Airborne Geophysical Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439420 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Airborne Geophysical Service Market Size

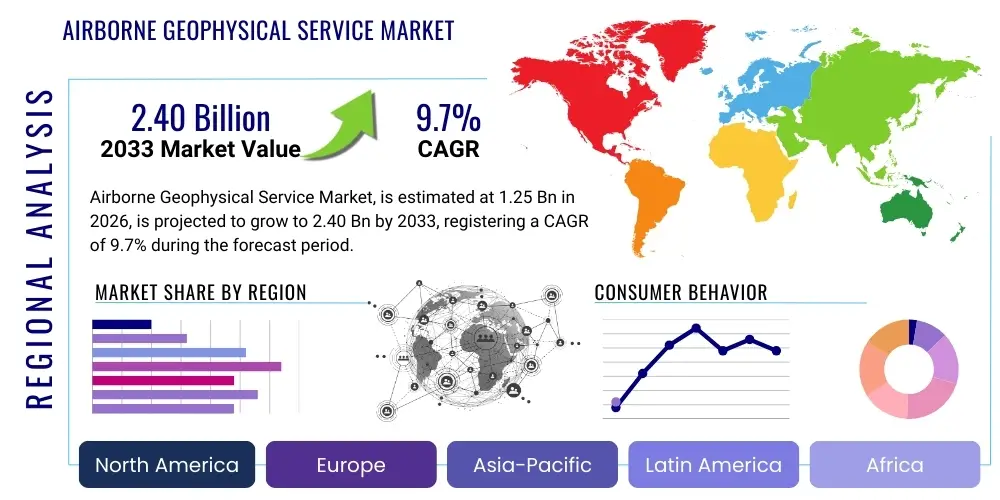

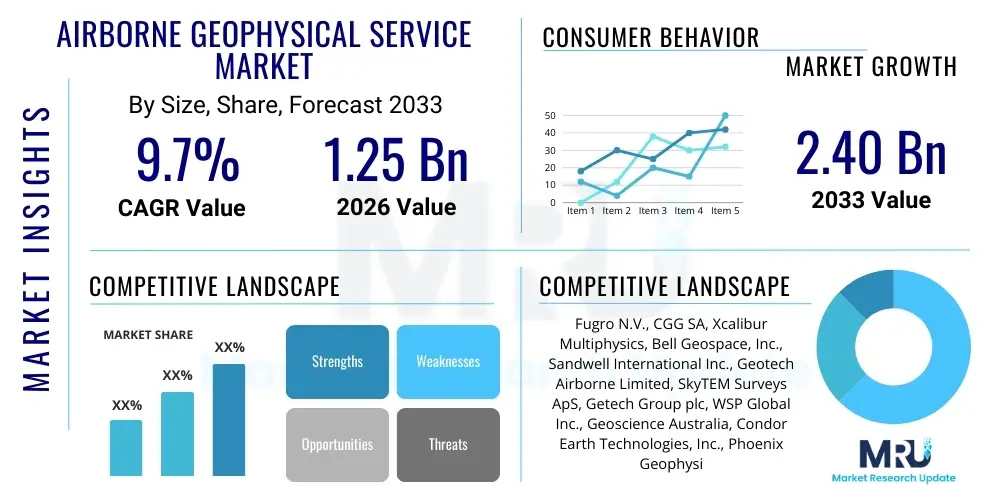

The Airborne Geophysical Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 2.40 billion by the end of the forecast period in 2033.

Airborne Geophysical Service Market introduction

The Airborne Geophysical Service Market encompasses the deployment of specialized aircraft, including fixed-wing planes, helicopters, and increasingly Unmanned Aerial Vehicles (UAVs), equipped with advanced sensors to collect geological and environmental data from above the Earth's surface. These services are critical for understanding subsurface structures, identifying natural resources, and monitoring environmental changes without extensive ground-based operations. The primary objective is to acquire high-resolution geophysical data across vast or inaccessible terrains efficiently and cost-effectively, providing invaluable insights for various industrial and scientific applications.

Key services typically offered include magnetic surveys, electromagnetic (EM) surveys, radiometric surveys, and gravity surveys. Magnetic surveys detect variations in the Earth's magnetic field, often indicating mineral deposits or geological faults. EM surveys measure subsurface conductivity, useful for groundwater mapping, mineral exploration, and environmental assessments. Radiometric surveys identify and map naturally occurring radioactive elements, aiding in uranium exploration and environmental monitoring. Gravity surveys measure subtle changes in the Earth's gravitational field, providing insights into variations in subsurface density crucial for oil and gas exploration and crustal studies. These methods provide a non-invasive means to gather data across large areas, making them indispensable.

Major applications of airborne geophysical services span across diverse sectors, including mining for mineral exploration and resource delineation, oil and gas for structural mapping and prospect generation, environmental management for groundwater detection and pollution monitoring, civil engineering for infrastructure planning and hazard assessment, and national security for geological mapping. The benefits are substantial, including rapid data acquisition over large areas, reduced operational costs compared to ground surveys in challenging terrains, enhanced safety by minimizing personnel exposure to hazardous environments, and the ability to access remote or environmentally sensitive regions with minimal impact. Driving factors for market growth include the escalating global demand for critical minerals and energy resources, the need for efficient infrastructure development, growing environmental concerns requiring advanced monitoring solutions, and continuous technological advancements in sensor capabilities and data processing techniques, making these services more accurate, accessible, and affordable.

Airborne Geophysical Service Market Executive Summary

The Airborne Geophysical Service Market is experiencing robust growth driven by a confluence of technological innovation and increasing global demand across primary industries. Business trends indicate a strong move towards integrated service offerings, where companies provide not just data acquisition but also comprehensive processing, interpretation, and consulting services, thus enhancing value for end-users. There is a notable rise in the adoption of hybrid platforms that combine multiple geophysical sensors, enabling more holistic data collection in a single mission. Furthermore, strategic partnerships and mergers are becoming common as firms seek to expand their geographical reach, acquire specialized technologies, and consolidate market share. Emphasis on sustainability and environmental compliance is also shaping business strategies, pushing companies to develop less intrusive and more eco-friendly survey methods.

Regional trends reveal significant market expansion in emerging economies, particularly across Asia Pacific, Latin America, and Africa, where vast unexplored mineral and energy reserves, coupled with burgeoning infrastructure development projects, are fueling demand. North America and Europe, while mature markets, continue to invest heavily in advanced technologies for improved resolution and efficiency, as well as for environmental monitoring and civil engineering applications. Regulatory frameworks and government support for resource exploration and infrastructure development play a crucial role in shaping regional market dynamics. For instance, increased government funding for national geological surveys or specific mineral initiatives can provide substantial boosts to regional markets, fostering innovation and service expansion. Localized expertise and tailored solutions are key to success in these diverse geographical landscapes.

Segmentation trends highlight the increasing prominence of Unmanned Aerial Vehicles (UAVs) as a platform, especially for detailed, localized surveys, offering cost-effectiveness and flexibility. While fixed-wing and helicopter-based surveys remain essential for large-scale, deep penetration mapping, UAVs are carving out a significant niche for their precision and ability to operate in complex terrains with reduced logistical overhead. By application, the mining sector continues to be a dominant segment, driven by the exploration for critical minerals like lithium, cobalt, and rare earth elements, essential for the global energy transition. The oil and gas sector also maintains a steady demand, particularly for brownfield exploration and enhanced oil recovery studies. Environmental and civil engineering applications are witnessing accelerated growth due propelled by increasing awareness regarding climate change and the need for resilient infrastructure, driving demand for services like groundwater mapping, hazard assessment, and urban planning. The diversification of applications underscores the versatility and growing importance of airborne geophysical data.

AI Impact Analysis on Airborne Geophysical Service Market

User inquiries concerning AI's influence on the Airborne Geophysical Service Market frequently center on its potential to revolutionize data processing, interpretation, and operational efficiency, alongside concerns about job displacement and the need for new skill sets. Key themes revolve around AI's capacity to handle the increasing volume and complexity of geophysical data, its ability to identify subtle anomalies that human interpreters might miss, and its role in automating routine tasks, thereby accelerating project timelines. There is significant anticipation regarding AI's contribution to predictive modeling, risk assessment, and decision-making for resource exploration and environmental monitoring. Furthermore, users are keen to understand how AI can enhance the autonomous capabilities of survey platforms, leading to safer and more precise data acquisition, while also questioning the reliability and ethical implications of AI-driven interpretations without human oversight. The overarching expectation is that AI will drive a new era of innovation, efficiency, and discovery within the sector.

- AI enhances data processing speed and accuracy by automating tasks like noise reduction, anomaly detection, and geological feature extraction from vast datasets.

- Predictive analytics powered by AI improves exploration success rates by identifying high-probability targets for mineral and hydrocarbon deposits based on integrated geophysical and geological data.

- Machine learning algorithms enable more sophisticated interpretation of complex geophysical signals, revealing subtle patterns indicative of subsurface resources or environmental conditions.

- AI facilitates autonomous mission planning and execution for UAVs, optimizing flight paths, sensor settings, and real-time data acquisition in challenging environments.

- Improved safety protocols are achieved through AI-driven risk assessment and predictive maintenance for airborne platforms, reducing human exposure to hazardous situations.

- Enhanced data visualization and modeling tools, often integrated with AI, provide clearer, more actionable insights for geologists, engineers, and decision-makers.

- AI supports the integration of multi-sensor data, creating more comprehensive and robust subsurface models than individual survey techniques could achieve.

- Operational efficiency is significantly boosted by AI-driven automation of repetitive tasks, allowing human experts to focus on higher-level analysis and strategic planning.

DRO & Impact Forces Of Airborne Geophysical Service Market

The Airborne Geophysical Service Market is shaped by a dynamic interplay of driving forces, inherent restraints, and emergent opportunities, which collectively determine its growth trajectory and competitive landscape. Drivers include the ever-increasing global demand for mineral resources critical for industrial and technological advancement, alongside the sustained need for new hydrocarbon reserves to meet global energy requirements. Furthermore, rapid infrastructure development, particularly in developing economies, necessitates extensive geological surveys for safe and sustainable project planning. Environmental concerns and the push for sustainable resource management also act as significant drivers, promoting the use of non-invasive airborne methods for groundwater exploration, pollution mapping, and geological hazard assessment. Continuous technological advancements in sensor capabilities, data processing algorithms, and drone technology further enhance the efficiency, accuracy, and accessibility of these services, broadening their applicability and appeal across various industries. These drivers collectively create a robust foundation for sustained market expansion, pushing service providers to innovate and expand their operational capabilities to meet evolving client demands.

However, several significant restraints challenge market expansion. The high capital investment required for specialized aircraft, advanced geophysical equipment, and sophisticated data processing software presents a substantial barrier to entry for new players and can limit the scale of operations for existing ones. Stringent regulatory frameworks governing aerial surveys, environmental impact assessments, and international airspace restrictions can impose complex logistical challenges and increase operational costs. A persistent shortage of highly skilled geophysicists, data scientists, and pilots capable of operating and interpreting advanced airborne systems restricts the industry's capacity for growth and innovation. Furthermore, the inherent volatility of commodity prices, particularly for minerals and oil, can lead to fluctuations in exploration budgets, directly impacting the demand for geophysical services. Lastly, public perception and community opposition to exploration activities, often due to environmental concerns or land use conflicts, can delay or halt projects, adding another layer of complexity for service providers operating in sensitive regions. These restraints necessitate strategic planning, technological innovation, and careful navigation of regulatory and socio-economic landscapes to mitigate their impact.

Opportunities within the market are significant and promising, especially with the accelerated integration of artificial intelligence (AI) and machine learning (ML) for enhanced data processing, interpretation, and predictive modeling, which promises to unlock deeper insights and improve exploration success rates. The expanding role of Unmanned Aerial Vehicles (UAVs) and drones, which offer cost-effective, high-resolution data acquisition for localized and detailed surveys, represents a major growth avenue, particularly for environmental and civil engineering applications. The global energy transition away from fossil fuels towards renewable sources is creating new demand for critical minerals like lithium, cobalt, nickel, and rare earth elements, vital for batteries and green technologies, spurring a new wave of exploration activity. Furthermore, increasing investment in smart city development, resilience planning, and geological hazard mitigation worldwide is driving demand for detailed subsurface mapping services. Finally, the growing adoption of cloud computing and big data analytics offers opportunities for more efficient data management, collaboration, and delivery of insights to clients. By capitalizing on these opportunities, market players can overcome existing restraints and secure a competitive advantage, fostering sustainable growth and innovation within the airborne geophysical services sector.

Segmentation Analysis

The Airborne Geophysical Service market is comprehensively segmented to provide a detailed understanding of its diverse operational facets and target applications. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand competitive dynamics, and tailor their strategies to specific industry needs. The market is primarily broken down by Type of survey technology employed, the Platform used for data acquisition, and the various Applications across different end-user industries. Each segment reflects unique technological requirements, operational considerations, and market demands, contributing to the overall complexity and dynamism of the industry. Understanding these segments is crucial for any entity operating within or looking to enter this specialized market.

Further granularity within these segments reveals the depth of specialization within the airborne geophysical industry. For instance, specific types of electromagnetic surveys (e.g., VTEM, ZTEM, Resolve) cater to different depths and conductivities, while different platform sizes and capabilities dictate the scale and resolution of projects. The application segment showcases the versatility of airborne geophysical data, ranging from large-scale mineral exploration campaigns to detailed environmental site assessments. This intricate segmentation underscores the bespoke nature of airborne geophysical services, where solutions are often customized to meet the unique geological and logistical challenges of each project. As technology evolves and new applications emerge, these segments are continuously refined, reflecting the market's adaptive and innovative character.

- By Type

- Magnetic Surveys

- Electromagnetic (EM) Surveys

- Radiometric Surveys

- Gravity Surveys

- LiDAR and Remote Sensing

- Integrated Surveys

- By Platform

- Fixed-Wing Aircraft

- Helicopters

- Unmanned Aerial Vehicles (UAVs)/Drones

- Autonomous Underwater Vehicles (AUVs) (for marine applications, though less common in "Airborne" context but sometimes integrated in full geophysical service portfolios)

- By Application

- Mining & Mineral Exploration

- Oil & Gas Exploration

- Environmental Monitoring & Management

- Civil Engineering & Infrastructure

- Groundwater & Water Resource Management

- Geological Mapping & Research

- Defense & Security

- By End-User

- Government & Research Institutions

- Mining Companies

- Oil & Gas Companies

- Environmental Consulting Firms

- Engineering & Construction Firms

- Utilities

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Airborne Geophysical Service Market

The value chain for the Airborne Geophysical Service Market begins with the upstream suppliers of specialized equipment and technology. This segment includes manufacturers of high-precision geophysical sensors (e.g., magnetometers, EM systems, gamma-ray spectrometers, gravimeters), GPS and navigation systems, airborne platforms (aircraft, helicopters, UAVs), and sophisticated data acquisition hardware and software. These suppliers are critical for providing the foundational tools that enable data collection, often requiring significant R&D investment to produce cutting-edge, reliable, and precise instruments. The quality and performance of these upstream components directly impact the accuracy and efficiency of the entire geophysical survey process, forming the bedrock upon which the rest of the value chain relies. Strong relationships with these specialized manufacturers are essential for service providers to maintain technological superiority and operational effectiveness in a highly competitive market.

Moving downstream, the core of the value chain involves the airborne geophysical service providers themselves, who undertake data acquisition, processing, and interpretation. Data acquisition involves deploying the specialized equipment on airborne platforms to collect raw geophysical data over target areas. This phase requires skilled pilots, experienced field geophysicists, and precise operational planning. Following acquisition, the raw data undergoes rigorous processing, which includes filtering, correcting for noise, and converting signals into interpretable geological information using specialized software. The final, and arguably most crucial, stage is data interpretation, where expert geophysicists analyze the processed data to create detailed geological models, identify anomalies, and provide actionable insights relevant to the client's objectives. This interpretive phase transforms raw measurements into valuable intelligence, guiding decisions in exploration, environmental management, and infrastructure development. The integration of advanced computational techniques and expert knowledge at this stage significantly enhances the value proposition of the entire service.

The distribution channel for airborne geophysical services is predominantly direct, where service providers engage directly with end-users such as mining companies, oil and gas corporations, government geological surveys, environmental consulting firms, and civil engineering companies. These direct engagements allow for highly customized project planning, precise scope definition, and tailored reporting to meet specific client requirements. Indirect channels might exist through partnerships with broader engineering consulting firms or project management companies who then subcontract geophysical survey work. However, given the specialized and often complex nature of these projects, direct communication between the geophysical service provider and the ultimate end-user is typical. Effective communication and project management throughout this direct channel are vital for ensuring client satisfaction and repeat business, building long-term relationships based on trust and demonstrated expertise. The value chain is inherently collaborative, requiring seamless coordination from equipment design to final interpretative reports to deliver comprehensive and accurate subsurface insights.

Airborne Geophysical Service Market Potential Customers

Potential customers for airborne geophysical services represent a diverse array of industries and governmental entities, all sharing a fundamental need for subsurface information without the extensive costs and time associated with ground-based surveys. The primary segment comprises mining and mineral exploration companies, which rely heavily on these services to discover new deposits of critical minerals such as copper, gold, lithium, and rare earth elements, as well as to delineate known resources. These companies seek to identify geological structures and anomalies indicative of mineralization, reduce exploration risk, and optimize drilling targets. Similarly, oil and gas exploration and production companies are significant consumers, utilizing airborne geophysical data to map subsurface geological structures, identify potential hydrocarbon traps, and monitor reservoir dynamics, especially in frontier areas or mature basins where conventional methods may be less efficient or environmentally sensitive. These industries are driven by the imperative to secure future resource supplies and maintain competitive advantages.

Beyond resource extraction, governmental agencies and research institutions form another substantial customer base. National geological surveys utilize airborne data for comprehensive regional geological mapping, hazard assessment (e.g., fault lines, potential landslides), and groundwater resource management, which are crucial for national planning and public safety. Environmental consulting firms and organizations focused on land management also engage these services for tasks such as environmental impact assessments, contamination mapping, landfill site selection, and identifying water resources. For example, remote sensing techniques can detect subsurface water flows or changes in soil conductivity indicative of pollution plumes. The efficiency and non-invasive nature of airborne surveys make them ideal for these large-scale environmental monitoring and management tasks, supporting sustainable development initiatives.

Furthermore, civil engineering and infrastructure development companies increasingly rely on airborne geophysical services for pre-construction site investigations, route planning for pipelines and roads, and assessing geological stability for large-scale projects like dams, bridges, and urban expansions. These services help identify potential geological hazards, locate suitable foundation conditions, and map buried utilities or archaeological sites, thereby mitigating risks and reducing construction costs and delays. Utilities companies, particularly those involved in power transmission and water supply, use these services for corridor mapping and monitoring infrastructure integrity. The increasing demand for resilient infrastructure and the need to mitigate geological risks in urban and rural development projects ensure a steady demand for precise, comprehensive subsurface data, positioning civil engineering and infrastructure as a rapidly growing segment of the customer base for airborne geophysical services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Growth Rate | 9.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fugro N.V., CGG SA, Xcalibur Multiphysics, Bell Geospace, Inc., Sandwell International Inc., Geotech Airborne Limited, SkyTEM Surveys ApS, Getech Group plc, WSP Global Inc., Geoscience Australia, Condor Earth Technologies, Inc., Phoenix Geophysics Ltd., TerraQuest Ltd., Paterson, Grant & Watson Limited, Geoinformatics Australia Pty Ltd., Airborne Geophysics International, TGS-NOPEC Geophysical Company ASA, Geoscanners AB, Micro-g LaCoste, Inc., Zonge International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airborne Geophysical Service Market Key Technology Landscape

The Airborne Geophysical Service market is characterized by a rapidly evolving technological landscape, driven by the continuous demand for higher resolution, deeper penetration, and more efficient data acquisition and interpretation. At the core are advanced sensor technologies, which include ultra-high-resolution magnetometers capable of detecting subtle magnetic anomalies crucial for mineral exploration and geological mapping. State-of-the-art electromagnetic (EM) systems, such as time-domain (e.g., VTEM, SkyTEM) and frequency-domain variants, are essential for mapping conductivity variations in the subsurface, providing insights into groundwater, ore bodies, and environmental contaminants. Gamma-ray spectrometers measure natural radioactivity to identify and map geological units and search for radioactive minerals. Additionally, modern gravimeters offer unparalleled precision in detecting subtle changes in the Earth's gravitational field, critical for oil and gas exploration and crustal studies. The integration of these disparate sensor types into single survey platforms, often referred to as multi-physics systems, maximizes data acquisition efficiency and provides a more comprehensive understanding of the subsurface from a single flight mission.

Complementing these sensors are sophisticated airborne platforms and navigation systems. While fixed-wing aircraft and helicopters remain foundational for large-scale, high-altitude surveys, the proliferation of Unmanned Aerial Vehicles (UAVs) or drones has revolutionized localized, high-resolution data acquisition. UAVs offer unprecedented flexibility, cost-effectiveness, and the ability to operate in challenging or hazardous terrains with minimal environmental impact. These platforms are equipped with advanced GPS and Inertial Navigation Systems (INS) that ensure precise flight path control and accurate georeferencing of collected data, which is paramount for creating reliable subsurface maps. The development of autonomous flight capabilities, powered by AI, is further enhancing the efficiency and safety of these platforms, allowing for complex survey patterns and real-time data adjustments. The convergence of miniaturized sensors with robust drone technology is opening new frontiers for detailed investigations in previously inaccessible areas, pushing the boundaries of what is possible in airborne geophysics.

Beyond data acquisition, the technological landscape is heavily reliant on advanced data processing and interpretation software, increasingly incorporating artificial intelligence (AI) and machine learning (ML) algorithms. These tools are crucial for transforming raw, noisy data into clean, interpretable geophysical products. Modern software can automate tasks like noise reduction, anomaly detection, and 3D inversion modeling, significantly reducing processing time and improving the accuracy of interpretations. AI and ML are particularly transformative in their ability to identify subtle patterns in large datasets, integrate multi-disciplinary geological information, and generate predictive models for resource potential or environmental risks. Cloud computing and big data analytics are also playing an increasingly vital role, enabling the efficient storage, sharing, and collaborative analysis of massive geophysical datasets. These digital technologies empower geophysicists to generate more robust, detailed, and actionable subsurface insights, ultimately accelerating decision-making processes for exploration, development, and environmental management projects, thereby enhancing the overall value proposition of airborne geophysical services.

Regional Highlights

- North America: A mature market characterized by significant investment in advanced technology and R&D. Demand is robust from oil and gas (especially unconventional resources), mining for critical minerals (e.g., lithium, rare earths), and extensive environmental monitoring for regulatory compliance and remediation projects. Strong governmental support for geological mapping and infrastructure projects further drives the market.

- Europe: Focuses on environmental applications, civil engineering, and specialized mining for industrial minerals. Strong emphasis on sustainable exploration practices and renewable energy-related resource mapping. The market benefits from advanced technological infrastructure and skilled workforce, with a growing interest in UAV-based surveys for urban and precise site investigations.

- Asia Pacific (APAC): Emerging as the fastest-growing market, propelled by rapid industrialization, burgeoning demand for energy and minerals, and massive infrastructure development projects (e.g., Belt and Road Initiative). Countries like Australia, China, India, and Indonesia are key contributors, with significant exploration activities for base metals, precious metals, and hydrocarbons. Rising environmental awareness also fuels demand for groundwater and pollution mapping.

- Latin America: A significant market driven primarily by intensive mining and mineral exploration activities, particularly for copper, gold, and silver. Brazil, Chile, Peru, and Argentina are major players. The region also sees demand from oil and gas exploration in both onshore and offshore frontier areas. Political stability and commodity prices can significantly impact market dynamics.

- Middle East & Africa (MEA): Offers immense growth potential, largely due to untapped mineral resources (Africa) and continued oil and gas exploration (Middle East). African countries are increasingly investing in geological mapping to attract foreign direct investment in their mining sectors. The Middle East focuses on optimizing existing oil fields and exploring new hydrocarbon reserves, with growing interest in groundwater resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airborne Geophysical Service Market.- Fugro N.V.

- CGG SA

- Xcalibur Multiphysics

- Bell Geospace, Inc.

- Sandwell International Inc.

- Geotech Airborne Limited

- SkyTEM Surveys ApS

- Getech Group plc

- WSP Global Inc.

- Geoscience Australia

- Condor Earth Technologies, Inc.

- Phoenix Geophysics Ltd.

- TerraQuest Ltd.

- Paterson, Grant & Watson Limited

- Geoinformatics Australia Pty Ltd.

- Airborne Geophysics International

- TGS-NOPEC Geophysical Company ASA

- Geoscanners AB

- Micro-g LaCoste, Inc.

- Zonge International, Inc.

Frequently Asked Questions

Analyze common user questions about the Airborne Geophysical Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an airborne geophysical service?

Airborne geophysical service involves using aircraft equipped with specialized sensors to collect geological and environmental data from above the Earth's surface, providing insights into subsurface structures, resources, and environmental conditions efficiently and non-invasively.

What are the main applications of airborne geophysical services?

Key applications include mineral and oil & gas exploration, environmental monitoring, civil engineering for infrastructure planning, groundwater management, and regional geological mapping, offering versatile solutions for diverse industries.

How is AI impacting the airborne geophysical service market?

AI is transforming the market by enhancing data processing speed, improving the accuracy of interpretations, enabling predictive analytics for exploration, optimizing autonomous survey operations, and boosting overall operational efficiency and safety.

Which regions are driving the growth of this market?

Asia Pacific is currently the fastest-growing region due to significant mineral and energy demand and infrastructure development. North America and Europe remain key markets with high technological adoption, while Latin America and Africa offer substantial potential from resource exploration.

What are the key technologies used in airborne geophysical services?

Key technologies include advanced magnetic, electromagnetic, radiometric, and gravity sensors, high-precision GPS and INS, diverse airborne platforms (fixed-wing, helicopters, UAVs), and sophisticated data processing and interpretation software, increasingly powered by AI and ML.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager