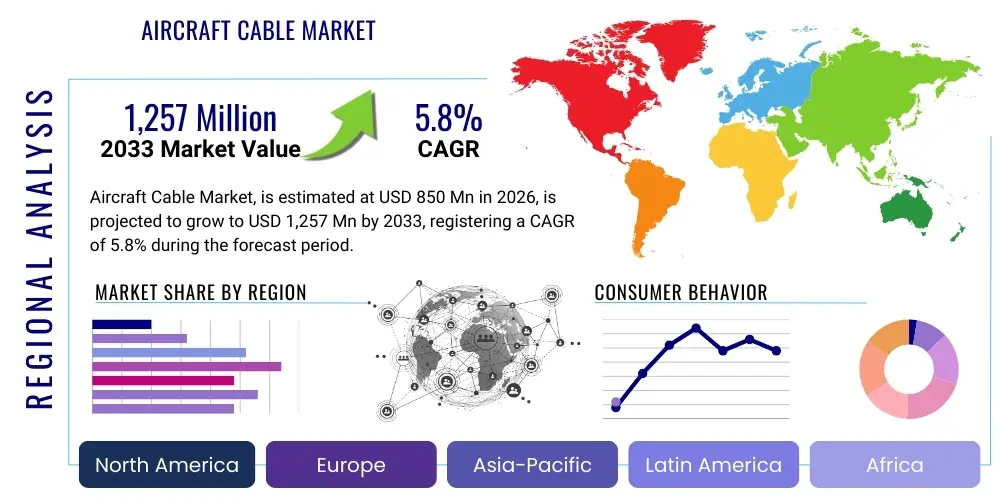

Aircraft Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437155 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aircraft Cable Market Size

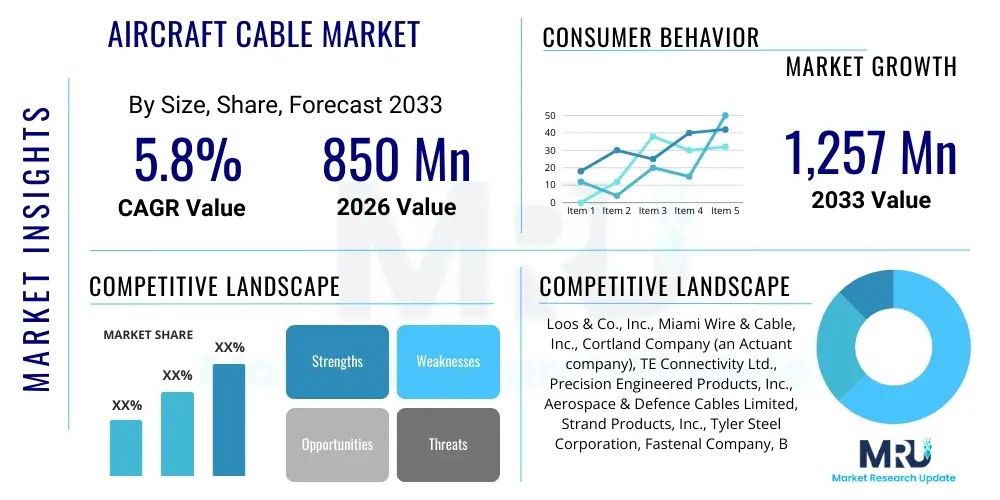

The Aircraft Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,257 Million USD by the end of the forecast period in 2033.

Aircraft Cable Market introduction

Aircraft cables, often referred to as wire ropes or control cables, are highly critical components within the aerospace industry, designed for load-bearing applications, flight control systems, and structural integrity. These cables are typically constructed from high-strength materials like stainless steel, galvanized steel, or specialized alloys, ensuring exceptional tensile strength, fatigue resistance, and corrosion immunity required for harsh operational environments. The rigorous demands of aviation—including exposure to extreme temperatures, varying pressures, and constant vibration—necessitate that these cables adhere to stringent international quality standards, such as those set by SAE International and military specifications (MIL-SPEC), guaranteeing reliability and safety across commercial, military, and general aviation sectors. The core function of these components extends beyond mere connectivity, serving as essential links in primary flight controls, secondary systems, and utility applications.

The primary applications of aircraft cables span across crucial systems, including aileron control, rudder control, elevator mechanisms, engine throttle systems, and landing gear operation. In addition to flight control surfaces, they are vital in safety and utility mechanisms such as cargo tie-downs, seatbelt restraint systems, and door opening mechanisms. The inherent benefits of using high-quality aircraft cable include superior operational longevity, reduced maintenance intervals, and an enhanced safety margin for airborne operations. The selection of cable material and construction (e.g., 7x7 or 7x19 strand configurations) is determined by the specific force transmission requirements and flexibility needed for the intended application, underscoring the technical complexity embedded in this seemingly simple component.

Key driving factors propelling the growth of the Aircraft Cable Market include the rapid increase in global commercial aircraft orders, particularly from emerging economies, spurred by growing air travel demand and the necessity for fleet modernization. Furthermore, the robust spending on military aviation platforms, including the development and maintenance of advanced fighter jets and transport aircraft, provides a consistent demand base for high-specification cables. The continuous focus on improving aircraft safety and performance mandates the regular replacement of aging cables during maintenance, repair, and overhaul (MRO) activities. Technological advancements focusing on lighter, stronger, and more durable cable materials—such as high-performance composite cables—also contribute significantly to market expansion by offering enhanced fuel efficiency and reduced operational weight.

Aircraft Cable Market Executive Summary

The Aircraft Cable Market is poised for stable expansion, underpinned by sustained growth in both commercial aerospace manufacturing and global defense spending. Business trends indicate a strong move towards specialized, lightweight cable solutions, driven by the imperative to reduce aircraft weight and enhance fuel efficiency, leading manufacturers to prioritize stainless steel variants and high-tensile coated cables. The market structure is moderately fragmented, with key players focusing on establishing long-term supply agreements with major original equipment manufacturers (OEMs) and certified MRO facilities to secure consistent revenue streams. Supply chain resilience, particularly concerning the sourcing of high-grade raw materials like specialty steel alloys and galvanized coatings, remains a critical operational focus for leading vendors.

Regionally, North America continues to dominate the market due to the presence of major global aircraft manufacturers (Boeing, Lockheed Martin) and significant defense budgets, driving demand for high-performance military-grade cables. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, fueled by massive investment in new airport infrastructure, burgeoning air traffic, and the establishment of local aircraft assembly and MRO hubs in countries like China and India. Europe maintains a strong market presence, driven by Airbus production and strict regulatory requirements mandating the use of certified, durable components in all phases of aviation maintenance. The emphasis across all regions is shifting towards compliance with stricter environmental standards, influencing the material choices and manufacturing processes used for cable production.

Segment trends reveal that the stainless steel segment maintains market leadership owing to its inherent strength, corrosion resistance, and suitability for critical control applications. However, the galvanized steel segment remains vital for utility and secondary applications where cost efficiency is a consideration. By application, the Flight Control Systems segment commands the largest market share, directly correlated with the constant output of new aircraft and the required periodic maintenance of these essential mechanisms. The MRO end-user segment is growing faster than the OEM segment, attributed to the increasing average age of the global commercial fleet, necessitating greater frequency of cable inspection, repair, and replacement to ensure operational safety and compliance.

AI Impact Analysis on Aircraft Cable Market

User queries regarding the integration of Artificial Intelligence (AI) in the Aircraft Cable Market primarily revolve around predictive maintenance, quality assurance efficiency, and supply chain optimization. Users are keen to understand how AI algorithms can move the industry beyond traditional time-based maintenance schedules towards condition-based monitoring, potentially extending the service life of expensive control cables while mitigating risks of in-flight failure. Key concerns center on the reliability of sensor data collection in harsh environments and the complexity of integrating AI models into legacy MRO IT infrastructure. Expectations are high regarding AI’s potential to dramatically improve defect detection during manufacturing and automate the inventory management of thousands of cable types used across various aircraft platforms.

AI is set to revolutionize quality control processes in aircraft cable manufacturing by leveraging machine vision and deep learning models. These systems can analyze high-resolution images of manufactured cables instantaneously, identifying microscopic flaws, inconsistencies in stranding, or coating defects that might be missed by human inspectors, thereby ensuring zero-defect output. Furthermore, AI-driven simulations allow engineers to model complex fatigue and wear patterns under various operational loads and environmental conditions with greater accuracy than traditional finite element analysis (FEA). This predictive capability enables manufacturers to design cables with optimized material compositions and structural configurations that precisely match the specified endurance requirements, leading to safer and more reliable products.

In the MRO sector, the adoption of AI-powered predictive maintenance platforms is generating significant interest. By collecting real-time sensor data—such as tension, vibration, and temperature—from critical cable systems on active aircraft, AI algorithms can accurately forecast the remaining useful life (RUL) of a cable. This proactive approach ensures that replacement activities are scheduled precisely when needed, minimizing unscheduled downtime, reducing unnecessary parts replacement costs, and crucially, preventing catastrophic failures related to cable fatigue. AI also plays a vital role in optimizing the complex global supply chain, forecasting demand fluctuations based on fleet size, flight hours, and regulatory cycles, ensuring that MRO providers maintain optimal stock levels of diverse cable types.

- AI integration enhances predictive maintenance modeling for critical flight control cables.

- Machine learning algorithms improve real-time defect detection during cable manufacturing processes.

- AI optimizes supply chain logistics and inventory forecasting for diverse cable stock.

- Advanced data analytics predict Remaining Useful Life (RUL), shifting MRO from time-based to condition-based.

- Neural networks are used to analyze sensor data related to cable tension and fatigue in operation.

- AI tools assist in simulating extreme environmental stress tests on new cable designs.

DRO & Impact Forces Of Aircraft Cable Market

The Aircraft Cable Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global demand for new commercial aircraft, particularly narrow-body jets, and the sustained expansion of military aviation modernization programs worldwide. These drivers are bolstered by strict global safety regulations (mandating scheduled replacement and high-quality certification) and the ongoing need for MRO services due to the aging global fleet. Conversely, the market faces restraints such as the volatility in raw material prices (nickel, chromium, steel alloys), the highly demanding certification process which slows innovation adoption, and the high cost associated with manufacturing and rigorous testing of specialized cables. These counter-forces necessitate careful strategic planning by market participants to ensure profitability and sustained compliance.

Opportunities in the market are primarily centered on technological innovation and geographical expansion. The move towards producing ultra-lightweight cables utilizing advanced composite materials or high-performance aramid fibers presents a significant growth avenue, aligning with industry goals of fuel efficiency and weight reduction. Furthermore, penetrating the rapidly developing MRO market in the Asia Pacific region, specifically establishing local production and certified distribution centers, offers substantial untapped potential. The rise of Unmanned Aerial Vehicles (UAVs) and advanced air mobility (AAM) aircraft also creates a new specialized niche market requiring smaller, yet equally robust, control and transmission cables tailored for electric propulsion systems and autonomous controls, opening doors for specialized product development.

The impact forces within this market are predominantly driven by regulatory shifts and safety mandates. Any change in FAA or EASA standards regarding cable wear tolerances, inspection frequency, or material specification immediately affects demand and production protocols globally. The need for absolute safety means quality and certification are non-negotiable impact forces; manufacturers must maintain impeccable traceability and adhere to military and aerospace material standards (AMS). Furthermore, the long product lifecycle of aircraft necessitates that replacement components, including cables, remain available for decades, forcing manufacturers to manage complex inventory and obsolescence issues. Competitive pressure focuses less on price and more on reliability, lead time, and the ability to fulfill highly customized, small-batch orders for diverse aircraft platforms.

Segmentation Analysis

The Aircraft Cable Market is systematically segmented based on material, construction type, application, and end-user, allowing for a granular understanding of demand dynamics across the global aerospace industry. This segmentation highlights the diverse technical requirements driven by functional necessity, where the choice of material and construction dictates the suitability of the cable for critical flight controls versus non-critical utility operations. Stainless steel cables dominate the market due to their strength and corrosion resistance, while the 7x19 construction is widely adopted for applications requiring high flexibility, such as operating pulleys or routing around tight bends in aircraft structure. Understanding these distinct segments is crucial for manufacturers to tailor their production capabilities and marketing strategies effectively.

By application, the market is broadly divided into Flight Control Systems, Engine Systems, Landing Gear Systems, and Utility Systems. Flight Control Systems represent the most critical and highest-value segment, requiring the most stringent certification and quality standards, directly impacting aircraft maneuverability and safety. The market also sees differentiation by end-user: Original Equipment Manufacturers (OEMs) require large volumes of cables for new aircraft assembly, whereas Maintenance, Repair, and Overhaul (MRO) service providers drive demand for replacement cables, which is characterized by high variability and a focus on minimizing aircraft downtime. The growing MRO sector provides stable, long-term revenue streams independent of cyclical new aircraft production rates.

Further analysis of segmentation reveals emerging trends. For instance, in the construction type segment, specialized cables, including jacketed cables (with nylon or Teflon coatings) designed to resist abrasion, moisture, or specific chemicals, are experiencing accelerated uptake. Furthermore, the material segmentation is seeing growth in specialty alloys and high-strength galvanized carbon steel which offers a cost-effective alternative for certain non-primary applications without compromising essential safety features. These detailed segment insights enable stakeholders to identify niche opportunities, such as providing tailored solutions for rotorcraft or next-generation urban air mobility (UAM) vehicles, each demanding unique cable specifications.

- Material Type:

- Stainless Steel (302/304, 316)

- Galvanized Carbon Steel

- Specialty Alloys (e.g., Inconel)

- High-Performance Composites

- Construction Type:

- 7x7 (Less flexible, high strength)

- 7x19 (High flexibility)

- 1x19 (Stiff, high tension)

- Application:

- Flight Control Systems (Aileron, Rudder, Elevator)

- Engine & Thrust Systems (Throttle)

- Landing Gear Systems

- Utility & Secondary Systems (Doors, Cargo Restraint)

- End-User:

- Original Equipment Manufacturers (OEM)

- Maintenance, Repair, and Overhaul (MRO)

- Defense & Military

Value Chain Analysis For Aircraft Cable Market

The value chain for the Aircraft Cable Market commences with the upstream sourcing and processing of specialized raw materials, primarily high-grade steel alloys such as stainless steel (e.g., 302/304) and corrosion-resistant coatings (e.g., zinc galvanization). Upstream suppliers, which include specialized metallurgy companies, must provide materials that strictly adhere to aerospace material specifications (AMS) regarding purity, tensile strength, and fatigue life. The quality and stability of raw material procurement directly impact the final product integrity and the manufacturer's ability to achieve mandatory aerospace certifications. Fluctuations in commodity prices and the limited number of certified specialty alloy providers introduce significant supply chain risks at this initial stage.

The subsequent crucial stage involves the manufacturing process, where core wire drawing, stranding (e.g., forming 7x7 or 7x19 construction), and specialized coating application take place. Manufacturers invest heavily in precision machinery and advanced quality control systems to ensure uniformity, minimal friction, and optimal resistance to wear. Downstream distribution is highly regulated and often involves certified aerospace distributors who maintain extensive inventories and handle the complex logistics of delivering highly specialized parts globally. Due to the critical nature of the product, direct sales from the manufacturer to large OEMs are common, allowing for customized specifications and integrated supply programs. Indirect channels, primarily through authorized distributors, serve smaller MRO facilities and independent repair shops.

The final stage encompasses the integration of the cables by the end-users—OEMs during initial assembly and MRO providers during maintenance cycles. The complexity of the distribution channel is compounded by the need for meticulous documentation and traceability for every batch of cable, a non-negotiable requirement in aviation safety. The ability of a manufacturer to offer integrated solutions, including cable assemblies with pre-installed fittings (terminals, sleeves, turnbuckles), provides a significant competitive advantage. Efficiency and cost optimization throughout the value chain are achieved through strategic partnerships between raw material providers, certified processors, and high-volume aerospace component distributors, focusing on reducing lead times while maintaining uncompromising quality standards demanded by regulatory bodies.

Aircraft Cable Market Potential Customers

The primary customer base for the Aircraft Cable Market is segmented into three major categories: commercial aircraft Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) service providers, and global Military/Defense organizations. Commercial OEMs, such as Boeing, Airbus, Embraer, and Bombardier, constitute a high-volume, steady demand segment driven by new aircraft production backlogs. These customers require cables in large batches, often demanding bespoke specifications integrated into their complex assembly lines, and prioritize suppliers who offer integrated logistical support and exceptional compliance with technical blueprints and certification requirements.

MRO service providers form a critical and rapidly growing segment of potential customers. This includes third-party maintenance organizations, airline-owned MRO divisions, and specialized component repair shops globally. As the average age of commercial and regional aircraft increases, the mandatory scheduled replacement of flight control and structural cables drives consistent, recession-resistant demand for replacement parts. MRO customers typically require a high diversity of cable types in smaller quantities, emphasizing the supplier's ability to provide rapid fulfillment, verified documentation, and immediate availability to minimize aircraft grounding time (AOG—Aircraft on Ground).

The defense sector, encompassing government military procurement agencies and specialized defense contractors (such as Lockheed Martin, Northrop Grumman), represents a high-specification, premium-priced customer segment. Military applications often require cables resistant to extreme environmental conditions, specialized electromagnetic shielding, or adherence to unique MIL-SPEC standards that exceed commercial requirements. Procurement in the defense sector is characterized by longer contract cycles, extremely rigorous quality assurance, and often requires domestic supply sources for security reasons. Furthermore, emerging potential customers include manufacturers of Advanced Air Mobility (AAM) vehicles, electric Vertical Take-Off and Landing (eVTOL) aircraft, and large-scale UAVs, which necessitate new classes of lightweight, high-performance cables suitable for electric powertrains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,257 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Loos & Co., Inc., Miami Wire & Cable, Inc., Cortland Company (an Actuant company), TE Connectivity Ltd., Precision Engineered Products, Inc., Aerospace & Defence Cables Limited, Strand Products, Inc., Tyler Steel Corporation, Fastenal Company, Bergen Cable Technology, Lexco Cable, Inc., Brunton Wire Ropes Ltd., Wire Rope Corporation of America (WRCA), Bethlehem Wire Rope, MacWhyte Wire Rope, Continental Wire & Cable, Carl Stahl GmbH, Trefilerie Service. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Cable Market Key Technology Landscape

The technology landscape in the Aircraft Cable Market is dominated by advancements in material science, focusing primarily on achieving higher strength-to-weight ratios and enhanced resistance to fatigue and environmental degradation. Traditional stainless steel cables (e.g., 304, 316) are continually being refined through specialized heat treatment and cold drawing processes to maximize tensile strength while maintaining flexibility required for complex control systems. A significant technological shift involves the integration of high-performance coatings, such as specialized nylon or PVC jacketing, which not only protect the core cable from abrasion and moisture ingress but also dampen vibration, thereby extending the operational lifespan and reducing maintenance requirements in MRO cycles. Furthermore, the development of non-magnetic specialty alloy cables is gaining traction for applications near sensitive navigation and electronic equipment.

Another pivotal technological area is the rise of synthetic and composite cables, presenting a revolutionary alternative to traditional steel ropes. Materials like aramid fibers (e.g., Kevlar) and specialized polymer matrix composites are being developed for secondary and utility systems. While synthetic options currently face challenges in meeting the extremely high temperature and fatigue resistance required for primary flight controls, their superior lightweight properties are highly attractive for next-generation aircraft and UAVs where every kilogram saved contributes significantly to fuel economy or payload capacity. Continuous research focuses on improving the termination technology and integration methods for these composite cables to ensure they meet the same rigorous safety standards as metallic options, particularly concerning creep and secure end-fitting attachment under sustained load.

Manufacturing technology also plays a crucial role, with increased adoption of automated, high-precision stranding and closing machines. Modern manufacturing facilities utilize sophisticated computerized control systems to monitor tension and lay length precisely during the stranding process, ensuring impeccable uniformity across long cable runs. Non-destructive testing (NDT) techniques, including eddy current testing and advanced ultrasonic inspection, are integrated into the production line to guarantee internal structural integrity before certification. The technological focus is shifting towards 'smart cables,' incorporating embedded fiber optic sensors or micro-electrical systems (MEMS) within the cable structure itself, enabling continuous, real-time health monitoring (Structural Health Monitoring or SHM) throughout the cable's operational life, linking directly to the predictive maintenance goals of the aerospace industry.

Regional Highlights

- North America: This region maintains its dominant position, driven by the massive presence of aerospace giants like Boeing and Lockheed Martin, and substantial governmental investment in defense and military modernization programs. The U.S. market specifically benefits from high MRO spending mandated by rigorous FAA regulations. The demand is skewed towards highly certified, specialized stainless steel and specialty alloy cables for military and commercial wide-body aircraft production. Innovation in lightweight materials is heavily concentrated in this region, often driven by defense contract requirements.

- Europe: Europe represents a mature and vital market, primarily fueled by the strong manufacturing base of Airbus and various regional jet producers, supported by robust supply chains in countries like Germany, France, and the UK. Strict adherence to EASA standards necessitates consistent demand for premium, certified cables. The regional focus is strong on sustainability and regulatory compliance, influencing the adoption of eco-friendly materials and manufacturing processes, particularly in the MRO segment servicing aging regional fleets.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by explosive growth in passenger traffic, massive new fleet procurement by airlines (especially in China and India), and significant investment in localized MRO capabilities. The rapid expansion of new airport and aviation infrastructure generates high demand for both new installations (OEM) and the supporting MRO supply chain. The region offers significant opportunity for manufacturers seeking to expand production capacity and establish distribution hubs to mitigate long lead times from Western suppliers.

- Latin America: This region shows moderate growth, primarily driven by fleet modernization programs among major Latin American carriers and increased demand for certified MRO services for regional aircraft. The market relies heavily on imports of certified cables, making efficient distribution and localized inventory management critical success factors for suppliers targeting this region. Economic stability remains a key determinant of market demand fluctuation.

- Middle East and Africa (MEA): Growth in the MEA region is attributed to the expansion of major Gulf carriers (Emirates, Qatar Airways) and strategic investments in defense capabilities. The Middle East, in particular, requires high-durability cables capable of withstanding extreme heat and desert conditions. The African segment is driven by general aviation and the need for MRO support for older aircraft models utilized in regional operations, requiring cost-effective, durable cable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Cable Market.- Loos & Co., Inc.

- Miami Wire & Cable, Inc.

- Cortland Company (an Actuant company)

- TE Connectivity Ltd.

- Precision Engineered Products, Inc.

- Aerospace & Defence Cables Limited

- Strand Products, Inc.

- Tyler Steel Corporation

- Fastenal Company

- Bergen Cable Technology

- Lexco Cable, Inc.

- Brunton Wire Ropes Ltd.

- Wire Rope Corporation of America (WRCA)

- Bethlehem Wire Rope

- MacWhyte Wire Rope

- Continental Wire & Cable

- Carl Stahl GmbH

- Trefilerie Service

- Pfeifer Seil- und Hebetechnik GmbH

- Specialty Wire & Cable, LLC

Frequently Asked Questions

Analyze common user questions about the Aircraft Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in critical flight control aircraft cables?

The primary material used in critical flight control systems is typically high-strength stainless steel (302/304 or 316), valued for its superior tensile strength, fatigue resistance, and high immunity to corrosion, ensuring aircraft safety and reliability.

How does the 7x7 cable construction differ from the 7x19 construction?

The 7x7 construction consists of seven strands, each made up of seven wires, offering higher stiffness and strength, primarily used for stationary or running applications. The 7x19 construction provides greater flexibility and is preferred for applications involving repeated bending around pulleys or control drums.

What regulatory bodies govern the standards and certification for aircraft cables?

The primary regulatory bodies governing aircraft cable standards are the Federal Aviation Administration (FAA) in the US and the European Union Aviation Safety Agency (EASA). Additionally, cables must often comply with military specifications (MIL-SPEC) and standards set by organizations like SAE International (Aerospace Material Specification, AMS).

What is the role of the MRO segment in driving the demand for aircraft cables?

The Maintenance, Repair, and Overhaul (MRO) segment drives significant demand because aircraft cables are considered life-limited components that must be inspected and replaced periodically due to fatigue or wear, ensuring compliance with strict safety mandates regardless of new aircraft production rates.

Are composite and synthetic cables replacing traditional steel aircraft cables?

While composite and synthetic materials offer advantages in weight reduction, they are primarily being adopted in secondary and utility systems. Traditional steel cables remain the standard for primary flight control systems due to their proven strength, durability, and mandatory certification requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager