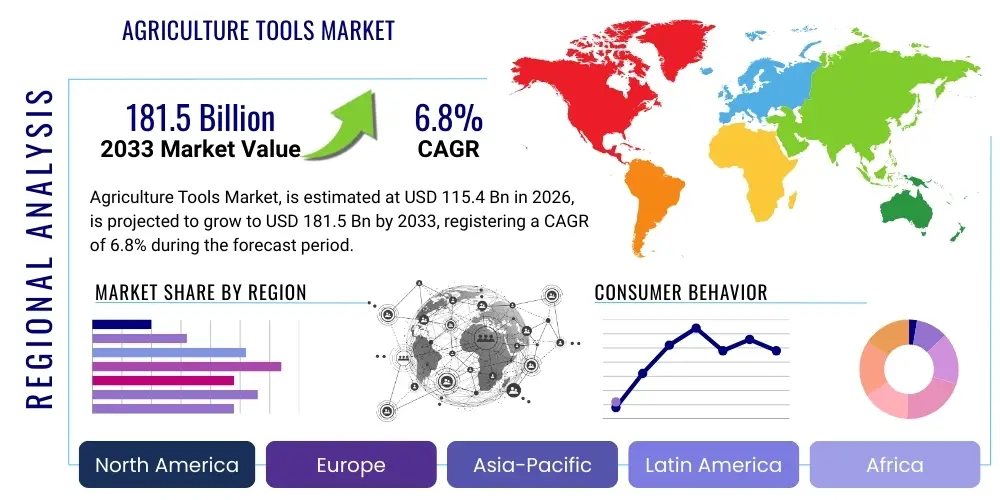

Agriculture Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435954 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Agriculture Tools Market Size

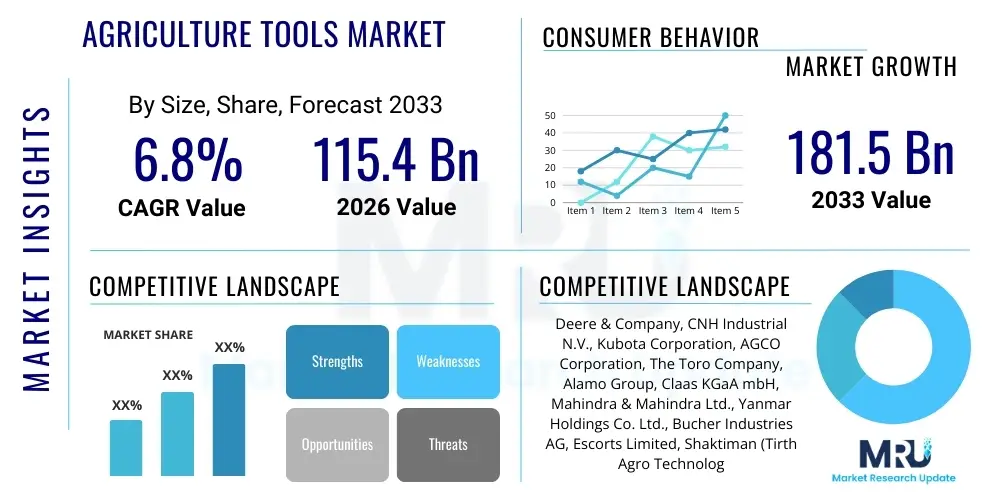

The Agriculture Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 115.4 Billion in 2026 and is projected to reach USD 181.5 Billion by the end of the forecast period in 2033.

Agriculture Tools Market introduction

The Agriculture Tools Market encompasses a wide range of machinery, equipment, and implements utilized for various agricultural operations, spanning from land preparation to harvesting and post-harvest management. This sector is crucial for enhancing farm productivity, efficiency, and sustainability globally. Key product categories include tractors, combines, tillers, plows, planters, sprayers, and specialized precision agriculture tools. The continuous demand for increased food production driven by global population growth, coupled with the necessity to optimize labor and resource utilization, positions agricultural tools as indispensable assets in modern farming practices. The increasing adoption of advanced technologies like GPS, sensors, and telematics within these tools further solidifies their importance in achieving high yields and reducing operational costs across different farm sizes and geographies.

Major applications of agricultural tools cover the entire farming cycle, including primary and secondary tillage (plowing, harrowing), planting and seeding (seed drills, planters), crop cultivation and maintenance (inter-row cultivators, sprayers), and efficient harvesting (combine harvesters, reapers). The core benefits derived from deploying these modern tools involve significant time savings, reduction in manual labor dependence, improved accuracy in resource application (seeds, fertilizers, pesticides), and ultimately, higher yields per unit of land. Furthermore, specialized tools enable sustainable practices such as minimum tillage or no-till farming, contributing to soil health preservation and reduced environmental impact, which aligns with increasingly stringent global environmental regulations and consumer preferences for sustainably produced food.

The market is predominantly driven by global trends emphasizing farm mechanization, particularly in developing economies where labor shortages are becoming acute, and in developed nations seeking higher efficiency through automation. Government subsidies and favorable loan schemes aimed at bolstering agricultural infrastructure, especially in Asia Pacific and Latin America, provide significant impetus for market expansion. Furthermore, the integration of digital technologies, often termed 'Smart Farming' or 'Agriculture 4.0', is a major driving factor. This integration includes the use of data analytics, IoT devices, and sophisticated machinery to enable variable rate technology and prescriptive farming, thereby optimizing input costs and maximizing output quality and quantity.

Agriculture Tools Market Executive Summary

The global Agriculture Tools Market is characterized by robust growth, primarily fueled by the accelerating adoption of farm mechanization across emerging economies and the continuous integration of precision agriculture technologies in mature markets. Business trends indicate a strong focus on merger and acquisition activities among key industry players to consolidate market share and acquire specialized technology firms focused on automation and data analytics. Furthermore, manufacturers are heavily investing in R&D to develop lightweight, fuel-efficient, and autonomous equipment to meet sustainability goals. The shift towards electrification of smaller agricultural vehicles and battery-powered tools represents a nascent but rapidly growing business segment, responding to rising fuel costs and regulatory pressures regarding carbon emissions. Manufacturers are also exploring innovative financing and rental models to make expensive, high-tech machinery accessible to small and mid-sized farmers.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive governmental support for mechanization, large populations dependent on agriculture, and the imperative to improve efficiency in traditionally labor-intensive farming systems. North America and Europe, while being mature markets, dominate in terms of technological adoption, particularly precision agriculture tools and high-horsepower equipment. These regions exhibit high replacement rates for older machinery and a significant demand for sophisticated implements capable of handling complex crop rotations and data-driven farming techniques. The Middle East and Africa (MEA) and Latin America are poised for substantial growth due to increasing commercial farming activities, infrastructure development, and governmental initiatives focusing on food security, necessitating substantial investments in advanced agricultural machinery.

Segment trends reveal that the Tractors category continues to hold the largest market share, serving as the foundational power unit for most farming operations. However, the fastest-growing segments are projected to be specialized equipment related to precision farming, such as variable rate technology (VRT) sprayers and advanced seeding equipment. Within power source segmentation, electric and battery-powered tools are expected to witness exponential growth, moving away from traditional fuel-based dependence, driven by environmental concerns and advancements in battery technology offering longer operational times. The market is also seeing polarization in demand: high-horsepower, automated machinery for large commercial farms, and compact, versatile, affordable tools for small-scale and subsistence farming, reflecting the diverse global agricultural landscape.

AI Impact Analysis on Agriculture Tools Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the operation, maintenance, and output of agricultural tools, focusing heavily on issues of automation, prescriptive decision-making, and resource efficiency. Common user questions revolve around the practicality and cost-effectiveness of integrating AI into legacy equipment, the development timeline for fully autonomous farming fleets, and how AI-powered tools will address increasingly complex challenges like localized pest infestations, nutrient deficiencies, and unpredictable weather patterns. There is significant interest in understanding the role of machine learning in optimizing tool settings for variable soil types and topography, thus maximizing yield while minimizing environmental impact. Key themes emerging from user concerns include data privacy, the requirement for high-speed connectivity (5G) to enable real-time decision-making, and the need for standardized AI interfaces across different brands of agricultural machinery, highlighting a market expectation for interoperability and actionable, reliable predictive insights derived directly from equipment performance data.

- AI drives the development of fully autonomous tractors and harvesting equipment, reducing the dependency on human operators.

- Machine Learning algorithms optimize tool performance, adjusting implement depth, speed, and angle based on real-time soil and crop data.

- Predictive maintenance schedules are generated using AI analysis of equipment sensor data, reducing downtime and operational costs for users.

- Computer Vision systems integrated into sprayers and harvesters enable highly accurate, localized resource application (e.g., spot spraying), dramatically cutting chemical use.

- AI facilitates prescriptive planting and fertilization, recommending precise seed varieties, density, and nutrient ratios based on field historical data and current environmental conditions.

- Enhanced farm management platforms utilize AI to synthesize data from multiple tools and sensors, offering holistic operational insights and yield forecasting.

- AI models support the development of robotics for specialized tasks like weeding, pruning, and harvesting delicate crops, where precision is paramount.

DRO & Impact Forces Of Agriculture Tools Market

The dynamics of the Agriculture Tools Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. A primary driver is the necessity to feed a burgeoning global population, demanding higher agricultural output coupled with shrinking arable land and labor availability, thus necessitating immediate and widespread mechanization. Governments worldwide, recognizing food security as a national priority, are actively promoting the adoption of modern tools through subsidies, tax breaks, and favorable policies, especially targeting the replacement of traditional farming methods. Simultaneously, the rapid evolution of technology, particularly in GPS, IoT, and AI, provides manufacturers with the capability to offer tools that are vastly more efficient, precise, and sustainable than previous generations, acting as a crucial market impetus.

Conversely, significant restraints hinder growth, notably the high initial capital expenditure required for sophisticated, large-scale machinery, which often remains unaffordable for small and marginal farmers, particularly in developing regions. Furthermore, the increasing fragmentation of landholdings in densely populated countries limits the feasibility and return on investment for large, high-capacity equipment. Technical challenges, such as the complexity of operating and maintaining advanced machinery requiring specialized training, and the reliance on robust digital infrastructure (connectivity) for precision tools, also pose barriers to widespread adoption, requiring considerable investment in farmer education and regional infrastructure upgrades.

Opportunities abound, centering primarily on the growth of precision agriculture and controlled environment farming (CEF). The push towards integrating tools with data analytics, satellite imagery, and soil sensors creates lucrative avenues for manufacturers specializing in smart implements and software solutions. Moreover, the vast, untapped markets in Africa and specific regions of Asia represent significant potential for companies offering durable, medium-horsepower, and cost-effective machinery. The global movement towards sustainable farming practices, including reduced tillage and organic farming, opens up a niche market for specialized tools designed to enhance environmental stewardship, ensuring that the market trajectory remains highly positive despite prevailing economic and infrastructural restraints.

Segmentation Analysis

The Agriculture Tools Market is extensively segmented based on criteria such as product type, application, power source, and ownership, reflecting the diverse and specialized requirements of the global agricultural sector. Analyzing these segments provides a clear understanding of market dynamics, growth hotspots, and competitive landscapes. Product segmentation, encompassing everything from basic hand tools to advanced harvesting machinery, highlights where technological innovation and capital investment are concentrated. The fastest growth is observed in segments that facilitate efficiency improvements and sustainable farming practices, driven by the increasing integration of electronics and sophisticated hydraulic systems into traditional equipment designs.

- Product Type

- Tractors (Two-wheel drive, Four-wheel drive, Compact Tractors, High-Horsepower Tractors)

- Harvesters (Combine Harvesters, Forage Harvesters, Specialized Harvesters for specific crops)

- Cultivation Equipment (Plows, Tillers, Harrows, Cultivators)

- Planting Equipment (Seed Drills, Planters, Transplanters)

- Irrigation Equipment (Sprinklers, Drip Systems, Center Pivots)

- Spraying Equipment (Boom Sprayers, Aerial Sprayers, Specialized Chemical Applicators)

- Hand Tools and Other Implements (Shovels, Rakes, Machetes, Specialized Attachments)

- Application

- Tillage and Cultivation

- Sowing and Planting

- Weed and Pest Management (Crop Protection)

- Harvesting and Threshing

- Post-Harvest Management

- Power Source

- Manual/Animal-Drawn

- Fuel-Based (Diesel/Gasoline)

- Electric and Battery-Powered

- Hybrid and Solar-Powered

- Ownership

- Owned

- Rental and Sharing Services (Machine-as-a-Service)

Value Chain Analysis For Agriculture Tools Market

The value chain of the Agriculture Tools Market begins with upstream activities involving raw material procurement, primarily steel, specialized alloys, plastics, and electronic components (e.g., sensors, GPS modules, telematics). Key players in this stage are raw material suppliers and component manufacturers, whose pricing and quality significantly impact the final product cost and reliability. Research and Development (R&D) and design activities follow, focusing on engineering robust, fuel-efficient, and technologically advanced machinery, often involving collaboration with software and AI specialists. Manufacturing and assembly constitute the core process, where economies of scale and efficient production techniques are crucial for maintaining competitive pricing in a globally traded market. Quality control and rigorous testing are vital to ensure compliance with diverse regional safety and performance standards.

Downstream analysis focuses on the distribution, sales, and aftermarket services. The distribution channel is typically dominated by a network of authorized dealers and distributors who provide regional sales support, inventory management, and technical expertise. Direct sales models are increasingly utilized by major original equipment manufacturers (OEMs) for large fleet buyers or governmental contracts. Aftermarket services, including maintenance, spare parts supply, and digital service subscriptions (e.g., precision data services), are highly crucial, often representing a substantial revenue stream for manufacturers and ensuring the longevity and performance of the tools in the field. Effective logistics management, given the size and weight of many agricultural tools, is critical to ensuring timely delivery and minimizing transport costs.

Both direct and indirect channels play complementary roles in reaching the diverse customer base. Direct channels usually involve direct interaction between the OEM and large commercial farming entities or governmental organizations purchasing large volumes, facilitating customized orders and specialized technical support. Indirect channels, relying on extensive dealer networks, are essential for reaching small to medium-sized farmers, particularly in rural or remote areas, providing localized sales, credit facilities, and essential maintenance services. The complexity and high value of modern agricultural tools necessitate highly skilled distribution partners capable of offering comprehensive technical support and financing solutions, ensuring that the value chain maximizes customer lifetime value through reliable service and readily available spare parts.

Agriculture Tools Market Potential Customers

The potential customer base for the Agriculture Tools Market is highly heterogeneous, ranging from subsistence farmers utilizing basic hand tools to large-scale, vertically integrated commercial agricultural corporations demanding fully autonomous, high-capacity machinery. Large commercial farms and corporate agricultural enterprises constitute the primary target demographic for high-value, specialized, and precision-enabled equipment, such as high-horsepower tractors, self-propelled combine harvesters, and advanced variable rate technology (VRT) sprayers. These customers prioritize efficiency, data integration, and total cost of ownership (TCO) over initial cost, viewing technological adoption as a means to achieve competitive advantage and economies of scale. Their purchasing decisions are often influenced by agronomic consultants and detailed ROI calculations, driving demand for machine monitoring and predictive maintenance services.

Another significant customer segment includes small and medium-sized farmers (SMEs), particularly those in emerging markets, who typically require compact, multi-functional, and affordable equipment. For this group, the demand is often driven by access to government subsidies, favorable financing options, and the availability of rental or shared ownership models. Tools in demand here include power tillers, smaller tractors (under 60 HP), and essential implements like moldboard plows and basic seed planters. Market success in serving this segment hinges on providing durable, easy-to-maintain, and versatile machinery that can significantly reduce reliance on manual labor while fitting within tighter budget constraints. The rising popularity of micro-financing and equipment leasing programs directly addresses the affordability challenges faced by this extensive customer base.

Furthermore, specialized end-users represent niche but growing customer groups. These include agricultural cooperatives, who purchase equipment collectively for shared use among members; government agencies and research institutions involved in large-scale farm trials and agricultural development projects; and, increasingly, companies involved in contract farming and agricultural machinery rental services (Machine-as-a-Service providers). These rental entities are crucial intermediaries, as they purchase and maintain large fleets of modern equipment, subsequently providing access to technology to farmers who cannot afford outright purchase, thereby expanding the reach of advanced agricultural tools across all farmer demographics and farm sizes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.4 Billion |

| Market Forecast in 2033 | USD 181.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., Kubota Corporation, AGCO Corporation, The Toro Company, Alamo Group, Claas KGaA mbH, Mahindra & Mahindra Ltd., Yanmar Holdings Co. Ltd., Bucher Industries AG, Escorts Limited, Shaktiman (Tirth Agro Technology), Foton Lovol International Heavy Industry Co., Ltd., Zetor Tractors a.s., SDF Group, Jiangsu World Group Co., Ltd., J.C. Bamford Excavators Ltd. (JCB), Sany Heavy Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agriculture Tools Market Key Technology Landscape

The technology landscape of the Agriculture Tools Market is rapidly transitioning from mechanical efficiency to data-driven precision, integrating several interconnected technologies to enhance operational efficacy and resource management. Global Navigation Satellite System (GNSS) technology, including GPS and GLONASS, forms the foundational layer, enabling precise steering, automated section control on sprayers and spreaders, and field mapping. This precision capability allows farmers to implement variable rate technology (VRT), where inputs like seeds, fertilizers, or pesticides are applied at optimized rates based on localized field conditions identified through geospatial data. Furthermore, the adoption of advanced hydraulic and electronic systems ensures that modern machinery operates with unprecedented control, responsiveness, and fuel economy, facilitating high-speed operations without compromising accuracy or performance quality.

The emergence of Internet of Things (IoT) sensors and connectivity platforms is transforming agricultural tools into 'smart' machines that continuously generate vast amounts of operational and agronomic data. These sensors monitor everything from engine health and fuel consumption to implement performance, soil moisture levels, and crop health status in real-time. Telematics systems installed in high-value assets enable remote monitoring, fault diagnosis, and over-the-air software updates, significantly enhancing operational uptime and supporting predictive maintenance strategies. This data collection capability is crucial for implementing data-driven farming models, allowing farmers and agronomists to make immediate adjustments to farming inputs and techniques based on highly localized information, optimizing every pass of the tool across the field.

Automation and robotics represent the cutting edge of the technology landscape. Autonomous tractors and machinery, driven by AI and sophisticated sensor fusion, are moving from experimental stages to commercial deployment, addressing persistent agricultural labor shortages. Furthermore, specialized agricultural robots are being developed for delicate or repetitive tasks such as weeding, fruit picking, and scouting. These technologies leverage computer vision and machine learning algorithms to identify and act upon individual plants, dramatically increasing precision compared to traditional blanket applications. The future trajectory is focused on enhancing interoperability through industry standards like ISO BUS, ensuring seamless communication between tractors, implements, and farm management software, irrespective of the manufacturer, thereby accelerating the adoption of complex, multi-brand farming systems.

Regional Highlights

Regional dynamics heavily influence the demand patterns and technological adoption within the Agriculture Tools Market, reflecting differing economic structures, governmental support mechanisms, and farm sizes globally. North America, characterized by large farm sizes and high capital investment capacity, leads the market in the adoption of high-horsepower tractors and advanced precision agriculture equipment, including fully integrated guidance systems and robotics. The high cost of labor and a strong regulatory environment promoting sustainability drive continuous investment in tools that maximize efficiency and minimize environmental impact. The demand is heavily concentrated in sophisticated machinery replacement cycles and specialized crop production tools.

- North America: Market leader in high-end, precision-enabled machinery. Driven by large commercial farms, high labor costs, and a quick embrace of automation and IoT integration.

- Europe: Focuses significantly on sustainable farming practices, leading the demand for low-emission, fuel-efficient, and sophisticated tools, especially in Western Europe. Strong governmental support for organic and regenerative agriculture necessitates specialized implements.

- Asia Pacific (APAC): The fastest-growing region globally, fueled by rapid mechanization necessitated by population pressure and shrinking farm labor pools. Government subsidies in countries like India, China, and Southeast Asia are massively boosting demand for compact tractors, power tillers, and basic implements.

- Latin America: Characterized by vast tracts of land dedicated to large-scale commodity crops (soybeans, corn). High demand for large, robust harvesting equipment and high-horsepower tractors capable of sustained heavy-duty operation. Brazil and Argentina are key growth engines.

- Middle East and Africa (MEA): Significant investment driven by food security agendas and large-scale farming projects, particularly in North Africa and the Gulf states. High demand for efficient irrigation equipment and durable machinery capable of handling arid or semi-arid conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agriculture Tools Market.- Deere & Company

- CNH Industrial N.V.

- Kubota Corporation

- AGCO Corporation

- The Toro Company

- Alamo Group

- Claas KGaA mbH

- Mahindra & Mahindra Ltd.

- Yanmar Holdings Co. Ltd.

- Bucher Industries AG

- Escorts Limited

- Shaktiman (Tirth Agro Technology)

- Foton Lovol International Heavy Industry Co., Ltd.

- Zetor Tractors a.s.

- SDF Group

- Jiangsu World Group Co., Ltd.

- J.C. Bamford Excavators Ltd. (JCB)

- Sany Heavy Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Agriculture Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Agriculture Tools Market?

The Agriculture Tools Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increasing mechanization efforts globally and technological integration.

Which technology is driving the most significant change in agricultural tools?

Precision Agriculture technology, including GPS/GNSS, IoT sensors, and Artificial Intelligence (AI) for prescriptive farming and autonomous operation, is currently driving the most significant advancements in efficiency and sustainability across all tool segments.

Which segment holds the largest market share by product type?

Tractors consistently hold the largest market share globally due to their indispensable role as the primary power source for tillage, planting, and harvesting operations across diverse farm sizes and geographical regions.

What are the primary factors restraining market growth, especially in emerging economies?

The key restraints include the high initial capital investment required for modern, advanced machinery, coupled with the challenge of land fragmentation, which limits the economies of scale necessary for utilizing large-capacity equipment effectively.

How is sustainability influencing the design of new agricultural tools?

Sustainability demands are driving manufacturers toward developing electric and hybrid machinery, tools supporting reduced tillage methods, and VRT applicators that minimize waste, chemical use, and carbon emissions, aligning with global environmental standards.

What role do government subsidies play in the Agriculture Tools Market?

Government subsidies and favorable financing schemes, particularly in regions like Asia Pacific, are crucial drivers, directly lowering the cost barrier to entry and accelerating the rate of farm mechanization among small and mid-sized farmers.

How is the market addressing the needs of small and marginal farmers?

Manufacturers are developing compact, multi-functional, and modular equipment, alongside promoting rental and equipment sharing services (Machine-as-a-Service) to make advanced tools accessible and cost-effective for smaller landholders.

What is telematics and its impact on modern agricultural equipment?

Telematics involves the use of telecommunication and informatics to transmit operational data from machinery in the field. This impacts tools by enabling remote monitoring, predictive maintenance, theft prevention, and optimizing fleet management efficiency in real-time.

In which region is the adoption of farm mechanization growing the fastest?

The Asia Pacific (APAC) region is experiencing the fastest growth in farm mechanization, spurred by supportive government policies, rapid economic development, and an urgent need to increase domestic food production efficiency.

What distinguishes autonomous agricultural tools from conventional automated machinery?

Autonomous tools utilize advanced sensor fusion, AI, and precise navigation (GNSS) to operate entirely without a human driver in the cab, performing complex tasks and making real-time decisions, unlike conventional automated tools which still require operator oversight.

What is Variable Rate Technology (VRT) and how is it applied in tools?

VRT allows tools like sprayers and planters to automatically adjust the rate of input application (seeds, fertilizer, chemicals) based on field zone prescriptions derived from satellite maps or sensor data, ensuring precise and non-uniform application.

Why is the aftermarket service segment crucial for OEMs in the market?

Aftermarket service, including spare parts and maintenance, is crucial because modern agricultural tools are high-value, complex assets. Reliable service minimizes downtime, maximizes equipment lifespan, and often generates significant, stable revenue for Original Equipment Manufacturers (OEMs).

How are mergers and acquisitions affecting the competitive landscape?

M&A activities are driving market consolidation, allowing major players to integrate specialized technology (like software or robotics companies) into their offerings, enhancing technological capability and expanding their global distribution networks.

What challenges does data privacy pose in the context of connected agricultural tools?

Data privacy presents a challenge as connected tools generate proprietary agronomic and operational data. Farmers are concerned about data ownership, security, and how manufacturers or third-party providers might utilize this sensitive information for commercial gain.

Is there a trend toward electrification in larger agricultural machinery?

While electrification is dominant in smaller tools and specialized robots, full electrification of high-horsepower tractors faces challenges related to battery density and sustained power requirements, though hybrid and battery-assist systems are increasingly being developed for larger machinery.

What defines the upstream segment of the Agriculture Tools Market value chain?

The upstream segment is defined by the procurement of raw materials (steel, composites) and critical high-tech components (sensors, advanced hydraulics, electronic control units), whose cost and reliability directly influence manufacturing efficiency and final product quality.

How are environmental regulations influencing equipment design in Europe?

Strict European environmental regulations necessitate the development of engines meeting stringent emission standards (e.g., Tier 4 Final/Stage V), driving investment in advanced emission control technologies and promoting lighter, more fuel-efficient equipment designs to minimize environmental footprint.

What is the role of specialized agricultural robots in crop management?

Specialized robots perform highly accurate tasks like precise weeding (distinguishing weeds from crops using computer vision), targeted spraying, and automated fruit harvesting, addressing labor scarcity and maximizing crop yield by minimizing environmental damage.

How do fluctuations in commodity prices affect demand for agricultural tools?

High commodity prices generally boost farmer income, leading to increased investment in new, high-value tools and machinery upgrades. Conversely, sustained low commodity prices typically lead to delayed purchases and preference for used or rented equipment.

What opportunities exist in the market related to controlled environment agriculture (CEA)?

The rise of CEA (e.g., vertical farms, greenhouses) creates opportunities for specialized, small-scale, automated tools and robotics designed for indoor operation, precision nutrient delivery, and climate-controlled harvesting, distinct from traditional field equipment.

Why is training and education essential for the adoption of modern agricultural tools?

Modern tools, especially those integrated with software and data analytics, are complex. Adequate training and education are essential to ensure farmers and operators can maximize the potential of the technology, interpret data effectively, and perform routine maintenance, guaranteeing ROI.

What are the key differences between two-wheel drive and four-wheel drive tractors in the market?

Four-wheel drive (4WD) tractors offer superior traction, power efficiency, and stability, typically preferred for heavy tillage and large-scale operations. Two-wheel drive (2WD) tractors are generally more affordable, easier to maneuver, and suitable for light tasks and smaller farms.

What is the primary factor driving the demand for harvesting equipment?

The demand for harvesting equipment is primarily driven by the need for quick, efficient, and mechanized crop collection to minimize post-harvest losses, particularly crucial during narrow harvest windows dictated by weather conditions and large crop volumes.

How do distribution channels differ between developed and developing markets?

In developed markets, distribution relies heavily on authorized dealers offering high-level technical support and financing. In developing markets, the channel often involves a larger network of local distributors, focused on accessibility, micro-financing options, and basic, durable tool inventory.

Why is soil health management becoming a major application focus for new tools?

Growing awareness and regulation concerning soil degradation are driving demand for tools that support conservation tillage (minimum or no-till farming), specialized deep rippers, and implements designed to reduce soil compaction and enhance organic matter retention.

What is the typical lifespan considered for a high-horsepower agricultural tractor?

A high-horsepower agricultural tractor is typically designed for a lifespan exceeding 10,000 to 15,000 engine hours, often supported by rigorous maintenance schedules and the ability to refurbish key components, ensuring a long operational life.

How does IoT specifically improve the efficiency of seeding and planting equipment?

IoT sensors on seeding equipment monitor metrics like seed spacing, planting depth, and population density in real-time, allowing immediate VRT adjustments and ensuring optimal, uniform planting across varied field conditions, maximizing germination and yield potential.

What is the significance of the shift from owned equipment to rental models?

The shift to rental or Machine-as-a-Service models increases accessibility to expensive, advanced technology for farmers who cannot afford ownership. This flexibility reduces capital outlay and maintenance burden, while ensuring that the latest efficiency-enhancing tools are utilized.

How do adverse weather conditions impact the agricultural tools market?

Adverse weather increases the demand for specialized, robust tools that can operate under challenging conditions, such as high-traction tractors for wet fields or specialized irrigation equipment for drought-prone areas, pushing innovation in durability and versatility.

What role does standardization (like ISO BUS) play in tool compatibility?

Standardization, particularly ISO BUS, ensures that tractors and implements from different manufacturers can communicate digitally and operate seamlessly together, reducing technical barriers for farmers and promoting greater market competition and flexibility in equipment choice.

How are manufacturers addressing the environmental impact of fuel-based engines?

Manufacturers are heavily investing in developing advanced after-treatment systems (like Selective Catalytic Reduction and Diesel Particulate Filters) to meet emission standards, alongside improving engine efficiency and exploring alternative fuels like bio-diesel to reduce the environmental footprint.

Which sub-segment of cultivation equipment is experiencing renewed interest due to sustainability trends?

Equipment related to minimum and no-tillage systems, such as specialized no-till seeders and residue management tools, is experiencing renewed interest as farmers increasingly adopt practices focused on soil carbon sequestration and moisture retention.

What is the competitive advantage for companies specializing in compact tractors?

Companies specializing in compact tractors gain a competitive edge by catering to the massive demand from small and marginal farmers, livestock farmers, and specialized operations (e.g., vineyards), offering affordability, maneuverability, and versatility suitable for diverse tasks.

How does the shortage of skilled agricultural labor affect market demand for tools?

The shortage of skilled labor significantly accelerates the demand for automated, high-capacity machinery and robotic solutions that can perform tasks traditionally requiring large workforces, driving the market toward full mechanization.

What is the expected long-term impact of 5G deployment on the Agriculture Tools Market?

5G deployment is expected to enable true real-time communication for fully autonomous fleets and high-volume sensor data transfer, critically enhancing the operational reliability and decision-making speed of precision agriculture and connected machinery.

How do manufacturers ensure the durability and reliability of tools for MEA and Latin American markets?

For MEA and Latin America, manufacturers prioritize robust engineering, heavy-duty chassis design, and simplified mechanics to withstand extreme operating conditions, high temperatures, and limited access to sophisticated maintenance facilities, focusing on longevity and ease of repair.

What are the key components included in the post-harvest management segment?

Post-harvest management tools include grain dryers, cleaning and sorting machines, specialized storage systems, and handling equipment designed to preserve the quality and extend the shelf life of harvested crops before processing or market distribution.

Why are large technology companies increasingly collaborating with traditional equipment manufacturers?

Tech companies offer expertise in AI, data processing, and software integration, which traditional OEMs require to transform their hardware into 'smart' connected tools, fostering collaboration that accelerates the development of precision farming platforms.

What is the significance of the base year 2025 in the market analysis?

The base year 2025 serves as the definitive reference point for calculating the projected Compound Annual Growth Rate (CAGR) and market size estimations for the subsequent forecast period (2026-2033), grounding the future projections in recent market realities.

Which type of financing is most commonly used by farmers to purchase expensive machinery?

Farmers typically rely on specialized agricultural financing, leasing arrangements, and favorable government-backed loan programs, as well as OEM-provided financing schemes, to manage the substantial capital outlay required for high-value agricultural tools.

What impact does the growth of specialized crops have on tool design?

The growth of specialized high-value crops (e.g., specific vegetables, nuts, fruits) necessitates the development of highly specific, often robotic, tools designed for gentle handling, targeted treatment, and selective harvesting to maximize quality and minimize physical damage.

How do OEM warranty policies influence customer purchasing decisions?

Comprehensive and extended warranty policies significantly influence purchasing decisions, especially for expensive equipment, as they offer assurance regarding reliability, reduce long-term risk, and demonstrate the manufacturer's confidence in product durability and performance.

What is the expected future trend for power sources in agricultural tools?

The future trend indicates a shift toward electric and battery-powered tools for lighter-duty applications, while high-horsepower machinery will increasingly adopt hybrid systems or highly efficient, low-emission diesel engines until battery technology matures sufficiently for heavy-duty, long-duration tasks.

Why is R&D investment critical for market players in this sector?

R&D investment is critical for maintaining competitive relevance by developing patented technologies in automation, fuel efficiency, and digital integration, ensuring that a manufacturer's product portfolio remains aligned with rapidly evolving agronomic requirements and environmental regulations.

What role do agricultural cooperatives play in market dynamics?

Agricultural cooperatives enhance market access for small farmers by collectively purchasing and sharing expensive machinery, acting as influential bulk buyers, and demanding specific machinery features tailored to the collective needs of their membership.

How does the market distinguish between a planter and a seed drill?

A seed drill is primarily used for sowing seeds in precise rows at uniform depth for small grains or cereals, while a planter is designed for larger seeds (like corn or soybeans) and utilizes specialized metering systems to ensure precise, individualized seed spacing and density.

What are the primary challenges related to the interoperability of farm management software?

Interoperability challenges arise from proprietary data formats and communication protocols used by different manufacturers, making it difficult for farmers to integrate data seamlessly across diverse fleets and utilize unified farm management software platforms effectively.

How are government initiatives for agricultural infrastructure boosting tool demand?

Government initiatives supporting irrigation development, land consolidation, and modern food processing centers create guaranteed demand for specific types of tools, such as sophisticated irrigation systems, high-capacity material handlers, and specialized processing equipment.

Why is the ability to handle crop residue becoming a key design requirement for tillage tools?

Increased crop yields mean more residue is left on the field. Tillage tools must be designed with robust mechanisms to effectively cut and manage this residue without clogging, facilitating subsequent planting and maintaining soil health under conservation practices.

What is the primary driver for high replacement rates of equipment in North America?

The primary driver is the rapid advancement of technology, where new models offer significant leaps in fuel efficiency, precision capabilities, and automation features, making the return on investment through replacement justify the cost for large commercial operations.

How does the trend of smart farming influence the distribution channel?

Smart farming requires distributors to evolve from simple sales agents to technical consultants, necessitating specialized training to advise customers on software integration, data management, and the optimal calibration and operation of complex, connected tools.

What is the significance of the USD 181.5 Billion market projection for 2033?

The projection of USD 181.5 Billion by 2033 signifies the immense economic value placed on agricultural efficiency and technology adoption, highlighting sustained global investment in farm modernization as a critical strategy for future food security and industrial growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager