Aircraft Blades Aluminum Castings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431915 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aircraft Blades Aluminum Castings Market Size

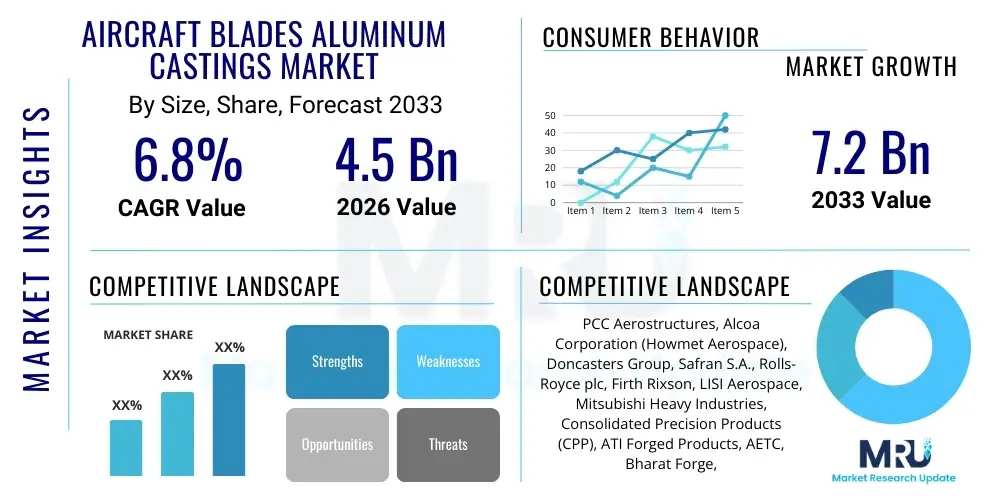

The Aircraft Blades Aluminum Castings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Aircraft Blades Aluminum Castings Market introduction

The Aircraft Blades Aluminum Castings Market encompasses the specialized manufacturing and supply of high-precision aluminum alloy components used primarily in turbine engines, fan blades, compressor blades, and structural parts within aerospace propulsion systems. These castings are critical for modern aircraft due to their superior strength-to-weight ratio, which directly contributes to fuel efficiency and reduced operational costs. The primary manufacturing techniques employed involve highly sophisticated processes such as investment casting (lost-wax process) and permanent mold casting, tailored to meet stringent aerospace quality standards like AS9100 and NADCAP certification. Aluminum castings, particularly those utilizing high-performance alloys like A356, A357, and specialized variants, offer the necessary durability to withstand extreme thermal and mechanical stresses encountered during flight operations, making them indispensable in both commercial and military aviation sectors.

The product scope extends beyond main rotor or fan blades to include various intricate static vanes, internal engine components, and accessory gearbox housings where weight reduction is paramount but structural integrity cannot be compromised. The demand for new generation, fuel-efficient turbofan engines (such as those employed in narrow-body aircraft like the Airbus A320neo and Boeing 737 MAX families) is a dominant driver for market growth. These engines often incorporate larger fan diameters requiring highly reliable and lightweight blade supports and structural frames, which are increasingly realized through advanced aluminum casting techniques rather than traditional forging or machining processes. Furthermore, the burgeoning Maintenance, Repair, and Overhaul (MRO) sector contributes significantly to the steady replacement demand for these critical components, ensuring a sustained market trajectory.

Key applications of these aluminum castings are predominantly found in the rotating and static sections of turbojet, turboprop, and turbofan engines, though their usage is also expanding into helicopter rotors and Unmanned Aerial Vehicle (UAV) systems requiring high performance at minimal weight. Benefits associated with adopting aluminum castings include complexity integration (allowing multiple parts to be cast as one), near-net shape manufacturing (reducing machining costs and material waste), and superior fatigue resistance compared to alternative metallic structures in specific temperature regimes. Driving factors for market expansion include escalating global air traffic, increasing defense spending focused on modernizing aerial fleets, and continuous advancements in aluminum alloy metallurgy offering enhanced thermal properties and corrosion resistance.

Aircraft Blades Aluminum Castings Market Executive Summary

The Aircraft Blades Aluminum Castings Market is experiencing robust expansion driven by concurrent trends across commercial aviation build rates and defense modernization programs globally. Business trends emphasize strategic partnerships between specialized foundries and Tier 1 aerospace manufacturers (OEMs), focused on optimizing supply chain efficiency and accelerating qualification processes for new materials and casting methodologies. There is a perceptible shift towards integrating advanced digital technologies, such as computational fluid dynamics (CFD) modeling for solidification simulation and automated quality inspection systems (e.g., industrial CT scanning), to ensure zero-defect output required by safety-critical applications. Furthermore, market competition is increasingly defined by the ability of suppliers to manage complex geometrical tolerances and provide components meeting the rigorous standards demanded by next-generation engine designs characterized by higher bypass ratios and lighter material composition.

Regionally, North America and Europe maintain dominance, owing to the presence of major aerospace OEMs (Boeing, Airbus, GE Aviation, Safran) and a highly established regulatory and R&D infrastructure. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment, fueled by massive increases in regional air travel demand, resulting in large backlogs for new aircraft deliveries and corresponding localized MRO expansion. This regional growth is spurring capacity additions and technology transfer initiatives, though stringent adherence to Western aerospace certification remains a key barrier to entry for local manufacturers. Geopolitical stability and defense procurement cycles significantly influence regional demand, especially in the Middle East and parts of Asia, where military fleet upgrades necessitate specialized high-strength aluminum parts.

In terms of segmentation trends, the market categorized by application shows the largest share captured by the commercial aviation sector, directly linked to high volume production of narrow-body airliners. The material segmentation is witnessing increased focus on specific high-performance aluminum-silicon alloys modified with elements like magnesium and copper to enhance elevated temperature performance and fatigue life. Technology-wise, investment casting (or precision casting) retains its premium status due to its capability to produce complex, thin-walled geometries required for intricate blade and vane components. Future growth is anticipated to be led by the proliferation of electric and hybrid aircraft, which, while reducing reliance on traditional turbine blades, will still require vast quantities of complex, lightweight structural aluminum castings for battery housings, motor mounts, and airframe structures, maintaining market relevance.

AI Impact Analysis on Aircraft Blades Aluminum Castings Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the efficiency, precision, and quality assurance within the highly specialized aluminum casting process for aircraft components. Key concerns revolve around AI’s role in predicting casting defects, optimizing mold design and gating systems, and accelerating material qualification timelines. The general expectation is that AI integration will mitigate the high scrap rates often associated with complex investment casting, thereby significantly reducing production costs and lead times. Furthermore, users anticipate AI-powered inspection and non-destructive testing (NDT) to surpass current human capabilities in identifying microscopic flaws, guaranteeing the utmost safety and reliability required for flight-critical parts. The integration of digital twins and predictive maintenance models based on real-time operational data is also a focal point of user interest, aiming to transition the casting industry toward a more data-driven, quality-centric manufacturing paradigm.

- AI-driven optimization of mold filling and solidification simulations, leading to proactive identification and elimination of porosity and shrinkage defects.

- Machine Learning algorithms applied to high-resolution imaging (e.g., X-ray computed tomography) for automated, non-destructive inspection and superior quality control checks on internal structures.

- Predictive maintenance analytics for casting equipment, minimizing unplanned downtime and maximizing the longevity and precision of critical machinery like vacuum induction melting furnaces.

- AI integration into the supply chain for demand forecasting and inventory management of specialized raw materials (aluminum ingots, alloying elements), optimizing procurement efficiency.

- Enhanced material informatics through AI, accelerating the discovery and certification process for novel lightweight aluminum alloys with improved temperature resistance for blade applications.

DRO & Impact Forces Of Aircraft Blades Aluminum Castings Market

The Aircraft Blades Aluminum Castings Market is fundamentally driven by the robust growth in global commercial air travel and the corresponding necessity for increased aircraft production, particularly fuel-efficient narrow-body jets. These modern aircraft require advanced engine architectures that rely heavily on lightweight components to achieve mandated emissions and efficiency targets. Technological advancements in casting techniques, such as improvements in surface finish, dimensional stability, and the ability to cast near-net shapes, act as significant drivers by reducing post-casting machining costs and material wastage. Furthermore, the cyclical replacement demand within the MRO sector ensures sustained market activity regardless of temporary fluctuations in new aircraft delivery schedules. The necessity for military fleet renewal across major global powers, focusing on performance upgrades and unmanned aerial systems (UAS), provides a steady secondary driver for high-performance aluminum casting demand.

Conversely, the market faces significant restraints, primarily revolving around the extremely high capital investment required for establishing and maintaining aerospace-certified casting facilities, including specialized equipment for vacuum melting and controlled atmosphere heat treatment. The stringent regulatory environment, necessitating extensive lead times for component qualification (up to 3–5 years for critical engine parts), acts as a substantial barrier to entry for new players and slows down the adoption of innovative casting methods. Furthermore, the volatility in raw material prices, particularly primary aluminum and specialized alloying elements (magnesium, titanium, nickel), directly impacts the production cost and profit margins of foundries. The ongoing shortage of highly skilled technical personnel, capable of managing complex casting processes and adhering to rigorous aerospace standards, also poses an operational constraint.

Opportunities for growth lie primarily in the development of hyper-lightweight alloys specifically tailored for next-generation aerospace programs, including Urban Air Mobility (UAM) and high-altitude long-endurance (HALE) platforms. The increasing trend toward additive manufacturing (AM) hybrid processes presents an opportunity where cast components are enhanced or repaired using 3D printing, optimizing material usage and component life. Impact forces—which encompass Porter's Five Forces—indicate high bargaining power for buyers (major OEMs) due to consolidation in the aerospace procurement landscape, yet high barriers to entry maintain moderate competitive rivalry among established suppliers. The threat of substitutes, while present (e.g., carbon composites, titanium alloys), remains moderate as aluminum offers an unparalleled combination of cost-effectiveness, processability, and weight characteristics for specific mid-temperature applications within the engine architecture.

Segmentation Analysis

The Aircraft Blades Aluminum Castings Market is complexly segmented based on critical operational and technological parameters, ensuring detailed analysis of market dynamics across diverse end-user requirements and material constraints. Key segments include the component type (defining the specific use within the aircraft), the casting technology utilized (reflecting precision and cost structure), the specific aluminum alloy employed (indicating thermal and structural performance), and the primary end-user application (commercial versus military aviation). Understanding these segmentations allows stakeholders to precisely tailor their strategic investments towards areas of highest expected demand growth, such as the increasing global requirements for narrow-body aircraft engine parts and the modernization demands of global defense fleets.

- By Component Type:

- Fan Blades

- Compressor Blades/Vanes (Static and Rotating)

- Turbine Guide Vanes

- Structural Engine Housings and Frames

- Accessory Gearbox Components

- By Casting Technology:

- Investment Casting (Precision Casting)

- Permanent Mold Casting (Gravity Die Casting)

- Sand Casting (Limited high-performance application)

- Die Casting (Limited use in high-stress components)

- By Material/Alloy Type:

- Aluminum-Silicon Alloys (e.g., A356, A357)

- Aluminum-Copper Alloys (e.g., A201)

- Specialty Aerospace Aluminum Alloys

- By Application/End-User:

- Commercial Aviation (Airframe & Engine OEMs, MRO)

- Military Aviation (Fighters, Transports, Helicopters)

- General Aviation

- By Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Rotorcraft

Value Chain Analysis For Aircraft Blades Aluminum Castings Market

The value chain for the Aircraft Blades Aluminum Castings Market is highly integrated and subject to strict regulatory oversight, beginning with the upstream supply of specialized primary aluminum and high-purity alloying elements, which dictates the performance characteristics of the final component. Upstream analysis highlights that suppliers of high-grade aluminum ingots (often requiring certified virgin material) possess moderate bargaining power due to the specialized nature of aerospace specifications and long-term supply contracts required for consistency. Foundries often engage in proprietary metal refinement and degassing processes before casting, adding significant intellectual property and value at this initial stage. Efficiency and quality control at the raw material procurement stage are crucial, as defects introduced here are highly costly to rectify later in the process.

The mid-stream segment involves the core manufacturing process: mold design, wax injection (for investment casting), slurry coating, dewaxing, casting (often in vacuum furnaces), heat treatment (critical for achieving desired mechanical properties), and preliminary machining. This stage represents the highest value addition, driven by the specialized expertise and capital-intensive technology required. Quality control—including non-destructive testing (NDT), dimensional inspection, and metallurgical analysis—is embedded throughout this phase. Distribution channels are predominantly direct, linking the certified foundry directly to the OEM’s Tier 1 suppliers (engine integrators like GE Aviation, Pratt & Whitney, or Rolls-Royce) or directly to the engine OEM itself. The high level of technical communication and quality assurance mandates preclude extensive reliance on generalized distributors.

Downstream analysis focuses on the end-users: the major airframe manufacturers and the extensive MRO network. Direct distribution ensures complete traceability and adherence to rigorous configuration control demanded by aviation authorities (FAA/EASA). Indirect channels primarily involve certified MRO service providers who source replacement castings through authorized channels, maintaining the certified status of the component life cycle. The relationship between the foundry and the OEM is often deeply collaborative, starting from the design phase, where casting feasibility and optimization are integrated early on. The final application of the casting into the propulsion system is the culmination of this chain, where the component’s performance is validated over decades of operational flight time, requiring ongoing support and quality monitoring from the original casting supplier.

Aircraft Blades Aluminum Castings Market Potential Customers

The primary potential customers and end-users of aircraft blades aluminum castings are concentrated within the global aerospace manufacturing ecosystem, primarily comprising Original Equipment Manufacturers (OEMs) specializing in aircraft engines and airframe assembly. Engine manufacturers, such as General Electric Aviation, Pratt & Whitney, and Rolls-Royce, represent the largest and most demanding customer segment. These entities require massive volumes of highly reliable, serialized castings for their flagship turbofan programs, including the CFM LEAP and Pratt & Whitney GTF families. Given the critical nature of engine blades and vanes, the procurement cycle is characterized by long-term contracts, intense scrutiny over supplier performance, and mandatory compliance with detailed technical specifications and quality certifications like AS9100 and NADCAP.

A secondary, yet rapidly growing, customer base is the Maintenance, Repair, and Overhaul (MRO) sector. MRO facilities worldwide require certified replacement castings to support the lifecycle maintenance and repair of aging aircraft fleets. As the average age of the global fleet increases, the demand for spares, including aluminum compressor components susceptible to foreign object damage (FOD) or fatigue, escalates significantly. These MRO customers prioritize quick lead times, competitive pricing for spares, and absolute assurance of component authenticity and airworthiness certification. Specialized defense contractors and government entities involved in military aircraft maintenance and modernization programs also form a crucial, albeit cyclical, customer segment.

Furthermore, emerging aerospace sectors are generating new demand pockets. Manufacturers focused on next-generation aerospace vehicles, including advanced rotorcraft (helicopters), high-performance Unmanned Aerial Systems (UAS/drones), and the burgeoning Urban Air Mobility (UAM) sector (electric vertical takeoff and landing or eVTOL aircraft), are actively seeking lightweight, high-integrity aluminum castings. While these platforms may use different propulsion methods (e.g., electric motors), they still require precision cast aluminum structures for motor mounts, control surface linkages, and structural airframe components where traditional composites may not offer the requisite stiffness or electromagnetic shielding. These new customers represent a strategic opportunity for foundries to diversify their portfolios beyond traditional turbofan engine applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PCC Aerostructures, Alcoa Corporation (Howmet Aerospace), Doncasters Group, Safran S.A., Rolls-Royce plc, Firth Rixson, LISI Aerospace, Mitsubishi Heavy Industries, Consolidated Precision Products (CPP), ATI Forged Products, AETC, Bharat Forge, Precision Castparts Corp. (Berkshire Hathaway), Impro Precision Industries, Arconic, Magna International (Cosma Casting), Tital GmbH, VDM Metals, Haynes International, Waupaca Foundry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Blades Aluminum Castings Market Key Technology Landscape

The technological landscape of the Aircraft Blades Aluminum Castings Market is dominated by advanced precision casting methods, where Investment Casting (or the lost-wax method) stands out for its capability to produce components with intricate internal cooling passages, complex geometries, and superior surface finishes required for engine airfoils. Continuous investment is directed towards optimizing shell manufacturing processes, ensuring dimensional consistency, and controlling the grain structure during solidification, particularly through specialized directional solidification (DS) and single-crystal (SX) casting techniques, although aluminum is less frequently subjected to these compared to nickel-based superalloys. The adoption of advanced computer-aided design (CAD) and simulation tools, such as finite element analysis (FEA) for stress mapping and computational solidification modeling, is crucial for validating new casting designs before physical prototyping, significantly reducing the development cycle time for new engine programs.

Another significant technological focus involves material science advancements. While traditional aluminum-silicon alloys (like A356 and A357) remain prevalent due to their excellent castability, high-performance alloys such as aluminum-lithium (Al-Li) and specialized aluminum-copper variants are gaining traction. These materials offer incremental weight savings and improved high-temperature creep resistance, necessary for higher performance military applications or next-generation commercial engines that operate under increasingly demanding thermal conditions. The specialized heat treatment processes, including solution heat treatment and artificial aging (T6, T7 treatments), are proprietary to many foundries and are critical technological steps that determine the final mechanical properties, tensile strength, and fracture toughness of the blade components.

Furthermore, the manufacturing environment itself is becoming highly digitized, representing a critical technological shift. Key developments include the integration of automated robotic systems for handling hot molds and components, high-throughput automated inspection systems utilizing industrial CT scanning and ultrasonic testing for defect detection, and the deployment of sensor technology within the casting floor to monitor environmental variables (temperature, humidity) and process parameters in real-time. This emphasis on Industry 4.0 principles, coupled with strict traceability systems (Digital Product Definition - DPD), ensures that every cast component meets the rigorous quality requirements of the aerospace sector, minimizing human error and maximizing process consistency across high-volume production runs.

Regional Highlights

- North America (NA)

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

North America, spearheaded by the United States, represents the largest and most technologically mature market for Aircraft Blades Aluminum Castings. This dominance is intrinsically linked to the presence of global aerospace giants like Boeing, Lockheed Martin, Northrop Grumman, and key engine manufacturers such as GE Aviation and Pratt & Whitney. The U.S. defense sector, characterized by substantial R&D spending and continuous fleet modernization programs (e.g., replacement parts for F-35 and specialized rotorcraft), provides a consistent and high-value demand stream. The market benefits from a robust ecosystem of highly specialized, NADCAP-accredited foundries and advanced material research institutions, which collectively drive innovation in precision casting methodologies and high-performance alloy development. Regulatory standards, enforced by the FAA, are the global benchmark, necessitating that suppliers maintain exemplary quality control and traceability records, reinforcing the competitive barrier to entry.

The commercial aviation boom, particularly the high production rates of narrow-body aircraft, dictates the volume requirements for aluminum engine components. Recent investments in advanced manufacturing techniques, including automated quality assurance systems and digital twin modeling for casting simulation, are concentrated here to manage the complex supply chain logistics and stringent specifications imposed by OEMs. Canada also contributes significantly, primarily through specialized aerospace suppliers integrated into the broader U.S. and European supply chains. The region is actively exploring the integration of castings into emerging segments such as hypersonic vehicle technology and commercial space applications, ensuring long-term technological leadership.

Europe holds the second-largest share, driven primarily by Airbus, Safran, and Rolls-Royce, alongside a dense network of Tier 1 suppliers in the UK, Germany, France, and Italy. The European market distinguishes itself through its focus on complex wide-body aircraft components and high-efficiency engine architectures (such as those developed by CFM International, a joint venture between GE and Safran). The region excels in advanced investment casting techniques, leveraging deep engineering expertise and heritage in complex metallic component manufacturing. European regulations (EASA) and initiatives like Clean Sky promote material lightweighting and efficiency, directly stimulating demand for advanced aluminum alloys that maximize performance while reducing fuel consumption and emissions.

Market dynamics in Europe are influenced by government-backed defense cooperative programs, which require reliable sourcing of critical engine parts for fighter jets (e.g., Eurofighter Typhoon) and transport aircraft. Foundry consolidation is a key trend, with major suppliers focusing on regional strategic acquisitions to enhance capacity and technical capabilities, particularly in automated inspection and precision machining. While facing stiff competition from lower-cost manufacturing centers, European suppliers retain a competitive edge through their ability to manage extremely demanding material certification and quality documentation, often collaborating closely with research institutions like the Fraunhofer Society to push the boundaries of casting technology for aerospace applications.

The Asia Pacific region is forecast to exhibit the fastest growth rate, fueled by unprecedented demand for commercial air travel, especially within China, India, and Southeast Asia. The necessity to support rapid fleet expansion—driven by significant orders for Boeing and Airbus aircraft—is leading to massive investment in local MRO infrastructure and, increasingly, in localized manufacturing capabilities. While still highly reliant on Western suppliers for the most critical, high-performance blades, countries like China are aggressively developing indigenous aerospace manufacturing capabilities, intending to become self-sufficient in the production of aircraft engines and structural components through government subsidies and technology transfer agreements.

The strategic shift towards local production, particularly for components related to regional jets and general aviation, presents both opportunities and challenges. Suppliers entering the APAC market must navigate complex intellectual property concerns and the rigorous process of gaining necessary certifications to supply multinational OEMs. India's burgeoning aerospace and defense sector, backed by the 'Make in India' initiative, is also creating localized demand for high-integrity castings for both civil and military programs. Japan and South Korea maintain highly advanced, niche manufacturing sectors focused on supplying precision cast components to their domestic aerospace and international partners, characterized by extremely high standards of quality and dimensional tolerance.

The Latin American market remains relatively smaller but is characterized by a stable demand for MRO services and localized manufacturing for regional aircraft programs, notably those led by Embraer in Brazil. Brazil serves as the regional hub for aerospace manufacturing, maintaining certified casting capabilities primarily focused on components for regional jets and structural airframe parts. Demand for aluminum blades and associated engine castings is largely tied to the maintenance cycles of the existing commercial and military fleets, often supplied directly through authorized distributors of North American or European OEMs. Investment in advanced casting technology within the region is growing steadily but cautiously, focusing on improving process efficiency and cost reduction to better compete with global suppliers.

Other countries in the region, such as Mexico, are increasingly integrated into the North American supply chain, primarily serving as Tier 2 or Tier 3 suppliers for machined components derived from castings. However, specialized, flight-critical aluminum casting production remains concentrated in the more developed economies of the region. Future growth will be dependent on economic stability, fleet renewal investments by regional airlines, and the extent of foreign direct investment into specialized manufacturing infrastructure capable of meeting demanding aerospace quality standards. The defense segment is driven by sporadic modernization programs, creating intermittent spikes in demand for certified spares.

The Middle East and Africa region presents a unique demand profile, characterized by significant military expenditure and the rapid growth of large international airlines in the Gulf Cooperation Council (GCC) states. Military demand is substantial, driven by investments in modern fighter aircraft and specialized defense platforms procured from the US and Europe, requiring certified spare parts and MRO support. Commercial demand is concentrated in the UAE, Qatar, and Saudi Arabia, which host major international hubs and large, modern fleets of wide-body and narrow-body aircraft. These carriers generate substantial, continuous demand for MRO services and certified engine castings.

Manufacturing capability for high-precision aluminum castings is nascent in the MEA region, resulting in almost total reliance on imports from North America and Europe. However, strategic initiatives are underway in countries like the UAE to develop localized MRO and potentially component manufacturing capabilities, driven by national economic diversification strategies. The African segment is largely focused on necessary MRO activities for aging fleets, with demand often constrained by capital availability. The long-term outlook for the MEA market is strong, particularly as regional MRO capacity expands, creating robust downstream requirements for certified, traceable aluminum engine components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Blades Aluminum Castings Market.- Precision Castparts Corp. (PCC Aerostructures)

- Howmet Aerospace (formerly Arconic)

- Doncasters Group

- Safran S.A. (Safran Aircraft Engines)

- Rolls-Royce plc

- LISI Aerospace

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Consolidated Precision Products (CPP)

- ATI Forged Products (Allegheny Technologies Incorporated)

- AETC (Aerospace Engineering and Technology Co., Ltd.)

- Bharat Forge Ltd.

- Impro Precision Industries Limited

- Tital GmbH (A division of BMT Aerospace)

- Magna International (Cosma Casting)

- Hahn & Clay

- Waupaca Foundry, Inc. (Hitachi Metals)

- Viking Castings, Inc.

- RMC Advanced Technologies

- ZOLLNER Group

- Alcoa Corporation

Frequently Asked Questions

Analyze common user questions about the Aircraft Blades Aluminum Castings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Aircraft Blades Aluminum Castings Market?

The market is primarily driven by the escalating demand for new, fuel-efficient commercial aircraft, particularly narrow-body jets, which necessitate lightweight and high-integrity aluminum castings for fan frames, compressor vanes, and associated engine structures to meet strict operational efficiency targets.

What specialized casting technology is predominantly used for high-performance aircraft blades?

Investment Casting (or precision casting) is the dominant technology, favored for its capability to produce complex, near-net shape geometries with excellent dimensional accuracy and surface finish, essential for flight-critical aluminum compressor and guide vane components.

Which stringent certifications are mandatory for suppliers in this market?

Suppliers must strictly adhere to aerospace quality management systems such as AS9100 and specialized process certifications, including NADCAP (National Aerospace and Defense Contractors Accreditation Program), particularly for casting, heat treatment, and non-destructive testing processes.

How does the MRO sector influence the demand for aluminum castings?

The Maintenance, Repair, and Overhaul (MRO) sector provides a stable, continuous demand stream for replacement parts and certified spares, ensuring market resilience regardless of fluctuations in new aircraft delivery schedules, especially as the global aircraft fleet ages.

What role do advanced aluminum alloys play in engine performance?

Advanced aluminum alloys, such as specific Al-Si and Al-Cu variants, are crucial for providing an optimal strength-to-weight ratio, superior fatigue resistance, and necessary thermal stability, enabling lighter engines that consume less fuel and meet demanding operational lifespan requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager