Air Filter Regulators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434769 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Air Filter Regulators Market Size

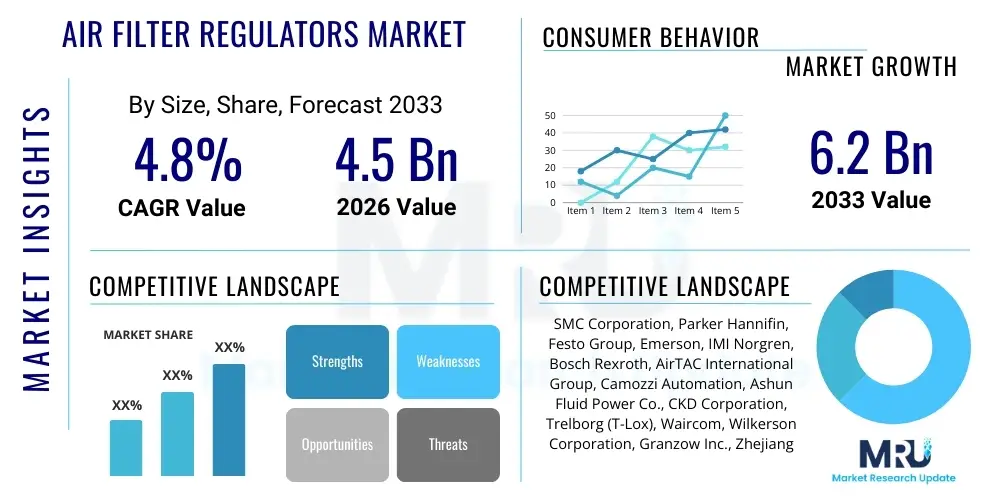

The Air Filter Regulators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Air Filter Regulators Market introduction

Air Filter Regulators, critical components in pneumatic systems, serve the indispensable function of preparing compressed air before it reaches the final operational machinery, tools, or actuators. These integrated units, frequently combined with lubricators to form FRL assemblies (Filter, Regulator, Lubricator), are tasked with three primary functions: removing contaminants (particulate matter, moisture, and oil aerosols), precisely adjusting the system pressure to meet specific application requirements, and optionally, introducing lubrication to extend the life of downstream tools. The necessity of clean, dry, and consistently regulated air cannot be overstated, as contaminated or fluctuating air supplies are the leading causes of component failure, premature wear, and efficiency degradation in sophisticated pneumatic networks across all industrial sectors. The effectiveness of the air filter regulator directly correlates with the overall reliability and longevity of the factory floor equipment it serves, cementing its foundational role in modern industrial operations.

The products available in the Air Filter Regulators Market range from basic, manual drain filters and standard spring-operated regulators to highly complex, electro-pneumatic precision regulators equipped with advanced digital display interfaces and proportional control capabilities. Product differentiation is primarily driven by maximum flow capacity, filtration efficiency (measured in microns), material compatibility (e.g., stainless steel for corrosive environments), and maximum working pressure ratings, catering to diverse needs from light assembly robotics to heavy-duty mining equipment. Major applications are concentrated in industries where compressed air is central to manufacturing processes, including automated assembly lines in the automotive industry, precise control and movement in the packaging sector, and hygienic handling in the food and beverage industry. These applications demand zero tolerance for air quality compromise, compelling end-users to invest in high-performance filter regulators that comply with stringent sector-specific standards.

Market expansion is principally driven by the global wave of industrial automation, marked by the increasing installation of pneumatic machinery in emerging economies and the continuous upgrading of legacy systems in developed industrial regions. The benefits derived from utilizing high-quality air filter regulators—including substantial reductions in machine downtime, minimization of pneumatic seal erosion, and significant energy savings achieved through optimized pressure management—provide a compelling economic justification for sustained investment. Furthermore, increasingly strict international environmental and worker safety standards mandate the use of efficient, low-leakage pneumatic components. This regulatory pressure, combined with the technological shift toward incorporating smart sensors for real-time performance monitoring, ensures a steady demand cycle for technologically advanced and highly reliable air preparation units worldwide, underpinning the projected market growth trajectory throughout the forecast period.

Air Filter Regulators Market Executive Summary

The Air Filter Regulators Market is navigating a transformative period characterized by a strategic pivot towards smart, connected components essential for implementing Industry 4.0 paradigms. Key business trends include the convergence of mechanical robustness with digital intelligence, leading to the proliferation of modular FRL units embedded with IO-Link communication protocols and diagnostic sensors. This technological evolution allows manufacturers to offer comprehensive air management solutions that extend beyond simple pressure control to include predictive maintenance services, remote diagnostics, and detailed operational reporting. Furthermore, sustainability is an increasing driver, pushing R&D towards developing ultra-low leakage regulators and filter designs that minimize pressure drop, directly contributing to energy conservation in large industrial compressed air systems, thus creating premium market segments focused on ecological performance and Total Cost of Ownership (TCO) optimization.

Geographically, market dynamics are bifurcated: high-volume growth is centered in the Asia Pacific (APAC) region, capitalizing on rapid greenfield industrialization and massive state-backed investments in manufacturing capacity, particularly in China and India. In contrast, mature markets such as North America and Europe demonstrate growth driven primarily by high-value replacement demand and the mandatory adoption of advanced technology. These regions exhibit strong demand for precision regulators in specialized sectors like aerospace and pharmaceuticals, where regulatory oversight on process control and air purity is extremely rigid. The European market, supported by strong regulations promoting resource efficiency, shows a distinct preference for modular, high-efficiency FRL systems capable of seamlessly integrating into existing sophisticated factory automation setups, thereby setting the technological benchmark for global competitors and driving regional market stability and revenue quality.

Segment-wise, the FRL Combination Unit segment maintains its dominance due to the advantages of single-point installation and guaranteed operational compatibility among the components, simplifying procurement and maintenance for end-users. The high-pressure regulator segment is experiencing accelerated growth, fueled by applications in heavy industries such as oil and gas, shipbuilding, and automotive tire manufacturing, which require higher operating pressures and exceptional component durability under extreme load conditions. The end-user landscape confirms the Automotive and Machinery Manufacturing sectors as anchor clients, yet the Food & Beverage and Pharmaceutical segments are becoming increasingly vital. These sensitive industries are demanding specialized filter regulators constructed from materials such as stainless steel, featuring higher particle filtration efficiency (often 0.1 microns or less) and specific coatings to withstand rigorous sanitation procedures, thereby driving innovation in non-standard product lines and creating lucrative, specialized market niches.

AI Impact Analysis on Air Filter Regulators Market

Common inquiries surrounding the role of Artificial Intelligence in the Air Filter Regulators Market invariably highlight the potential for enhanced operational autonomy and optimized energy consumption within large-scale industrial compressed air networks. Users frequently ask how machine learning algorithms can analyze pressure fluctuation data, monitored through smart regulators, to accurately predict impending filter exhaustion or internal component wear months in advance. The core expectation is that AI will shift the current reactive or time-based maintenance model to a highly efficient, condition-based approach. Users are actively exploring solutions where historical data, combined with real-time operational context (such as production schedules and machine tool usage), allows the AI to recommend optimal pressure settings that minimize air consumption while guaranteeing adequate pneumatic force for all operational tasks, thereby striking a crucial balance between throughput and cost efficiency.

The transformative effect of AI on the market lies predominantly in its ability to generate actionable intelligence from the massive datasets produced by IoT-enabled filter regulators. These devices capture not only standard metrics like pressure and flow but also granular data related to temperature, vibration, and differential pressure across the filter media. AI algorithms process these complex data streams to detect subtle anomalies that precursors to system failure or significant air leakage, which are traditionally difficult for human operators to identify. By utilizing pattern recognition and predictive modeling techniques, AI systems can automatically trigger maintenance alerts, order replacement components, or even initiate localized pressure adjustments via electro-pneumatic regulators, minimizing human error and ensuring continuous performance stability of the pneumatic system, which is vital for uninterrupted production schedules in modern high-speed facilities.

Furthermore, AI plays a pivotal role in democratizing best practices for energy management across vast industrial footprints. Since compressed air generation can account for a significant portion of a factory’s total energy bill, optimizing regulator performance is critical for corporate sustainability objectives. AI systems analyze the collective performance of hundreds or thousands of regulators within a facility, identifying systemic inefficiencies, recommending appropriate regulator sizing for specific tools, and calculating the precise monetary savings achieved through targeted pressure reductions. This level of data-driven optimization, enabled by AI interfacing with smart regulators, empowers facilities managers to make evidence-based decisions regarding system layout, component selection, and operational parameters, effectively monetizing the data generated by the installed base of advanced filter regulators and driving the demand for regulators with native AI compatibility.

- AI algorithms predict component failure (e.g., diaphragm wear, filter clogging) by analyzing real-time pressure decay curves and differential pressure readings transmitted by smart regulators.

- Machine learning models dynamically adjust regulator output pressures based on tool requirements and variable production loads, resulting in significant energy savings and reduced compressor strain.

- Integrated diagnostic features, supported by AI, facilitate automatic leak detection within the pneumatic network monitored by the upstream filter regulators, improving system integrity.

- AI enhances system calibration efficiency by providing automated recommendations for optimizing regulator setpoints during commissioning and scheduled system adjustments.

- The technology enables advanced anomaly detection in air quality metrics, ensuring compliance standards are met, particularly in critical sectors like semiconductor manufacturing and food processing.

DRO & Impact Forces Of Air Filter Regulators Market

The dynamics of the Air Filter Regulators Market are currently defined by strong foundational drivers, specific market restraints, and powerful technological opportunities, which together constitute the defining impact forces. The primary and most potent driver is the unrelenting global commitment to industrial efficiency and the expansion of automated production lines, especially in high-growth manufacturing hubs across APAC and Latin America. Every new pneumatic tool or machine installation requires a dedicated air preparation unit, ensuring constant baseline demand. Simultaneously, increased awareness and regulatory pressure regarding workplace safety and the necessity of high-quality compressed air (to prevent contamination and tool degradation) further stimulate the adoption of high-performance, precision FRL units, effectively expanding the total addressable market and driving premium product sales across all major industrial verticals.

However, market growth is consistently constrained by two significant factors. Firstly, the ongoing operational expenditure associated with the replacement of filter elements—which must be changed periodically to maintain air quality—often presents a deterrent for budget-sensitive SMEs, encouraging them to seek low-cost, less effective solutions, or delay necessary maintenance. Secondly, technological competition from alternative actuation methods, predominantly electric linear actuators, poses a long-term threat in certain high-precision, low-force applications where electric alternatives offer superior control and energy efficiency without the dependency on compressed air infrastructure. This substitution risk compels pneumatic component manufacturers to continually innovate in terms of energy efficiency and operational simplicity to clearly articulate the TCO benefits and inherent robustness of pneumatic systems equipped with modern regulators.

The most compelling opportunity lies in the seamless integration of FRL technology into the Industrial Internet of Things (IIoT). The development of regulators equipped with integrated sensors and communication capabilities (Smart FRLs) unlocks new service revenue models, enabling manufacturers to transition from pure component sales to offering comprehensive air management services and data analytics subscriptions. This shift not only justifies higher component pricing but also deepens the relationship between supplier and end-user through continuous value provision. The convergence of these factors creates significant impact forces: the positive push from automation and regulatory compliance outweighs the cost and technological restraints, especially as component durability and intelligence improve, ultimately guiding the market toward premium, digitally enabled solutions that promise significant returns on efficiency investments for the adopting industries worldwide.

Segmentation Analysis

Segmentation analysis for the Air Filter Regulators Market is critical for understanding the varied demand structure dictated by different industrial processes and operational requirements globally. The market is primarily categorized based on the physical configuration of the product, the performance capability in terms of pressure handling, and the specific application sector. By product, the market is dissected into three main categories: integrated FRL combination units, which are the market mainstay due to their compact nature and functional completeness; Filter Regulator (FR) units, often used when lubrication is provided elsewhere or not required; and standalone Filters or Regulators, which cater primarily to replacement demands or highly customized system designs requiring separate positioning of components. This structural segmentation allows manufacturers to tailor marketing and distribution strategies based on installation complexity and customer preference.

Further segmentation by performance metrics focuses on the required level of pressure management. Standard regulators, designed for typical industrial pressures up to 10 Bar, dominate the volume segment, catering to general manufacturing and tooling applications. Conversely, high-pressure regulators, built to manage 16 Bar, 25 Bar, or even higher, address niche, high-value applications such as deep-sea exploration equipment, heavy vehicle brake systems, and specialized metal forming processes. This pressure-based distinction is crucial as it involves significant differences in materials science, seal technology, and safety certifications. Material segmentation is also vital, distinguishing between standard aluminum/zinc die-cast bodies for general use and stainless steel construction mandatory for sterile processing or extreme chemical resistance, directly influencing product pricing and market suitability across diverse global operating environments.

- By Product Type:

- Filter Regulator (FR) Units

- Filter, Regulator, Lubricator (FRL) Combination Units

- Standalone Air Filters (Particulate, Coalescing, Adsorption)

- Standalone Air Regulators (Standard, Precision, Proportional)

- Dedicated Lubricator Units

- By Pressure Type:

- Standard Pressure Regulators (Up to 10 Bar / 150 psi)

- Medium Pressure Regulators (10 Bar to 16 Bar)

- High Pressure Regulators (Above 16 Bar)

- By Port Size:

- Small Port Size (Up to 1/4 inch NPT/G)

- Medium Port Size (3/8 inch to 1/2 inch NPT/G)

- Large Port Size (3/4 inch NPT/G and above)

- By End-User Industry:

- Automotive and Transportation Manufacturing (Body shops, assembly, painting)

- Machinery and Equipment Manufacturing (CNC machines, robotics, fabrication)

- Food and Beverage Processing (Packaging, sterile handling, automation)

- Pharmaceutical and Healthcare (Cleanroom applications, medical devices)

- Chemical and Petrochemical Industry (Hazardous areas, corrosive environments)

- Aerospace and Defense (High-precision assembly, testing equipment)

- Textile and Packaging Industries

Value Chain Analysis For Air Filter Regulators Market

The value chain for Air Filter Regulators is complex, commencing with the sourcing and preparation of highly specialized materials in the upstream segment. This includes precision components such as high-purity aluminum alloys and zinc for housing construction, engineering plastics (e.g., polycarbonates, nylons) for bowls and internal mechanisms, and critical filter media, which requires sophisticated manufacturing processes like sintering or advanced polymer weaving to achieve specified micron ratings. Upstream suppliers are focused on quality, consistency, and compliance with material standards, especially corrosion resistance and pressure vessel safety standards. Key value addition at this stage involves sophisticated computer-numerical control (CNC) machining and precise casting to ensure components meet the tight tolerances required for reliable sealing and precise pressure regulation, minimizing potential for internal leakage and system failures during long-term operation.

The core manufacturing and assembly stage involves integrating these components, which includes developing proprietary diaphragm designs, spring mechanisms, and valve seats that define the regulator's precision and responsiveness. Modern manufacturing practices emphasize lean assembly and rigorous, automated testing, including hydrostatic pressure testing and calibration against NIST-traceable standards, ensuring that every unit performs within its guaranteed specifications. The incorporation of electronic sensors and digital interfaces (for smart FRLs) adds a layer of complexity and high-tech value capture at this stage, requiring expertise in both fluid power dynamics and industrial electronics. This is where intellectual property, such as patented filter media designs or regulator valve configurations, differentiates market leaders from generic component suppliers, justifying premium pricing and establishing brand reputation for reliability.

Distribution constitutes the subsequent vital link, governed by a dual approach. Direct distribution channels are essential for high-volume OEM contracts and large-scale, complex projects requiring custom engineering, where the manufacturer provides intensive pre- and post-sales technical consultation. However, the majority of the market transactions, especially MRO sales and standard product procurement, rely on indirect channels: a robust network of authorized industrial distributors, pneumatic specialists, and regional MRO providers. These partners provide crucial local inventory, immediate technical support, and logistical speed, which are non-negotiable for minimizing operational downtime for end-users. The downstream activities center on installation, system integration, and the crucial aftermarket services, including the sale of replacement filters, service kits, and calibration services, ensuring continued revenue generation and customer lock-in through ongoing maintenance requirements, forming a highly valuable segment of the total market ecosystem.

Air Filter Regulators Market Potential Customers

The expansive customer base for Air Filter Regulators includes every industrial entity that relies on pneumatic power for production, ranging from heavy manufacturing giants to highly specialized laboratory environments. A primary customer group consists of large multinational Original Equipment Manufacturers (OEMs) specializing in capital goods, such as builders of industrial robots, automated packaging machinery, material handling systems, and advanced machine tools. These OEMs integrate FRL units as standard safety and performance components within their finished products. Their purchasing criteria are dominated by reliability, compact form factor, international certifications (e.g., CE, UL), and the global availability of support and spare parts, making them highly strategic customers who often require extensive technical collaboration during the design and integration phases to ensure seamless compatibility and optimum performance under varied operational stress conditions.

The second substantial customer segment is the collective universe of End-User Facilities and their associated Maintenance, Repair, and Operations (MRO) departments. These include vast automotive assembly plants, major food and beverage processing facilities, chemical plants, and general fabrication workshops. These customers purchase regulators for two distinct needs: expansion of existing lines and routine component replacement. For MRO buyers, the critical purchasing drivers are immediate availability, interchangeability with legacy systems, ease of installation, and proven long-term durability, minimizing the frequency and complexity of future maintenance interventions. Their reliance on local distributors for rapid supply chain responsiveness makes the distributor network’s efficiency a direct factor in their purchasing decisions, often favoring brands with well-established and localized stocking capabilities.

A third, highly specialized customer category includes entities operating in tightly regulated or extreme environments, such as pharmaceutical manufacturers, electronics fabrication facilities (cleanrooms), and offshore oil and gas platforms. These segments demand highly customized filter regulators: pharmaceuticals require components compliant with stringent hygienic standards, often constructed of specialized stainless steel and equipped with ultra-fine filtration (e.g., 0.01 micron ratings) to prevent micro-contamination of products. Similarly, oil and gas customers require regulators certified for hazardous (Ex-proof) locations, capable of enduring corrosive salt spray, high vibration, and extreme temperature swings. Although smaller in volume, these customers typically represent high-margin sales due to the technical expertise and compliance requirements embedded in the product specifications, driving focused innovation among specialized FRL providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMC Corporation, Parker Hannifin, Festo Group, Emerson, IMI Norgren, Bosch Rexroth, AirTAC International Group, Camozzi Automation, Ashun Fluid Power Co., CKD Corporation, Trelborg (T-Lox), Waircom, Wilkerson Corporation, Granzow Inc., Zhejiang Sanlixin, STNC, Peninsular Cylinder, Master Pneumatic, Pisco, Shavo Norgren |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Filter Regulators Market Key Technology Landscape

The contemporary technology landscape for Air Filter Regulators is defined by continuous advancements in three core areas: filtration efficiency, pressure control precision, and digital connectivity. In filtration, the adoption of multi-stage filtration units, combining particulate removal with high-performance coalescing stages, has become standard practice for protecting sensitive equipment. Manufacturers are leveraging nanotechnology and specialized fiber compositions to create filter elements that achieve 99.99% oil mist removal at 0.01 micron while maintaining low differential pressure and extending service intervals. Furthermore, automatic condensate draining systems, moving away from simple mechanical floats to electronically controlled pilot valves, ensure reliable moisture removal even under high flow rates, preventing water carryover which is detrimental to pneumatic system integrity and overall performance.

In the regulation technology sphere, the focus is heavily on enhancing responsiveness and stability. Advanced regulators now incorporate balanced poppet valve designs that minimize the effect of inlet pressure variations on the downstream regulated pressure (supply pressure effect), crucial for maintaining consistent operation of pneumatic tooling. For high-precision applications, the shift towards proportional electro-pneumatic regulators is significant. These devices utilize embedded microprocessors and solenoid valves to precisely control outlet pressure based on an electronic signal (e.g., 4-20mA or 0-10V), offering instantaneous and remote pressure adjustment capabilities far superior to traditional manual spring-loaded regulators, enabling dynamic process control required in high-speed and quality-critical manufacturing environments like semiconductor fabrication and robotic assembly.

The most disruptive technological trend is the seamless integration of sensing and communication capabilities, transforming the FRL into a vital node within the Industrial Internet of Things (IIoT). Modern filter regulators are equipped with non-contact sensors to monitor pressure, temperature, and flow, providing diagnostic data via open standards like IO-Link. This data is leveraged for sophisticated predictive maintenance models, allowing facility operators to schedule filter changes based on measured pressure drop rather than fixed calendar schedules, maximizing filter life and minimizing waste. Moreover, the modular design philosophy, utilizing standardized interfaces and quick-connect mechanisms, simplifies maintenance, reduces the number of leak points compared to traditional pipe connections, and allows end-users to easily customize FRL stacks to meet evolving operational demands without extensive retooling, thereby optimizing the total installed cost and long-term operational expenditure for complex pneumatic infrastructures.

Regional Highlights

The Asia Pacific (APAC) region stands out as the primary engine of volume growth in the Air Filter Regulators Market, driven by unprecedented rates of industrial expansion and manufacturing migration. Countries like China, which has heavily invested in automation to counter rising labor costs, and India, with its rapidly growing automotive and infrastructure sectors, are constantly installing new production lines requiring millions of filter regulator units. The regional demand is characterized by a need for cost-effective, durable, and highly reliable FRL components that can withstand demanding production schedules in diverse operational climates. Local manufacturers are rapidly closing the technological gap with international players, focusing particularly on mid-range and standard pressure regulators, although premium demand for specialized high-purity regulators in electronics and pharmaceutical manufacturing remains robust, ensuring the APAC region's pivotal role in shaping global market dynamics for the foreseeable future.

North America and Europe, while growing at more modest volume rates, dominate the market in terms of value, owing to high adoption rates of premium, technologically advanced filter regulators. In North America, strict environmental regulations and high labor costs necessitate the use of advanced, energy-efficient pneumatic systems. The market is concentrated on sophisticated components that enable predictive maintenance and integrated system diagnostics, particularly favored in the aerospace, heavy machinery, and high-tech manufacturing sectors across the US and Canada. The European market, guided by EU directives on energy efficiency (e.g., maximizing compressor efficiency and minimizing system leakage), exhibits a pronounced preference for proportional regulators and modular FRL systems that offer superior control repeatability and verifiable energy savings, emphasizing TCO over initial acquisition cost and reinforcing the region's position as a hub for regulatory-driven technological uptake.

Emerging markets in Latin America and the Middle East & Africa (MEA) offer substantial, untapped potential, though growth is susceptible to regional economic volatility. Latin America's market health is intrinsically linked to investments in its core resource industries—mining, oil and gas, and agriculture—which require rugged, high-flow, and durable regulators capable of operating in harsh outdoor environments. In the MEA region, particularly the Gulf nations, economic diversification efforts are driving investment into new manufacturing, logistics, and infrastructure projects, generating new demand. Here, specialized FRL units designed to handle extreme ambient temperatures and high levels of atmospheric dust and sand are critical requirements. While volume remains lower compared to APAC, the complexity and specialized nature of the components required for these environmental challenges translate into high-value opportunities for manufacturers capable of providing robust, certified solutions tailored to regional operational demands.

- Asia Pacific (APAC): Highest volume consumer due to new factory construction and robotics adoption in China, India, and Southeast Asia; strong demand for both standard and high-purity regulators.

- North America: High-value market focused on smart FRL solutions, driven by aerospace, automotive, and regulatory push towards energy optimization and remote diagnostic capabilities.

- Europe: Driven by stringent efficiency regulations and industrial compliance, leading to high adoption of precision proportional regulators and modular pneumatic systems for advanced manufacturing.

- Latin America: Demand concentrated in mining, oil & gas, and domestic automotive sectors, requiring robust, reliable equipment often operating under challenging environmental and logistical conditions.

- Middle East & Africa (MEA): Growth tied to infrastructure development and petrochemical investments, necessitating equipment resistant to extreme heat and dust, focusing on durability and certified safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Filter Regulators Market.- SMC Corporation

- Parker Hannifin Corporation

- Festo Group

- Emerson Electric Co.

- IMI Norgren (now part of IMI plc)

- Bosch Rexroth AG

- AirTAC International Group

- Camozzi Automation S.p.A.

- CKD Corporation

- Ashun Fluid Power Co., Ltd. (Airtac)

- Trelborg (T-Lox)

- Waircom

- Wilkerson Corporation

- Granzow Inc.

- Zhejiang Sanlixin Co., Ltd.

- STNC Pneumatic

- Peninsular Cylinder Co.

- Master Pneumatic Inc.

- Pisco Co., Ltd.

- Shavo Norgren

Frequently Asked Questions

Analyze common user questions about the Air Filter Regulators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Air Filter Regulators Market?

The Air Filter Regulators Market is projected to achieve a robust Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period spanning from 2026 to 2033. This growth is primarily attributed to the pervasive need for optimized pneumatic systems in manufacturing and compliance with stringent operational quality standards globally.

Which industry segment is the largest consumer of Air Filter Regulators?

The Machinery and Equipment Manufacturing sector, alongside the Automotive and Transportation industry, represents the largest consumer segment. These industries require regulated, contaminant-free compressed air to protect critical components like robotic actuators, assembly tools, and intricate control systems from wear and moisture damage, necessitating continuous investment in high-quality FRL units.

How does the integration of IoT impact the Air Filter Regulator technology landscape?

IoT integration enables smart regulators to monitor and communicate real-time operational data, facilitating predictive maintenance by forecasting filter life based on pressure drop analysis. This shift allows dynamic pressure optimization, significantly enhancing system energy efficiency and alignment with advanced Industry 4.0 automation architectures.

What are the primary factors restraining the market growth?

Key restraints include the relatively high ongoing costs associated with mandatory periodic replacement of high-efficiency filter elements, which impacts MRO budgets, and the increasing competitive pressure from more energy-efficient electric linear actuators displacing pneumatic components in certain specific high-precision industrial applications.

Why is the Asia Pacific region dominating the market volume?

The Asia Pacific region dominates market volume due to extensive greenfield investment in industrial infrastructure and the rapid growth of automation in manufacturing facilities, particularly in rapidly industrializing nations such as China and India, leading to high initial procurement volumes of FRL units for new production line installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager