Agricultural Rubber Tracks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434906 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Agricultural Rubber Tracks Market Size

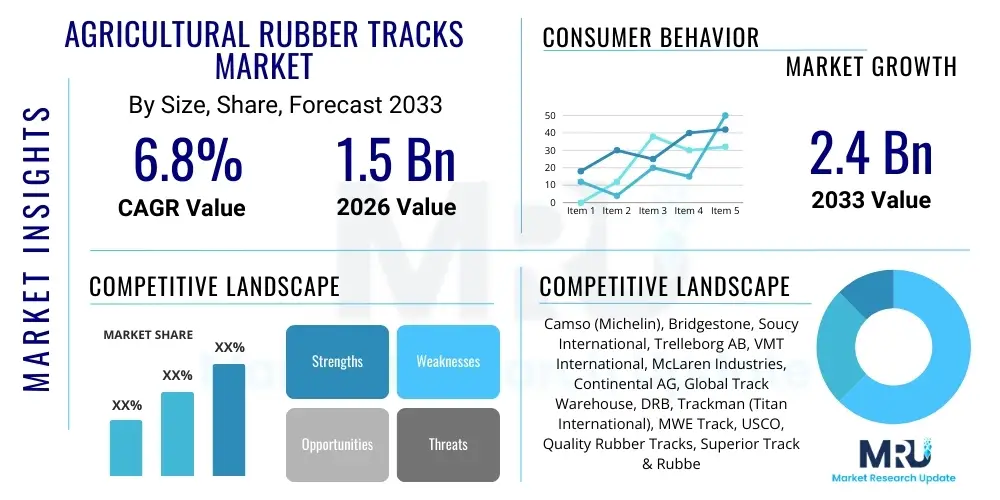

The Agricultural Rubber Tracks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing global adoption of heavy-duty, high-horsepower agricultural machinery, where rubber tracks offer superior traction and significantly reduce detrimental soil compaction compared to traditional wheeled systems. The necessity for enhanced productivity in farming operations, coupled with stringent environmental regulations promoting sustainable farming practices, solidifies the market's positive trajectory over the coming decade.

Agricultural Rubber Tracks Market introduction

The Agricultural Rubber Tracks Market encompasses the manufacturing, distribution, and utilization of continuous rubber track systems designed specifically for agricultural machinery, including high-horsepower tractors, combines, sprayers, and specialized harvesters. These tracks are engineered using specialized rubber compounds reinforced with high-strength materials, such as steel cords or aramid fibers, providing robustness, flexibility, and durability under severe operational stress and varied terrain conditions. The primary product differentiation in this market revolves around track width, lug pattern design (for optimal grip and self-cleaning), and material composition focused on maximizing longevity and minimizing rolling resistance.

Major applications of agricultural rubber tracks include row cropping, tillage, planting, and harvesting across large-scale commercial farms globally. These systems are crucial in modern precision agriculture as they facilitate reduced ground pressure, which is vital for maintaining soil health, improving water retention, and ultimately boosting crop yields. The inherent benefits, such as superior floatation, decreased vibration for operator comfort, and enhanced machine stability on slopes, drive their adoption across diverse agricultural landscapes, from the soft soils of the Midwestern United States to the challenging rice paddies of Asia.

Key driving factors fueling market expansion include the global shift towards larger and heavier machinery necessitated by farm consolidation and the demand for increased operational efficiency. Furthermore, governmental incentives and farmer awareness programs focusing on sustainable land management, particularly concerning mitigating soil erosion and compaction, strongly support the demand for tracked machinery. The market also benefits from technological advancements in material science, leading to lighter yet stronger track systems that offer extended service life and lower lifetime operational costs, further accelerating the replacement cycle in mature agricultural markets.

Agricultural Rubber Tracks Market Executive Summary

The global Agricultural Rubber Tracks Market exhibits strong growth momentum, underpinned by critical business trends such as increasing original equipment manufacturer (OEM) integration and a burgeoning high-margin aftermarket segment focused on durable replacement tracks. Business strategies are heavily concentrated on vertical integration, ensuring a stable supply of raw materials like synthetic elastomers and steel reinforcement components, alongside significant investment in R&D to enhance track flexibility, heat resistance, and traction performance, particularly for extreme temperature environments. Manufacturers are also adapting their product portfolios to align with the electrification trends in agricultural machinery, requiring tracks that handle higher instantaneous torque loads efficiently. This operational shift mandates continuous innovation in compound design and manufacturing precision to maintain a competitive edge.

Regionally, North America and Europe dominate the market due to established infrastructure supporting precision farming, high average farm size, and substantial capital investment capacity among farmers. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid agricultural mechanization in countries like China, India, and Southeast Asia. The transition from labor-intensive farming methods to mechanized systems, coupled with growing government support for modernizing agriculture, presents vast opportunities. Segment-wise, the high-horsepower tractor application segment remains the largest revenue contributor, although the demand for tracks on specialized harvesting equipment (e.g., sugar cane harvesters, grape harvesters) is showing accelerated adoption rates, driven by the need for low-impact operation during delicate harvesting periods.

A significant trend influencing market segmentation is the growing demand for specialty tracks optimized for specific soil types and applications, moving beyond general-purpose tracks. This customization includes specialized tread patterns for wet environments (rice farming) or abrasive, rocky terrains. Furthermore, sustainability concerns are influencing product development, with manufacturers exploring bio-based polymers and advanced recycling technologies for end-of-life tracks, positioning the industry favorably in alignment with global environmental objectives. The shift toward predictive maintenance and smart integration through sensor-equipped tracks represents a forward-looking trend that will define future market leadership and customer value propositions.

AI Impact Analysis on Agricultural Rubber Tracks Market

Common user questions regarding AI's impact on agricultural rubber tracks primarily focus on how Artificial Intelligence can extend track lifespan, optimize maintenance schedules, and enhance machinery performance in autonomous farming scenarios. Users frequently ask about the practical application of embedded sensors within tracks—specifically, how AI algorithms process data on temperature, stress, and vibration to predict failure before it occurs, thereby reducing costly downtime during critical planting or harvesting seasons. There is also significant curiosity about AI's role in material science research, such as simulating complex wear patterns and optimizing new rubber compound formulations for improved durability and fuel efficiency.

AI algorithms are fundamentally transforming the design, manufacturing, and operational phases of agricultural rubber tracks. In the design stage, Machine Learning (ML) models analyze vast datasets of track failure modes under varying conditions (soil type, load, speed) to inform engineers on optimal tread geometry and reinforcement placement, leading to inherently more resilient products. Operationally, AI-driven diagnostics utilize telematics data streaming from tracks equipped with passive or active sensor systems to provide real-time condition monitoring. This capability moves maintenance from reactive or scheduled interventions to a highly efficient, condition-based approach, ensuring that tracks are utilized to their maximum viable lifespan without incurring unexpected operational failures.

The advent of fully autonomous agricultural vehicles represents the most profound long-term impact of AI on the track market. Autonomous machinery relies heavily on precise operational data for optimal path planning, minimizing slippage, and ensuring stable movement across uneven terrain. AI systems manage the dynamic adjustments of the vehicle's drive train based on continuous feedback from the tracks regarding traction and load distribution. Furthermore, AI contributes significantly to the sustainability profile of the tracks by optimizing wear patterns, leading to reduced material consumption over the track's life cycle and ultimately enhancing the vehicle's energy efficiency, a crucial factor in both diesel and electric farm equipment.

- AI-powered predictive maintenance reduces catastrophic failures by up to 40%.

- Machine learning optimizes rubber compound formulation for specific performance metrics (e.g., abrasion resistance).

- Autonomous vehicle systems rely on AI feedback from tracks for optimized traction control and reduced fuel consumption.

- Data analytics models identify and prioritize key wear indicators (e.g., internal temperature fluctuations, steel cord strain).

- AI assists in quality control during manufacturing by analyzing visual inspection data for minute structural defects.

DRO & Impact Forces Of Agricultural Rubber Tracks Market

The Agricultural Rubber Tracks Market is shaped by powerful Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces that dictate its evolution. Key drivers include the global push for precision agriculture adoption, which mandates low soil compaction to preserve arable land health, and the continuous increase in the average horsepower of agricultural tractors and combines, necessitating advanced traction solutions. Restraints primarily involve the high initial capital investment required for tracked vehicles compared to wheeled counterparts and the specialized nature of maintenance and replacement, often requiring dedicated dealership services. Opportunities are emerging through advancements in material science, focusing on developing lighter, more durable, and potentially biodegradable track compounds, alongside expanding adoption in emerging markets undergoing rapid agricultural modernization. These forces combine to create a dynamic environment demanding continuous innovation in product design and service offerings.

Drivers are exerting sustained upward pressure on market demand. The necessity for high-efficiency operation over extended periods, particularly in North America and Europe where farming windows are tightly scheduled, makes the reduced slippage and higher traction of rubber tracks economically compelling. Furthermore, regulatory frameworks, such as specific EU directives concerning soil degradation and water retention, subtly incentivize the use of low-ground-pressure equipment. The increasing awareness among large commercial farm operators regarding the long-term economic benefits of mitigating soil compaction, which includes higher future yields and reduced deep tillage costs, is a crucial internal driver.

However, market growth faces friction from several restraints. The perception of high replacement costs for rubber tracks compared to standard tires acts as a barrier, particularly for smaller and medium-sized farming enterprises. While the cost-benefit analysis often favors tracks over the long term, the upfront expenditure remains a significant hurdle. Additionally, the complexity associated with repairing damaged tracks, often requiring specialized tooling or complete replacement of sections, adds to the operational cost and downtime concerns. Opportunities are centered on addressing these restraints through innovation, such as developing modular track systems for easier repair or introducing advanced telematics services to schedule track replacement proactively based on wear rate, maximizing value for the customer.

Impact forces, including geopolitical shifts affecting raw material supply (synthetic rubber derivatives and steel) and intense competition from traditional tire manufacturers innovating high-flexion tires, constantly influence market stability and pricing power. Technological impact forces, particularly the integration of Internet of Things (IoT) sensors into tracks, are creating new competitive arenas based on data services and enhanced warranty offerings derived from usage monitoring. The regulatory environment also plays a pivotal role; shifts in fuel standards, vehicle weight limits, and environmental protection laws directly impact machinery design and, consequently, the specifications required for the rubber tracks utilized.

Segmentation Analysis

The Agricultural Rubber Tracks Market is extensively segmented based on application, material type, and distribution channel, reflecting the highly specialized demands within the global agricultural sector. This segmentation allows manufacturers to tailor products precisely to end-user needs, whether for heavy-duty row crop tractors requiring high pull force and minimal slip, or delicate harvesting machinery that prioritizes flotation and low ground pressure during sensitive operations. The differentiation across segments is crucial for market participants seeking competitive advantage through specialization, especially concerning material durability and load-bearing capacity.

By application, the market is broadly divided into segments like tractors (further categorized by horsepower range), combines, and other specialized equipment. This categorization is vital because the engineering requirements for a high-horsepower tractor operating continuous tillage are vastly different from a combine operating intermittently on softer ground during harvest. Material segmentation focuses on the composition of the rubber tracks, ranging from standard natural/synthetic blends to advanced high-performance compounds reinforced with specialized fibers designed for enhanced wear resistance and reduced internal heat build-up. The fastest-growing segments typically involve high-performance materials and tracks designed for mega-tractors (>400 HP), reflecting the trend towards larger equipment globally.

Distribution channel analysis distinguishes between Original Equipment Manufacturers (OEMs) and the Aftermarket. The OEM channel involves tracks supplied directly to major agricultural machinery manufacturers (e.g., John Deere, AGCO, CNH Industrial) for installation on new vehicles. The Aftermarket channel involves replacement sales to farmers, dealers, and third-party repair shops. While the OEM segment provides stable, high-volume contracts, the Aftermarket segment often offers higher margins and is less susceptible to immediate fluctuations in new equipment sales, making robust aftermarket supply chain management a strategic priority for key players.

- By Application:

- High Horsepower Tractors (Above 300 HP)

- Medium Horsepower Tractors (150-300 HP)

- Combines and Harvesters

- Specialized Equipment (Sprayers, Tillers, Planters)

- By Material Type:

- Standard Rubber Tracks

- High-Performance Rubber Tracks (Aramid/Steel Reinforced)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Agricultural Rubber Tracks Market

The value chain for agricultural rubber tracks is characterized by several distinct stages, starting from the sourcing of specialized raw materials, moving through complex manufacturing processes, and concluding with sophisticated distribution networks reaching global farming communities. The upstream segment is dominated by the procurement of critical components: synthetic rubber (such as polyisoprene and butadiene rubber), reinforcement materials (high-tensile steel cords or aramid fibers), and chemical additives necessary for vulcanization and durability enhancement. Prices and stability in the petrochemical sector directly impact raw material costs, making strategic supplier relationships crucial for managing margins. Manufacturers must invest heavily in proprietary compounding techniques to achieve the required performance metrics for agricultural use, such as heat resistance and flexibility under heavy load.

The midstream phase, comprising manufacturing and assembly, involves high-precision machinery for molding, curing (vulcanization), and bonding the rubber compounds with the steel/fiber reinforcements. Quality control at this stage is paramount, as even minor defects can lead to catastrophic field failures under intense agricultural use. Downstream activities involve distribution and sales. The distribution channel is bifurcated into direct supply to large OEMs, which requires just-in-time inventory management and strict quality adherence, and supply to the aftermarket, which is managed primarily through authorized dealer networks, third-party distributors, and increasingly, specialized online portals. Effective inventory management in the aftermarket is vital due to the wide variety of track sizes and tread patterns required for different machinery models and applications.

Both direct (OEM) and indirect (Aftermarket) channels play pivotal roles. The OEM channel provides predictable, large-volume sales integrated into the machinery production cycle. This channel requires manufacturers to participate in the machinery design process, often leading to custom track specifications. The indirect aftermarket channel, conversely, relies on robust logistics and deep dealer relationships to ensure timely replacement parts availability, which is crucial during peak farming seasons. The complexity of the product, requiring professional installation and alignment, favors a distribution strategy centered around knowledgeable service dealers rather than purely direct-to-consumer models, though e-commerce is gaining traction for specific, standardized components and accessories.

Agricultural Rubber Tracks Market Potential Customers

The primary customers for the Agricultural Rubber Tracks Market are diverse but largely centered on organizations and individuals utilizing high-value, heavy agricultural machinery where operational efficiency and soil preservation are critical economic factors. The largest segment of end-users consists of large-scale commercial farming enterprises, particularly those engaged in row cropping (corn, soybeans, wheat) in regions like North America, Australia, and Western Europe. These customers prioritize high-horsepower tracks that minimize downtime, reduce input costs (via better fuel economy and reduced tillage needs), and maximize the lifespan of the equipment by reducing shock loads.

A secondary, rapidly expanding customer base includes agricultural contractors and custom harvesting operations. These businesses require highly reliable, versatile track systems that can operate across multiple farms, often transitioning between different soil types and weather conditions within a single operational window. Their demand centers on tracks offering superior durability, ease of maintenance, and universal fitment options across various brands of machinery. They view tracks as an essential investment to mitigate environmental risk (preventing fields from being inaccessible due to wet conditions) and ensure contract fulfillment through reliable operation.

Furthermore, specialty agriculture sectors, such as rice farming (where flotation is essential) and perennial crop harvesting (e.g., vineyards and orchards), constitute important niche markets. In these areas, customers seek specialized, narrower tracks or unique tread designs engineered for low-impact operation to protect sensitive root systems or minimize field disruption. Government entities and agricultural research institutions also represent niche buyers, procuring tracked machinery for specific research projects, land reclamation, or demanding civil engineering applications related to rural infrastructure development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Camso (Michelin), Bridgestone, Soucy International, Trelleborg AB, VMT International, McLaren Industries, Continental AG, Global Track Warehouse, DRB, Trackman (Titan International), MWE Track, USCO, Quality Rubber Tracks, Superior Track & Rubber, Intertrac. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Rubber Tracks Market Key Technology Landscape

The technology landscape of the Agricultural Rubber Tracks Market is rapidly evolving, driven by the need for enhanced durability, reduced soil impact, and integration with modern smart farming systems. A critical technological focus is on advanced rubber compounding. Manufacturers are moving away from simple blends towards highly engineered elastomers, often incorporating proprietary synthetic polymers (such as specialty polyisoprene or high-grade EPDM) tailored to withstand extreme environmental conditions—including high internal heat generated during continuous operation and resistance to agricultural chemicals and fertilizers. These advanced materials are essential for reducing abrasion and increasing the flexural strength of the track body, directly translating into longer service life and reduced operational costs for farmers.

Reinforcement technology also constitutes a core area of innovation. Traditional tracks relied heavily on steel cables, but modern designs increasingly utilize lighter, high-strength alternatives, such as aramid fibers (Kevlar-type materials), or hybrid steel-fiber reinforcement systems. This shift reduces the overall weight of the track without compromising its tensile strength or load-bearing capacity, leading to better fuel efficiency and reduced wear on the machine's drive components. Furthermore, track geometry optimization, involving sophisticated Finite Element Analysis (FEA) simulations, is used to refine the tread patterns (lugs) and internal carcass structure to maximize flotation, minimize vibration, and ensure optimal self-cleaning capability in muddy conditions, a key performance indicator for farmers.

The most forward-looking technological advancements involve the integration of sensor and smart technology. This includes embedding passive RFID tags or more complex active wireless sensors (IoT devices) within the tracks to monitor operational parameters like internal temperature, tension, ground contact pressure, and cord strain. This data, when processed by onboard or cloud-based AI systems, enables predictive maintenance alerts, allowing farmers to adjust track tension or plan replacements before critical failure occurs. This technological shift is moving the product from a static component to an intelligent, data-generating asset, enhancing the overall value proposition and facilitating the transition towards fully optimized, autonomous agricultural machinery operations.

Regional Highlights

The market dynamics of agricultural rubber tracks vary significantly across major geographical regions, influenced by farming scale, regulatory frameworks, climate conditions, and technology adoption rates. North America stands as a dominant market, characterized by large commercial farms operating high-horsepower machinery. The intense competition and need for maximum operational efficiency during short harvest windows drive demand for premium, high-performance rubber tracks that offer superior durability and minimal soil compaction across vast acreage. Manufacturers often utilize North America as a proving ground for their newest, heaviest-duty track systems designed for 500+ horsepower tractors and large continuous-flow combines. The region also features a highly active and mature aftermarket due to the long lifespan of farming equipment.

Europe represents another key region, though its market is driven slightly differently, focusing heavily on sustainability and compliance with strict environmental regulations (e.g., the EU Green Deal). European farms, while often smaller than North American counterparts, exhibit a high degree of technological sophistication, favoring tracks that offer precise handling, low fuel consumption, and verifiable soil protection capabilities. Demand is strong for narrow-gauge tracks suitable for row crop applications and specialized vineyard/orchard equipment. Furthermore, European manufacturers are leading innovation in track material recycling and developing bio-based rubber compounds to meet regional sustainability targets, influencing global material standards.

The Asia Pacific (APAC) region is projected to experience the fastest growth rate. This surge is attributed to the widespread mechanization of agriculture, particularly in China, India, and Southeast Asia, as governments invest heavily in modernizing farm infrastructure and increasing food production capacity. While the initial demand centers on standardized, cost-effective tracks for medium-sized machinery, the growing adoption of Western-style large farm equipment in key arable zones is quickly increasing the appetite for advanced, high-performance tracks. Specific regional demands include tracks designed for wet, paddy field conditions (rice farming) that require specialized flotation characteristics and self-cleaning ability, presenting unique challenges and opportunities for specialized track manufacturers.

Latin America and the Middle East & Africa (MEA) represent emerging but promising markets. Latin America, particularly Brazil and Argentina, is characterized by large-scale soybean and sugarcane production, driving demand for powerful tracked machinery capable of operating efficiently in harsh tropical conditions. The focus here is on resistance to abrasion and high operational temperatures. The MEA market is highly heterogeneous, with pockets of rapid mechanization in countries addressing food security challenges. Growth in MEA depends significantly on government subsidies and foreign investment in large-scale commercial farming ventures, typically favoring durable, reliable tracks that can withstand semi-arid or desert-like operating environments.

- North America: Dominates revenue share; high demand for tracks on 500+ HP machinery; mature replacement market; focus on efficiency and large-scale operation.

- Europe: Growth driven by sustainability regulations and precision farming adoption; emphasis on low-impact, specialized tracks; strong R&D focus on bio-materials.

- Asia Pacific (APAC): Fastest-growing region; rapid mechanization in China and India; high demand for tracks suited for paddy/wet soil conditions.

- Latin America: Significant growth in Brazil and Argentina; demand driven by sugarcane and soybean production; focus on high heat and abrasion resistance.

- Middle East and Africa (MEA): Emerging market growth tied to large commercial agricultural projects; focus on robust tracks for arid and semi-arid conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Rubber Tracks Market.- Camso (Michelin)

- Bridgestone

- Soucy International

- Trelleborg AB

- Continental AG

- VMT International

- McLaren Industries

- Global Track Warehouse

- DRB

- Trackman (Titan International)

- MWE Track

- USCO

- Quality Rubber Tracks

- Superior Track & Rubber

- Intertrac

- Pirelli (Pneus Industrial Division)

- Jiangsu Zhenglei Rubber Co., Ltd.

- Zhejiang Rubber & Plastic Co., Ltd.

- Jinma Rubber Track Manufacturing Co., Ltd.

- Tongda Rubber Track Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Agricultural Rubber Tracks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using rubber tracks over tires in agricultural applications?

The primary benefit is the significant reduction in ground pressure (improved flotation) due to the larger contact patch area of the tracks. This minimizes soil compaction, which is critical for preserving soil health, improving water retention, and ultimately leading to higher crop yields compared to wheeled machinery.

How do advancements in material science affect the longevity and performance of agricultural rubber tracks?

Modern material science utilizes high-grade synthetic elastomers reinforced with aramid fibers or advanced steel cords. This technology drastically improves abrasion resistance, reduces internal heat buildup during operation, and enhances flexibility, extending the track's service life and ensuring consistent performance under heavy loads and high speeds.

Which application segment holds the largest share in the Agricultural Rubber Tracks Market?

The High Horsepower Tractors segment (typically 300 HP and above) currently holds the largest market share. This dominance is driven by the global trend toward using large, heavy machinery on commercial farms where optimal traction and low ground pressure are essential for maximizing efficiency during demanding operations like deep tillage.

What role does the Aftermarket segment play in the overall rubber track distribution channel?

The Aftermarket segment is crucial for market sustainability, as it involves the sale of replacement tracks to existing machinery owners. It often provides higher profit margins than OEM sales and is driven by the necessity of timely replacement to avoid operational downtime during peak farming seasons, requiring robust inventory and dealer service networks.

Is the adoption of sensor technology standard in modern agricultural rubber tracks?

While not yet universally standard, the adoption of sensor technology (IoT integration) is rapidly becoming a key differentiator. These embedded sensors monitor critical operational data like temperature and strain, enabling predictive maintenance schedules and contributing to higher machine uptime and lower overall lifecycle costs for the end-user.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager