Air Cargo Pallet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435868 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Air Cargo Pallet Market Size

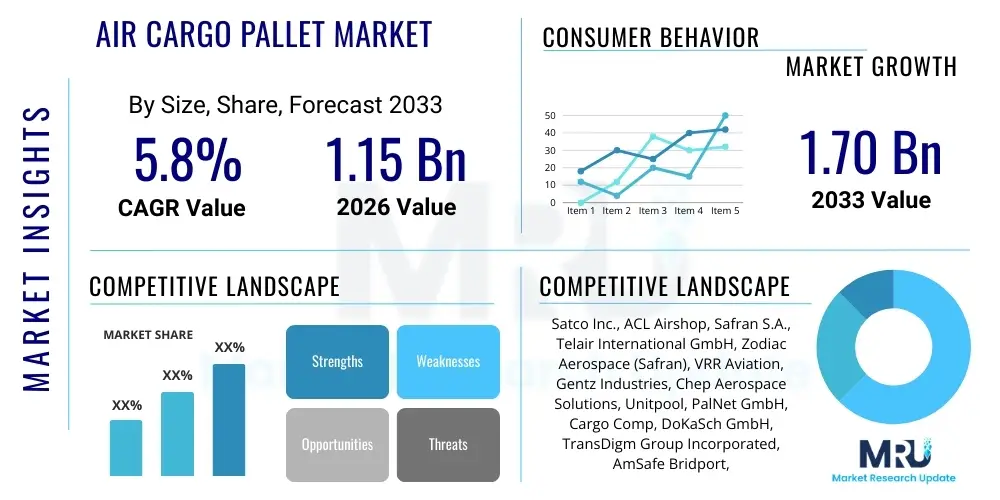

The Air Cargo Pallet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.15 Billion in 2026 and is projected to reach USD 1.70 Billion by the end of the forecast period in 2033.

Air Cargo Pallet Market introduction

The Air Cargo Pallet Market encompasses the production, distribution, and utilization of specialized Unit Load Devices (ULDs) designed to facilitate the rapid and secure transport of goods within the strict confines and structural requirements of air freight logistics. These pallets, predominantly constructed from high-strength aluminum or advanced composite materials, serve as essential interface platforms between the cargo and the aircraft's handling systems, ensuring maximum utilization of cargo space while maintaining strict adherence to aviation safety standards, particularly concerning fire resistance and weight limitations. The primary function of an air cargo pallet is to consolidate multiple packages into a single unit, minimizing handling time, reducing the risk of damage, and streamlining the loading and unloading processes for freight forwarders, airlines, and ground handling operations globally.

Major applications of air cargo pallets span high-value goods transport, including pharmaceuticals requiring rigorous cold chain management, high-tech components, automotive parts, and perishables. The proliferation of international trade agreements and the exponential rise of global e-commerce have fundamentally increased the demand for reliable and standardized ULDs. Benefits derived from using these pallets include enhanced operational efficiency, standardized handling protocols globally (driven by IATA specifications), reduced incidence of cargo shifting during flight, and improved aircraft payload capacity optimization. Air cargo pallets are critical enablers of the global supply chain, providing the necessary infrastructural component for time-sensitive logistics operations.

Key driving factors accelerating market expansion include the continuous expansion of global trade routes, significant investment in logistics infrastructure modernization, and the increasing complexity of international cold chain logistics, which necessitates high-quality, temperature-sensitive ULDs. Furthermore, the development of lightweight composite pallets that reduce overall aircraft fuel consumption while increasing payload capacity represents a major technological driver. Regulatory pressures concerning cargo safety and security also mandate the use of certified and well-maintained pallets, further underpinning market demand for robust and compliant solutions within the dynamic air transport sector.

Air Cargo Pallet Market Executive Summary

The Air Cargo Pallet Market is characterized by robust growth, driven primarily by the sustained expansion of cross-border e-commerce and the increasing sophistication of pharmaceutical supply chains, which rely heavily on specialized ULDs for temperature control and security. Business trends indicate a pronounced shift towards lightweight, durable composite materials to minimize fuel burn and increase aircraft operating efficiency, prompting significant R&D investment among leading manufacturers. Consolidation in the maintenance, repair, and overhaul (MRO) sector for ULDs is also observed, focusing on digital tracking technologies like RFID integration to improve inventory management and utilization rates across vast operational networks. Furthermore, sustainability initiatives are pushing carriers and logistics providers towards durable, long-life products, reducing the frequency of replacement and minimizing environmental footprint associated with manufacturing.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, propelled by rapid economic industrialization, massive export volumes from manufacturing hubs in China and Southeast Asia, and escalating internal air freight demand within India and Vietnam. North America and Europe, while mature, exhibit strong demand for high-specification pallets catering to specialized cargo, particularly high-value electronics and advanced biotechnological products, emphasizing regulatory compliance and stringent safety protocols. The Middle East serves as a critical global transshipment hub, driving demand for intercontinental cargo handling solutions and contributing significantly to global leasing and maintenance activities for ULD assets.

Segment trends reveal that the standard Aluminum Pallet segment, owing to its cost-effectiveness and proven durability, maintains the largest market share. However, the Composite Pallet segment is registering the highest growth CAGR due to superior weight reduction benefits and resistance to environmental factors like corrosion and temperature extremes, making them ideal for long-haul and specialized applications. In terms of end-use, the Air Carriers segment remains paramount, though the Leasing and Logistics Providers segment is expanding rapidly as more airlines opt to outsource their ULD fleet management to specialized asset management companies, demanding flexibility and standardized global inventory.

AI Impact Analysis on Air Cargo Pallet Market

User queries regarding AI's influence in the Air Cargo Pallet Market commonly center on topics such as predictive maintenance schedules for ULD structural integrity, optimizing pallet utilization and routing to minimize empty movements, and leveraging machine vision systems for automated damage detection during ground handling. Key concerns revolve around the integration cost of AI infrastructure, the accuracy of predictive models given varying operational environments, and the necessary standardization of data input (e.g., from RFID, IoT sensors, and historical damage reports) to train robust AI algorithms effectively. Users expect AI to move beyond simple tracking to become a core tool for preemptive asset management, regulatory compliance verification, and dramatically enhancing the efficiency of dynamic cargo handling operations, especially in time-critical hubs where bottlenecks are frequent.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the lifecycle management and operational deployment of air cargo pallets, shifting the industry from reactive maintenance to proactive, data-driven optimization. AI algorithms can analyze massive datasets encompassing flight hours, handling history, environmental exposure (temperature, humidity), and specific aircraft loading patterns to predict the probability and timing of pallet failure or required maintenance. This predictive capability allows airlines and ULD management companies to schedule repairs optimally, minimizing asset downtime, ensuring regulatory compliance, and maximizing the operational lifespan of expensive ULD components. Furthermore, optimized scheduling reduces the need for large buffer inventories, significantly lowering capital expenditure and storage costs across the logistics chain.

AI also plays a pivotal role in optimizing cargo loading sequences and spatial arrangement within the aircraft hold. Advanced ML models integrate pallet dimensions, weight restrictions, center of gravity calculations, and flight manifest data to determine the most efficient stacking and placement pattern, which is crucial for both fuel efficiency and flight safety. These systems can dynamically adjust loading plans in real-time based on unexpected changes in cargo dimensions or last-minute flight schedule alterations, substantially improving turnaround times at busy airports. The efficiency gains delivered by AI-enhanced loading protocols not only improve operational throughput but also indirectly extend the life of pallets by ensuring cargo is distributed and secured according to precise engineering standards, reducing stress points.

- AI-driven Predictive Maintenance: Forecasts structural failures based on historical operational stress data, improving ULD longevity and reducing unplanned service interruptions.

- Dynamic Inventory Optimization: Uses real-time tracking and demand forecasting to strategically reposition pallets globally, minimizing empty backhauls and optimizing asset utilization rates.

- Automated Damage Assessment: Utilizes Machine Vision (computer vision systems) during ground handling to instantly detect minute structural damages, ensuring immediate regulatory intervention.

- Optimized Payload Planning: ML algorithms calculate optimal pallet arrangement and weight distribution within aircraft, maximizing fuel efficiency and adhering strictly to aircraft structural limits.

- Enhanced Security and Auditing: AI processes IoT and RFID data to provide immutable, compliant records of pallet custody and handling history, critical for security and insurance validation.

- Cold Chain Integrity Monitoring: Integrated sensors combined with AI verify continuous temperature compliance within specialized pallets, issuing alerts for deviations crucial for pharmaceutical transport.

DRO & Impact Forces Of Air Cargo Pallet Market

The Air Cargo Pallet Market dynamics are intensely influenced by a matrix of intertwined Drivers, Restraints, and Opportunities (DRO) that shape investment decisions and technological innovation within the air freight industry. Key drivers, such as the surging demand from e-commerce logistics and the increasingly complex requirements of the global cold chain (especially for biopharmaceuticals), necessitate robust, high-specification ULDs. Simultaneously, the market faces significant restraints, primarily the high initial acquisition and maintenance costs associated with certified aviation equipment, coupled with stringent international aviation regulations (like IATA and FAA standards) that complicate innovation cycles and mandate costly, frequent inspections. Opportunities reside predominantly in material science breakthroughs, particularly the widespread adoption of lightweight composites, and the integration of smart technologies (IoT/RFID) for enhanced asset tracking and condition monitoring, promising substantial operational efficiencies and safety improvements across the supply chain.

Drivers: The globalized nature of modern manufacturing and consumption necessitates rapid, reliable transport, making air cargo the default choice for high-value and time-sensitive goods. The rise of express logistics services, directly fueled by online consumer demand, places immense pressure on airlines and logistics providers to maintain vast, efficiently managed fleets of standardized ULDs. Moreover, as aircraft manufacturers continue to introduce more fuel-efficient models, there is a corresponding industry drive to minimize the weight of all components, including pallets, thereby amplifying the demand for cutting-edge, lightweight aluminum alloys and carbon fiber reinforced polymers (CFRP) that offer the required strength-to-weight ratio. Compliance with increasingly strict global standards regarding safety, such as requirements for fire-resistant materials in cargo areas, also mandates continuous upgrading of the installed pallet base.

Restraints: The primary restraint is the significant capital expenditure required for ULD acquisition and the ongoing, highly regulated maintenance lifecycle. Air cargo pallets must undergo stringent certification processes (often requiring compliance with specific Technical Standard Orders - TSOs) and regular inspections, which adds complexity and cost compared to standard sea or road freight pallets. Furthermore, the operational challenge of managing and tracking ULD assets across disparate international hubs—leading to high rates of loss or misplacement—exposes airlines to substantial financial losses. Economic volatility, global trade wars, and unexpected events like pandemics can severely disrupt air freight volumes, leading to temporary oversupply or underutilization of pallet assets, impacting profitability for leasing companies and carriers alike.

Opportunities: The market presents substantial opportunities through technological innovation, specifically in smart ULD development. Integrating IoT sensors and GPS/RFID trackers into pallets offers precise location data, temperature monitoring for cold chain applications, and early warnings for damage or unauthorized access. This digital transformation improves asset recovery rates and significantly enhances the transparency required by high-security supply chains. Furthermore, emerging markets in Asia and Latin America, characterized by burgeoning middle classes and expanding industrial bases, offer untapped potential for logistics growth, demanding large volumes of new ULDs for both narrow-body and wide-body aircraft fleets. Strategic partnerships between material science firms and ULD manufacturers focusing on sustainability and circular economy principles also represent a long-term growth avenue.

Impact Forces: The combined influence of these factors creates dynamic market forces. The structural demand driven by e-commerce forms a strong upward force (Driver). However, high regulatory hurdles and capital intensity exert persistent downward pressure (Restraint). The technological leap offered by composites and smart ULDs acts as a transformative force, enabling premium pricing and niche market specialization (Opportunity). Geopolitical stability and global economic health act as external modulators, impacting air freight capacity and investment confidence. Crucially, the mandatory standardization dictated by IATA ULD regulations serves as a powerful, non-negotiable force, ensuring product uniformity but simultaneously creating significant barriers to entry for non-compliant innovations.

Segmentation Analysis

The Air Cargo Pallet Market is comprehensively segmented based on material type, product type, application, and end-user, providing granular insights into demand patterns and technological adoption across the global air freight ecosystem. Segmentation by material type distinguishes between traditional aluminum and advanced composite pallets, reflecting the industry's trade-off between cost-efficiency and performance metrics like weight savings and durability. Product type segmentation typically involves standardized IATA codes (e.g., PAG, PMC, P6P, etc.), which dictate the size and compatibility with specific aircraft cargo holds (narrow-body vs. wide-body). Application segments focus on the nature of the goods carried, such as general cargo versus specialized applications like cold chain or high-security logistics. This structure allows market participants to tailor their offerings—from manufacturing lightweight structures to providing specialized maintenance services—to meet specific sector needs and regulatory compliance demands.

- By Material Type:

- Aluminum Pallets (Standard and Lightweight Alloys)

- Composite Pallets (Fiber-reinforced Polymers, Carbon Composites)

- By Product Type (IATA Standard):

- Full Pallets (e.g., PAG, PMC)

- Half Pallets (e.g., P1P, P6P)

- Specialized Pallets (e.g., Horse Stall ULDs, Car Racks)

- By Application:

- General Cargo

- Perishables and Cold Chain Logistics (Pharmaceuticals, Food)

- High-Security Cargo (Valuables, Military)

- Express and E-commerce Freight

- By End-User:

- Air Carriers (Passenger and All-Cargo Airlines)

- Freight Forwarders and Logistics Service Providers (LSPs)

- ULD Leasing Companies

- Ground Handlers and MRO Providers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Air Cargo Pallet Market

The value chain for the Air Cargo Pallet Market is a complex sequence of activities spanning raw material sourcing, highly specialized manufacturing, stringent regulatory certification, distribution, and extensive aftermarket services. Upstream activities involve procuring high-grade materials, primarily aviation-grade aluminum alloys (like 7075 T6 or 2024) and specialized composite prepregs. Suppliers in this phase must adhere to strict quality control standards to ensure the longevity and structural integrity required for repeated use in pressurized aircraft environments. The manufacturing phase is highly capital-intensive, requiring advanced tooling for extrusion, heat treatment, and specialized assembly techniques, culminating in comprehensive structural testing and regulatory sign-off by authorities like the FAA or EASA before commercial deployment.

Downstream activities are dominated by distribution channels, which include both direct sales from manufacturers to major air carriers and indirect channels utilizing large global leasing companies and specialized MRO providers. Direct sales often characterize new fleet purchases or specific requirements for specialized ULDs (e.g., refrigerated containers). Indirect channels are crucial for inventory flexibility, especially for smaller carriers or peak season demand surges, where leasing companies manage the logistics and maintenance burden of the ULD fleet. The aftermarket is a critical component, involving mandatory periodic maintenance, repair services (especially relating to pallet sheet replacement and edge rail repair), and recertification, typically handled by certified Part 145 repair stations globally.

The distribution network is segmented into high-volume direct transactions with global flag carriers and highly localized MRO service contracts. Leasing companies act as major intermediaries, buying in bulk from manufacturers and providing flexible, pay-per-use solutions to airlines, thereby decoupling capital expenditure from operational logistics. Digitalization, particularly the tracking and management software offered by ULD management firms, is integrating the upstream and downstream segments, improving visibility and reducing operational friction across the entire value chain. This seamless integration of logistics, maintenance, and asset tracking is becoming a key competitive differentiator, moving beyond mere manufacturing capability.

Air Cargo Pallet Market Potential Customers

Potential customers for air cargo pallets are concentrated within organizations that own, operate, lease, or manage large fleets of air cargo assets requiring adherence to international aviation standards. The largest segment of end-users is undoubtedly Air Carriers, encompassing both dedicated cargo airlines (like FedEx, UPS, and Volga-Dnepr) and passenger airlines operating belly-hold cargo capacity (e.g., Emirates, Lufthansa Cargo, and Cathay Pacific). These carriers require large volumes of standardized pallets (PAG, PMC) and are the primary buyers of new ULDs, often demanding bespoke specifications regarding weight and integrated tracking technologies.

The second major customer group comprises Freight Forwarders and Logistics Service Providers (LSPs), particularly those managing significant air freight volumes for their corporate clients (e.g., Kuehne + Nagel, DHL Global Forwarding, and DSV). While LSPs often utilize the ULDs provided by the airlines, increasingly, major LSPs are investing in their own dedicated ULD fleets, especially specialized, high-security, or temperature-controlled units (like active cooling pallets) to ensure guaranteed service quality and asset control throughout the cold chain delivery process, positioning them as significant buyers of premium products.

Finally, ULD Leasing Companies and specialized Asset Management Firms constitute a rapidly growing customer base. Companies such as ULD CARE, CHEP Aerospace Solutions, and ACL Airshop specialize in providing pool management and leasing solutions. These firms purchase pallets in massive volumes, manage their global distribution, handle all mandated maintenance and repair cycles, and lease them out to multiple airlines and ground handlers on flexible terms. This group prioritizes durability, low maintenance costs, and advanced tracking integration to maximize return on asset investment (ROA) across a shared-fleet model, making them crucial influencers of design specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Satco Inc., ACL Airshop, Safran S.A., Telair International GmbH, Zodiac Aerospace (Safran), VRR Aviation, Gentz Industries, Chep Aerospace Solutions, Unitpool, PalNet GmbH, Cargo Comp, DoKaSch GmbH, TransDigm Group Incorporated, AmSafe Bridport, Nordisk Aviation Products, Core Transport Technologies, TLD Group, Air Crate Inc., AAR Corp., and Leki Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Cargo Pallet Market Key Technology Landscape

The technology landscape of the Air Cargo Pallet Market is evolving rapidly, moving beyond basic structural engineering towards advanced material science and comprehensive digital integration. The most significant technological thrust is in material substitution, specifically the transition from traditional, heavier aluminum alloys to advanced composite materials, particularly those based on carbon fiber reinforced polymers (CFRP) and specialized fiberglass. This shift is driven by the imperative to reduce overall aircraft weight, translating directly into fuel savings and increased payload capacity. Composite pallets are typically 20-40% lighter than their aluminum counterparts while offering superior resistance to physical damage, corrosion, and extreme temperature fluctuations, making them ideal for long-haul and sensitive cargo operations like pharmaceutical transport.

Another pivotal technological development involves the integration of Smart ULD features, facilitated by the deployment of Internet of Things (IoT) devices, Radio Frequency Identification (RFID) tags, and GPS tracking modules directly embedded into the pallet structure. These technologies enable real-time location tracking, condition monitoring (e.g., impact alerts, tilt sensors), and critical environmental surveillance (temperature, humidity), which is non-negotiable for adhering to the Good Distribution Practices (GDP) required for temperature-sensitive drugs. This digital layering provides unprecedented transparency into the asset's location and status, dramatically improving asset recovery rates, reducing logistics costs associated with lost ULDs, and ensuring regulatory compliance through automated data logging accessible across the entire logistics chain.

Furthermore, the manufacturing processes themselves are benefiting from technological advancements, utilizing techniques such as advanced laser welding, automated riveting systems, and robotic inspection units that ensure higher precision and consistency in production, especially for complex edge rail assemblies crucial for structural safety. Digital twin technology is increasingly employed in the design and testing phases, allowing manufacturers to simulate millions of operational cycles and stress scenarios virtually before physical prototyping. This approach significantly accelerates product development cycles and ensures that new pallet designs inherently comply with the rigorous structural integrity and fire resistance requirements stipulated by international aviation bodies, driving continuous improvement in safety and lifespan.

- Lightweight Composite Materials: Utilization of Carbon Fiber Reinforced Polymers (CFRP) and high-performance thermoplastics to achieve weight reduction without compromising structural safety or durability.

- Smart ULD Integration: Embedding IoT sensors (temperature, humidity, pressure, impact), GPS trackers, and active RFID chips for real-time asset monitoring and environmental compliance verification.

- Predictive Maintenance Software: Use of machine learning algorithms to analyze sensor data and predict component wear, allowing for scheduled, preemptive repairs rather than reactive fixes.

- Enhanced Aluminum Alloys: Development of new high-strength, low-density aluminum alloys offering improved fatigue resistance and corrosion protection, extending the operational life of traditional pallets.

- Fire Containment Technologies: Incorporation of advanced fire-resistant coatings and materials, particularly in specialized ULDs, to meet evolving regulatory requirements for enhanced cargo safety.

- Automated Damage Inspection: Implementing automated 3D scanning and computer vision systems at cargo terminals to rapidly assess pallet damage during turnaround, improving inspection accuracy and speed.

Regional Highlights

The global Air Cargo Pallet Market exhibits distinct regional dynamics driven by unique trade patterns, manufacturing outputs, and regulatory frameworks. Asia Pacific (APAC) stands as the largest and most dynamically growing region, primarily fueled by its status as the world’s manufacturing hub and the resultant massive volume of exports across electronics, textiles, and high-tech components. Countries like China, South Korea, and Vietnam generate immense air freight traffic, necessitating continuous investment in new ULD assets to support large-scale international trade. Additionally, the rapid expansion of intra-Asia e-commerce logistics, coupled with the modernization of cargo hubs in Singapore, Hong Kong, and Shanghai, further reinforces APAC’s dominant position in both demand and innovative adoption of cargo handling equipment. The region shows strong uptake of both standard aluminum pallets for bulk freight and specialized temperature-controlled ULDs to service the expanding Asian pharmaceutical sector.

North America and Europe represent mature markets characterized by high demand for specialized and premium ULD solutions. In North America, demand is heavily influenced by cross-border express delivery services, the robust aerospace sector, and high-value domestic transport. The focus here is less on sheer volume and more on compliance, security, and technological integration, driving the adoption of smart, tracked ULDs and high-security containers for sensitive materials. Europe benefits from strong inter-continental trade links and acts as a central hub for global pharmaceutical manufacturing (Germany, Switzerland, Ireland), making it a crucial market for active and passive cold chain pallets. European regulations, particularly those set by EASA, maintain some of the strictest maintenance and inspection standards globally, ensuring consistent aftermarket demand for repair and certification services.

The Middle East and Africa (MEA) region plays a pivotal role as a strategic global transshipment corridor, linking Asia and Europe. Major hubs like Dubai (UAE) and Doha (Qatar) manage significant volumes of international air freight, leading to high utilization rates for ULDs. This region is a major consumer of leased ULD assets, emphasizing the need for robust fleet management and efficient maintenance operations provided by third-party logistics firms. While Africa’s internal air freight market is emerging, it presents substantial long-term growth opportunities, particularly related to the humanitarian aid, perishables (flowers, produce), and mining sectors, demanding durable and easily maintained pallets suitable for diverse operational environments. Latin America (LATAM), driven by growing agricultural exports (e.g., Brazilian meat and Chilean fruit) and industrial expansion in Mexico, shows steady demand, focusing on intermodal compatibility and reliable cold chain solutions for time-sensitive exports.

- Asia Pacific (APAC): Dominant manufacturing and export base (China, Vietnam). Highest growth rate driven by e-commerce expansion and significant infrastructural investments in new cargo terminals.

- North America: Mature market focused on high-security, express logistics, and technology integration (Smart ULDs, RFID tracking). Strong presence of major cargo airlines and integrators.

- Europe: Key market for advanced cold chain logistics due to the pharmaceutical industry concentration. Strict regulatory environment (EASA) driving demand for certified maintenance and high-quality ULDs.

- Middle East: Central global transshipment hub; high utilization rates for leased ULDs; focus on strategic asset management and rapid turnaround services in major hubs.

- Latin America (LATAM): Growth driven by agricultural perishables and expanding industrial sectors; increasing need for reliable, temperature-controlled pallets for export markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Cargo Pallet Market.- Satco Inc.

- ACL Airshop

- Safran S.A.

- Telair International GmbH

- Zodiac Aerospace (Safran)

- VRR Aviation

- Gentz Industries

- Chep Aerospace Solutions

- Unitpool

- PalNet GmbH

- Cargo Comp

- DoKaSch GmbH

- TransDigm Group Incorporated

- AmSafe Bridport

- Nordisk Aviation Products

- Core Transport Technologies

- TLD Group

- Air Crate Inc.

- AAR Corp.

- Leki Tech

Frequently Asked Questions

Analyze common user questions about the Air Cargo Pallet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a ULD and how does it relate to air cargo pallets?

A Unit Load Device (ULD) is any type of container, pallet, or igloo used to consolidate cargo into a single unit for transport on an aircraft. The air cargo pallet is the fundamental, flat ULD platform that interfaces directly with the aircraft's cargo loading system.

What drives the shift from aluminum to composite air cargo pallets?

The primary driver is weight reduction. Composite pallets are significantly lighter (up to 40%) than aluminum, leading to substantial fuel savings for airlines and increased available payload capacity per flight, improving overall operating economics.

How is AI impacting the maintenance and tracking of air cargo pallets?

AI is transforming maintenance through predictive analytics, analyzing sensor data (IoT) to forecast when structural repairs are necessary, thereby optimizing service schedules, maximizing asset lifespan, and reducing costly unplanned downtime.

What is the most critical regulatory requirement for air cargo pallets?

All air cargo pallets must comply with IATA standards for dimensions and handling, and receive specific airworthiness certification (e.g., FAA TSO or EASA approval) to ensure they meet stringent structural integrity and fire safety requirements for flight operations.

Which geographical region dominates the air cargo pallet market in terms of demand?

The Asia Pacific (APAC) region currently dominates the market, driven by its massive manufacturing output, resulting high export volumes, and continuous expansion of logistics infrastructure to support booming e-commerce activities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager