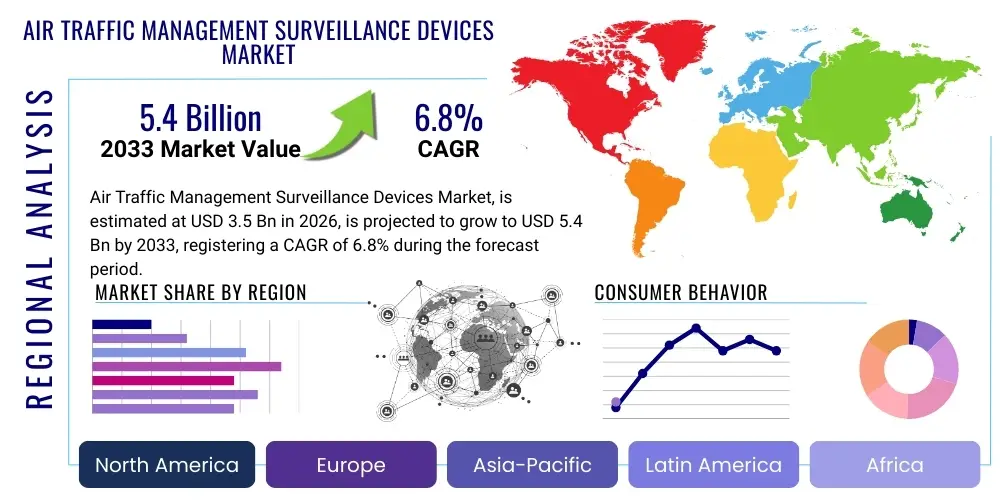

Air Traffic Management Surveillance Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439187 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Air Traffic Management Surveillance Devices Market Size

The Air Traffic Management Surveillance Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Air Traffic Management Surveillance Devices Market introduction

The Air Traffic Management (ATM) Surveillance Devices Market encompasses advanced technological solutions essential for tracking, monitoring, and managing aircraft movement safely and efficiently across various airspace sectors, including terminal areas and en-route environments. Key product categories within this sector include Primary Surveillance Radar (PSR), Secondary Surveillance Radar (SSR), Automatic Dependent Surveillance-Broadcast (ADS-B), and Multilateration (MLAT) systems. These devices form the backbone of modern air navigation service providers (ANSPs), supplying air traffic controllers with precise positional data, identification, and intent information necessary to prevent collisions, optimize flight paths, and manage increasing air density. The sophistication of these systems is constantly evolving, driven by the global imperative to enhance aviation safety standards and maximize airspace capacity.

Major applications for ATM surveillance devices span civil aviation, military operations, and increasingly, the management of Unmanned Aircraft Systems (UAS) traffic. In civil aviation, these devices are crucial for terminal area surveillance, ensuring the safe landing and takeoff procedures at busy international airports, and for wide-area en-route surveillance, guaranteeing separation standards between aircraft traveling long distances. The core benefit derived from these technologies is the substantial improvement in operational safety and efficiency, enabling controllers to handle a greater volume of traffic while reducing delays and fuel consumption. Furthermore, the integration of new technologies like space-based ADS-B is expanding coverage to remote and oceanic regions previously lacking consistent surveillance.

Driving factors for market expansion are multifaceted, anchored primarily by the sustained global growth in air passenger traffic, which necessitates continuous upgrades to existing air navigation infrastructure to prevent system saturation. Regulatory mandates, particularly those issued by bodies such as the International Civil Aviation Organization (ICAO), the Federal Aviation Administration (FAA) in North America, and the European Union Aviation Safety Agency (EASA) regarding the compulsory adoption of ADS-B Out and modern SSR Mode S systems, compel ANSPs globally to invest heavily in modern surveillance technologies. Moreover, the increasing complexity of airspace due to the integration of commercial space launches and widespread drone operations is creating demand for adaptive, high-fidelity surveillance solutions capable of discerning targets across various speeds and altitudes.

Air Traffic Management Surveillance Devices Market Executive Summary

The Air Traffic Management Surveillance Devices market is characterized by robust investment driven by the imperative of global airspace harmonization and digitalization initiatives. Business trends indicate a pronounced shift towards software-defined surveillance systems and the integration of non-traditional data sources, such such as space-based surveillance and low-cost sensor networks, enhancing coverage fidelity and reducing reliance on legacy ground-based radar infrastructure. Segmentation trends highlight the ADS-B segment as the fastest-growing technology due to its lower deployment cost and higher data update rates compared to conventional radar, accelerated by widespread regulatory deadlines. Simultaneously, the market is seeing strong demand for advanced data fusion platforms that merge inputs from diverse surveillance devices, offering controllers a unified and highly reliable picture of the operational environment. These technology transitions necessitate significant investments in cybersecurity infrastructure to protect critical air traffic data.

Regional trends underscore Asia Pacific (APAC) as the key growth engine, fueled by massive government expenditures on new airport construction, air traffic capacity expansion, and the modernization of ANSP capabilities across developing economies like India, China, and Southeast Asian nations. North America and Europe, while mature markets, maintain high market share due to continuous replacement cycles for aging radar systems and the implementation of advanced programs like NextGen (US) and SESAR (Europe), focusing heavily on digitalization and system interoperability. The competitive landscape remains highly consolidated, dominated by established defense and aerospace prime contractors who leverage long-standing governmental relationships and deep technical expertise in complex system integration. Strategic partnerships and mergers focused on acquiring specialized digital and AI capabilities are becoming common tactical moves among key industry players to maintain relevance.

The convergence of surveillance technology with remote digital tower concepts and unmanned traffic management (UTM) systems represents a major emerging segment for market penetration. While the initial capital expenditure associated with high-precision surveillance systems remains a significant restraint, the long-term operational cost savings and the ability to manage densely packed airspace safely provide compelling justification for ANSPs. The market’s future is intrinsically linked to the successful deployment of harmonized global standards, ensuring seamless data exchange between different national surveillance systems. Furthermore, the necessity for robust, redundant systems capable of operating effectively even in adverse weather conditions or in jamming environments drives continuous innovation in sensor resilience and signal processing capabilities.

AI Impact Analysis on Air Traffic Management Surveillance Devices Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on ATM surveillance devices frequently center on three critical areas: enhanced operational predictive capabilities, the role of AI in improving sensor data processing, and the potential implications for system safety assurance and human involvement. Users are keenly interested in how machine learning algorithms can predict potential traffic conflicts far earlier than current human-centric methods, thereby maximizing system throughput and controller workload distribution. A parallel theme of inquiry involves the use of AI for advanced maintenance diagnostics, seeking to understand how predictive analytics, fueled by sensor data, can minimize unexpected system downtime and optimize maintenance scheduling for expensive radar and transponder equipment. Finally, considerable attention is paid to the regulatory hurdles and validation requirements needed to trust AI-driven surveillance outputs, particularly regarding the certification of autonomous detection and tracking algorithms.

Based on these inquiries, the primary impact themes revolve around the transition from reactive data monitoring to proactive, predictive airspace management. AI integration promises to drastically enhance the precision and reliability of surveillance data by employing sophisticated algorithms to filter out clutter, compensate for sensor bias, and fuse disparate data sources (such as radar, ADS-B, and meteorological feeds) into a single, highly accurate synthetic environment. This capability is crucial for managing the emerging complexity of lower airspace. While AI is unlikely to replace human air traffic controllers entirely, it will augment their decision-making process by autonomously handling routine tasks, detecting anomalies, and providing probabilistic risk assessments in real-time. This functional transformation necessitates specialized training for personnel and significant architectural upgrades to existing surveillance networks to handle the computational load of deep learning models.

The implementation of AI/ML models is expected to dramatically redefine the performance benchmarks for ATM surveillance. For instance, AI can optimize MLAT networks by dynamically recalibrating sensor timing or can automatically adjust radar parameters based on atmospheric conditions, thus ensuring consistent performance. However, this deployment introduces new security vulnerabilities, as the integrity of AI models against adversarial attacks becomes a critical safety concern. Successful market adoption hinges on the development of rigorous, certifiable AI validation frameworks that ensure predictability and explainability (XAI) in all automated surveillance decisions. The market is therefore seeing accelerated investment in AI-enhanced data processing units integrated directly into surveillance device hardware to enable edge computing capabilities, enhancing both speed and network security.

- AI enhances predictive conflict detection and resolution advice for controllers.

- Machine learning algorithms optimize sensor performance by filtering noise and compensating for atmospheric interference.

- AI-driven predictive maintenance reduces system downtime and extends the operational life of surveillance hardware.

- Data fusion using neural networks integrates inputs from heterogeneous sources (ADS-B, radar, satellite) into a unified, high-fidelity tracking picture.

- Integration of AI supports autonomous monitoring for low-altitude drone traffic (UTM applications).

- Demand increases for secure, high-performance edge computing hardware integrated within surveillance sites to run complex AI models locally.

DRO & Impact Forces Of Air Traffic Management Surveillance Devices Market

The dynamics of the Air Traffic Management Surveillance Devices Market are shaped by a powerful combination of drivers, significant restraints, and clear opportunities that exert measurable impact forces on industry growth and technological direction. Key drivers include the exponential increase in global commercial flight volumes, which necessitates immediate improvements in airspace capacity and safety protocols, and the continuous imposition of mandatory modernization programs by international and regional regulatory bodies (such as the FAA’s ADS-B mandates). These drivers create consistent, non-negotiable demand for high-performance and resilient surveillance infrastructure. Restraints primarily involve the exceptionally high capital expenditure required for deploying and maintaining complex radar and network systems, coupled with budgetary constraints faced by many public-funded ANSPs, especially in developing regions. Furthermore, the limited radio frequency spectrum available for traditional radar operations presents a technical ceiling on future growth and drives the necessity for alternative technologies like space-based systems.

Opportunities center around the burgeoning demand for monitoring new airspace users, particularly the integration of Unmanned Aircraft Systems (UAS) and commercial space vehicles, which require specialized, scalable surveillance solutions distinct from traditional systems. The adoption of Remote Virtual Tower (RVT) technology also creates a substantial market opportunity, as these systems rely heavily on integrated sensor suites (including cameras, MLAT, and local ADS-B receivers) for situational awareness, effectively broadening the customer base beyond traditional large international airports. The Impact Forces resulting from the interplay of these factors are pushing the market away from standalone, monolithic radar installations toward highly networked, decentralized, and redundant surveillance architectures. This shift mandates a focus on data security, system interoperability, and sophisticated data fusion techniques to handle the increased complexity and volume of inputs from diverse sensors.

The strongest impact force is the regulatory pressure for harmonized global standards, which accelerates the sunsetting of older, less efficient surveillance technologies and mandates the rapid uptake of ADS-B and SSR Mode S capabilities worldwide. This force ensures continuous investment cycles. Simultaneously, the inherent constraint of high costs is mitigated by technological opportunities—specifically, the lower cost and faster deployment of networked MLAT and space-based systems compared to legacy primary radar. This equilibrium leads to strategic investment choices where ANSPs often adopt hybrid surveillance models, retaining high-fidelity primary radar for critical terminal areas while deploying cost-effective, wide-area ADS-B solutions for oceanic and remote coverage. This structured evolution ensures both safety compliance and fiscal prudence within the sector.

Segmentation Analysis

The Air Traffic Management Surveillance Devices Market is comprehensively segmented across several dimensions, including component type, application, technology, and end-user, allowing for detailed analysis of consumption patterns and technological dominance. The component segment typically divides the market between hardware (antennas, transponders, sensors, signal processors) and software (data fusion systems, monitoring tools, AI algorithms). The application segmentation differentiates demand between highly critical Terminal Area (TMA) surveillance, requiring high update rates and precision for approaches and departures, and En-Route surveillance, which covers vast geographical areas using systems optimized for range and reliability. Furthermore, technology segmentation clearly delineates the adoption rates of legacy radar systems versus modern dependent surveillance and networked solutions.

- By Type:

- Primary Surveillance Radar (PSR)

- Secondary Surveillance Radar (SSR) (Including Mode S)

- Automatic Dependent Surveillance-Broadcast (ADS-B)

- Multilateration (MLAT)

- Surface Movement Guidance and Control System (SMGCS)

- Space-Based ADS-B

- By Component:

- Hardware (Antennas, Receivers, Transponders, Processors)

- Software (Data Fusion, Visualization, Maintenance & Monitoring Suites)

- By Application:

- Terminal Area Surveillance (TMA)

- En-Route Surveillance

- Surface Surveillance

- By End-User:

- Civil Aviation (Airports and ANSPs)

- Military/Defense

Value Chain Analysis For Air Traffic Management Surveillance Devices Market

The value chain for ATM surveillance devices is highly integrated and complex, starting with specialized upstream suppliers and culminating in long-term maintenance contracts. The upstream segment involves the research, development, and manufacturing of highly specialized electronic components, including radio frequency (RF) components, advanced antennas, microprocessors, high-speed digital signal processors (DSPs), and certified aviation-grade sensors (GPS/GNSS receivers). This phase requires stringent quality control and compliance with aviation safety standards. Key players in this segment are component manufacturers and subsystem suppliers who often specialize in specific high-reliability defense or aerospace-grade components. The competitive advantage at this stage is derived from miniaturization, reliability, and frequency bandwidth optimization.

The core of the value chain involves the design, integration, and deployment of the complete surveillance system. System integrators and Original Equipment Manufacturers (OEMs) procure components, develop proprietary software algorithms for signal processing and data fusion, and undertake extensive site surveys and system calibration. Distribution channels are predominantly direct, characterized by long-cycle, high-value contracts between the OEM and the Air Navigation Service Provider (ANSP) or national defense ministries. Indirect channels are less common but may involve certified local partners or authorized distributors handling smaller-scale MLAT or ADS-B deployments in specific regional markets. The complexity of certification and regulatory oversight necessitates this direct engagement model to ensure system compliance and performance guarantees.

The downstream activities are crucial for long-term revenue generation and operational stability, focusing on installation, commissioning, training, and extensive maintenance and support services. Because ATM systems are critical infrastructure operating 24/7, ANSPs require comprehensive support contracts, often including predictive maintenance (now increasingly AI-enhanced), software updates, and hardware replacement cycles. This downstream segment maintains high barriers to entry due to the necessity of system-specific expertise and certification. Furthermore, the provision of specialized consultancy services regarding airspace design and system optimization also forms a profitable downstream activity, ensuring maximum efficiency and regulatory adherence for the ANSP customer base.

Air Traffic Management Surveillance Devices Market Potential Customers

The primary end-users and buyers of Air Traffic Management Surveillance Devices are governmental entities and specialized agencies responsible for regulating and managing airspace, alongside military organizations requiring highly resilient and secure tracking capabilities. The most significant customer base comprises Air Navigation Service Providers (ANSPs), such as the Federal Aviation Administration (FAA) in the US, Eurocontrol member states’ ANSPs (e.g., NATS, DFS, DSNA), and growing national providers across Asia Pacific and the Middle East. These organizations are responsible for purchasing, upgrading, and maintaining both terminal and en-route surveillance infrastructure to meet safety and capacity targets dictated by national policy and international ICAO standards.

A secondary, yet rapidly expanding, customer segment includes major international, regional, and municipal airport authorities. While core en-route surveillance is typically managed by ANSPs, airport operators often invest directly in surface movement guidance and control systems (SMGCS), runway surveillance radars (RSR), and localized MLAT installations. This demand is driven by the need to mitigate runway incursions, manage ground traffic flow, and improve operational efficiency during low visibility conditions. Furthermore, the proliferation of remote tower technologies expands the customer demographic to include smaller, regional airports seeking cost-effective digital surveillance solutions without the need for traditional control tower infrastructure.

The defense sector represents a critical, high-value customer segment, procuring surveillance devices for both national airspace defense and tactical military operations. Military requirements often prioritize mobility, ruggedness, electronic protection (anti-jamming), and the ability to integrate stealth aircraft tracking capabilities, leading to distinct demand for specialized primary radar and highly secure data links. Finally, emerging potential buyers include private consortia and governmental agencies involved in establishing Unmanned Traffic Management (UTM) corridors, requiring novel, low-altitude surveillance networks optimized for drone tracking and beyond visual line of sight (BVLOS) operations, representing a future growth vector for device manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thales Group, Raytheon Technologies (RTX), Leonardo S.p.A., Saab AB, L3Harris Technologies, Indra Sistemas S.A., Frequentis AG, BAE Systems, Honeywell International Inc., Northrop Grumman Corporation, Rohde & Schwarz, Terma A/S, Searidge Technologies, Metis Aerospace, Aeromao S.A., TransponderTech, Becker Avionics, Garmin Ltd., Lockheed Martin Corporation, General Dynamics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Traffic Management Surveillance Devices Market Key Technology Landscape

The technology landscape of the ATM surveillance market is defined by a shift from traditional radar reliance to networked, cooperative surveillance systems that leverage digital data sharing. Secondary Surveillance Radar (SSR) Mode S, which provides selective interrogation capabilities and data link services, remains critical, serving as a transitional technology bridge to fully dependent systems. However, the most disruptive technology is Automatic Dependent Surveillance-Broadcast (ADS-B). ADS-B systems rely on aircraft transmitting their precise position derived from GNSS (Global Navigation Satellite System) receivers, offering lower implementation costs and superior accuracy compared to ground radar, particularly for en-route and oceanic tracking. The global mandate for ADS-B Out functionality has spurred massive investment in both airborne transponders and ground receiving stations, while ADS-B In offers enhanced situational awareness to pilots.

Multilateration (MLAT) and Wide Area Multilateration (WAM) technologies offer an accurate, non-cooperative surveillance solution, especially effective in challenging environments like mountainous terrain or densely covered airport surfaces where line-of-sight radar can be hindered. MLAT calculates aircraft position by measuring the Time Difference of Arrival (TDOA) of transponder signals at multiple ground receivers. These systems are highly adaptable and scalable, making them preferred for surface movement tracking (often integrated into SMGCS) and medium-range terminal area surveillance, offering redundancy when radar systems fail or are blocked. The synergy between ADS-B and MLAT creates a resilient surveillance environment, as MLAT can passively track targets that fail to broadcast ADS-B data.

Looking forward, the concept of Digital Twins and virtualization is gaining traction. Digital Twins of the airspace and airport infrastructure allow ANSPs to model, simulate, and test changes to surveillance systems and procedures in a risk-free environment, optimizing performance before real-world deployment. Furthermore, the development of robust cyber-physical systems is crucial, given that modernized ATM relies heavily on networked digital data exchange. Enhanced signal processing techniques, often leveraging high-performance computing and AI/ML, are continuously being developed to improve radar target discrimination, especially against smaller, slower moving UAS targets, ensuring that both legacy and contemporary surveillance assets remain effective in highly congested and electromagnetically noisy environments.

Regional Highlights

- North America: North America, dominated by the US and Canada, holds a substantial market share characterized by high technological maturity and continuous government investment through programs like the FAA’s Next Generation Air Transportation System (NextGen). This region was an early adopter of mandatory ADS-B technology, leading to a strong market for system upgrades, space-based ADS-B deployment over oceanic routes, and the integration of highly secure data links. The mature market requires frequent replacement and modernization of legacy radar assets, maintaining steady demand for high-end surveillance hardware and sophisticated data fusion software solutions.

- Europe: The European market is strongly influenced by the Single European Sky ATM Research (SESAR) program, which aims for harmonized and integrated air traffic management across the continent. Key drivers include regulatory standardization requiring interoperable Mode S and ADS-B systems, and significant investment in Remote Virtual Towers (RVT) which rely heavily on integrated surveillance sensor suites. Europe exhibits strong growth in MLAT deployment for enhanced surface surveillance at major hubs and a high propensity for adopting centralized, digitalized ATM infrastructure, ensuring predictable demand for high-fidelity surveillance data processing solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, driven by soaring air passenger traffic volumes and corresponding large-scale infrastructure projects, including new airport construction and vast airspace reorganization across nations like China, India, and Indonesia. These developing economies are often leapfrogging older technologies, directly installing advanced ADS-B networks and modern Mode S SSR systems rather than investing in costly, legacy Primary Surveillance Radar (PSR). Government initiatives to improve safety standards and reduce flight delays necessitate accelerated modernization, making APAC a critical hub for new installations and large-scale system deployments.

- Latin America, Middle East, and Africa (LAMEA): This combined region represents emerging markets with diverse surveillance requirements. The Middle East, driven by significant oil wealth and ambitious global hub strategies (e.g., UAE, Qatar), sees heavy investment in state-of-the-art radar and surface surveillance systems at major international airports. Latin America and Africa often face infrastructure funding constraints, leading to slower adoption of high-cost primary radar but strong interest in cost-effective, wide-area surveillance solutions such as space-based ADS-B and WAM to cover remote and low-traffic areas effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Traffic Management Surveillance Devices Market.- Thales Group

- Raytheon Technologies (RTX)

- Leonardo S.p.A.

- Saab AB

- L3Harris Technologies

- Indra Sistemas S.A.

- Frequentis AG

- BAE Systems

- Honeywell International Inc.

- Northrop Grumman Corporation

- Rohde & Schwarz

- Terma A/S

- Searidge Technologies

- Metis Aerospace

- Aeromao S.A.

- TransponderTech

- Becker Avionics

- Garmin Ltd.

- Lockheed Martin Corporation

- General Dynamics Corporation

Frequently Asked Questions

Analyze common user questions about the Air Traffic Management Surveillance Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Primary Surveillance Radar (PSR) and Secondary Surveillance Radar (SSR) in ATM?

PSR is a non-cooperative system that detects aircraft by bouncing radio waves off the fuselage and analyzing the reflection (target range and bearing). SSR is a cooperative system that sends an interrogation signal, requiring the aircraft’s transponder to reply with coded data, providing not just position but also altitude and identification, which is crucial for modern ATM.

How is the mandated adoption of ADS-B impacting the future of traditional radar systems?

The widespread regulatory mandate for ADS-B (Automatic Dependent Surveillance-Broadcast) is leading to the decommissioning of many aging SSR units, particularly in remote areas, due to ADS-B’s superior cost efficiency and performance. However, PSR remains essential in terminal areas for safety redundancy, tracking non-cooperative aircraft, and providing resilience against potential transponder failures or cyber threats.

What role does Multilateration (MLAT) play in air traffic surveillance compared to radar?

MLAT systems calculate aircraft position by measuring the time difference of arrival of transponder signals at multiple ground receivers. Unlike traditional radar, MLAT is highly effective for surface surveillance (airport ground tracking) and in areas blocked by terrain, providing a scalable, non-radar based alternative with high accuracy for local and wide-area tracking.

What are the main technological challenges limiting market growth in surveillance devices?

Key technical limitations include the scarcity of available radio frequency spectrum for traditional radar expansion, the need for enhanced cybersecurity protocols to protect networked surveillance data from digital attack, and the complexity and high cost associated with deploying and maintaining globally interoperable systems across varied geographical terrains.

Which geographical region is expected to drive the largest market growth through 2033?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This acceleration is driven by substantial governmental investment in new airport infrastructure, rapidly increasing domestic and international flight volumes, and widespread mandates to modernize aging air traffic management capabilities across major economic hubs like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager