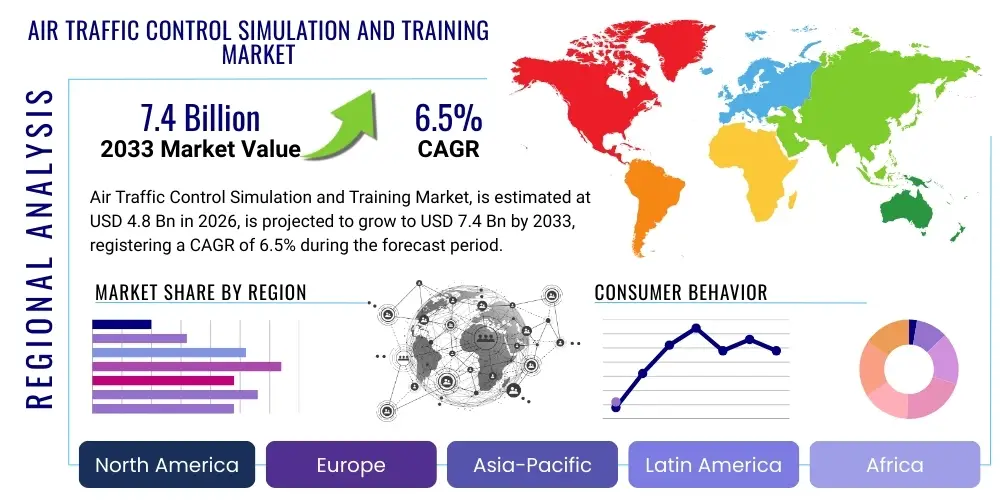

Air Traffic Control Simulation and Training Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438351 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Air Traffic Control Simulation and Training Market Size

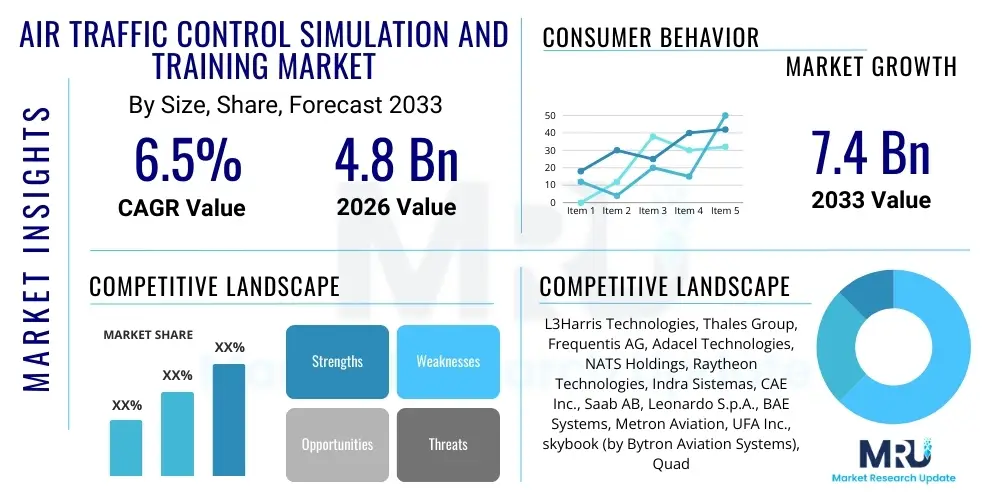

The Air Traffic Control Simulation and Training Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Air Traffic Control Simulation and Training Market introduction

The Air Traffic Control (ATC) Simulation and Training Market encompasses advanced systems designed to replicate real-world air traffic management scenarios for the purposes of training, certifying, and refreshing the skills of air traffic controllers (ATCOs) and airside personnel. These sophisticated platforms range from high-fidelity 360-degree tower simulators and radar/approach control systems to desktop-based training modules utilizing advanced visualization and physics engines. The core objective of these solutions is to provide a safe, scalable, and controlled environment where controllers can practice managing complex, high-density traffic flows, respond to emergencies, and familiarize themselves with new procedures or technological upgrades without risking operational safety.

Product offerings in this market are diverse, including specialized hardware components such as instructor operator stations (IOS), communication simulation systems, and realistic controller consoles, coupled with proprietary software that manages scenario generation, performance assessment, and data logging. Major applications span across civilian aviation (national air navigation service providers (ANSPs), airport authorities) and military applications, where training focuses on tactical airspace management and coordination. The increasing global demand for air travel, the mandated transition to modernized airspace concepts like NextGen (North America) and SESAR (Europe), and the simultaneous requirement to replace a retiring generation of ATCOs are collectively driving the adoption of these advanced training solutions globally. These systems ensure that ATCOs maintain the highest level of proficiency, directly impacting aviation safety and operational efficiency.

Key benefits derived from adopting state-of-the-art ATC simulation systems include the reduction of on-the-job training duration, standardization of training quality across diverse geographical locations, and the capability to conduct repetitive training for rare or high-risk events (e.g., severe weather deviations, runway incursions). Furthermore, the simulation environment allows ANSPs to rigorously test and validate new procedures and system upgrades before deployment in live airspace, mitigating operational risks. The primary driving factors fueling market expansion are stringent international aviation safety standards set by bodies like ICAO, continuous investments by major ANSPs in upgrading legacy training infrastructure, and the inherent cost-effectiveness of simulation over real-time training exercises, particularly for large scale coordination tasks.

Air Traffic Control Simulation and Training Market Executive Summary

The Air Traffic Control Simulation and Training Market is experiencing robust growth driven by mandatory regulatory requirements for controller proficiency and large-scale modernization initiatives across global airspace management systems. Key business trends indicate a shift toward integrated, modular training platforms that combine high-fidelity visualization with adaptive learning methodologies, heavily leveraging cloud computing and subscription-based service models (SaaS) to enhance accessibility and reduce upfront capital expenditure for ANSPs. Geographically, North America and Europe continue to hold significant market shares due to early adoption, established regulatory frameworks, and major modernization programs, while the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by massive infrastructure development, establishment of new airports, and a critical need to rapidly train a large workforce to meet soaring air traffic volumes. The competitive landscape is characterized by strategic mergers and acquisitions, focusing on integrating specialized software capabilities (e.g., AI-driven scenario generation) and expanding regional presence through local partnerships to navigate complex procurement processes.

Segment trends highlight the increasing demand for advanced tower simulators (360-degree visualization) due to the complexity of surface operations and the rollout of digital tower technology, requiring specialized training modules. The software segment is outpacing hardware growth, largely attributed to the continuous need for updates, customization services, and the incorporation of sophisticated features like realistic voice recognition and synthetic traffic injection. Furthermore, the specialized training segment, focusing on specific competencies such as drone integration (UAS Traffic Management or UTM) and cybersecurity procedures related to ATC systems, is emerging as a high-growth niche. These simulation tools are crucial not only for initial qualification (ab-initio) but also for recurrent training, ensuring controllers remain competent with constantly evolving procedures, especially concerning the harmonization of international standards and protocols, which requires frequent system adjustments and retraining cycles.

The market outlook remains highly positive, underpinned by long-term contractual engagements between simulation providers and governmental ANSPs, providing stable revenue streams. The adoption of virtual reality (VR) and augmented reality (AR) is transitioning from proof-of-concept stages to practical deployment, offering highly immersive yet cost-effective alternatives for specific training aspects, such as familiarization with airport layouts and non-radar procedural control. Successful market participants are those who offer comprehensive, end-to-end solutions covering the entire training lifecycle—from initial assessment to performance monitoring—and demonstrating strong adherence to strict civil and military aviation regulatory compliance, cementing their position as trusted partners in national critical infrastructure development.

AI Impact Analysis on Air Traffic Control Simulation and Training Market

User inquiries regarding the impact of Artificial Intelligence (AI) in ATC simulation predominantly revolve around three key themes: the enhancement of training fidelity through adaptive scenario generation, the role of AI in objective performance assessment of trainees, and the utilization of machine learning to simulate highly realistic and unpredictable pilot and traffic behavior. Users are keen to understand how AI can move beyond simple rule-based scenarios to create dynamic, complex, and high-stress environments that mirror real-world operational unpredictability. Concerns often center on the ethics and reliability of AI-driven evaluation systems replacing human instructor judgment and the required investment in data infrastructure to support sophisticated machine learning models necessary for high-fidelity behavior modeling. There is a strong expectation that AI will ultimately lead to personalized, just-in-time training curricula that drastically reduce overall training time while increasing controller competency in handling rare or emergent situations, thereby optimizing the training pipeline efficiency for large workforce requirements.

- AI enables highly adaptive training scenarios that adjust difficulty and complexity in real-time based on the trainee's current performance and stress levels.

- Machine learning algorithms analyze large datasets of real operational incidents, allowing for the generation of statistically relevant and realistic non-standard events (NSSEs).

- AI facilitates objective, automated evaluation of controller performance metrics, identifying specific skill gaps (e.g., decision-making speed, resource management) more precisely than manual assessment.

- Natural Language Processing (NLP) improves the realism of pilot-controller communications within the simulator, generating dynamic and contextually appropriate responses.

- Predictive modeling using AI helps ANSPs forecast future training needs and allocate simulation resources more efficiently based on projected traffic growth and workforce retirement rates.

- Integration of Generative AI assists instructors in rapidly developing new, customized training content and complex airspace layouts.

DRO & Impact Forces Of Air Traffic Control Simulation and Training Market

The Air Traffic Control Simulation and Training Market is primarily driven by rigorous international safety standards and the ongoing need to manage increasing air traffic density, which necessitates highly proficient air traffic controllers. Restraints largely center on the significant upfront capital investment required for high-fidelity simulator hardware and the lengthy, complex procurement and regulatory approval processes specific to ANSPs (Air Navigation Service Providers). However, substantial opportunities exist through the development and integration of virtual and augmented reality (VR/AR) solutions, which promise reduced hardware costs and enhanced accessibility, particularly in emerging markets. The integration of advanced data analytics and AI for personalized training curriculum design further solidifies market potential. These forces collectively shape a market environment prioritizing safety and efficiency, favoring suppliers who offer scalable, flexible, and technologically advanced solutions capable of meeting the diverse training needs arising from global air traffic modernization initiatives.

Segmentation Analysis

The market segmentation for ATC Simulation and Training systems is critical for understanding targeted deployment and technological focus. The market is broadly classified based on the component type (hardware, software, services), the specific application (civilian vs. military), the training type (ab-initio, recurrent, specialized), and the platform used (tower, radar, desktop). The services segment, encompassing maintenance, customization, and long-term support, is anticipated to show the fastest growth due to the complexity and longevity of simulator lifecycles requiring continuous technical intervention and system upgrades. The civilian application segment dominates the market share due to the global scale of commercial aviation and the ongoing need for large-scale controller recruitment and training programs mandated by international civil aviation bodies. Furthermore, within the platform segment, high-fidelity tower simulators command premium pricing due to their complexity in replicating realistic visual and auditory environments necessary for surface and approach control training.

- Component:

- Hardware (e.g., Full-Scope Simulators, Controller Workstations, Communication Systems)

- Software (e.g., Scenario Generation Tools, Visualization Engines, Assessment Modules)

- Services (e.g., Maintenance, Consulting, Upgrade, Technical Support)

- Application:

- Civilian (Air Navigation Service Providers, Airport Authorities)

- Military (Air Force, Naval Air Traffic Control)

- Training Type:

- Ab-Initio Training (Initial Qualification)

- Recurrent and Refresher Training (Annual Proficiency)

- Specialized Training (e.g., Emergency Procedures, Digital Towers, ATM Concept Validation)

- Platform Type:

- Tower Simulators (360-degree, Digital Tower Simulation)

- Radar and Approach Control Simulators (Area Control Center Simulation)

- Desktop/PC-based Trainers

Value Chain Analysis For Air Traffic Control Simulation and Training Market

The value chain for the ATC Simulation and Training Market begins with the upstream suppliers providing highly specialized components, including high-resolution projection systems, sophisticated physics engines, geospatial mapping data, and high-performance computing hardware (GPUs, servers). Key upstream activities involve intensive research and development to maintain technological parity, particularly in visualization fidelity and realistic aircraft behavior modeling. Specialized software developers, often subsidiaries or key partners of major integrators, contribute proprietary scenario generation algorithms and complex air traffic management logic, forming the technological core of the simulation product.

Mid-stream activities are dominated by system integrators—the major market players—who perform complex tasks such as customization, system integration, software adaptation to local airspace procedures, and conducting rigorous acceptance testing to meet strict regulatory standards (e.g., EUROCONTROL specifications). This integration phase is resource-intensive and requires deep domain expertise in air traffic management procedures. The distribution channel is predominantly direct, characterized by long-term, high-value procurement contracts executed directly between the system integrator and the governmental Air Navigation Service Provider (ANSP) or military entity. Indirect channels are rare but may involve regional consulting firms facilitating procurement in specific emerging markets.

Downstream activities focus heavily on installation, continuous maintenance, and post-sales services, which contribute significantly to the total cost of ownership and recurring revenue for vendors. End-users (ANSPs and military commands) utilize these systems for mandated ab-initio and recurrent controller training. The service component, including software updates (incorporating new procedures like free-route airspace or drone integration protocols) and hardware maintenance over a 15-20 year operational lifespan, is crucial. The value chain is heavily regulated and relationship-driven, necessitating robust partnerships and adherence to localized aviation safety standards, ensuring that the delivered solutions provide maximum training efficacy and operational compliance.

Air Traffic Control Simulation and Training Market Potential Customers

The primary customers in the Air Traffic Control Simulation and Training Market are large-scale, governmental entities and specialized aviation institutions responsible for managing national or regional airspace. The most significant customer segment comprises Air Navigation Service Providers (ANSPs), which are either state-owned enterprises or private organizations operating under government mandate, such as the Federal Aviation Administration (FAA) in the U.S., EUROCONTROL members in Europe, or major entities like NATS (UK) and DFS (Germany). These organizations require full-scale, certified simulation facilities to train thousands of controllers across tower, approach, and area control operations, necessitating continuous system upgrades and long-term service contracts to maintain regulatory compliance.

Secondary but crucial customers include defense and military organizations globally. Military air traffic control requires specialized training focused on tactical maneuvering, managing joint civil-military airspace, and handling classified operational procedures, often demanding custom-built simulation environments that can integrate radar systems specific to military aircraft. Furthermore, dedicated ATC training academies and vocational institutions, both governmental and private, that offer ab-initio controller courses constitute a growing customer base, often preferring modular, scalable, and sometimes PC-based simulation solutions that provide a cost-effective alternative for foundational training before controllers proceed to high-fidelity ANSP facilities.

Finally, international bodies and consortiums focused on aviation infrastructure modernization, such as the Single European Sky ATM Research (SESAR) Joint Undertaking, and large international airport operators increasingly act as influential buyers, particularly for specialized training modules related to new technologies like Digital Tower operations or integrated ground handling simulation. These customers are driven by the need for operational efficiency, compliance with rapidly evolving international standards (ICAO mandates), and the critical requirement to sustain a pipeline of highly skilled air traffic management professionals capable of handling projected increases in global air traffic volumes while maintaining stringent safety parameters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L3Harris Technologies, Thales Group, Frequentis AG, Adacel Technologies, NATS Holdings, Raytheon Technologies, Indra Sistemas, CAE Inc., Saab AB, Leonardo S.p.A., BAE Systems, Metron Aviation, UFA Inc., skybook (by Bytron Aviation Systems), Quadrant Simulation Systems, Micro Nav Ltd., EIZO Corporation, Searidge Technologies, Advanced Simulation Technology Inc. (ASTi), Rockwell Collins (now part of Collins Aerospace). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Traffic Control Simulation and Training Market Key Technology Landscape

The technological evolution in the ATC Simulation and Training Market is accelerating, primarily focusing on enhancing realism, scalability, and integration capabilities. A fundamental technology deployed is high-fidelity visual simulation, utilizing advanced projection systems, rendering engines, and detailed geo-specific databases to create photorealistic 360-degree views from the control tower cab. This visual realism is critical for surface movement training and tower operational awareness. Concurrently, synthetic environments are being built using advanced game engines (such as Unity or Unreal Engine) adapted for professional use, allowing for rapid scenario development, detailed atmospheric modeling, and realistic interaction between ground vehicles and aircraft within the simulated airspace.

Another major technological trend involves the increasing adoption of Virtual Reality (VR) and Augmented Reality (AR) to complement or partially replace expensive, fixed-base simulators. VR headsets offer a cost-effective, portable solution for initial procedure training and familiarity with specific airport layouts, especially beneficial for remote training centers or lower-tier airports. AR technology is particularly valuable in digital tower simulation, overlaying vital operational data onto real-time visual feeds or simulated environments. Furthermore, sophisticated communication simulation systems integrating Voice over Internet Protocol (VoIP) and advanced voice recognition software are used to accurately replicate the pressure and complexity of pilot-controller radio communications, which is a critical skill component in ATCO training curricula.

Data analytics and Artificial Intelligence (AI) form the backbone of next-generation training systems. Machine learning is increasingly utilized to create highly intelligent and unpredictable non-player characters (simulated pilots), moving beyond predictable script execution to model complex, sometimes erroneous, human behavior, thus testing the controller’s cognitive load and decision-making under stress. Additionally, AI-powered performance monitoring tools use biometric data (e.g., eye-tracking, heart rate variability) and operational inputs (e.g., phraseology adherence, conflict resolution time) to provide objective, standardized performance assessments, streamlining the certification process and offering personalized remedial training pathways tailored to individual learning needs.

Regional Highlights

North America maintains a dominant position in the global ATC Simulation and Training Market, largely attributable to the massive size of the US airspace and the continuous funding directed toward the FAA's Next Generation Air Transportation System (NextGen) initiative. This modernization drive mandates constant retraining and system upgrades, ensuring a robust and stable demand for high-fidelity radar and area control simulators, as well as specialized training for new procedures like Performance-Based Navigation (PBN). Key drivers in this region include the high volume of legacy ATC infrastructure requiring simulation-based testing prior to modernization, and strong government spending on national security, ensuring demand from both civil and military sectors. Major players in the region benefit from proximity to large ANSPs and a well-established ecosystem of specialized technology providers.

Europe represents the second-largest market, primarily governed by the Single European Sky (SES) initiative and the implementation of the SESAR program, which aims to harmonize and optimize air traffic management across the continent. European demand is characterized by a strong focus on cross-border coordination training, interoperability testing, and the deployment of advanced digital tower solutions, leading to high investment in specialized software and complex network-centric simulation environments. The market here is highly competitive, with strong local expertise in integration and customization needed to address the fragmented nature of ANSPs across member states. Strict regulatory mandates concerning controller competence and mandatory recurrent training ensure predictable, long-term demand for services and software maintenance contracts.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is driven by exponential increases in air passenger traffic, the construction of numerous new airports (especially in China, India, and Southeast Asia), and the critical necessity to quickly train a substantial workforce of new air traffic controllers. Many countries in APAC are leapfrogging older technologies, often opting directly for cutting-edge simulation solutions that include VR/AR and modular training centers, viewing simulation as essential for rapid capacity building and enhancing safety standards to meet global benchmarks. Infrastructure investment by governments and public-private partnerships across developing economies are major growth catalysts. The Middle East and Africa (MEA) region also shows promising growth, fueled by major hub airports expansion and ambitious diversification efforts, requiring advanced training centers to manage complex, often international, airspace.

- North America: Market leader driven by FAA NextGen deployment, high military spending, and established regulatory mandates for ATCO certification and recurrent training.

- Europe: Strong demand fueled by SESAR implementation, focus on digital tower technology, and complex cross-border airspace management simulation requirements.

- Asia Pacific (APAC): Fastest growing market due to significant air traffic growth, rapid construction of aviation infrastructure, and urgent requirement for large-scale ab-initio controller training.

- Latin America: Characterized by intermittent investment cycles focused on regional airport upgrades and modernization of existing radar systems, driving demand for scalable, mid-range simulators.

- Middle East and Africa (MEA): Emerging high-growth region linked to mega-projects in aviation hubs (UAE, Saudi Arabia) and the need to establish localized, modern ATC training academies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Traffic Control Simulation and Training Market.- L3Harris Technologies

- Thales Group

- Frequentis AG

- Adacel Technologies

- NATS Holdings

- Raytheon Technologies

- Indra Sistemas

- CAE Inc.

- Saab AB

- Leonardo S.p.A.

- BAE Systems

- Metron Aviation

- UFA Inc.

- skybook (Bytron Aviation Systems)

- Quadrant Simulation Systems

- Micro Nav Ltd.

- EIZO Corporation

- Searidge Technologies

- Advanced Simulation Technology Inc. (ASTi)

- Rockwell Collins (now part of Collins Aerospace)

Frequently Asked Questions

Analyze common user questions about the Air Traffic Control Simulation and Training market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the ATC Simulation and Training Market?

The market is primarily driven by rigorous global aviation safety mandates (ICAO standards), substantial investments in air traffic management (ATM) modernization programs (such as NextGen and SESAR), and the demographic requirement to replace a retiring generation of air traffic controllers globally, necessitating continuous high-volume, high-quality training.

How is Artificial Intelligence (AI) transforming ATC simulation platforms?

AI is transforming platforms by enabling adaptive learning environments, automating the objective assessment of trainee performance, and generating highly realistic, dynamic, and unpredictable non-standard operational scenarios (synthetic traffic behavior), thereby increasing training efficacy and reducing manual instructor workload.

Which geographic region presents the most significant growth opportunities for simulation providers?

The Asia Pacific (APAC) region offers the most significant growth opportunities, characterized by explosive air traffic growth, widespread new airport development, and urgent governmental initiatives to rapidly scale up the qualified air traffic controller workforce through advanced, frequently imported, simulation technology.

What is the difference between Ab-Initio and Recurrent training in ATC simulation?

Ab-Initio training refers to the initial, foundational phase required for new candidates to gain their basic controller certification. Recurrent training is the mandatory periodic training (typically annual or biennial) required for certified controllers to maintain proficiency, practice emergency procedures, and adapt to new operational procedures or technological updates.

What is the role of Virtual Reality (VR) and Augmented Reality (AR) in ATC training?

VR and AR offer cost-effective and portable training alternatives. VR is used for immersive procedural training and familiarity with tower environments, while AR is crucial for advanced applications, such as overlaying data onto simulated views in digital tower systems, enhancing operational decision-making training.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager