Air Cargo Containers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432362 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Air Cargo Containers Market Size

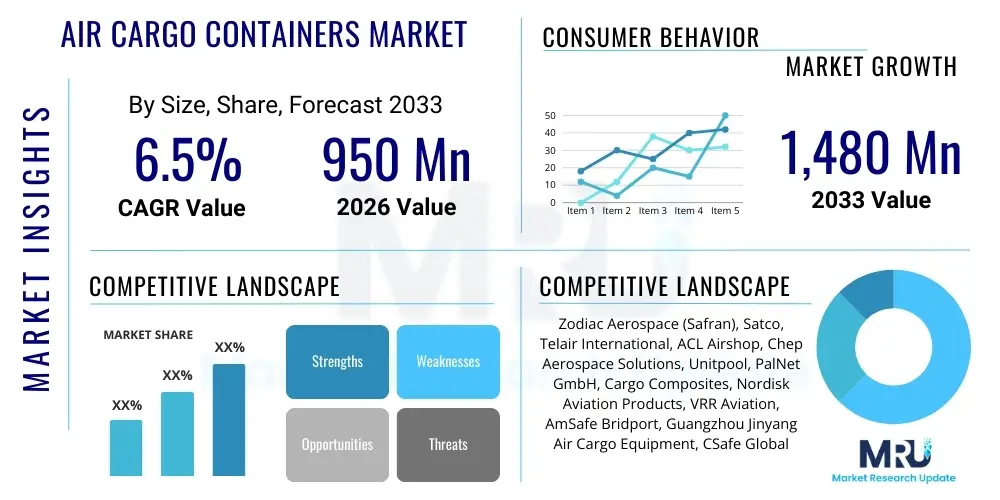

The Air Cargo Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,480 million by the end of the forecast period in 2033.

Air Cargo Containers Market introduction

The Air Cargo Containers Market encompasses the manufacturing, leasing, and maintenance of Unit Load Devices (ULDs) utilized for the efficient and safe transportation of freight within the cargo holds of commercial and dedicated freighter aircraft. ULDs, which include pallets and containers of standardized sizes and specifications (such as AKE, LD3, and LD8), are crucial components of the global logistics and supply chain ecosystem. These specialized units facilitate rapid loading and unloading operations, maximize volumetric efficiency inside the aircraft, and provide essential protection to sensitive or high-value shipments from damage, theft, and environmental factors during transit and ground handling.

The core product offering in this market involves devices constructed primarily from lightweight aluminum alloys and durable composite materials, emphasizing strength-to-weight ratio to minimize fuel consumption while meeting strict regulatory requirements imposed by aviation bodies like IATA and the FAA. Major applications of air cargo containers span general freight, temperature-sensitive pharmaceuticals (cold chain logistics), high-tech electronics, perishables, and specialized cargo such as live animals or oversized industrial equipment. The ongoing expansion of global e-commerce, coupled with increasing demand for rapid cross-border movement of time-critical goods, serves as a primary driver propelling market expansion and technological innovation within the ULD manufacturing sector.

Benefits derived from the effective use of ULDs include enhanced security due to standardized locking mechanisms, optimized cargo density resulting in lower operational costs per flight, and significant improvements in ground handling efficiency, reducing aircraft turnaround times. Furthermore, the market is characterized by a growing focus on sustainability, leading to the adoption of lighter materials and smart ULD technologies that incorporate tracking and monitoring capabilities. These innovations address key industry challenges related to asset visibility, loss prevention, and ensuring cargo integrity throughout the entire air transport journey, positioning air cargo containers as indispensable assets in modern aviation logistics.

Air Cargo Containers Market Executive Summary

The Air Cargo Containers Market is poised for substantial growth driven by robust macroeconomic trends, particularly the continued globalization of trade and the explosive expansion of e-commerce platforms requiring rapid fulfillment. Business trends indicate a significant shift towards leasing models rather than outright purchasing, driven by airlines and freight forwarders seeking greater financial flexibility, reduced capital expenditure, and simplified maintenance logistics. Furthermore, manufacturers are increasingly integrating advanced IoT and telematics solutions into ULDs, transforming them from simple physical assets into 'smart containers' that provide real-time data on location, temperature, humidity, and shock events, thereby enhancing transparency and accountability across the cold chain and general cargo segments.

Regionally, the Asia Pacific market is dominating growth momentum, fueled by the establishment of major manufacturing hubs, expanding intra-Asia trade, and the rapid urbanization increasing consumer demand for imported goods. North America and Europe remain mature markets characterized by stringent regulatory standards and high demand for specialized containers, particularly those catering to pharmaceuticals and high-tech industries. The Middle East, serving as a critical global transshipment hub, is also experiencing intensified investment in ULD fleet expansion and modernization to support rapidly growing carrier capacities and logistical efficiency demands across east-west trade routes.

Segment trends reveal that the specialty ULD category, including temperature-controlled and insulated containers, is exhibiting the highest growth rate, necessitated by the stringent requirements of the global pharmaceutical supply chain and vaccine distribution networks. In terms of material, composite materials are gaining increasing traction over traditional aluminum due to their superior durability, reduced weight, and lower maintenance costs, aligning with industry goals of maximizing payload and improving fuel efficiency. This strategic shift towards specialized and lightweight solutions underscores the market's trajectory towards performance optimization and adherence to increasingly complex industry logistics standards.

AI Impact Analysis on Air Cargo Containers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Air Cargo Containers Market frequently center around three main themes: optimization of ULD utilization and positioning, predictive maintenance scheduling to minimize asset downtime, and enhancing supply chain security and integrity through advanced data analysis. Stakeholders, including airlines and leasing companies, are keenly interested in how machine learning algorithms can analyze vast datasets—including flight schedules, weather patterns, historical demand, and container movements—to predict future ULD requirements more accurately, thereby reducing the chronic issue of container imbalance and costly repositioning. There is a strong expectation that AI will move beyond simple tracking to offer prescriptive insights for operations.

The deployment of AI is significantly transforming the maintenance, repair, and overhaul (MRO) sector associated with air cargo containers. Traditional maintenance relies on fixed schedules or reactive reporting of damage. AI systems, coupled with sensors embedded in smart ULDs, enable predictive maintenance by analyzing usage patterns, load stress, and component degradation indicators. This capability allows operators to schedule repairs precisely when needed, extending the lifespan of assets, reducing unexpected failures, and ensuring a higher percentage of the fleet is airworthy at any given time. This shift from reactive to proactive asset management is crucial for maintaining operational efficiency in high-volume cargo environments.

Furthermore, AI plays a pivotal role in optimizing the physical loading and stowage process of containers onto aircraft. Advanced algorithms can calculate the optimal placement and stacking of ULDs based on factors such as weight distribution (critical for flight safety), route scheduling, and priority cargo requirements. This not only maximizes payload efficiency but also ensures compliance with complex airworthiness directives. The integration of AI-powered vision systems in ground handling environments is also expected to improve damage detection upon arrival and departure, leading to faster claims processing and better accountability for asset handling throughout the logistics chain.

- AI-driven Predictive Analytics: Optimizing ULD inventory levels and repositioning based on anticipated demand surges and historical movement data, significantly reducing demurrage and minimizing fleet imbalance costs.

- Automated Damage Assessment: Utilizing machine vision and machine learning models for rapid, automated structural integrity checks during turnaround, ensuring compliance and speeding up inspection processes.

- Smart Load Planning: Employing optimization algorithms to calculate precise ULD placement within aircraft holds, maximizing volumetric efficiency while strictly adhering to center-of-gravity and load distribution safety parameters.

- Enhanced Cold Chain Monitoring: AI analyzing temperature fluctuation data from sensors within refrigerated ULDs to predict potential failure points or temperature excursions before they compromise sensitive cargo like pharmaceuticals.

- Demand Forecasting for Manufacturing: Using AI to predict future ULD type requirements (e.g., standard vs. specialty) based on evolving global trade routes and emerging industry logistics needs, guiding manufacturers' production schedules.

DRO & Impact Forces Of Air Cargo Containers Market

The dynamics of the Air Cargo Containers Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers center around the inexorable rise of global e-commerce and the associated requirement for expedited shipping, which necessitates reliable and efficient ULD utilization. This is strongly supported by the increasing professionalization and standardization requirements of specialized logistics, particularly the cold chain for temperature-sensitive products such as biologicals and vaccines, which mandates certified, high-performance containers. Continuous innovation in material science, focusing on reducing ULD weight while maintaining structural integrity, further drives market growth by directly addressing airline fuel efficiency and sustainability goals.

However, the market faces significant restraints, primarily stemming from the high initial cost associated with specialized and smart ULDs, which can deter smaller airlines or freight forwarders from adopting the latest technology. The perpetual challenge of ULD imbalance and loss—where containers end up in locations without immediate backhaul demand, leading to costly retrieval or replacement—remains a major operational bottleneck. Furthermore, the stringent regulatory environment governing ULD maintenance, certification, and traceability, while ensuring safety, adds complexity and overhead costs, potentially slowing down the rapid adoption of non-standardized innovative solutions.

Opportunities abound, particularly in the growth of leasing models, which provide flexible access to high-quality ULDs without the need for heavy capital investment, thus expanding market reach. The burgeoning adoption of Internet of Things (IoT) technologies and telematics offers substantial opportunities to enhance fleet management, provide real-time asset visibility, and monetize data insights related to cargo condition. The growing demand for environmentally sustainable aviation practices presents a strong opportunity for manufacturers specializing in lightweight composite materials and designing ULDs for optimal circularity and repairability. The interplay between these factors defines the market trajectory, where technological solutions addressing asset tracking and maintenance efficiency become paramount impact forces.

Impact forces currently shaping the market include strict IATA and FAA regulations concerning fire safety and structural integrity, especially following incidents involving undeclared hazardous materials, which compels manufacturers towards enhanced material testing and container designs. The global geopolitical landscape and trade agreements significantly influence air freight volumes, impacting ULD demand cycles. Furthermore, the rising crude oil prices necessitate extreme focus on reducing overall aircraft weight, making lightweighting technology a decisive competitive factor. The cumulative effect of these forces demands resilience, innovation, and adherence to global safety standards from all market participants, influencing procurement decisions and product lifecycling.

Segmentation Analysis

The Air Cargo Containers Market is comprehensively segmented based on Type, Material, and End-User, providing a detailed view of demand characteristics across the aviation logistics industry. Segmentation by type differentiates between highly standardized units, which form the bulk of general freight handling, and specialized units designed for niche, high-value, or regulated cargoes. The increasing complexity of global supply chains, coupled with strict handling requirements for sensitive goods like biologics and high-value electronics, is driving differentiation and growth within the specialty segment. Standard ULDs remain foundational, serving the vast majority of cross-border shipments efficiently, but the growth trajectory is leaning heavily toward sophisticated solutions.

Material segmentation is crucial as it directly impacts weight, durability, and cost. While aluminum has historically been the standard due to its robustness and cost-effectiveness, the industry is transitioning towards composite materials. Composites offer a superior strength-to-weight ratio, leading to lower fuel consumption and reduced maintenance requirements due to their resistance to corrosion and minor impact damage. This material shift reflects the aviation industry's deep commitment to operational efficiency and environmental performance. Manufacturers are continuously exploring hybrid material combinations to balance capital costs with long-term operational savings.

End-User segmentation clarifies the primary consumption patterns, identifying airlines, freight forwarders, and leasing companies as the principal buyers or users. Airlines utilize ULDs for proprietary cargo and maximizing the efficiency of their fleet’s belly capacity. Freight forwarders often require flexible access to ULDs for consolidation purposes, driving demand for short-term leases and varied unit types. Leasing companies act as major asset holders, providing crucial fleet flexibility and maintenance services, representing a rapidly growing segment that facilitates capital light operations for their clients. Understanding these distinct purchasing behaviors is vital for market participants seeking to tailor product offerings and financing structures.

- By Type:

- Standard ULDs (e.g., AKE, LD3, LD8, LD11, Pallets)

- Non-Standard/Specialty ULDs (e.g., Refrigerated/Active Containers, Insulated/Passive Containers, Horse Stalls, Car Racks, High-Security Containers)

- By Material:

- Aluminum

- Composites (e.g., Fiberglass, Carbon Fiber Reinforced Polymers)

- Hybrid and Other Materials

- By End-User:

- Airlines

- Freight Forwarders

- Leasing Companies

Value Chain Analysis For Air Cargo Containers Market

The value chain for the Air Cargo Containers Market begins with the upstream procurement of essential raw materials, primarily aviation-grade aluminum alloys, high-performance polymers, and composite materials like carbon fiber. Key players at this initial stage are specialized metal suppliers and composite manufacturers who must meet stringent aerospace quality standards regarding material consistency and traceability. Manufacturing and assembly follow, where companies design, mold, and certify the ULDs according to IATA and regulatory specifications. This stage also includes integrating advanced technology components, such as IoT sensors and GPS trackers, which are sourced from specialized electronics providers, adding intelligence to the basic structure.

Midstream activities primarily involve distribution and financing. This includes direct sales channels, where manufacturers sell new units directly to large flag carriers or military operators, and the critical leasing channel. Leasing companies, such as specialized ULD management firms, play a vital role by purchasing large volumes of containers and subsequently leasing them out to airlines and global freight forwarders on flexible terms. This model provides crucial operational flexibility and mitigates the capital expenditure burden for end-users, ensuring asset utilization across varying seasonal demands and trade lanes. Standardization in design facilitates ease of maintenance and interchangeability across various aircraft types.

The downstream sector is characterized by maintenance, repair, and overhaul (MRO) activities, which are essential for maintaining the airworthiness and certified status of the ULDs throughout their operational lifespan. Dedicated MRO facilities, often run by manufacturers, airlines, or third-party specialists, perform routine inspections, structural repairs, and component replacements. The distribution channel is both direct, often utilizing dedicated logistics arms for repositioning and storage, and indirect, heavily relying on the global network of air transport hubs where ULD pools are managed. Effective reverse logistics for asset tracking and damaged unit retrieval is a major focus area for optimization in the downstream value chain.

Air Cargo Containers Market Potential Customers

The primary purchasers and key end-users of air cargo containers are fundamentally segmented into three major categories, each with distinct needs and purchasing drivers. Firstly, global passenger and dedicated freighter airlines represent the largest consumer base. These entities require a consistent and reliable supply of ULDs to maximize the efficiency of their belly and main deck cargo capacity, viewing containers as critical operational assets that directly influence flight profitability and turnaround times. Their purchasing decisions are heavily influenced by durability, weight reduction potential, and compatibility with their diverse aircraft fleets, often preferring long-term supply agreements directly with manufacturers.

Secondly, international freight forwarders and logistics integrators constitute a substantial and growing segment of the market. Companies like DHL, FedEx, and Kuehne+Nagel require flexible access to a wide variety of ULD types to consolidate shipments from multiple clients and manage complex, multi-modal routes. Their procurement often leans towards leasing solutions, utilizing ULD management companies to ensure availability and maintenance without tying up significant capital. They prioritize flexibility, traceability features (smart containers), and the ability to meet specialized cargo requirements, particularly for temperature-sensitive or high-security shipments.

Finally, specialized ULD leasing and pooling companies form the third major customer group. These companies, such as ACL Airshop and Chep Aerospace Solutions, specialize in the ownership, maintenance, and global management of ULD fleets, essentially providing the containers as a service. They are characterized by large-volume purchases and focus intensely on asset lifecycle management, durability, and optimizing the technology stack for tracking and utilization across their vast client base. These leasing firms often drive the adoption of new, lightweight, and smart container technologies, acting as early adopters and distributors of innovation across the broader air cargo ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,480 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zodiac Aerospace (Safran), Satco, Telair International, ACL Airshop, Chep Aerospace Solutions, Unitpool, PalNet GmbH, Cargo Composites, Nordisk Aviation Products, VRR Aviation, AmSafe Bridport, Guangzhou Jinyang Air Cargo Equipment, CSafe Global, Dokasch, Envirotainer, TFI Aerospace, Shanghai Aviation, TransDigm Group, Unilode Aviation Solutions, Transact International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Cargo Containers Market Key Technology Landscape

The Air Cargo Containers Market is undergoing a rapid technological transformation, moving beyond basic metallic structures to sophisticated, connected assets. A cornerstone of this evolution is the widespread adoption of smart technology, primarily driven by the implementation of IoT sensors, GPS, and RFID systems embedded directly into the ULD structure. These technologies enable real-time tracking of container location globally, significantly mitigating the long-standing problem of ULD loss and improving fleet utilization rates. Beyond location, advanced sensors monitor crucial environmental parameters such as internal temperature, humidity, light exposure, and shock events, which is non-negotiable for high-value and temperature-sensitive shipments like pharmaceuticals and specialized electronics. This data integration facilitates enhanced operational transparency and enables proactive interventions to preserve cargo integrity.

Another dominant technological trend is the advancement in material science, focusing on the deployment of lightweight and highly durable composites, including carbon fiber reinforced polymers and specialized Kevlar-based materials. The primary objective is to significantly reduce the tare weight of the container without compromising structural integrity or fire resistance capabilities, directly translating into reduced aircraft fuel burn and lower operating costs for airlines. This shift is also intertwined with maintenance technology; composites often require different repair techniques than aluminum, leading to the development of specialized MRO processes and tools. Manufacturers are increasingly prioritizing modular designs that allow for easy repair or replacement of individual panels, further reducing maintenance downtime and increasing the overall economic lifespan of the ULD.

Furthermore, technology is playing a pivotal role in strengthening security measures for air cargo. This involves the development and certification of high-security containers (HSC) featuring reinforced structures, tamper-evident seals, and advanced locking mechanisms that can be remotely monitored. The integration of advanced data analytics and cloud-based platforms is essential for processing the large volumes of data generated by smart ULDs, providing actionable insights into logistics bottlenecks, asset performance, and compliance reporting. The technological landscape is shifting towards fully integrated digital solutions that link the physical ULD to a comprehensive software ecosystem for end-to-end asset management and supply chain visualization.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand for air cargo containers, reflecting disparities in manufacturing output, e-commerce penetration, and regulatory maturity. The Asia Pacific (APAC) region is currently the most rapidly expanding market globally, largely attributed to its status as the world's primary manufacturing base and the resulting high volume of outbound air freight. Countries like China, Vietnam, and India are experiencing immense growth in air traffic and logistics infrastructure development, leading to continuous demand for new ULDs to support expanding cargo capacities. The region's increasing consumption power is also fueling intra-Asia e-commerce trade, further necessitating efficient cargo management solutions.

North America and Europe represent mature markets characterized by significant investments in specialized, high-specification ULDs. These regions are primary hubs for the pharmaceutical and biotechnology sectors, driving a concentrated demand for sophisticated temperature-controlled containers (active and passive). In Europe, stringent environmental and safety regulations enforce continuous upgrades and the adoption of lightweight, composite materials. North America benefits from high-density cargo traffic and sophisticated logistics networks, where the emphasis is placed heavily on ULD utilization rates and advanced fleet management technologies provided by leading leasing companies.

The Middle East, particularly the Gulf Cooperation Council (GCC) states, is strategically positioned as a critical transshipment nexus connecting East and West. Major carriers in this region are heavily investing in expanding their cargo operations and ground infrastructure, fostering demand for robust, standardized ULDs capable of handling massive volumes of consolidated freight. Latin America and Africa, while smaller in market share, represent high-potential emerging markets. Growth here is primarily driven by increasing international trade links and investment in modernizing existing cargo infrastructure, prompting a gradual shift from legacy equipment to newer, more efficient ULD models.

- Asia Pacific (APAC): Dominant growth region fueled by massive manufacturing exports, expanding e-commerce market penetration, and significant investment in new airport capacity and freighter fleets, particularly in China and India.

- North America: Focus on high-value and specialized cargo (pharma, high-tech), driving demand for smart ULDs and sophisticated leasing services. Mature market with high operational efficiency demands.

- Europe: Strong regulatory environment promoting lightweight composites and sustainable ULD solutions. Key market for cold chain logistics and standardized units for intra-European trade.

- Middle East & Africa (MEA): Critical global transshipment corridor. Demand concentrated on large-capacity ULDs supporting major hub operations and facilitating East-West trade flows, coupled with investments in connectivity.

- Latin America: Emerging market characterized by infrastructure upgrades and increasing requirements for international logistics support, leading to measured, consistent demand for standardized containers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Cargo Containers Market.- Zodiac Aerospace (Safran)

- Satco, Inc.

- Telair International GmbH

- ACL Airshop

- Chep Aerospace Solutions

- Unitpool GmbH

- PalNet GmbH

- Cargo Composites

- Nordisk Aviation Products

- VRR Aviation

- AmSafe Bridport

- Guangzhou Jinyang Air Cargo Equipment Co., Ltd.

- CSafe Global

- Dokasch GmbH

- Envirotainer AB

- TFI Aerospace

- Shanghai Aviation Accessories Manufacturing Co., Ltd.

- TransDigm Group Incorporated (through subsidiaries)

- Unilode Aviation Solutions

- Transact International Inc.

Frequently Asked Questions

Analyze common user questions about the Air Cargo Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a ULD and how does it impact air freight efficiency?

A Unit Load Device (ULD) is an air cargo container or pallet used to load freight onto wide-body aircraft. ULDs are standardized, optimizing volumetric efficiency and ensuring cargo security, which significantly reduces aircraft turnaround time and lowers operational costs per flight kilometer.

Why are smart containers becoming increasingly critical in the market?

Smart containers, equipped with IoT sensors and GPS, provide real-time data on location, temperature, and condition. This technology is critical for compliance in cold chain logistics (especially pharmaceuticals) and improves asset utilization by tackling the industry challenge of container imbalance and loss.

Which material is preferred for new air cargo containers, aluminum or composites?

While aluminum remains standard, composite materials (such as carbon fiber) are increasingly preferred for new containers due to their superior strength-to-weight ratio. Composites reduce the container's tare weight, leading directly to lower fuel consumption and maintenance costs for airlines.

How do leasing models influence the air cargo containers market structure?

Leasing models allow airlines and freight forwarders to access high-quality ULDs without heavy capital expenditure. Leasing firms manage maintenance and repositioning, providing operational flexibility and scalability, which is increasingly favored over outright purchase.

What is the primary regulatory body governing the design and use of air cargo containers?

The International Air Transport Association (IATA) establishes the primary standards and specifications for ULD design, maintenance, handling, and operation globally. Adherence to IATA standards and national regulations (like FAA/EASA) is mandatory for airworthiness and operational safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager