Air Filters and Filtration Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432974 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Air Filters and Filtration Equipment Market Size

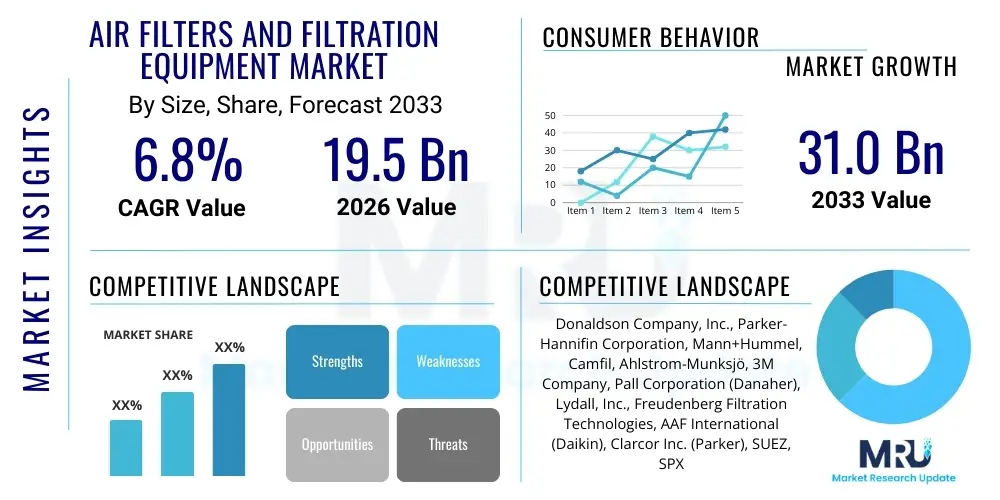

The Air Filters and Filtration Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $19.5 Billion in 2026 and is projected to reach $31.0 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global awareness regarding air quality, stringent regulatory standards imposed by governmental bodies, and the expansion of industrial and manufacturing activities, particularly in emerging economies. The necessity for high-efficiency particulate air (HEPA) filters in critical environments such as healthcare and pharmaceuticals further contributes significantly to market valuation.

Air Filters and Filtration Equipment Market introduction

The Air Filters and Filtration Equipment Market encompasses devices and systems designed to remove particulate matter, volatile organic compounds (VOCs), gases, and other contaminants from the air stream in various settings, ranging from residential HVAC systems to highly specialized industrial processes. These systems are crucial for ensuring compliance with occupational safety standards, protecting sensitive equipment from dust and corrosion, and maintaining public health by minimizing exposure to airborne pollutants. Key products include mechanical filters, electronic air cleaners, and gas-phase filtration units, utilized across a vast spectrum of applications including commercial buildings, heavy industry, automotive systems, and sterile manufacturing environments. The fundamental benefit provided by these products is the improvement of Indoor Air Quality (IAQ) and the efficiency enhancement of industrial machinery.

The core product description revolves around the media used, such as fiberglass, synthetic fibers, carbon, and specialized polymers, engineered to capture contaminants based on size, inertia, diffusion, and electrostatic attraction. Major applications span critical infrastructure, including hospitals requiring ultra-clean environments, power plants mitigating particulate emissions, and data centers needing protection against dust accumulation which can lead to equipment failure. The continued push toward energy efficiency drives demand for advanced filtration equipment that minimizes pressure drop while maintaining high efficiency, thus reducing the energy load on HVAC systems and industrial ventilation apparatus.

Driving factors for sustained market growth include escalating urbanization, leading to higher pollution concentrations, coupled with stricter environmental protection laws, especially concerning industrial emissions and workplace air quality. Furthermore, the global recognition of the impact of airborne pathogens, notably post-pandemic, has heightened demand for high-efficiency filtration solutions (e.g., MERV 13 and HEPA standards) in commercial, institutional, and residential settings. Technological innovations, such as smart filters integrated with IoT sensors for predictive maintenance and performance monitoring, are also accelerating adoption rates across mature and developing markets.

Air Filters and Filtration Equipment Market Executive Summary

The Air Filters and Filtration Equipment Market exhibits robust growth, primarily fueled by global mandates for environmental protection and worker safety, coupled with rapid industrialization in the Asia Pacific region. Business trends indicate a strong move toward advanced synthetic media and sustainable, recyclable filter designs, driven by corporate environmental, social, and governance (ESG) goals. Key strategic activities involve mergers and acquisitions aimed at consolidating specialized technology portfolios, particularly in the HEPA and Ultra-Low Penetration Air (ULPA) filtration segments, alongside increased investment in digital integration to offer filter performance monitoring and automated replacement scheduling services to B2B customers. Demand is bifurcated, with stable replacement cycles in mature markets and rapid expansion in new installations across industrial and commercial construction sectors globally.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to escalating air pollution levels in major economies like China and India, coupled with significant investments in manufacturing and infrastructure development, which necessitate improved industrial ventilation and particulate control. North America and Europe maintain dominance in terms of technological adoption and market maturity, characterized by stringent air quality regulations (e.g., EU's Industrial Emissions Directive and EPA standards) driving the adoption of premium, energy-efficient filtration solutions. The Middle East and Africa (MEA) are emerging due to massive construction projects and expanding oil and gas industries requiring specialized filtration equipment to operate efficiently in harsh, dusty environments.

Segmentation trends reveal that the HVAC filtration segment dominates the market share due to its ubiquitous application in commercial and residential infrastructure, with significant growth observed in the high-efficiency particulate air (HEPA) filter sub-segment following increased regulatory focus on airborne health hazards. The industrial manufacturing segment, particularly power generation and cement production, constitutes a major revenue stream, driven by mandatory emission control technologies. Material-wise, synthetic media are rapidly gaining preference over traditional cellulose materials due to superior moisture resistance and durability, contributing to longer service life and reduced operational costs for end-users.

AI Impact Analysis on Air Filters and Filtration Equipment Market

User inquiries regarding AI's impact frequently center on how machine learning algorithms can optimize filter maintenance, predict filter failure, and enhance overall system efficiency in complex HVAC and industrial environments. Common themes include the potential for AI to analyze real-time air quality data (e.g., particulate concentration, differential pressure) transmitted via IoT sensors to determine the precise optimal time for filter replacement, moving away from time-based or fixed differential pressure thresholds. Users are also keen on understanding how AI can optimize filter selection based on specific environmental profiles and how generative AI might assist in designing next-generation filtration media with enhanced capture efficiency and minimal pressure drop. The consensus expectation is that AI integration will fundamentally shift the industry from reactive maintenance models to highly proactive, data-driven performance management, potentially reducing operational expenditure significantly for large facility managers.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to revolutionize the maintenance and operation phases within the air filtration market. AI algorithms are deployed to process vast amounts of data collected from smart sensors embedded in filtration systems. This data includes flow rate, particulate loading, energy consumption of the fans, and pressure drop across the filter media. By analyzing these complex datasets, AI can create highly accurate predictive models that forecast the remaining useful life of a filter, ensuring filters are replaced precisely when their efficiency drops below optimal levels or when the energy cost associated with the pressure drop becomes uneconomical. This predictive capability minimizes premature replacements, maximizes filter life, and ensures continuous compliance with air quality standards, offering substantial economic benefits to industrial operators and building managers.

Furthermore, AI-driven systems contribute significantly to energy optimization. By continuously monitoring the relationship between fan speed, air quality requirements, and filter loading, AI can dynamically adjust the ventilation system parameters. This fine-tuning minimizes the parasitic load placed on the system by heavily loaded filters, which traditionally requires fans to work harder, consuming more electricity. In industrial settings, AI enables sophisticated fault detection and diagnostics, alerting maintenance teams to potential issues not only with the filter itself but also with associated components like dampers and fan belts, thereby ensuring the filtration system operates at peak effectiveness and reducing unplanned downtime, a critical factor in sensitive manufacturing environments.

- AI-powered predictive maintenance minimizes unscheduled downtime and optimizes filter replacement timing.

- Machine learning algorithms enhance energy efficiency by dynamically controlling HVAC fan speeds based on real-time filter loading.

- IoT sensor data, analyzed by AI, enables precise monitoring of pressure drop and contaminant levels, ensuring regulatory compliance.

- AI facilitates advanced fault detection and diagnostics within complex filtration and ventilation infrastructure.

- Generative AI tools are being utilized to simulate and optimize novel filter media designs for higher efficiency and lower resistance.

- Data analytics driven by AI provides insights into long-term air quality trends, supporting better strategic investment in filtration technology.

DRO & Impact Forces Of Air Filters and Filtration Equipment Market

The market is fundamentally driven by stringent government regulations mandating clean air standards, coupled with increasing public and corporate awareness regarding the adverse health effects of air pollution and the need for improved IAQ. Restraints include the high initial installation cost of specialized, high-efficiency filtration systems (e.g., HEPA and activated carbon units) and the need for frequent replacement of filter media, contributing to high operational expenditures. Opportunities lie in the rapidly expanding construction sector, particularly in emerging economies, the development of sustainable and biodegradable filter materials, and the increasing demand for smart, connected filtration solutions integrated with building management systems. These forces collectively exert significant impact, necessitating continuous innovation in filter media technology and system efficiency to balance performance requirements with cost constraints and environmental sustainability goals.

Drivers: The primary driver remains the escalating level of air pollution globally, both outdoor and indoor, stemming from industrial emissions, vehicular traffic, and natural events. Regulatory bodies worldwide are implementing stricter emission control standards for industrial stacks (e.g., relating to PM2.5 and PM10), compelling industries such as power generation, cement, and metal processing to invest heavily in robust dust collectors and baghouse filtration systems. Furthermore, the commercial sector, including offices, schools, and retail, is increasingly adopting high-efficiency HVAC filters (MERV 13 and above) to meet post-pandemic health guidelines, thus providing a consistent, high-volume demand stream for replacement filters.

Restraints: Despite the benefits, market growth is often hampered by the operational expense associated with filtration systems. The recurring cost of replacing filters, especially high-efficiency ones, can be substantial. Moreover, the lack of awareness or reluctance among small and medium-sized enterprises (SMEs) to invest in high-quality filtration, often prioritizing lower-cost, less efficient alternatives, acts as a brake on premium segment expansion. Technical challenges, such as the disposal of contaminated filter waste which is often classified as hazardous material and requires specialized handling, also pose logistical and cost restraints for end-users.

Opportunities: Significant opportunities exist in the transition towards sustainable filtration solutions, focusing on materials that are easier to recycle or are inherently biodegradable, aligning with global circular economy goals. The rapid digitalization of infrastructure presents a chance for manufacturers to capture recurring revenue through service contracts centered on predictive maintenance and remote monitoring via IoT and cloud platforms. Emerging applications in niche areas, such as advanced air purification within electric vehicle (EV) cabins and specialized pharmaceutical manufacturing cleanrooms, also represent high-value growth potential. Impact forces are concentrated around technological advancements; competitive differentiation is increasingly achieved through superior performance (lower pressure drop) and integration capabilities (smart systems).

Segmentation Analysis

The Air Filters and Filtration Equipment Market is extensively segmented based on product type, application, end-use sector, and material, reflecting the diversity of operational environments and contaminant challenges globally. Product segmentation distinguishes between mechanical filters (like pleated and panel filters), specialized media (such as HEPA, ULPA, and activated carbon), and equipment systems (including dust collectors and baghouse filters). This structure allows for precise mapping of demand drivers, where HEPA and activated carbon units are crucial for indoor quality and safety, while heavy-duty dust collectors address industrial emissions compliance. The complexity of industrial processes necessitates highly specialized and robust equipment, contrasting with the high-volume, standardized needs of the HVAC sector.

Segmentation by application clearly delineates the market’s primary verticals, with HVAC systems dominating in sheer volume, driven by residential and commercial building requirements. Industrial manufacturing, however, accounts for significant revenue due to the high cost and bespoke nature of the required filtration equipment, often integrated directly into production lines. The healthcare and pharmaceutical sectors are pivotal, demanding the highest efficiency filters (ULPA/HEPA) under stringent regulatory oversight to maintain sterile environments. Analyzing these segments is crucial for understanding investment priorities, as the growth rate in the healthcare application is typically high-value and non-cyclical, whereas industrial demand is often tied to capital expenditure cycles.

Further analysis by end-use sector categorizes demand into Residential, Commercial, and Industrial. Industrial use typically demands the largest, most robust, and highest maintenance cost systems. Commercial applications require balanced efficiency and energy conservation, prioritizing MERV 13+ filters for employee health and building efficiency. Residential demand, while price-sensitive, is increasingly adopting higher-quality portable and whole-house filtration systems, driven by growing awareness of the effects of poor IAQ and increasing incidences of respiratory illnesses. The granular breakdown of these segments provides manufacturers with targeted strategies for product development and market penetration in specific high-growth areas like smart commercial buildings and specialized cleanroom technology.

- By Product Type: Dust Collectors, Cartridge Collectors, Bag Filters, HEPA Filters, Activated Carbon Filters, HVAC Filters, Others.

- By Application: HVAC, Industrial Manufacturing, Power Generation, Pharmaceuticals, Food & Beverage, Automotive, Healthcare, Others.

- By End-Use Sector: Residential, Commercial, Industrial.

- By Material: Fiberglass, Cellulose, Synthetic Polymer, Activated Carbon, Metal Mesh.

Value Chain Analysis For Air Filters and Filtration Equipment Market

The value chain begins with upstream analysis, focusing on raw material suppliers, predominantly providers of specialized media like synthetic fibers (e.g., polyester, polypropylene), glass fiber (fiberglass), activated carbon granules, and structural components (frames, sealants, metal casings). The price volatility and quality consistency of these raw materials directly impact the manufacturing cost and final filter performance. Innovation at this stage involves developing lighter, more durable, and environmentally sustainable filter media. The manufacturing stage involves intricate processes such as pleating, molding, and assembling the media into finished filter cartridges or robust industrial systems. Efficiency in production, automation, and maintaining stringent quality control are critical determinants of profitability and product reliability.

Moving downstream, the distribution channel is highly diversified. Direct sales are common for large, bespoke industrial filtration systems and sophisticated projects where manufacturers provide installation, engineering, and long-term service contracts directly to major industrial end-users (e.g., power plants, large pharmaceutical companies). Conversely, the standard HVAC filter market predominantly relies on indirect distribution through a complex network of wholesalers, regional distributors, HVAC contractors, facility management firms, and increasingly, e-commerce platforms for residential and small commercial clients. Effective supply chain management is crucial here due to the high volume and frequent replacement cycle nature of standard filters.

The structure of the value chain is characterized by strong differentiation based on product complexity. For standardized filters, the chain is commodity-driven, emphasizing cost-efficiency and logistics. For high-efficiency and specialized industrial equipment, the chain is knowledge-intensive, requiring high technical expertise in system design, installation, and ongoing maintenance support. Key competitive advantages are secured by companies that vertically integrate media production or those that establish strong, long-term service agreements with downstream customers, ensuring recurring revenue streams. The final stage involves installation, commissioning, and long-term maintenance, often handled by third-party contractors who play a critical role as influencers and direct purchasers.

Air Filters and Filtration Equipment Market Potential Customers

Potential customers for air filters and filtration equipment are broadly segmented across institutional, commercial, and heavy industrial sectors, driven by regulatory compliance and operational necessity. In the industrial sector, key end-users include power generation facilities (coal, gas), cement manufacturers, metal foundries, chemical processing plants, and mining operations, all of whom require large-scale dust collection systems and baghouse filters to meet atmospheric emission standards and protect workers. These industrial buyers prioritize reliability, high throughput capacity, and compliance certifications above all else, often making large capital investments in sophisticated, high-maintenance systems.

The commercial and institutional segment represents a high-volume market focused on Indoor Air Quality (IAQ) and energy efficiency. Key buyers include healthcare providers (hospitals, clinics), education facilities (schools, universities), corporate offices, data centers, hotels, and retail complexes. These customers primarily purchase HVAC filters (ranging from MERV 8 to MERV 16, and HEPA filters for sensitive areas) and increasingly demand smart filters that integrate with Building Management Systems (BMS) to optimize maintenance cycles and energy consumption. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), incorporating both acquisition cost and energy savings derived from low-pressure drop filters.

The pharmaceutical, biotechnology, and semiconductor manufacturing sectors form a highly specialized, premium customer base. These industries require Ultra-Low Penetration Air (ULPA) and stringent HEPA filtration systems to maintain ISO-defined cleanroom standards necessary for product integrity and process safety. Their purchasing behavior is entirely non-negotiable on quality, focusing on validated performance, certification, and traceability, often leading to long-term partnerships with specialized filter manufacturers who can guarantee precise environmental controls. Furthermore, the automotive sector, both in vehicle manufacturing paint shops and in the final product (cabin air filters), remains a substantial and continuously evolving customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $19.5 Billion |

| Market Forecast in 2033 | $31.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson Company, Inc., Parker-Hannifin Corporation, Mann+Hummel, Camfil, Ahlstrom-Munksjö, 3M Company, Pall Corporation (Danaher), Lydall, Inc., Freudenberg Filtration Technologies, AAF International (Daikin), Clarcor Inc. (Parker), SUEZ, SPX FLOW, Inc., Spectrum Filtration Pvt. Ltd., Trojan Technologies (Danaher), General Motors, Cummins Filtration, Lennard Corporation, Rensa Filtration, Vokes Air. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Filters and Filtration Equipment Market Key Technology Landscape

The technology landscape of the air filters market is rapidly evolving, driven primarily by the need for enhanced efficiency, lower energy consumption, and smarter operational management. Key advancements center on the development of novel filter media, moving beyond conventional fiberglass and cellulose to highly efficient synthetic melt-blown polymers, electrospun nanofibers, and functionalized carbon materials. Nanofiber technology, in particular, allows for the production of media with extremely high porosity and fine fiber diameters, achieving HEPA-level filtration with a significantly lower pressure drop, thereby directly reducing the energy consumption of the associated ventilation fans. This focus on maximizing the MERV rating per unit of pressure drop is a core technological objective across all product categories, especially HVAC and general ventilation systems.

A major technological shift involves the integration of smart technologies, commonly referred to as IoT (Internet of Things) filtration systems. These systems incorporate embedded sensors that monitor critical parameters such as differential pressure, airflow volume, and, in advanced units, real-time particulate loading and gas concentrations. This data is transmitted wirelessly to cloud platforms, enabling predictive maintenance schedules. This transition from static, scheduled replacement to dynamic, condition-based monitoring is critical for improving operational efficiency and reducing waste. Furthermore, some systems are integrating antimicrobial coatings (e.g., silver ions) directly onto the filter media to inhibit the growth of bacteria and viruses captured from the air stream, enhancing the hygienic profile of the filtration solution, particularly in healthcare settings.

In the industrial sphere, technological focus remains on optimizing dust collector performance and durability. Pulse-jet cleaning systems are continuously refined to ensure maximum particulate release from bag filters or cartridges with minimal energy expenditure and reduced wear and tear on the media. Advanced simulation tools, often leveraging Computational Fluid Dynamics (CFD), are employed during the design phase to optimize airflow within dust collection systems, minimizing turbulent flow and maximizing collection efficiency across varying load conditions. Finally, the growing emphasis on sustainable manufacturing necessitates technology development focused on material science, aiming to create filtration media that are biodegradable or easily separable from supporting components to facilitate efficient recycling at the end of the filter’s life cycle, addressing increasing environmental regulatory pressure.

Regional Highlights

The global market for air filters and filtration equipment exhibits pronounced regional disparities in growth rates, market maturity, and regulatory drivers. Understanding these regional dynamics is crucial for manufacturers establishing supply chain and distribution strategies. The market can be broadly segmented into four primary zones: North America, Europe, Asia Pacific (APAC), and the rest of the world (Latin America, Middle East, and Africa).

- Asia Pacific (APAC) Dominance: APAC is currently the fastest-growing region, driven by explosive industrial growth, large-scale infrastructure projects, and critically, severe air pollution problems in key economies like China, India, and Southeast Asia. Regulatory tightening around industrial emissions (e.g., coal-fired power plants, manufacturing complexes) mandates the use of high-volume dust collection systems. Furthermore, rising disposable incomes lead to increased residential adoption of advanced air purifiers, bolstering the consumer segment. This region is a major hub for both manufacturing and consumption.

- North America (Mature Market, High Value): North America maintains a significant market share, characterized by high technological adoption, stringent occupational safety standards (OSHA), and established HVAC system replacement cycles. Demand here is heavily influenced by energy efficiency standards and the increasing focus on advanced Indoor Air Quality (IAQ) in commercial and educational buildings. The U.S. remains the single largest national market, emphasizing high-efficiency (MERV 13+) and smart filtration systems integrated with sophisticated building management platforms.

- Europe (Regulation-Driven Innovation): Europe is characterized by extremely strict environmental and industrial safety regulations, such as the EU's directives on particulate matter emissions and workplace exposure limits. This regulatory environment drives continuous investment in premium, technologically advanced filtration solutions, particularly gas-phase filtration and sustainable filter media options. Germany, France, and the UK are key markets, focusing heavily on energy-efficient filtration technology to meet ambitious decarbonization goals.

- Latin America & MEA (Emerging Opportunities): Latin America and the Middle East & Africa (MEA) represent significant opportunities due to substantial investments in oil and gas infrastructure, mining, construction, and rapid urbanization. Harsh operating environments in the MEA region, characterized by high dust and sand content, necessitate highly specialized, durable filtration equipment. Market growth in these regions is volatile but promises strong expansion as infrastructure projects move from planning to execution phases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Filters and Filtration Equipment Market.- Donaldson Company, Inc.

- Parker-Hannifin Corporation

- Mann+Hummel

- Camfil

- Ahlstrom-Munksjö

- 3M Company

- Pall Corporation (Danaher)

- Lydall, Inc.

- Freudenberg Filtration Technologies

- AAF International (Daikin)

- Clarcor Inc. (Parker)

- SUEZ

- SPX FLOW, Inc.

- Spectrum Filtration Pvt. Ltd.

- Trojan Technologies (Danaher)

- General Motors (Filtration Divisions)

- Cummins Filtration

- Lennard Corporation

- Rensa Filtration

- Vokes Air

Frequently Asked Questions

Analyze common user questions about the Air Filters and Filtration Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Air Filters Market?

The primary factor is the increasing enforcement of stringent government regulations globally regarding industrial emissions and occupational health, coupled with heightened public awareness concerning the detrimental health effects of airborne particulate matter and pathogens, leading to massive investments in high-efficiency filtration solutions across all sectors.

How does the integration of IoT and AI affect the operational efficiency of filtration systems?

IoT and AI integration allows for continuous, real-time monitoring of filter performance parameters such as pressure drop and particulate loading. This capability enables predictive maintenance, ensuring filters are replaced precisely at the optimal point, which minimizes energy consumption and significantly reduces the total cost of ownership (TCO) compared to time-based schedules.

Which filter technology segment is expected to show the highest growth rate during the forecast period?

The High-Efficiency Particulate Air (HEPA) and specialized gas-phase filtration segments are expected to show the highest growth rate, driven by escalating demand from the healthcare, pharmaceutical (cleanroom standards), and commercial building sectors where stringent IAQ requirements mandate the removal of ultra-fine particulates and volatile organic compounds (VOCs).

What are the key sustainability challenges facing the air filtration industry?

The main sustainability challenges include the disposal of contaminated, non-recyclable filter media, which often ends up in landfills. The industry is responding by investing in biodegradable filter materials, designing filters with easily separable components, and improving recycling logistics to support a circular economy model for filtration products.

Which geographical region represents the largest potential market opportunity for new entrants?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asia, presents the largest potential market opportunity for new entrants, characterized by rapid industrial expansion, high levels of air pollution requiring immediate remediation, and a less mature filtration market compared to North America or Europe, suggesting significant unmet demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager