Air Wire Hoist Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439165 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Air Wire Hoist Market Size

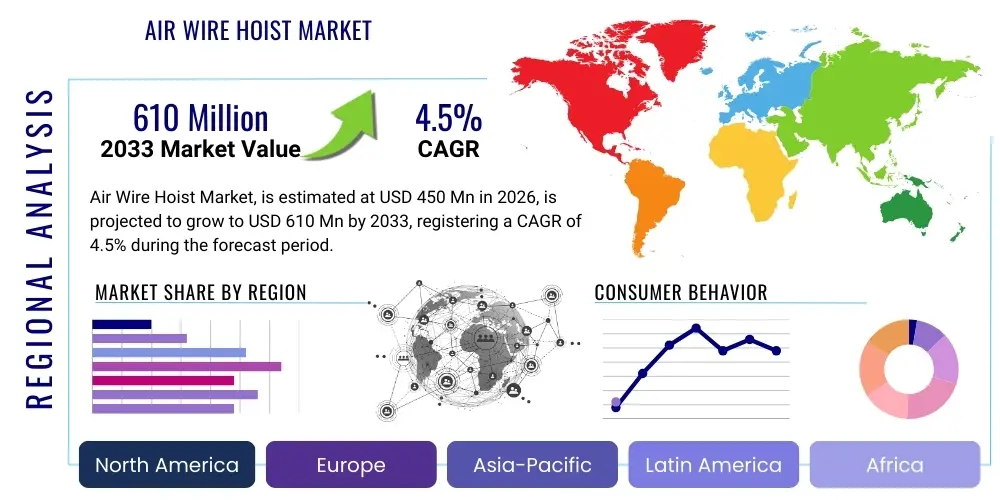

The Air Wire Hoist Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $610 Million USD by the end of the forecast period in 2033.

Air Wire Hoist Market introduction

The Air Wire Hoist Market encompasses material handling equipment designed for lifting and positioning heavy loads using compressed air as the primary power source and a wire rope (or cable) as the lifting medium. These hoists are crucial components in environments where explosion-proof operation, durability, and high duty cycles are required, distinguishing them from electric or chain hoists. Air wire hoists, often pneumatic hoists, are widely utilized across various industrial sectors due to their inherent safety features—specifically, their resistance to overheating and sparks—making them indispensable in hazardous locations such as chemical plants, paint shops, and mining operations. The robustness of the wire rope mechanism allows for lifting heavier loads over greater distances compared to traditional chain hoists, enhancing their applicability in large-scale manufacturing and construction projects.

Product descriptions typically emphasize operational characteristics such as load capacity (ranging from fractional tons up to 100 tons), lifting speed, and headroom requirements. Modern air wire hoists are increasingly integrating advanced features like precise speed control (variable speed) and ergonomic controls to enhance operator efficiency and safety. The core mechanism involves a pneumatic motor driving a drum around which the wire rope is wound. This simple yet highly effective design ensures reliable performance even under continuous heavy-duty use and harsh environmental conditions, including excessive dust, humidity, or extreme temperatures. Furthermore, the modular design often allows for easier maintenance and component replacement, minimizing operational downtime.

Major applications for air wire hoists span shipbuilding, heavy machinery manufacturing, aerospace assembly, automotive production lines, and oil and gas exploration. Key benefits driving their adoption include intrinsic safety in explosive atmospheres (ATEX compliance), smooth acceleration/deceleration capabilities providing precise load placement, and a high power-to-weight ratio. The primary driving factors currently influencing market growth include stringent industrial safety regulations demanding non-sparking equipment, the expansion of global manufacturing capacity, particularly in emerging economies, and the continuous necessity for efficient and reliable material handling solutions capable of managing increasingly heavy components in infrastructure projects.

Air Wire Hoist Market Executive Summary

The Air Wire Hoist market demonstrates robust growth driven primarily by increasing investment in heavy infrastructure and stringent workplace safety mandates across industrialized nations. Current business trends indicate a strong shift towards developing hoists that offer integrated data logging capabilities and enhanced durability against corrosive environments, particularly within the marine and chemical processing sectors. Manufacturers are focusing on modular designs that facilitate swift deployment and maintenance, reducing the total cost of ownership for end-users. Consolidation among major players is also a notable trend, aiming to capture larger market share through comprehensive product portfolios offering customized lifting solutions tailored to specific industry needs, thereby cementing long-term contractual relationships with large industrial enterprises.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by the rapid expansion of manufacturing hubs, robust construction activities, and significant government spending on infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe maintain substantial market share due to established industrial bases and early adoption of advanced, high-capacity pneumatic lifting solutions, especially within aerospace and specialized automotive manufacturing. These mature markets are characterized by high demand for customized, automated handling systems where precision and adherence to strict safety standards are paramount, driving innovation in control systems and energy efficiency.

Segmentation trends highlight the increasing demand for high-capacity hoists (over 20 tons) used in large-scale projects such as bridge construction and power plant maintenance. Furthermore, the end-use segment is witnessing significant traction from the specialized manufacturing and energy sectors, where the non-electric nature of air wire hoists provides a critical safety advantage over electric alternatives. Technological advancements are concentrating on improving air efficiency and incorporating sensors for predictive maintenance, moving the hoists from simple lifting devices toward integrated components of smart material flow systems. This technological pivot aims to optimize operational uptime and reduce unexpected equipment failure, addressing a core concern for industrial operators.

AI Impact Analysis on Air Wire Hoist Market

User queries regarding AI in the Air Wire Hoist market frequently center on how machine learning can enhance operational efficiency, safety compliance, and predictive maintenance schedules. Key concerns revolve around the integration feasibility of advanced sensor technologies with traditionally pneumatic systems and the return on investment for implementing complex AI algorithms for load analysis and equipment health monitoring. Users anticipate AI will minimize manual inspections, automatically optimize lifting speeds based on real-time load dynamics, and provide prescriptive maintenance insights, thereby extending the lifespan of the wire rope and other critical components. The consensus expectation is that AI will transform reactive maintenance into highly precise predictive upkeep, significantly reducing downtime and operational hazards associated with equipment failure.

While the mechanical core of the air wire hoist remains robustly pneumatic, AI’s primary influence lies in the peripheral monitoring and control systems. AI algorithms process vast amounts of sensor data—including air pressure fluctuations, vibration levels, temperature, and cycle counts—to identify subtle deviations that precede equipment failure. This shift towards data-driven condition monitoring ensures that maintenance activities are scheduled precisely when needed, rather than following arbitrary time intervals. This optimization not only saves maintenance costs but also significantly enhances safety by proactively addressing component wear, especially critical in high-risk, heavy-duty applications common for wire hoists.

Furthermore, AI-powered systems can enhance operational safety by analyzing load movements and operator input patterns. For instance, AI can detect anomalous lifting behavior, such as excessive swinging or sudden stops, and automatically intervene by adjusting lifting parameters or alerting the operator, preventing potential accidents and damage to the load or infrastructure. In manufacturing environments, AI can coordinate multiple air hoists simultaneously, optimizing complex material transfer sequences, ensuring smoother integration into automated assembly lines, and ultimately boosting the throughput and quality of production processes without requiring continuous human oversight of delicate maneuvering tasks.

- AI-driven Predictive Maintenance: Analyzing sensor data (vibration, pressure) to forecast component failure, reducing unplanned downtime by up to 30%.

- Optimized Load Handling: Using machine learning to adjust lifting speeds and trajectory in real-time for improved precision and reduced load swing.

- Safety Compliance Monitoring: Automated recording and analysis of operational metrics to ensure adherence to predefined safety protocols and load limits.

- Resource Efficiency: AI algorithms optimize compressed air consumption based on load requirements and operational cycle, enhancing energy efficiency.

- Remote Diagnostics and Monitoring: Enabling manufacturers and operators to diagnose equipment health remotely, streamlining troubleshooting and service deployment.

DRO & Impact Forces Of Air Wire Hoist Market

The Air Wire Hoist market is dynamically influenced by a confluence of driving factors related to safety and operational reliability, stringent restraints such as competition from electric alternatives, and significant opportunities arising from technological integration and market expansion. The core driver is the increasing global focus on industrial safety standards, particularly in explosive environments (Zone 1 and Zone 2 areas), where the non-electric, non-sparking nature of air hoists is mandated by regulatory bodies like ATEX and IECEx. Simultaneously, the restraints include the necessity for a dedicated and consistent supply of compressed air, which adds to the initial infrastructure cost and requires ongoing energy input for compressor operation, sometimes making electric hoists a more economically viable option in general-purpose applications. The major opportunity lies in the burgeoning infrastructure and construction sectors of developing economies that require robust, high-capacity, and reliable lifting solutions for large-scale projects.

Drivers are strongly supported by the inherent durability and high duty cycle capability of pneumatic systems, enabling continuous operation in challenging industrial settings without the risk of motor burnout common in electric counterparts under sustained, heavy use. This factor is critical in high-throughput manufacturing and demanding environments like foundries or steel mills. Restraints are also compounded by the noise levels associated with pneumatic equipment, which may require additional investment in noise mitigation strategies to comply with occupational health and safety regulations in some regions. Furthermore, the maintenance complexity of pneumatic systems, requiring specialized skills for air quality management and seal replacement, presents a hurdle for widespread adoption, particularly for small and medium-sized enterprises (SMEs) lacking dedicated maintenance staff.

Impact forces are driven by shifts in global supply chain resilience and the cost volatility of raw materials, particularly steel and specialized alloys used in wire rope and hoist components, which directly affect manufacturing costs and final pricing. Opportunities are significantly amplified by the trend toward automation and smart factories (Industry 4.0), where air wire hoists can be equipped with sensors and IoT gateways to seamlessly integrate into automated production lines, enhancing data exchange and centralized control. The competitive landscape is characterized by a high degree of product differentiation based on load capacity, environmental certification, and after-sales service, compelling manufacturers to continually innovate in terms of weight reduction and operational precision to maintain market relevance and secure large-scale industrial contracts.

Segmentation Analysis

The Air Wire Hoist market segmentation provides a granular view of market dynamics based on capacity, lift height, operational mechanism, and the specific application sector. This analysis is vital for stakeholders to identify high-growth niches and tailor product development strategies. The market is broadly categorized by the load-bearing capacity, which directly correlates with the primary target industry—from light-duty hoists used in small workshops and assembly operations to heavy-duty hoists essential for shipbuilding and large-scale metal fabrication. Further segmentation by lift height differentiates products suitable for low-headroom facilities from those designed for high-bay warehouses or deep mine shafts. Understanding these divisions is essential as customer requirements vary drastically based on operational environment and required throughput.

Focusing on the capacity segment, light to medium-duty hoists (up to 10 tons) dominate the volume sales, serving the general manufacturing, repair, and maintenance sectors, offering flexibility and relatively lower initial investment. However, the high-capacity segment (above 10 tons) drives the higher revenue growth due to their use in capital-intensive projects within the heavy engineering and energy industries. These heavy-duty units command premium pricing due to the sophisticated engineering, robust materials, and extensive safety certifications required. Manufacturers in this segment compete fiercely on reliability, maximum lifting height, and compliance with severe environment specifications (e.g., marine or offshore platform use).

The end-use segmentation is critical, illustrating the dependency of the market on major industrial verticals. Automotive and aerospace sectors demand extremely precise and safe lifting equipment, often favoring air hoists for assembly lines involving volatile materials or delicate component placement. Conversely, the mining and petrochemical industries prioritize ruggedness, ATEX compliance, and resistance to corrosive agents. Growth in infrastructure spending globally directly translates into increased demand from the construction and utility sectors, requiring portable, yet powerful, wire hoists for installation and maintenance work. This diverse application spectrum ensures market resilience against downturns in any single industrial sector.

- Capacity

- Light Duty (Below 5 Tons)

- Medium Duty (5 to 20 Tons)

- Heavy Duty (Above 20 Tons)

- Operation Type

- Manual Control

- Remote/Pendant Control

- Lift Height

- Standard Lift

- High Lift

- End-Use Industry

- Automotive and Aerospace

- Manufacturing and Heavy Engineering

- Oil and Gas (Petrochemical)

- Mining and Construction

- Marine and Shipbuilding

Value Chain Analysis For Air Wire Hoist Market

The value chain for the Air Wire Hoist market begins with the upstream suppliers providing high-grade raw materials, primarily specialized steel alloys for load-bearing components, wire ropes, and precision pneumatic components like motors, valves, and control systems. Quality control at this stage is paramount, as the integrity of the materials directly influences the hoist's safety ratings and operational lifespan. Manufacturers typically engage in sophisticated in-house fabrication and assembly, focusing on design customization to meet specific industry certifications (e.g., explosion-proof ratings). Investment in research and development is concentrated on optimizing pneumatic efficiency and minimizing overall product weight while maintaining maximum load capacity, necessitating complex design processes and rigorous testing protocols before reaching the distribution phase.

The distribution channel plays a critical role, leveraging both direct and indirect methods. Direct distribution involves large-scale manufacturers selling customized, integrated lifting systems directly to major industrial end-users (e.g., automotive assembly plants or shipbuilding yards) through dedicated sales and engineering teams. This ensures deep integration support and specialized after-sales service. Conversely, indirect distribution relies heavily on a global network of authorized distributors, local dealers, and specialized material handling equipment resellers. These indirect channels are crucial for reaching SMEs, providing local inventory, immediate technical support, and facilitating quicker turnaround times for standard hoist models and replacement parts.

Downstream activities include installation, commissioning, maintenance, repair, and overhaul (MRO) services. The provision of robust after-sales support is a significant competitive differentiator, particularly for complex, high-capacity installations. Training specialized technicians to handle pneumatic systems and ensuring the availability of genuine spare parts are critical components of the downstream value proposition. The market trend shows an increasing reliance on service contracts and condition monitoring systems (often integrating IoT) to transition from corrective to preventive maintenance, optimizing the total cost of ownership for end-users and stabilizing revenue streams for service providers.

Air Wire Hoist Market Potential Customers

Potential customers for Air Wire Hoists are concentrated within heavy industrial sectors characterized by operations requiring the safe, precise lifting of heavy materials in challenging or hazardous environments. The primary end-users include large integrated manufacturing facilities, particularly those involved in automotive stamping, aerospace component assembly, and heavy machinery production. These customers require reliable, high duty cycle equipment capable of continuous operation with minimal failure risk. Furthermore, industries operating with flammable gases or dust, such as petrochemical refineries, oil and gas drilling platforms, and chemical processing plants, represent a crucial customer base where the inherent non-sparking feature of air hoists is a mandatory safety requirement, often enforced by regulatory mandates and insurance liabilities.

The shipbuilding and marine industries also constitute major potential customers, needing hoists that can withstand corrosive salt environments and handle extremely heavy, large modules during construction and refitting processes. These applications often demand custom-engineered hoists with specialized protective coatings and high-capacity wire ropes. Similarly, the global mining sector, facing deep excavation challenges, utilizes air wire hoists for handling ventilation equipment, materials transport, and maintenance within potentially explosive underground environments. The demand from these sectors is directly tied to global commodity prices and capital expenditure cycles in the energy and natural resources markets.

In addition to large corporations, SMEs involved in maintenance, repair, and operational services (MRO) for industrial equipment, as well as construction companies involved in specialized infrastructure projects (e.g., power generation plants or specialized bridge maintenance), are significant buyers. These smaller customers often prioritize flexibility, ease of installation, and readily available local technical support, favoring distributors who can offer integrated solutions combining the air hoist with complementary components such as trolleys, cranes, and air treatment units. The decision-making process for these buyers is heavily influenced by equipment certifications, proven reliability statistics, and the overall longevity of the product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $610 Million USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbus McKinnon (CM), Kito Corporation, J.D. Neuhaus (JDN), Harrington Hoists, Ingersoll Rand, R&M Materials Handling, Street Crane Company, Konecranes, DEMAG (Terex), Munck Cranes, Gorbel Inc., Lifting Gear Hire (LGH), Stahl CraneSystems, Vestil Manufacturing, Air Technical Industries, Ace Industries, ABUS Kransysteme, EMH Inc., Simmers Crane Design & Services, ACCO Material Handling Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Wire Hoist Market Key Technology Landscape

The technological landscape of the Air Wire Hoist market is evolving towards greater precision, energy efficiency, and safety integration, driven by demands from the sophisticated manufacturing sector. Traditional pneumatic motor technology is being refined with advanced vane designs and improved sealing materials to maximize torque output while minimizing compressed air consumption, directly addressing the restraint of high operational energy cost. A key advancement is the incorporation of sophisticated proportional valving and control systems, which allow for exceptionally precise, infinitely variable speed control, surpassing the step-wise speed adjustments common in older models. This precision is critical in industries like aerospace, where delicate components must be manipulated with millimeter accuracy, reducing the risk of costly damage and enhancing overall assembly quality.

The integration of sensor technology is transforming air hoists into smart industrial assets. Modern hoists are increasingly equipped with sensors to monitor air pressure consistency, temperature, vibration profiles, and, crucially, the remaining useful life of the wire rope based on operational load cycles. This data is processed locally and transmitted via integrated IoT gateways, supporting the implementation of condition-based monitoring programs. Such predictive capabilities significantly improve maintenance planning, ensuring compliance with rigorous safety standards and extending the operational lifespan of the equipment. Furthermore, advancements in materials science are leading to the adoption of lighter, high-strength materials for the hoist housing and chassis, improving the power-to-weight ratio and reducing static structural load on the supporting infrastructure.

Another area of intense focus is the development of robust, intrinsically safe remote control systems. While pneumatic hoists are inherently safe in hazardous zones, the control mechanisms must also meet high safety standards. Manufacturers are deploying advanced wireless pendant controls that use intrinsically safe circuit designs, enabling operators to maintain a safe distance from the load and hazardous area while ensuring seamless, responsive control. This technological push is coupled with ergonomic improvements, making the hoists easier to handle and operate, thereby reducing operator fatigue during prolonged shifts and contributing to overall workplace safety compliance. The convergence of precise pneumatics and smart monitoring is defining the next generation of air wire hoisting solutions, positioning them as high-reliability tools in industrial settings.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC is anticipated to exhibit the highest growth rate, driven by massive industrialization, high levels of FDI into manufacturing, and large-scale infrastructure projects across China, India, and ASEAN countries. The region’s burgeoning automotive and shipbuilding sectors are major consumers of heavy-duty, reliable air wire hoists, particularly given the widespread presence of large industrial complexes and hazardous processing facilities demanding ATEX-compliant lifting solutions.

- North America (NA) Focus on Automation and Safety: North America holds a substantial market share, characterized by high adoption rates of advanced, highly automated material handling systems. Demand is strong in the aerospace, defense, and oil and gas industries, emphasizing custom-engineered hoists that integrate seamlessly with robotic systems and adhere to stringent safety and regulatory frameworks (e.g., OSHA standards). The focus here is less on volume and more on high-value, specialized applications.

- Europe’s Established Industrial Base and Regulatory Demand: Europe represents a mature market with established industrial sectors, including sophisticated machinery manufacturing and chemical processing. Growth is sustained by the need for replacement and modernization of existing infrastructure, strictly adhering to European Union directives such as ATEX for explosion protection. Western European countries demonstrate high demand for energy-efficient pneumatic systems and premium brands known for long-term reliability and precise operation.

- Latin America (LATAM) and Resource Sector Growth: The LATAM market growth is closely tied to the volatile but significant mining and mineral extraction industries in countries like Chile, Brazil, and Peru. These sectors require robust, high-capacity hoists capable of operating reliably in harsh, often remote, environmental conditions. Investment cycles in resource extraction are key determinants of market growth in this region.

- Middle East and Africa (MEA) Oil, Gas, and Construction: The MEA region is primarily driven by massive capital expenditure in the oil and gas sector (upstream and downstream processing) and large-scale construction mega-projects, particularly in the Gulf Cooperation Council (GCC) countries. The demand for air hoists in MEA is almost exclusively tied to the need for non-sparking equipment in potentially flammable petrochemical environments, positioning pneumatic hoists as the preferred lifting solution over electric alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Wire Hoist Market.- Columbus McKinnon Corporation (CMCO)

- Kito Corporation

- J.D. Neuhaus (JDN)

- Harrington Hoists, Inc.

- Ingersoll Rand

- R&M Materials Handling, Inc.

- Street Crane Company Ltd.

- Konecranes

- DEMAG Cranes & Components GmbH

- Munck Cranes AS

- Gorbel Inc.

- Stahl CraneSystems GmbH

- Vestil Manufacturing Corp.

- Air Technical Industries (ATI)

- Ace Industries, Inc.

- ABUS Kransysteme GmbH

- EMH Inc.

- Simmers Crane Design & Services

- Lifting Gear Hire (LGH)

- ACCO Material Handling Solutions

Frequently Asked Questions

Analyze common user questions about the Air Wire Hoist market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety advantages of using air wire hoists over electric hoists?

Air wire hoists are intrinsically safe because they do not use electricity and do not produce sparks, making them mandatory and ideal for use in hazardous, explosive environments (ATEX zones), such as petrochemical plants, painting booths, and mining operations.

How does the total cost of ownership (TCO) compare between air and electric wire hoists?

While air hoists generally have a higher initial infrastructure cost due to the requirement for dedicated compressed air systems, their TCO can be lower over the long term in heavy-duty applications because they have fewer wear parts, higher duty cycles, and are less susceptible to motor burnout, leading to lower repair and replacement costs.

Which capacity segment is experiencing the fastest revenue growth in the global Air Wire Hoist market?

The Heavy Duty segment (above 20 tons capacity) is demonstrating the fastest revenue growth, driven by increasing global investment in large-scale infrastructure, energy projects, and heavy engineering sectors, which require robust, high-precision lifting solutions for massive components.

What is the role of IoT and sensors in modern air wire hoist technology?

IoT integration allows modern air hoists to utilize sensors to monitor operational parameters like pressure and vibration in real-time. This data facilitates advanced predictive maintenance programs, optimizing equipment uptime, reducing unexpected failures, and ensuring compliance with operational safety limits through remote diagnostics.

Which geographical region dominates the consumption of air wire hoists, and what drives this demand?

Asia Pacific (APAC) dominates the consumption of air wire hoists, primarily fueled by rapid industrial expansion, significant capital investment in manufacturing hubs, and the corresponding high demand for reliable, heavy-duty material handling equipment necessary for continuous operation in developing industrial economies.

The Air Wire Hoist Market analysis confirms that industrial safety compliance and the need for durable lifting solutions in demanding environments are the core pillars supporting market growth. The evolution of the technology landscape, particularly the integration of smart monitoring capabilities, is poised to enhance the competitive advantage of pneumatic hoists against traditional electric counterparts. The market’s resilience is guaranteed by sustained capital expenditures in global heavy industries, particularly in APAC and the highly specialized sectors of North America and Europe. Future success for manufacturers hinges on balancing the traditional robustness of pneumatic systems with modern demands for precision, energy efficiency, and data-driven maintenance protocols, solidifying the air wire hoist’s position as essential equipment for critical lifting tasks worldwide.

The strategic recommendations derived from this analysis focus on two main vectors: leveraging the inherent safety benefits of air hoists to penetrate regulatory-intensive sectors such as oil, gas, and chemicals, and investing in advanced control systems that address the perceived energy inefficiency restraint. Companies focusing on modular designs that simplify maintenance and maximize air consumption efficiency will be best positioned to capture market share. Furthermore, establishing strong distribution networks in high-growth regions like Southeast Asia and strengthening service contracts that incorporate predictive monitoring will ensure long-term customer loyalty and recurring revenue streams, essential for maintaining profitability in a capital-intensive equipment market. The projected growth reflects a steady, essential demand rather than cyclical volatility.

Crucially, manufacturers must recognize the divergent requirements across key end-use segments. The automotive industry prioritizes precision and integration speed, necessitating hoists with advanced variable speed drives and automation readiness. Conversely, the mining sector prioritizes maximum robustness, corrosion resistance, and simplified field maintenance. Successful market penetration requires highly targeted product development and specialized marketing efforts that directly address these sector-specific pain points. As global supply chains continue to mature, reducing lead times for high-capacity hoists and securing stable supply routes for critical pneumatic components will remain a key operational challenge impacting overall market performance and timely delivery to critical infrastructure projects worldwide.

The competitive dynamics within the Air Wire Hoist sector are increasingly dictated by adherence to international standards and the ability to provide total lifting solutions rather than standalone equipment. Key players are constantly engaged in mergers and acquisitions to consolidate technological expertise, particularly in adjacent fields such as overhead crane manufacturing and control software development. This trend ensures that offerings are comprehensive, covering the entire material handling ecosystem for large industrial clients. Emerging manufacturers, often located in Asia, are primarily competing on cost, but global heavy industries continue to favor established brands known for unparalleled safety records, rigorous testing, and extensive global service infrastructure, confirming quality and reliability as non-negotiable purchasing criteria.

The long-term outlook for the air wire hoist market remains positive, supported by global macroeconomic trends favoring industrial output and infrastructure development. While alternative technologies, such as advanced electric hoists with explosion-proof ratings, present competitive pressure, the reliability and simplified operation of pneumatic systems in extreme duty cycles ensure their continued relevance. Furthermore, the push towards green manufacturing and reduced carbon footprint may incrementally favor pneumatic solutions if they can successfully demonstrate improved efficiency through optimized air compression technology and less reliance on sophisticated electronics. The industry must continue to innovate in materials and sensor integration to maintain its trajectory of moderate but stable growth.

Technological differentiation is expected to widen the gap between leading premium hoist providers and general manufacturers. Investment in additive manufacturing (3D printing) for complex, lightweight hoist components is an emerging trend that could disrupt traditional manufacturing processes, offering greater customization and faster prototyping for specialized industrial requirements. However, regulatory oversight remains extremely strict, particularly concerning the structural integrity and safety factors of lifting equipment, ensuring that any radical material or manufacturing changes must undergo lengthy certification processes before market introduction. This regulation acts as a strong barrier to entry for new, uncertified players.

Finally, the labor market dynamics also play a subtle but important role. As skilled industrial labor becomes scarce, there is a growing demand for hoists that are intuitive to operate and require minimal manual input for safe functioning. This accelerates the adoption of ergonomic controls, remote operation, and automated safety features, further justifying the higher initial capital outlay for advanced air hoist systems. Training and technical documentation provided by manufacturers are therefore increasingly emphasized as part of the total product offering, transforming the selling proposition from merely equipment provision to integrated solutions and knowledge transfer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager