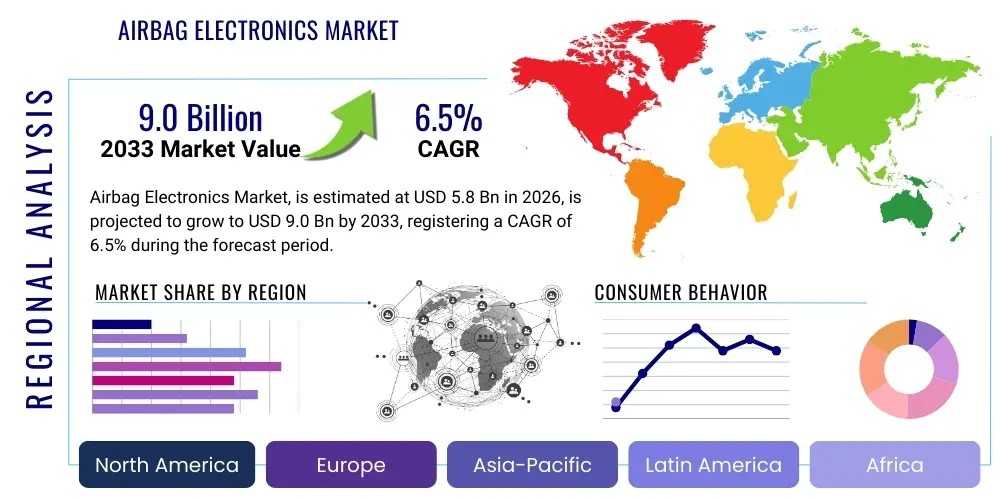

Airbag Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436845 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Airbag Electronics Market Size

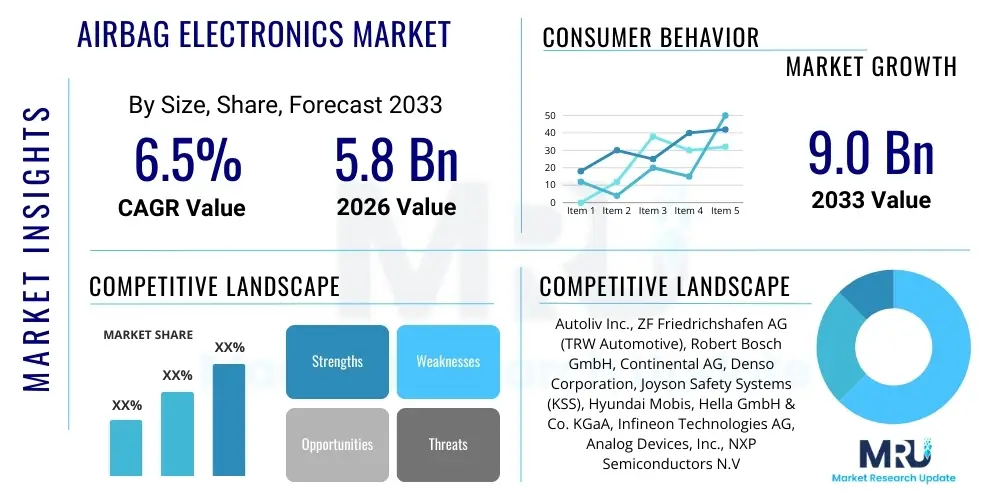

The Airbag Electronics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Airbag Electronics Market introduction

The Airbag Electronics Market encompasses the sophisticated electronic control units (ECUs), sensors, microcontrollers, and wiring harnesses critical for the reliable and timely deployment of passive safety systems within modern vehicles. These electronic components are responsible for interpreting data from various crash sensors—including accelerometers, pressure sensors, and angular rate sensors—to determine the severity and type of collision. The core product, the Airbag Control Unit (ACU), processes this information instantaneously, deciding which safety restraints (airbags, seatbelt pretensioners) must be activated to maximize occupant protection. This complex ecosystem ensures system integrity and adherence to rigorous global automotive safety standards, making it a foundation of vehicle safety architecture.

Major applications of airbag electronics extend beyond standard front airbags to sophisticated systems such as side curtain airbags, knee airbags, pedestrian protection systems, and increasingly, external airbags designed to mitigate collision impact before the crash fully occurs. The rapid deployment sequence, often executed in milliseconds, relies entirely on the precision and redundancy built into the electronic architecture. Benefits derived from these advanced systems include significant reductions in severe injury and fatality rates, improved insurance ratings for vehicles, and enhanced consumer trust in automotive safety features. The transition towards autonomous and semi-autonomous vehicles is further integrating these systems with broader ADAS functionalities, demanding even higher levels of electronic reliability and data processing capability.

Driving factors propelling market expansion include increasingly stringent government regulations globally, particularly those mandated by bodies like the National Highway Traffic Safety Administration (NHTSA) and Euro NCAP, which continuously raise the bar for crash testing performance and safety feature inclusion. Furthermore, rising consumer awareness regarding vehicle safety, coupled with the growing production of premium and mid-range vehicles in emerging economies, drives the demand for comprehensive passive safety packages. Innovation in sensor technology, migrating from traditional mechanical sensors to highly integrated micro-electro-mechanical systems (MEMS) sensors, enhances system accuracy, responsiveness, and packaging efficiency, supporting market growth.

Airbag Electronics Market Executive Summary

The Airbag Electronics Market is characterized by robust growth, primarily fueled by the mandate for higher safety standards across all vehicle segments and the integration of advanced sensor fusion technologies within the automotive ecosystem. Business trends show a strong shift towards consolidating electronic control units (ECUs) into centralized safety domains, leveraging powerful microprocessors capable of handling real-time sensor data from dozens of input sources simultaneously. Key players are investing heavily in software validation and cyber-security measures, as the increasing connectivity of vehicles necessitates protection against electronic tampering and ensuring the absolute integrity of safety-critical systems. Mergers, acquisitions, and strategic partnerships between Tier 1 suppliers and specialized semiconductor manufacturers are common strategies employed to maintain competitive advantage in this technology-intensive sector.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by skyrocketing vehicle production in countries like China and India, coupled with the swift adoption of global safety standards (e.g., Bharat NCAP). North America and Europe remain mature but vital markets, characterized by demand for premium features such as advanced restraint systems that dynamically adjust deployment force based on occupant size and crash kinematics. European regulations, particularly concerning pedestrian safety and stricter passenger compartment intrusion standards, continuously push the boundaries of electronic sophistication required for next-generation airbag systems. This geopolitical distribution highlights a dual market trajectory: mass-market adoption driving volume in APAC, and technological refinement driving value in Western markets.

Segmentation trends indicate significant market momentum in the crash sensor segment, particularly utilizing MEMS accelerometers due to their compact size, high sensitivity, and cost-effectiveness. Furthermore, the increasing complexity of vehicle interiors is elevating the importance of specialized ECUs capable of managing multiple stage deployments and integrating data from pre-crash sensing systems like radar and cameras. The shift toward Electric Vehicles (EVs) is also influencing segment trends, requiring customized electronic architectures to protect occupants during potential battery structure intrusions, thereby accelerating demand for side-impact and structural monitoring electronics.

AI Impact Analysis on Airbag Electronics Market

User queries regarding the impact of Artificial Intelligence (AI) on the Airbag Electronics Market overwhelmingly focus on enhanced predictive capabilities and the reduction of system latency and errors. Common questions center around how machine learning algorithms can utilize sensor fusion data—combining inputs from traditional crash sensors with ADAS cameras and radar—to achieve superior classification of collision types (e.g., pole impacts vs. offset collisions) and severity before the actual physical impact necessitates deployment. Users are highly concerned with decreasing the probability of false deployment, which is a significant safety and cost issue, and expect AI to provide context-aware deployment strategies tailored to specific situations, such as anticipating occupant posture just milliseconds before contact. The key theme is the shift from purely reactive electronics to highly predictive, intelligent safety systems that minimize injury severity by optimizing restraint timing and force.

AI’s role extends significantly into improving system reliability and fault detection. Machine learning models can continuously monitor the performance of all electronic components—sensors, wiring harnesses, and the ECU itself—identifying subtle deviations indicative of future failure long before traditional diagnostics flag a problem. This preventative maintenance capability, supported by AI-driven diagnostics, is crucial for maintaining the operational integrity of safety-critical systems over the vehicle’s lifespan. Furthermore, AI facilitates the rapid validation of new electronic designs, simulating millions of crash scenarios to calibrate deployment algorithms optimally, thereby accelerating the product development lifecycle and ensuring compliance with evolving regulatory mandates.

The implementation of edge AI processing directly within the airbag ECU is becoming a critical expectation. This allows for near-instantaneous decision-making without reliance on cloud processing, which is vital for systems operating under strict millisecond constraints. The ability of AI to assess real-time vehicle dynamics (speed, yaw rate, brake application) and environmental factors (road surface, weather) enhances the system’s capacity to deploy restraint devices dynamically and proportional to the perceived risk, moving beyond binary decision gates. This advancement positions airbag electronics as a central hub for complex safety decision-making rather than a simple trigger mechanism.

- AI enables predictive restraint deployment by utilizing pre-crash sensor fusion data (LIDAR, radar, camera).

- Machine learning algorithms significantly reduce false deployment rates by improving collision type classification accuracy.

- AI optimizes deployment characteristics (timing, force modulation) based on real-time occupant posture and crash kinetics.

- Enhanced system diagnostics and reliability monitoring through continuous, intelligent fault detection.

- Facilitates rapid calibration and validation of complex deployment logic via extensive scenario simulation.

DRO & Impact Forces Of Airbag Electronics Market

The Airbag Electronics Market is powerfully influenced by regulatory mandates and technological innovation, forming a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Primary Drivers include the global proliferation of stringent governmental safety standards, such as the mandating of multiple airbags (e.g., six standard airbags in many regions) and the continuous updating of crash test protocols by NCAP bodies, which requires sophisticated electronics for compliance. Consumer preference for vehicles with superior safety ratings acts as a secondary, market-driven motivator, compelling Original Equipment Manufacturers (OEMs) to adopt the latest electronic safety features across all vehicle price points. This environment creates high demand for robust, high-performance sensing and control systems.

Restraints primarily revolve around the high initial cost associated with incorporating advanced electronic architecture, particularly the high-specification microcontrollers and specialized MEMS sensors required for reliable operation. Furthermore, the extreme complexity of integrating airbag ECUs with the broader vehicle network (CAN bus systems) presents significant engineering and validation challenges, demanding lengthy and expensive development cycles. Supply chain vulnerability, particularly concerning the global availability of automotive-grade semiconductors, also restricts volume production and introduces pricing volatility, impacting market scalability. The need for absolute functional safety (ASIL-D requirements) imposes rigorous development processes that inherently increase time-to-market and component cost.

Opportunities for market expansion are concentrated in two main areas: the rapid growth of the Electric Vehicle (EV) sector, which requires unique crash sensing solutions due to differences in chassis structure and battery placement; and the ongoing development of predictive passive safety systems that utilize ADAS sensor data. Moving forward, the development of zonal E/E architectures, which consolidate computation for multiple vehicle domains, presents an opportunity for higher integration efficiency and reduced wiring complexity for airbag systems. Additionally, emerging markets represent significant growth potential as they harmonize local safety standards with global best practices, opening vast new segments for established electronic suppliers. The cumulative impact forces favor growth, driven by non-negotiable safety requirements and continuous technological advancement toward fully autonomous, highly protected vehicles.

Segmentation Analysis

The Airbag Electronics Market is meticulously segmented based on components, vehicle type, and distribution channel, reflecting the varied requirements of the automotive industry. Component segmentation highlights the dominance of Control Units and Crash Sensors, which represent the technological core of the system. Vehicle type differentiation is crucial, distinguishing the requirements and volume demands between Passenger Cars and Commercial Vehicles, with passenger cars demanding more intricate, multi-stage deployment capabilities. Analyzing these segments provides strategic insights into investment priorities, R&D focus areas, and potential growth vectors within the passive safety ecosystem.

Within the component segment, the Airbag Control Unit (ACU) typically accounts for the largest revenue share due to its complexity, proprietary software, and central role in decision-making. However, the Crash Sensor segment, encompassing accelerometers, pressure sensors, and rollover sensors, is projected to exhibit the fastest growth rate, driven by the increased number of sensor points required per vehicle to meet advanced NCAP requirements for side-impact and frontal offset protection. The proliferation of affordable, high-precision MEMS sensors is democratizing advanced safety features across mid-range vehicle platforms, fueling volume growth in this category. These distinctions guide strategic resource allocation for semiconductor manufacturers and Tier 1 suppliers.

The bifurcation between Passenger and Commercial vehicles underscores differing needs: passenger cars focus on refined occupant protection and comfort, whereas commercial vehicles prioritize robust durability and specific protection requirements for larger vehicle structures and potentially heavier occupants. Furthermore, the segmentation by distribution channel—OEM vs. Aftermarket—is significant, although the OEM channel overwhelmingly dominates due to the safety-critical nature of these electronics, demanding factory installation and rigorous vehicle-level validation.

- By Component:

- Airbag Control Unit (ACU)

- Crash Sensors (Accelerometers, Pressure Sensors, Rollover Sensors)

- Wiring Harnesses and Connectors

- Power Interface Devices

- By Vehicle Type:

- Passenger Cars

- Commercial Vehicles (LCVs, HCVs)

- By Application/Airbag Type:

- Front Airbags

- Side Airbags (Thorax, Curtain)

- Knee Airbags

- External/Pedestrian Airbags

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Airbag Electronics Market

The value chain for the Airbag Electronics Market is complex and highly structured, starting with specialized semiconductor and sensor fabrication and concluding with the integration of the final safety system into the vehicle. Upstream analysis involves the procurement of high-grade raw materials, particularly silicon wafers, microcontrollers (MCUs), and specialized electronic components built to stringent automotive specifications (AEC-Q100). This stage is dominated by major semiconductor producers who supply processors and application-specific integrated circuits (ASICs) essential for the real-time processing capabilities of the ACU. The quality and reliability of these upstream components dictate the performance integrity of the entire safety system.

Midstream activities are primarily managed by Tier 1 suppliers, who take the raw electronic components and integrate them into proprietary Airbag Control Units (ACUs) and assembled sensor clusters. These suppliers perform complex software development, functional safety engineering (ASIL-D implementation), system calibration, and rigorous testing before delivering the subsystem to the automotive OEMs. The distribution channel is heavily skewed towards direct supply to OEMs, as the safety-critical nature of airbag systems necessitates seamless integration during the vehicle manufacturing process. Indirect channels, represented by the aftermarket, exist mainly for replacement sensors or ACUs following repair or salvage operations, though this segment is relatively small compared to the OEM market.

Downstream analysis focuses on the integration and final validation by the Original Equipment Manufacturers (OEMs). OEMs install the ACU and sensors, perform vehicle-level crash testing, and ensure compliance with regional safety mandates. Distribution to the end-user (vehicle purchaser) occurs through established dealership networks. Given the safety-critical nature, distribution is highly controlled, with minimal third-party involvement. The complexity and liability associated with these systems enforce a strictly managed, direct B2B relationship between Tier 1 suppliers and OEMs, ensuring quality control and traceability throughout the entire supply chain.

Airbag Electronics Market Potential Customers

The primary and most significant end-users and buyers of Airbag Electronics are global Original Equipment Manufacturers (OEMs) across the light vehicle and heavy commercial vehicle sectors. These customers require high volumes of validated, reliable, and compliant electronic subsystems for integration into their vehicle platforms. Passenger car manufacturers, including high-volume producers (e.g., Toyota, VW Group, Ford) and luxury vehicle makers (e.g., Mercedes-Benz, BMW, Audi), represent the core customer base, driving demand for increasingly sophisticated, multi-stage, and personalized restraint systems that enhance their brand image and safety ratings.

A growing segment of potential customers includes specialized vehicle manufacturers and emerging mobility solution providers, such as dedicated Electric Vehicle (EV) startups and autonomous shuttle developers. These entities require customized electronic safety solutions tailored to unique platform architectures, often involving different sensor placements and deployment strategies to account for the heavy battery structure or non-traditional seating arrangements. Furthermore, the commercial vehicle sector, encompassing heavy-duty trucks and buses, is an accelerating customer base, driven by regulatory pressures to extend advanced safety features traditionally reserved for passenger cars into commercial transport to protect drivers and fleets.

Secondary, albeit less dominant, customers include fleet operators and large governmental agencies that maintain substantial vehicle inventories. While they typically source through OEM channels, their focus is on long-term reliability and cost of ownership, driving demand for electronic systems known for low failure rates and easy diagnostics. Finally, authorized repair shops and insurance companies, acting as intermediaries in the aftermarket, purchase replacement ACUs and sensors, though this volume is small compared to the bulk orders placed by global OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autoliv Inc., ZF Friedrichshafen AG (TRW Automotive), Robert Bosch GmbH, Continental AG, Denso Corporation, Joyson Safety Systems (KSS), Hyundai Mobis, Hella GmbH & Co. KGaA, Infineon Technologies AG, Analog Devices, Inc., NXP Semiconductors N.V., Sensata Technologies, Delphi Technologies, Toyoda Gosei Co., Ltd., Takata Corporation (Acquired portions by Key Players), Veoneer Inc., Aptiv PLC, Stoneridge, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airbag Electronics Market Key Technology Landscape

The technological landscape of the Airbag Electronics Market is defined by the migration from analog signal processing to highly digitized, integrated electronic systems, emphasizing speed, redundancy, and diagnostic capability. A key technology advancement is the widespread adoption of Micro-Electro-Mechanical Systems (MEMS) sensors. MEMS technology allows for highly sensitive, miniaturized accelerometers and gyroscopes to be placed strategically around the vehicle chassis, providing extremely low latency data regarding vehicle deceleration and angular rate changes. This shift reduces system weight, simplifies manufacturing processes, and significantly enhances the accuracy and reliability of crash detection compared to older ball-and-tube mechanical sensors, meeting the stringent ASIL-D functional safety integrity requirements.

Another crucial technological development involves the sophistication of the Airbag Control Unit (ACU) itself. Modern ACUs integrate powerful multi-core microcontrollers capable of executing complex sensor fusion algorithms in real-time, often within sub-10 millisecond windows. These controllers utilize proprietary algorithms to process data from multiple sensor inputs—including dedicated crash sensors, seat belt tension sensors, and increasingly, pre-crash data from radar and cameras—to determine the optimal deployment strategy. Redundancy is built into the electronics through dual-core processing units and robust power supply management, ensuring the system remains operational even during catastrophic electrical failures post-impact, maintaining functional safety.

Furthermore, the integration of advanced diagnostic technologies and networking protocols is transforming the market. Airbag ECUs are now fully integrated into the vehicle's High-Speed CAN or Ethernet networks, allowing for continuous communication and diagnostics with other vehicle safety and powertrain controllers. Technologies such as high-side and low-side driver circuits are specialized for pyrotechnic deployment control, ensuring safe and precise energy delivery to the squibs. Looking forward, the introduction of AI and machine learning techniques for predictive sensing and the standardization of vehicle zonal electronic architectures promise greater component consolidation and improved software update capabilities, leading to more resilient and intelligent passive safety systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by mass production in China and India and the accelerated adoption of stricter safety regulations (e.g., China NCAP, Bharat NCAP). Increasing disposable income and consumer demand for vehicles with six or more airbags are fueling high-volume growth for electronic components, making it a critical hub for global suppliers seeking scale.

- North America: A technologically mature market characterized by high consumer expectation for advanced safety features. North America emphasizes the integration of sophisticated occupant classification systems (OCS) and advanced restraint electronics that cater to diverse occupant sizes and crash conditions. Regulatory focus on side-impact protection and rollover mitigation sustains high demand for advanced gyroscopic and pressure sensor electronics.

- Europe: Europe mandates rigorous safety standards, particularly through Euro NCAP, which drives innovation in pedestrian protection and secondary collision mitigation systems. The region is a pioneer in implementing high functional safety standards (ASIL-D) for electronic systems. The transition toward Electric Vehicles (EVs) necessitates customized electronic architecture to ensure battery pack protection during severe collisions.

- Latin America: This region is transitioning towards global safety parity, witnessing increasing pressure to mandate safety features like ABS and multiple airbags. While currently dominated by cost-effective solutions, the market is quickly adopting more complex electronic control units as local NCAP ratings become influential consumer purchasing criteria.

- Middle East and Africa (MEA): Growth in MEA is moderate but steady, largely dependent on vehicle imports and local assembly. The demand is increasing, particularly in high-growth economies in the Gulf Cooperation Council (GCC) and South Africa, driven by urbanization and rising road safety concerns, leading to an increased requirement for standard electronic safety packages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airbag Electronics Market.- Autoliv Inc.

- ZF Friedrichshafen AG (TRW Automotive)

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Joyson Safety Systems (KSS)

- Hyundai Mobis

- Hella GmbH & Co. KGaA

- Infineon Technologies AG

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Sensata Technologies

- Delphi Technologies

- Toyoda Gosei Co., Ltd.

- Aptiv PLC

- Veoneer Inc.

- STMicroelectronics N.V.

- Visteon Corporation

Frequently Asked Questions

Analyze common user questions about the Airbag Electronics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of the Airbag Control Unit (ACU)?

The ACU is the central nervous system of the airbag system, integrating and processing real-time data from crash sensors (accelerometers and pressure sensors) to determine if a collision meets the deployment threshold. Its primary function is to instantaneously decide which pyrotechnic devices (airbags and pretensioners) must be triggered to mitigate occupant injury, ensuring deployment is proportional to crash severity.

How do MEMS sensors improve the reliability of modern airbag systems?

MEMS (Micro-Electro-Mechanical Systems) sensors, such as high-precision accelerometers, offer superior crash sensing capabilities due to their miniaturization, high sensitivity, and digital output. They allow for distributed sensing across multiple points in the vehicle, enabling faster and more accurate detection of impact angle and severity, which is crucial for meeting stringent functional safety requirements (ASIL-D).

What role does Artificial Intelligence (AI) play in next-generation airbag electronics?

AI is used to enable predictive passive safety. By fusing pre-crash data from ADAS sensors (radar, cameras) with traditional crash sensor inputs, AI algorithms can anticipate the severity and type of collision milliseconds before impact. This allows the system to optimize restraint timing and deployment force dynamically, reducing the risk of injuries and minimizing false deployments.

Which region currently dominates the Airbag Electronics Market and why?

The Asia Pacific (APAC) region currently dominates the market in terms of volume growth. This dominance is driven by high vehicle production volumes in countries like China and India, coupled with the rapid enforcement of local and global safety standards (NCAP), which mandates the inclusion of complex electronic safety packages across mass-market vehicles.

What are the main challenges restraining the growth of this market?

The main restraints include the high development cost associated with achieving the necessary functional safety integrity levels (ASIL-D) for safety-critical components, the engineering complexity of integrating these electronics into heterogeneous vehicle networks, and ongoing vulnerability to global semiconductor supply chain disruptions, which impact component availability and pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager