Air Demister Hose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433586 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Air Demister Hose Market Size

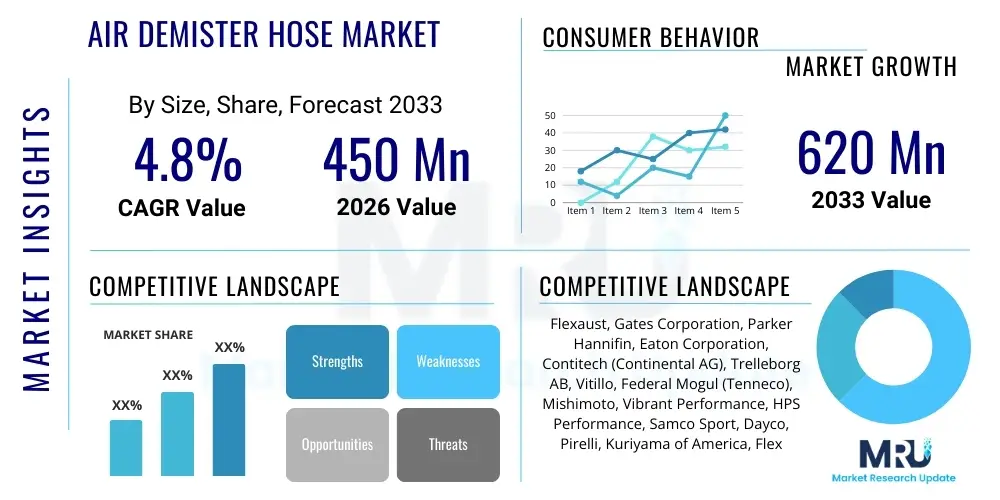

The Air Demister Hose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the continuous need for reliable moisture and particulate matter management in critical operational environments, particularly within the automotive, aerospace, and heavy industrial sectors. While the automotive sector remains the primary consumer due to stringent engine performance and longevity requirements, the expanding use of these specialized hoses in high-efficiency industrial dehumidification and HVAC systems is contributing significantly to the overall market expansion.

Air Demister Hose Market introduction

The Air Demister Hose Market encompasses the production and distribution of specialized flexible ducting solutions designed primarily to transport air while effectively mitigating and separating entrained moisture, oil mist, and particulate contaminants. These hoses are engineered from advanced materials such as high-grade silicone, EPDM (Ethylene Propylene Diene Monomer), and specific polymer blends, offering essential resistance to high temperatures, chemical exposure, and mechanical stress, ensuring reliable performance in harsh environments. The core function of these components is critical in maintaining the efficiency and longevity of complex mechanical systems by preventing corrosion, fouling, and hydraulic lock within sensitive machinery, thereby reducing maintenance downtime and operational costs.

Major applications of Air Demister Hoses span across several high-stakes industries, including their predominant use in automotive Positive Crankcase Ventilation (PCV) systems, engine air intake systems, and turbocharger circuits where they manage blow-by gases and oil mist. Beyond the transportation sector, these hoses are vital in industrial air filtration, compressed air systems, marine engines, and specialized HVAC installations where maintaining dry, clean airflow is non-negotiable for process integrity. The inherent benefits of utilizing high-quality demister hoses include enhanced system efficiency, extended component lifespan, improved air quality, and compliance with increasingly strict environmental and emission control regulations globally. Furthermore, the development of lightweight, highly flexible, and custom-molded hoses tailored for specific aerodynamic requirements is a driving factor accelerating product adoption across performance-oriented and weight-sensitive applications.

Key market driving factors include the escalating global production of passenger and commercial vehicles, particularly those equipped with forced induction and advanced emission reduction technologies that necessitate precise mist separation. Regulatory mandates imposing tighter controls on industrial emissions and workplace air quality further necessitate the implementation of robust demisting solutions. The continuous technological advancements in material science, focusing on developing elastomers with superior heat resistance, chemical inertness, and durability, are also significantly contributing to the market's robust growth. The reliability and safety benefits provided by these specialized hoses ensure their consistent demand across all major industrial and mobile sectors seeking optimal operational performance.

Air Demister Hose Market Executive Summary

The Air Demister Hose Market is characterized by robust business trends centered on material innovation and supply chain resilience. Manufacturers are increasingly focusing on vertical integration and securing long-term contracts with key raw material suppliers, particularly for high-performance silicone and fluorosilicone elastomers, to stabilize production costs amid fluctuating polymer prices. A significant business trend involves the shift toward custom-molded hose assemblies, moving away from generic straight lengths, enabling highly specific fitments required by Original Equipment Manufacturers (OEMs) in aerospace and automotive high-performance segments. Furthermore, strategic partnerships between hose manufacturers and Tier 1 automotive suppliers are crucial for securing high-volume contracts, demanding rigorous quality control and certification standards, emphasizing the market’s focus on precision engineering and documented reliability.

Regionally, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by the massive expansion of automotive manufacturing bases in China, India, and Southeast Asian nations, coupled with increasing investments in industrial infrastructure and pollution control technologies. North America and Europe, while mature markets, maintain a leading position in terms of value, primarily due to the stringent regulatory landscape concerning engine emissions (such as EPA and Euro standards) and the presence of major aerospace and high-performance vehicle manufacturers, which demand premium, customized demister solutions. These developed regions are characterized by a strong aftermarket segment focused on performance upgrades and specialized maintenance, further bolstering regional revenue streams. The demand dynamics across regions are heavily influenced by local automotive production volume and the speed of adoption of advanced emission control hardware.

Segmentation trends indicate a clear preference for Silicone-based demister hoses over traditional EPDM or natural rubber variants, particularly in applications exposed to extreme temperature variations, owing to their superior heat aging resistance and flexibility. The application segment continues to be dominated by the automotive sector, although the industrial machinery and HVAC segments are gaining traction, demanding larger diameter and more robust hose structures capable of handling high volumetric flow rates in continuous industrial operations. Within the segmentation by type, custom-molded hoses are witnessing accelerated adoption due to the complex routing requirements in modern, densely packed engine bays and specialized industrial equipment, reflecting a market moving towards highly engineered, application-specific solutions rather than standardized products.

AI Impact Analysis on Air Demister Hose Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Air Demister Hose Market frequently revolve around optimizing complex hose geometry design, predicting material degradation under specific operational loads, and enhancing supply chain efficiency to mitigate raw material price volatility. Users are specifically concerned about whether AI-driven Generative Design can rapidly produce optimal flow-path geometries that traditional CAD methods cannot easily achieve, leading to performance gains in moisture separation and reduced pressure drop. Key themes emerging from these inquiries include the expectation that AI will automate Quality Control (QC) through image recognition of surface defects, predict the remaining useful life (RUL) of hoses based on real-time sensor data, and significantly streamline inventory management and demand forecasting for aftermarket parts, thereby reducing waste and improving responsiveness to market shifts. The expectation is that AI will move demister hose manufacturing from a primarily material science challenge to a data science and predictive engineering discipline.

- AI-Driven Generative Design: Optimizes hose curvature and internal surface textures to maximize moisture separation efficiency while minimizing pressure drop and material usage, leading to lighter, more efficient components.

- Predictive Maintenance Integration: Utilizes machine learning models trained on sensor data (temperature, pressure, vibration) to forecast potential failure points or degradation in demister hoses before catastrophic failure occurs, shifting maintenance from reactive to proactive.

- Supply Chain Optimization: AI algorithms enhance procurement strategies by predicting fluctuations in polymer and reinforcement material prices (e.g., fiberglass, aramid fibers), optimizing inventory levels, and identifying the most cost-effective and reliable sourcing paths globally.

- Automated Quality Control (AQC): Implements computer vision systems on production lines to automatically inspect molded and extruded hoses for subtle surface imperfections, dimensional inaccuracies, and material inconsistencies at high speed, ensuring zero-defect output.

- Enhanced Material Performance Simulation: AI accelerates the development of new elastomer compounds by simulating material performance under various chemical and thermal stresses, reducing physical testing cycles and accelerating time-to-market for specialized hoses.

DRO & Impact Forces Of Air Demister Hose Market

The dynamics of the Air Demister Hose Market are primarily shaped by a confluence of accelerating regulatory pressures, sustained growth in target end-use industries, and inherent challenges related to raw material procurement and evolving vehicle propulsion technologies. Drivers are fundamentally rooted in the global push for enhanced machinery efficiency and reduced emissions, compelling OEMs across automotive and industrial sectors to integrate high-performance demister solutions to manage internal engine contaminants effectively. Restraints largely focus on the volatile nature of key raw material costs, especially high-grade silicone and specialized synthetic rubbers, which directly impact manufacturing margins and product pricing stability. Furthermore, the global shift towards electric vehicles (EVs) poses a long-term restraint, as EVs require less complex air and mist management systems compared to traditional Internal Combustion Engine (ICE) vehicles, potentially tempering demand growth in the dominant automotive segment post-2035. Opportunities, however, lie in specialized, high-growth niche markets, particularly aerospace, defense, and high-performance motorsports, which prioritize extreme heat resistance and superior lightweight materials, demanding bespoke, high-margin demister hose assemblies. These interwoven factors create a complex environment where technological adaptation and strategic sourcing are paramount for market participants to succeed.

The market is strongly driven by the implementation of increasingly stringent governmental regulations concerning air quality and vehicle emissions, globally exemplified by Euro 6/7 standards and EPA regulations, which mandate effective control over blow-by gases and crankcase ventilation systems to prevent environmental leakage of harmful vapors and particulate matter. This regulatory framework forces vehicle manufacturers to adopt high-efficiency demister hoses that can maintain integrity and filtration performance over extended operational periods and under extreme conditions. Furthermore, the general industrial trend toward system miniaturization and increased power density in engines and machinery means components are operating at higher temperatures and pressures, necessitating the use of specialized hose materials (like Fluorosilicone) that maintain mechanical properties far beyond the capability of conventional rubber. This escalating requirement for specialized performance drives significant value growth in the market segment focused on advanced material compositions.

However, the market's progression is frequently hampered by external impact forces, most notably the dependency on petrochemical derivatives for synthetic rubber production, exposing manufacturers to global oil market volatility and geopolitical disruptions. The significant capital investment required for precision molding and curing equipment necessary for producing intricate, high-quality demister hose assemblies also acts as a barrier to entry for smaller manufacturers. Moreover, the long design and certification cycles, especially in the demanding aerospace and heavy-duty truck sectors, require substantial commitment to research and development (R&D) and stringent testing protocols, which can slow down market responsiveness to immediate technological changes. Successfully navigating these restraints demands continuous process optimization, diversification of material suppliers, and strategic investments in automation to improve cost efficiency and uphold compliance standards across different global markets.

Segmentation Analysis

The Air Demister Hose Market is rigorously segmented based on material composition, application area, and hose type, allowing for precise market analysis tailored to specific industrial requirements and performance demands. Segmentation by material is critical as it dictates the hose's resistance to temperature, oil, chemicals, and physical abrasion, with high-performance segments relying heavily on customized polymer formulations. The application segmentation clearly delineates the market dominance of the automotive sector, while simultaneously highlighting the growing, specialized needs of the aerospace, marine, and industrial processing industries. Analyzing the market through these defined segments provides manufacturers and suppliers with actionable insights for targeted product development, resource allocation, and market penetration strategies, ensuring that product offerings align perfectly with the demanding operational environments faced by end-users.

Detailed analysis of the market segments reveals distinct trends and growth pockets. For instance, within the material segment, while EPDM hoses offer a cost-effective solution for general temperature applications, the demand growth is predominantly skewed towards silicone and fluorosilicone hoses, which command higher price points but offer unmatched reliability in extreme heat and chemical exposure (such as managing oil mist in turbo-charged engines). In terms of application, the Aftermarket segment, particularly for performance tuning and heavy-duty vehicle repair, represents a robust revenue stream characterized by higher unit margins compared to the bulk sales required for OEM contracts, demanding different distribution strategies and branding approaches tailored to end-user installers and repair professionals. This granular segmentation allows stakeholders to accurately gauge competitive dynamics and identify underserved or rapidly expanding market niches.

- By Material:

- Silicone Demister Hoses

- EPDM Rubber Demister Hoses

- Natural Rubber Demister Hoses

- Fluorosilicone Demister Hoses (For extreme chemical/oil resistance)

- Other Elastomer Blends

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles, Heavy-Duty Trucks)

- Aerospace & Defense

- Industrial Machinery and Equipment

- Marine Engines

- HVAC and Air Filtration Systems

- By Hose Type:

- Flexible Hoses (Highly maneuverable)

- Semi-Rigid Hoses

- Custom Molded Hoses (Application-specific shapes)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Air Demister Hose Market

The Value Chain of the Air Demister Hose Market begins with the highly specialized Upstream segment, dominated by petrochemical and specialty chemical companies responsible for synthesizing raw elastomers, including silicone polymers, EPDM, and fluorocarbon rubbers, along with necessary reinforcing agents, fillers, and additives like curing agents and antioxidants. Securing high-quality, consistent supplies of these foundational materials is critical, as material integrity directly determines the hose's performance characteristics (e.g., burst pressure, temperature rating). The Upstream complexity lies in maintaining stringent quality control over chemical composition and achieving necessary material certifications before compounding and formulation by primary hose manufacturers, which often involves specialized blending processes tailored to meet specific end-user performance specifications.

The Midstream segment involves the core manufacturing processes, including extrusion, braiding, winding, and precision compression molding or transfer molding, particularly for complex custom shapes. This stage requires significant investment in automated machinery, tooling (molds and dies), and quality assurance systems, such as non-destructive testing and endurance simulators. The distinction between general-purpose hose production and specialized demister hose manufacturing is crucial here, as demister products often involve multi-layered construction, specialized internal coatings, and integrated connectors. Direct sales to large OEMs (Tier 1 and Tier 2 suppliers) constitute the dominant Distribution Channel, characterized by long-term contracts, just-in-time delivery requirements, and high-volume consistency, demanding robust logistics and inventory management systems tailored to the automotive and aerospace production schedules.

The Downstream activities center around distribution and final installation. Indirect distribution channels primarily serve the global Aftermarket, utilizing vast networks of independent distributors, authorized dealers, and online performance parts retailers. The Aftermarket segment demands rapid fulfillment of a diverse inventory of repair and upgrade hoses, often necessitating complex warehousing and inventory tracking systems. Potential customers, including vehicle assembly plants, aircraft maintenance organizations (MROs), and heavy industrial repair shops, are the ultimate consumers. The value chain concludes with installation and post-sale technical support, where product performance documentation and warranty provisions are vital, particularly for safety-critical applications in the aerospace and heavy-duty transportation sectors, reinforcing the importance of supplier reliability and continuous product quality monitoring.

Air Demister Hose Market Potential Customers

Potential customers and primary buyers of Air Demister Hoses are highly concentrated within industrial sectors that operate machinery requiring stringent control over internal air quality, specifically moisture, oil, and particulate separation. The largest segment of end-users are Original Equipment Manufacturers (OEMs) within the global automotive industry, including passenger vehicle manufacturers, heavy-duty truck producers, and specialized vehicle builders (e.g., agricultural and construction machinery). These customers demand customized, high-volume hose assemblies integrated directly into engine ventilation systems (PCV, crankcase breathing) and turbocharger circuits. Their purchasing decisions are driven by factors such as material certification, adherence to strict dimensional tolerances, long-term durability validation, and highly competitive pricing structures dictated by large-scale production requirements.

Beyond the high-volume OEM market, another critical customer base comprises the global Aftermarket participants, including independent repair facilities, specialized performance tuning shops, and wholesale parts distributors. These customers seek readily available replacement hoses, often requiring higher specifications (e.g., enhanced heat resistance or higher flexibility) than the original equipment for maintenance or performance upgrades. Additionally, large-scale industrial operators, such as chemical processing plants, power generation facilities, and shipbuilding companies, constitute a significant niche segment. They utilize demister hoses for managing exhaust air from compressors, turbines, and specialized ventilation systems where moisture control is essential for preventing corrosion or equipment failure, demanding products with specific chemical resistance profiles and robust structural integrity suited for continuous, heavy-duty industrial operation.

Finally, the aerospace and defense sectors represent high-value, low-volume customers requiring the most stringent performance criteria. Aircraft manufacturers and specialized defense contractors purchase demister hoses for managing cabin air systems, engine compartments, and highly sensitive electronic cooling systems. These applications necessitate hoses made from exotic, flame-retardant, and ultra-lightweight materials (like aramid-reinforced silicone) that adhere to demanding aerospace standards (e.g., AS9100 certification). Purchasing in these sectors is characterized by long qualification periods, detailed technical specifications, and a significant emphasis on traceable documentation and supplier stability, underscoring the market's differentiation based on specific industrial compliance and performance thresholds.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flexaust, Gates Corporation, Parker Hannifin, Eaton Corporation, Contitech (Continental AG), Trelleborg AB, Vitillo, Federal Mogul (Tenneco), Mishimoto, Vibrant Performance, HPS Performance, Samco Sport, Dayco, Pirelli, Kuriyama of America, Flexfab LLC, Silicone Engineering, TIPSA, Guttas, Vetus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Demister Hose Market Key Technology Landscape

The technological landscape of the Air Demister Hose Market is defined by continuous advancements in material science, precision manufacturing, and integrated system design, aiming to optimize both flow dynamics and durability. Extrusion and calendering technologies remain central to manufacturing, particularly for flexible, long-length hoses, but the competitive edge increasingly lies in advanced compression and injection molding techniques used for producing complex, multi-angled, custom-molded hose assemblies. These custom components often integrate specialized internal features or baffles designed precisely to enhance the demisting effect through inertial separation or optimized flow turbulence, thereby improving the efficiency of moisture and oil vapor removal from the airflow stream while maintaining tight dimensional tolerances critical for modern engine packaging.

A crucial technological trend involves the development and application of high-performance elastomeric compounds. Silicone remains the benchmark for high-temperature resistance, but material science focuses heavily on enhancing its resistance to oil and unburnt hydrocarbons, leading to greater adoption of fluorosilicone elastomers (FVMQ) and specialized EPDM grades tailored for specific chemical environments. Furthermore, reinforcement technology, incorporating materials like aramid fibers (e.g., Kevlar) and high-strength polyesters within the hose wall structure, is essential for increasing burst pressure resistance and preventing collapse under high vacuum conditions encountered in turbocharged systems. Manufacturers are also implementing advanced adhesive and bonding technologies to securely integrate end-fittings and connectors, ensuring leak-proof and vibration-resistant assembly interfaces crucial for maintaining system integrity over the vehicle’s or machine’s lifespan.

Moreover, digital manufacturing processes, including 3D scanning for reverse engineering and Computer-Aided Engineering (CAE) for rigorous simulation, are becoming standard practice. Finite Element Analysis (FEA) is extensively utilized during the design phase to simulate thermal stress, vibration fatigue, and flow characteristics, minimizing the need for extensive physical prototyping and accelerating the product development lifecycle. The integration of Non-Destructive Testing (NDT) methods, such as ultrasonic inspection and advanced optical gauging, on the production line ensures consistent material thickness, integrity of reinforcement layers, and absence of internal defects, ensuring every manufactured hose meets the stringent performance and safety standards required by global OEMs and regulatory bodies in high-stakes application environments like aerospace and heavy-duty transportation.

Regional Highlights

The regional analysis of the Air Demister Hose Market reveals highly diverse growth patterns and operational characteristics driven by local automotive production capacities, the maturity of industrial sectors, and the specific regulatory frameworks governing emissions and air quality across different geographies. North America, characterized by its substantial heavy-duty truck manufacturing, significant aerospace and defense spending, and a robust performance aftermarket, holds a prominent market share in terms of value. This region demands high-specification products, often requiring specialized fire-retardant materials and compliance with complex military and federal standards (e.g., DOT, FAA). The ongoing implementation of stricter engine efficiency and emissions standards continues to stimulate demand for premium, durable demister hoses capable of handling extreme temperatures and pressures inherent in high-displacement engines.

Europe represents a mature and technologically advanced market, strongly influenced by the stringent emission targets set by the European Union, such as the upcoming Euro 7 standards, which necessitate superior efficiency in managing engine blow-by and oil mist. The region's dense concentration of luxury and high-performance automotive manufacturers (Germany, Italy, UK) drives demand for custom-molded, aesthetically refined, and highly durable silicone and fluorosilicone hoses. Furthermore, Europe leads in the adoption of sustainable materials and manufacturing practices, pushing manufacturers toward incorporating recyclable components and reducing the carbon footprint of hose production, aligning with broader industrial sustainability goals and consumer preferences for eco-friendly engineered solutions.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, propelled by rapidly increasing vehicle production and industrialization, particularly in emerging economies like China, India, and ASEAN nations. This market is characterized by mass-volume demand, often prioritizing cost-effectiveness alongside functionality, driving the high production of EPDM and standard rubber demister hoses for entry-level and mid-range vehicle segments. However, the increasing presence of global automotive brands and the adoption of advanced emission technologies in these countries are simultaneously stimulating high demand for premium silicone demister hoses for high-specification engines. APAC also serves as the global manufacturing hub for many international hose suppliers, benefiting from localized production and extensive supply chain infrastructure that supports high-volume output.

- North America: Market dominance driven by heavy-duty trucking and aerospace industries; stringent safety and emissions regulations (EPA); strong demand for specialized, certified hose assemblies; robust aftermarket for performance upgrades.

- Europe: High-value market focused on premium automotive sectors and adherence to advanced Euro emission standards; growing adoption of sustainable materials; significant R&D investment in material science and precision molding techniques.

- Asia Pacific (APAC): Highest growth trajectory due to expanding automotive manufacturing and rapid industrialization in China and India; balance between high-volume, cost-effective standard hoses and growing demand for premium silicone products in high-spec vehicles.

- Latin America (LATAM): Emerging market driven by growth in the commercial vehicle and mining sectors; demand sensitive to economic fluctuations and local regulatory updates; focus on durable, reliable components suitable for challenging operating conditions.

- Middle East and Africa (MEA): Niche market driven primarily by the oil and gas industry, infrastructure development, and defense spending; requirement for hoses that withstand extreme desert temperatures and chemical exposure; reliance on imports for specialized products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Demister Hose Market.- Flexaust

- Gates Corporation

- Parker Hannifin Corporation

- Eaton Corporation

- Contitech (Continental AG)

- Trelleborg AB

- Vitillo

- Federal Mogul (Tenneco Inc.)

- Mishimoto

- Vibrant Performance

- HPS Performance

- Samco Sport

- Dayco

- Pirelli

- Kuriyama of America

- Flexfab LLC

- Silicone Engineering

- TIPSA

- Guttas

- Vetus

Frequently Asked Questions

Analyze common user questions about the Air Demister Hose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Silicone demister hoses over EPDM hoses?

Silicone demister hoses offer superior heat resistance, flexibility, and longevity, particularly in high-temperature engine compartments. While EPDM is more cost-effective and offers good chemical resistance, silicone retains its mechanical properties better under extreme thermal cycling and resists permanent deformation, making it preferred for high-performance and critical applications like managing oil mist in turbo systems.

How is the growth of Electric Vehicles (EVs) impacting the demand for Air Demister Hoses?

The long-term shift toward EVs is anticipated to restrain volume growth in the traditional automotive segment, as electric powertrains do not require the complex crankcase ventilation and demisting systems found in Internal Combustion Engines (ICE). However, growth in specialized industrial, aerospace, and high-performance ICE sectors, along with HVAC applications in large EVs, will partially offset this decline, focusing market demand on higher-value, niche products.

Which material provides the best resistance to oil and chemical contamination for demister hose applications?

Fluorosilicone elastomers (FVMQ) provide the best combined resistance to high temperatures and aggressive chemical exposure, specifically petroleum-based oil and fuels. This material is typically utilized in extreme operating environments, such as aerospace engines or heavy-duty industrial machinery, where standard silicone or EPDM compounds would quickly degrade, ensuring reliable long-term performance.

What is the significance of custom molded hoses in the current market landscape?

Custom molded hoses are increasingly significant because they allow for precise routing and fitment within highly constrained and complex modern engine bays, minimizing installation time and optimizing airflow dynamics. They offer superior performance compared to flexible hoses by maintaining a consistent internal diameter and eliminating potential kink points, which is crucial for maximizing the efficiency of the demisting function and reducing pressure losses.

What are the main drivers of pricing volatility in the Air Demister Hose market?

Pricing volatility is primarily driven by fluctuations in the global price of key upstream raw materials, particularly silicone polymers and synthetic rubbers, which are derivatives of petrochemical processes. Additionally, energy costs associated with the high-temperature curing and molding processes, along with tariffs and global supply chain disruptions, significantly influence the final product pricing across all market segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager