Agriculture Dripper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432727 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Agriculture Dripper Market Size

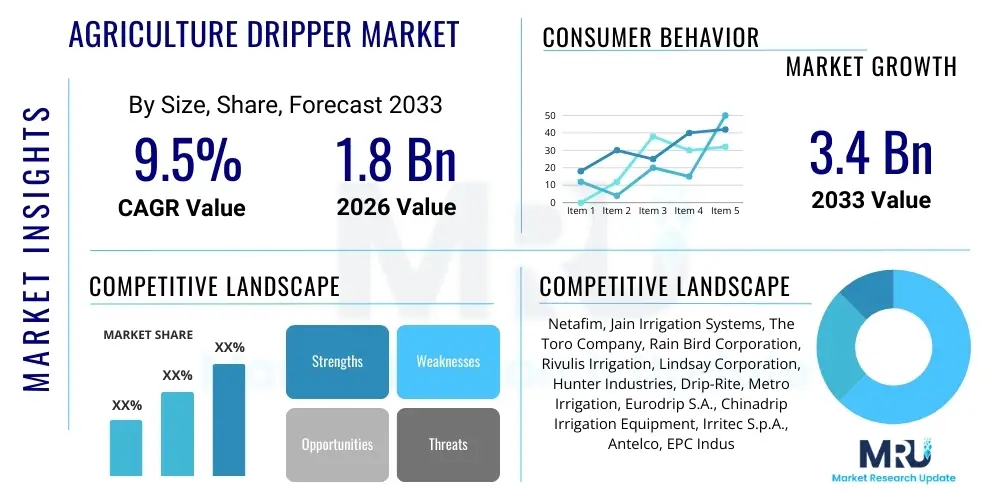

The Agriculture Dripper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Agriculture Dripper Market introduction

The Agriculture Dripper Market encompasses the manufacturing, distribution, and utilization of micro-irrigation components, specifically drippers and emitters, designed to deliver water and nutrients directly to the plant root zone. These systems are crucial elements of modern precision agriculture, aimed at maximizing water use efficiency, improving crop yields, and reducing operational costs associated with traditional flood or sprinkler irrigation methods. The core product, the agriculture dripper, is engineered to release water at a controlled, consistent flow rate, often compensating for pressure variations across long lateral lines in fields.

Major applications for agriculture drippers span diverse agricultural sectors, including high-value crops like fruits, vegetables, and ornamentals grown in orchards, vineyards, and greenhouses, as well as row crops where water conservation is critical. The primary benefits of employing these systems include significant water savings (up to 50% compared to conventional methods), efficient fertilizer delivery (fertigation), reduced incidence of fungal diseases due to minimized foliage wetting, and suitability for utilizing marginal quality water. This technology directly addresses global challenges related to freshwater scarcity and the need for sustainable food production under changing climatic conditions.

Driving factors for the market growth include stringent governmental regulations promoting water conservation, increasing adoption of advanced farming techniques such as protected cultivation (greenhouses), and rising investment in smart irrigation infrastructure globally. Furthermore, the persistent need among farmers to achieve higher productivity from limited arable land and scarce water resources solidifies the foundational demand for reliable and efficient agriculture dripper systems. Technological advancements, particularly in pressure compensating (PC) and anti-siphon drippers, are continuously improving system performance and longevity, contributing significantly to market expansion.

Agriculture Dripper Market Executive Summary

The global Agriculture Dripper Market is characterized by robust growth, driven primarily by the paradigm shift towards sustainable water management practices and the necessity for increased food security. Business trends indicate a strong focus on integration, where major irrigation companies are offering comprehensive, end-to-end solutions that combine drippers with control valves, filters, and smart monitoring systems. Key strategic moves include mergers and acquisitions aimed at expanding product portfolios, enhancing distribution networks, and securing raw material supplies, particularly specialized polymers used in dripper manufacturing. The competitive landscape is intensely focused on innovation, particularly the development of clog-resistant drippers and systems compatible with recycled or saline water sources, addressing a critical pain point for end-users.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market due to massive governmental support for micro-irrigation adoption in countries like India and China, coupled with high population density necessitating high-yield farming. North America and Europe, representing mature markets, emphasize technological sophistication, demanding smart drippers integrated with IoT platforms for real-time monitoring and automation. Latin America and the Middle East & Africa (MEA) are emerging growth frontiers, propelled by increasing agricultural commercialization and acute water stress, making efficient irrigation solutions an immediate necessity for regional stability and economic development. The diversity in crop type and climate globally mandates tailored dripper solutions, ensuring sustained localized market activity.

Segment trends highlight the dominance of the Pressure Compensating (PC) drippers segment due to their superior performance in undulating terrains and long row applications, ensuring uniform water delivery critical for maximizing crop homogeneity and yield. Application-wise, Orchards & Vineyards remain a major segment, driven by the high economic value of permanent crops and the ease of implementing permanent drip systems. However, the adoption of drip irrigation in row crops, historically dominated by traditional methods, is accelerating rapidly, supported by the development of thin-walled, cost-effective drip tapes. This transition underscores the broader market movement towards pervasive implementation of water-efficient technology across all major agricultural operations.

AI Impact Analysis on Agriculture Dripper Market

User queries regarding AI in the Agriculture Dripper Market center around themes of predictive maintenance, optimization of irrigation scheduling, and seamless integration with broader farm management systems. Common concerns revolve around the cost of implementation, data privacy, and the complexity of managing AI-driven systems on small to medium-sized farms. Users consistently seek information on how AI can utilize sensor data (soil moisture, weather patterns) to dynamically adjust dripper flow rates and irrigation duration, thereby achieving maximum water efficiency far beyond static scheduling. Expectations are high for AI to minimize human intervention, prevent system failures through early detection of clogs or leaks, and ultimately translate into measurable increases in crop productivity and reduced environmental footprint.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is rapidly transforming the operational dynamics of the agriculture dripper sector, shifting the paradigm from simple water delivery to holistic resource management. AI systems analyze vast datasets, including historical weather information, current soil conditions, crop specific evapotranspiration rates, and real-time sensor inputs from drip lines, to generate highly accurate, predictive irrigation schedules. This move towards prescriptive irrigation ensures that every drop of water is delivered precisely when and where the plant requires it, optimizing nutrient uptake and preventing both over-irrigation and drought stress, leading to substantial resource savings and yield improvements.

Furthermore, AI significantly enhances the maintenance and longevity of dripper systems. By analyzing pressure anomalies, flow rate fluctuations, and filter performance data, AI algorithms can instantly detect potential clogging issues or leaks in the subterranean network before they cause significant crop damage or system failure. This capability enables proactive, precise maintenance interventions, reducing downtime and operational costs associated with manual system checks across vast fields. The integration of AI tools, often embedded within proprietary cloud platforms offered by leading dripper manufacturers, ensures that the physical hardware (the dripper itself) becomes part of a sophisticated, intelligent ecosystem, fundamentally increasing the value proposition of drip irrigation technology.

- AI-driven optimization of irrigation schedules based on real-time soil moisture, weather, and crop growth stages.

- Predictive maintenance for dripper systems, identifying clogs or leaks using pressure and flow data analysis.

- Integration of dripper control with broader Farm Management Systems (FMS) for automated fertigation.

- Enhanced decision support for water allocation in regions facing severe water scarcity.

- Development of prescriptive models to automatically adjust Pressure Compensating (PC) dripper output based on field variability.

DRO & Impact Forces Of Agriculture Dripper Market

The Agriculture Dripper Market is strongly influenced by a convergence of environmental imperatives and economic incentives. Drivers (D) center around global freshwater scarcity, favorable government policies (subsidies and mandates for micro-irrigation adoption), and the economic benefit of higher yield per drop of water (Water Use Efficiency, WUE). Restraints (R) primarily include the high initial capital investment required for installing drip systems compared to traditional methods, the susceptibility of drippers to clogging from poor water quality, and the lack of comprehensive farmer education in developing regions regarding system maintenance. Opportunities (O) arise from technological advancements, such as solar-powered pumping systems and biodegradable drip tapes, alongside the expansion into dryland agriculture and the lucrative segment of cannabis and high-value medicinal crops requiring precise water delivery. The overall Impact Forces are high, dictated by climate change making efficient water use a mandatory practice rather than an optional enhancement.

The primary driving force remains the increasing pressure on global water resources, exacerbated by population growth and unpredictable climate patterns, which necessitate highly efficient irrigation technologies. Governments worldwide recognize drip irrigation as a sustainable solution and are implementing significant financial incentives, including tax breaks and direct subsidies, particularly in water-stressed agricultural belts of Asia and the Middle East. Furthermore, the economic advantage for farmers—achieving faster return on investment (ROI) through enhanced yield uniformity, lower labor costs, and reduced fertilizer consumption—provides a powerful, self-sustaining market driver that encourages continuous technology adoption and expansion.

Conversely, market restraints are significant but addressable through innovation. The upfront investment remains a barrier for small and marginal farmers, particularly when credit access is limited. Clogging, caused by sediment, biological growth (algae/bacteria), or chemical precipitates, is a persistent operational challenge that mandates rigorous filtration and chemical treatment, adding complexity and cost. However, market players are actively mitigating these restraints by developing advanced anti-clogging dripper designs (e.g., self-flushing mechanisms) and offering flexible financing models, thereby softening the impact of these limiting factors and reinforcing the long-term growth trajectory of the market.

Segmentation Analysis

The Agriculture Dripper Market is comprehensively segmented based on product type, material, application, and end-user, providing a granular view of specific market dynamics and growth areas. Segmentation by Type, dividing the market into Pressure Compensating (PC) and Non-Pressure Compensating (Non-PC) drippers, reflects fundamental differences in system performance and suitability for varied terrain. PC drippers are technologically superior, ensuring consistent flow regardless of pressure fluctuations or slope, thus dominating professional large-scale applications. Segmentation by Application highlights the crucial roles drip irrigation plays across permanent crops (orchards, vineyards) and high-density protected cultivation (greenhouses), which are critical centers of high-value agricultural production globally.

Material segmentation focuses primarily on the polymer used, predominantly Polyethylene (PE) and Polyvinyl Chloride (PVC), affecting durability, cost, and lifespan. PE materials are favored for the main drip lines and laterals due to their flexibility and resistance to degradation. The end-user analysis distinguishes between commercial farms, small farms, and nurseries, recognizing the different scales of operation and corresponding technology requirements, ranging from sophisticated automated systems for commercial operations to cost-effective drip kits for smallholder farmers. The trend across all segments is the increasing demand for integrated systems that are durable, easy to install, and provide high water distribution uniformity (DU).

- By Type:

- Pressure Compensating (PC) Drippers

- Non-Pressure Compensating (Non-PC) Drippers

- By Application:

- Row Crops (Sugarcane, Cotton, Corn)

- Orchards and Vineyards (Fruits, Nuts, Grapes)

- Greenhouses and Protected Cultivation

- Nurseries and Landscaping

- Others (Turf, Ornamental Gardens)

- By Material:

- Polyethylene (PE)

- PVC

- Others (e.g., specialized polymers, biodegradable materials)

- By End-User:

- Commercial Farms

- Small and Medium Farms

- Horticulture and Nurseries

Value Chain Analysis For Agriculture Dripper Market

The Value Chain for the Agriculture Dripper Market begins with the upstream procurement of raw materials, primarily specialized engineering plastics such as high-density polyethylene (HDPE) and low-density polyethylene (LDPE), along with complex mold components and filtration materials. Key upstream activities involve resin polymerization and specialized extrusion processes, requiring significant energy and technological expertise to ensure the plastic components meet stringent durability and chemical resistance standards crucial for irrigation systems exposed to sun, soil, and fertilizers. Major companies often maintain strong relationships with global chemical producers to secure favorable pricing and consistent quality, recognizing that material input costs significantly impact the final product pricing and market competitiveness.

Midstream operations involve the core manufacturing of the drippers and associated fittings, including highly specialized injection molding processes for precision-engineered components like the diaphragm in Pressure Compensating drippers, which determines flow consistency. This stage is characterized by intense R&D focusing on hydraulic design, clog resistance, and integration of smart features. The downstream aspect is defined by complex distribution channels, which must navigate disparate agricultural ecosystems globally. Distribution typically involves a mix of large-scale direct sales to major commercial farming conglomerates, indirect sales through a network of specialized agricultural dealers and distributors who provide local technical support, and increasingly, e-commerce platforms for smaller add-on components and service kits.

Direct distribution often includes large infrastructure projects funded by government initiatives, requiring complex tender processes and installation support directly from the manufacturer. Indirect channels are vital for penetrating local markets, where distributors often handle system design, installation, and post-sales technical service, acting as the primary point of contact for farmers. The efficiency of this downstream network, especially the availability of trained technical staff to address installation and maintenance challenges, is crucial for market success, particularly in regions where drip technology adoption is still nascent. Ultimately, system integrators and irrigation consultants play a vital role in bridging the gap between manufacturers and the diverse needs of the end-user base.

Agriculture Dripper Market Potential Customers

The primary potential customers and end-users of agriculture drippers are diverse, spanning large-scale commercial agricultural enterprises specializing in cash crops and high-value horticulture, as well as millions of smallholder farmers globally who are transitioning from traditional irrigation methods. Commercial farms, particularly those cultivating permanent crops like citrus fruits, almonds, grapes, and olives, are major buyers due to the necessity of ensuring high yield uniformity and quality demanded by export markets. These customers require robust, high-durability systems, often demanding advanced features such as self-flushing, pressure compensation, and full integration with automation and fertigation systems.

Protected cultivation facilities, including large commercial greenhouses focused on vegetables, flowers, and medicinal crops (such as cannabis), represent a high-growth customer segment. These facilities rely entirely on precision drippers to maintain strict environmental controls and deliver tailored nutrient solutions, making the dripper a non-negotiable component of their operational success. The focus here is on precision-engineered, anti-siphon drippers suitable for substrates and pots, often paired with sophisticated monitoring technology to manage nutrient delivery down to the milliliter.

Finally, governmental agencies and large agricultural cooperatives frequently act as intermediary customers, particularly in developing nations, procuring vast quantities of basic drip kits and tapes for subsidized distribution to small and marginal farmers as part of national water conservation and food security programs. These procurement decisions prioritize cost-effectiveness and ease of installation. Therefore, the market strategy must cater to a spectrum of needs, from high-tech solutions for industrial agriculture to affordable, resilient options for resource-constrained growers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netafim, Jain Irrigation Systems, The Toro Company, Rain Bird Corporation, Rivulis Irrigation, Lindsay Corporation, Hunter Industries, Drip-Rite, Metro Irrigation, Eurodrip S.A., Chinadrip Irrigation Equipment, Irritec S.p.A., Antelco, EPC Industries, Elgo Irrigation Systems, Alkhorayef Group, Palaplast S.A., Drip Irrigation Specialists. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agriculture Dripper Market Key Technology Landscape

The technological landscape of the Agriculture Dripper Market is rapidly evolving, driven by the twin goals of enhanced water efficiency and system durability. A primary area of innovation focuses on Pressure Compensating (PC) technology, which utilizes highly elastic silicone or rubber diaphragms within the dripper structure to maintain a constant, pre-set flow rate across a wide range of input pressures. This ensures optimal water distribution uniformity (DU) even on undulating terrain or in systems with long lateral runs, significantly improving yield homogeneity and reducing system complexity for large agricultural operations. Recent advancements include developing PC drippers capable of handling extremely low pressures, thus enabling compatibility with gravity-fed systems common in developing markets, widening the technology's accessibility.

Another critical area involves anti-clogging mechanisms and materials science. Manufacturers are integrating turbulent flow path designs, self-flushing features that briefly increase flow velocity at startup or shutdown, and acid-resistant or chemically inert materials to minimize buildup of biological slime or mineral deposits (e.g., calcium carbonate). Furthermore, the integration of smart technology is paramount. This includes the development of Internet of Things (IoT) enabled drippers and sensors embedded within the drip tape itself, capable of communicating flow data, pressure variations, and even soil moisture levels wirelessly back to a central farm management system. This sensor integration facilitates real-time performance monitoring and enables the AI-driven predictive irrigation strategies crucial for maximizing resource utilization.

In addition to hardware improvements, the manufacturing process itself is undergoing technological transformation. Advanced injection molding techniques are achieving micron-level precision in dripper construction, which is essential for ensuring reliable flow rates over the product lifespan. The rise of thin-walled drip tapes, designed for single-season use in row crops, relies on high-speed extrusion technology to produce cost-effective, high-volume products. Collectively, these technological advancements are shifting the market focus from basic water delivery components to sophisticated, intelligent end-points within a fully digitized precision agriculture ecosystem, fundamentally altering how water is managed on the farm.

Regional Highlights

The global Agriculture Dripper Market exhibits significant regional variations in growth and maturity, driven by local governmental policies, climate challenges, and the predominant types of agricultural practices. Asia Pacific (APAC) stands as the dominant and fastest-growing region, primarily fueled by massive government subsidies aimed at increasing irrigation efficiency in populous countries like India and China, where water stress is chronic and agricultural output must keep pace with demographic demands. The large-scale adoption of both permanent drip systems for horticulture and affordable drip tapes for staple row crops positions APAC at the forefront of volume consumption.

North America and Europe represent mature markets characterized by high technological penetration and a focus on premium, integrated, and automated drip systems. In North America, particularly the US and Canada, demand is driven by large commercial farms cultivating high-value permanent crops (e.g., California almonds, grapes) and a strong emphasis on smart irrigation integrated with IoT platforms for regulatory compliance and labor efficiency. European growth is sustained by greenhouse operations and strict environmental regulations promoting highly efficient water use, with key markets including Spain, Italy, and the Netherlands demanding advanced, durable drippers for intensive farming.

The Middle East and Africa (MEA) region presents a critical emerging market, defined by extreme water scarcity and the strategic necessity to ensure localized food production (food security). Countries in the Gulf Cooperation Council (GCC) are investing heavily in protected cultivation and precision irrigation technologies to make desert agriculture viable, relying almost exclusively on drip systems. Latin America, particularly Brazil, Chile, and Mexico, shows accelerated growth due to expanding commercial fruit and vegetable production destined for export, requiring highly reliable drip systems to meet international quality standards and manage variable climate conditions.

- Asia Pacific (APAC): Dominates consumption volume; characterized by large government subsidy programs, high water stress, and rapid adoption in India and China for both staple crops and horticulture.

- North America: Mature market focusing on advanced PC drippers, IoT integration, and automation; key demand from high-value crop production in water-stressed regions like the Western US.

- Europe: Focus on greenhouse technology, precision fertigation, and compliance with stringent environmental regulations; strong demand from Mediterranean countries (Spain, Italy).

- Middle East & Africa (MEA): High growth potential driven by acute water scarcity and strategic government investment in desert agriculture and food security initiatives.

- Latin America: Growing export-oriented agriculture (fruits, vegetables, coffee) driving demand for reliable, high-durability drip systems and efficient water management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agriculture Dripper Market.- Netafim Ltd. (A Orbia Company)

- Jain Irrigation Systems Ltd.

- The Toro Company

- Rain Bird Corporation

- Rivulis Irrigation Ltd.

- Lindsay Corporation

- Hunter Industries Inc.

- Drip-Rite Irrigation Products

- Metro Irrigation Ltd.

- Eurodrip S.A. (Now part of Rivulis)

- Chinadrip Irrigation Equipment Co. Ltd.

- Irritec S.p.A.

- Antelco Pty Ltd.

- EPC Industries Limited

- Elgo Irrigation Systems

- Alkhorayef Group

- Palaplast S.A.

- Drip Irrigation Specialists, Inc.

- Komet Austria GmbH

- Plastro Plasson Industries

Frequently Asked Questions

Analyze common user questions about the Agriculture Dripper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Agriculture Dripper Market?

The Agriculture Dripper Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven primarily by global water conservation mandates and the expansion of precision agriculture techniques, especially in Asia Pacific.

How do Pressure Compensating (PC) drippers differ from Non-PC drippers, and which is dominant?

PC drippers utilize a flexible diaphragm to maintain a constant flow rate irrespective of pressure variations caused by slope or line length, ensuring uniform water delivery. PC drippers dominate professional agriculture due to their superior efficiency, although Non-PC types remain cost-effective for flat, short-run applications.

What are the main challenges restraining the growth of the dripper market?

The primary restraints include the relatively high initial capital expenditure required for system installation compared to traditional irrigation, and persistent issues related to dripper clogging caused by poor water quality (sediment, biological growth, or chemical precipitates), which necessitates advanced filtration systems.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share and exhibits the fastest growth trajectory, predominantly due to significant government subsidies for micro-irrigation adoption in countries facing acute water scarcity, such as India and China, alongside rapid agricultural modernization.

How is Artificial Intelligence (AI) impacting the efficiency of agriculture dripper systems?

AI is impacting the market by enabling highly accurate, prescriptive irrigation scheduling based on real-time sensor data, optimizing water and nutrient delivery. Furthermore, AI algorithms are crucial for predictive maintenance, detecting pressure anomalies indicative of clogs or leaks before system failure occurs.

What role do government policies play in driving dripper market demand?

Government policies are major market drivers, particularly through direct financial subsidies, tax incentives, and mandates promoting the adoption of water-saving technologies like drip irrigation. These policies significantly reduce the financial burden on farmers and accelerate the transition toward water-efficient farming practices globally.

What material is predominantly used in manufacturing agriculture drippers and drip lines?

Polyethylene (PE), particularly low-density polyethylene (LDPE) and high-density polyethylene (HDPE), is the dominant material used for manufacturing drip tapes, lateral lines, and mainlines due to its flexibility, durability, and resistance to chemical degradation and UV exposure in field conditions.

Which application segment shows the strongest potential for future growth?

While Orchards and Vineyards remain a strong traditional segment, the Row Crops segment (e.g., sugarcane, cotton, corn) shows the strongest potential for future volume growth, driven by the increasing availability of cost-effective, thin-walled disposable drip tapes suitable for large-scale staple crop production.

How does the value chain address the challenge of installation and maintenance support?

The downstream value chain addresses support challenges through specialized indirect channels, utilizing local agricultural dealers and distributors who provide essential technical services, system design consulting, installation assistance, and post-sales maintenance training to end-users across diverse geographic locations.

Are biodegradable drip tapes gaining traction in the market?

Yes, biodegradable drip tapes represent a key technological opportunity, particularly in row crops where thin-walled systems are used for a single season. These materials aim to mitigate the environmental impact associated with the disposal of plastic irrigation components, aligning with global sustainability trends.

How do dripper systems contribute to crop yield improvement?

Dripper systems significantly improve crop yield by ensuring highly uniform water distribution, preventing water stress, and enabling precise fertigation (delivery of nutrients directly with water). This precision reduces weed growth and minimizes nutrient runoff, leading to healthier plants and predictable, higher-quality harvests.

Who are the major end-users of high-tech automated dripper systems?

Major end-users of high-tech automated dripper systems are large-scale commercial farms, especially those specializing in high-value permanent crops (like almonds and grapes) and industrial protected cultivation (greenhouses), where maximum efficiency and minimal labor intervention are paramount.

What is the significance of the "Water Use Efficiency" (WUE) metric in this market?

WUE is the central economic and environmental metric, defining the ratio of crop yield to the amount of water consumed. Drip irrigation dramatically improves WUE compared to traditional methods, often achieving water savings of 30% to 50%, making it a crucial technology for profitable and sustainable agriculture.

How are dripper manufacturers tackling the issue of clogged emitters?

Manufacturers are tackling clogging through several innovations, including the incorporation of turbulent flow paths, developing self-flushing mechanisms that clean the emitter when pressure changes, and utilizing chemical-resistant plastics to reduce biofilm and mineral scale formation within the dripper labyrinth.

What impact does the increasing global demand for organic produce have on the dripper market?

The demand for organic produce positively impacts the dripper market because organic farming often requires careful water and nutrient management to maintain soil health and comply with organic standards, making the precision and control offered by drip systems highly valuable for these operations.

How does solar power adoption influence the agriculture dripper market?

Solar power adoption is a significant opportunity, particularly in remote areas or developing countries, as solar-powered pumping systems provide an energy-independent solution for running drip irrigation infrastructure, reducing operational costs and enabling efficient farming where grid electricity is unavailable or unreliable.

What distinguishes specialized greenhouse drippers from standard field drippers?

Greenhouse drippers are often specialized, pressure compensating, and sometimes anti-drain or anti-siphon types, designed for potted plants or substrates. They require higher precision for delicate nutrient delivery (fertigation) and are typically installed in dense configurations compared to the rugged, long-run drippers used in open fields.

In the context of the dripper market, what does the term "fertigation" refer to?

Fertigation refers to the simultaneous application of fertilizers or other soluble nutrients along with the irrigation water through the drip system. This process is highly efficient as it delivers nutrients directly to the plant root zone, minimizing waste and optimizing nutrient uptake.

How does the volatile pricing of crude oil and plastics affect the market?

Volatile pricing of crude oil significantly impacts the market as polyethylene (PE) and PVC, the primary raw materials, are petroleum derivatives. Fluctuations in oil prices directly influence the manufacturing cost of drip lines and drippers, potentially affecting final product prices and market accessibility, especially for cost-sensitive segments like disposable drip tape.

Why is Latin America considered an important emerging market for drippers?

Latin America is an important emerging market due to the expansion of export-oriented commercial agriculture, particularly fruits, vegetables, and coffee, which requires high standards of quality and efficiency. Countries like Brazil and Chile are rapidly adopting drip technology to manage water scarcity and improve crop consistency for international trade.

What are the typical lifespan expectations for different types of agriculture dripper systems?

Dripper systems vary widely: thin-walled drip tapes used for row crops typically last one season (disposable). Permanent systems utilizing thick-walled tubing and durable PC drippers are designed for longevity, often lasting 7 to 15 years, depending on maintenance, material quality, and exposure to environmental elements and chemicals.

How are dripper manufacturers integrating connectivity and IoT into their products?

Manufacturers integrate connectivity by developing smart valves and flow meters that interface with wireless communication protocols (like LoRaWAN or cellular networks). These IoT-enabled components transmit data on pressure, flow, and system health to cloud platforms, allowing farmers to monitor and control the system remotely, often via mobile applications.

What are the key technical specifications farmers look for when selecting a dripper?

Farmers prioritize several technical specifications: flow rate consistency (measured in liters per hour, LPH), distribution uniformity (DU), operating pressure range, anti-clogging features (e.g., self-flushing), and the chemical resistance of the material to fertilizers and water treatment agents used in the system.

What market opportunities exist related to the refurbishment and repair of existing drip systems?

Significant market opportunities exist in aftermarket services, including the supply of replacement components, advanced filtration units, and specialized chemicals for cleaning and descaling drip lines. As existing installations age, the demand for maintenance kits and professional repair services is growing steadily.

Does the market favor individual component sales or integrated irrigation solutions?

The market trend favors integrated irrigation solutions (turnkey systems) offered by major players. These solutions package drippers, mainlines, filters, valves, and automation controllers into a single comprehensive system, simplifying procurement, installation, and ensuring component compatibility for the end-user, particularly large commercial enterprises.

How does climate change specifically drive the demand for agriculture drippers?

Climate change drives demand by increasing the frequency and severity of droughts, making precipitation unreliable, and heightening the necessity for precise, measured water application. Drip irrigation is essential for climate resilience as it maximizes the yield achievable from limited and uncertain water resources.

What is the significance of the anti-siphon feature in certain drippers?

The anti-siphon feature is crucial for preventing debris or contaminated water from being drawn back into the system when the water pressure drops. This is particularly important in subsurface drip irrigation (SDI) and greenhouse applications to maintain system hygiene and prevent clogging from soil particles.

How do competition and pricing strategies vary between developed and developing markets?

In developed markets, competition centers on technological sophistication, integration capabilities (IoT/AI), and system durability, allowing for premium pricing. In developing markets, competition is highly price-sensitive, focusing on cost-effective manufacturing, high-volume production of drip tape, and alignment with government subsidy schemes.

What is the role of filtration technology in the overall efficiency of a dripper system?

Filtration technology is foundational to dripper efficiency, serving as the first line of defense against clogging. Adequate filtration (screen, disk, or media filters) removes suspended solids, sediments, and organic matter from the irrigation water, ensuring the drippers operate at their designed flow rate and maximizing system longevity.

What is Subsurface Drip Irrigation (SDI) and its implications for dripper technology?

SDI involves burying the drip lines beneath the soil surface, directly delivering water to the root zone. SDI requires specialized drippers (often pressure-compensating and anti-siphon) and necessitates greater durability against root intrusion and soil pressure, leading to specific technological advancements in these components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager