Air Cooled Condenser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436877 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Air Cooled Condenser Market Size

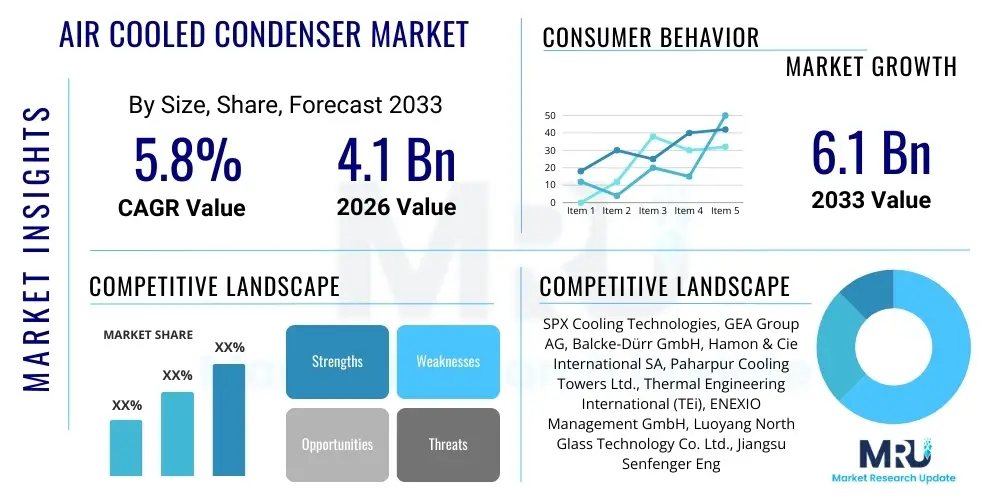

The Air Cooled Condenser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Air Cooled Condenser Market introduction

The Air Cooled Condenser (ACC) market encompasses highly engineered heat exchange systems designed to condense steam discharged from industrial turbines, primarily within thermal power generation facilities, without the need for vast quantities of cooling water. ACCs operate by circulating exhaust steam through finned tube bundles, where large axial fans force ambient air across the tubes to facilitate heat transfer and subsequent condensation. This mechanism provides a critical alternative to traditional water-intensive cooling towers, making it indispensable in arid regions or areas facing stringent water usage restrictions. The core components include the fan assemblies, heat exchanger bundles, and support structures, all designed for efficient, large-scale thermal management in utility and industrial settings.

Major applications for Air Cooled Condensers span utility-scale thermal power plants, including combined cycle gas turbines (CCGT), coal-fired power stations, and niche applications such as geothermal and concentrated solar power (CSP) facilities. The shift towards ACC technology is directly proportional to global mandates promoting sustainable industrial practices and addressing increasing fresh water scarcity worldwide. By eliminating the necessity for a continuous cooling water supply, ACCs offer enhanced flexibility in power plant site selection, allowing construction closer to fuel sources or consumption centers, regardless of proximity to major water bodies.

Key driving factors supporting market expansion include robust regulatory pressures concerning industrial water discharge and consumption, particularly in rapidly industrializing economies in Asia Pacific and water-stressed regions globally. Furthermore, the inherent benefits of ACCs, such as reduced maintenance requirements compared to complex wet cooling systems and the elimination of plume formation, contribute significantly to their adoption. The market’s trajectory is strongly linked to new power plant construction and the retrofitting of existing facilities seeking to improve operational sustainability and compliance.

Air Cooled Condenser Market Executive Summary

The Air Cooled Condenser Market is characterized by intense competition driven by technological advancements focused on optimizing heat transfer efficiency and reducing parasitic power consumption of fan drives. A primary business trend observed is the increasing demand for modular ACC solutions, which expedite installation timelines and minimize on-site construction complexity, proving particularly attractive for mid-sized power generation projects and industrial applications. Furthermore, market players are actively investing in proprietary fin and tube geometries, as well as advanced fan blade designs, to maximize thermodynamic performance, especially under challenging high ambient temperature conditions, a critical limitation traditionally associated with dry cooling technologies. The emphasis on high-efficiency components directly addresses the long-term operational costs associated with large-scale dry cooling systems.

Regionally, the market dynamics are heavily skewed towards the Asia Pacific region, which remains the epicenter for new coal and gas-fired power plant construction, often located in inland, water-scarce areas of China, India, and Southeast Asia. Regulatory frameworks across Europe and North America, focusing on replacing older, water-intensive infrastructure and enhancing overall plant efficiency, also drive demand for advanced ACC retrofits. Segment trends highlight the dominance of the power utility segment, specifically within gas and coal power generation, although concentrated solar power (CSP) is emerging as a significant, high-growth application segment where water conservation is paramount for project viability.

Overall, the strategic landscape is defined by the convergence of environmental mandate compliance and economic necessity. Companies successful in this market are those providing tailored solutions that balance high capital expenditure against low operating expenditure, primarily through enhanced thermal performance and predictive maintenance capabilities. The market is transitioning from purely mechanical optimization to incorporating smart controls and digital twin technologies, ensuring that ACCs maintain optimal performance across varying load demands and fluctuating atmospheric conditions, thereby mitigating the performance penalties traditionally associated with dry cooling.

AI Impact Analysis on Air Cooled Condenser Market

User queries regarding AI’s influence on the Air Cooled Condenser Market frequently revolve around optimizing operational efficiency, predicting equipment failure, and dynamic control under fluctuating environmental conditions. Users seek assurance that AI can overcome the inherent performance drop experienced by ACCs during peak ambient temperatures. The key themes include leveraging machine learning for precise fan speed modulation based on real-time weather forecasts and load demands, optimizing energy consumption, and using sensor data to identify and pre-emptively manage heat transfer degradation caused by fouling or uneven airflow distribution. There is strong user expectation that AI algorithms will transform ACCs from passive cooling systems into highly adaptive, 'smart' industrial assets, maximizing turbine output stability while minimizing auxiliary power usage (parasitic load).

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and performance data from fan assemblies and gearbox systems to anticipate component failure, reducing unplanned downtime and optimizing maintenance scheduling.

- Dynamic Performance Optimization: Employing neural networks to continuously adjust fan pitch and speed in response to real-time ambient temperature, humidity, and plant load, thereby maximizing heat rejection efficiency while minimizing parasitic power consumption.

- Digital Twin Modeling: Creation of precise digital replicas of ACC systems to simulate different operational scenarios, test control strategies, and train operators, leading to improved system design validation and operational responsiveness.

- Automated Fault Detection and Diagnosis (FDD): Rapid identification of anomalies such as tube leakage, uneven airflow distribution, or motor degradation, allowing for immediate corrective action before performance is significantly compromised.

- Optimized Cleaning Schedules: AI algorithms determine the precise moment required for fin cleaning based on thermal degradation patterns and calculated impact on overall plant efficiency, moving away from fixed maintenance intervals.

DRO & Impact Forces Of Air Cooled Condenser Market

The Air Cooled Condenser market is powerfully influenced by the confluence of strict environmental regulations and pressing global water scarcity issues, which serve as primary market drivers. Regulations enacted by environmental protection agencies globally, restricting the withdrawal of fresh water for industrial cooling and mandating zero liquid discharge (ZLD) practices in sensitive ecosystems, compel power plant developers to adopt dry cooling technologies like ACCs. The escalating risk associated with operational shutdowns due to drought conditions further enhances the commercial attractiveness of water-independent cooling solutions. Simultaneously, geopolitical shifts in energy infrastructure investment, favoring gas-fired generation in water-stressed regions, solidify the need for robust dry cooling apparatus.

However, significant restraints temper the market’s growth rate. The foremost restraint is the high initial capital expenditure (CAPEX) required for ACC installation compared to conventional wet cooling systems, primarily due to the large footprint and complex material requirements (extensive finned tubing). Furthermore, the intrinsic limitation of air cooling—performance degradation at high ambient temperatures—leads to reduced turbine efficiency and output (known as derating) during peak summer periods. This operational hurdle necessitates advanced engineering solutions, such as hybrid cooling systems, to mitigate the economic impact of reduced power generation capacity, adding to the system complexity and overall cost, thereby acting as a competitive disadvantage in some temperate climates.

Opportunities for market expansion are significant, particularly through technological innovation and penetration into emerging industrial sectors. The development of advanced elliptical tube designs and specialized air distribution systems promises to enhance thermal efficiency and reduce the high parasitic load associated with fan power. Moreover, the integration of ACCs into industrial processes beyond traditional power generation, such as petrochemical refining, steel manufacturing, and large-scale data center cooling, represents a burgeoning opportunity. The market is also seeing increased demand for sophisticated hybrid cooling solutions that combine the water conservation benefits of ACCs with the performance stability of a supplementary wet system, offering an optimal balance for regions with seasonal temperature extremes.

Segmentation Analysis

The Air Cooled Condenser market is meticulously segmented based on the configuration type, capacity, and the specific end-use application, providing a granular view of demand dynamics across various industries. Configuration types primarily differentiate between natural draft systems and mechanical draft systems, with mechanical draft ACCs dominating due to their higher control flexibility and compact design, making them suitable for most utility and industrial installations. Capacity segmentation helps distinguish between systems used for small industrial processes and those utilized for large-scale utility power blocks (over 500 MW), where efficiency and reliability are paramount. End-use segmentation clearly identifies the power generation sector as the primary consumer, though industrial adoption is rapidly gaining traction as sustainability targets become stricter globally.

- By Type:

- A-Frame (Horizontal Configuration)

- Vertical Configuration

- Module Size (Large, Medium, Small)

- By End-Use Application:

- Power Utility (Coal, Natural Gas, Nuclear, Geothermal, CSP)

- Industrial (Petrochemical, Refining, Steel Mills, Data Centers)

- By Capacity:

- Below 250 MW

- 250 MW – 500 MW

- Above 500 MW

- By Component:

- Heat Exchanger Bundles (Finned Tubes)

- Fan Systems (Axial Fans, Drives, Gearboxes)

- Ducting and Structure

Value Chain Analysis For Air Cooled Condenser Market

The value chain for Air Cooled Condensers is intensive, beginning with the procurement of critical raw materials, predominantly high-grade steel for structural components and aluminum or specialized alloys for finned tubing, which significantly impacts overall system cost and thermal performance. Upstream analysis focuses on securing reliable supply chains for large-diameter steel tubing and efficient, high-surface-area aluminum fins. Manufacturing involves highly specialized welding, bending, and assembly processes, often requiring stringent quality control to ensure leak-proof performance and compliance with thermal specifications. Key challenges in the manufacturing stage include managing the scale and precision required for producing massive heat exchanger modules and integrating complex fan and drive systems.

The midstream segment involves detailed engineering, procurement, and construction (EPC) activities. ACC manufacturers typically work closely with EPC firms, providing customized designs tailored to specific power plant footprints and local environmental conditions. Distribution channels are generally direct, leveraging project-based sales cycles where manufacturers bid directly on large utility and industrial projects. Given the massive size of ACC components, logistics and transportation become critical cost and time factors, requiring specialized transport arrangements for bulky modules from manufacturing facilities to often remote project sites.

Downstream analysis centers on installation, commissioning, and long-term service agreements. Direct engagement with end-users (power plant operators) is essential for successful system integration and performance validation. Post-installation services, including predictive maintenance, spare parts supply, and performance optimization consulting, represent a growing revenue stream, particularly as power producers seek to minimize downtime and maximize operational efficiency. The lifecycle value is high, as operational longevity and continuous system upgrades are crucial for maintaining the competitive edge of power generation assets.

Air Cooled Condenser Market Potential Customers

The primary and largest segment of potential customers for Air Cooled Condensers consists of electric power generation utilities, encompassing both private independent power producers (IPPs) and government-owned utilities. These customers operate large-scale thermal power plants fueled by natural gas (Combined Cycle Gas Turbines - CCGT) and coal. For these utility buyers, the decision to invest in ACC technology is driven by the regulatory mandate to conserve water and the economic necessity of locating plants in proximity to fuel sources or grid connections, irrespective of water availability. ACCs are seen as a strategic long-term investment that mitigates operational risk associated with climate change and water stress, ensuring consistent power output capacity.

A rapidly expanding customer base includes operators of concentrated solar power (CSP) and geothermal facilities. In CSP plants, high temperatures necessitate efficient steam condensation, and these facilities are often located in high-irradiance, arid desert regions where water is prohibitively expensive or unavailable, making ACCs the only viable cooling option. Similarly, geothermal plants, which rely on steam derived from subsurface heat, increasingly use ACCs to maintain a closed-loop system, minimizing impact on local water resources and maximizing resource recovery. These sectors prioritize performance stability and extreme climate resilience in their cooling system procurement decisions.

Beyond the traditional energy sector, large industrial facilities represent an emerging, high-potential customer base. Petrochemical refineries, steel manufacturers, and large-scale data center operators are increasingly scrutinizing their water footprint as part of corporate sustainability initiatives. These industrial buyers utilize ACCs to manage process heat rejection, contributing to their zero liquid discharge (ZLD) goals and reducing cooling expenses associated with water treatment and disposal. The increasing scale of industrial operations, coupled with public pressure for sustainability, ensures that these industries will become critical drivers of demand for medium-capacity ACC units in the coming decade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SPX Cooling Technologies, GEA Group AG, Balcke-Dürr GmbH, Hamon & Cie International SA, Paharpur Cooling Towers Ltd., Thermal Engineering International (TEi), ENEXIO Management GmbH, Luoyang North Glass Technology Co. Ltd., Jiangsu Senfenger Engineering Co. Ltd., Shouguang Juneng Electric Co. Ltd., Evapco Inc., Johnson Controls International plc, Kelvion Holding GmbH, Babcock & Wilcox Enterprises, Inc., Alstom Power (GE). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Cooled Condenser Market Key Technology Landscape

The technological landscape of the Air Cooled Condenser market is defined by continuous innovation focused on enhancing heat transfer efficiency and minimizing parasitic power load. A major area of development involves advanced heat exchanger geometries, particularly the adoption of elliptical or flat tubes rather than traditional circular tubes. These specialized profiles increase the surface area available for heat exchange and reduce air-side pressure drop, leading to significantly improved thermal performance and lower fan power consumption. Furthermore, fin technology is advancing, with proprietary designs and specialized coatings being utilized to optimize fin density, manage fouling, and enhance corrosion resistance, especially in harsh industrial or coastal environments, thereby extending the operational lifespan and efficiency of the bundles.

Another crucial technological advancement is the focus on variable speed drive (VSD) fan systems and optimized fan blade designs. Traditional ACCs operated fans at a fixed speed, leading to high energy consumption even when full cooling capacity was not required. The integration of VSDs allows for precise control over airflow, enabling operators to modulate cooling capacity dynamically based on ambient conditions and turbine load, resulting in significant energy savings (parasitic load reduction). Furthermore, computational fluid dynamics (CFD) modeling is extensively used in the design phase to optimize the plenum and fan arrangements, ensuring uniform airflow distribution across the entire heat exchanger matrix, which is vital for maximum thermal efficiency and vibration mitigation.

The increasing digitalization and incorporation of smart sensor technology constitute a third vital technology area. Modern ACCs are equipped with dense arrays of sensors monitoring air temperature, steam conditions, vibration levels, and fan performance. This infrastructure supports the implementation of advanced control algorithms, including predictive maintenance systems and integration with plant-wide Distributed Control Systems (DCS). The objective is to enable real-time condition monitoring, identify subtle performance drifts, and facilitate autonomous control adjustments, thereby ensuring that the ACC system operates consistently near its peak efficiency point, effectively bridging the performance gap between dry cooling and water-based systems.

Regional Highlights

Regional dynamics within the Air Cooled Condenser market exhibit significant variability driven by regional energy policies, climate conditions, and water stress levels.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market due to rapid industrialization and substantial investments in new thermal power generation capacity, particularly in China and India. Inland locations, where water resources are often highly stressed, necessitate the widespread adoption of ACC technology for new coal and gas-fired power projects. Government policies promoting infrastructure development and addressing water security strongly influence this market growth.

- North America: This region demonstrates mature market characteristics, with growth driven primarily by the replacement of aging infrastructure and the retrofitting of existing power plants, particularly in Southwestern states like Texas and California, which experience chronic water shortages. Stringent environmental standards and a focus on operational longevity necessitate investment in high-efficiency, low-maintenance ACC solutions.

- Europe: Growth is steady, focused mainly on enhancing the efficiency of combined heat and power (CHP) facilities and transitioning away from once-through cooling systems to comply with the European Union’s Water Framework Directive. Innovation in hybrid cooling technologies, which address performance limitations during brief heatwaves, is a key regional trend.

- Middle East and Africa (MEA): This region is characterized by high ambient temperatures and extreme water scarcity, making ACCs and hybrid systems essential for industrial and power projects. Investments in concentrated solar power (CSP) and large-scale utility projects in the Gulf Cooperation Council (GCC) countries are major demand drivers, prioritizing systems designed for desert conditions and high thermal performance resilience.

- Latin America: Market expansion is linked to new energy projects, particularly in Brazil and Chile, where vast inland areas are prone to water access issues. Economic stability and foreign direct investment into the energy sector are crucial determinants of ACC adoption rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Cooled Condenser Market.- SPX Cooling Technologies

- GEA Group AG

- Balcke-Dürr GmbH

- Hamon & Cie International SA

- Paharpur Cooling Towers Ltd.

- Thermal Engineering International (TEi)

- ENEXIO Management GmbH

- Luoyang North Glass Technology Co. Ltd.

- Jiangsu Senfenger Engineering Co. Ltd.

- Shouguang Juneng Electric Co. Ltd.

- Evapco Inc.

- Johnson Controls International plc

- Kelvion Holding GmbH

- Babcock & Wilcox Enterprises, Inc.

- Clyde Bergemann Power Group

- Xian SunPower Group

- Heller Systems GmbH

- Thermax Limited

- Hitachi Zosen Corporation

- Trane Technologies plc

Frequently Asked Questions

Analyze common user questions about the Air Cooled Condenser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using an Air Cooled Condenser (ACC) over traditional wet cooling towers?

The primary benefit is water conservation. ACCs eliminate the need for significant quantities of cooling water, which drastically reduces operational water consumption, operational costs associated with water treatment and discharge, and allows power plants to be strategically located in water-scarce or arid regions without reliance on major water sources. This enhances site flexibility and long-term operational sustainability.

How do high ambient temperatures affect the performance and efficiency of ACC systems?

High ambient temperatures directly reduce the heat rejection capacity of ACCs because the temperature difference between the steam and the cooling air is diminished. This results in an increased condenser pressure, leading to 'derating'—a measurable reduction in the steam turbine's electrical power output. Modern ACC designs and predictive AI controls are aimed at mitigating this performance penalty through optimized fan operation and enhanced heat transfer surfaces.

Which power generation sectors are driving the highest demand for Air Cooled Condensers?

The highest demand is driven by utility-scale thermal power generation, specifically natural gas-fired combined cycle gas turbines (CCGT) and coal power plants, particularly in Asia Pacific regions where new construction is prevalent. Additionally, concentrated solar power (CSP) and geothermal facilities represent critical growth sectors, as they are inherently located in water-limited environments where dry cooling is mandatory for project feasibility.

What are the main constraints impacting the adoption rate of Air Cooled Condensers?

The main constraints are the high initial capital investment (CAPEX) required for ACC installations, which is significantly higher than for wet cooling towers, and the large physical footprint required. Furthermore, the operational constraint of performance degradation during peak hot periods makes economic feasibility evaluation complex, requiring robust engineering and financial modeling to justify the long-term operational benefits.

What technological innovations are shaping the future competitiveness of the ACC market?

Future competitiveness is being shaped by three key innovations: advanced heat transfer geometries (e.g., elliptical tubes for improved efficiency), integration of variable speed drive (VSD) systems for reduced auxiliary power consumption, and the application of Artificial Intelligence (AI) and Digital Twins for dynamic performance optimization and predictive maintenance, enhancing overall reliability and mitigating operational risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager