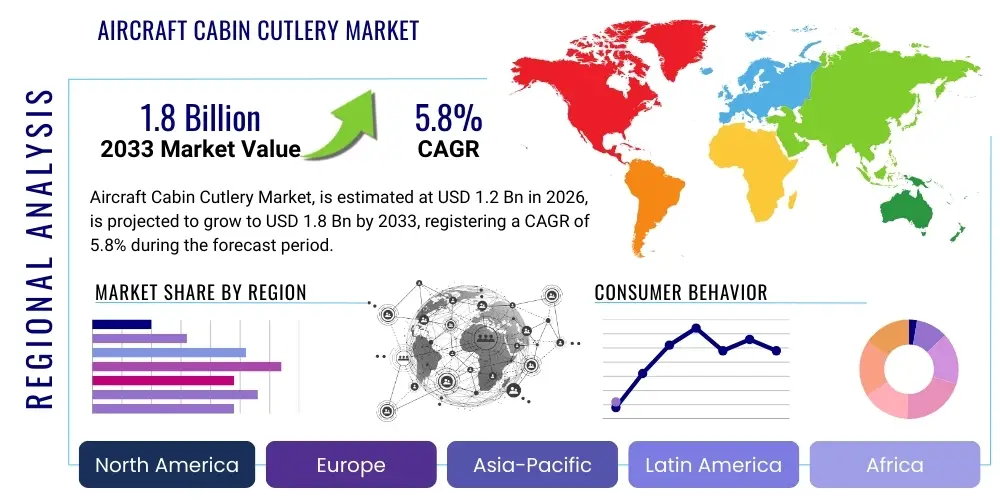

Aircraft Cabin Cutlery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438872 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Aircraft Cabin Cutlery Market Size

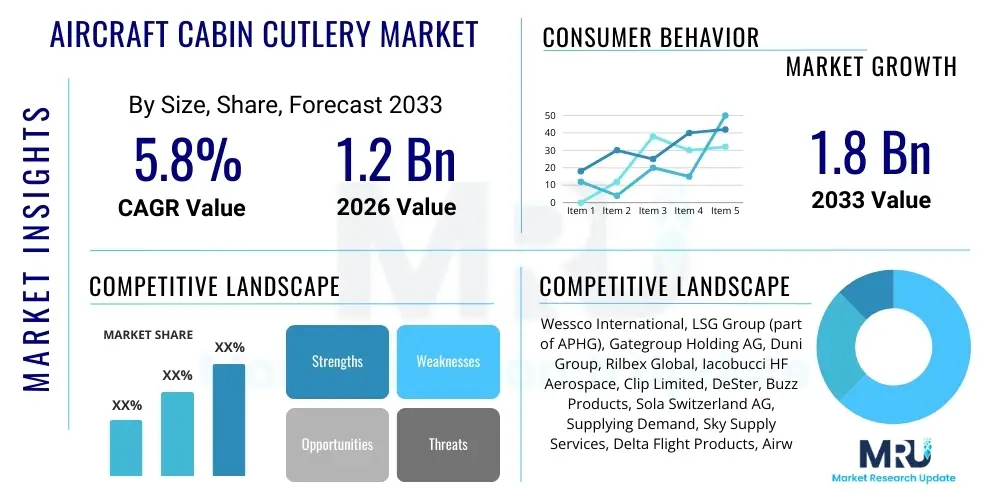

The Aircraft Cabin Cutlery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Aircraft Cabin Cutlery Market introduction

The Aircraft Cabin Cutlery Market constitutes a critical subset of the broader aviation catering and cabin interiors industry, dedicated to supplying functional, aesthetically pleasing, and safety-compliant utensils for in-flight meal service across global commercial, charter, and private aviation sectors. This market is intrinsically linked to the macroeconomic performance of the airline industry, with demand fluctuations highly sensitive to global passenger traffic volumes and airline profitability margins. Product offerings span a wide spectrum, ranging from high-volume, cost-optimized disposable solutions made from advanced biodegradable or traditional polymer compounds, predominantly utilized in economy and short-haul services, to premium, durable stainless steel and specialized composite sets that reflect bespoke luxury and branding in high-yield first and business class cabins. The evolution of this market is significantly influenced by twin pressures: the operational imperative of minimizing aircraft weight for fuel efficiency and the increasing global mandate for environmental sustainability through reduction of non-recyclable waste.

The principal application of specialized aircraft cabin cutlery is the facilitation of hygienic and standardized food service, a crucial element in defining the overall passenger experience and airline service quality. Core benefits derived from advanced cutlery design include enhanced passenger comfort through ergonomic form factors, reduced logistic complexity for catering companies due to optimized storage and handling features, and rigorous compliance with global aviation health regulations, especially post-pandemic. Major driving forces sustaining market expansion include the sustained recovery and projected growth in international and domestic air travel, particularly across burgeoning markets in Asia Pacific and the Middle East. Furthermore, airlines consistently utilize upgraded cabin service ware as a tangible method for service differentiation and competitive branding, compelling continuous product innovation in design, material usage, and packaging efficiency. The adoption of materials that offer high thermal stability and superior strength-to-weight ratios remains a key technological focus for market participants.

The strategic dynamics of this market involve complex interactions between raw material suppliers, specialized manufacturing entities, large-scale airline catering organizations (such as Gategroup and LSG Group), and the airline procurement departments themselves. Due to the high frequency of use, rapid turnover, and stringent regulatory environment—particularly concerning flammability standards and food contact safety—the barrier to entry for manufacturers is considerable. Long-term contractual agreements and the ability to provide bespoke, globally consistent supply across major hub airports are critical competitive advantages. Looking ahead, the focus on closed-loop recycling systems for specialized polymers and the pursuit of ultra-lightweight, high-performance metallic alloys are expected to dominate research and development agendas, ensuring the industry meets future demands for service quality and environmental accountability. The pursuit of certification for novel bio-based materials under rigorous aviation safety protocols represents a significant challenge and opportunity for market leaders.

Aircraft Cabin Cutlery Market Executive Summary

The global Aircraft Cabin Cutlery Market is navigating a phase of accelerated transformation, marked by a decisive transition toward sustainable sourcing and advanced material substitution across all segments. Key business trends indicate a highly sophisticated, bifurcated market strategy: premium carriers are deepening investment in luxury, customized, and durable stainless steel sets to elevate the high-end passenger experience, often involving partnerships with renowned industrial designers for exclusivity and brand alignment. Simultaneously, the volume-intensive economy segment is rapidly adopting bio-plastics, plant-based composites, and lightweight recyclable polymer alternatives in response to tightening governmental regulations, such as the EU’s Single-Use Plastics Directive, and mounting consumer preference for eco-conscious travel options. The push for operational efficiency remains central, manifesting in the design of optimized stacking and cleaning features that reduce catering labor time, minimize asset loss, and improve overall supply chain throughput speed.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market acceleration, driven by unparalleled aircraft fleet expansion, the rapid establishment of new flight routes, and high propensity for domestic travel. This momentum positions APAC to command a dominant market share in volume terms, particularly for high-quality disposable and composite cutlery solutions required by burgeoning low-cost carrier operations. North America and Europe, while growing at moderate rates, maintain strong market value dominance, characterized by early adoption of sophisticated sustainability practices and high investment in complex, reusable premium inventory management systems, often integrating RFID tracking for superior asset control. Furthermore, carriers based in the Middle East continue to drive innovation in the ultra-luxury segment, demanding proprietary designs and specialized materials that withstand rigorous international operations while maintaining exceptional aesthetic quality and perceived luxury standards, ensuring differentiation in competitive long-haul markets.

Segmentation trends highlight the increasing viability and market penetration of advanced polymer materials, which are offering performance characteristics—such as improved thermal resistance, crystallinity, and rigidity—that previously necessitated the use of traditional, less sustainable plastics. The First and Business Class segments, though lower in volume, represent the highest growth in terms of revenue contribution per unit, benefiting from airline efforts to increase ancillary service revenue and passenger loyalty through highly differentiated in-flight service elements and luxury dining experiences. The competitive landscape is consolidating, with major catering groups increasingly influencing product specifications and procurement decisions, preferring suppliers capable of providing a comprehensive suite of cabin service items, including complementary glassware, chinaware, and textile products, alongside specialized cutlery, simplifying their complex global procurement process.

AI Impact Analysis on Aircraft Cabin Cutlery Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Aircraft Cabin Cutlery Market predominantly concern optimization methodologies for the massive logistical operation that manages in-flight service equipment globally. Common themes include the application of predictive analytics to improve catering precision, thereby significantly reducing waste associated with over-kitting of disposable items or unnecessary cleaning cycles for reusable assets. Stakeholders are keen to understand how AI can interpret complex variables—such as varying load factors, sudden route changes, meal pre-order data, and historical usage patterns—to generate highly accurate forecasts for required cutlery quantities for each specific flight leg. The consensus expectation is that AI will revolutionize the backend operational effectiveness, translating directly into tangible cost savings and substantial improvements in the supply chain’s environmental footprint by ensuring resource efficiency and minimizing logistics failure points.

Furthermore, AI-driven solutions are expected to enhance quality assurance protocols critical for reusable metal and composite cutlery. Users frequently ask about the deployment of computer vision systems powered by deep learning models to conduct automated inspections during the catering facility's washing and sanitization process. These systems can accurately detect minute scratches, corrosion, or contamination that manual inspection might miss, ensuring that only items meeting the highest hygiene standards are reloaded onto aircraft. By minimizing the human element in asset verification and standardizing the quality check process, airlines can achieve superior regulatory compliance and passenger safety assurance. The long-term trajectory suggests AI will foster a more transparent, efficient, and responsive supply chain that links consumer demand directly to manufacturing capacity, impacting inventory holding costs across the aviation industry by promoting just-in-time logistics strategies.

- AI-driven Predictive Maintenance: Algorithms analyze cleaning cycle data and material fatigue rates of reusable metal cutlery to schedule proactive replacement, reducing in-flight failure rates and ensuring asset longevity, thereby optimizing capital expenditure and ensuring continuous service quality.

- Demand Forecasting Optimization: Machine learning models integrate real-time booking data, specific passenger meal preferences (including dietary restrictions), seasonality indices, and historical consumption metrics to precisely determine the required quantity and type of cutlery for specific routes, leading to a demonstrable reduction in inventory waste and over-kitting expenses.

- Automated Supply Chain Logistics: AI platforms manage global stock distribution across multi-site catering hubs, utilizing real-time visibility derived from IoT sensors to dynamically reallocate inventory and optimize transportation routes for faster response times and reduced logistic costs, particularly important for customized premium sets and emergency stock replenishment.

- Quality Control Enhancement: Advanced computer vision systems, trained via deep learning, perform automated high-speed inspection of sanitized reusable cutlery, ensuring zero tolerance for contamination or physical defects before packaging and reloading onto the aircraft, thus guaranteeing adherence to stringent public health and safety regulations.

- Resource Utilization Reporting: AI tools track the full lifecycle of bio-degradable cutlery, monitoring proper disposal channels, verifying compostability rates, and quantifying the actual reduction in environmental impact, providing verifiable data that supports airline sustainability claims and regulatory reporting requirements with high accuracy.

- Dynamic Pricing Strategies: AI analyzes competitor pricing, raw material volatility forecasts, and airline procurement budgets to assist manufacturers in setting competitive and profitable pricing models for customizable high-volume disposable and specialized reusable contracts, maximizing revenue generation and contract retention.

- Cabin Crew Optimization: AI models analyze service flows and cutlery placement efficiency, informing ergonomic design improvements that reduce cabin crew workload and enhance the speed and quality of in-flight meal service delivery, leading to improved passenger satisfaction scores.

- Material Compliance Verification: AI systems quickly cross-reference raw material batches and manufacturing records against international aviation regulations (e.g., non-flammability standards) to streamline the complex certification process for new composite or polymer cutlery products.

DRO & Impact Forces Of Aircraft Cabin Cutlery Market

The market for aircraft cabin cutlery is driven predominantly by the continuous expansion of global air travel networks, which mandates increasing procurement volumes for both reusable and disposable items, alongside a critical need for product differentiation in premium cabin service. Key drivers include the massive aircraft order backlogs signaling long-term industry confidence, the intensifying competition among airlines requiring enhanced passenger service differentiation to capture market share, and the non-negotiable requirement for all service components to comply with strict aviation safety standards, particularly fire safety and non-toxicity of materials. These factors compel manufacturers to constantly innovate, balancing material strength, weight reduction, and regulatory compliance to meet evolving airline specifications globally, often necessitating significant investment in R&D and specialized tooling infrastructure to maintain competitiveness.

Major constraints inhibiting market fluidity include the volatile pricing and supply chain instability of key raw materials, especially high-grade stainless steel alloys and specialized petroleum-derived or bio-based polymers, which severely affects manufacturing cost structures and profit margins, making long-term fixed-price contracts risky. Furthermore, the stringent regulatory environment around in-cabin equipment, particularly the need for non-flammable or self-extinguishing materials (FAR 25.853 compliance), significantly limits the selection of lightweight polymers suitable for high-volume production, creating bottlenecks in adopting innovative materials. This complexity adds considerable time and financial cost to new product certification and rigorous testing cycles, often slowing the pace of sustainable product adoption across global fleets.

Opportunities, conversely, are centered on the accelerating demand for genuinely eco-friendly solutions that offer certified end-of-life options. The transition toward certified compostable, closed-loop recyclable, or advanced hybrid materials presents a major opportunity for vendors who can secure intellectual property around sustainable, high-performance replacements for traditional plastics, capturing favorable contracts with environmentally conscious carriers. Technological breakthroughs in polymer science and advanced metal fabrication techniques allow for the creation of thinner, yet stronger and safer, cutlery, directly addressing the core conflict between durability and weight reduction. Moreover, the increasing consolidation of the airline catering market means that manufacturers must handle larger contract volumes and stricter quality control mandates from dominant global players, demanding robust operational scale and guaranteed global supply chain reliability, elevating the competitive barrier for smaller, regional suppliers and favoring those with extensive international logistical footprints.

Segmentation Analysis

The detailed segmentation of the Aircraft Cabin Cutlery Market provides crucial insight into the varying demands and service priorities across the aviation sector. The material segmentation—encompassing stainless steel, conventional and advanced polymers, and specialized bio-based composites—is paramount, as it directly correlates with service quality expectations and capital expenditure models. Stainless steel, dominating the reusable, high-value segment, emphasizes durability, aesthetic appeal, and brand image projection, often requiring anti-corrosion treatments to endure industrial dishwashing protocols. Conversely, the advanced polymers and composites segment is experiencing rapid innovation, focusing on achieving superior rigidity and thermal stability in disposable products while meeting environmental disposal requirements, making it the highest volume growth area due to universal use in economy cabins and the regulatory push away from traditional plastics.

Segmentation by product type further clarifies usage patterns, distinguishing between individual knives, forks, and spoons, and pre-packaged cutlery kits. The kits are highly preferred in economy and premium economy classes for logistical efficiency, simplifying catering operations, minimizing handling, and ensuring standardized, hygienic delivery of all necessary utensils. The segmentation by aircraft class is the most reflective of price and quality elasticity; First and Business Class segments demand customized, often weighted, silverware and specialized dessert implements, requiring sophisticated procurement and asset tracking systems due to their high unit cost. Economy Class, conversely, necessitates the most durable and cost-effective disposable solutions, often procured in massive quantities under long-term supply contracts to optimize unit cost and minimize inventory management complexity across vast global networks and turnaround operations.

The end-user segmentation clearly defines the procurement landscape: Commercial Airlines are the overwhelming volume purchasers, subdivided into full-service legacy carriers (high focus on premium sets and brand alignment) and low-cost carriers (exclusive focus on disposable, lightweight options and aggressive cost control). The niche but high-margin segments of Private Jets and Charter Services prioritize highly customized luxury, often seeking unique, high-design cutlery manufactured from specialized materials or proprietary designs to enhance exclusivity. Understanding the precise needs of these end-user groups, including their unique regulatory environments and specialized operational timelines, is crucial for market participants looking to tailor their sales and marketing strategies, ensuring their product offerings align perfectly with the distinct operational and branding requirements of each aviation segment globally and allowing for optimal inventory positioning.

- By Material Type:

- Stainless Steel Cutlery (Premium Grade 18/10, Lightweight Alloys, Silver-plated)

- Plastic Cutlery (Traditional Polymers: PP, PS, ABS, optimized for cost-effectiveness)

- Composites and Advanced Polymers (Bio-based/PLA, CPLA, PHA, Hybrid Fiber Composites, addressing sustainability mandates)

- Natural Materials (Bamboo, Wood Fiber, Fiber-reinforced Pulp, used for niche, eco-conscious services)

- By Product Type:

- Knives (Steak Knives, Butter Knives, Serrated Disposable Knives, designed for optimal safety)

- Forks (Salad Forks, Dinner Forks, ergonomic designs for passenger comfort)

- Spoons (Teaspoons, Dessert Spoons, Soup Spoons, varying sizes for multi-course meals)

- Cutlery Sets/Kits (Packaged, Sealed, Hygiene-Optimized Kits, essential for LCCs and hygiene compliance)

- By Aircraft Class:

- First Class (High-end, bespoke reusable sets emphasizing luxury and weight)

- Business Class (Durable, premium reusable sets focusing on design and asset longevity)

- Premium Economy Class (High-quality disposable or lightweight composite reusable, balancing cost and experience)

- Economy Class (Cost-effective, high-volume disposable solutions prioritizing hygiene and low mass)

- By End-User:

- Commercial Airlines (Legacy Carriers, Low-Cost Carriers, Regional Airlines, largest volume purchasers)

- Private Jets and Charter Services (Luxury, Customized Procurement, highest unit value)

- Military and Government Aviation (Utilitarian, Highly Durable Specifications, focused on resilience)

Value Chain Analysis For Aircraft Cabin Cutlery Market

The upstream segment of the Aircraft Cabin Cutlery Value Chain is dominated by highly specialized raw material providers. For reusable products, this involves global suppliers of high-grade stainless steel (typically 18/8 or 18/10 alloys) and specialized lightweight aluminum or titanium composites, requiring certifications for non-toxicity, corrosion resistance, and structural fatigue resilience mandated by aerospace standards. For disposable products, sourcing involves major petrochemical companies supplying commodity polymers (PP, PS) and, increasingly, specialized chemical manufacturers providing certified bio-based resins (PLA, CPLA, PHA) that meet rigorous aviation safety standards for thermal stability and reduced flammability. The efficiency of this upstream phase is critical, as volatility in metal or polymer feedstock prices directly impacts the final product cost and procurement budgeting for airlines, necessitating strong supplier relationships and inventory hedging strategies.

The manufacturing and fabrication stage is characterized by highly automated processes, including high-precision metal stamping, advanced multi-cavity injection molding for polymer parts, and specialized processes for integrating composite or hybrid materials into product designs. Key activities here include tooling design (crucial for achieving lightweighting targets and optimal stacking geometry), surface treatment (polishing, plating, anti-microbial coating), and rigorous quality control checks for dimensional accuracy, material composition, and hygienic compliance prior to packaging. The distribution channel is strategically bifurcated. Direct distribution involves established, global manufacturers supplying bespoke, large-volume, multi-year contracts directly to Tier 1 catering providers (e.g., Gategroup, LSG Group) or major airline groups. These direct relationships demand robust logistical agreements, guaranteed inventory buffers at major global hubs, and continuous product specification collaboration to manage specialized needs.

The indirect channel relies on specialized aviation supply distributors, procurement agencies, and consolidators who aggregate demand from smaller regional airlines, charter companies, and LCCs, providing them with standardized, off-the-shelf certified products. This channel offers faster turnaround times, simplified logistics, and smaller minimum order quantities crucial for smaller operators. Downstream, the end-users are primarily the airline catering entities responsible for the labor-intensive processes of washing, sanitizing (for reusable items), kitting, and loading the cutlery onto the aircraft cabin carts. Efficient turnaround and minimal asset loss require cutlery designs optimized for high-throughput industrial cleaning processes and specific compatibility with standardized cabin storage compartments (Atlas boxes), emphasizing the critical link between product design and operational efficiency in the final stages of the value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wessco International, LSG Group (part of APHG), Gategroup Holding AG, Duni Group, Rilbex Global, Iacobucci HF Aerospace, Clip Limited, DeSter, Buzz Products, Sola Switzerland AG, Supplying Demand, Sky Supply Services, Delta Flight Products, Airware, Huhtamaki, Spire Flight Solutions, Zibo Rainbow Star Trade Co. Ltd., Fiji Catering Supplies, Walki Group, Pak-Lite Inc., Dishware Solutions Ltd., In-Flight Services (IFS), Evertis Packaging Solutions, Brammer Standard Company, Inc., Atlas Air Worldwide Holdings, Specialty Metals Company, Carlisle FoodService Products, Orion Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Cabin Cutlery Market Key Technology Landscape

The Aircraft Cabin Cutlery Market is underpinned by continuous technological evolution primarily focused on achieving optimal balance between weight reduction, product durability, and environmental sustainability compliance. A core technological area is advanced material science, specifically the engineering of new bio-polymer formulations that overcome previous drawbacks, such as low thermal deflection temperature and inherent brittleness when exposed to in-flight catering conditions. Innovators are developing advanced composite materials that integrate natural fibers or specialized mineral fillers into plant-based polymers (like CPLA, which is crystalline PLA) to significantly enhance heat resistance and structural rigidity, making disposable eco-friendly cutlery suitable for hot meals served in-flight without compromising food safety standards or passenger experience expectations, a key technical challenge.

Furthermore, sophisticated manufacturing techniques, including high-speed precision injection molding with multi-cavity tooling and robotic automation, are key to scaling the production of lightweight and complex geometries for cutlery, minimizing material usage while maximizing structural integrity and ensuring high-volume consistency. For reusable stainless steel cutlery, technological focus is on surface engineering: applying advanced PVD (Physical Vapor Deposition) coatings or specialized anti-microbial treatments. These technologies not only improve corrosion resistance against aggressive industrial detergents used in catering facilities but also enhance the hygienic properties and aesthetic appeal (e.g., customized matte or satin finishes), effectively extending the asset lifecycle and reducing total cost of ownership for airlines over time by minimizing replacement frequency.

A major emerging technology in the operational side is the application of Internet of Things (IoT) sensors and integrated RFID (Radio-Frequency Identification) integration. High-value reusable cutlery sets are increasingly embedded with micro-RFID tags, allowing catering companies to track every individual piece throughout the logistics chain—from aircraft loading to washing and storage. This technology drastically minimizes inventory loss (a significant financial drain in premium cabins), automates compliance audits regarding sanitation cycles, and provides granular data necessary for AI-driven inventory management systems, thus bridging the gap between physical product manufacturing and smart supply chain management critical for minimizing operational expenditure and maximizing asset utilization in modern aviation catering operations.

Regional Highlights

- Asia Pacific (APAC): APAC is set for explosive growth, driven by rapid urbanization, burgeoning middle-class air travel, and massive governmental investments in aviation infrastructure, particularly in Southeast Asia, India, and China. The market is highly dualistic: demand for economical, sealed disposable kits is enormous due to high-volume LCC traffic, while flagship carriers are concurrently investing heavily in new premium reusable cutlery to compete globally on luxury routes. Regulations on plastics are becoming stricter, positioning APAC as a major testing ground for large-scale biodegradable solutions that meet stringent domestic and international environmental compliance standards.

- North America: This mature market is characterized by high operational standards and a strong consumer focus on sustainability, driven by vocal passenger groups and corporate social responsibility goals. North American carriers are key drivers in the adoption of advanced, lightweight reusable metal alloys and designer composite cutlery for their first and business class services. Regulatory focus is strong, demanding transparent sourcing and verifiable claims regarding recyclability and disposal pathways, pushing suppliers to offer specialized supply chain solutions that manage end-of-life logistics effectively, often partnering with local waste management experts for closed-loop solutions.

- Europe: The European market, highly influenced by the European Union's directives on single-use plastics (SUPD), is leading the global charge in material substitution, often preceding other regions in adopting comprehensive bans. This regulatory environment creates a significant competitive advantage for manufacturers specializing in certified compostable and bio-degradable polymers (e.g., meeting EN 13432 standards). European airlines frequently partner with local design firms to produce aesthetically unique, high-quality stainless steel and composite sets, reinforcing their reputation for refined in-flight service and compliance with robust ESG mandates and cultural emphasis on design excellence.

- Middle East and Africa (MEA): Dominated by major international hub airlines (Emirates, Qatar Airways, Etihad), the MEA region focuses heavily on providing luxury and ultra-premium in-flight experiences, necessitating bespoke and opulent service ware. This translates into high demand for highly customized, often silver-plated or unique metal alloy reusable cutlery that forms a cornerstone of their high-end catering brand presentation. While the African market is smaller and more cost-sensitive, the Gulf carriers’ commitment to premium service ensures that MEA maintains the highest Average Selling Price (ASP) for premium cutlery worldwide, fostering innovation in design aesthetics and manufacturing precision tailored to elite global travelers.

- Latin America (LATAM): The LATAM market exhibits stable growth, highly concentrated around key regional hubs and tourism routes. Cost-effectiveness is a paramount concern for both full-service and LCCs operating within the region, leading to a predominant reliance on standardized, durable plastic disposable cutlery to manage budget constraints. However, growing environmental awareness and international trade pressures are slowly compelling regional carriers to pilot sustainable material alternatives, particularly in international routes linking LATAM to North America and Europe, indicating a future transition towards advanced bio-polymers, albeit at a slower pace due to economic factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Cabin Cutlery Market.- Wessco International

- LSG Group (part of APHG)

- Gategroup Holding AG

- Duni Group

- Rilbex Global

- Iacobucci HF Aerospace

- Clip Limited

- DeSter

- Buzz Products

- Sola Switzerland AG

- Supplying Demand

- Sky Supply Services

- Delta Flight Products

- Airware

- Huhtamaki

- Spire Flight Solutions

- Zibo Rainbow Star Trade Co. Ltd.

- Fiji Catering Supplies

- Walki Group

- Pak-Lite Inc.

- Dishware Solutions Ltd.

- In-Flight Services (IFS)

- Evertis Packaging Solutions

- Brammer Standard Company, Inc.

- Atlas Air Worldwide Holdings

- Specialty Metals Company

- Carlisle FoodService Products

- Orion Group

Frequently Asked Questions

Analyze common user questions about the Aircraft Cabin Cutlery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major sustainability trends are impacting aircraft cabin cutlery adoption?

The primary trend is the rapid transition away from conventional, non-recyclable single-use plastics towards sustainable alternatives, notably bio-based polymers (like PLA) and compostable composites. Airlines are investing heavily in lightweight stainless steel for premium cabins to maximize reusability and minimize waste generation, aligning with global environmental, social, and governance (ESG) targets, driven by regulatory bodies and passenger expectations.

How significant is weight reduction in the design of in-flight cutlery?

Weight reduction is a critical driver, as every gram saved contributes directly to decreased aircraft fuel consumption and lower operational costs over the fleet lifespan. Manufacturers utilize advanced, lightweight composite materials and optimized design geometry to achieve functional strength while prioritizing minimal mass, particularly for high-volume disposable cutlery, resulting in substantial long-term fuel cost savings for airlines.

Which material segment currently dominates the Aircraft Cabin Cutlery Market in terms of revenue and volume?

While plastic/polymer cutlery dominates the market volume due to high usage in economy class and hygiene requirements, the stainless steel segment contributes significantly higher revenue and market value due to the premium pricing, bespoke customization, superior durability, and longer asset lifespan associated with reusable sets used extensively in first and business class services globally.

What are the key regulatory hurdles manufacturers face in this market?

Manufacturers must adhere to stringent aviation safety regulations, especially concerning material flammability and non-toxicity, mandated by organizations like FAA and EASA (FAR 25.853). Additionally, international health and safety protocols regarding sanitation, industrial sterilization durability, and food contact compliance are non-negotiable, requiring comprehensive certification and rigorous material testing for all product lines.

How does the segmentation by aircraft class affect product specifications and cost?

Specifications vary dramatically: Economy class demands high-volume, standardized, cost-effective disposable solutions focused on safety and stacking efficiency. In contrast, First and Business Class require bespoke, aesthetically superior, heavy-gauge stainless steel or high-end reusable composites, emphasizing unique design, brand alignment, and enhancing the perceived luxury of the passenger experience, leading to significantly higher unit costs.

What role do third-party catering companies play in cutlery procurement?

Major catering companies (Tier 1 providers) act as primary procurement agents, managing the logistics, inventory, and sanitation of cutlery for multiple airline clients. They set standardized operational specifications, demanding global supply consistency and durable products that can withstand industrial washing cycles, thus influencing manufacturer production capacity and quality control standards substantially.

Are there technological advancements related to anti-theft measures for premium cutlery?

Yes, technological advancements are focusing on implementing micro-chipping or integrating low-profile RFID (Radio-Frequency Identification) tags within high-value reusable stainless steel sets. This allows catering and airline inventory management systems to track assets accurately during turnaround operations, drastically minimizing loss and reducing the significant replacement costs associated with premium cabin inventory, thereby improving asset utilization.

What is the competitive landscape like for the Aircraft Cabin Cutlery Market?

The competitive landscape is moderately fragmented but dominated by a few global players and specialized cabin interior suppliers who possess extensive aviation certifications and logistical networks. Competition is fierce, particularly in the disposable segment based on price and material innovation, while the premium reusable segment relies on superior design, customization capabilities, and long-standing contractual relationships with flag carriers.

How do fluctuations in raw material costs impact the market?

Fluctuations in the price of stainless steel, aluminum, and petrochemical/bio-polymer resins significantly impact manufacturer profitability, leading to high price sensitivity in contract negotiations. Manufacturers often hedge or utilize long-term supply agreements to mitigate volatility, but these cost changes directly translate to shifts in pricing for large-volume airline procurement tenders, particularly affecting disposable cutlery margins.

Why is the Asia Pacific region expected to see the highest growth rate?

APAC is experiencing the highest growth due to exponential increases in domestic and international air passenger traffic, extensive modernization and expansion of aircraft fleets across China and India, and the simultaneous rise of both low-cost carriers (driving disposable volume) and luxury tourism (driving premium reusable demand), creating diverse and substantial market opportunities underpinned by regional economic expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager