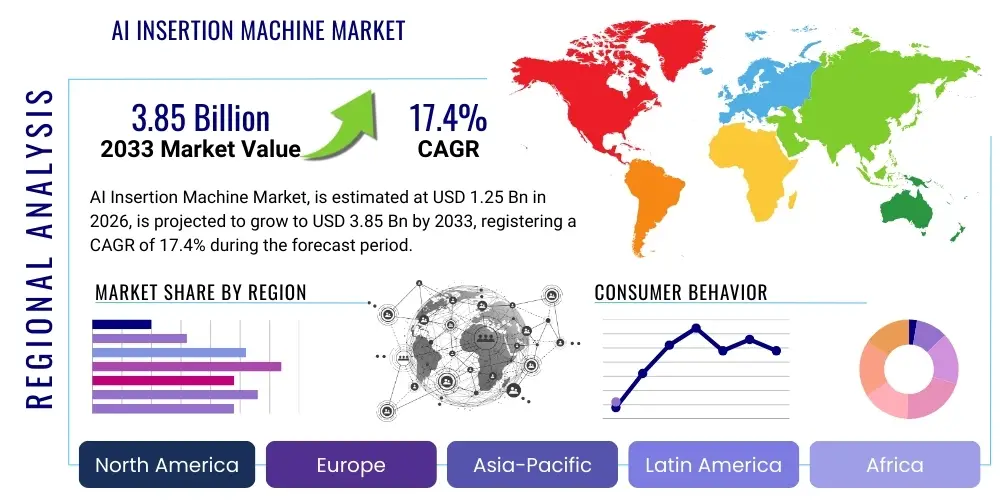

AI Insertion Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437220 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

AI Insertion Machine Market Size

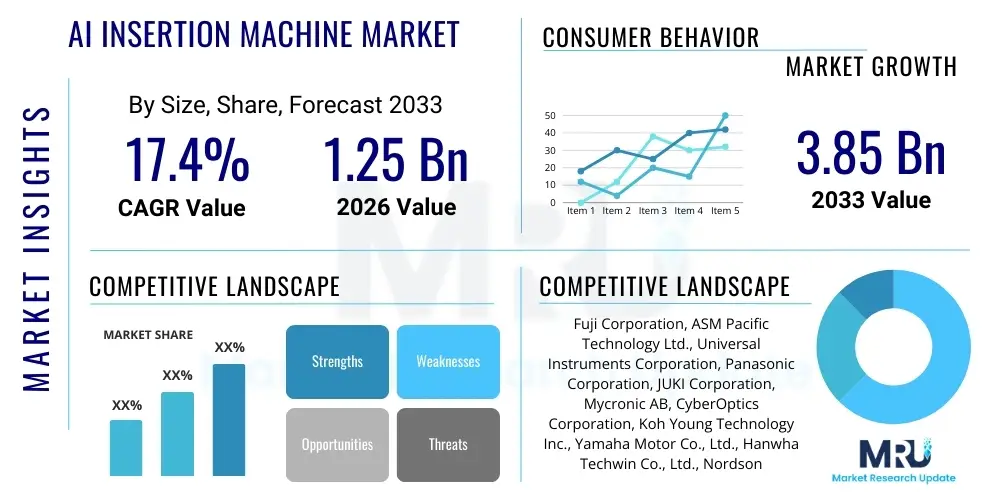

The AI Insertion Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.4% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $3.85 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-density electronic products, increased complexity in printed circuit board (PCB) designs, and the critical requirement for superior manufacturing precision across various high-tech industries. The integration of advanced computational intelligence, machine learning algorithms, and sophisticated robotics is enhancing the operational capability and throughput of these systems, solidifying their essential role in the future of automated assembly lines globally.

AI Insertion Machine Market introduction

The AI Insertion Machine Market encompasses highly sophisticated automated systems designed for the precise placement and insertion of components, primarily electronic parts such such as through-hole components, integrated circuits, or specialized mechanical parts, onto substrates like Printed Circuit Boards (PCBs). Unlike traditional mechanical insertion equipment, these machines utilize Artificial Intelligence (AI), deep learning models, and advanced computer vision systems to optimize insertion paths, perform real-time quality checks, and adapt dynamically to variations in component tolerance and substrate alignment. This technological leap enables superior speed, unparalleled accuracy, and significantly reduced error rates, which are crucial factors in modern, miniaturized electronics manufacturing. The integration of predictive maintenance capabilities, driven by AI, further enhances uptime and operational efficiency, making these machines indispensable assets in high-volume production environments across the world.

The primary applications of AI Insertion Machines are centered around complex manufacturing sectors, notably consumer electronics, automotive electronics (especially EV components and advanced driver-assistance systems—ADAS), medical devices, and industrial automation control systems. These sectors demand flawless assembly and high reliability, making the precision offered by AI-driven insertion critical. Key benefits derived from adopting this technology include enhanced manufacturing throughput, minimization of manual intervention and associated human error, optimized material utilization, and a profound improvement in overall product quality and consistency. The versatility of AI systems allows machines to handle a wider array of component types and adjust quickly to product changeovers, offering manufacturers a flexible and scalable solution for evolving production needs.

The market is predominantly driven by powerful macro-economic and technological factors. The global push towards Industry 4.0 mandates higher levels of automation and smart factory implementation, positioning AI insertion technology as a core enabler. Furthermore, the relentless miniaturization of electronic devices necessitates insertion accuracy beyond human capability, providing a significant impetus for market growth. Other driving factors include the rising cost of skilled labor in developed economies, increasing regulatory requirements for product traceability and quality assurance, and the exponential growth in demand for complex, interconnected IoT devices. The continuous advancement in sensor technology and AI processing power is concurrently making these high-precision systems more accessible and cost-effective for a broader range of manufacturing enterprises.

AI Insertion Machine Market Executive Summary

The AI Insertion Machine Market is characterized by robust business trends focusing on integration, customization, and subscription-based service models. Key business trends show a marked shift among original equipment manufacturers (OEMs) towards offering holistic automation packages that combine insertion machinery with sophisticated data analytics platforms and cloud connectivity. This allows manufacturers to monitor performance remotely, leverage predictive maintenance, and gain actionable insights into production efficiency. Furthermore, strategic alliances between machine vendors and specialized AI software developers are becoming increasingly common, ensuring that the underlying intelligence supporting insertion processes remains cutting-edge and adaptable to future component challenges. The competitive landscape is intensely focused on precision benchmarks, cycle time reduction, and the total cost of ownership (TCO) for end-users, driving innovation in robotic arm dexterity and vision system resolution.

Regional trends indicate that the Asia Pacific (APAC) region currently dominates the market both in terms of consumption and manufacturing capacity, primarily due to the presence of large contract manufacturing hubs and significant investments in electronics production across China, South Korea, Taiwan, and Japan. This dominance is sustained by massive government initiatives promoting advanced manufacturing and the large-scale production of consumer electronics and automotive components. However, North America and Europe are exhibiting strong growth in high-value segments, driven by demand from aerospace, defense, and advanced medical device manufacturing, where stringent quality requirements justify the higher initial investment in highly customized AI-driven solutions. These regions are also leading in the development and deployment of next-generation AI and machine learning algorithms specific to complex assembly tasks, focusing on software differentiation rather than pure volume manufacturing.

Segmentation trends highlight the increasing importance of application-specific machines and the rising adoption of specialized radial insertion machines for densely populated boards. Based on end-use industry, the consumer electronics segment remains the largest consumer, but the automotive electronics segment is witnessing the fastest growth due to the proliferation of electric vehicles (EVs) and autonomous driving technologies, both requiring extremely reliable, high-density PCBs. Technology segmentation reveals a critical trend towards enhanced vision systems, specifically those leveraging deep learning for fault detection and alignment correction, moving beyond simple programmed routines. The market is also seeing greater adoption of flexible, modular insertion solutions that can be easily reconfigured to handle diverse product lines, catering to the trend of low-volume, high-mix manufacturing popularized across Western markets.

AI Impact Analysis on AI Insertion Machine Market

User inquiries regarding the impact of Artificial Intelligence on the AI Insertion Machine Market frequently revolve around four core themes: performance metrics, financial implications, operational integration, and future workforce readiness. Users commonly ask about quantifiable improvements in accuracy and speed compared to conventional insertion methods, seeking validated data on increased yield rates and reduction in rework costs. Financial concerns focus on the Return on Investment (ROI) period for adopting high-cost AI systems, including queries about potential savings derived from reduced waste and lower long-term maintenance needs through predictive analytics. Operational questions concentrate on the complexity of integrating these smart machines into existing Manufacturing Execution Systems (MES) and enterprise resource planning (ERP) platforms, and how AI handles novel components or unexpected manufacturing anomalies. Finally, there is significant interest in how AI capabilities, such as self-optimization and automated troubleshooting, will redefine the roles and skillsets required of factory technicians, prompting concerns about workforce transition and training requirements necessary to manage sophisticated autonomous equipment.

The implementation of AI has fundamentally transformed insertion machine capabilities, moving them from merely programmable automatons to intelligent, self-optimizing assembly tools. AI algorithms are crucial for processing high volumes of data captured by multi-spectral vision systems, allowing for micro-adjustments in real-time that ensure precise component placement even under fluctuating environmental conditions or minor variations in component geometry. This adaptability drastically reduces the rate of placement defects, especially in fine-pitch or densely packed component environments. Furthermore, AI's role extends into sophisticated quality control (QC), where deep learning models are trained to identify subtle defects in solder paste, component integrity, or board traces that might be invisible or overlooked by human inspectors or traditional machine vision rules. This superior performance translates directly into higher first-pass yield and significant long-term cost savings, fundamentally reshaping production economics in high-reliability manufacturing.

- Enhanced Precision and Yield: AI enables sub-micron placement accuracy and reduces defect rates through continuous self-calibration and real-time path optimization.

- Predictive Maintenance Integration: Machine learning models analyze vibration, temperature, and component usage data to forecast failure points, minimizing unplanned downtime and maximizing machine lifespan.

- Adaptive Component Handling: Deep learning algorithms allow machines to recognize and handle a wider variety of component shapes and orientations without extensive reprogramming.

- Optimized Throughput: AI dynamically adjusts insertion speed and force based on component type and substrate material, optimizing cycle time while maintaining quality integrity.

- Automated Quality Inspection: Utilizes computer vision and neural networks for real-time inspection, identifying complex manufacturing flaws far beyond the capabilities of traditional vision systems.

- Simplified Programming and Setup: AI facilitates rapid product changeover by learning optimal insertion parameters from minimal training data or previous production runs, decreasing setup time significantly.

DRO & Impact Forces Of AI Insertion Machine Market

The AI Insertion Machine Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and influence investment decisions. Key drivers propelling the market include the inexorable global demand for electronic miniaturization, especially in sectors like 5G infrastructure, IoT devices, and advanced medical diagnostics, all of which require ultra-high precision assembly capabilities. The competitive pressures within global manufacturing to achieve operational excellence, reduce labor costs, and maintain zero-defect production standards provide a continuous impetus for adopting these advanced machines. Furthermore, the growing sophistication of AI algorithms, coupled with falling costs of high-performance computing hardware (GPUs/TPUs), makes the integration of machine learning into standard factory equipment increasingly feasible and financially attractive, driving mass adoption across various production tiers.

Conversely, the market faces significant restraints that slow down adoption, particularly among Small and Medium-sized Enterprises (SMEs). The primary barrier remains the exceptionally high initial capital investment required for AI insertion machinery, specialized tooling, and associated integration software. This high entry cost often necessitates long depreciation periods and rigorous cost-benefit analysis. A secondary, but critical, restraint is the complexity of implementation and the reliance on highly specialized technical expertise for maintenance, programming, and troubleshooting of complex AI systems. The scarcity of qualified engineers skilled in both robotics and deep learning poses a challenge. Moreover, concerns regarding data security, intellectual property protection, and the standardization of communication protocols between diverse machine types within a smart factory environment also act as friction points, demanding careful consideration from manufacturers and regulators.

Opportunities within the AI Insertion Machine Market are largely concentrated around advancements in software-driven services and expanded application areas. The growing trend of offering AI capabilities through software-as-a-service (SaaS) models, including remote diagnostics, performance tuning, and software updates, presents a sustainable revenue stream and lowers the barrier to entry for smaller firms. Furthermore, the expansion of AI insertion technologies beyond traditional PCB assembly into new areas such as flexible electronics, advanced packaging (e.g., heterogeneous integration), and micro-assembly for specialized optics or photonics components represents substantial untapped market potential. The continuous development of collaborative robots (cobots) equipped with AI insertion capabilities offers a flexible solution that bridges the gap between fully automated and manual assembly, allowing for phased adoption and optimized workspace utilization. These forces collectively define a high-growth but complex market landscape demanding strategic innovation.

Segmentation Analysis

The AI Insertion Machine Market segmentation provides a detailed structural view based on product type, application, and end-use industry, enabling stakeholders to strategically target specific growth areas. The segmentation based on machine type typically differentiates between axial and radial insertion systems, where axial systems handle components oriented lengthwise and radial systems handle components oriented perpendicular to the component body. Application-wise, the market is broadly divided into through-hole technology (THT) assembly, surface-mount technology (SMT) component integration (though limited, AI assists SMT pre-processing), and specialized component insertion. The end-use industry segmentation is critical, highlighting the varying demands from major consumers such as consumer electronics (volume and speed focus), automotive (reliability and durability focus), medical devices (precision and traceability focus), and aerospace/defense (ultra-reliability and specialized component handling). Understanding these segments is key to tailoring product offerings and market entry strategies effectively within the highly competitive automated manufacturing sector.

- By Machine Type:

- Axial Insertion Machines (Taping Components, Capacitors)

- Radial Insertion Machines (Disk Capacitors, Radial Transistors)

- Odd-Form Insertion Machines (Specialized Connectors, Transformers)

- By Application:

- Through-Hole Technology (THT) Assembly

- High-Density PCB Assembly

- Semiconductor Packaging and Module Assembly

- Specialized Component Placement (Optics, Mechanical)

- By End-Use Industry:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive Electronics (ECUs, ADAS Modules, EV Battery Management)

- Industrial Automation and Control Systems

- Healthcare and Medical Devices (Diagnostic Equipment, Implants)

- Aerospace and Defense

- By Technology:

- AI-Powered Vision Systems

- Predictive Maintenance Software

- Deep Learning Optimization Modules

Value Chain Analysis For AI Insertion Machine Market

The Value Chain for the AI Insertion Machine Market starts with the Upstream activities, which involve the sourcing and manufacturing of highly specialized components necessary for machine construction. This includes high-precision mechanical parts (e.g., robotic arms, linear motion systems), advanced sensor technologies (e.g., high-resolution cameras, laser sensors), and crucially, computational hardware like high-performance GPUs, custom ASICs, and specialized memory modules required to run complex AI models in real-time. Suppliers in this phase are often specialized material science and component providers who must adhere to stringent quality and performance specifications, as the ultimate accuracy of the insertion machine is highly dependent on the quality of its foundational hardware components. Maintaining stable supply chains for these sophisticated, often proprietary, components is a significant factor in managing production costs and delivery times for machine manufacturers.

The Midstream phase involves the core activity of machine design, assembly, and integration, executed by the major original equipment manufacturers (OEMs). This is where the proprietary AI algorithms and specialized software are developed, integrated, and calibrated with the physical hardware. OEMs invest heavily in research and development to improve insertion algorithms, vision system resolution, and overall machine reliability. Distribution channels are varied, involving both direct and indirect sales models. Direct sales are typically preferred for large-scale, highly customized, and expensive AI insertion lines sold to Tier 1 electronics manufacturers and large Contract Manufacturing Services (CMS) providers, allowing the OEM to maintain close control over installation, training, and service. Indirect channels, involving regional distributors and system integrators, are often utilized for smaller clients or in niche geographical markets, providing localized support and faster market penetration. System integrators play a vital role by combining the insertion machine with other factory automation equipment (e.g., conveyors, feeders, soldering stations) to create a complete, functioning production line.

Downstream activities focus on the installation, continuous maintenance, and post-sales service, which are particularly critical for high-tech AI machinery. Given the complexity of the systems, service contracts, remote diagnostics, and software updates (often delivered via the cloud) constitute significant revenue streams for OEMs. End-users, the buyers of these machines (e.g., electronics manufacturers, automotive suppliers), rely heavily on the manufacturer’s support to ensure maximum uptime and to continuously optimize the machine's performance as product designs evolve. The efficacy of the downstream service network, particularly the ability to remotely diagnose and fix AI software issues or apply machine learning updates, directly impacts customer satisfaction and repeat business, thus making robust service infrastructure a key competitive differentiator in the AI Insertion Machine Market.

AI Insertion Machine Market Potential Customers

The primary potential customers for AI Insertion Machines are sophisticated manufacturers operating in high-volume, high-reliability, and high-complexity assembly environments. Contract Manufacturing Service (CMS) providers represent the largest buying group globally, as they require flexible, high-speed machines capable of handling a diverse portfolio of products for multiple clients, demanding fast changeover times and exceptional quality control, which AI systems inherently provide. Large Original Equipment Manufacturers (OEMs) in sectors like IT hardware (servers, networking equipment) and consumer electronics (smartphones, gaming consoles) also constitute a major customer base, focusing on maintaining proprietary control over their complex manufacturing processes and achieving extremely high production volumes to meet global consumer demand quickly and efficiently.

Beyond the core electronics assembly sector, the automotive electronics industry is rapidly emerging as a high-growth customer segment. The shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) mandates the production of highly durable, densely populated PCBs and sensor modules where insertion accuracy is non-negotiable for safety-critical applications. Tier 1 automotive suppliers are investing heavily in AI insertion technology to meet the rigorous standards and traceability requirements of the industry. Additionally, specialized manufacturers in the medical device sector (e.g., implantable devices, diagnostic imaging systems) represent premium customers, where the AI’s precision and documentation capabilities are valued above cost, as slight placement errors can have critical consequences. These customers prioritize machines offering advanced data logging, process validation, and capability for handling extremely small or delicate components with utmost care and repeatability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $3.85 Billion |

| Growth Rate | 17.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuji Corporation, ASM Pacific Technology Ltd., Universal Instruments Corporation, Panasonic Corporation, JUKI Corporation, Mycronic AB, CyberOptics Corporation, Koh Young Technology Inc., Yamaha Motor Co., Ltd., Hanwha Techwin Co., Ltd., Nordson Corporation, Viscom AG, SMT Schober GmbH, Heller Industries, KUKA AG, ABB Ltd., FANUC Corporation, Component Express Inc., Shenzhen NeoDen Technology Co., Ltd., Europlacer. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AI Insertion Machine Market Key Technology Landscape

The technology landscape of the AI Insertion Machine Market is dominated by sophisticated integration between precision mechanics, advanced computer vision, and machine learning methodologies. Central to these systems are high-speed, multi-axis robotic arms and specialized insertion heads, often equipped with force sensing capabilities to manage delicate components. These mechanical systems are governed by highly optimized motion control software, but their real intelligence derives from the vision systems. State-of-the-art AI Insertion Machines utilize ultra-high-resolution 3D vision systems, often leveraging structured light or laser scanning alongside traditional 2D imaging, to create precise topographical maps of the PCB and the component leads. Deep Learning algorithms, such as Convolutional Neural Networks (CNNs), are then employed to instantaneously analyze these images for accurate component recognition, lead alignment, defect identification, and real-time calculation of optimal insertion vectors, significantly surpassing the speed and reliability of older rule-based vision systems.

Another crucial technological element is the deployment of predictive maintenance and self-optimization frameworks. These systems utilize embedded sensors (vibration, temperature, current draw) and operational data collected during thousands of insertion cycles to train machine learning models. These models are designed to detect subtle anomalies that signal impending mechanical failure or performance drift well before a critical breakdown occurs. By shifting maintenance from a reactive to a proactive state, manufacturers can dramatically increase machine uptime and efficiency, leading to significant reductions in operational expenditure and consistent production quality. The communication backbone, relying on industrial IoT standards and secure cloud computing platforms, facilitates this continuous data exchange, allowing OEMs to provide advanced remote diagnostics and performance tuning, essentially creating a 'living' machine that improves its efficiency and precision over time based on collective operational experience.

Regional Highlights

The global distribution of the AI Insertion Machine Market is heavily skewed towards regions with dominant electronics manufacturing capabilities, sophisticated R&D infrastructures, and high manufacturing automation rates. Asia Pacific (APAC) holds the commanding market share, primarily driven by massive electronics production volumes in countries such as China, Taiwan, South Korea, and Vietnam. This region is characterized by aggressive adoption of advanced automation to maintain global cost competitiveness while grappling with rising domestic labor costs. Government support, coupled with the presence of major EMS providers and consumer electronics OEMs, ensures APAC remains the epicenter of both demand and production innovation for AI insertion machinery. The rapid expansion of automotive and industrial electronics manufacturing within the region further solidifies its leading position in both market size and annual growth rate.

- Asia Pacific (APAC): Dominates the global market due to high-volume manufacturing hubs (China, South Korea) and massive investments in electronics, 5G infrastructure, and electric vehicle production. Key focus on scalability and operational throughput.

- North America: Characterized by high-value, low-volume manufacturing in defense, aerospace, and medical devices. Strong focus on R&D, specialized component handling, and integration of cutting-edge AI vision systems for critical applications.

- Europe: Exhibits robust growth driven by high-reliability manufacturing, particularly in automotive (Germany, Italy) and industrial automation. Emphasis on precision engineering, standardized quality control, and sustainable manufacturing practices, leading to steady uptake of advanced AI insertion systems.

- Latin America & Middle East/Africa (MEA): Emerging markets showing gradual adoption, primarily focused on automotive assembly (Mexico, Brazil) and basic consumer electronics manufacturing. Adoption rates are constrained by high upfront investment costs and limited local technical expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AI Insertion Machine Market.- Fuji Corporation

- ASM Pacific Technology Ltd.

- Universal Instruments Corporation

- Panasonic Corporation

- JUKI Corporation

- Mycronic AB

- CyberOptics Corporation

- Koh Young Technology Inc.

- Yamaha Motor Co., Ltd.

- Hanwha Techwin Co., Ltd.

- Nordson Corporation

- Viscom AG

- SMT Schober GmbH

- Heller Industries

- KUKA AG

- ABB Ltd.

- FANUC Corporation

- Component Express Inc.

- Shenzhen NeoDen Technology Co., Ltd.

- Europlacer

Frequently Asked Questions

Analyze common user questions about the AI Insertion Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the AI Insertion Machine Market?

The AI Insertion Machine Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 17.4% during the forecast period from 2026 to 2033, driven primarily by accelerating demands for electronic miniaturization and advanced factory automation (Industry 4.0).

How does AI technology enhance the precision of component insertion compared to traditional machines?

AI, leveraging deep learning and high-resolution computer vision systems, enables real-time dynamic path correction and alignment adjustments, allowing machines to achieve sub-micron placement accuracy and reliably handle component tolerance variations, thus minimizing insertion defects significantly.

Which end-use industry is driving the fastest adoption of AI Insertion Machinery?

The automotive electronics segment is currently experiencing the fastest growth in adopting AI Insertion Machinery, largely due to the rigorous quality and reliability requirements for components used in electric vehicles (EVs) and sophisticated Advanced Driver-Assistance Systems (ADAS).

What are the main obstacles hindering the widespread adoption of these high-tech machines?

The primary constraints include the exceptionally high initial capital investment required for procurement and integration, coupled with the reliance on specialized engineering expertise for maintenance and programming of the complex AI and robotic systems.

Which region currently holds the largest market share for AI Insertion Machines?

The Asia Pacific (APAC) region maintains the largest market share, driven by its concentration of high-volume electronics manufacturing hubs and continuous governmental investment into advanced manufacturing capabilities across countries like China, South Korea, and Taiwan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager