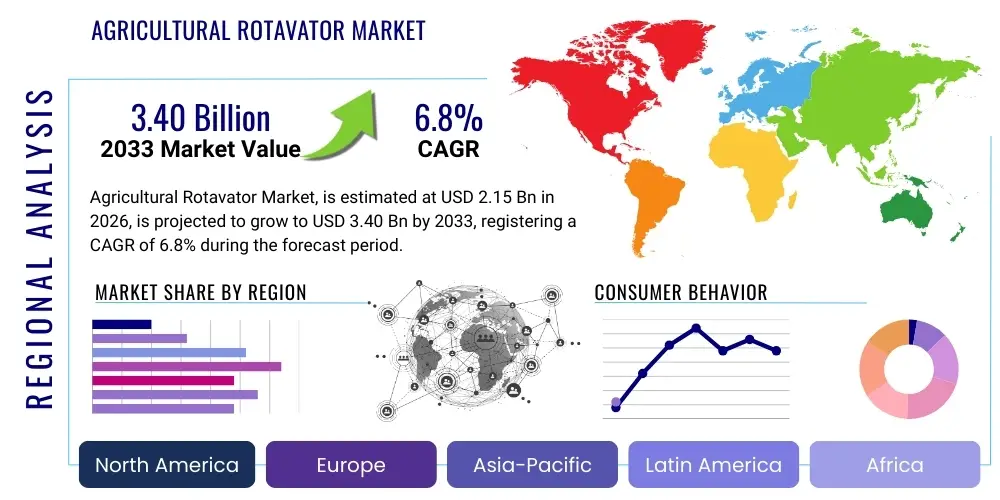

Agricultural Rotavator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436580 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Agricultural Rotavator Market Size

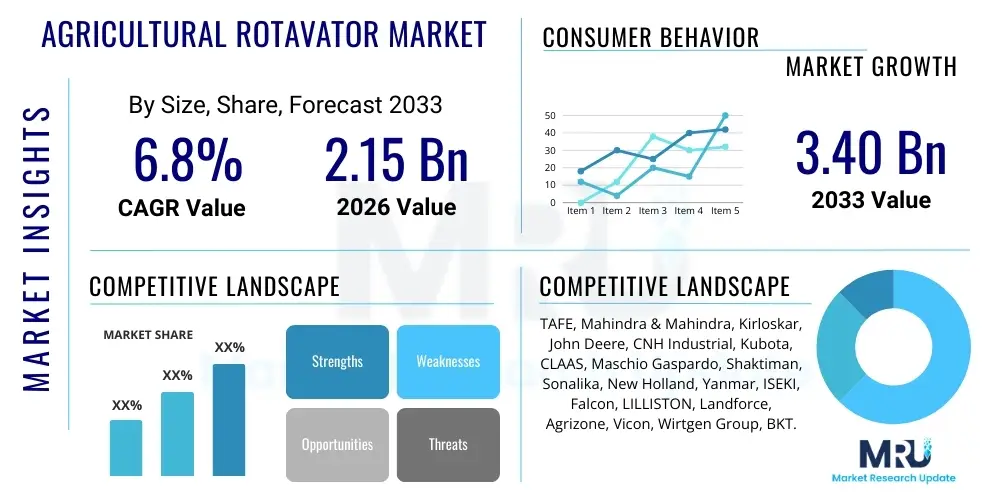

The Agricultural Rotavator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.40 Billion by the end of the forecast period in 2033.

Agricultural Rotavator Market introduction

The Agricultural Rotavator Market encompasses the manufacturing, distribution, and sale of rotary tillers used for secondary tillage, primarily preparing seedbeds by breaking up and mixing the soil. These implements, also known as power tillers or rotary hoes, are critical mechanical attachments compatible with tractors or designed as walk-behind units, performing functions essential for modern farming practices such as soil aeration, weed control, and incorporating crop residue or organic matter efficiently. The rotavator's product description emphasizes its robust design, featuring rotating blades (tines) mounted on a horizontal axle, driven by the tractor’s power take-off (PTO), offering better seedbed preparation compared to traditional ploughing methods, thereby enhancing crop yield potential and reducing preparation time.

Major applications of rotavators span diverse farming environments, including preparation of fields for cash crops, cereals, fruits, and vegetables, being particularly vital in regions characterized by high levels of residue or where fine seedbeds are mandatory, such as paddy cultivation. The primary benefits driving adoption include superior soil pulverization, reduced fuel consumption per hectare compared to disc harrows or cultivators, and the ability to operate effectively in various soil types, minimizing soil compaction. Rotavators contribute significantly to sustainable agriculture by enabling zero or minimum tillage practices when equipped with specialized settings.

Key driving factors accelerating the market growth include rapidly increasing farm mechanization rates across developing economies, stringent government subsidies and supportive policies promoting agricultural equipment modernization, and the persistent shortage of manual labor in many rural areas, necessitating efficient automated solutions. Furthermore, advancements in rotavator design, such as adjustable speed gearboxes, heavy-duty build quality for challenging terrains, and integrated seed drills, are expanding their versatility and appeal to large commercial farms and small landholders alike, solidifying their status as indispensable farm implements for optimized productivity.

Agricultural Rotavator Market Executive Summary

The Agricultural Rotavator Market is witnessing robust expansion, driven by favorable business trends centered on automation adoption and the shift toward precision agriculture methodologies, particularly in the Asia Pacific region which is dominated by small and medium-sized farms benefiting from high-efficiency tillage equipment. Global business trends highlight increased investment in research and development by Original Equipment Manufacturers (OEMs) focused on producing specialized rotavators tailored for specific soil and crop conditions, alongside the growing prominence of the aftermarket segment for spares and maintenance, ensuring equipment longevity and minimizing operational downtime for farmers.

Regional trends indicate that Asia Pacific remains the largest and fastest-growing market due to massive agrarian populations, high levels of government support, and the specific needs of rice paddy cultivation which heavily relies on rotavators for puddling operations. North America and Europe, characterized by established mechanization and larger farm sizes, show stable demand, predominantly for high-horsepower, heavy-duty rotavators integrating advanced sensor technology for optimized depth control. Latin America is also emerging as a significant market, fueled by increasing commercial farming activities and the need to improve soil health on large tracts of arable land.

Segmentation trends reveal a strong preference for medium-duty rotavators, offering a balance between cost, performance, and compatibility with mid-range tractors, making them accessible to a broader farmer base globally. In terms of mounting, tractor-mounted rotavators command the dominant market share due to the widespread ownership of tractors, while the walk-behind segment maintains importance in regions with highly fragmented land holdings or mountainous terrain. The continuous demand for high-quality soil preparation is consistently favoring sophisticated rotavator designs, integrating variable geometry features to adapt to changing field requirements instantaneously.

AI Impact Analysis on Agricultural Rotavator Market

User queries regarding AI's influence on the Agricultural Rotavator Market frequently focus on how artificial intelligence can optimize tillage depth, predict maintenance needs, and integrate rotavator operations within broader farm management systems. Users are concerned about the cost of integrating these smart technologies into traditional equipment and the required connectivity infrastructure in remote farming locations. Key expectations revolve around using AI to process real-time soil data (e.g., moisture, texture, resistance) collected via sensors mounted on the rotavator, allowing the machine to dynamically adjust parameters like PTO speed, tilling depth, and forward speed for optimal energy efficiency and superior seedbed quality. This shift implies a move from manual, static operation settings to intelligent, responsive soil preparation.

- AI-driven real-time soil mapping and texture analysis for automated depth adjustment.

- Predictive maintenance schedules for rotavator components, reducing unplanned downtime using machine learning algorithms.

- Integration with farm management software (FMS) for optimized fleet utilization and path planning during tillage operations.

- Enhanced fuel efficiency through AI optimization of PTO speed relative to soil resistance, lowering operational costs.

- Development of autonomous rotavator systems paired with self-driving tractors, increasing operational scalability and precision.

- Quality control monitoring of seedbed preparation using computer vision to assess soil uniformity and clod size distribution.

- AI-enabled training modules and diagnostics for field mechanics, accelerating repair times and improving service quality.

DRO & Impact Forces Of Agricultural Rotavator Market

The Agricultural Rotavator Market expansion is fundamentally propelled by technological drivers such as increased focus on soil health improvement and reduced turnaround time between harvesting and planting, while restrained primarily by the initial high investment cost for heavy-duty machinery and fragmented land ownership patterns in certain regions. Opportunities arise through the development of specialized, energy-efficient rotavators suitable for small land holdings and the increasing trend of custom hiring services, making equipment access feasible for resource-limited farmers. The key impact forces dictating market trajectory include stringent governmental regulations encouraging mechanization through subsidies, rapid urbanization leading to labor shortages, and volatility in raw material prices (steel) affecting manufacturing costs, forcing OEMs to continually seek optimized supply chains and innovative materials.

Segmentation Analysis

The segmentation analysis of the Agricultural Rotavator Market provides a granular view of demand distribution across various product types, mounting mechanisms, end-use applications, and sales channels. This detailed categorization helps stakeholders understand specific needs, enabling tailored product development and targeted marketing strategies. Key segmentation variables reflect the diversity in farming scale, soil conditions, crop types, and farmer purchasing power globally, ensuring the market offers solutions ranging from compact, low-power tillers for subsistence farming to robust, high-performance rotavators for large commercial operations focused on deep tillage and extensive residue management.

- Type: Light Duty, Medium Duty, Heavy Duty, Specialized Duty

- Mounting: Tractor Mounted, Walk-Behind (Power Tiller Attached)

- Application: Dry Land Farming, Paddy Fields (Wet Land), Horticulture and Vineyard, Commercial Operations

- Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket

- Power Requirement (HP): Up to 35 HP, 35 HP to 60 HP, Above 60 HP

Value Chain Analysis For Agricultural Rotavator Market

The value chain for the Agricultural Rotavator Market begins with upstream activities, involving the procurement of raw materials, predominantly high-grade steel, cast iron, and specialized alloys required for the robust construction of the chassis, rotor assembly, and tines. Key suppliers in the upstream segment include specialized forging and casting companies, and gearbox manufacturers. Efficiency in this stage is crucial, as raw material price volatility significantly impacts the final cost of the equipment. OEMs focus on establishing long-term agreements with reliable suppliers to ensure consistent material quality and manage costs effectively, which is a major determinant of competitive advantage in the highly price-sensitive market.

Mid-stream activities encompass the manufacturing and assembly process, which includes precision machining of the rotor shafts, heat treatment of the tines (blades) to ensure wear resistance, and the final integration of the gearbox and protective shields. Market leaders often employ advanced manufacturing technologies, such as robotic welding and computer-aided design (CAD) to optimize product durability and performance. Quality control and testing are integral parts of this phase to ensure the rotavators meet international safety standards and operational specifications required for various soil types and agricultural practices globally, including specialized requirements for deep tillage or shallow seedbed preparation.

Downstream analysis focuses on the distribution channel, which is a complex network involving direct and indirect sales methods. Direct sales are often utilized for large institutional buyers or government tenders, ensuring streamlined delivery and service. Indirect channels, which dominate the market, rely on extensive networks of authorized dealers, regional distributors, and specialized agricultural retailers. This network not only facilitates equipment sales but also provides critical after-sales services, spare parts availability, and technical support. The effectiveness of the dealer network in providing prompt maintenance and genuine spares is a significant factor in customer satisfaction and repeat business, particularly important for maintaining high equipment utilization during peak farming seasons.

Agricultural Rotavator Market Potential Customers

The primary potential customers and end-users of agricultural rotavators are diverse, ranging from small-scale subsistence farmers relying on walk-behind models to large, mechanized corporate farming enterprises utilizing heavy-duty, high-horsepower tractor-mounted units. Specifically, individual farmers constitute the largest customer segment, driven by the need to increase efficiency and overcome labor shortages, seeking durable and cost-effective solutions for timely seedbed preparation. The increasing trend of leasing or custom hiring service providers represents a rapidly growing customer base; these businesses invest in multiple units of diverse specifications to rent out to smaller farmers, effectively democratizing access to high-end mechanization.

Institutional buyers, including government agricultural departments, agricultural universities, and co-operative societies, also represent a substantial customer segment. These entities frequently purchase rotavators in bulk for distribution under subsidy programs or for research and demonstration purposes aimed at promoting modern farming techniques and improving soil structure across different regions. Furthermore, businesses engaged in horticulture, vineyard management, and specialized crop cultivation require specific, often narrow or offset, rotavator designs tailored to work between rows without damaging crops, expanding the customer profile beyond traditional cereal and staple crop growers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.40 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TAFE, Mahindra & Mahindra, Kirloskar, John Deere, CNH Industrial, Kubota, CLAAS, Maschio Gaspardo, Shaktiman, Sonalika, New Holland, Yanmar, ISEKI, Falcon, LILLISTON, Landforce, Agrizone, Vicon, Wirtgen Group, BKT. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Rotavator Market Key Technology Landscape

The technology landscape of the Agricultural Rotavator Market is rapidly evolving beyond basic mechanical tillage towards integrated, precision soil preparation systems designed for efficiency and sustainability. One crucial technological advancement is the introduction of variable geometry rotavators, allowing operators to electronically adjust the working width and offset position dynamically from the tractor cabin, maximizing coverage while minimizing fuel consumption. Furthermore, the incorporation of advanced gearbox technology, specifically multi-speed gearboxes, enables farmers to precisely match the rotor speed to different soil conditions and moisture levels, ensuring optimum clod size and mixing efficiency. This capability is vital for specialized crops requiring finely pulverized soil and reduces strain on the tractor’s PTO system.

Another significant development involves enhanced tine and blade metallurgy. Manufacturers are investing heavily in research to develop wear-resistant materials and specialized coatings, such as tungsten carbide tipped blades, which significantly extend the operational life of the components, particularly when working in abrasive or rocky soils. This addresses a major operational constraint—frequent component replacement—thereby lowering long-term maintenance costs for the end-user. Furthermore, sensor technology is becoming standard on high-end models; these sensors monitor parameters like tilling depth, angle of attack, and soil resistance, transmitting data back to the tractor’s central control unit or integrated farm management system, paving the way for data-driven tillage decisions and enhancing overall operational precision.

The integration of the rotavator into the broader scope of precision agriculture is defining the future technology trajectory. This includes GPS and telematics integration, which allows for precise guidance and mapping of tilled areas, preventing overlaps and optimizing fertilizer or residue incorporation patterns. Autonomous and semi-autonomous rotavator systems, relying on advanced computer vision and machine learning for obstacle detection and automatic field boundary recognition, are currently in pilot testing phases, promising substantial increases in operational throughput. The continuous push toward electric and hybrid agricultural machinery is also influencing rotavator design, requiring lighter, yet more powerful PTO systems that can efficiently handle the high energy demands of rotary tillage while meeting increasingly stringent environmental regulations concerning emissions and noise pollution.

Detailed elaboration on technological implementation reveals that multi-sensor platforms are being developed to measure real-time soil characteristics (e.g., pH, organic carbon content, compaction level) immediately ahead of the rotavator. This data is processed instantaneously by an on-board micro-controller, which then adjusts the rotavator’s settings via hydraulic actuators. This closed-loop system ensures that every square meter of the field receives optimized tillage, a stark contrast to traditional methods where a single setting is applied uniformly across heterogeneous soil environments. This high degree of customization significantly contributes to maximizing seed germination rates and reducing unnecessary soil disturbance, aligning perfectly with modern regenerative agriculture practices focused on maintaining soil microbial diversity and structure. The adoption of robust, ruggedized IoT components capable of withstanding the harsh vibrations and dust of farm operations is crucial for the successful deployment of these smart rotavators, demanding specialized engineering solutions that ensure reliability and longevity under extreme operating conditions globally.

Regional Highlights

The Agricultural Rotavator Market exhibits distinct regional dynamics driven by varying levels of mechanization, governmental support, and prevailing crop cultivation practices. Asia Pacific (APAC) dominates the global market, both in terms of volume and growth rate. This dominance is primarily attributable to the vast agricultural land base in countries like India, China, and Southeast Asian nations, where small land holdings necessitate efficient, versatile equipment like rotavators, which are often subsidized by national governments to promote timely planting and double cropping. The region's extensive paddy cultivation heavily relies on rotavators for puddling operations, creating specialized demand for waterproof and wetland-specific models. The high demand is further compounded by favorable policy environments, including tax exemptions and credit facilities for farm machinery acquisition.

North America and Europe represent mature markets characterized by large-scale commercial farming and high levels of mechanization. Demand in these regions is focused on heavy-duty, high-horsepower rotavators (above 60 HP) integrated with sophisticated precision agriculture technologies, such as GPS mapping and automated depth control. European demand is particularly influenced by rigorous environmental regulations concerning soil erosion and biodiversity, driving demand for rotavators that facilitate minimum tillage or specialized residue management techniques. Adoption rates here are stable, driven mainly by replacement cycles and the continuous upgrading to more fuel-efficient and technologically advanced models that integrate seamlessly with high-tech tractor fleets.

Latin America (LATAM) is emerging as a strong growth center, particularly in Brazil and Argentina, where large-scale soybean, maize, and sugarcane farming require robust, reliable soil preparation tools. The increasing foreign direct investment in agricultural infrastructure and the push towards improving farm yields to meet global commodity demand are key drivers. Conversely, the Middle East and Africa (MEA) market is currently smaller but possesses high growth potential, driven by national initiatives to enhance food security and modernize traditional farming systems, particularly in regions like South Africa and Turkey, where government purchases often stimulate market entry for international manufacturers. Challenges in MEA include the lack of robust dealer networks and fragmented distribution infrastructure, requiring customized market entry strategies focused on establishing localized service centers.

- India: Largest consumer globally due to extensive government subsidies, fragmented land holdings favoring medium-duty models, and high reliance on rotavators for diverse crop cycles.

- China: Significant manufacturer and consumer, rapidly modernizing agriculture with a focus on powerful, automated, and specialized rotavators for various topographies.

- United States: Focus on heavy-duty, high-horsepower rotavators (60 HP+) integrated with precision GPS technology for large acreage and residue incorporation.

- Brazil: Key growth market in LATAM, driven by large-scale commercial farming and increasing adoption of specialized equipment for challenging soil conditions and tropical crops.

- Europe (Germany, France): Stable demand for premium, technologically advanced rotavators adhering to strict environmental standards regarding soil structure preservation and energy consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Rotavator Market.- TAFE (Tractors and Farm Equipment Limited)

- Mahindra & Mahindra Ltd.

- Kirloskar Oil Engines Ltd. (KOEL)

- John Deere (Deere & Company)

- CNH Industrial N.V. (New Holland Agriculture, Case IH)

- Kubota Corporation

- CLAAS Group

- Maschio Gaspardo S.p.A.

- Shaktiman (Tirth Agro Technology Private Limited)

- Sonalika Tractors (International Tractors Limited)

- Yanmar Holdings Co., Ltd.

- ISEKI & Co., Ltd.

- Falcon (Lalitha Agrotech)

- LILLISTON (a brand of Bush Hog)

- Landforce Implements (Pvt. Ltd.)

- Agrizone (Agris.co)

- Wirtgen Group (for specialized milling applications in forestry/agriculture)

- BKT (Balkrishna Industries Limited - though specialized in tires, often impacts equipment adoption)

- Vicon (Kverneland Group)

- Howard Rotavator (Part of Alamo Group)

Frequently Asked Questions

Analyze common user questions about the Agricultural Rotavator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Agricultural Rotavator Market?

The Agricultural Rotavator Market is anticipated to grow at a steady Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by increasing farm mechanization and government support globally.

Which segment dominates the rotavator market based on application?

Dry Land Farming applications hold a dominant market share due to the global prevalence of cereal and commercial crop cultivation; however, the Paddy Fields (Wet Land) segment shows exceptionally high growth rates, especially in Asia Pacific, driven by the specialized need for puddling operations.

How does AI technology impact the efficiency of agricultural rotavators?

AI impacts rotavator efficiency by enabling predictive maintenance to reduce downtime and through real-time adjustment systems that optimize tilling depth and speed based on instantaneous soil characteristics, leading to superior seedbed quality and reduced fuel consumption.

What are the primary factors restraining the growth of the rotavator market?

The key restraints include the high initial investment cost required for purchasing heavy-duty rotavators, particularly challenging for small farmers, and the logistical challenges presented by fragmented land holdings in developing economies which limit the economic viability of very large machinery.

Which region is the primary driver of demand for agricultural rotavators globally?

The Asia Pacific (APAC) region is the primary driver and largest consumer market, owing to supportive government subsidies promoting farm mechanization, large agricultural populations, and intensive cultivation practices requiring efficient soil preparation tools like rotavators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager