Agritech Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436679 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Agritech Market Size

The Agritech Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $47.5 Billion by the end of the forecast period in 2033.

Agritech Market introduction

The Agritech Market encompasses the application of modern technology to agriculture with the aim of increasing yield, improving efficiency, and ensuring sustainability across the food production value chain. This domain integrates sophisticated tools such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), robotics, and geographic information systems (GIS) into traditional farming practices. Products range from precision farming software platforms and drone-based monitoring systems to advanced irrigation technologies and genetic engineering solutions. The core description of Agritech involves moving beyond manual, heuristic farming toward data-driven, precise, and automated agricultural management, addressing complex challenges posed by fluctuating climate patterns and limited natural resources globally. The comprehensive scope of these solutions positions them as critical enablers for future global food security, making the market highly dynamic and critical for economic development.

Major applications for Agritech solutions span the entire farm-to-fork continuum, though primary emphasis is placed on field and farm operations. Precision agriculture, which utilizes sensors, satellite imagery, and localized data analytics to optimize resource deployment (water, fertilizer, pesticides), constitutes a major application area. Other significant applications include livestock monitoring, vertical farming environmental control, supply chain management and traceability systems, and automated harvesting machinery. The fundamental benefits derived from the adoption of these technologies include significant reduction in operational costs due to efficient resource utilization, enhanced crop quality and quantity, minimization of environmental impact through targeted inputs, and improved farm resilience against adverse weather conditions. Furthermore, enhanced data collection capabilities provide farmers with deep, actionable insights necessary for strategic decision-making, transforming farming into a highly specialized, technically sophisticated operation.

The driving factors propelling the Agritech market growth are multifaceted and structurally linked to global socioeconomic pressures. Rapid global population growth necessitates a corresponding increase in food production, placing immense pressure on existing agricultural land and practices. Concurrently, the increasing scarcity of arable land and water resources, coupled with the profound and unpredictable effects of climate change, compels farmers and governments to seek efficiency-maximizing technologies. Government initiatives and supportive regulatory frameworks, particularly in developed economies, promoting sustainable agriculture and digital transformation also fuel market expansion. Additionally, the increasing integration of corporate farming models and the rising penetration of high-speed internet in rural areas are lowering technological adoption barriers, making advanced Agritech solutions more accessible to a broader base of agricultural stakeholders seeking competitive advantages and long-term sustainability.

Agritech Market Executive Summary

The global Agritech market is undergoing a profound transformation characterized by aggressive capital infusion, rapid technological convergence, and a concentrated effort towards creating scalable, sustainable agricultural models. Current business trends indicate a strong move toward platform-based solutions that offer end-to-end integration, moving away from disparate, single-function hardware tools. Strategic mergers and acquisitions (M&A) are common, driven by larger technology firms seeking to integrate specialized software capabilities, particularly in AI-driven predictive analytics and robotics, accelerating market consolidation and standardizing operational efficiencies. Furthermore, venture capital interest remains robust, focused primarily on disruptive innovations in vertical farming, alternative proteins, and enhanced input optimization tools, reflecting an investor preference for technologies addressing both production efficiency and environmental externalities. This shift is creating a highly competitive landscape where data ownership and platform security are becoming crucial differentiators among market participants.

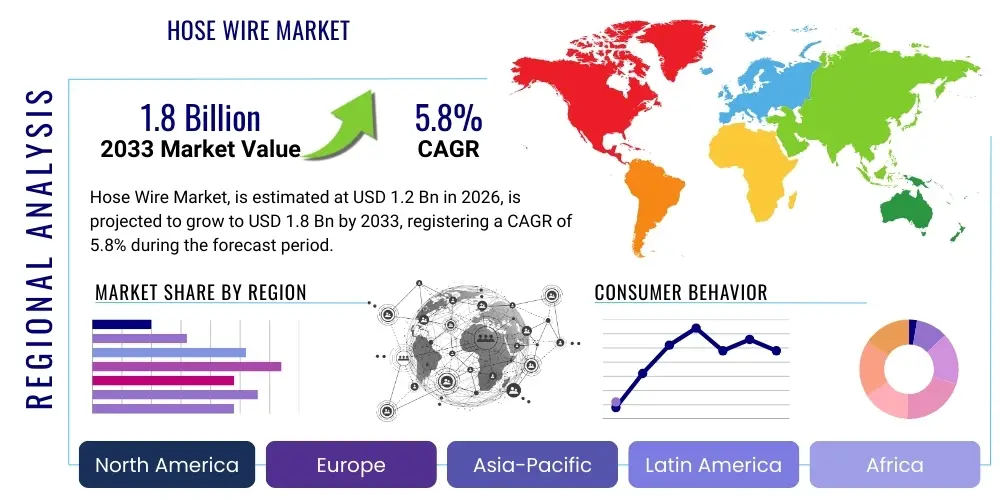

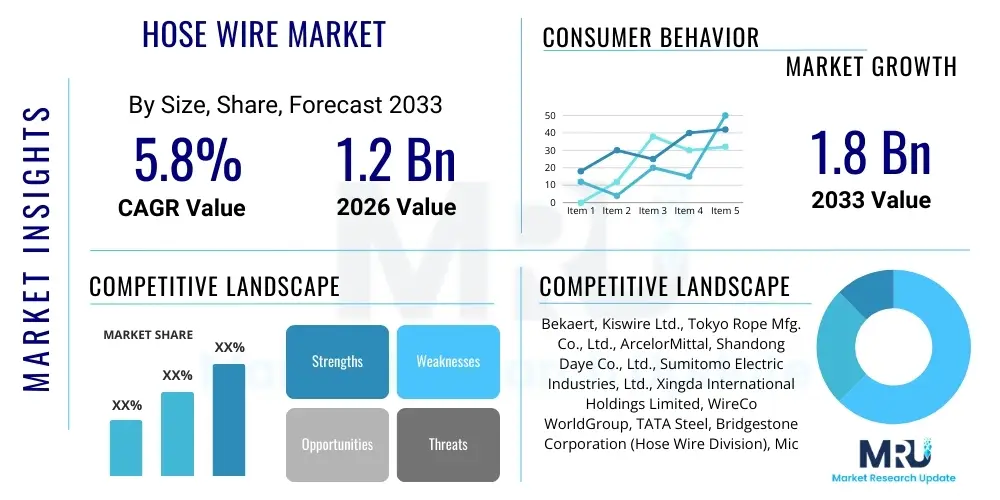

Regional trends exhibit significant heterogeneity in adoption rates and technological focus. Asia Pacific (APAC) currently dominates the market in terms of production volume and is projected to exhibit the highest growth rate, fueled by large-scale government support, necessity-driven efficiency demands in countries like India and China, and increasing adoption of IoT sensors for large-scale farm monitoring. North America and Europe, while possessing higher initial adoption maturity, lead the market in technological innovation, particularly concerning sophisticated software analytics, genetic modification, and advanced robotics deployed on specialized, high-value crops. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily focused on adopting fundamental farm management software and efficient irrigation systems to stabilize production and manage water scarcity, indicating substantial untapped potential for hardware and basic digital infrastructure providers.

Segmentation trends reveal a clear preference for software and service components over traditional hardware sales, a pattern driven by the recurring revenue models and the continuous value derived from data analytics and prescriptive recommendations. Within the hardware segment, drone technology and advanced sensing devices remain pivotal, though their functionality is increasingly reliant on cloud-based processing services. Precision irrigation and nutrient management segments are expanding rapidly due to global water stress and regulatory mandates pushing for reduced environmental leakage. Moreover, the Farm Management Software (FMS) segment is witnessing exponential growth as it centralizes complex data streams—including climate, soil, drone, and historical yield data—into user-friendly dashboards, empowering farmers with real-time, sophisticated decision support capabilities necessary for optimizing inputs and maximizing overall farm profitability in dynamic market conditions.

AI Impact Analysis on Agritech Market

User queries regarding the integration of Artificial Intelligence (AI) into the Agritech sector typically center on its practical application, economic feasibility, and potential socio-economic ramifications. Common concerns involve quantifying the Return on Investment (ROI) for small to medium-sized farms, the necessary level of digital infrastructure required for effective deployment, and issues surrounding data security and ownership when utilizing AI-driven platforms. Users frequently inquire about AI's ability to precisely predict localized pest outbreaks, optimize complex irrigation schedules based on hyper-local microclimatic data, and enhance crop yield forecasts with greater accuracy than traditional statistical models. Furthermore, there is significant interest in understanding how AI-powered robotics will reshape agricultural labor demands, balancing the benefits of automation with the potential for rural job displacement, thereby driving the need for clear training pathways and technology accessibility policies to ensure equitable transition across the agricultural workforce.

- AI drives predictive analytics for localized weather patterns and yield forecasting, enhancing operational planning.

- Machine learning algorithms optimize resource allocation, specifically minimizing the overuse of water, fertilizers, and pesticides.

- Computer vision and deep learning enable autonomous machinery for precise planting, weeding, and harvesting operations.

- AI enhances livestock monitoring by analyzing behavioral data to detect early signs of disease and optimize feeding schedules.

- It accelerates genetic research by identifying optimal breeding traits and resistance genes in various crops.

- AI platforms provide customized, real-time prescriptive recommendations to farmers, transitioning from reactive to proactive farm management.

DRO & Impact Forces Of Agritech Market

The Agritech market is driven by compelling global needs and technological advancements, yet faces significant structural limitations, creating a complex interplay of forces. Key drivers include the critical need to enhance global food security amid a rising population and diminishing arable land, strong governmental backing through subsidies and digital agriculture mandates, and increasing consumer demand for sustainably sourced and traceable food products. These drivers are fundamentally reshaping farm economics towards efficiency and high-tech adoption. However, market expansion is restrained by the high initial capital investment required for implementing sophisticated hardware and software systems, which creates a substantial barrier to entry for small-scale farmers, particularly in emerging markets. Further restraints include poor internet connectivity and lack of robust technical infrastructure in many rural areas, alongside a significant skill gap among agricultural workers required to operate and maintain complex digital systems. Opportunities for growth lie significantly in the untapped potential of emerging economies, the development of vertical and controlled-environment agriculture (CEA) supported by highly optimized Agritech, and the continuous evolution of low-cost, scalable sensor technologies and integrated farm management software that lowers the cost threshold for adoption. The primary impact forces include rapid technological innovation in sensor capabilities and AI processing power, coupled with evolving international regulations demanding reduced environmental footprint from agricultural practices, pushing stakeholders towards immediate and mandatory technological integration.

Segmentation Analysis

The Agritech market segmentation is crucial for understanding the varying needs of different agricultural systems and the diverse technologies available. The market is typically segmented based on the component type, the application area within the agricultural cycle, and the deployment model utilized. Understanding these segment boundaries allows for targeted development and investment, recognizing that efficiency demands vary significantly between large-scale row crop operations and small, high-value horticultural farms. The rapid evolution of integrated platforms means that the boundaries between segments like software and services are increasingly blurring, emphasizing the need for flexible, modular solutions that can be customized to individual farm sizes and specific operational requirements globally. This structured approach ensures market offerings remain relevant to the multifaceted challenges inherent in modern food production systems across various climates and economic settings.

- By Component:

- Hardware (Automation & Control Systems, Sensing & Monitoring Devices, Drones/UAVs, GPS/GNSS)

- Software (Farm Management Software, Data Analytics, Cloud-Based Solutions, On-Premise Solutions)

- Services (Maintenance & Support, System Integration, Consulting Services, Managed Services)

- By Application:

- Precision Farming (Variable Rate Technology, Yield Monitoring, Soil Mapping)

- Smart Irrigation Management

- Farm Management & Inventory Tracking

- Livestock Monitoring

- Indoor Farming (Vertical Farms, Greenhouses)

- Supply Chain Traceability

- By Farm Type:

- Large Farms

- Small and Medium Farms

Value Chain Analysis For Agritech Market

The Agritech value chain commences with upstream activities centered on research and development (R&D) and the manufacturing of core components, including sensor arrays, drone hardware, AI processors, and specialized agricultural machinery. Key upstream players include specialized component manufacturers, software developers creating proprietary algorithms, and established agricultural equipment giants integrating smart technology into their machinery offerings. This stage is characterized by significant investment in intellectual property and standardization efforts to ensure interoperability. Downstream activities focus on the distribution, integration, and deployment of these technologies directly to end-users, primarily farmers and agricultural enterprises. This includes system integrators, Agritech solution providers, and local agricultural dealerships that offer installation, customization, and critical post-sales support services, ensuring the technology is correctly utilized in complex field environments. The value generated at this end is heavily dependent on effective localization and responsive technical maintenance.

Distribution channels in the Agritech market are multifaceted, encompassing both direct and indirect routes to market. Direct channels often involve large Agritech solution providers engaging directly with corporate farming operations or governmental entities to implement large-scale, customized projects, ensuring bespoke integration and maintenance contracts. Indirect channels are more common for standardized products like sensors or Farm Management Software (FMS) subscriptions, utilizing established networks of agricultural distributors, regional dealers, and, increasingly, specialized e-commerce platforms focused on farming supplies. The movement towards subscription-based software models has also introduced channel partners focused purely on digital service delivery. Both direct and indirect models are essential, though the latter helps overcome geographic barriers and leverages existing farmer trust established by traditional agricultural dealerships, which is vital for new technology adoption among conservative farming communities.

The optimization of the value chain is critical for market success, requiring synergistic collaboration between hardware manufacturers, software developers, and farm consultants. Efficiency is generated by minimizing data silos—ensuring seamless integration between farm hardware (sensors, machinery) and analytical software. Disruptions often occur when integration is poor or when data standards are inconsistent, reducing the utility of precision tools. Therefore, modern Agritech firms prioritize a holistic approach, offering bundled solutions (Hardware-as-a-Service or Software-as-a-Service) that simplify procurement and maintenance for the end-user. The ability to collect, process, and securely transmit large volumes of agricultural data efficiently across the chain is the fundamental source of competitive advantage, driving continuous improvements in yield predictions and resource optimization recommendations delivered to the farmer.

Agritech Market Potential Customers

The potential customer base for Agritech products is broadly defined by all entities engaged in commercial agricultural production, extending from smallholder farmers to multinational food corporations, alongside governmental bodies focused on agricultural planning and sustainability. Primary end-users include independent large-scale farm operators specializing in row crops (e.g., corn, wheat, soy) who seek efficiency gains through precision farming technology and automated machinery. These entities represent significant buyers of sophisticated, high-cost capital equipment and complex data analytics platforms, valuing technologies that offer maximized output per acre and reduced input waste. Secondary, yet rapidly growing, customer segments include Controlled Environment Agriculture (CEA) facilities, such as vertical farms and large greenhouse operations, which require specialized Agritech for climate control, nutrient delivery optimization, and robotics to manage their intensive, year-round production cycles.

Beyond traditional crop farmers, the livestock and aquaculture sectors represent distinct and expanding customer categories for Agritech. Livestock producers utilize sensor technology and AI analytics for herd health monitoring, tracking animal location, welfare, and productivity metrics, driving demand for specialized biometric tags and monitoring systems. Aquaculture operations deploy IoT sensors and remote monitoring tools to manage water quality, feed disbursement, and growth cycles in complex marine or freshwater environments. Furthermore, large multinational food and beverage companies, often operating contractual farming models, act as powerful indirect customers. They mandate the use of certain traceability and sustainability-focused Agritech solutions across their supply chains to meet corporate social responsibility (CSR) goals and regulatory standards, effectively driving technology adoption down to their contracted growers.

The diversification of the customer base underscores the necessity for flexible product development that addresses varying scales of operation and financial capacity. While large corporations demand highly customized, enterprise-level integration services, small and medium-sized farms (SMEs) are increasingly targeted with affordable, modular, and easy-to-use SaaS (Software-as-a-Service) solutions, often delivered via mobile platforms. Governments and non-profit organizations also serve as key customers, particularly in developing regions, by investing in large-scale data infrastructure (e.g., soil mapping, regional weather prediction models) and implementing technology demonstration projects designed to uplift agricultural productivity across specific geographic areas. Targeting these diverse segments requires tailored sales strategies that emphasize either sophisticated ROI justification or simplified ease-of-use and low maintenance costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $47.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, Trimble Inc., Agco Corporation, Bayer CropScience AG, IBM Corporation, Farmers Edge Inc., Taranis, CropX Ltd., The Climate Corporation (a subsidiary of Bayer), Precision Planting LLC, Granular (a subsidiary of Corteva Agriscience), Bosch Deepfield Robotics, Raven Industries (acquired by CNH Industrial), Ceres Imaging, Sensei Ag, Topcon Positioning Systems, Hexagon AB, Innovasea, Aquabyte, AeroFarms |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agritech Market Key Technology Landscape

The technology landscape of the Agritech market is characterized by convergence, where previously disparate systems are now integrating to form holistic farm management platforms. The core technological pillar remains the Internet of Things (IoT), utilizing sophisticated sensors (soil, weather, crop) and remote sensing (satellite, drone imagery) to gather massive amounts of real-time data from the field. This data forms the foundation for all subsequent analysis and automation. Critically, the integration of 5G and Low Power Wide Area Networks (LPWAN) is crucial for efficient data transmission across expansive rural areas, overcoming historical bandwidth limitations. Furthermore, advanced robotics and automation, encompassing autonomous tractors, weeding robots utilizing computer vision, and specialized harvesters, are transitioning from conceptual prototypes to commercially viable solutions, fundamentally altering the economics of agricultural labor and input management, particularly in high-wage economies.

A second crucial technological front is the widespread deployment of Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are essential for converting raw IoT data into actionable insights, enabling predictive modeling for disease risk, yield forecasting, and optimal nutrient application scheduling. ML algorithms refine their recommendations based on historical farm performance and external variables like market pricing, providing prescriptive guidance rather than merely descriptive reporting. Complementing AI, sophisticated Geographic Information Systems (GIS) and Global Navigation Satellite Systems (GNSS), including high-accuracy Real-Time Kinematic (RTK) GPS, ensure that all farm operations—from seed placement to pesticide spraying—are executed with centimeter-level precision, maximizing efficacy and minimizing environmental impact through localized interventions.

The forward-looking technological landscape also heavily features biotechnology and controlled environment technology. Precision breeding and genetic modification techniques, often supported by AI analysis of genomic data, are accelerating the development of crops resistant to specific diseases and climate stresses, offering high-yield varieties tailored to regional conditions. Simultaneously, the rise of specialized Agritech for Controlled Environment Agriculture (CEA), including advanced HVAC systems, LED grow lighting optimized for specific spectral outputs, and hydroponic/aeroponic nutrient delivery systems, is creating highly productive, land-independent food production systems in urban centers and non-arable areas. Blockchain technology is also gaining traction, offering immutable record-keeping for supply chain transparency, ensuring traceability and validating sustainability claims for premium food products demanded by modern consumers.

Regional Highlights

- Asia Pacific (APAC): APAC is projected as the fastest-growing market globally, driven by large agricultural economies like China and India facing urgent demands for increased productivity and sustainable resource management due to massive population density. Government schemes promoting farm mechanization and digital literacy, combined with the increasing adoption of basic IoT sensors and affordable farm management software, are key growth catalysts. The region's focus is on maximizing yield efficiency and reducing post-harvest losses through better cold chain monitoring technologies.

- North America: North America holds a substantial market share, characterized by high technological maturity, large-scale commercial farming operations, and substantial R&D investment. Adoption rates are high for advanced technologies, including autonomous machinery, sophisticated AI-driven predictive analytics platforms, and high-accuracy GPS solutions (RTK). The market here is driven by the desire for reduced labor dependency and highly precise input management to meet stringent environmental regulations and maximize commodity returns.

- Europe: Europe is characterized by strict environmental policies, notably the Farm to Fork strategy, which drives the demand for sustainable and precise agriculture. The focus is heavily placed on reducing chemical inputs, minimizing emissions, and ensuring high animal welfare standards. This necessitates the strong uptake of low-power sensor networks, specialized robotic weeding solutions, and highly integrated farm data management systems that comply with demanding traceability requirements and data privacy regulations (GDPR).

- Latin America (LATAM): LATAM is an emerging powerhouse for Agritech, particularly in high-volume commodities like soy, sugar cane, and beef production. The market is increasingly adopting technologies related to irrigation efficiency, soil health monitoring, and crop protection due to variable climate conditions. Brazil and Argentina are leading the regional adoption curve, driven by the need to increase export competitiveness and manage vast tracts of land efficiently, requiring robust connectivity solutions.

- Middle East and Africa (MEA): Agritech adoption in MEA is fundamentally driven by the severe challenges of water scarcity, desertification, and climate variability. The focus is on specialized solutions such as controlled environment agriculture (greenhouses, vertical farms) to enable localized production, highly efficient drip irrigation systems, and satellite imaging for remote monitoring of water usage. Government funding in Gulf Cooperation Council (GCC) countries strongly supports food security initiatives through advanced technology procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agritech Market.- Deere & Company

- Trimble Inc.

- Agco Corporation

- Bayer CropScience AG

- IBM Corporation

- Farmers Edge Inc.

- Taranis

- CropX Ltd.

- The Climate Corporation (a subsidiary of Bayer)

- Precision Planting LLC

- Granular (a subsidiary of Corteva Agriscience)

- Bosch Deepfield Robotics

- Raven Industries (acquired by CNH Industrial)

- Ceres Imaging

- Sensei Ag

- Topcon Positioning Systems

- Hexagon AB

- Innovasea

- Aquabyte

- AeroFarms

- PneumaticScale Angelus (PSG)

- Tropic Biosciences

- Grizzly Ag

- BioConsortia

- I-Feeder

- Hortifrut S.A.

- Lettuce Grow

Frequently Asked Questions

Analyze common user questions about the Agritech market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Agritech market?

The market is primarily driven by the escalating global demand for food due to population growth, the necessity for improved resource efficiency (water and land), and robust government policies promoting sustainable and digital agriculture practices globally. Technological advancements in AI and IoT also act as major facilitators, enabling highly precise and automated farm operations.

How does precision farming differ from traditional agriculture and what core technologies does it rely on?

Precision farming moves beyond generalized field management by utilizing data-driven insights to apply treatments (fertilizers, water, pesticides) precisely where and when needed. It relies heavily on core technologies such as high-accuracy GPS/GNSS, IoT sensors for soil and environment monitoring, variable rate technology (VRT) equipment, and advanced aerial imagery (drones and satellites) processed by machine learning algorithms.

What major restraints hinder the widespread adoption of Agritech solutions, especially in developing regions?

Key restraints include the high upfront capital expenditure required for sophisticated hardware and software systems, posing a financial barrier for small farmers. Additionally, inadequate internet and cellular connectivity in rural and remote agricultural areas severely limits the functionality of cloud-based and real-time data-intensive Agritech solutions, alongside a critical lack of skilled personnel capable of operating these complex systems.

Which geographical region is expected to demonstrate the highest growth rate in the Agritech market forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) between 2026 and 2033. This growth is spurred by the massive scale of agricultural operations in countries like China and India, increased investment in digitalization supported by governmental initiatives, and the imperative to increase productivity on shrinking arable land.

What is the role of Artificial Intelligence (AI) in optimizing farm resource utilization?

AI plays a transformative role by analyzing vast datasets (weather, soil conditions, historical yields) to provide highly accurate predictive models and prescriptive recommendations. This enables farmers to optimize resource utilization by determining the exact amount and timing for inputs like water and nutrients, leading to significant reduction in waste, lower operational costs, and minimized environmental runoff.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager