to this segment, enabling them to streamline their operations and reduce in-house handling costs. The reliability and efficiency of warehousing partners are paramount for food processors to maintain continuous production and meet market demand without disruption.

Retailers, supermarkets, wholesalers, and distributors represent the final major segment of potential customers in the agricultural product warehousing service market. These businesses require consistent and timely access to a diverse range of agricultural products to stock their shelves or supply their networks. Their warehousing needs are often complex, involving cold chain logistics, cross-docking, and efficient distribution capabilities to multiple outlets or clients. E-commerce platforms specializing in fresh produce or groceries also fall into this category, demanding highly agile and responsive warehousing and fulfillment services to meet rapid delivery expectations. For these customers, warehousing services are not merely about storage but about efficient inventory turnover, reduced spoilage during transit, and ensuring product freshness until it reaches the end consumer, making integrated logistics solutions highly desirable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lineage Logistics, Americold Realty Trust, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, DB Schenker, Agility, XPO Logistics, Nippon Express, Genco (a FedEx Company), Rhenus Logistics, C.H. Robinson, Ryder System, Inc., VersaCold Logistics Services, NewCold, Ingersoll Rand, Tippmann Group, United States Cold Storage, Preferred Freezer Services, Capstone Logistics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Product Warehousing Service Market Key Technology Landscape

The Agricultural Product Warehousing Service Market is undergoing a profound technological transformation, driven by the imperative for enhanced efficiency, precision, and traceability in handling sensitive agricultural commodities. A cornerstone of this evolution is the widespread adoption of Warehouse Management Systems (WMS). These sophisticated software solutions provide comprehensive control over inventory, optimizing storage space, streamlining order fulfillment, and managing labor, thereby ensuring operational fluidity from goods reception to dispatch. Modern WMS often integrate with other enterprise resource planning (ERP) systems, offering real-time visibility and data-driven insights into the entire warehousing process. The continuous enhancement of WMS capabilities, including mobile access and cloud-based deployments, further boosts their utility and accessibility for diverse agricultural operations, allowing for more adaptive and responsive logistics management.

Automation and robotics are increasingly becoming integral to the agricultural warehousing landscape. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are deployed for transporting goods within facilities, reducing reliance on manual labor and increasing throughput speed and accuracy. Robotic arms are utilized for precise tasks such as picking, packing, and sorting, particularly for delicate produce or repetitive operations. These automated systems mitigate the challenges of labor shortages, enhance worker safety, and minimize human error, leading to significant improvements in operational efficiency and cost reduction. The shift towards greater automation also facilitates 24/7 operations, allowing warehouses to maintain continuous productivity and meet growing demand without interruption, which is particularly vital for highly perishable agricultural products.

The Internet of Things (IoT) and sensor technologies play a crucial role in maintaining optimal storage conditions and ensuring product integrity. Wireless sensors embedded within warehouses and even directly with produce monitor critical environmental parameters such as temperature, humidity, CO2 levels, and even ethylene gas concentrations in real time. This data is transmitted to centralized monitoring systems, often leveraging AI and machine learning algorithms, which can trigger alerts or automatically adjust environmental controls to prevent spoilage. This proactive approach significantly reduces post-harvest losses, extends shelf life, and enhances food safety. Furthermore, blockchain technology is emerging as a powerful tool for enhancing traceability across the agricultural supply chain, providing an immutable record of a product's journey from farm to warehouse to consumer, thereby building trust and ensuring compliance with stringent regulatory standards. This comprehensive technological suite collectively elevates the capabilities and responsiveness of agricultural product warehousing services.

Regional Highlights

- North America: A mature market characterized by advanced logistics infrastructure and a strong emphasis on automation and cold chain solutions. Key countries like the United States and Canada benefit from large-scale commercial farming and a well-developed food processing industry. The region is a leader in adopting smart warehousing technologies, focusing on efficiency, sustainability, and reducing food waste through sophisticated storage and distribution networks.

- Europe: This region showcases a diverse market with varying levels of technological adoption. Western European countries are at the forefront of implementing automated and environmentally controlled warehousing solutions, driven by stringent food safety regulations and high consumer expectations. Eastern Europe is experiencing rapid growth as investments pour into modernizing agricultural infrastructure and cold chain logistics to meet both domestic and export demands, particularly within the EU common market.

- Asia Pacific (APAC): The fastest-growing market globally, fueled by its immense agricultural output, large population, and expanding middle class. Countries such as China, India, and ASEAN nations are witnessing substantial investments in modern warehousing, especially cold storage, to reduce massive post-harvest losses and improve food security. E-commerce growth in food and groceries is a significant driver, pushing demand for integrated and efficient storage and distribution networks across the region.

- Latin America: An emerging market with significant agricultural potential, particularly in countries like Brazil, Argentina, and Mexico. The region is progressively investing in improving its warehousing infrastructure, with a focus on enhancing cold chain capabilities to support the export of fresh produce, meat, and dairy products. Challenges include fragmented logistics networks, but opportunities abound for solutions that can connect producers to global markets more efficiently.

- Middle East & Africa (MEA): This region is experiencing considerable development in agricultural warehousing, driven by efforts to diversify economies, enhance food security, and reduce reliance on food imports. Countries in the GCC are investing heavily in state-of-the-art climate-controlled facilities, while various African nations are focusing on establishing basic yet effective storage solutions to minimize spoilage and stabilize local food supplies, often with international support and investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Product Warehousing Service Market.- Lineage Logistics

- Americold Realty Trust

- Kuehne + Nagel

- DHL Supply Chain

- CEVA Logistics

- DB Schenker

- Agility

- XPO Logistics

- Nippon Express

- Genco (a FedEx Company)

- Rhenus Logistics

- C.H. Robinson

- Ryder System, Inc.

- VersaCold Logistics Services

- NewCold

- Ingersoll Rand

- Tippmann Group

- United States Cold Storage

- Preferred Freezer Services

- Capstone Logistics

Frequently Asked Questions

What is the projected growth rate for the Agricultural Product Warehousing Service Market?

The Agricultural Product Warehousing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by increasing global food demand and supply chain optimization needs.

Which factors are primarily driving the growth of this market?

Key drivers include the rising global population and food demand, increasing focus on food safety and quality, expansion of international agricultural trade, and the growing adoption of e-commerce for food products. Technological advancements in warehousing also play a crucial role.

What types of storage services are most prevalent in the agricultural sector?

The most prevalent storage services include cold storage for perishable goods, controlled atmosphere (CA) storage for extended shelf life, dry storage for grains and non-perishables, and specialized silos for bulk commodities.

How is technology impacting agricultural product warehousing?

Technology is revolutionizing the market through Warehouse Management Systems (WMS), automation and robotics for handling and sorting, IoT sensors for real-time environmental monitoring, and AI/predictive analytics for optimized inventory and demand forecasting. These innovations enhance efficiency, reduce waste, and improve product traceability.

Which regions are leading in market expansion and technological adoption?

Asia Pacific is the fastest-growing market due to its vast agricultural output and increasing investment in modern infrastructure. North America and Europe lead in technological adoption, particularly in automation and cold chain solutions, driven by advanced logistics networks and stringent regulatory environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager