Agriculture Technology-as-a-Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434752 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Agriculture Technology-as-a-Service Market Size

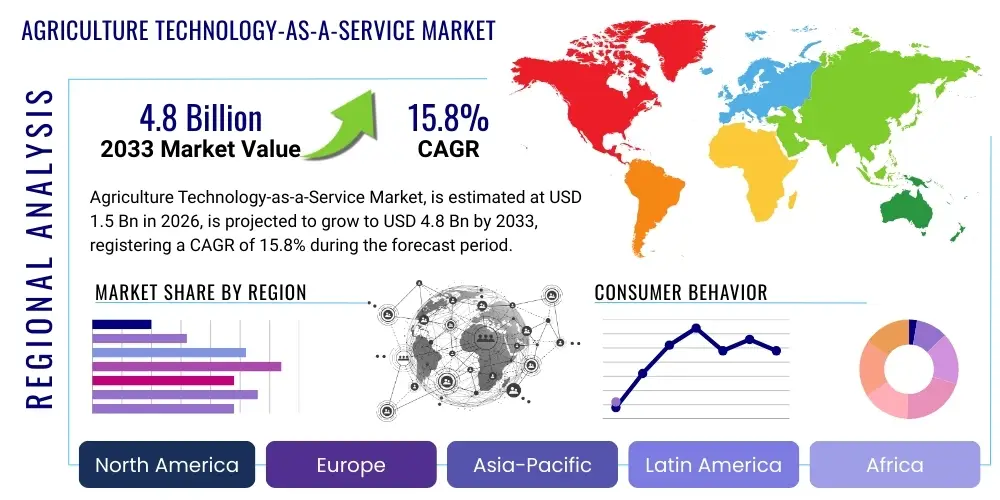

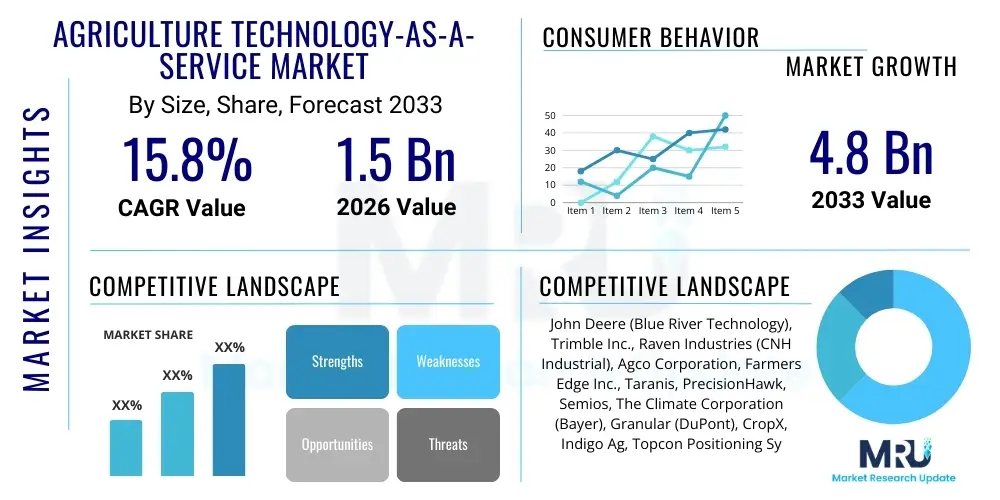

The Agriculture Technology-as-a-Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Agriculture Technology-as-a-Service Market introduction

The Agriculture Technology-as-a-Service (Ag-TaaS) Market encompasses the provision of digital agricultural tools, software, hardware, and analytical capabilities to farmers and agribusinesses through flexible, subscription-based models. This paradigm shift moves away from large, upfront capital expenditures for machinery and technology toward operational expense structures, making advanced farming techniques accessible to a wider range of agricultural stakeholders, particularly small and medium-sized farms. Ag-TaaS solutions typically integrate several components, including sensor technologies, IoT devices, remote sensing (drones and satellites), data analytics platforms, and automated machinery control systems, all delivered via cloud infrastructure. The core product offering is not just the technology itself, but the actionable insights and managed services derived from continuous data collection and processing, enabling precision agriculture practices that optimize resource use and enhance yield predictability.

Major applications of Ag-TaaS span the entire farming lifecycle, from pre-season planning and soil analysis to harvesting and post-harvest logistics. Key uses include precision irrigation scheduling based on real-time weather and soil moisture data, pest and disease prediction using machine learning models, autonomous tractor operation managed via cloud APIs, and granular crop monitoring across large tracts of land. The service model allows farmers to rapidly adopt cutting-edge technologies like high-resolution satellite imagery analysis and specialized robotic services without the burden of maintenance, upgrades, or technical expertise, as these responsibilities are outsourced to the service provider. This fractional access to high-value technology democratizes innovation within the agricultural sector.

The primary benefits driving the adoption of Ag-TaaS are the enhanced efficiency, cost reduction associated with input usage (water, fertilizers, pesticides), and significant improvements in sustainability metrics. By utilizing data-driven insights delivered as a service, farmers can achieve higher yields with reduced environmental impact, meeting increasing consumer demand for sustainably sourced food. Furthermore, the inherent flexibility and scalability of the TaaS model—allowing users to scale services up or down based on seasonal needs or farm expansion—is a crucial driving factor, especially in regions facing significant labor shortages or unpredictable climatic conditions. This model accelerates the digitalization of agriculture globally.

Agriculture Technology-as-a-Service Market Executive Summary

The Agriculture Technology-as-a-Service market is characterized by robust business trends emphasizing digitalization and servitization across the agricultural value chain. A major trend is the accelerated shift from outright technology ownership to outcome-based subscription models, driven by the necessity for predictable operational expenditures (OpEx) versus volatile capital expenditures (CapEx). Technology providers are increasingly forming deep partnerships with telecom operators and agricultural consultants to ensure seamless delivery and localized support, prioritizing platform integration to offer comprehensive farm management ecosystems rather than disparate, isolated tools. This move towards bundled service packages—including hardware, software, and consultation—is defining competitive differentiation, placing data security and interoperability at the forefront of market development.

Regionally, North America and Europe currently represent the largest revenue share due to high technology adoption rates, strong governmental support for sustainable farming, and the presence of large-scale corporate farming operations capable of quickly integrating complex TaaS solutions. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by massive investments in infrastructure (especially 5G connectivity), the necessity to feed rapidly expanding populations, and increasing awareness among smallholder farmers regarding the yield benefits of precision agriculture. Countries such as India and China are becoming crucial markets, witnessing unique localized Ag-TaaS offerings tailored to fragmented land holdings and distinct climatic challenges.

Segment trends indicate that Software-as-a-Service (SaaS) components, particularly those focusing on farm management information systems (FMIS) and data analytics, remain the dominant segment in terms of revenue, primarily due to their low barrier to entry and high scalability. Within application segments, precision farming services (including variable rate application and yield monitoring) continue to capture the largest market share, reflecting the immediate return on investment provided by optimizing input costs. However, the Drone/Robotics-as-a-Service (RaaS) segment is anticipated to witness the highest compound annual growth rate, fueled by advancements in autonomous navigation, improved battery life, and the critical need for automated labor replacement solutions in tasks such as complex topographical mapping and targeted spot spraying.

AI Impact Analysis on Agriculture Technology-as-a-Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Ag-TaaS frequently center on the shift from reactive farming to predictive agriculture, seeking clarity on how AI can enhance decision reliability, automate complex tasks, and justify the investment in data infrastructure. Common themes include the efficacy of AI in predicting micro-climatic events, optimizing variable rate fertilization, diagnosing crop diseases before visual symptoms appear, and managing autonomous equipment fleets safely. Users are concerned about data privacy, the transparency of AI models (explainable AI), and the integration challenges of incorporating AI-driven insights into existing farm machinery and operational workflows. The prevailing expectation is that AI will be the foundational layer transforming raw Ag-TaaS data into quantifiable, time-sensitive, and highly localized recommendations, thereby moving TaaS offerings beyond simple monitoring to prescriptive action planning.

AI's primary influence is enabling the transition from technology rental to intelligent service provisioning. In the Ag-TaaS model, AI algorithms process massive datasets—including satellite imagery, drone scans, ground sensors, historical yield records, and global weather patterns—to generate highly accurate predictive models for pests, irrigation needs, and optimal planting/harvesting times. This capability elevates the value proposition of TaaS providers, allowing them to offer guaranteed outcome contracts or highly specialized consulting services that are impossible without sophisticated machine learning. Furthermore, AI facilitates the autonomous operation of agricultural robotics; deep learning models enable real-time object detection and classification for tasks like weeding, harvesting, and livestock monitoring, transforming robotics-as-a-service (RaaS) from remote control to true autonomy, thus maximizing efficiency and minimizing human error in the field.

The integration of AI also addresses key restraints related to market penetration and user expertise. By simplifying complex data into clear, automated instructions or dashboard alerts, AI minimizes the technological burden on the end-user (the farmer). This accessibility is crucial for expanding TaaS adoption among smallholder farmers who may lack dedicated IT staff or extensive training. Furthermore, AI contributes significantly to sustainability tracking by providing verifiable data trails showing resource consumption (water, energy) and emission footprints, positioning Ag-TaaS as a critical enabler for compliance with evolving global environmental standards and consumer demands for transparent food systems. This enhanced data utility solidifies AI as the core differentiator in next-generation Ag-TaaS offerings.

- AI enhances predictive analytics for yield forecasting, pest outbreaks, and precise weather impacts.

- Machine learning models automate complex decision-making, optimizing variable rate application of inputs (fertilizer, water).

- Deep learning drives the autonomy and efficiency of Robotics-as-a-Service (RaaS) platforms, facilitating tasks like selective harvesting and weeding.

- AI improves resource allocation, leading to significant reduction in waste and enhancing sustainability metrics.

- Computer vision systems, powered by AI, enable real-time crop health monitoring via drone and sensor data analysis.

- AI facilitates the localization of services, tailoring prescriptive advice to specific field topography and soil conditions.

DRO & Impact Forces Of Agriculture Technology-as-a-Service Market

The Agriculture Technology-as-a-Service market is propelled by a confluence of powerful drivers, tempered by specific operational and financial restraints, which collectively generate substantial opportunities, influencing market trajectory through significant impact forces. The foundational driver is the escalating global demand for food security coupled with the necessity for sustainable agricultural intensification; farmers must produce more with fewer resources while minimizing environmental degradation. Restraints, predominantly centered around high upfront data infrastructure costs, reliable broadband connectivity challenges in rural areas, and the inherent complexity of integrating disparate systems, slow down the widespread adoption, particularly in developing economies. Opportunities arise through governmental incentives promoting digitalization and precision farming subsidies, along with the potential for Ag-TaaS providers to offer bespoke financial models catering to risk-averse smallholder farmers, thereby broadening the addressable market.

Key drivers include the pervasive global shortage of skilled agricultural labor, making automated and remote solutions delivered via TaaS models essential for operational continuity. The rising price and volatility of agricultural inputs (fertilizers, energy) compel farmers to adopt data-driven optimization tools to control costs, which TaaS models provide affordably. Furthermore, increasing regulatory pressure regarding water usage, pesticide application, and carbon footprint measurement accelerates the demand for traceable and efficient farming technologies that are typically packaged within TaaS offerings. These macroeconomic and legislative factors create a strong, sustained pull for service adoption over traditional capital purchasing models, validating the TaaS approach.

The primary impact forces shaping the market include the rapid advancement and cost reduction of sensor technology and IoT devices, lowering the barrier to entry for TaaS infrastructure providers. Regulatory mandates related to environmental protection and traceability force compliance, positioning TaaS solutions as a necessary operational expenditure. Conversely, cybersecurity threats and data ownership disputes represent restraining impact forces; as farming becomes data-intensive, concerns about proprietary agricultural data security and who controls the predictive models influence purchasing decisions and partnership formations. The overarching force is the democratization of advanced technology; TaaS allows small farms access to technology previously reserved for large corporate farms, fundamentally reshaping the competitive landscape of global agriculture.

Segmentation Analysis

The Agriculture Technology-as-a-Service market is meticulously segmented across multiple dimensions, including service type, technology component, application, farm size, and deployment model, allowing for a granular understanding of user needs and market penetration strategies. The segmentation highlights the versatility of the TaaS model, which extends beyond pure software solutions to encompass the fractional use of high-cost hardware, such as sophisticated sensors, autonomous vehicles, and drones. This structured analysis is essential for identifying high-growth niches, such as micro-services tailored for vertical farms or integrated data platforms designed specifically for large-scale commodity crop production, enabling vendors to optimize their service portfolios for maximum market relevance and profitability.

The segmentation by service type typically differentiates between pure Software-as-a-Service (SaaS), which covers analytical platforms and farm management systems; Platform-as-a-Service (PaaS), offering development environments for specialized agricultural applications; and Infrastructure-as-a-Service (IaaS), which includes cloud storage and processing power for large telemetry datasets. Furthermore, specialized segments like Robotics-as-a-Service (RaaS) and Drone-as-a-Service (DaaS) are gaining prominence, reflecting the increasing maturity and operational deployment of autonomous hardware in field operations. The adoption rate varies significantly across segments, with SaaS solutions generally having the highest uptake due to ease of deployment and low infrastructure dependency, while RaaS models, though high-growth, require more specialized infrastructure and operational complexity.

Application-based segmentation reveals the critical areas where TaaS delivers immediate value, such as precision irrigation, crop scouting, nutrient monitoring, and livestock management. Precision farming applications dominate due to their direct link to input optimization and yield increase. Conversely, supply chain and traceability services, while nascent, are expected to accelerate rapidly as regulatory bodies and consumers demand higher levels of transparency regarding food origin and production methods. Understanding these nuanced segments allows market players to focus their research and development efforts on service optimization—for instance, developing highly robust connectivity solutions for livestock monitoring in remote locations or ultra-precise imaging services for high-value specialty crops.

- By Service Type:

- Software-as-a-Service (SaaS) (e.g., Farm Management Software, Analytics Platforms)

- Platform-as-a-Service (PaaS) (e.g., Data Integration and Development Frameworks)

- Infrastructure-as-a-Service (IaaS) (e.g., Cloud Computing, Data Storage)

- Robotics-as-a-Service (RaaS)

- Drone-as-a-Service (DaaS)

- By Technology Component:

- Sensing and Monitoring Devices (IoT Sensors, Weather Stations)

- Automation and Control Systems (Actuators, Variable Rate Controllers)

- Software and Data Analytics Platforms (GIS, AI/ML Tools)

- Connectivity Solutions (5G, Satellite, LoRaWAN)

- By Application:

- Precision Crop Management (Scouting, Yield Monitoring, VRA)

- Precision Livestock Monitoring and Management

- Supply Chain Management and Traceability

- Inventory Management and Logistics

- Smart Greenhouse and Indoor Farming

- By Farm Size:

- Large Farms (Above 1,000 Hectares)

- Medium Farms (100 to 1,000 Hectares)

- Small Farms (Below 100 Hectares)

Value Chain Analysis For Agriculture Technology-as-a-Service Market

The value chain for the Agriculture Technology-as-a-Service market is complex, spanning foundational hardware manufacturing to sophisticated data interpretation and end-user delivery. Upstream activities involve the development and supply of critical components, including advanced sensor manufacturing (soil, weather, chemical), drone hardware production (UAV platforms and high-resolution cameras), and connectivity hardware (cellular modems, satellite communication kits). Key players in this phase focus heavily on miniaturization, robustness, and cost-efficiency to ensure the physical infrastructure supporting TaaS is reliable in harsh agricultural environments. Success at this stage relies on forging strong, high-volume manufacturing partnerships and maintaining rigorous quality control standards for components designed for prolonged outdoor exposure and minimal maintenance requirements.

Midstream activities are characterized by platform development, service integration, and data processing. TaaS providers acquire raw data from upstream hardware and utilize proprietary software and cloud infrastructure (PaaS/IaaS) to process, analyze, and convert it into actionable insights. This phase requires expertise in machine learning, agricultural science, and data security. Midstream players, often the primary TaaS vendors, create the core intellectual property—the algorithms and user interfaces—that define the value delivered to the farmer. Distribution channels in this market are predominantly indirect, relying heavily on partnerships with established agricultural dealers, input suppliers (e.g., fertilizer distributors), and local agricultural consulting firms, which possess the necessary trust and local market knowledge to effectively introduce technology to farmers.

Downstream analysis focuses on the final delivery, implementation, and support of the service to the end-user. Direct channels involve large TaaS platform providers offering services straight to corporate farms that have dedicated IT departments for implementation. However, for smaller and medium-sized farms, the indirect channel is vital, involving agricultural consultants who act as intermediaries, interpreting complex data and integrating TaaS recommendations into practical farming decisions. Success downstream hinges on excellent customer support, comprehensive training, and proving the return on investment (ROI) through tangible results, such as documented reductions in water usage or verified increases in yield per hectare. This final stage is crucial for customer retention and market growth.

Agriculture Technology-as-a-Service Market Potential Customers

The potential customer base for the Agriculture Technology-as-a-Service Market is highly diverse, ranging significantly across farm size, type of crop/livestock managed, and geographical location, but generally includes any entity seeking to improve operational efficiency and sustainability through data-driven approaches without incurring heavy capital expenditure. Large corporate farms and agribusinesses are primary targets; they utilize TaaS for scalability, centralized management of multiple sites, and complex regulatory compliance across vast operations. These customers often opt for comprehensive service bundles, including RaaS for autonomous fieldwork and advanced AI platforms for strategic, long-term resource planning, valuing integration with existing enterprise resource planning (ERP) systems.

However, the TaaS model is uniquely tailored to rapidly expand its customer base among small and medium-sized farms (SMEs). For these entities, the cost-prohibitive nature of outright purchasing precision agriculture equipment is completely bypassed by the subscription model. SMEs typically favor simpler SaaS offerings focused on immediate operational improvements, such as localized weather forecasting, basic crop monitoring via satellite imagery, and streamlined farm record-keeping. TaaS providers often create modular service tiers to specifically cater to the budget constraints and limited technical expertise found within the SME farming segment, making advanced technology accessible and driving significant market penetration in regions dominated by smallholder agriculture, particularly in APAC and parts of Latin America.

Beyond traditional farmers, institutional buyers represent a rapidly growing customer segment. These include governmental agricultural agencies utilizing TaaS for large-scale environmental monitoring, water resource management, and aggregated yield prediction for national food security planning. Food processing companies and large retailers are also increasingly becoming buyers of TaaS solutions, not for direct farming but for implementing robust traceability systems and ensuring contractual compliance with sustainability standards across their supply chain. Furthermore, commodity traders leverage Ag-TaaS data feeds to gain predictive insights into global crop yields, highlighting the market’s expanding relevance beyond the primary production sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | John Deere (Blue River Technology), Trimble Inc., Raven Industries (CNH Industrial), Agco Corporation, Farmers Edge Inc., Taranis, PrecisionHawk, Semios, The Climate Corporation (Bayer), Granular (DuPont), CropX, Indigo Ag, Topcon Positioning Systems, IBM (Watson Decision Platform for Agriculture), Microsoft (FarmBeats), Syngenta (ADAMA), Robert Bosch GmbH, Descartes Labs, Fasal, AgEagle Aerial Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agriculture Technology-as-a-Service Market Key Technology Landscape

The technological landscape underpinning the Agriculture Technology-as-a-Service market is characterized by the convergence of high-resolution geospatial intelligence, pervasive IoT networking, advanced AI-driven analytics, and sophisticated cloud infrastructure optimized for agricultural data volumes. At the core, high-accuracy sensing technology, including hyperspectral imaging, LiDAR, and specialized soil chemistry sensors, provides the raw, granular data necessary for precision application. This data is collected and transmitted via diverse connectivity solutions, moving beyond traditional cellular networks to embrace low-power wide-area network (LPWAN) technologies like LoRaWAN for widespread, battery-efficient deployment across remote farmlands, ensuring continuous data flow essential for effective TaaS operations.

A critical technology component is the cloud-native platform architecture that handles data aggregation and processing. These platforms must be scalable, supporting petabytes of telemetry and imagery data from millions of sensors and drones. They incorporate advanced geographic information system (GIS) capabilities and robust Application Programming Interfaces (APIs) to allow third-party tools (such as farm accounting software or fertilizer recommendation engines) to integrate seamlessly, facilitating the "service" aspect of TaaS. Furthermore, the development of secure data lakes and federated data environments is vital for managing proprietary farm data while ensuring compliance with stringent regional data sovereignty and privacy regulations, which is a key concern for potential customers engaging with a service model.

The operational edge of the TaaS technology landscape is defined by robotics and automation. Autonomous tractors, targeted sprayers, and robotic harvesting units are increasingly managed through cloud-based RaaS platforms. These systems rely on high-precision Global Navigation Satellite System (GNSS) technology, often supplemented by Real-Time Kinematic (RTK) correction services, to achieve centimeter-level accuracy in the field. The software managing these fleets utilizes reinforcement learning and predictive maintenance algorithms to optimize routes, minimize downtime, and manage energy consumption, thereby maximizing the economic efficiency and reliability of the Robotics-as-a-Service offering and justifying the recurring subscription cost to the end-user.

Regional Highlights

- North America: This region is a mature market leader in Ag-TaaS adoption, driven by large-scale corporate farming, high labor costs, and significant investment in R&D, particularly in autonomous vehicles and advanced precision agriculture platforms. The US and Canada benefit from extensive governmental subsidies and sophisticated data infrastructure, making them early adopters of comprehensive SaaS and RaaS bundles.

- Europe: Characterized by stringent environmental regulations (e.g., EU Green Deal), Europe shows robust growth focused on TaaS solutions that promote sustainability, traceability, and resource efficiency. Demand is high for services related to nutrient management, variable rate application, and verifiable carbon farming solutions. Connectivity challenges in Central and Eastern Europe present opportunities for LPWAN providers.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to the enormous volume of smallholder farms, rapid digitalization, and the critical need for yield increase amid population growth. Ag-TaaS solutions here are often localized, focusing on affordability, simple mobile interfaces, and services applicable to fragmented land holdings, such as micro-weather forecasting and crop insurance powered by remote sensing.

- Latin America (LATAM): This region is a significant market for TaaS, particularly in large agricultural economies like Brazil and Argentina, where large-scale commodity farming drives demand for satellite monitoring, logistics optimization, and sophisticated financial tools integrated with farm management systems. Adoption is primarily concentrated in the highly capitalized agribusiness sector.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around resource scarcity management, specifically precision irrigation and drought monitoring services. Governments and large agri-investors drive adoption in high-tech indoor and controlled-environment agriculture (CEA) TaaS solutions, mitigating risk associated with arid climates and relying heavily on sensor and data services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agriculture Technology-as-a-Service Market.- John Deere (Blue River Technology)

- Trimble Inc.

- Raven Industries (CNH Industrial)

- Agco Corporation

- Farmers Edge Inc.

- Taranis

- PrecisionHawk

- Semios

- The Climate Corporation (Bayer)

- Granular (DuPont)

- CropX

- Indigo Ag

- Topcon Positioning Systems

- IBM (Watson Decision Platform for Agriculture)

- Microsoft (FarmBeats)

- Syngenta (ADAMA)

- Robert Bosch GmbH

- Descartes Labs

- Fasal

- AgEagle Aerial Systems

Frequently Asked Questions

Analyze common user questions about the Agriculture Technology-as-a-Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines the core difference between Ag-TaaS and traditional agriculture technology purchasing?

Ag-TaaS (Technology-as-a-Service) shifts the model from high upfront capital expenditure (CapEx) for equipment ownership to a flexible, subscription-based operational expenditure (OpEx) model, providing access to advanced software, hardware, and data analytics on demand, usually bundled with maintenance and support.

How does the Ag-TaaS market address labor shortages in the agricultural sector?

Ag-TaaS heavily incorporates Robotics-as-a-Service (RaaS) and Drone-as-a-Service (DaaS) offerings, providing automated solutions for labor-intensive tasks such as planting, spraying, scouting, and harvesting. This automation minimizes reliance on manual labor, ensuring operational continuity and efficiency.

Which technology component is currently driving the highest revenue growth in Ag-TaaS?

Software-as-a-Service (SaaS) components, specifically Farm Management Information Systems (FMIS) and AI-driven data analytics platforms, currently account for the largest revenue share due to their scalability, low implementation cost, and immediate utility in optimizing input usage and decision-making.

What are the primary challenges hindering widespread Ag-TaaS adoption, especially in emerging markets?

The main challenges are unreliable or non-existent rural broadband connectivity, which is essential for data transmission, high data management complexity requiring technical expertise, and skepticism among traditional smallholder farmers regarding the security and ownership of their proprietary agricultural data.

How does precision farming utilize the service model to enhance sustainability?

Precision farming delivered via TaaS uses real-time data from sensors and satellites, processed by AI, to apply inputs (water, fertilizer, pesticides) only where and when necessary (variable rate application). This optimization drastically reduces waste, minimizes environmental runoff, and ensures compliance with sustainability standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager