Air Pollution Control Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434303 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Air Pollution Control Equipment Market Size

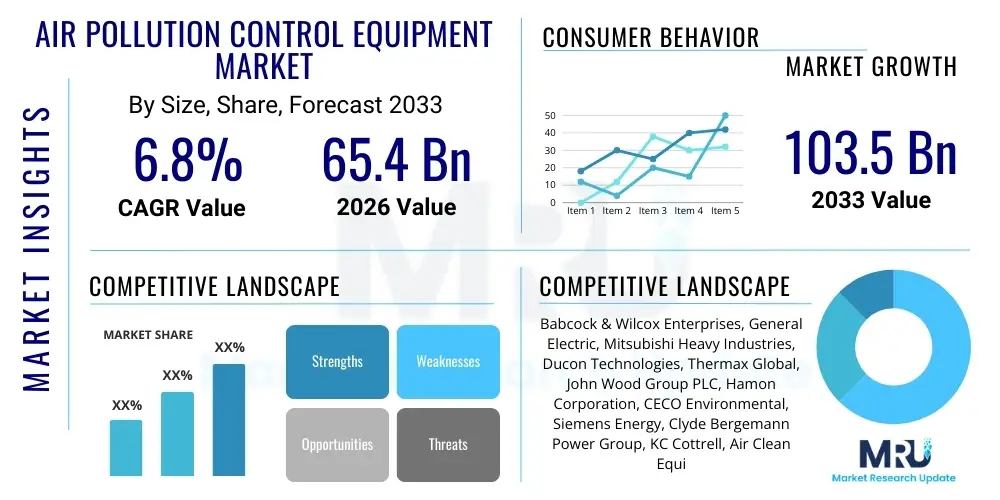

The Air Pollution Control Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 103.5 Billion by the end of the forecast period in 2033.

Air Pollution Control Equipment Market introduction

The Air Pollution Control Equipment (APCE) market encompasses a highly specialized segment of environmental technology dedicated to mitigating the detrimental effects of industrial atmospheric emissions. These systems are essential components in complex manufacturing and energy production cycles, functioning as the final barrier before gaseous and particulate effluent is released. The core objective of APCE is to ensure industrial facilities comply with local, national, and international emission standards, which are constantly being revised and tightened in response to global climate concerns and localized public health imperatives. The scope of APCE solutions ranges from physical separation techniques, such as filtration and gravitational settling, to complex physicochemical processes involving chemical absorption, catalytic conversion, and thermal destruction of hazardous compounds.

The functional description of major APCE includes technologies targeting specific pollutants. For instance, Flue Gas Desulfurization (FGD) systems are primarily installed in coal-fired power stations to capture sulfur dioxide ($\text{SO}_2$) through chemical reactions, typically using limestone slurry, resulting in gypsum as a byproduct. Selective Catalytic Reduction (SCR) units utilize catalysts and a reducing agent (like ammonia or urea) to convert nitrogen oxides ($\text{NO}_x$) into inert nitrogen ($\text{N}_2$) and water ($\text{H}_2\text{O}$). Meanwhile, particulate matter (PM) control relies heavily on Electrostatic Precipitators (ESPs) and Fabric Filters (Baghouses), which offer high efficiency in capturing fine dust particles across varied temperature and moisture conditions, crucial for industries like cement, metals, and incinerators. The integration of these varied technologies underscores the market's complexity and the necessity for tailored, site-specific solutions that must adhere rigorously to performance guarantees established by regulatory bodies.

The market is critically driven by a confluence of accelerating factors. Regulatory frameworks, such as the European Union’s Industrial Emissions Directive (IED), the U.S. EPA’s Maximum Achievable Control Technology (MACT) standards, and increasingly strict norms across the Asia Pacific region, impose non-negotiable compliance deadlines, necessitating continuous investment. Benefits derived from deploying advanced APCE extend beyond compliance, offering improved corporate image, reduced liability risks, and in many cases, enhanced operational efficiency through energy recovery mechanisms built into systems like Regenerative Thermal Oxidizers (RTOs). The overall market trajectory is strongly upward, supported by urbanization trends which concentrate industrial activity near population centers, magnifying the need for effective pollution abatement, alongside unprecedented industrial capacity expansion in key developing economies.

Air Pollution Control Equipment Market Executive Summary

The global Air Pollution Control Equipment market is experiencing a period of intense innovation and regulatory convergence, driving a demand surge for integrated and high-efficiency solutions. Current business trends indicate a critical shift away from end-of-pipe solutions towards holistic environmental management systems. Major equipment providers are strategically focusing on offering comprehensive lifecycle services, including advanced maintenance contracts and performance-based guarantees, moving the revenue model beyond initial capital sales. The market's competitive dynamics are characterized by vertical integration, where large Engineering, Procurement, and Construction (EPC) firms acquire specialist technology manufacturers to provide single-source solutions, simplifying procurement and risk management for large utility and industrial clients. Furthermore, the increasing adoption of digital transformation initiatives, leveraging IoT and Artificial Intelligence, is reshaping operational capabilities and service delivery.

Regionally, Asia Pacific maintains its undisputed position as the engine of market expansion, primarily due to the mandated installation of abatement technologies in thousands of new and existing heavy industrial facilities, particularly in the power and manufacturing sectors of China and India. The rapid economic growth in Southeast Asian nations, coupled with tightening local environmental laws, further contributes to this regional dominance. Conversely, mature markets in North America and Europe are witnessing significant demand not from new construction, but from modernization, retrofitting, and the implementation of technologies designed to meet the newest, extremely low emission benchmarks for fine particulates ($\text{PM}_{2.5}$) and emerging pollutants like mercury and certain Persistent Organic Pollutants (POPs). These markets prioritize technological sophistication and low lifecycle cost solutions.

Segmentation analysis reveals that the Fabric Filters (Baghouses) segment continues to hold robust growth due to their superior efficiency in capturing $\text{PM}_{2.5}$. The gaseous pollutant control segment, led by Selective Catalytic Reduction (SCR) and Flue Gas Desulfurization (FGD), remains vital, though highly sensitive to regional energy policies concerning coal usage. Critically, the service sector, covering maintenance, optimization, spare parts, and chemical reagent supply, is projected to be the fastest-growing segment. This reflects the high complexity and long operational lifespan of modern APCE installations, positioning continuous aftermarket support as a key strategic differentiator and a stable revenue source for leading market players.

AI Impact Analysis on Air Pollution Control Equipment Market

User queries regarding the intersection of Artificial Intelligence and Air Pollution Control Equipment frequently focus on automating complex control strategies that human operators struggle to manage efficiently, especially under variable load conditions. Users are interested in how AI can move systems from reactive (responding to high emission alarms) to proactive (predicting emission spikes based on process variables). Common concerns revolve around the return on investment (ROI) for digital transformation projects, the accuracy and reliability of AI models fed by industrial sensors operating in harsh environments, and the ability of ML algorithms to effectively manage multi-pollutant control systems where changes in one abatement process (e.g., SCR temperature) impact the efficiency of another (e.g., ESP power settings). Ensuring data quality and cyber security for critical infrastructure remains a top priority.

The prevailing expectation is that AI integration will fundamentally transform the economics of pollution control by significantly lowering operational expenditures (OPEX). By precisely tuning parameters such as reagent injection rates in SCR/FGD or voltage levels in ESPs, AI minimizes the consumption of expensive chemicals and electricity while simultaneously guaranteeing optimal environmental performance, often surpassing mandated thresholds. This predictive capability extends the life of critical components, such as catalyst beds and filter bags, transforming maintenance from time-based or reactive scheduling to a highly precise, condition-based strategy. The application of sophisticated data analytics is also crucial for regulatory reporting, providing transparent, immutable records of compliance, thereby reducing regulatory scrutiny and associated risks and streamlining audit processes globally.

Ultimately, the successful deployment of AI in APCE hinges on the establishment of highly reliable, high-frequency data pipelines from the plant floor to the cloud/edge computing infrastructure. This integration is vital for achieving the ultra-fine tuning required to push APCE performance to the limits of environmental regulations (often referred to as Best Available Techniques Reference, or BREF, limits). The industry views AI not merely as an optional add-on but as the essential tool for managing the complexity inherent in achieving near-zero emission targets across varied industrial processes, providing a competitive edge through efficiency and reliability. Early adopters are already demonstrating substantial reductions in chemical use and energy consumption, setting a new industry benchmark for environmental compliance operations.

- AI-Powered Process Optimization: Implementing specialized ML models to continuously analyze massive datasets from industrial sensors, adjusting variables (temperature, pressure, reagent input, catalyst activation) minute-by-minute to maintain peak pollution destruction efficiency while reducing energy use by 5-15% and minimizing the consumption of expensive abatement chemicals.

- Predictive Maintenance (PdM): Leveraging neural networks to analyze vibrational, acoustic, and thermal signatures of equipment, forecasting the remaining useful life (RUL) of high-wear components like heat exchangers, pumps, filter bags, and electrodes with high accuracy, drastically minimizing unplanned outages and associated penalties.

- Enhanced Compliance Monitoring: Developing intelligent dashboards and alert systems that utilize AI to detect anomalies in emission patterns instantaneously, ensuring continuous compliance with stack emission limits (SELs) and facilitating automated generation of auditable, time-stamped regulatory reports for environmental agencies.

- Data-Driven Design and Simulation: Utilizing generative AI and advanced computational fluid dynamics (CFD) simulations to rapidly prototype and test new APCE designs, optimizing component geometry and material selection for maximum performance under specific, often corrosive or high-temperature, industrial exhaust gas characteristics.

- Autonomous Control Systems: Implementing digital twin technology combined with reinforcement learning (RL) to allow complex, multi-pollutant APCE systems (e.g., integrated SCR and wet scrubber) to autonomously adapt to rapid fluctuations in industrial pollutant load and gas flow rate, ensuring stable output regardless of upstream process variability.

- Emissions Forecasting: Integrating AI with plant production scheduling, meteorological forecasts, and sensor data to accurately predict potential excursions above permitted limits, enabling operators to take proactive corrective action hours or days in advance, thereby shifting compliance strategy from reactive to anticipatory.

- Remote Diagnostics and Technical Support: Using AI-powered virtual assistants and diagnostic tools to analyze equipment failures and operational inefficiencies across a fleet of global installations, allowing remote technical experts to provide immediate, data-backed solutions, drastically reducing response times and associated travel costs for critical service interventions.

DRO & Impact Forces Of Air Pollution Control Equipment Market

The Air Pollution Control Equipment market is characterized by structural demand driven by legislative mandate, making regulatory enforcement the strongest market driver. The fundamental necessity for industries to operate within permitted limits compels continuous investment, regardless of short-term economic fluctuations. Specifically, the adoption of stricter $\text{PM}_{2.5}$ and $\text{NO}_x$ standards globally forces industries to retire older, less efficient abatement equipment in favor of advanced, capital-intensive solutions. Simultaneously, the increasing global scrutiny on corporate Environmental, Social, and Governance (ESG) performance acts as a powerful non-regulatory driver, pushing companies towards investing in systems that showcase superior environmental stewardship, often exceeding basic legal requirements to satisfy stakeholders and investors.

However, the market faces significant restraints that dampen immediate investment, particularly in economically sensitive regions. The initial capital expenditure (CapEx) for installing large-scale, customized APCE, such as complex multi-stage wet scrubbers or massive SCR units, can be prohibitive, especially for facilities operating on thin margins or those in nascent industrial economies. Beyond CapEx, the operational expenditure (OpEx) for reagents (limestone, ammonia, activated carbon) and high energy consumption (for fans, pumps, and ESPs) poses a continuous financial burden. Furthermore, technical complexity is a restraint; operating and maintaining highly specialized equipment requires a skilled workforce, which can be scarce, leading to reliance on costly long-term service agreements (LTSAs) with equipment manufacturers, increasing total cost of ownership.

Opportunities for growth are abundant through technological innovation and market expansion into new industry verticals. The largest opportunity lies in the retrofitting market, where aging infrastructure across North America and Europe requires modernization to meet new emission standards without complete plant decommissioning, demanding creative engineering solutions. Furthermore, the development of specialized abatement systems for niche or emerging pollutants (e.g., mercury removal from cement kilns, abatement of PFAS/PFOA in industrial solvents) opens lucrative, high-margin market segments. The growing waste-to-energy sector, which requires extremely robust and flexible APCE to handle diverse fuel streams, represents another significant, future-oriented opportunity. These dynamics create a robust market where mandatory expenditure intersects with highly advanced technology adoption and service complexity.

Segmentation Analysis

Market segmentation provides a critical view of the complex technological landscape and diverse end-user applications within the APCE sector. The categorization by equipment type reflects the specific engineering solution deployed to target specific pollutants, with each segment possessing distinct operational characteristics, cost profiles, and regulatory adherence capabilities. For instance, particulate control technologies (ESPs and Baghouses) dominate volume in heavy manufacturing, whereas gaseous control systems (FGD, SCR) dominate value due to their high complexity, large scale, and high reagent costs in the utility sector. Understanding these technological nuances is crucial for strategists aiming to penetrate specific industrial verticals and anticipate shifts in demand based on evolving regulatory mandates.

Segmentation by end-use application highlights the concentration of demand. The power generation segment historically accounts for the largest market share, driven by the sheer volume of flue gas requiring treatment. However, rapid industrial diversification in APAC is shifting demand toward smaller, distributed solutions required by the chemicals, food and beverage, and metals processing industries, emphasizing modularity and operational flexibility. Pollutant-based segmentation, particularly the focus on $\text{NO}_x$ and $\text{SO}_x$ abatement, directly tracks legislative cycles, indicating where future investment will be concentrated based on regulatory timelines for compliance enforcement, such as new $\text{NO}_x$ limits for gas turbines or stricter $\text{SO}_2$ caps for refineries.

The future evolution of segmentation is expected to be significantly influenced by the growing importance of the service and maintenance component, which is increasingly being segmented based on the complexity of the service offered—from basic spare parts supply to highly advanced, AI-driven performance optimization consulting. This reflects the realization that APCE performance is highly dependent on continuous, expert management throughout the equipment lifecycle, sustaining long-term, high-margin revenue streams for market leaders. Furthermore, geographical segmentation remains vital, as technologies suitable for developing economies (emphasizing cost-efficiency) differ significantly from those for mature markets (emphasizing ultra-low emissions and digitalization).

- By Type:

- Electrostatic Precipitators (ESPs): Utilized for high-volume gas streams, effective for medium to coarse PM control in power generation and cement. Sub-segments include Wet ESPs (for high moisture/sticky dust) and Pulse-Jet ESPs (for improved efficiency).

- Fabric Filters (Baghouses): High-efficiency particulate collection (E.g., pulse-jet, reverse-air, shaker designs), mandatory for fine dust capture ($\text{PM}_{2.5}$) in metallurgical, cement, and specialized chemical sectors.

- Scrubbers:

- Wet Scrubbers: Highly effective for acid gas removal ($\text{SO}_2$, $\text{HCl}$) and fine particulates, utilizing liquid reagents; primary drawback is the handling of wastewater/slurry. Examples: Venturi, packed-bed, tray scrubbers.

- Dry/Semi-dry Scrubbers: Employ dry or slurry reagents, significantly reducing water consumption and complexity; increasingly popular in medium-sized industrial boilers and waste incinerators.

- Thermal and Catalytic Oxidizers: Used predominantly for Volatile Organic Compound (VOC) and Hazardous Air Pollutant (HAP) destruction in chemical, coating, pharmaceutical, and printing industries. Sub-segments include Regenerative Thermal Oxidizers (RTOs) for energy efficiency and Catalytic Oxidizers (COs) for lower operating temperatures.

- Selective Catalytic Reduction (SCR): Premier technology for high-efficiency $\text{NO}_x$ reduction (up to 95%), requiring ammonia/urea injection and costly catalyst media; essential for utility boilers, large gas turbines, and specialized industrial furnaces.

- Selective Non-Catalytic Reduction (SNCR): Lower $\text{NO}_x$ reduction efficiency (20-50%) compared to SCR, but significantly lower CapEx; uses ammonia/urea injected directly into the boiler hot zone without a catalyst.

- Flue Gas Desulfurization (FGD): Critical for high-volume $\text{SO}_x$ removal in coal and heavy oil combustion. Segments include Limestone Wet FGD (most common), Magnesium Oxide FGD, and Sea Water FGD.

- Adsorbers: Specialized systems utilizing porous media like activated carbon or molecular sieves to capture specific trace pollutants, notably mercury, heavy metals, and niche toxic organic compounds in industrial effluent streams.

- By Application/End-Use Industry:

- Power Generation: The largest segment; covers utility-scale operations (coal, gas, oil) requiring massive, continuous-operation SCR, FGD, and high-efficiency ESP/Baghouse installations due to high volume of emissions.

- Cement Manufacturing: High demand for baghouses and ESPs due to intense particulate and dust emission regulations, alongside specialized $\text{NO}_x$ abatement for energy-intensive rotary kilns.

- Chemicals and Petrochemicals: Focuses heavily on VOC abatement (Oxidizers, Flares) and specialized gas cleaning (Adsorbers, tailored scrubbers) for highly varied, often corrosive, effluent streams; demand often involves modular and explosion-proof designs.

- Metals Processing (Iron & Steel, Non-ferrous): Requires robust, high-temperature APCE (ESPs, Baghouses) to manage dense particulate loads and process off-gases from sintering and furnace operations, often complicated by variable flow rates and temperatures.

- Manufacturing (Pulp & Paper, Textiles, Food & Beverage): Demand for smaller, modular scrubbing systems and RTOs to manage odor, localized emissions, and specific HAPs generated in processing stages.

- Incineration and Waste-to-Energy Plants: Requires multi-stage, comprehensive systems (Quench, Scrubbers, Baghouses, Adsorbers) to control particulates, acid gases ($\text{HCl}$), $\text{NO}_x$, and highly toxic dioxins/furans simultaneously, demanding the highest level of system integration.

- By Pollutant Type:

- Particulate Matter ($\text{PM}_{10}$ and $\text{PM}_{2.5}$): Addressed primarily by physical separation technologies (ESPs, Baghouses), with a growing focus on capturing the ultra-fine $\text{PM}_{2.5}$ component.

- Sulfur Oxides ($\text{SO}_x$): Primary target of FGD systems and various wet, dry, and semi-dry scrubbers, crucial for compliance in fossil fuel combustion.

- Nitrogen Oxides ($\text{NO}_x$): Target of SCR and SNCR technologies, requiring sophisticated post-combustion control and demanding high maintenance for catalyst performance.

- Volatile Organic Compounds (VOCs) and HAPs: Target of thermal and catalytic oxidizers, biofilters, and specialized adsorption units in manufacturing and chemical industries.

- Mercury and Heavy Metals: Captured via activated carbon injection systems (ACI) followed by particulate control devices, often driven by specific regulatory standards like the U.S. MATS rule.

Value Chain Analysis For Air Pollution Control Equipment Market

The efficiency and cost-competitiveness of Air Pollution Control Equipment manufacturers are intrinsically linked to the reliability and cost structure of the upstream supply chain. Upstream involves sourcing highly specialized materials: high-nickel alloys and corrosion-resistant plastics for corrosive environments (e.g., acidic scrubbers), specialized high-temperature resistant filtration media (e.g., PTFE, fiberglass, PPS for baghouses), and critical chemical reagents like catalyst substrates (vanadium, titanium oxides for SCR) and absorption chemicals (lime, ammonia, sodium bicarbonate). Manufacturers must skillfully manage long lead times and volatile global commodity prices for these inputs, necessitating robust inventory management and strategic supplier partnerships, particularly for performance-critical consumables like specialized catalyst blocks and high-efficiency filtration fabrics, which often have limited global suppliers.

The manufacturing and system integration phase is where significant engineering value is added. This stage requires sophisticated in-house engineering teams capable of advanced computational fluid dynamics (CFD) modeling to design custom ductwork, reaction vessels, and internal components that maximize gas flow and pollutant contact efficiency while minimizing pressure drop. Due to the massive scale and customization of many APCE projects (e.g., large-scale utility installations), efficient project management, strict adherence to quality control standards (ISO certification is common), and minimization of on-site construction time are paramount for achieving profitability and meeting client deadlines. The midstream firms often differentiate themselves through proprietary design engineering, patented component technologies, and specialized manufacturing capabilities, allowing them to offer superior performance and extended operational warranties.

Downstream activities—installation, commissioning, and aftermarket service—represent the critical and increasingly lucrative high-growth area of the value chain. As equipment lifespan often exceeds 20 years, the provision of high-quality replacement parts, reagent supply logistics, performance auditing, system optimization, and advanced remote monitoring (via IoT/AI platforms) constitutes a major, stable recurring revenue source. Direct distribution via internal sales teams and established relationships with global EPC contractors is dominant, reflecting the project-based, custom nature of the business. The trend towards integrating predictive maintenance software and comprehensive service level agreements (SLAs) with performance guarantees ensures continued client engagement and loyalty, cementing the long-term, high-margin revenue potential of the service side.

Air Pollution Control Equipment Market Potential Customers

The demand structure for Air Pollution Control Equipment is highly segmented, driven decisively by regulatory exposure, capacity utilization, and inherent pollutant release profiles. Utility companies, especially those operating large centralized coal, natural gas, or heavy oil-fired power plants, represent the cornerstone customer segment globally. Their requirement for continuous, high-volume abatement necessitates investments in multi-billion-dollar SCR and FGD systems to comply with utility-sector emission standards. Due to the mission-critical nature of their operations, these buyers prioritize maximum reliability, guaranteed performance, and comprehensive long-term service support from established, large-scale vendors over simple cost savings.

The second major cohort comprises the heavy manufacturing sector, including primary metals (iron, steel, aluminum), cement, and industrial mineral processing. These customers primarily require highly durable particulate control equipment (ESPs and Baghouses) designed to handle high-temperature, high-dust load, and sometimes explosive environments. Their purchasing decisions are often tied to securing or renewing critical operational permits in densely populated industrial zones, compelling continuous upgrades aimed at achieving stringent compliance targets for fugitive dust and process emissions. The cost of non-compliance, including fines and operational shutdowns, makes APCE a non-discretionary procurement item for this group.

A rapidly expanding and highly technical segment involves specialized manufacturing and process industries, such as petrochemicals, pharmaceuticals, and specialized chemical production. These clients are the primary consumers of advanced thermal oxidizers (RTO/RCO), biofilters, and tailored scrubbing solutions designed to destroy volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Their demand is characterized by the need for customized, smaller-scale, often modular units that can effectively manage highly toxic or corrosive, but low-volume, waste streams, making them critical buyers in the high-value technology segments where complexity and safety specifications drive pricing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 103.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises, General Electric, Mitsubishi Heavy Industries, Ducon Technologies, Thermax Global, John Wood Group PLC, Hamon Corporation, CECO Environmental, Siemens Energy, Clyde Bergemann Power Group, KC Cottrell, Air Clean Equipment, Wärtsilä, Donaldson Company, KSB SE & Co. KGaA, Lurgi GmbH, Fuji Electric Co., Ltd., Beltran Technologies, Inc., EnviroCare International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Pollution Control Equipment Market Key Technology Landscape

The current technology landscape in APCE is characterized by an intensified effort to enhance removal efficiency while simultaneously minimizing the energy footprint and secondary waste generation, aligning with circular economy principles. In particulate control, the focus has strongly shifted towards Pulse-Jet Fabric Filters and hybrid ESP-Baghouse systems, known as Hybrid Collectors, which strategically combine the high-volume pre-cleaning capabilities of ESPs with the superior fine particle capture efficiency of baghouses, particularly crucial for capturing ultra-fine $\text{PM}_{2.5}$ particles that pose the greatest health risk. Innovations in filter media, such as specialized membranes and composite materials (e.g., ePTFE membrane laminates), are allowing filters to operate effectively at higher temperatures and with greater resistance to acidic or abrasive process gases, extending their lifespan and reducing filter replacement frequency and associated maintenance costs.

For gaseous abatement, the development of next-generation catalysts for SCR systems is pivotal. Researchers and leading manufacturers are concentrating on developing catalyst formulations that perform effectively at significantly lower flue gas temperatures (Low-Temperature SCR), thus reducing the need for expensive upstream gas reheating, resulting in substantial energy savings. Furthermore, the industry is increasingly investing in non-ammonia based $\text{NO}_x$ reduction techniques to mitigate the safety and logistical challenges associated with handling anhydrous ammonia and urea in specific industrial environments. In $\text{SO}_x$ control, the dry and semi-dry injection processes, utilizing advanced sorbents like sodium bicarbonate and trona, are gaining significant traction in smaller industrial applications and areas facing severe water scarcity, where the operational complexity and high water requirements of traditional wet FGD systems are prohibitive.

The most transformative trend across all APCE segments remains the pervasive integration of digital technologies. Modern APCE systems are no longer standalone mechanical units but are managed by sophisticated IoT and AI control platforms. IoT sensors continuously monitor critical operational metrics such as stack gas composition, temperature gradients, reagent flow rates, and pressure drop across filters, transmitting data to cloud-based systems for machine learning analysis. This technological evolution allows manufacturers to offer performance optimization contracts, where the vendor is financially incentivized to keep emissions below guaranteed thresholds, fundamentally shifting the risk profile and enhancing the value proposition of modern air pollution control technology solutions for industrial operators by transforming equipment into highly optimized, data-driven assets.

Regional Highlights

- Asia Pacific (APAC): APAC is the global market leader, driven by unparalleled industrial expansion in East and South Asia. Governments, reacting to severe public health crises caused by air pollution, have enacted strict, often retrospective, environmental mandates (e.g., China's ultra-low emission limits for thermal power and steel). This necessitates massive capital deployment for new APCE installations and extensive retrofits of older facilities, ensuring sustained high demand across all technology types, particularly large-scale FGD, SCR, and high-efficiency Fabric Filters in the utility and metals sectors.

- North America: This mature market is characterized by high levels of environmental consciousness and a complex regulatory environment (e.g., Mercury and Air Toxics Standards, regional ozone transport rules). Market activity focuses primarily on modernization, lifecycle extension, and meeting highly specialized requirements, such as controlling mercury emissions from coal facilities and managing fugitive emissions and volatile organic compounds (VOCs) in the rapidly expanding oil and gas midstream sector (shale operations), driving demand for RTOs and advanced scrubbers.

- Europe: Driven by the stringent Best Available Techniques (BAT) requirements under the Industrial Emissions Directive (IED) and the European Green Deal, European demand centers on sophisticated, multi-pollutant control systems. Key market segments include advanced technology for waste-to-energy plants (focusing on dioxins, heavy metals, and acid gases) and implementing high-efficiency SCR and dust control in industrial processes, with a strong regulatory push towards achieving the lowest possible emission levels and adopting advanced monitoring techniques.

- Latin America (LATAM): Market adoption is highly uneven, concentrated in industrialized nations like Brazil, Mexico, and Chile. The mining and metallurgical sectors are major drivers, demanding robust particulate control equipment capable of handling challenging, high-volume dust loads. Regulatory enforcement is strengthening, often utilizing North American or European standards as benchmarks, creating significant latent demand for advanced APCE as local industry adapts to increased government oversight and pressure from international stakeholders.

- Middle East and Africa (MEA): Growth in MEA is strongly tied to large, state-owned industrial projects in the Gulf Cooperation Council (GCC), especially new refineries, petrochemical complexes, and power generation facilities fueled by gas. Demand is focused on specialized scrubbers for acid gas removal, effective $\text{NO}_x$ abatement for new gas turbines, and high-durability equipment that can withstand extreme heat, high ambient dust, and abrasive conditions, alongside ongoing efforts to mitigate harmful gas flaring emissions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Pollution Control Equipment Market.- Babcock & Wilcox Enterprises, Inc.

- General Electric Company

- Mitsubishi Heavy Industries, Ltd.

- Ducon Technologies Inc.

- Thermax Global

- John Wood Group PLC

- Hamon Corporation

- CECO Environmental Corp.

- Siemens Energy AG

- Clyde Bergemann Power Group

- KC Cottrell Co., Ltd.

- Air Clean Equipment, Inc.

- Wärtsilä Corporation

- Donaldson Company, Inc.

- KSB SE & Co. KGaA

- Lurgi GmbH

- Fuji Electric Co., Ltd.

- Beltran Technologies, Inc.

- EnviroCare International

- Hellenic Environmental Center S.A. (HEC)

Frequently Asked Questions

Analyze common user questions about the Air Pollution Control Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Air Pollution Control Equipment market?

The market is primarily driven by escalating global and regional regulatory mandates imposing strict limits on industrial emissions (SOx, NOx, PM), coupled with rapid industrial expansion, particularly in Asian economies, and increasing public and corporate focus on environmental sustainability and health outcomes, supported by robust ESG investment frameworks.

How does the type of end-user industry influence the choice of APCE technology?

The end-user industry dictates the unique pollutant profile and operational conditions. For example, the power sector requires large, continuous systems like FGD and SCR for high-volume gas streams, while smaller chemical plants rely on specialized thermal oxidizers and customized scrubbers for low-volume, high-toxicity VOC streams, demanding specific hazardous environment certifications.

What role does digitalization play in modern air pollution control?

Digitalization, powered by IoT and AI, is essential for optimizing operational performance. It enables real-time monitoring, predictive maintenance to prevent costly downtime, and automated process adjustments (reducing reagent and energy use), ensuring compliance is maintained efficiently while significantly lowering long-term operational expenditures (OPEX).

Which geographical region represents the largest and fastest-growing market for APCE?

The Asia Pacific (APAC) region currently holds the largest market share due to unprecedented industrial growth and is projected to exhibit the highest CAGR through 2033, driven by mandatory installation and retrofitting projects in China and India aimed at achieving global best-practice environmental standards.

What are the key technical challenges facing the deployment of new APCE?

Major technical challenges include managing the high initial capital cost, integrating complex, sophisticated equipment into aging or existing plant infrastructure during retrofits, ensuring continuous supply of specialized reagents (catalysts, sorbents), and effectively managing secondary waste streams, such as hazardous sludge and spent catalysts, in an environmentally sound manner.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager