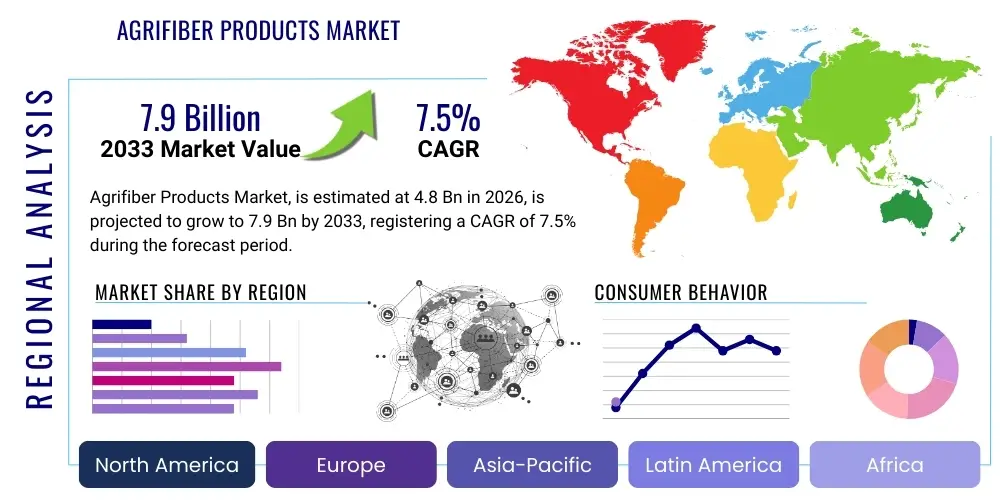

Agrifiber Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439465 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Agrifiber Products Market Size

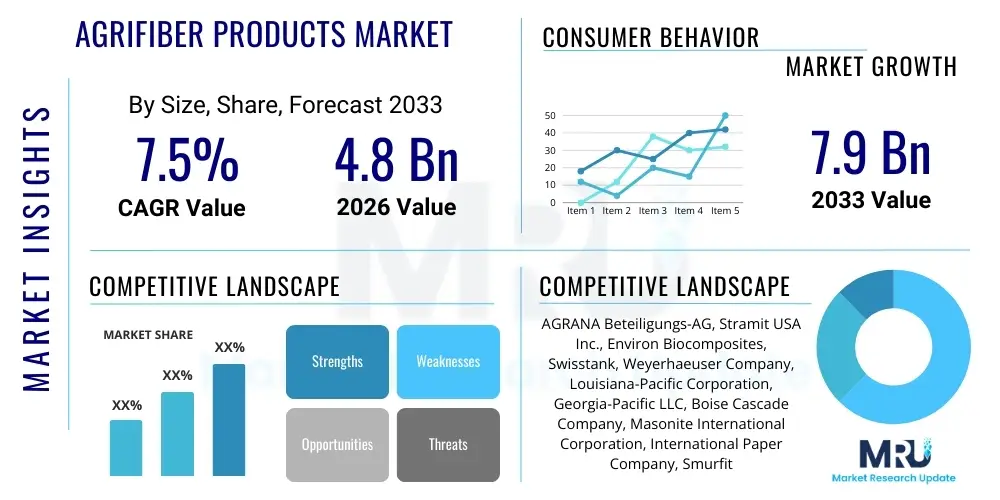

The Agrifiber Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033. This robust growth is attributed to increasing global awareness of sustainability, stringent environmental regulations pushing industries towards eco-friendly alternatives, and technological advancements enhancing the versatility and performance of agrifiber materials across various applications. The market is poised for significant expansion as industries seek to reduce their reliance on traditional, non-renewable resources and mitigate their environmental footprint.

Agrifiber Products Market introduction

The Agrifiber Products Market encompasses a diverse range of materials manufactured from agricultural residues and by-products, offering sustainable alternatives to conventional wood-based products, plastics, and other materials. These products are derived from sources such as wheat straw, rice husks, bagasse (sugarcane residue), corn stover, hemp, flax, and various other plant fibers that would otherwise be considered waste. The core principle involves converting these abundant agricultural wastes into valuable resources through various processing techniques, including pulping, pressing, and compounding, creating materials with unique properties suitable for a multitude of applications. This approach not only provides economic benefits to agricultural communities by creating new revenue streams but also addresses critical environmental challenges related to waste management and deforestation.

Major applications for agrifiber products span several key industries, notably construction, packaging, automotive, and furniture manufacturing. In construction, agrifiber is utilized for insulation boards, particleboards, fiberboards, and structural panels, offering lightweight, durable, and fire-resistant properties. The packaging sector leverages agrifiber for biodegradable containers, molded pulp products, and paperboard, significantly reducing plastic waste. The automotive industry integrates agrifiber composites into interior components, achieving weight reduction and enhancing sustainability profiles. Furthermore, the furniture industry uses agrifiber boards as core materials, promoting eco-friendly designs and reducing dependence on virgin timber. The versatility of these materials allows for customization to meet specific industry requirements, making them increasingly attractive across a broad spectrum of manufacturing processes.

The benefits associated with agrifiber products are substantial and multifaceted. Environmentally, they contribute to a circular economy by utilizing agricultural waste, thereby reducing landfill burden and greenhouse gas emissions from waste burning. They also alleviate pressure on forest resources, mitigating deforestation and supporting biodiversity. Economically, agrifiber products often offer cost-effective alternatives to traditional materials, especially as raw material prices for conventional resources fluctuate. Technologically, ongoing research and development are enhancing the performance characteristics of agrifiber, making them competitive or even superior in certain applications regarding strength, insulation, and moisture resistance. Driving factors for market growth include escalating consumer demand for sustainable products, robust governmental policies and regulations promoting bio-based materials, corporate sustainability initiatives, and advancements in processing technologies that improve material quality and reduce production costs. The increasing investment in green infrastructure and sustainable building practices further propels the adoption of agrifiber products globally.

Agrifiber Products Market Executive Summary

The Agrifiber Products Market is experiencing dynamic growth driven by a confluence of business, regional, and segment-specific trends. Business trends highlight a strong focus on innovation, with companies investing heavily in R&D to develop novel agrifiber composites and advanced processing techniques that enhance material performance and broaden application possibilities. Strategic partnerships and collaborations between agricultural producers, technology providers, and end-use manufacturers are becoming more prevalent, aimed at streamlining the supply chain and accelerating market penetration. Furthermore, mergers and acquisitions are observed as larger entities seek to consolidate market share and expand their product portfolios, integrating specialized agrifiber technologies into their operations. The emphasis on certifications, such as FSC (Forest Stewardship Council) for sustainability and bio-based content certifications, is also a key business trend, providing credibility and market differentiation for agrifiber product manufacturers.

From a regional perspective, the market exhibits varying growth trajectories and drivers. Asia Pacific, particularly China and India, is emerging as a dominant market due to its vast agricultural output, burgeoning construction sector, and increasing governmental support for sustainable manufacturing practices. North America and Europe are characterized by stringent environmental regulations, high consumer awareness regarding sustainability, and significant investments in green building initiatives, fostering a robust demand for advanced agrifiber solutions. These regions are also at the forefront of technological innovation, leading the development of high-performance agrifiber composites for specialized applications. Latin America, the Middle East, and Africa are showing promising potential, with growing industrialization and a rising focus on local resource utilization driving early adoption and market development in these regions. Each region presents unique opportunities based on local agricultural waste availability, regulatory landscapes, and industrial development stages, requiring tailored market entry strategies.

Segment-wise, the market is witnessing distinct patterns of expansion. The construction materials segment, including particleboard, fiberboard, and insulation, continues to be a major revenue contributor, benefiting from green building standards and the demand for lightweight, durable, and energy-efficient alternatives. The packaging segment is experiencing rapid growth, fueled by the global push to reduce plastic waste and the increasing consumer preference for biodegradable and compostable packaging solutions. Innovations in molded pulp packaging and agrifiber-based paperboard are driving this expansion. The automotive interior components segment is also on an upward trajectory, as manufacturers aim to meet sustainability targets and reduce vehicle weight, leading to greater adoption of agrifiber composites. Other segments, such as furniture, textiles, and biofuels, are demonstrating steady growth as the versatility of agrifiber materials is explored further. The increasing diversification of applications underscores the market's long-term potential and its critical role in the transition towards a bio-based economy.

AI Impact Analysis on Agrifiber Products Market

Users frequently inquire about AI's potential to revolutionize the Agrifiber Products Market, focusing on how it can enhance efficiency, optimize material properties, and foster sustainable practices. Key themes revolve around leveraging AI for predictive analytics in agricultural waste management, improving quality control during production, accelerating R&D for novel material formulations, and optimizing supply chain logistics. There is significant interest in AI's role in making agrifiber production more cost-effective and competitive, addressing challenges such as raw material variability and processing complexities. Users anticipate AI will lead to more consistent product quality, enable personalized material design, and provide deeper insights into market trends and consumer preferences, ultimately driving widespread adoption of agrifiber solutions.

- AI-driven optimization of agricultural residue collection and supply chain logistics, minimizing waste and ensuring consistent raw material availability.

- Predictive analytics for raw material quality assessment, enabling precise sorting and blending of agrifibers to achieve desired product specifications.

- Enhanced process control in manufacturing, using AI to monitor parameters like temperature, pressure, and moisture content for improved efficiency and reduced energy consumption.

- Automated quality inspection systems for finished agrifiber products, utilizing computer vision and machine learning to detect defects and maintain high standards.

- AI-accelerated material discovery and formulation, allowing researchers to simulate and predict the properties of new agrifiber composites with varied binders and additives.

- Personalized product development and customization, with AI assisting in designing agrifiber products tailored to specific end-user requirements and performance criteria.

- Market demand forecasting and trend analysis, enabling manufacturers to optimize production schedules and inventory management based on real-time insights.

- Robotics and automation in handling and processing agrifiber materials, leading to increased productivity and reduced labor costs.

- Development of smart agrifiber products with embedded sensors and AI capabilities for monitoring performance, durability, and end-of-life biodegradability.

- Optimization of energy consumption in agrifiber production facilities through AI-powered energy management systems.

DRO & Impact Forces Of Agrifiber Products Market

The Agrifiber Products Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the escalating global demand for sustainable and eco-friendly materials, spurred by heightened environmental awareness among consumers and industries alike. This is coupled with increasingly stringent environmental regulations and governmental mandates worldwide, which actively promote the reduction of waste, resource conservation, and the adoption of bio-based alternatives to conventional materials. The abundant availability of agricultural residues, which often pose disposal challenges, provides a readily accessible and renewable raw material source, further fueling market growth. Furthermore, advancements in processing technologies have significantly improved the performance, durability, and cost-effectiveness of agrifiber products, making them competitive with traditional materials across various applications.

However, several restraints pose challenges to the market's full potential. The inconsistent quality and variability of agricultural raw materials, which can differ based on crop type, harvest practices, and regional conditions, present significant hurdles in achieving standardized product manufacturing. The relatively higher production costs associated with certain agrifiber processing technologies, especially when compared to established conventional methods, can deter widespread adoption. Limited awareness and acceptance among some end-users and manufacturers, who may be hesitant to transition from familiar materials, also act as a restraint. Additionally, the fragmented nature of the agricultural waste supply chain can lead to logistical complexities and inefficiencies in sourcing and transportation, impacting overall cost-effectiveness and scalability. Overcoming these challenges requires continuous innovation in processing techniques and robust supply chain management strategies.

Opportunities for growth in the agrifiber market are extensive and diverse. The burgeoning demand for sustainable packaging solutions offers a significant avenue for expansion, as companies strive to meet consumer preferences and regulatory requirements for reduced plastic waste. The rapidly expanding green building and construction sector globally presents a substantial market for agrifiber-based insulation, panels, and structural components. Moreover, the development of advanced agrifiber composites for high-performance applications in industries like automotive and aerospace creates premium market segments with higher profit margins. Investing in research and development to explore novel applications, improve material properties, and reduce production costs remains a critical opportunity. Key impact forces include fluctuating prices of petrochemical-based materials, which can make agrifiber more competitive, and ongoing technological breakthroughs in material science and engineering. Regulatory frameworks, such as carbon pricing and waste management policies, exert significant pressure on industries to adopt more sustainable practices, indirectly boosting the agrifiber market. The shift towards a circular economy model and increasing corporate social responsibility initiatives also act as powerful external drivers, compelling industries to integrate agrifiber products into their value chains.

Segmentation Analysis

The Agrifiber Products Market is comprehensively segmented based on various critical parameters, including product type, source material, application, and end-use industry. This segmentation provides a granular view of the market's diverse components, enabling a detailed analysis of growth drivers, regional variations, and competitive landscapes within each category. Understanding these segments is crucial for identifying specific market opportunities, tailoring product development strategies, and effectively targeting diverse customer bases. The inherent versatility of agricultural fibers allows for the creation of a wide array of products, from basic construction boards to advanced bio-composites, catering to distinct industrial demands and consumer preferences, all while maintaining a strong commitment to environmental sustainability.

- By Product Type:

- Fiberboards (Medium Density Fiberboard MDF, High Density Fiberboard HDF, Low Density Fiberboard LDF)

- Particleboards

- Molded Pulp Products

- Insulation Panels

- Paper and Paperboard

- Bio-composites

- Bio-plastics (e.g., PLA reinforced with agrifibers)

- Textile Fibers

- Pellets (for bioenergy)

- Animal Bedding

- By Source Material:

- Wheat Straw

- Rice Husks

- Bagasse (Sugarcane Residue)

- Corn Stover

- Hemp Fibers

- Flax Fibers

- Cotton Stalks

- Jute Fibers

- Palm Oil Mill Effluent (POME) Fiber

- Sorghum Stover

- Bamboo Residues

- Coconut Coir

- Kenaf

- Other Agricultural By-products (e.g., barley straw, oat straw, sunflower husks)

- By Application:

- Construction and Building Materials (e.g., walls, ceilings, flooring, roofing)

- Packaging (e.g., food packaging, industrial packaging, protective packaging, molded containers)

- Automotive Interiors (e.g., door panels, headliners, dashboards, seatbacks)

- Furniture (e.g., cabinets, tables, chairs, shelving)

- Textiles and Apparel (e.g., natural fiber fabrics, non-wovens)

- Agriculture (e.g., mulches, erosion control, plant pots)

- Consumer Goods (e.g., disposable tableware, crafts)

- Energy (e.g., bio-fuel pellets)

- Filtration Media

- By End-Use Industry:

- Building and Construction

- Packaging Industry

- Automotive Industry

- Furniture Manufacturing

- Consumer Goods & Retail

- Textile Industry

- Bioenergy Sector

- Agriculture and Horticulture

- Filtration and Environmental Management

Value Chain Analysis For Agrifiber Products Market

The value chain for the Agrifiber Products Market is intricate, beginning with the sourcing of agricultural residues and extending through processing, manufacturing, distribution, and final consumption. Upstream analysis focuses on the availability, collection, and initial processing of agricultural waste materials. This segment involves farmers and agricultural cooperatives as primary suppliers of raw fibers. Key challenges here include ensuring consistent supply, managing transportation logistics from diverse and often dispersed sources, and implementing efficient pre-treatment methods like drying, cleaning, and baling to prepare the fibers for industrial use. Innovations in collection methods and storage solutions are crucial for maintaining the quality and viability of the raw materials, which significantly impacts the downstream manufacturing processes and the final product's properties. Developing robust partnerships with agricultural communities is essential for securing a sustainable and cost-effective supply of feedstock.

Midstream activities involve the transformation of raw agrifibers into various intermediate and finished products. This phase includes pulping for paper products, pressing for boards like particleboard and fiberboard, and compounding for bio-composites where fibers are mixed with resins and additives. Key players in this segment are material processors and manufacturers who invest in specialized machinery and technologies for fiber extraction, refinement, and product formation. Research and development play a vital role here, focusing on optimizing manufacturing processes to enhance product performance, reduce energy consumption, and minimize waste generation. The selection of appropriate binders, resins, and other additives is critical to impart desired characteristics such as water resistance, fire retardancy, and mechanical strength to the final agrifiber products. Quality control and testing are paramount to ensure that manufactured products meet industry standards and consumer expectations.

Downstream analysis encompasses the distribution channels and end-user markets. Agrifiber products are distributed through various channels, including direct sales to large industrial clients, wholesalers, retailers, and specialized distributors serving niche markets. Direct distribution is common for bulk materials sold to construction companies, automotive manufacturers, or large packaging producers. Indirect channels involve a network of distributors and retailers who supply smaller businesses or individual consumers, especially for products like furniture components or consumer packaging. The effectiveness of distribution networks relies on efficient logistics, warehousing capabilities, and strong relationships with clients. Marketing and sales efforts are tailored to highlight the environmental benefits, performance advantages, and cost-effectiveness of agrifiber products to penetrate diverse end-use industries such. Aftermarket services and technical support also form an important part of the downstream value chain, ensuring customer satisfaction and promoting repeat business, while also feeding back critical information for product improvement and innovation.

Agrifiber Products Market Potential Customers

The Agrifiber Products Market caters to a wide spectrum of potential customers across various industries, all united by a growing imperative for sustainable and environmentally responsible materials. The primary end-users are typically large-scale manufacturers and commercial enterprises that integrate agrifiber materials into their production processes or utilize them as essential components. This includes sectors heavily scrutinized for their environmental footprint, as well as those actively seeking competitive advantages through green innovation. Understanding the specific needs and regulatory environments of these diverse customers is paramount for manufacturers to tailor their product offerings and market strategies effectively, ensuring that the unique benefits of agrifiber products, such as their renewability, biodegradability, and performance characteristics, are clearly communicated and valued. The expanding scope of applications further broadens the customer base, encompassing both traditional industrial users and emerging niche markets committed to sustainable practices.

Within the construction and building materials industry, key buyers include commercial and residential construction firms, architects, developers, and manufacturers of building components. These customers seek agrifiber products like particleboards, fiberboards, insulation panels, and structural composites for their lightweight properties, thermal and acoustic insulation capabilities, and fire resistance, all while contributing to green building certifications. The packaging industry represents another significant customer segment, comprising food and beverage companies, e-commerce giants, pharmaceutical firms, and general consumer goods manufacturers. Their demand is driven by the urgent need for biodegradable and compostable packaging solutions to replace plastics, including molded pulp packaging, paperboard, and specialty containers made from agrifibers that align with corporate sustainability goals and consumer preferences for eco-friendly products.

The automotive industry is an increasingly vital customer, with major vehicle manufacturers purchasing agrifiber composites for interior components such as door panels, headliners, dashboards, and seatbacks. Their interest lies in reducing vehicle weight to improve fuel efficiency and lower emissions, alongside meeting sustainability targets for material sourcing. Furniture manufacturers are also key buyers, utilizing agrifiber-based boards for cabinets, tables, chairs, and other furniture items, driven by consumer demand for sustainable and aesthetically pleasing designs. Beyond these major segments, potential customers also include the textile industry, seeking natural fibers for eco-friendly apparel and non-woven fabrics; the agriculture sector, which uses agrifiber products for mulches, erosion control, and biodegradable plant pots; and companies in the bioenergy sector that use agrifiber pellets as a renewable fuel source. The diversity of these end-users underscores the broad applicability and growing acceptance of agrifiber products across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGRANA Beteiligungs-AG, Stramit USA Inc., Environ Biocomposites, Swisstank, Weyerhaeuser Company, Louisiana-Pacific Corporation, Georgia-Pacific LLC, Boise Cascade Company, Masonite International Corporation, International Paper Company, Smurfit Kappa Group Plc, WestRock Company, DS Smith Plc, BRP Inc. (Can-Am), Ford Motor Company (for sustainable materials research), IKEA (for sustainable furniture materials), Ecovative Design LLC, GreenFiber, Columbia Forest Products, Homasote Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agrifiber Products Market Key Technology Landscape

The Agrifiber Products Market is underpinned by a dynamic and evolving technological landscape that focuses on efficiently converting diverse agricultural residues into high-performance materials. At the core are various fiber extraction and preparation technologies, ranging from mechanical pulping and chemical pulping processes, adapted from the traditional paper industry, to more advanced methods like steam explosion and enzymatic treatments. These techniques aim to isolate and refine the cellulosic fibers from raw biomass, removing undesirable components such as lignin and hemicellulose while preserving fiber integrity. Optimizing these initial steps is critical, as the quality and characteristics of the extracted fibers directly influence the properties of the final agrifiber products, dictating their suitability for different applications. Continuous innovation in these pre-processing methods is crucial for reducing energy consumption, minimizing environmental impact, and improving yield, thereby enhancing the overall economic viability of agrifiber production.

Beyond fiber preparation, a significant portion of the technology landscape is dedicated to material consolidation and composite manufacturing. This includes well-established methods like hot pressing for the production of particleboards and fiberboards, where prepared agrifibers are mixed with binders (e.g., formaldehyde-free resins, bio-based polymers) and compressed under heat and pressure. Extrusion and injection molding techniques are increasingly employed for producing agrifiber-reinforced bio-composites and bio-plastics, where fibers are compounded with thermoplastic polymers to create materials with enhanced strength, stiffness, and dimensional stability. Advancements in binder technologies are particularly impactful, with a growing shift towards bio-based and sustainable adhesives that improve the environmental profile of the final products. Innovations also extend to the development of additive manufacturing (3D printing) capabilities for agrifiber-based materials, opening new possibilities for complex geometries and customized product designs.

Furthermore, the key technology landscape encompasses a range of post-processing and surface treatment techniques designed to enhance the durability, aesthetics, and specific functionalities of agrifiber products. These include specialized coatings for moisture resistance, fire retardant treatments, and surface laminations that improve wear resistance and appearance. Research into nanotechnology is also gaining traction, with nanoparticles being incorporated into agrifiber matrices to improve mechanical properties, barrier functions, and antimicrobial characteristics. Automation and digitalization play a crucial role in modern agrifiber production facilities, with advanced sensors, control systems, and data analytics being integrated to optimize process parameters, ensure consistent product quality, and reduce operational costs. The convergence of material science, chemical engineering, and digital technologies is driving the rapid evolution of the agrifiber market, enabling the creation of sustainable materials that meet stringent performance requirements across diverse industrial applications.

Regional Highlights

- North America: This region is characterized by high environmental awareness, stringent regulations promoting sustainable construction and packaging, and significant investment in R&D. The U.S. and Canada are leading adopters of agrifiber products, particularly in green building initiatives and the automotive industry. Abundant agricultural residues from corn, wheat, and forestry operations provide a strong raw material base. Demand for high-performance, lightweight composites and sustainable packaging is a key driver. Innovation in bio-based binders and advanced processing techniques is prominent, positioning North America as a hub for cutting-edge agrifiber solutions.

- Europe: European countries are at the forefront of the circular economy transition, with robust policies supporting bio-based materials and waste valorization. Germany, France, the UK, and the Nordic countries demonstrate strong market growth, driven by ambitious climate targets, consumer preferences for eco-friendly products, and a mature infrastructure for sustainable manufacturing. The region benefits from diverse agricultural outputs including hemp, flax, and various cereal straws. Emphasis is placed on certified sustainable products, energy efficiency in production, and novel applications in automotive, construction, and design-led furniture.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to its vast agricultural lands producing immense quantities of residues like rice husks, wheat straw, and bagasse. Countries such as China, India, and Southeast Asian nations are witnessing rapid industrialization, urbanization, and a growing middle class, leading to increased demand for construction materials and packaging. Governmental support for reducing agricultural waste burning and promoting sustainable industries is a major catalyst. Cost-effectiveness and local resource utilization are key drivers, alongside rising environmental consciousness. The region is also becoming a significant manufacturing hub for agrifiber products.

- Latin America: This region presents substantial untapped potential, fueled by abundant agricultural resources (e.g., sugarcane bagasse, coffee husks, maize stover) and emerging industrial development. Brazil, Mexico, and Argentina are key markets, with increasing focus on sustainable construction, pulp and paper production, and the utilization of agricultural by-products for energy. Economic development and a growing awareness of resource efficiency are stimulating investment in agrifiber manufacturing. Challenges include developing robust collection infrastructures and overcoming market fragmentation, but the long-term outlook is positive due to high raw material availability and industrial growth.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the agrifiber market, primarily driven by investments in sustainable development projects and diversified economic initiatives. Countries like South Africa, Egypt, and Saudi Arabia are exploring the use of local agricultural residues for construction materials and packaging. The focus is often on import substitution and maximizing the value of domestic resources. While nascent, growing environmental concerns, infrastructure development, and a push towards industrial diversification are creating opportunities for agrifiber product adoption, particularly in building materials and eco-friendly packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agrifiber Products Market.- AGRANA Beteiligungs-AG

- Stramit USA Inc.

- Environ Biocomposites

- Swisstank

- Weyerhaeuser Company

- Louisiana-Pacific Corporation

- Georgia-Pacific LLC

- Boise Cascade Company

- Masonite International Corporation

- International Paper Company

- Smurfit Kappa Group Plc

- WestRock Company

- DS Smith Plc

- BRP Inc. (Can-Am)

- Ford Motor Company (for sustainable materials research)

- IKEA (for sustainable furniture materials)

- Ecovative Design LLC

- GreenFiber

- Columbia Forest Products

- Homasote Company

Frequently Asked Questions

Analyze common user questions about the Agrifiber Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Agrifiber Products and why are they important?

Agrifiber products are materials made from agricultural residues like wheat straw or rice husks. They are crucial for sustainability by reducing waste, lowering carbon footprints, and offering eco-friendly alternatives to traditional materials in construction, packaging, and automotive industries, promoting a circular economy.

How do agrifiber products compare in performance to traditional materials?

Agrifiber products often offer comparable or superior performance, particularly in terms of lightweight properties, insulation, and acoustic damping. Ongoing technological advancements are continually improving their strength, durability, and moisture resistance, making them increasingly competitive with conventional materials like wood or plastic.

What are the primary challenges facing the Agrifiber Products Market?

Key challenges include ensuring consistent quality and supply of diverse agricultural raw materials, managing initial production costs which can be higher than established alternatives, overcoming limited market awareness, and navigating the complexities of fragmented supply chains for agricultural waste.

Which industries are the largest consumers of agrifiber products?

The largest consumers are the construction and building materials sector (for boards, insulation), the packaging industry (for biodegradable containers), and the automotive industry (for interior components). Furniture manufacturing and various consumer goods sectors are also significant and growing end-users.

What is the future outlook for the Agrifiber Products Market?

The future outlook is highly positive, driven by increasing global sustainability mandates, escalating consumer demand for green products, and continuous technological innovations in material science. The market is expected to witness substantial growth, expanding into new applications and playing a vital role in the transition towards a bio-based and circular economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager