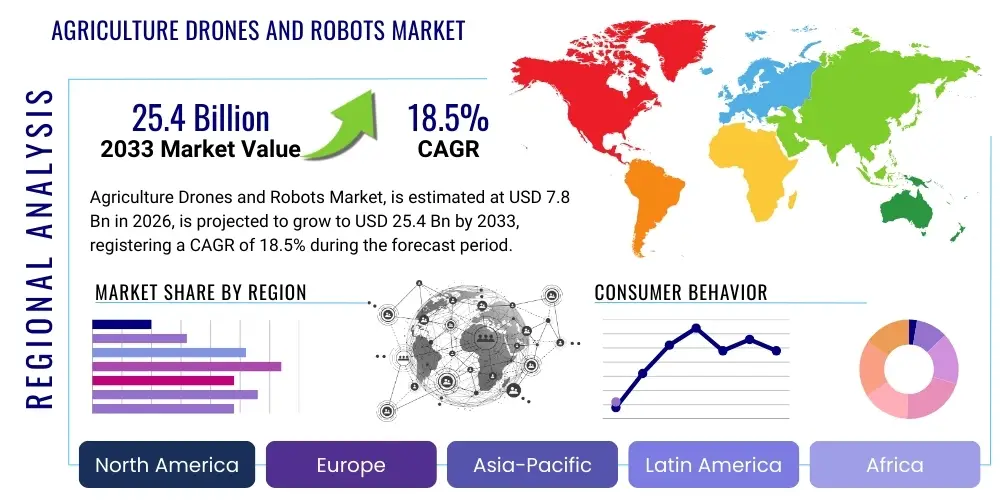

Agriculture Drones and Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437474 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Agriculture Drones and Robots Market Size

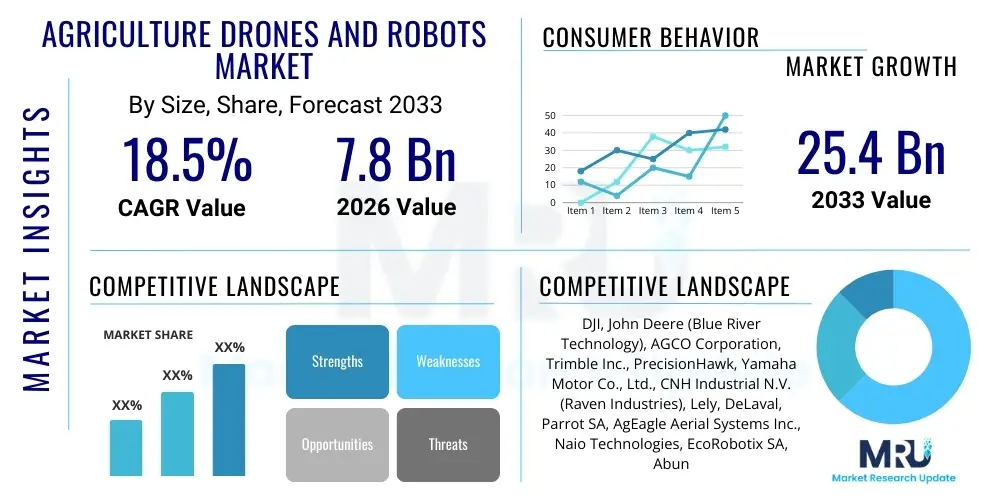

The Agriculture Drones and Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $7.8 Billion USD in 2026 and is projected to reach $25.4 Billion USD by the end of the forecast period in 2033.

Agriculture Drones and Robots Market introduction

The Agriculture Drones and Robots Market encompasses the development, manufacturing, and deployment of unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) specifically engineered for agricultural applications. These systems are integral components of the modern precision farming ecosystem, offering advanced capabilities ranging from detailed crop monitoring and aerial imaging to autonomous planting, spraying, and harvesting. The core product offering includes sophisticated hardware platforms equipped with multispectral, thermal, and LiDAR sensors, coupled with high-precision GPS and real-time kinematic (RTK) positioning systems, all powered by proprietary or open-source agricultural management software.

Major applications of these technologies span the entire agricultural lifecycle, notably in soil and field analysis, seed planting, crop scouting, variable rate fertilization, irrigation management, and livestock monitoring. Drones, particularly multi-rotor and fixed-wing variants, excel in rapid surveying and data collection across vast fields, providing actionable insights into plant health, pest infestation, and topographical variations. Conversely, agricultural robots (UGVs) are increasingly utilized for heavy-duty, repetitive tasks requiring high accuracy and endurance, such as targeted weeding (using computer vision), autonomous harvesting, and precise material application, thereby minimizing human labor requirements and reducing operational variance.

The primary benefits driving the rapid adoption of agricultural drones and robots include significant enhancements in resource efficiency—specifically optimizing water, fertilizer, and pesticide use—and substantial increases in overall crop yield and quality. These technologies address critical global challenges such as labor shortages in developed agricultural regions and the necessity of sustainable farming practices amid increasing population demands. Key driving factors include supportive government policies promoting agricultural technology adoption, the continuous decline in sensor and hardware costs, and rapid advancements in artificial intelligence (AI) and machine learning (ML) capabilities, which enable real-time decision-making and heightened operational autonomy on the farm.

Agriculture Drones and Robots Market Executive Summary

The global Agriculture Drones and Robots market is experiencing robust acceleration, driven primarily by the global shift towards precision agriculture methodologies and the critical need for increased operational efficiency amidst rising climate volatility and diminishing arable land. Key business trends include aggressive mergers and acquisitions among traditional agricultural equipment manufacturers and specialized robotics startups, leading to integrated solutions that encompass both hardware and sophisticated data analytics platforms. Furthermore, the market is pivoting toward a "Robots-as-a-Service" (RaaS) business model, particularly beneficial for small and medium-sized farms that cannot afford high upfront capital investments, thereby democratizing access to advanced agricultural automation technology and expanding the total addressable market globally.

Regionally, the market dynamics are characterized by high adoption rates in North America and Europe, supported by mature infrastructure and large-scale commercial farming operations focused on minimizing operational costs and maximizing yield efficiency through data-driven decisions. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by substantial government investment in modernizing traditional farming practices, particularly in economies like China, India, and Japan, where farm sizes are smaller but the density of agricultural labor is higher, making automation a necessity. Latin America is also emerging as a high-potential market, driven by the expansion of large commodity crop plantations requiring efficient large-area management.

Segmentation trends highlight the increasing dominance of the robot segment (UGVs) in terms of revenue growth, especially in applications such as autonomous weeding and harvesting, which offer immediate and quantifiable returns on investment. Within the component segment, the demand for sophisticated imaging sensors (multispectral and hyperspectral) and high-performance software and data analytics services is significantly outpacing the growth of basic hardware platforms. Applications involving crop monitoring and spraying remain foundational but are becoming increasingly integrated with predictive analytics derived from AI algorithms. The market exhibits a clear preference for specialized, application-specific robotic systems over general-purpose automation tools, emphasizing accuracy and repeatability.

AI Impact Analysis on Agriculture Drones and Robots Market

User queries regarding the impact of Artificial Intelligence (AI) in the Agriculture Drones and Robots Market frequently center on three main areas: predictive analytics capabilities, the level of operational autonomy, and the Return on Investment (ROI) derived from AI-driven decision-making. Users consistently ask how AI algorithms can translate drone-collected raw data (such as multispectral images or thermal readings) into immediate, actionable insights, moving beyond simple visualization to genuine predictive management of diseases, pests, and nutrient deficiencies. Furthermore, there is significant interest in understanding how AI enables true autonomy in robotic platforms, allowing tasks like autonomous navigation, object recognition (distinguishing weeds from crops), and real-time path planning in complex field environments without continuous human oversight. Expectations are high that AI integration will substantially lower operational costs and maximize precision, thereby accelerating technology adoption.

The integration of AI is fundamentally transforming the value proposition of agricultural robotics, shifting the focus from mere automation of labor to intelligent optimization of inputs and management strategies. AI algorithms, particularly deep learning models, are now essential for processing the massive datasets generated by drone sensors, identifying subtle biotic and abiotic stresses far earlier than human observers or traditional scouting methods. This advanced analytic capability allows for hyper-localized, variable-rate treatment applications, ensuring that chemicals or fertilizers are applied only where and when necessary, leading to dramatic reductions in environmental impact and input costs.

Furthermore, AI is crucial for enhancing the navigational stability, safety, and efficiency of both UAVs and UGVs. Computer vision, powered by machine learning, enables robots to interpret their environment dynamically, handle unexpected obstacles, and perform complex manipulative tasks, such as selective harvesting based on maturity levels. This advanced level of intelligence is critical for achieving true operational scalability, ensuring that a fleet of diverse autonomous agricultural machinery can operate cohesively and optimally under varying field conditions and across different crop types, ultimately serving as the core engine driving the market’s technological innovation and sustained growth.

- AI-Powered Precision Spraying: Enables real-time target recognition, reducing chemical usage by up to 90% via spot application.

- Predictive Crop Health Monitoring: Utilizes deep learning on multispectral data to forecast disease outbreaks and nutrient deficiencies weeks in advance.

- Autonomous Navigation and Swarm Management: Facilitates coordinated operation of multiple drone and robot units without human intervention.

- Yield Forecasting Optimization: Improves accuracy of harvest estimates based on complex pattern recognition of crop density and health metrics.

- Robotic Weed Classification: Differentiates specific weed species from cash crops for targeted mechanical or chemical removal.

DRO & Impact Forces Of Agriculture Drones and Robots Market

The Agriculture Drones and Robots Market is characterized by powerful dynamic forces influencing its trajectory. The primary drivers revolve around the global imperative for enhanced productivity, especially given the decreasing availability of farm labor and the rising costs associated with manual operations. Technological advancements, particularly in sensor miniaturization, battery longevity, and real-time data processing capabilities, have made sophisticated robotic solutions commercially viable and highly effective. Moreover, the increasing adoption of 5G infrastructure in rural areas is addressing connectivity restraints, enabling complex remote operation and instantaneous data transfer necessary for large-scale fleet management and predictive modeling, significantly amplifying the feasibility of widespread deployment.

Restraints, however, pose significant challenges to mass adoption. Foremost among these is the high initial capital investment required for purchasing advanced drone and robot systems, particularly for specialized, high-capacity machinery. This cost barrier is often prohibitive for smallholder farms prevalent in developing economies. Regulatory hurdles also restrict market growth, particularly stringent airspace regulations governing UAV operations (e.g., flight altitude limitations, beyond visual line of sight (BVLOS) restrictions), which vary widely by region and complicate global scalability for manufacturers and service providers. Furthermore, the lack of skilled personnel capable of operating, maintaining, and interpreting the complex data generated by these systems remains a pervasive operational constraint.

Opportunities for expansion are primarily concentrated in the development of modular, multi-purpose robotic platforms and the scaling up of Robotics-as-a-Service (RaaS) models to penetrate underserved agricultural segments. The demand for environmental sustainability and organic farming practices presents a unique opportunity for robotics focused on mechanical weeding and biological pest control, reducing reliance on conventional chemicals. Impact forces, driven by consumer demand for traceable and sustainably sourced food, exert pressure on agricultural businesses to adopt technologies that verify environmental stewardship. The combination of technological progress (Driver) and the persistent labor deficit (Driver) is currently overcoming the high initial cost (Restraint), projecting a strong upward market movement, while favorable government subsidies (Opportunity) act as accelerants by mitigating the cost barrier, thereby sustaining the current high growth momentum.

Segmentation Analysis

The Agriculture Drones and Robots market is systematically segmented based on Type, Component, Application, and Farm Size, offering diverse pathways for technology adoption and market entry. Segmentation by Type distinguishes between aerial platforms (drones) primarily used for rapid scouting and imaging, and ground-based platforms (robots) dedicated to heavy-duty tasks like weeding, harvesting, and planting. Understanding these segments is crucial as the choice of technology depends heavily on the specific crop type, field topography, and the primary objective, whether it is maximizing data collection density or maximizing operational throughput and reducing labor.

The Component segmentation is vital for analyzing value distribution, separating market contributions from hardware (the physical drone/robot body, sensors, and GPS), software (flight control systems, data analytics platforms, AI algorithms), and services (maintenance, data processing, and RaaS models). The increasing sophistication of embedded software and AI analytics is driving profitability in the Software and Service segments. Application segmentation reveals where investment is most concentrated, with crop monitoring and precision spraying historically dominating drone usage, while autonomous harvesting and robotic weeding are rapidly becoming the primary drivers of robot market growth due to their direct impact on labor savings and efficiency.

Lastly, segmentation by Farm Size (large, medium, and small) dictates the type of solution adopted. Large commercial farms are primary purchasers of high-capacity, dedicated robotic fleets, aiming for full integration and owned assets. Conversely, small and medium-sized farms often rely on affordable, multi-functional drone systems and RaaS models, minimizing capital expenditure while benefiting from shared technology access. This layered segmentation allows stakeholders to accurately gauge market penetration, identify high-growth niches (such as autonomous weeding in organic farming), and tailor product development strategies to specific operational scales and geographical regulatory landscapes, thereby optimizing market outreach and product placement.

- Type

- Drones (UAVs)

- Fixed-Wing

- Rotary-Wing (Multi-Rotor)

- Hybrid

- Robots (UGVs)

- Automated Tractors

- Ground Rovers (Weeding/Seeding)

- Milking Robots

- Harvesting Robots

- Drones (UAVs)

- Component

- Hardware

- Frames, Batteries, Motors

- Sensors (Multispectral, Hyperspectral, Thermal, LiDAR)

- GPS/RTK Systems

- Nozzles and Dispensing Mechanisms

- Software and Analytics

- Farm Management Systems (FMS)

- Image Processing and Data Analysis Software

- Autonomous Navigation Software

- Services

- Data Collection and Mapping

- Maintenance and Repair

- Robotics-as-a-Service (RaaS)

- Hardware

- Application

- Crop Monitoring and Mapping

- Planting and Seeding

- Precision Spraying and Fertilization (Variable Rate Technology)

- Harvesting Management

- Field Surveying and Land Management

- Weeding and Pest Control

- Farm Size

- Large Farms (Above 100 Hectares)

- Medium Farms (50-100 Hectares)

- Small Farms (Below 50 Hectares)

Value Chain Analysis For Agriculture Drones and Robots Market

The value chain for the Agriculture Drones and Robots Market is complex, beginning with upstream activities focused on core technological inputs and extending through manufacturing, software integration, distribution, and critical downstream services. Upstream analysis involves the procurement of high-specification components, including advanced sensor technology (e.g., thermal and LiDAR components sourced from specialized electronics firms), high-end processors (GPUs/CPUs required for on-board AI processing), aerospace-grade materials for drone frames, and highly durable mechanical parts for ground robots. Key players in this stage are specialized component manufacturers who supply sophisticated, reliable parts necessary for operations in harsh agricultural environments. Success in the upstream segment relies heavily on maintaining rigorous quality control and securing resilient supply chains for specialized electronics.

Midstream activities primarily focus on the manufacturing, assembly, and integration phase, where specialized OEMs combine components, design the physical platforms (UAVs and UGVs), and install proprietary or licensed software. Crucially, this stage includes the integration of advanced navigation systems (RTK/GPS) and the development of the Farm Management System (FMS) software interface that farmers interact with. The focus here is on seamless integration of hardware capabilities with software intelligence to deliver a cohesive, functional product. Distribution channels are multifaceted, utilizing both direct sales models, especially for large automated tractor units sold directly by major agricultural equipment brands like John Deere or AGCO, and indirect channels such as specialized agricultural technology dealers, value-added resellers (VARs), and service providers offering RaaS solutions.

Downstream activities center around the end-user interaction and post-deployment services. This includes field deployment, operational training for farm staff, data processing, and analysis services, which are often provided by third-party data science firms or the robot manufacturers themselves. Direct engagement occurs when large corporate farms procure and operate their own fleets. Indirect engagement is common via RaaS models, where the farmer purchases the service (e.g., crop scouting data or autonomous spraying execution) rather than the physical equipment. The service segment, driven by the continuous need for data interpretation and system maintenance, represents a significant and growing profit pool, making the provision of ongoing service and software updates a critical competitive differentiator in the latter stages of the value chain.

Agriculture Drones and Robots Market Potential Customers

The customer base for the Agriculture Drones and Robots Market is diverse, encompassing various scales of farming operations and institutions dedicated to agricultural advancement. The primary and most lucrative customer segment consists of large-scale commercial farming enterprises and corporate farms, particularly those specializing in high-value, extensive row crops (corn, soy, wheat) or specialty crops (fruits, vegetables) where labor costs are substantial. These customers possess the financial capacity for significant capital investment and seek maximum efficiency gains, viewing automation as essential for managing vast land areas and optimizing complex input delivery systems. They prioritize reliable, high-throughput systems capable of integrating seamlessly into existing enterprise-level Farm Management Software platforms.

A rapidly expanding segment includes medium to small-sized farms and agricultural cooperatives. While these entities often lack the immediate capital for full fleet ownership, they are increasingly accessing drone and robotic technologies through shared service models and cooperatives. Agricultural cooperatives pool resources to hire RaaS providers, allowing members to benefit from precision farming without the overhead of ownership. These customers are highly sensitive to price and ROI, favoring subscription models and multi-purpose, modular robotic solutions that can perform various tasks throughout the growing season, maximizing their utility and financial viability on smaller plots of land.

Beyond traditional farming operations, significant demand originates from institutional buyers such as agricultural research institutions, university extension programs, and government agencies focused on land monitoring and resource management. These entities utilize advanced drones and robots primarily for controlled environment testing, yield mapping research, breeding programs, and rapid disaster assessment. Additionally, environmental consulting firms and insurance companies are becoming important secondary buyers, employing drone technology for detailed site assessments, verifying crop damage claims, and monitoring regulatory compliance across large geographic areas, thus adding a layer of risk management and compliance support to the end-user landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.8 Billion USD |

| Market Forecast in 2033 | $25.4 Billion USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, John Deere (Blue River Technology), AGCO Corporation, Trimble Inc., PrecisionHawk, Yamaha Motor Co., Ltd., CNH Industrial N.V. (Raven Industries), Lely, DeLaval, Parrot SA, AgEagle Aerial Systems Inc., Naio Technologies, EcoRobotix SA, Abundant Robotics (now defunct/IP acquired), AeroVironment, Inc., SenseFly (Parrot), Autonomous Solutions, Inc. (ASI), SwarmFarm Robotics, Harvest Automation, KUBOTA Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agriculture Drones and Robots Market Key Technology Landscape

The technological landscape of the Agriculture Drones and Robots Market is characterized by the convergence of several high-tech domains, including advanced robotics, sophisticated sensor technology, satellite navigation, and edge computing. Central to this landscape is the ubiquitous integration of Global Navigation Satellite Systems (GNSS), specifically utilizing Real-Time Kinematic (RTK) and Differential GPS (DGPS) to achieve centimeter-level positional accuracy. This hyper-precision is mandatory for tasks such as row planting, targeted spraying, and mechanical weeding, ensuring that inputs are placed exactly where they are needed, thereby maximizing efficacy and minimizing waste. The reliance on accurate positioning underscores the critical role of robust and reliable connectivity infrastructure, increasingly leveraging 5G networks for high-bandwidth, low-latency communication required for fleet management and real-time sensor data streaming.

Another pivotal technological area is advanced sensor technology and machine vision. Multispectral and hyperspectral cameras deployed on drones capture detailed light reflectance data across narrow bandwidths, allowing for the calculation of critical vegetation indices (like NDVI), which directly correlate with plant health, chlorophyll content, and stress levels. Machine vision systems, typically involving high-resolution RGB cameras paired with complex AI algorithms, enable ground robots to instantaneously distinguish between cash crops and weeds, facilitating autonomous selective spraying or robotic mechanical removal. These systems require powerful onboard processing capabilities (edge computing) to interpret visual data in real-time without reliance on constant cloud connectivity, a critical factor for operational efficiency in remote farming environments.

Furthermore, the development of sophisticated actuation and robotic manipulation systems is driving the efficiency of physical tasks. This includes the engineering of lightweight, durable drone frames and high-efficiency battery systems to maximize flight time and payload capacity for spraying tasks. For ground robots, the focus is on robust drivetrain systems capable of navigating diverse and challenging terrain, along with precision robotic arms or specialized tools designed for delicate tasks like fruit picking or high-speed seeding. Crucially, the advancement of swarm intelligence and collaborative robotics protocols allows multiple autonomous units (drones and robots) to coordinate their efforts, sharing data and optimizing field coverage dynamically, thereby achieving scale and efficiency far beyond what single units could accomplish.

Regional Highlights

The global market for Agriculture Drones and Robots exhibits distinct regional adoption patterns influenced by economic structure, farming practices, regulatory environments, and labor costs. These variations necessitate region-specific strategies for manufacturers and service providers to successfully penetrate local markets and achieve scale. North America and Europe, representing mature agricultural technology markets, have traditionally dominated market revenue due to large farm sizes, high labor costs, and government subsidies promoting digital agriculture, driving a strong focus on efficiency and yield maximization through sophisticated, often high-cost, fully autonomous solutions.

- North America (U.S., Canada): This region is characterized by early and substantial adoption of precision agriculture, driven by large commercial farms and high-tech integration. The U.S. leads in R&D and deployment of advanced robotics (UGVs and autonomous tractors) for large-scale operations like corn and wheat farming. Regulatory environments are generally favorable, particularly for BVLOS operations in sparsely populated agricultural areas, boosting market confidence.

- Europe: The European market, particularly in Western countries (Germany, France, UK), is driven by strict environmental regulations and high standards for food traceability. This has spurred demand for robotic weeding and highly precise, minimal-input spraying technologies to comply with environmental protection laws. The use of RaaS models is strong, addressing the cost concerns of smaller, family-owned farms prevalent across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive government initiatives to modernize agriculture in countries like India, China, and Japan. Despite smaller average farm sizes, the intense pressure for food security and the growing shortage of young farm workers are accelerating the adoption of specialized, small-scale drones (UAVs) for scouting and spraying paddy fields and horticultural crops. Investment is focused on making robust technology affordable and easily maintainable.

- Latin America (LATAM): Growth in LATAM is concentrated in large, industrial commodity agriculture areas (Brazil, Argentina) where vast plantations of soy, sugarcane, and cattle require efficient aerial monitoring and input management. The market relies heavily on robust data collection drones and specialized spraying services to manage extensive land holdings, often overcoming infrastructure challenges through localized solutions.

- Middle East and Africa (MEA): While currently holding the smallest market share, the MEA region presents unique opportunities due to acute water scarcity and the need for maximizing yields in arid environments. Adoption is primarily driven by governmental programs focused on large, state-sponsored agricultural projects requiring irrigation monitoring, climate-resilient crop management, and drone-based security monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agriculture Drones and Robots Market.- DJI (Da-Jiang Innovations)

- John Deere (Blue River Technology)

- AGCO Corporation

- Trimble Inc.

- PrecisionHawk

- Yamaha Motor Co., Ltd.

- CNH Industrial N.V. (Raven Industries)

- Lely

- DeLaval

- Parrot SA

- AgEagle Aerial Systems Inc.

- Naio Technologies

- EcoRobotix SA

- AeroVironment, Inc.

- SenseFly (Parrot Group)

- Autonomous Solutions, Inc. (ASI)

- SwarmFarm Robotics

- Harvest Automation

- KUBOTA Corporation

- Exyn Technologies (specializing in autonomous aerial platforms)

Frequently Asked Questions

Analyze common user questions about the Agriculture Drones and Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary ROI driver for adopting agricultural drones and robots?

The primary Return on Investment (ROI) is driven by significant savings in input costs (fertilizer, water, pesticides) achieved through hyper-precise, variable-rate application, coupled with increased yield per hectare resulting from early identification and targeted management of crop stress and disease.

How does regulatory restriction on Beyond Visual Line of Sight (BVLOS) impact drone market growth?

BVLOS restrictions are a major constraint, particularly in large-scale farming, as they limit drone flight distance and require continuous human presence. However, ongoing lobbying and the implementation of advanced sense-and-avoid technology are slowly leading to regulatory easing and specialized waivers in key agricultural regions, mitigating this impact.

Which component segment offers the highest growth potential in the forecast period?

The Software and Analytics segment is projected to experience the highest growth. The market value is rapidly shifting from hardware acquisition to the ongoing interpretation and utilization of sensor data, requiring sophisticated AI, machine learning algorithms, and subscription-based Farm Management System platforms.

Are agricultural robots primarily utilized by large commercial farms or smallholder farms?

Currently, large commercial farms are the primary owners due to the high capital cost of autonomous equipment. However, smallholder farm adoption is rapidly increasing through flexible Robotics-as-a-Service (RaaS) models and specialized cooperatives, democratizing access to these expensive technologies.

What role does 5G connectivity play in advancing agricultural robotics?

5G connectivity is crucial for enabling real-time, high-bandwidth data transfer between autonomous fleet components and central cloud processing platforms. This allows for complex swarm management, instantaneous fault correction, and large-volume data upload for advanced predictive modeling, vital for achieving true operational autonomy and scalability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager