Air and Water Pollution Control Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431597 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Air and Water Pollution Control Equipment Market Size

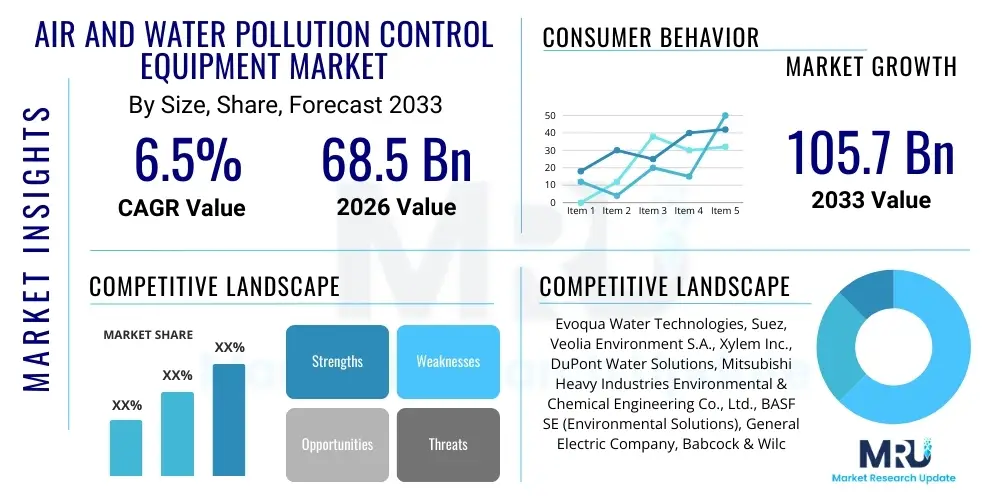

The Air and Water Pollution Control Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 68.5 Billion in 2026 and is projected to reach USD 105.7 Billion by the end of the forecast period in 2033.

Air and Water Pollution Control Equipment Market introduction

The Air and Water Pollution Control Equipment Market encompasses a broad range of technologies and systems designed to mitigate the release of harmful contaminants into the atmosphere and aquatic environments. This equipment is critical for compliance with increasingly stringent global environmental regulations, driving demand across diverse industrial sectors. Products range from advanced air filtration systems, scrubbers, electrostatic precipitators, and catalytic converters for air purification, to complex wastewater treatment plants, sludge management systems, reverse osmosis units, and advanced oxidation processes for water decontamination. The primary objective is to protect public health and ecological integrity by ensuring industrial discharges meet mandated quality standards before release.

Major applications of this equipment span heavy industries such, power generation (especially coal-fired plants), chemical manufacturing, oil and gas, metallurgy, cement production, and municipal services (water supply and wastewater treatment). The inherent benefits include enhanced operational sustainability, reduced regulatory fines, improved public relations, conservation of natural resources, and the recovery of valuable byproducts or reusable water. Key driving factors accelerating market expansion include rapid industrialization in developing economies, growing public awareness regarding environmental degradation, and continuous technological innovation focusing on energy efficiency and higher pollutant removal effectiveness. Furthermore, global initiatives aimed at addressing climate change and water scarcity mandates significant investment in these foundational environmental technologies, solidifying the market's long-term growth trajectory.

Air and Water Pollution Control Equipment Market Executive Summary

The Air and Water Pollution Control Equipment Market is experiencing robust growth fueled by converging macro-environmental trends and mandatory legislative frameworks. Business trends indicate a strong shift towards integrated environmental solutions, where suppliers offer comprehensive service packages encompassing equipment installation, maintenance, and compliance monitoring. Furthermore, consolidation among key players is observed, driven by the necessity to acquire specialized technologies, particularly in areas like digital water management and advanced air quality sensors. Investment in R&D is heavily concentrated on developing modular, scalable, and energy-efficient systems that can handle complex multi-pollutant streams, catering to the burgeoning needs of the circular economy where resource recovery is prioritized alongside pollution abatement.

Regionally, Asia Pacific continues to lead in market demand, primarily due to accelerated industrial expansion and the subsequent governmental implementation of strict environmental protection policies in countries like China and India. North America and Europe, characterized by established regulatory regimes and mature infrastructure, drive innovation, focusing on upgrading existing equipment with smart technologies and addressing emerging contaminants, such as microplastics and PFAS. Segment trends reveal the wastewater treatment equipment segment dominates in terms of market share, propelled by global urbanization and increased municipal demand. Conversely, the air pollution control market is seeing specialized growth in flue gas desulfurization (FGD) and Selective Catalytic Reduction (SCR) systems due to stringent regulations targeting sulfur and nitrogen oxide emissions from power generation facilities.

AI Impact Analysis on Air and Water Pollution Control Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the pollution control sector generally focus on three major themes: predictive maintenance efficiency, real-time optimization of treatment processes, and enhanced regulatory compliance through advanced data analytics. Users are keen to understand how AI can minimize operational downtime associated with equipment failure (a significant concern for industrial users), how machine learning algorithms can dynamically adjust chemical dosages or aeration rates to save energy while maintaining output quality, and how AI can provide highly accurate, continuous reporting needed to satisfy strict regulatory bodies. The underlying expectation is that AI will transform pollution control from a reactive, fixed-process operation into a highly proactive, intelligent, and cost-efficient system that maximizes pollutant removal efficiency with minimal human intervention.

The implementation of AI algorithms, particularly deep learning and predictive modeling, is revolutionizing the efficiency and effectiveness of pollution control equipment. For water treatment, AI enables smart dosing, reducing chemical consumption and sludge production while ensuring treated water quality consistency despite fluctuating inflow conditions. In air pollution control, AI-driven sensor networks monitor emissions in real-time, predicting operational drift and optimizing combustion processes in power plants or incinerators to ensure continuous compliance with strict stack emission limits. This shift from traditional control systems to smart, self-optimizing platforms represents a significant technological leap, improving uptime and reducing the Total Cost of Ownership (TCO) for end-users, thereby serving as a major facilitator of market growth and efficiency gains in managing complex environmental challenges across all industrial and municipal applications.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting equipment failure (e.g., pump cavitation, filter clogging) based on real-time operational data.

- Real-Time Process Optimization: Uses machine learning to dynamically adjust treatment parameters (e.g., aeration, chemical injection) for maximum pollutant removal efficiency and minimum energy usage.

- Enhanced Data Integrity and Reporting: Provides automated, auditable compliance reports, simplifying interaction with environmental regulatory agencies.

- Intelligent Leak Detection: Utilizes sensor fusion and AI modeling to quickly identify and localize leaks in extensive piping and distribution networks, significantly reducing water loss.

- Optimization of Chemical Consumption: Algorithms calculate precise chemical requirements, leading to substantial cost savings and reduced environmental impact from over-dosing.

- Autonomous System Calibration: Enables self-tuning and calibration of complex systems like SCR or specialized membrane bioreactors (MBRs) to adapt to varying pollution loads.

DRO & Impact Forces Of Air and Water Pollution Control Equipment Market

The Air and Water Pollution Control Equipment Market is fundamentally shaped by powerful regulatory drivers, offset by substantial capital expenditure requirements, yet underpinned by vast untapped opportunities in digitalization and emerging contaminant remediation. The primary driver remains the global escalation of environmental protection laws, such as the US Clean Air Act, the EU Industrial Emissions Directive (IED), and China's "Blue Sky" policies, which necessitate continuous investment in upgrading and replacing outdated equipment. Restraints largely revolve around the high initial investment (CAPEX) required for large-scale installations, particularly in developing nations, coupled with the complexity and operational expenditure (OPEX) associated with maintaining sophisticated pollution abatement technologies. Opportunities are highly concentrated in the industrial internet of things (IIoT), smart environmental monitoring, and the growing focus on decentralized and modular treatment solutions that cater to remote or smaller-scale industrial operations, promising efficiency gains and improved accessibility.

Key drivers include the pervasive issue of global water scarcity and the increasing incidence of air quality crises in urban centers, forcing governments to allocate substantial budgets toward infrastructure development and environmental technology procurement. Furthermore, corporate sustainability mandates (ESG - Environmental, Social, and Governance criteria) are increasingly compelling private companies, even those not strictly regulated, to adopt best-in-class pollution control technologies to enhance brand reputation and secure investment capital. The impact forces are further amplified by consumer activism and non-governmental organizations (NGOs) that pressure industries and municipalities for greater accountability regarding their environmental footprint, thus creating a moral and economic imperative for advanced pollution control deployment.

However, market growth is sometimes hindered by the long operational lifecycles of existing infrastructure, delaying replacement cycles, and the shortage of highly skilled technical personnel capable of operating and maintaining advanced control systems, particularly in highly specialized fields like wastewater reuse or hazardous air pollutant removal. The market's resilience and future expansion potential lie in exploiting opportunities related to the treatment of recalcitrant pollutants (e.g., pharmaceuticals, heavy metals) and focusing on solutions that enable industrial water recycling and zero liquid discharge (ZLD) systems, transforming waste streams from liabilities into valuable resources, thereby providing a clear return on investment beyond simple regulatory compliance.

Segmentation Analysis

The Air and Water Pollution Control Equipment Market is comprehensively segmented across several dimensions, primarily focusing on the Type of Equipment, the Application Sector (End-Use Industry), and the geographical region. Equipment types are broadly divided into air control systems (e.g., scrubbers, precipitators) and water treatment systems (e.g., filtration, disinfection, membrane separation). This segmentation is crucial as the technical requirements, capital costs, and regulatory compliance standards vary significantly between air and water applications, requiring specialized manufacturers for each domain.

Application segmentation reveals the dominance of the industrial sector, including power generation, chemicals, and manufacturing, which are the largest consumers due to the volume and complexity of their emissions and effluents. Municipal applications, covering public water supply and sewage treatment, form the second significant segment, characterized by high volume but lower complexity requirements compared to industrial waste streams. Analyzing these segments helps stakeholders understand where regulatory pressures and investment flows are most concentrated, guiding product development and market entry strategies for specialized equipment providers.

The future trajectory of market segmentation points towards greater granularity based on the specific pollutant treated (e.g., NOx control, particulate matter reduction, tertiary water treatment for microplastics). This detailed segmentation reflects the move towards highly targeted, effective, and environmentally responsive solutions mandated by modern environmental standards, moving beyond generic treatments to specific abatement strategies tailored to chemical composition and environmental sensitivity.

- By Equipment Type (Air Pollution Control):

- Scrubbers (Wet and Dry)

- Electrostatic Precipitators (ESPs)

- Fabric Filters/Baghouse Filters

- Catalytic Converters (SCR, SNCR)

- Thermal Oxidizers

- Adsorbers (Activated Carbon)

- By Equipment Type (Water Pollution Control):

- Filtration Systems (Sand, Activated Carbon, Multimedia)

- Sedimentation and Clarification Equipment

- Disinfection Equipment (UV, Ozonation, Chlorination)

- Membrane Separation Systems (RO, UF, NF, MBR)

- Sludge Treatment Equipment

- Aeration and Biological Treatment Systems

- By Application/End-Use:

- Power Generation (Coal, Gas)

- Chemical and Petrochemical Industry

- Metal and Mining Industry

- Cement and Construction Industry

- Municipal Water and Wastewater Treatment

- Pulp and Paper Industry

- Food and Beverage Industry

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (GCC Countries, South Africa)

Value Chain Analysis For Air and Water Pollution Control Equipment Market

The value chain for the Air and Water Pollution Control Equipment Market is extensive and complex, starting with the upstream supply of raw materials and specialized components, extending through manufacturing, installation, and culminating in crucial downstream maintenance and operational services. Upstream analysis reveals reliance on materials such as specialized polymers for membranes, high-grade metals for structural components (scrubbers, tanks), and various chemical inputs for treatment processes. Disruptions or price volatility in critical input markets, such as rare earth metals used in catalysts or the supply of essential filtration media, can significantly impact manufacturing costs and lead times. Suppliers specializing in high-performance materials that offer longevity, resistance to corrosive environments, and improved efficiency gain a competitive advantage in this capital-intensive sector.

The core manufacturing and assembly stage involves integrating complex technological components, requiring significant expertise in engineering and process design. Distribution channels are typically dual: direct and indirect. Direct sales are common for large, bespoke industrial projects (e.g., utility-scale FGD systems or large municipal wastewater plants), where direct negotiations, detailed customization, and long-term service agreements are mandatory. Indirect distribution utilizes specialized engineering procurement and construction (EPC) firms, system integrators, and local distributors, which are crucial for accessing smaller industrial customers or standardized product sales in geographically diverse regions, offering local support and faster deployment capabilities.

Downstream activities, encompassing commissioning, optimization, and long-term service contracts, constitute a substantial and high-margin component of the value chain. As equipment becomes increasingly digitized, the provision of predictive maintenance services, remote monitoring, and performance guarantee contracts ensures recurring revenue streams for manufacturers and service providers. Moreover, the disposal or recycling of used components, such as spent activated carbon or membrane filters, is a growing segment of the downstream market, emphasizing the evolving focus on cradle-to-grave responsibility and circular economy practices within the pollution control industry, necessitating strong collaborations with waste management specialists.

Air and Water Pollution Control Equipment Market Potential Customers

The potential customer base for Air and Water Pollution Control Equipment is highly diversified, spanning governmental bodies, large private corporations, and specialized service providers, all united by the need to manage environmental discharge responsibly and adhere to legal mandates. The largest segment of end-users are heavy industrial complexes, including power plants (both coal and natural gas), which require massive installations for controlling flue gas emissions (SOx, NOx, Particulate Matter). Similarly, the chemical and petrochemical industries are critical buyers, needing advanced water treatment to handle complex effluent containing hazardous compounds, demanding robust primary, secondary, and tertiary treatment capabilities.

Municipalities represent another foundational customer group, acting as the primary buyers for centralized public water and wastewater treatment infrastructure. Their procurement decisions are often driven by population growth, aging infrastructure replacement cycles, and stricter standards for potable water quality and effluent discharge into natural waterways. These customers prioritize reliability, operational longevity, and lifecycle cost optimization, often engaging in long-term public-private partnerships (PPPs) for system management and upgrade financing. The increasing global trend towards smart cities and sustainable infrastructure spending guarantees continuous demand from this sector, particularly for resilient and digitally-enabled treatment solutions.

Furthermore, specialized industries such as food and beverage, pharmaceuticals, and microelectronics also constitute vital niche markets. While their overall volume of pollution might be lower than heavy industry, the specificity and sensitivity of their waste streams demand highly specialized, often bespoke, pollution control technologies—such as ultra-filtration for high-purity water in semiconductor manufacturing or specific biological treatment processes for organic waste in the food sector. These sectors are characterized by extremely low tolerance for operational failure and high compliance requirements, making them willing to invest in premium equipment and comprehensive service contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 68.5 Billion |

| Market Forecast in 2033 | USD 105.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies, Suez, Veolia Environment S.A., Xylem Inc., DuPont Water Solutions, Mitsubishi Heavy Industries Environmental & Chemical Engineering Co., Ltd., BASF SE (Environmental Solutions), General Electric Company, Babcock & Wilcox Enterprises, Inc., Doosan Lentjes GmbH, Thermax Limited, John Cockerill, Donaldson Company, Inc., Lenntech B.V., Metso Outotec, Calgon Carbon Corporation, A. O. Smith Corporation, Krones AG, Pall Corporation, Tarmac International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air and Water Pollution Control Equipment Market Key Technology Landscape

The technological landscape of the Air and Water Pollution Control Equipment market is characterized by a rapid evolution toward higher efficiency, greater sustainability, and deep digitalization. In air pollution control, the primary technological focus is on optimizing flue gas treatment through advanced combinations of Selective Catalytic Reduction (SCR) and Flue Gas Desulfurization (FGD) systems to meet increasingly aggressive limits on NOx and SOx, respectively. Emerging technologies include pulsed-jet baghouses for enhanced particulate matter control and advanced oxidation processes (AOPs) utilizing ozone or UV light to destroy volatile organic compounds (VOCs) that traditional systems struggle to handle. Furthermore, the integration of sensor technology and IoT platforms allows for continuous emission monitoring systems (CEMS), providing real-time data crucial for dynamic compliance management and predictive operational tuning.

For water pollution control, membrane technologies remain a significant area of innovation. Reverse Osmosis (RO) and Ultrafiltration (UF) systems are becoming more robust, less energy-intensive, and more resistant to fouling, making advanced wastewater reuse and desalination economically viable. The development of Membrane Bioreactors (MBRs) combines biological treatment with membrane separation, offering superior effluent quality and a smaller footprint compared to conventional activated sludge processes. A pivotal technological push is directed towards Zero Liquid Discharge (ZLD) systems, which aim to recycle 100% of industrial wastewater, dramatically reducing environmental impact and water consumption, crucial for water-stressed regions and highly regulated industries.

Digitalization forms the overarching technological trend across both air and water sectors. The adoption of digital twins—virtual replicas of physical treatment plants—allows operators to simulate various scenarios, test process changes, and train personnel without impacting the live system. This not only enhances performance but also significantly reduces the risk associated with complex operations. Furthermore, sophisticated software is being developed to manage sludge and residual waste, converting these byproducts into energy or marketable resources, thereby closing the loop on waste and driving profitability within the pollution control ecosystem, positioning technology as a key differentiator in a compliance-driven market.

Regional Highlights

Regional dynamics are highly heterogeneous, reflecting varying stages of industrial development, regulatory maturity, and environmental priorities. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily driven by massive infrastructure spending, rapid urbanization, and the implementation of aggressive national environmental cleanup programs, particularly in China and India. The sheer scale of manufacturing and power generation capacity expansion in APAC necessitates continuous deployment of both air and water treatment facilities. Investment is focused heavily on fundamental infrastructure, such as establishing large-scale municipal wastewater treatment plants and retrofitting existing coal-fired power plants with modern scrubbers and filters to combat severe air quality issues.

North America and Europe represent mature markets characterized by replacement demand, strict regulatory enforcement, and a strong focus on advanced, specialized treatment solutions. In these regions, growth is less about volume and more about value, concentrating on technological upgrades (e.g., smart grid integration for power plant emission control, addressing microplastics in water treatment, and reducing energy consumption in existing facilities). European directives, such as the Water Framework Directive and the Industrial Emissions Directive, mandate continuous process improvement, ensuring sustained demand for high-efficiency membranes, advanced oxidation technologies, and continuous monitoring systems (CEMS) that integrate seamlessly with digital platforms.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting high potential, albeit with greater volatility. In MEA, especially the GCC nations, investments are heavily tilted toward water solutions, driven by severe water scarcity and the need for desalination and advanced industrial wastewater reuse for oil and gas operations. Latin American markets are driven by patchy, but intensifying, environmental legislation and growing municipal demand resulting from rapid urbanization, although funding stability can be a restraint. These regions prioritize modular and scalable solutions that can be deployed quickly to meet immediate environmental challenges associated with rapid industrial expansion and population density shifts.

- Asia Pacific (APAC): Dominates market share and growth rate; driven by stringent government mandates in China and India targeting severe air and water pollution from coal power and heavy manufacturing. Significant investment in municipal wastewater infrastructure.

- North America: Mature market focused on technological upgrades, particularly in smart water infrastructure and advanced emission controls for oil and gas and power sectors; strong emphasis on remediation of emerging contaminants.

- Europe: Characterized by highly stringent regulations (IED, WFD); high demand for energy-efficient equipment, ZLD solutions, and smart monitoring systems; strong corporate ESG adherence drives private sector investment.

- Middle East & Africa (MEA): High growth potential concentrated in water treatment, desalination, and water reuse technologies due to extreme water stress; driven by large-scale oil and gas sector needs and governmental sustainable development goals.

- Latin America: Emerging market with increasing regulatory pressure; demand focused on basic municipal water infrastructure upgrades and industrial compliance across mining and primary processing industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air and Water Pollution Control Equipment Market.- Veolia Environment S.A.

- Suez S.A.

- Xylem Inc.

- Evoqua Water Technologies Corp.

- DuPont Water Solutions

- Mitsubishi Heavy Industries Environmental & Chemical Engineering Co., Ltd.

- General Electric Company

- Babcock & Wilcox Enterprises, Inc.

- Doosan Lentjes GmbH

- Thermax Limited

- John Cockerill

- Metso Outotec

- Donaldson Company, Inc.

- Lenntech B.V.

- BASF SE (Environmental Solutions)

- Calgon Carbon Corporation

- A. O. Smith Corporation

- Krones AG

- Pall Corporation (a Danaher Company)

- Tarmac International, Inc.

Frequently Asked Questions

Analyze common user questions about the Air and Water Pollution Control Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary regulations are driving the demand for air pollution control equipment globally?

The primary global drivers include the US Clean Air Act, the European Union's Industrial Emissions Directive (IED), and major national policies such as China's Blue Sky Protection Campaign. These regulations enforce stringent limits on key pollutants like sulfur dioxide (SOx), nitrogen oxides (NOx), particulate matter (PM), and volatile organic compounds (VOCs), compelling industries to invest in technologies like SCR, FGD, and advanced fabric filters.

How is the concept of Zero Liquid Discharge (ZLD) influencing the water pollution control equipment sector?

ZLD systems are transforming the industrial wastewater market by requiring technologies that enable 100% wastewater recycling, eliminating discharge entirely. This necessitates sophisticated membrane separation (RO, NF), crystallizers, and evaporators. ZLD is increasingly mandated in water-stressed regions and for highly polluting industries, driving significant R&D investment and market growth in advanced thermal and non-thermal separation equipment.

What is the projected impact of AI and IIoT on the operation of pollution control infrastructure?

AI and the Industrial Internet of Things (IIoT) are expected to significantly enhance operational efficiency by enabling predictive maintenance, minimizing unplanned downtime, and optimizing chemical dosing and energy consumption in real-time. This digital integration reduces OPEX and improves regulatory compliance by providing continuous, data-driven performance verification, moving systems toward autonomous operation.

Which geographical region holds the highest market potential for new equipment installations?

Asia Pacific (APAC), particularly Southeast Asia, China, and India, holds the highest potential for new equipment installations due to ongoing rapid industrialization, massive urban development, and recent, aggressive government enforcement of environmental protection laws that require new facilities and the retrofitting of thousands of existing industrial units.

What are the greatest technological challenges facing the air and water pollution control industry today?

Key technological challenges include effectively treating emerging contaminants in water (e.g., microplastics, pharmaceuticals, and PFAS compounds) which traditional processes fail to remove, and developing highly energy-efficient, small-footprint solutions for decentralized or modular pollution control systems, especially for smaller industrial generators and remote municipalities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager