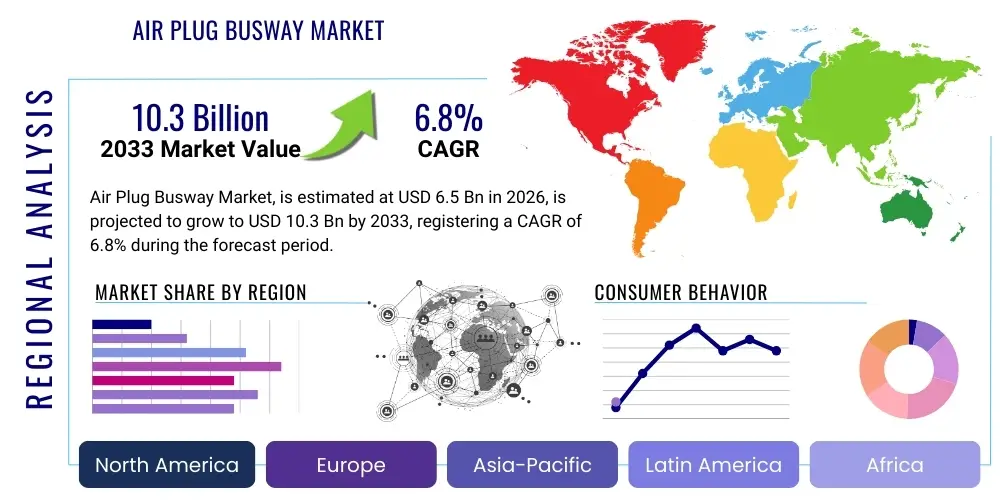

Air Plug Busway Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434980 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Air Plug Busway Market Size

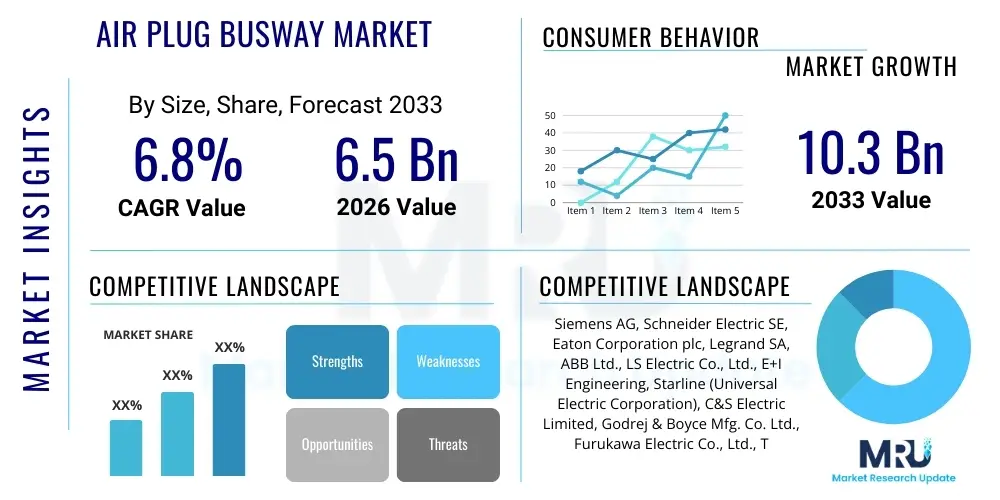

The Air Plug Busway Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Air Plug Busway Market introduction

The Air Plug Busway Market encompasses high-efficiency, flexible power distribution systems used as an alternative to traditional wiring and cable trays in commercial and industrial settings. Air plug busways, often referred to simply as bus ducts, utilize insulated conductors encased within a protective housing, providing a reliable and scalable method for transmitting and distributing electrical power, characterized by enhanced safety features and reduced installation complexity compared to conventional cabling. These systems are defined by their ability to allow power taps (plugs) to be inserted along the length of the busway, enabling quick changes to equipment location or layout reconfiguration without extensive downtime. Major applications include data centers, manufacturing plants, high-rise buildings, hospitals, and transportation infrastructure where high current capacity and system flexibility are paramount. The inherent benefits, such as superior thermal management, lower electromagnetic interference (EMI), enhanced fire safety, and significant space savings, are primary factors driving their widespread adoption across modern infrastructure projects globally.

Air Plug Busway Market Executive Summary

The Air Plug Busway Market is experiencing robust growth fueled by several macroeconomic and technological business trends, notably the exponential expansion of global data centers and the increasing focus on energy-efficient infrastructure in urban environments. Technologically, the integration of smart monitoring capabilities, including IoT sensors for real-time thermal and electrical diagnostics, is becoming a standard offering, enhancing predictive maintenance capabilities and system reliability. Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure investments in rapidly industrializing nations such as China, India, and Southeast Asian countries, coupled with the rapid deployment of 5G networks and supporting data facilities. North America and Europe maintain strong demand, largely driven by the modernization of aging electrical infrastructure and stringent regulatory mandates prioritizing power efficiency and safety. Segment trends indicate a strong preference for high-current rating busways (over 4,000 Amperes) utilizing copper conductors in mission-critical environments, while the medium current segment (800A to 4000A) sees increasing adoption of aluminum conductors to manage total cost of ownership in standard commercial applications. Overall market trajectory is characterized by a strategic shift towards modular, sustainable, and highly flexible power distribution solutions.

AI Impact Analysis on Air Plug Busway Market

Common user questions regarding AI's influence on the Air Plug Busway Market frequently center on predictive maintenance, optimizing system design, and enhancing manufacturing efficiency. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can move monitoring beyond simple alarm systems to genuinely predictive diagnostics, preventing catastrophic failures related to joint overheating or insulation degradation before they occur. There is also significant curiosity about using AI-driven generative design tools to model complex electrical loads and structural requirements, thus reducing material waste and optimizing busway sizing for specific installations, particularly in hyperscale data center environments where power density is paramount. Concerns often revolve around the security implications of integrating IoT devices and AI platforms into critical power infrastructure, alongside the cost-benefit analysis of implementing advanced ML algorithms compared to traditional preventative maintenance schedules. Overall user expectations are high for AI to deliver substantial improvements in operational expenditure (OpEx), system longevity, and installation precision, solidifying the busway system's reputation as a smart infrastructure component.

The application of AI in the manufacturing phase of air plug busways is poised to revolutionize quality control and production throughput. AI-powered visual inspection systems can analyze welding quality, insulation integrity, and dimensional accuracy far more consistently and rapidly than human inspectors, leading to higher product reliability and reduced defects leaving the factory floor. Furthermore, ML algorithms are being deployed to optimize the complex supply chain dynamics associated with sourcing key materials like copper and aluminum, anticipating price fluctuations and ensuring just-in-time inventory management, which is critical given the current volatility in global commodity markets. This sophisticated optimization reduces manufacturing lead times and allows busway providers to offer more competitive pricing and faster deployment schedules, appealing directly to large-scale construction and industrial projects with strict deadlines. The integration of these intelligent systems ensures that the core components of the busway—the conductors, housing, and connection points—meet exacting standards, reinforcing the long-term reliability and safety performance expected in mission-critical applications.

Beyond manufacturing, AI significantly enhances the operation and life-cycle management of installed air plug busway systems. By continuously analyzing data streams from embedded smart sensors—including temperature readings, voltage drops, and current fluctuations—AI models can detect subtle anomalies that precede component failure. These models create highly accurate digital twins of the busway network, allowing facility managers to simulate various load conditions and predict the optimal timing for maintenance interventions, transitioning from scheduled maintenance to condition-based maintenance, thereby minimizing operational disruption and maximizing asset utilization. This proactive approach not only extends the operational life of the busway system but also provides granular insights into energy usage patterns, enabling facility managers to make informed decisions about load balancing and energy conservation strategies, thereby contributing directly to the facility’s sustainability goals and overall operational efficiency in demanding environments like large data centers and specialized industrial complexes.

- AI-driven predictive maintenance predicts joint failures and thermal anomalies in real-time, significantly reducing unplanned downtime.

- Machine learning optimizes busway routing and sizing during design phases, ensuring material efficiency and optimal power delivery.

- Automated visual inspection systems enhance manufacturing quality control of insulation and conductor alignment.

- AI algorithms optimize raw material supply chain and production scheduling for faster deployment.

- Intelligent load balancing systems manage power distribution dynamically to maximize energy efficiency and prevent localized overheating.

- Digital twinning capabilities allow for high-fidelity simulation of operational stress and load changes on the busway infrastructure.

DRO & Impact Forces Of Air Plug Busway Market

The Air Plug Busway Market growth is primarily driven by the massive global demand generated by hyperscale data centers, which require highly reliable, scalable, and modular power distribution systems that can handle extreme power densities, alongside the rapid urbanization and associated development of modern commercial and residential high-rise buildings requiring safe and space-saving electrical infrastructure. However, the market faces significant restraints, chiefly the high initial capital expenditure (CAPEX) compared to traditional cable systems, which can deter smaller enterprises or projects with limited budgets, coupled with the inherent complexity associated with standardizing busway systems across different international regulatory frameworks, impacting cross-border project deployment. Opportunities are vast, particularly through the integration of busways with renewable energy sources and smart grid technology, enabling bidirectional power flow and advanced energy management, alongside the potential for retrofit projects modernizing aging industrial and commercial electrical systems. These factors combine to create strong impact forces, pushing manufacturers toward developing more cost-effective, modular, and IoT-enabled solutions while navigating pricing pressures and the need for global regulatory harmonization to sustain long-term market expansion.

Segmentation Analysis

The Air Plug Busway Market segmentation analysis provides a comprehensive framework for strategic market penetration, highlighting distinct categories based on crucial technical characteristics and end-user requirements. Key segmentation variables include the type of conductor material (Copper vs. Aluminum), current rating (Low, Medium, High), the housing structure (Sandwich vs. Air-Insulated), and the final application area (Data Centers, Industrial, Commercial, and Transportation). Understanding the performance differences and cost implications across these segments is vital; for instance, copper busways are preferred for high-current, mission-critical applications due to their superior conductivity and lower voltage drop, whereas aluminum busways offer cost advantages and lighter weight, making them suitable for broader commercial applications. The market is increasingly polarizing toward the high-current segment, driven by the intense power demands of AI and machine learning infrastructure housed within modern data centers, demanding robust and thermally optimized power distribution solutions capable of reliably handling thousands of amperes. Furthermore, regional regulatory standards significantly influence the choice between sandwich-type and air-insulated designs, focusing on fire safety and short-circuit withstand capabilities.

Segmentation by current rating is particularly indicative of market maturity and application focus. Low current busways (below 800A) are widely used in commercial distribution and residential complexes, prioritizing flexibility and ease of installation over peak power performance. The medium current segment (800A to 4000A) forms the backbone of general industrial facilities and large commercial buildings, balancing cost, performance, and modularity. The high current segment (above 4000A to 6500A) dominates the strategic investment areas, specifically utility infrastructure, large manufacturing facilities, and hyperscale data centers, where power density and minimal energy losses are non-negotiable prerequisites. Analyzing the growth trajectory within these current rating segments allows manufacturers to align their R&D investments, particularly focusing on materials science improvements and advanced thermal management techniques necessary to maintain operational efficiency and safety at higher current loads. This granular market view supports targeted product development, ensuring alignment with the rigorous performance standards demanded by high-value end-users across diverse geographic markets.

Segmentation based on end-use application further clarifies demand patterns. The Data Center segment leads in terms of technology adoption, demanding features such as continuous monitoring, liquid cooling integration, and extreme modularity to support rapid server deployment and configuration changes. The Industrial segment requires systems engineered for harsh environments, featuring high ingress protection (IP) ratings and resistance to chemical corrosion and vibration, suitable for heavy manufacturing and processing plants. The Commercial segment focuses on aesthetics, fire resistance standards, and system flexibility for office reconfigurations. Lastly, the Transportation segment (e.g., railways, ports) mandates specific certifications for vibration resistance, durability, and reliable operation in challenging outdoor or subterranean settings. The continuous drive toward higher system voltage and current capabilities, coupled with the mandatory integration of IoT monitoring tools, dictates the current competitive landscape, rewarding those manufacturers who can deliver fully integrated, smart power distribution solutions tailored to these specialized application needs. This diversity in demands necessitates a flexible product portfolio capable of meeting global safety and performance benchmarks while maintaining cost competitiveness.

- Conductor Type:

- Copper (High performance, mission-critical applications)

- Aluminum (Cost-effective, general commercial applications)

- Current Rating:

- Low Current (Below 800 A)

- Medium Current (800 A – 4,000 A)

- High Current (Above 4,000 A)

- Insulation Type:

- Air Insulated Busway

- Cast Resin Busway (for severe environments)

- End-Use Application:

- Data Centers and IT Infrastructure

- Industrial Manufacturing and Processing Plants

- Commercial Buildings (Offices, Retail, Hospitals)

- Transportation and Infrastructure (Railways, Airports)

- Utilities and Power Generation

Value Chain Analysis For Air Plug Busway Market

The value chain for the Air Plug Busway Market begins with the highly specialized procurement of critical raw materials, primarily high-grade electrolytic copper and electrical-grade aluminum, which account for a substantial portion of the system’s total cost, making manufacturers highly susceptible to global commodity price volatility. Upstream activities involve sophisticated material preparation, including extrusion and specialized surface treatment of the conductors to ensure optimal conductivity and prevent oxidation. The core manufacturing phase is complex, requiring precision engineering for the housing (often steel or aluminum sheet metal), specialized insulation molding (epoxy resins or proprietary coatings), and the intricate assembly of the plug-in connection points and mechanical fasteners, demanding high quality control standards to guarantee short-circuit withstand capacity and reliable electrical contact over the system's long lifespan. Strict adherence to international standards (like IEC and UL) is essential throughout this process.

Midstream activities primarily encompass the design and engineering phase, where customized solutions are developed based on specific project requirements, electrical load calculations, and spatial constraints of the end-user facility. This involves advanced CAD/CAE modeling to ensure thermal management and mechanical fit. Distribution channels are bifurcated into direct and indirect routes. Direct sales are common for large, high-value, and customized projects, such as hyperscale data center builds or major industrial plant installations, where manufacturers engage directly with EPC contractors, facility owners, and specialized electrical consultants. This allows for tailored technical support and deep integration during the design-build phase. Indirect distribution relies heavily on a network of specialized electrical distributors, wholesalers, and system integrators who stock standard busway components and handle sales to smaller commercial projects and maintenance/retrofit markets, providing localized support and faster turnaround times for standard products.

Downstream activities center on installation, commissioning, and post-sales service, which are crucial differentiators in this market. Installation often requires certified and trained personnel due to the precise mechanical connections and alignment needed to ensure electrical reliability and safety. Service includes routine inspection, thermal scanning, and predictive maintenance programs, often utilizing IoT sensors integrated into the busway system. The effectiveness of the service network significantly influences customer satisfaction and long-term brand loyalty. Furthermore, the longevity and high reliability of busway systems mean that the aftermarket, involving spare parts, extensions, and system modifications for facility expansions, represents a stable and recurring revenue stream, solidifying the importance of establishing robust direct and indirect service partnerships across key geographical markets. The overall value chain emphasizes precision, material quality, and specialized technical expertise at every stage, from conductor sourcing to final commissioning.

Air Plug Busway Market Potential Customers

The primary consumers and buyers of air plug busway systems represent sectors with high, critical, and dynamic power distribution requirements where system flexibility, reliability, and space efficiency are paramount. Data center operators, ranging from cloud service providers (hyperscalers) to colocation facilities, form the fastest-growing customer base due to their continuous need for high power density and modularity, allowing for rapid scaling and reconfiguration of IT racks without major electrical disruption. Another major segment includes large-scale industrial customers, such as automotive assembly plants, semiconductor fabrication facilities, and heavy processing industries, which rely on busways to reliably power extensive machinery and production lines while offering the flexibility to move or add equipment quickly as manufacturing processes evolve. These industrial end-users prioritize mechanical robustness and high fault current withstand capabilities, often selecting specialized cast resin or air-insulated systems designed for harsh environments.

Commercial building developers and owners, particularly those managing high-rise office towers, modern hospitals, and large retail centers, constitute a substantial customer segment. In these environments, space saving, safety (fire resistance), and aesthetic integration are key considerations, making the compact and organized nature of busway systems highly appealing compared to bulky cable trays. Hospitals, specifically, require extremely reliable power paths for life-support equipment, demanding redundant busway layouts and stringent safety certifications. Additionally, the public infrastructure sector, including utility companies, power generation facilities, and mass transit operators (metro systems, airports), are key buyers, valuing the long-term durability, low maintenance requirements, and reliable performance of busways in critical public safety and essential service applications. The shift towards smart cities and sustainable infrastructure further solidifies these end-users as perpetual customers, driving demand for technologically advanced, monitoring-enabled busway solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Schneider Electric SE, Eaton Corporation plc, Legrand SA, ABB Ltd., LS Electric Co., Ltd., E+I Engineering, Starline (Universal Electric Corporation), C&S Electric Limited, Godrej & Boyce Mfg. Co. Ltd., Furukawa Electric Co., Ltd., TE Connectivity, DB Busway, KEMA Labs (CESI), Powell Industries, Inc., Delta Busway, Huapeng Group, L&T Electrical & Automation, Anord Mardix, Rittal GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Plug Busway Market Key Technology Landscape

The technological evolution within the Air Plug Busway Market is characterized by a strong emphasis on smart integration, material science advancement, and enhanced safety features designed to meet the rigorous demands of modern electrical infrastructure. A key technological trend is the proliferation of embedded Internet of Things (IoT) sensors and wireless monitoring systems directly integrated into the busway joints and tap-off points. These systems continuously monitor critical operating parameters such as temperature, current, voltage, and vibration, allowing facility managers to gain real-time insights into system health. This capability supports sophisticated predictive maintenance strategies, shifting away from time-based maintenance to condition-based monitoring, which significantly improves reliability and minimizes the risk of catastrophic failures due to loose connections or excessive thermal stress. The collected data is processed by advanced data analytics platforms, often utilizing cloud services, providing actionable alerts and long-term performance trend analysis, thereby optimizing operational expenditure (OpEx).

Material science innovation is equally critical, particularly concerning conductor materials and insulation techniques. While copper remains the benchmark for high-performance systems, manufacturers are investing heavily in improving aluminum conductor joint technology to ensure electrical contact resistance remains low and stable over time, making aluminum a more viable and cost-effective option for many applications. Furthermore, advancements in fire-retardant and low-smoke zero-halogen (LSZH) insulation materials are mandatory, especially in commercial and institutional environments where fire safety standards are extremely stringent. The development of specialized cast resin busway technology is expanding its applicability beyond harsh industrial environments to areas requiring high degrees of ingress protection (IP ratings) and excellent resistance to moisture, chemicals, and mechanical impact. These material advancements directly address the longevity and safety concerns associated with high-density power distribution, positioning busways as inherently safer than traditional cabling.

The third major technological focus area involves the mechanical design of the busway housing and connection methodology. Modern air plug busways are designed for maximum modularity, featuring quick-connect mechanisms that allow tap-off units to be securely installed and removed while the busway remains energized (hot-tap capability), a critical feature for data centers requiring continuous operation. Sandwich busway designs, which minimize the distance between conductors, effectively reduce impedance and voltage drop, enhancing overall system efficiency, a key factor in energy-conscious markets. Furthermore, manufacturers are focusing on creating compact and lightweight designs without compromising short-circuit ratings, easing installation logistics, especially in constrained spaces like ceiling plenums or vertical risers in high-rise buildings. These innovations collectively ensure that air plug busways not only distribute power but do so intelligently, efficiently, and with inherent safety features that outperform traditional power distribution alternatives.

Regional Highlights

The Air Plug Busway Market demonstrates distinct dynamics across major geographical regions, driven by localized infrastructure spending, regulatory environments, and the concentration of high-power-consuming industries, resulting in varied growth rates and technological preferences. The North American market is characterized by mature infrastructure, high technological adoption, and substantial demand originating from the hyperscale data center industry, particularly in the US and Canada. The stringent requirements for power reliability, coupled with high labor costs, drive the demand for pre-fabricated, high-current, and smart-enabled busway systems that minimize installation time and maximize operational uptime. Furthermore, the push for modernization of aging utility and industrial infrastructure contributes significantly to market consumption, favoring solutions compliant with UL standards and focusing on energy efficiency protocols.

Asia Pacific (APAC) represents the fastest-growing market, largely fueled by rapid industrialization, extensive urbanization, and massive governmental investments in infrastructure development, including smart cities, railways, and power generation expansion in countries like China, India, and Southeast Asia. The region’s colossal demand for new commercial, residential, and industrial facilities necessitates large-scale electrical distribution solutions. While cost competitiveness remains a significant factor, leading to higher utilization of aluminum busways in general applications, the expanding data center footprint in key APAC hubs like Singapore, Japan, and Australia dictates strong demand for high-end copper sandwich busway systems integrated with advanced monitoring technologies. The sheer volume of new construction projects ensures APAC's dominance in market volume.

Europe maintains a strong and stable market, emphasizing environmental sustainability, strict regulatory compliance (IEC standards), and modernization projects. The European market exhibits high adoption rates for smart busway systems integrated into smart grid initiatives and renewable energy projects, focusing heavily on low voltage distribution efficiency and advanced fire safety ratings. Germany, the UK, and France are pivotal consumers, driven by the automation needs of their manufacturing sectors and the ongoing renovation of large public and private commercial properties. The Middle East and Africa (MEA) and Latin America, while smaller in absolute market size, show promising growth potential linked to significant investments in oil and gas infrastructure, major construction projects in Gulf Cooperation Council (GCC) countries, and industrial expansion in markets like Brazil and Saudi Arabia, necessitating robust and durable power distribution solutions suitable for often challenging environmental conditions.

- North America: Dominance in high-current copper busways driven by hyperscale data center construction and mission-critical applications; strong regulatory compliance focus (UL standards).

- Asia Pacific (APAC): Highest growth rate due to rapid urbanization, industrial expansion, infrastructure projects, and significant data center deployment across China, India, and ASEAN countries.

- Europe: Stable market driven by regulatory mandates (IEC), focus on energy efficiency, smart grid integration, and retrofitting older industrial facilities; preference for advanced fire safety features.

- Middle East & Africa (MEA): Growth tied to large-scale urban development projects (e.g., NEOM, Dubai) and investment in oil and gas infrastructure requiring high ingress protection busways.

- Latin America (LATAM): Market expansion driven by modernization of industrial plants and increased foreign direct investment in commercial construction and power utility upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Plug Busway Market.- Siemens AG

- Schneider Electric SE

- Eaton Corporation plc

- Legrand SA

- ABB Ltd.

- LS Electric Co., Ltd.

- E+I Engineering

- Starline (Universal Electric Corporation)

- C&S Electric Limited

- Godrej & Boyce Mfg. Co. Ltd.

- Furukawa Electric Co., Ltd.

- TE Connectivity

- DB Busway

- KEMA Labs (CESI)

- Powell Industries, Inc.

- Delta Busway

- Huapeng Group

- L&T Electrical & Automation

- Anord Mardix

- Rittal GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Air Plug Busway market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Air Plug Busways over traditional cable and conduit systems?

Air Plug Busways offer significantly higher power density, greater flexibility for system reconfiguration and expansion (due to plug-in tap-offs), superior thermal management, and lower overall installation labor costs. They also provide enhanced safety by minimizing the risk of insulation degradation and reducing electromagnetic interference (EMI), making them ideal for modern, high-load environments like data centers and manufacturing plants where reliability and scalability are essential.

How does the choice between copper and aluminum conductors impact busway performance and cost?

Copper conductors provide superior conductivity and thermal performance, resulting in lower voltage drop and greater resilience under high fault currents, making them the preferred choice for mission-critical and high-amperage applications (above 4,000A). Aluminum busways are typically 30-50% lighter and offer a lower material cost, providing an economical alternative for medium-current commercial and light industrial installations where weight and initial capital expenditure are key considerations. Technological advancements are continually improving the long-term reliability of aluminum joints.

Are Air Plug Busways considered a fire safe power distribution solution?

Yes, modern Air Plug Busways are engineered for high fire safety. Unlike traditional cable trays which can spread fire through large volumes of plastic cable insulation, busways utilize metal enclosures and fire-retardant, low-smoke insulation materials (LSZH). Specialized cast resin busways offer exceptional fire resistance and are often mandated in high-risk zones, such as hospitals or tunnels, providing high ingress protection (IP ratings) and containment of fire and smoke propagation, complying with stringent international safety standards like IEC 61439-6.

What role does IoT integration play in modern Air Plug Busway maintenance and operational efficiency?

IoT sensors embedded within modern busway joints and tap-off points provide real-time data on temperature, current load, and connection resistance. This data enables predictive maintenance protocols, allowing facility managers to identify and address minor issues like overheating joints before they cause system failure. This smart monitoring capability minimizes unplanned downtime, optimizes load balancing, and significantly extends the operational lifespan of the entire power distribution system, thereby transitioning maintenance from reactive to proactive, reducing overall operational costs.

In which end-use application segment is the highest growth anticipated for the Air Plug Busway Market?

The Data Centers and IT Infrastructure segment is projected to show the highest growth rate. The continuous global expansion of cloud computing, edge computing, and AI technologies necessitates power distribution systems that are highly dense, incredibly reliable, and modular. Air Plug Busways uniquely satisfy these requirements by offering the necessary power capacity and the rapid configurability required for deploying and reconfiguring servers within hyperscale facilities, making them the standard choice for mission-critical power delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager